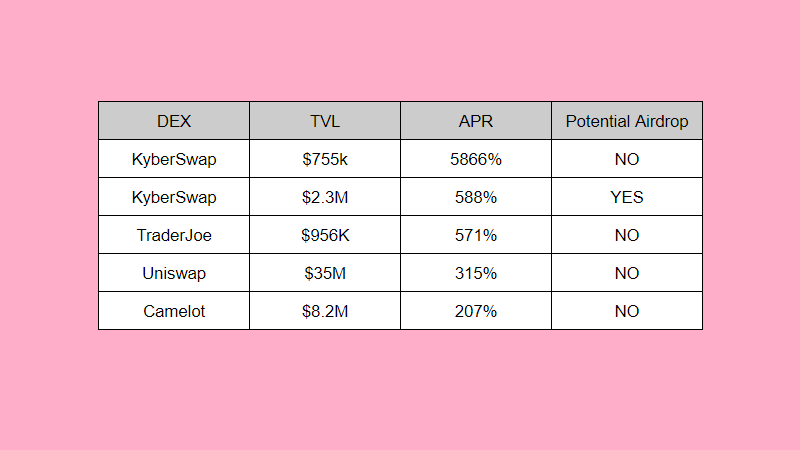

Which ARB liquidity provider offers the best yields? A comparison of LP returns from Kyber, Trader Joe, Uniswap, and Camelot

TechFlow Selected TechFlow Selected

Which ARB liquidity provider offers the best yields? A comparison of LP returns from Kyber, Trader Joe, Uniswap, and Camelot

This article lists several DEXs offering ARB liquidity, including KyberNetwork, Trader Joe, Uniswap, and Camelot, and provides a comparative analysis of their yields.

Written by: DeFi Made Here

Compiled by: TechFlow

The author lists several DEXs providing ARB liquidity, including KyberNetwork, Trader Joe, Uniswap, and Camelot, and compares their respective yields. It's worth noting that these platforms differ in ecosystem design and incentive structures, resulting in varying returns. Based on this analysis, the author further explains how certain aggregators route trades across these DEXs, along with their pros and cons.

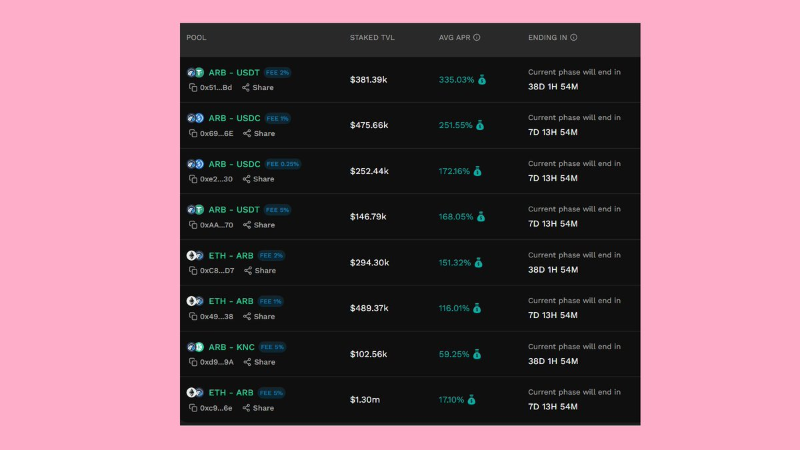

• KyberNetwork: 5866%

• Trader Joe: 571%

• Uniswap: 315%

• Camelot: 207%

Below are some details.

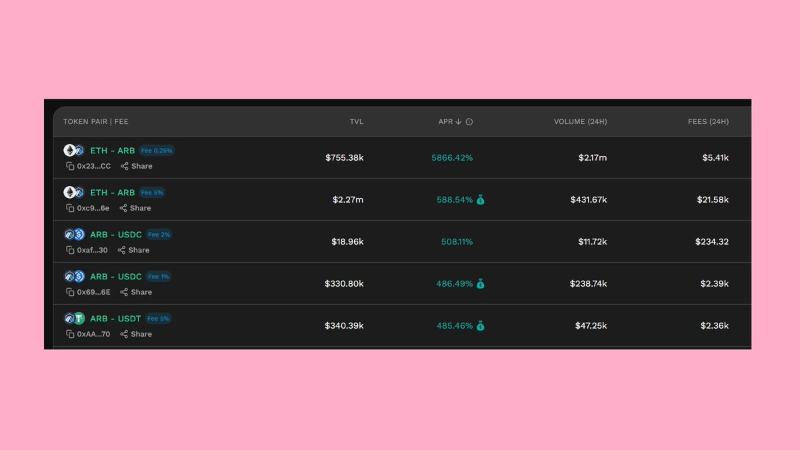

KyberSwap offers the highest yield at 5866%, and this figure is not influenced by external incentives.

I added liquidity to a 5% fee tier pool at 588% APR. I expect potential additional airdrops to outweigh the return gap.

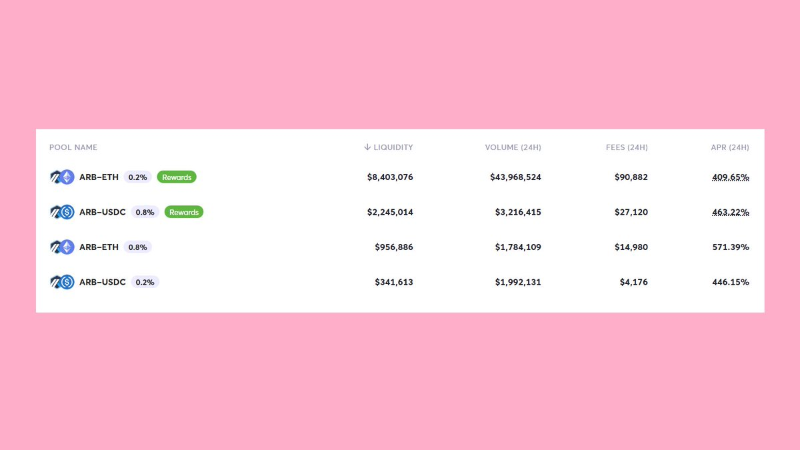

On Trader Joe, incentivized pools generate lower yields than non-incentivized ones. Users prefer earning more $JOE rewards rather than collecting trading fees.

Uniswap ranks third without any additional incentives. Users trust and are accustomed to using Uniswap, and LPs are willing to accept lower yields just to stay on their preferred platform.

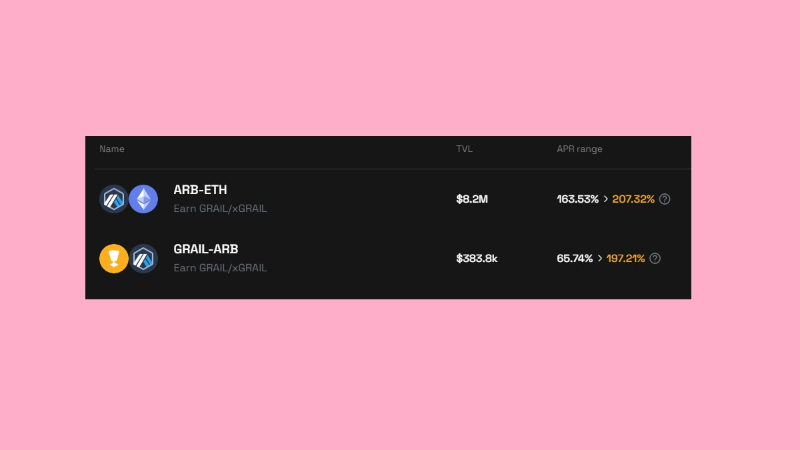

Camelot has the lowest yield. It appears many users prefer simple position management even if it means receiving lower rewards.

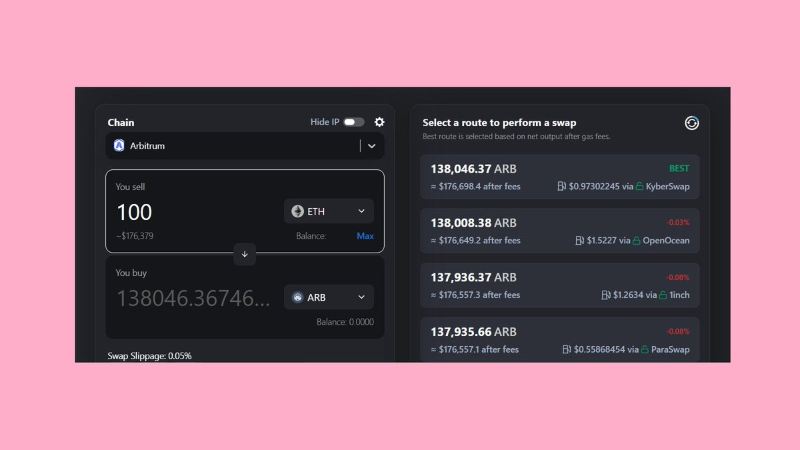

But how do aggregators route swaps across these DEXs? I checked DefiLlama’s meta DEX aggregator to see the optimal path for swapping 100 $ETH.

It directed me to the Kyber aggregator.

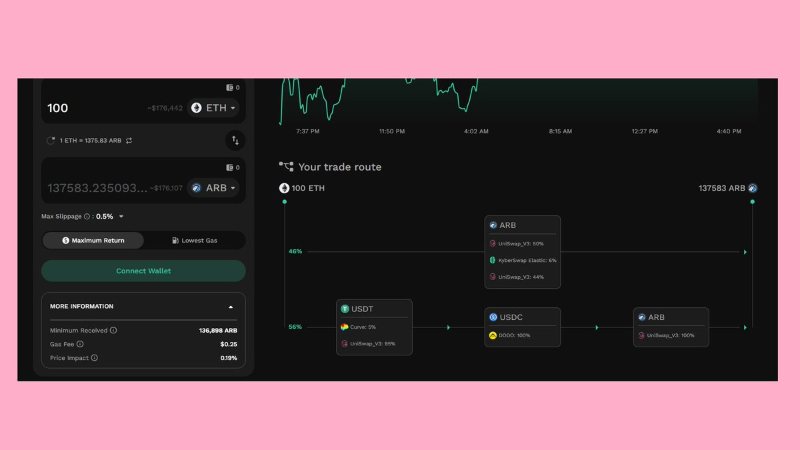

KyberSwap’s own DEX aggregator routes only about 2.8% of volume through its native pools, while the remaining 97% is routed via Uniswap.

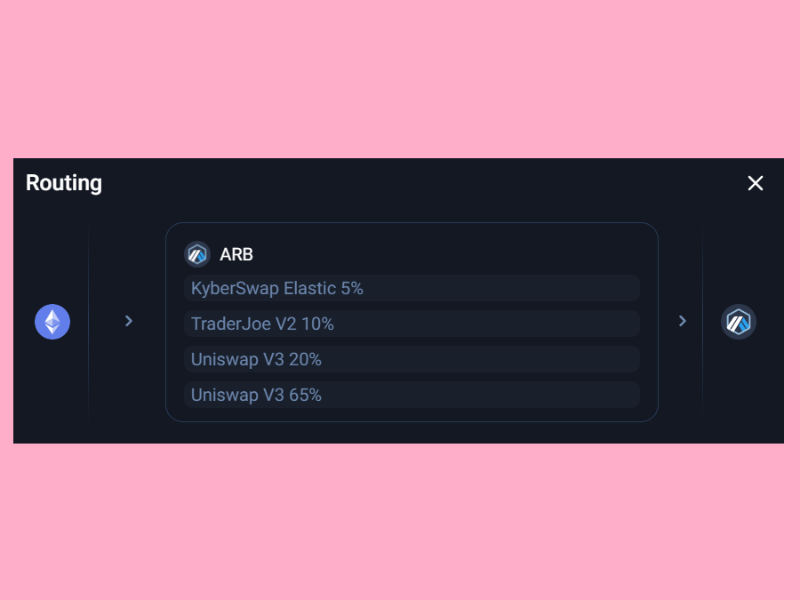

To make the test clearer, I decided to check how 1inch routes the same trade. This time, 5% was routed through KyberSwap, 10% through Trader Joe, and the remaining 85% through Uniswap.

This indicates that DEXs with concentrated liquidity offer the most efficient trading experience—liquidity truly is king.

While other DEXs compete aggressively by offering extra incentives to attract LPs, Uniswap dominates both TVL and trading volume without much effort. Inefficient DEXs like Camelot remain suitable options for users who don't want to actively manage positions but still seek higher rewards through additional incentives.

*Note:The APR shown for pools on KyberSwap is based on fees generated over 30 minutes (not 24 hours).

The 5% fee tier pool on KS will only see trading volume when the difference between the $ARB spot price and the $ARB price during this voting round exceeds 5%.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News