As the ZK Rollup wave arrives, how does ZKX, a protocol in the StarkNet ecosystem, build a premium trading experience for users?

TechFlow Selected TechFlow Selected

As the ZK Rollup wave arrives, how does ZKX, a protocol in the StarkNet ecosystem, build a premium trading experience for users?

While Ethereum is still working on solving its scalability issues, it has so far been unable to support大规模 user adoption—decentralization is a double-edged sword.

While Ethereum continues to work on solving its scalability issues, it still cannot support mass user adoption—decentralization is a double-edged sword. Other high-scalability Alt-Layer1s have achieved higher performance by compromising on decentralization and security.

However, amid the bear market's harsh selection process, the influence of Alt-Layer1s has visibly declined. In contrast, Ethereum Layer2 solutions are becoming mainstream—Arbitrum and Optimism have gained market recognition, and many DeFi innovations are now emerging on Layer2.

Beyond Optimistic Rollup-based Layer2s, another major technical direction for Layer2 adoption is ZK Rollup. The reason we haven't yet seen widespread adoption of ZK Rollups is due to their complex algorithms, high technical barriers, and unfriendly development experience for application builders. This is precisely why Optimistic Rollups were able to capture the market first.

The growth of a blockchain depends on the prosperity of its ecosystem. Unlike Arbitrum, which has driven new innovation in DeFi protocols, the ZK Rollup ecosystem currently lacks a flagship protocol capable of aggregating liquidity. However, there is growing excitement as the $OP and $ARB airdrops have drawn more participants and developers toward ZK Rollups. Especially after zkSync announced the launch of its Era mainnet, according to L2BEAT data, the TVL (Total Value Locked) of zkSync Lite and Era surged to $160 million, while StarkNet’s TVL increased by 37% within seven days, reaching $23 million.

This surge in market interest will drive more capital inflows and encourage deployment of new protocols. Today, we introduce one such promising protocol—ZKX. Next, we’ll break down ZKX to analyze how protocols on ZK Rollup can unlock the potential of zero-knowledge proof technology.

Understanding ZKX

ZKX is the first decentralized perpetual futures exchange built on StarkNet with self-custody and community governance, launching its testnet on March 30. It raised $4.5 million in funding on July 14, 2022, led by StarkWare, with participation from Amber Group and Huobi.

The primary challenge in building on-chain products like ZKX lies in the demand for high blockchain throughput and strong liquidity. This is also why most users prefer centralized exchanges (CEXs) for perpetual futures trading. Another factor is that CEXs offer a user experience aligned with Web2 habits, whereas DeFi protocols often provide subpar usability.

Fortunately, the emergence of high-scalability, low-cost Layer2 solutions has largely resolved transaction speed issues. Liquidity, however, typically requires financial incentives from the protocol to bootstrap.

A classic example is GMX, built on Avalanche and Arbitrum, which uses GLP—a basket of assets—to establish liquidity. Users purchase and stake GLP to earn a share of platform trading fees while providing liquidity.

Although GLP solves liquidity, the range of tradable assets remains very limited.

Another approach comes from Gains Network’s DAI Vault, where users simply deposit DAI to earn a portion of protocol revenue. The protocol creates synthetic assets using DAI and relies on oracle price feeds to determine asset values. This design allows Gains Network to offer more perpetual futures markets. Currently, Gains Network has already deployed on Arbitrum.

So how does ZKX address these challenges?

-

First, it operates on a ZK Layer2. Compared to Optimistic Rollups, ZK Rollups based on zero-knowledge proofs offer faster verification, enabling quick deposits into and withdrawals from Layer2 back to Ethereum. To withdraw funds instantly from an Optimistic Rollup, users must rely on bridges, which introduces smart contract security risks. The efficient settlement of ZK Rollups makes them better suited for applications requiring fast settlements, such as trading platforms and payment systems.

Another advantage of deploying on a ZK Layer2 is that users can access it via account abstraction. This means they can create wallets without needing private keys or seed phrases, significantly lowering the barrier to entry. Currently, Argent—a wallet without seed phrases/private keys featuring social recovery—has already integrated with the StarkNet network.

-

Second, to tackle liquidity shortages, ZKX has brought in professional market-making teams such as Amber Group to ensure liquidity provision. These professional partners help solve DeFi liquidity and market depth issues. Additionally, ZKX has partnered with Huobi and Crypto.com to provide low-latency price feeds, mitigating single points of failure associated with oracles and bridges.

The ZKX team aims to build a product that establishes a decentralized, permissionless on-chain liquidity infrastructure for the ZK Rollup ecosystem. With ZKX, participants in the ZK Rollup ecosystem will gain the ability to trade futures directly on a decentralized order book.

Compared to dYdX, which previously used StarkNet’s Layer2 solution, ZKX’s advantage lies in being natively built on the StarkNet network—an ecosystem with greater long-term potential. Users are more inclined to keep assets within StarkNet and engage with various DeFi protocols, resulting in superior user experience. This also fuels anticipation for more native StarkNet protocols that can attract additional liquidity.

Why Trade Perpetual Futures on ZKX?

Beyond the advantages mentioned above, ZKX isn’t just replicating another identical DEX on a different Layer2 using AMM engines, synthetic asset models, or CLOB (Central Limit Order Book). Instead, the ZKX team aims to control everything end-to-end—they’ve built a network powered by decentralized nodes. This decentralized node network consists of nodes running consensus algorithms for decentralized order matching, supported by data providers, pricing engines, and trade-matching components.

By combining the strengths of both AMM engines and CLOBs, this node network delivers a superior user experience. According to estimates, the current node network can handle over 9,000 TPS in transaction volume. Building upon AMM and CLOB foundations, ZKX elevates the user experience to a new level.

A key feature is that because the node network is decentralized, the CLOB has been upgraded to a Decentralized Limit Order Book (DLOB). This permissionless DLOB enables direct interactions among users, smart contracts, and ZKX nodes, ensuring secure and reliable trading—the security aspect guaranteed by permissionless nodes. This represents ZKX’s biggest advantage and distinction from other DEXs.

In product design, ZKX introduces a concept called Data Provider Service (DPS). DPS primarily assists the protocol with price feeds. Once implemented, ZKX’s order book can verify all trade matching requests off-chain. DPS acts as a bridge between external data sources and ZKX’s internal pricing mechanism.

Additionally, users can switch between ZKX’s AMM mode and DLOB mode directly, without intermediaries, based on their preferences. All validations occur on StarkNet, and every trade matched through the order book is verified within the ZK Rollup and ZK Proofs framework, safeguarding user security and privacy.

Tokenomics

Although the ZKX token has not yet launched and specific distribution details remain undisclosed, we can explore its intended utility.

ZKX has designed its native token around a liquidity governance model closely tied to protocol growth. It separates voting rights from simple token ownership to prevent large holders ("whales") from steering the protocol solely based on personal interests—a common issue when whale incentives misalign with broader protocol goals.

Users can earn governance weight by trading, staking, providing liquidity, or becoming a decentralized node in the ZKX network. Each activity accumulates non-transferable, non-tradable governance score points. These scores unlock the following benefits:

-

Protocol revenue dividends;

-

Trading fee discounts;

-

Access to advanced features on the ZKX trading platform;

Moreover, ZKX incorporates a real yield model—staking ZKX tokens entitles holders to a share of protocol revenues.

UI/UX

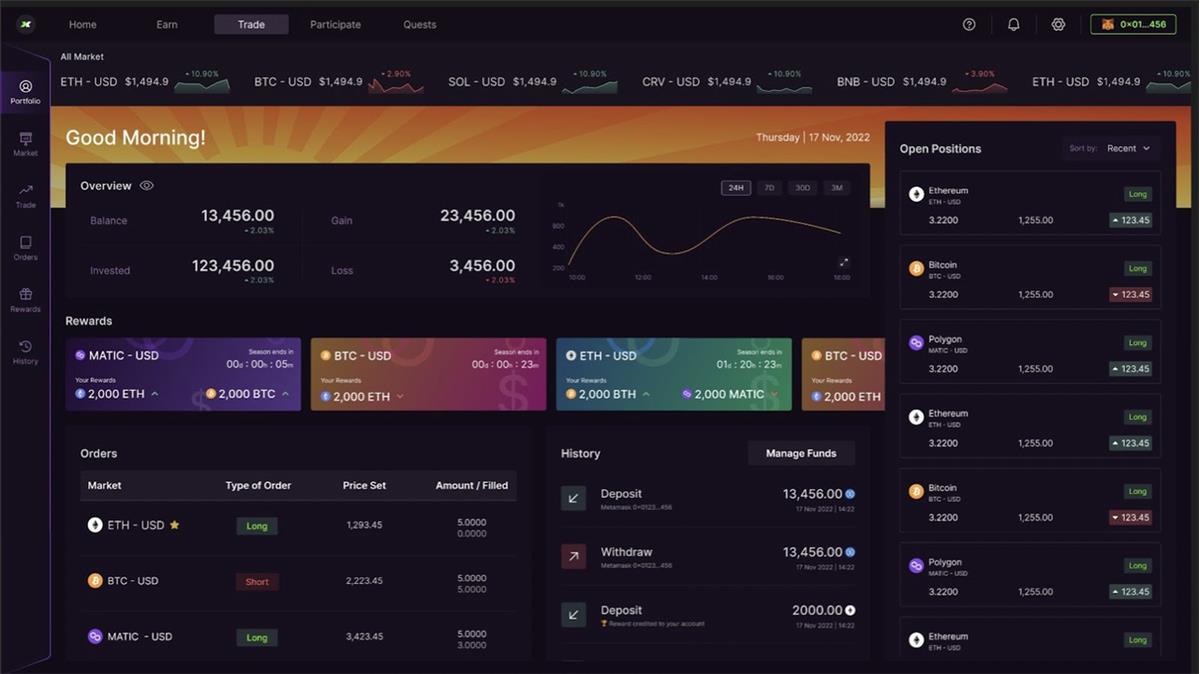

To attract broader participation, the team has designed an intuitive interface and smooth user experience. ZKX also incorporates gamified elements to guide user engagement.

For deposits and withdrawals, ZKX offers seamless cross-layer transactions. Users can directly deposit funds from Layer1 to Layer2 and participate in derivatives trading. Withdrawals from Layer2 back to Layer1 are equally seamless.

Furthermore, ZKX offers three distinct UI modes—Standard, Advanced, and Professional—to accommodate users of varying experience levels.

Community and ZKX Yakuza

Another notable aspect is ZKX’s community-building strategy. As mentioned earlier, ZKX employs gamification, which plays a crucial role in fostering community engagement.

This gamification system is called Yakuza. Designed as a narrative-driven program, Yakuza allows users to choose from eight unique characters based on personal interest, each contributing to community development in different ways.

For example, selecting Oyabun—the leader of ZKX DAO—assigns you the task of reading Oyabun’s blog, which tells a sci-fi-inspired fictional backstory, instilling a sense of mission into ZKX’s community development.

Other roles include Miss Saiko-Komon, a core contributor who guides users on becoming core contributors; Komon, the ZKX DAO moderator who helps users become moderators; Wakagashira, the ZKX ambassador guiding others to become ambassadors; Shateigashira (Level 1 OG), Kyodai (Level 2 OG), and Shatei (Level 3 OG), who assist users in completing Crew3 tasks and advancing within the community OG ranks.

Initially, every user starts at OG Level 4. By completing designated challenges, users can progressively advance up to Level 1. In the future, ZKX plans to offer economic incentives through DAO bounties, distributed as NFTs and token unlock rewards.

Yakuza spans three seasons from January to May. ZKX launched Season 1 on January 25. Season 1 has concluded, and Season 2 is underway, with over 9,000 users and 30 ambassadors from 10 regions completing more than 320,000 tasks and earning over 700 rewards.

Season 2 offers users three opportunities to win rewards:

-

March 27–30: Participate in the closed testnet using DegenScore credentials;

-

March 30–April 14: Join the public testnet;

-

April 14–May 1: Take part in a trading competition, with prizes awarded to top performers;

This gamified community-building approach is unprecedented. It serves two purposes: first, filtering genuine contributors from mere airdrop hunters by rewarding actual participation; second, engaging potential contributors in a fun and meaningful way, encouraging value creation within the ZKX community.

To date, ZKX’s Discord server has grown to 44,000 members, with a quarter deeply involved in early-stage contributions that helped shape the protocol’s development.

How to Join the ZKX Testnet?

Wallet Setup

Connect your ZKX testnet account using Metamask, Coinbase Wallet, or Wallet Connect by signing in. Note: You use your Ethereum Layer1 wallet to create an account on the ZKX testnet. The testnet will automatically generate a corresponding StarkNet Layer2 wallet. You can manage all funds, positions, orders, and trades through this StarkNet Layer2 wallet. Testnet users can control this Layer2 wallet directly via either their Layer1 or Layer2 wallet interface. Each test user receives 10,000 USDC in test funds.

Faucet (Claim Gas)

Although you have 10,000 USDC in test funds, you need Goerli ETH to cover gas fees. Visit any of the following websites to claim Goerli ETH:

「https://goerlifaucet.com/」

「https://faucet.paradigm.xyz/ 」

「https://faucets.chain.link/goerli」

「https://goerli-faucet.mudit.blog/」

「https://www.allthatnode.com/faucet/ethereum.dsrv」

Trading

After setting up your wallet and claiming gas, you can begin trading BTC-USDC and ETH-USDC pairs on ZKX. The testnet supports six order types: market, limit, stop-limit, stop-market, take-profit limit, and take-profit market. Three interface views—Standard, Advanced, and Professional—are available to suit different user needs. Each market allows holding both long and short positions simultaneously. Limit orders come with various parameters including time-in-force policies, order cancellation options, and post-only settings. Leverage is available up to 20x. Deposit functionality is currently unavailable.

Refer to: https://zkx.fi/blogs/how-to-trade-on-zkx

Economic Incentives

Testnet participants can earn Yakuza NFTs (based on their rank within ZKX Yakuza) and future $ZKX token rewards. Participation requires joining the ZKX Discord server.

Final Thoughts

Although ZK Rollups are known for their high technical complexity, the launch of the Era mainnet proves one thing—ZK Rollups are becoming a reality. Taking ZKX as an example, protocols built on ZK Rollups are continuously learning from predecessors to optimize user experience. This suggests two significant improvements ahead in the blockchain adoption wave:

-

Faster transaction speeds;

-

Better user experience;

Another standout feature of ZKX is its community-building strategy—through gamified activities and economic incentives, ZKX has tightly united its early community. With product testing beginning on March 30, the protocol is moving closer to reality. The testnet phase presents a valuable opportunity for early adoption—offering both economic rewards and the chance to experience cutting-edge trading powered by ZK Rollup and crafted by ZKX.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News