How to understand the prospects and differences between ZK and Optimistic Rollups?

TechFlow Selected TechFlow Selected

How to understand the prospects and differences between ZK and Optimistic Rollups?

People say that if there were an upgrade capable of increasing ETH L1's TPS by 100x and reducing gas fees by 100x, we wouldn't need Rollups—but is that really true?

Written by: Salazar.eth

Compiled by: TechFlow

People say that if there were an upgrade capable of increasing ETH L1's TPS by 100x and reducing gas fees by 100x, we wouldn't need rollups.

But is that really true?

Actually, no. The reason is the faster L1 becomes and the lower the gas fees, the faster rollups become.

So, would you choose a 100x L1 or a 10,000x rollup?

Ethereum scalability is one of the most discussed topics within the Ethereum community. As such, finding scaling solutions has been a top priority for multiple teams in the ETH ecosystem.

Currently, there are three popular approaches to scaling Ethereum: Layer 1 scaling (ETH 2.0), scaling on top of Layer 1 (Layer 2 scaling—state channels, Plasma, and rollups), and sidechains.

- Concerns about scalability within the Ethereum community have led to the development of multi-phase upgrades known as ETH 2.0.The goal of ETH 2.0 is to make Ethereum more scalable, secure, and sustainable.

- A sidechain is a separate blockchain connected to the main chain (ETH L1) via a two-way bridge. Sidechains use different consensus mechanisms and do not rely on the security of the main chain. This results in lower security compared to Layer 2 solutions.Many people mistakenly consider Polygon a sidechain. However, Polygon is actually a commit chain—a non-custodial sidechain whose consensus mechanism depends on the main chain (ETH L1).

- Layer 2 refers to any system built on top of Ethereum that inherits the security of ETH L1. These include Plasma, rollups, and state channels.

*In this article, we will focus specifically on rollups.*

Rollups are a common scaling solution that work by processing and executing transactions off L1, but publishing transaction data back to L1. This allows rollups to provide scalability while still deriving security from L1.

To achieve this, transactions in rollups are typically executed on a separate chain, which may run a rollup-specific EVM.

Next, transaction data is batched and published to ETH L1 by a sequencer.

This entire process involves executing transactions, collecting data, compressing it, and "rolling up" the transactions into batches on the main chain. Specifically, a batch of transactions in a rollup is aggregated into a state root (a compact witness), containing sufficient information to verify every transaction that occurred on L2.

How does Ethereum know the published data is valid?

Rollups deploy a set of smart contracts on L1 responsible for handling deposits and withdrawals, and verifying proofs. This proof mechanism is the key difference between Optimistic Rollups and ZK Rollups.

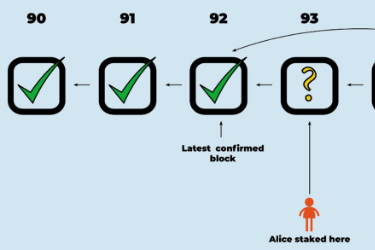

For Optimistic Rollups, transactions are published to ETH L1 under the assumption they are valid. In cases where a malicious actor submits invalid transactions, the network must detect them, revert the incorrect state, and penalize the fraudster.

To enable this, Optimistic Rollups implement a dispute resolution system capable of identifying invalid transactions and bad actors, preventing further fraudulent activity.

Optimistic Rollups require a "governance contract" to replay transactions executed on L1, ensuring their exact state matches the state when transactions were processed on the rollup.

Examples of Optimistic Rollups include Optimism, Arbitrum, and Cartesi—projects whose details can be easily found online. Now let’s turn to ZK Rollups.

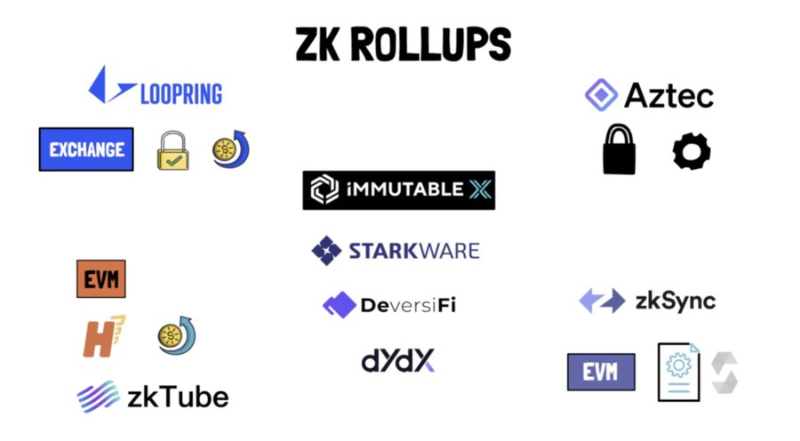

ZK Rollups use validity proofs (such as zk-SNARKs or zk-STARKs) to verify transactions and ensure their correctness before sending them to the ETH chain.

Ethereum ZK Rollups employ advanced mathematics and cryptography to guarantee that transactions are "settled" directly on the Ethereum mainnet, rather than relying on a dispute resolution system like Optimistic Rollups. Despite their complexity, teams have spent years refining complex transaction data into simpler proofs for efficient verification.

Just this year, three ZK EVMs have entered testnet phase, with some already live on mainnet—Scroll, Polygon Hermez, and Zksync 2.0.

Now, let's examine the differences between Optimistic Rollups and ZK Rollups.

Optimistic Rollups:

Slow fund withdrawals—Due to the dispute resolution mechanism, users are given a challenge period during which fraud proofs can be submitted before transactions are finalized.

Withdrawals can be slow; often, users must wait up to 7 days to withdraw funds back to L1. However, some projects now offer fast liquidity exit options to mitigate this issue.

EVM compatibility—Optimistic Rollups still require building their own version of the EVM. That said, in most cases, contracts can be ported from L1 to Optimistic Rollups without modification.

ZK Rollup:

Fast withdrawals—Since there is no dispute period, withdrawals in ZK Rollups are fast and accompanied by validity proofs once transactions are confirmed on L1.

EVM compatibility—Due to the complexity of zero-knowledge cryptography, most ZK Rollups (e.g., Starkware) are not natively EVM-compatible.

EVM-compatible ZK Rollups are known as ZK-EVMs. ZK-EVMs allow developers to port Solidity contracts from the Ethereum mainnet to the rollup without changing the underlying code.

Whether ZK, Optimistic, or sidechains, all are part of a race to enhance the ETH L1 mainnet, aiming to improve Ethereum’s scalability and advance blockchain technology.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News