Optimistic, zk-Rollups, L3... Where has Ethereum's scalability research reached now?

TechFlow Selected TechFlow Selected

Optimistic, zk-Rollups, L3... Where has Ethereum's scalability research reached now?

The future of blockchain scalability is right around the corner.

Written by: Thor Hartvigsen

Compiled by: TechFlow

The future of blockchain scalability is here! But what are zk-Rollups, zkEVMs, L3s, and modular blockchains? It's time to dive deep and level up our knowledge.

Based on recent research into blockchain and DeFi technologies, it is becoming increasingly clear that Ethereum will play a central role in cryptocurrency innovation and adoption.

The 2021 narrative around Layer 1 (L1) chains and rotation was driven by two main factors:

-

High demand for block space and Ethereum's limited scalability;

-

Unsustainable liquidity mining incentives driving demand for alternative L1 chains;

What is the current state of these alternative L1 chains?

From the chart above, DeFi has mostly been declining.

However, when looking at the TVL (Total Value Locked) and daily user counts of Arbitrum and Optimism, a clear difference emerges.

Note that Arbitrum has no native token and offers no incentives.

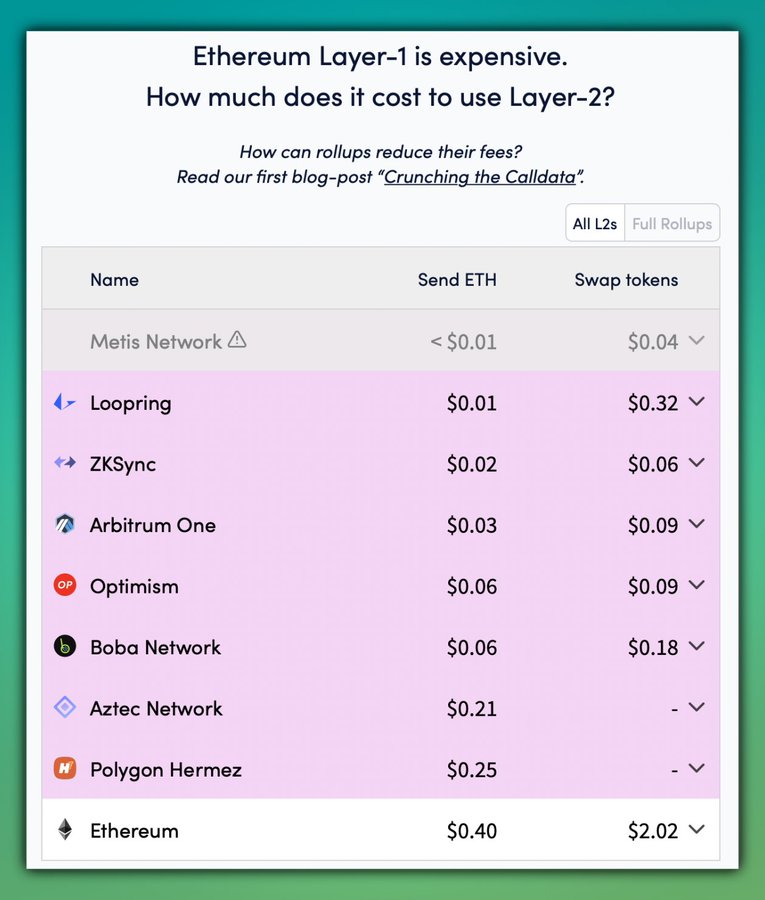

The bear market has proven that as gas fees dropped significantly, most on-chain activity remained concentrated on Ethereum.

Now that scalable Layer 2 (L2) solutions have emerged—whose security is inherited from Ethereum—it appears the next cycle will be even more centered around the Ethereum ecosystem.

Ethereum has over 435,000 validators, compared to Solana’s ~3,500, while many other L1s have fewer than 1,000 validators. Scalability alone is far from sufficient. The following chart further highlights the stark differences between alternative L1s and post-merge Ethereum.

It is now evident that Ethereum and its scalability solutions will play a significant role in blockchain technology and DeFi for the foreseeable future.

But there are substantial differences among these various scaling solutions.

Rollups (L2s) are designed to offload most of the burden from Ethereum’s mainnet by keeping only minimal data per transaction and compressing the rest. This results in lower TPS (transactions per second) requirements and significantly reduced fees.

As stated on Ethereum’s official website:

"Layer 2 is a separate blockchain that scales Ethereum and inherits Ethereum's security."

L2s are independent blockchains that bundle transactions and send them back to the Ethereum mainnet.

Therefore, Layer 2 blockchains inherit a similar level of security and decentralization as Ethereum itself. This model allows Ethereum to focus on security and decentralization, while Layer 2 focuses on scalability.

Now let’s define some key terms:

⬩ Optimistic rollups: use fraud proofs (e.g., Arbitrum and Optimism).

⬩ Zero-knowledge (zk) rollups: use validity proofs (e.g., zkSync, Starknet, zk-EVM).

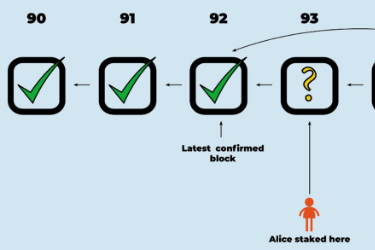

Fraud Proofs (Optimistic Rollups):

Information is exchanged between so-called "provers" and "verifiers." Data is assumed to be valid and added to batches of transactions, which are later scrutinized by "watchers" to detect any malicious activity.

Validity Proofs (Zk-Rollups):

Here, communication between "provers" and "verifiers" relies on cryptography and mathematics. Information is shared but never revealed.

There are two types of validity proofs: SNARKs and STARKs. STARKs are more scalable.

Validity proofs (zk-rollups) are harder to implement, but because they rely on cryptography, they offer higher privacy and data security. The current consensus is that zk-rollups are a superior scaling technology in most aspects.

This doesn’t mean one approach will dominate the future. We’ve already seen Arbitrum and Optimism achieve great success in building scalable models and large ecosystems/communities.

zk-EVM:

zk-EVM is one of the most anticipated scaling solutions, with several products nearing launch, such as Zksync and Polygon zkEVM.

This technology has been in development for a long time and is finally ready for deployment.

zk-EVM uses zk-rollups to handle execution—more specifically, zk-SNARKs (a type of validity proof)—to verify transactions.

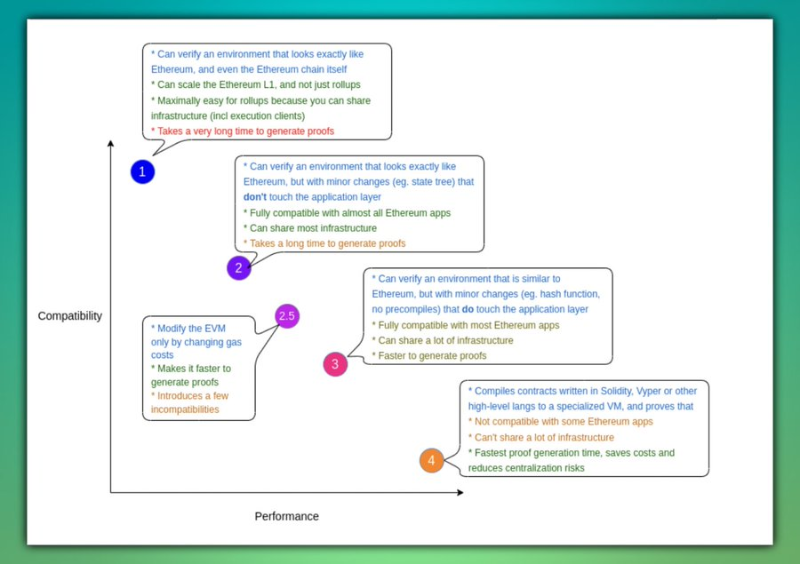

According to Vitalik Buterin, there are four different types of zk-EVM:

-

Fully equivalent to Ethereum;

-

Fully equivalent to EVM;

-

Fully equivalent to EVM except for gas costs;

-

Equivalent to Solidity;

All types face a trade-off between EVM compatibility and performance. Most zk-EVM projects currently fall between types 2 and 4.

Polygon zk-EVM (Polygon Hermes) is Type 2. It remains highly compatible with Ethereum but sacrifices some compatibility for better performance.

Performance is measured by the time required to generate zk proofs. The faster the generation, the higher the scalability.

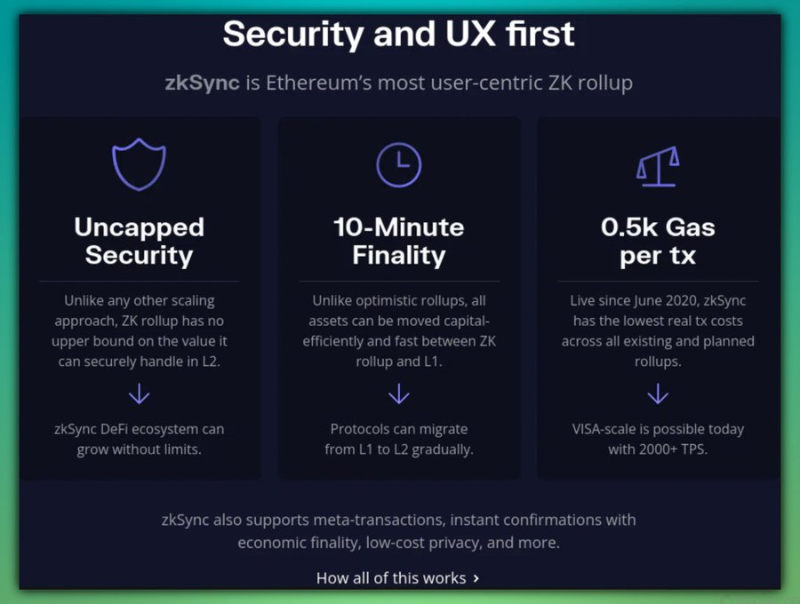

zksync is a Type 4 zk-EVM—lower compatibility but higher performance. Due to lower compatibility, this type is more difficult to implement.

zksync has created its own language that compiles Solidity into bytecode, along with its own virtual machine called ZinkVM.

Generally, bytecode is sent to an LLVM compiler before finally being processed by ZinkVM.

Despite lower compatibility, according to the zksync team, migrating dApps from Ethereum mainnet to zk-EVM is still relatively straightforward.

From zksync’s appearance on the Bankless podcast, it seems many protocols are eagerly anticipating this upcoming ecosystem.

zk-EVM is complex, and I recommend reading more about it, as this article only scratches the surface.

L3:

L3? Why are we discussing this when Layer 2 technology is still evolving?

L3 can be thought of as application-specific rollups, offering numerous use cases for companies wanting to bring their operations on-chain in a scalable and secure manner.

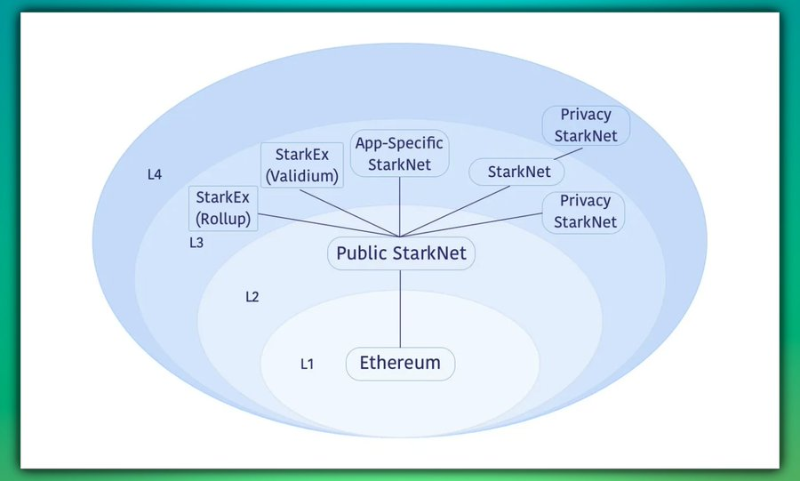

An example of this is Starknet.

More specifically, L3 refers to "validium" or "volition."

Validiums (a type of L3) are zk-rollups where data is processed off-chain (e.g., on L2).

In the diagram below, StarkEx is an application-specific L3, while Starknet is L2.

L3 generates proofs off-chain to improve transaction-per-second scalability.

These proofs are then batched and sent to L2, just as L2 sends large batches of transactions to L1. Could this extend to L4, L5, or even L6?

The trade-off lies between scalability and security. The further we move from Ethereum’s mainnet, the less secure the layer becomes.

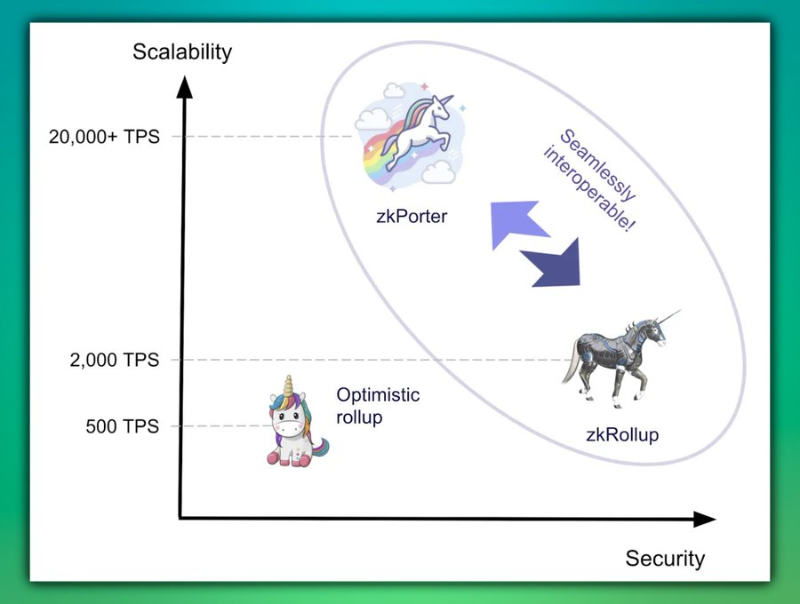

zkPorter (a product of zksync) is also an L3. Users can choose between L3, which offers higher TPS but lower security, or zkRollup (L2), which provides higher security but lower TPS.

The L3 structure I just described is known as 'validium'.

"Volition" is essentially a combination of L3 and zk-Rollup L2. In this case, users don't have to choose between security and TPS—they can have both, depending on their needs.

That concludes this article. It covers a lot of ground, and if you truly want to master the topic, I recommend revisiting it multiple times.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News