Taiko Labs Analyzes the Decentralization Path of Rollups: Shared Sequencing and the Ethereum-Based Dilemma

TechFlow Selected TechFlow Selected

Taiko Labs Analyzes the Decentralization Path of Rollups: Shared Sequencing and the Ethereum-Based Dilemma

Based Rollup provides a solution to liquidity fragmentation and full composability with L1 through its characteristics.

Author: Taiko Labs

Compilation: TechFlow

Key Takeaways

A rollup-centric roadmap has led to fragmentation and isolation of blockchains. This fragmentation results in a lack of value transfer between rollups. To address this, shared sequencing mechanisms such as Espresso, Astria, and Radius have emerged. However, these solutions inherently require new trust assumptions, since such layers must possess their own security set.

If we want to build a shared sequencing layer for rollups, Ethereum is the most credible neutral base upon which we can build or rely. Rollups based on Ethereum (i.e., Based Rollups) are natively fully composable with Ethereum and other Based Rollups. Yet, being a Based Rollup comes with challenges. The most significant is matching Ethereum’s block time—limited to 12 seconds. Solutions include introducing fast confirmation mechanisms like centralized sequencers, or accelerating Ethereum's block time itself. On testnets, preconfirmations based on Ethereum have already proven faster than current centralized sequencers.

The Crossroads

Looking back at the beginning of this article, the direction Ethereum chooses is critical. From day one, Ethereum has embraced decentralization as its top priority. This choice imposes certain limitations on user experience, stemming from the inherent challenges of designing decentralized distributed systems—such as managing global state and sequential execution. This is precisely what differentiates Ethereum from other L1s, which have taken alternative paths. Other L1s prioritize speed and low cost by sacrificing some degree of decentralization. They achieve speed and affordability through concepts like proof-of-history, larger block sizes, and parallel processing. These enable fast and cheap transactions but increase the burden on validators—this is why hardware requirements for validators on other L1s exceed those of Ethereum.

Pending Ethereum’s own scalability upgrades—such as state expiration, statelessness, and Verkle trees—we’ve delegated execution tasks to rollups.

Four years ago, Ethereum adopted a rollup-centric roadmap, outsourcing execution to create a more user-friendly environment until core improvements arrive. Thanks to this, Ethereum now averages around 250 TPS daily across all rollups.

rollup.wtf

As noted above, it has been four years since Ethereum committed to the rollup-centric path. During this time, L2s have conducted extensive experiments on “what Ethereum itself should be.” These include AltVMs (Fuel, Fluent), zkVMs (Aztec, Starknet), zkEVMs (Scroll, Linea, zkSync), and parallel EVMs (MegaETH). All provide valuable insights into Ethereum’s future. But they’ve also created numerous isolated blockchains with little to no interconnection. This fragmentation is exactly why shared sequencing layers have emerged.

Shared Sequencing Layer

Currently, rollups use centralized sequencers, introducing major risks around censorship, liveness, and MEV extraction. To become decentralized, rollups can adopt a shared sequencer. By using a shared sequencer, rollups gain finality, decentralization, fast transactions, and cross-chain atomicity. As Vitalik noted: “Decentralizing a rollup requires 90% of the effort needed to build a new L1.” Hence, choosing a shared sequencer avoids much of the engineering complexity of decentralization.

A shared sequencing layer essentially connects the sequencing rights of participating rollups to a single network of sequencers. It runs a consensus protocol—like BFT—and allows anyone to participate (within the design constraints of the protocol). Thus, multiple rollups share a common mechanism for transaction ordering, enabling fast L2 finality and composability across all participants.

A shared sequencing layer functions as a marketplace for sequencing. In this market, rollups can sell their blockspace (and proposal rights) slot-by-slot to the highest bidder. This also creates a layer that redistributes MEV across all participating rollups.

Concerns

Shared sequencing layers benefit from network effects, enabling atomic composability and shared MEV across all connected rollups. Rollups join the network to increase the value of their blocks (while decentralizing their sequencers).

However, depending on the system design, the number of participating rollups must remain high. If a major participant like Rollup X exits, MEV redistribution breaks down, directly weakening the network effect. Thus, shared sequencing is an endless game—participants must stay engaged. As Rushi put it, this is a pure B2B model.

Alongside the sequencing market, shared sequencing layers run protocols like BFT to achieve fast L2 finality, introducing honest-majority assumptions—specifically, that at least half of the validators are honest. If half go offline or act dishonestly, the chain may lose liveness (though fallbacks based on Ethereum can be used). If the BFT protocol fails, participating rollups lose access to fast finality, as they depend on BFT attestations. Withdrawals from the layer would also halt. However, even if BFT fails, MEV redistribution may continue—e.g., in Espresso, MEV redistribution is decoupled from the BFT protocol. In contrast, Ethereum remains the strongest BFT protocol in terms of cryptoeconomic security and liveness.

Additionally, if restaking is used, restaking risks arise. High hardware requirements could lead to validator centralization. If restaking services fail, mass slashing could occur; see Eigenlayer’s risk FAQ for details. For research on restaking in shared sequencers, see the joint study by Nethermind and Fourpillar here.

It’s important to note that since shared sequencers rely on preconfirmations, this process could instead be done directly on L1 (i.e., based preconfirmations), eliminating the need for a new layer. Also, shared sequencers still ultimately pipeline data through L1. Therefore, "fast finality" here offers limited advantage.

In summary, if a shared sequencing layer lacks decentralization and robustness, it becomes a single point of failure—the weakest link for every rollup that opts in.

Neutral Composability Is No Longer a Joke: Go Based

As previously stated, Ethereum is the most credibly neutral foundation for building diverse applications. Rollups leverage Ethereum as a data availability layer by sending batches and proofs to it. Currently, most rollups are managed by centralized sequencers, where all transactions are ordered by the rollup team. Some teams are still working on designs to decentralize their networks—for example, Aztec’s Fernet. Another way to achieve decentralization without massive engineering investment is via a based sequencing approach.

Taiko is the first Based Rollup using Ethereum as its sequencing layer. Block production is entirely dependent on Ethereum. Anyone can propose a block—an entirely permissionless process. Each rollup can achieve composability via Ethereum, avoiding the addition of another layer. Since the slots of Ethereum and Based Rollups move in sync, they are fully compatible. This enables, for instance, a flash loan on L1 to be followed by an action on a Based Rollup within the same slot (thanks to our BBR design; see here for details). However, basing on Ethereum also comes with trade-offs.

Source: L2Beat

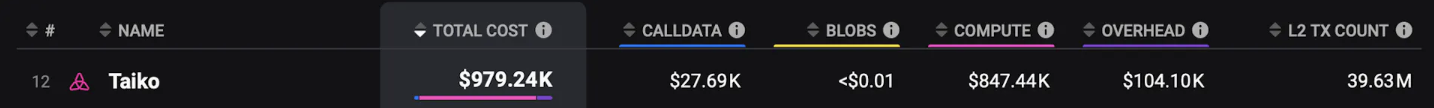

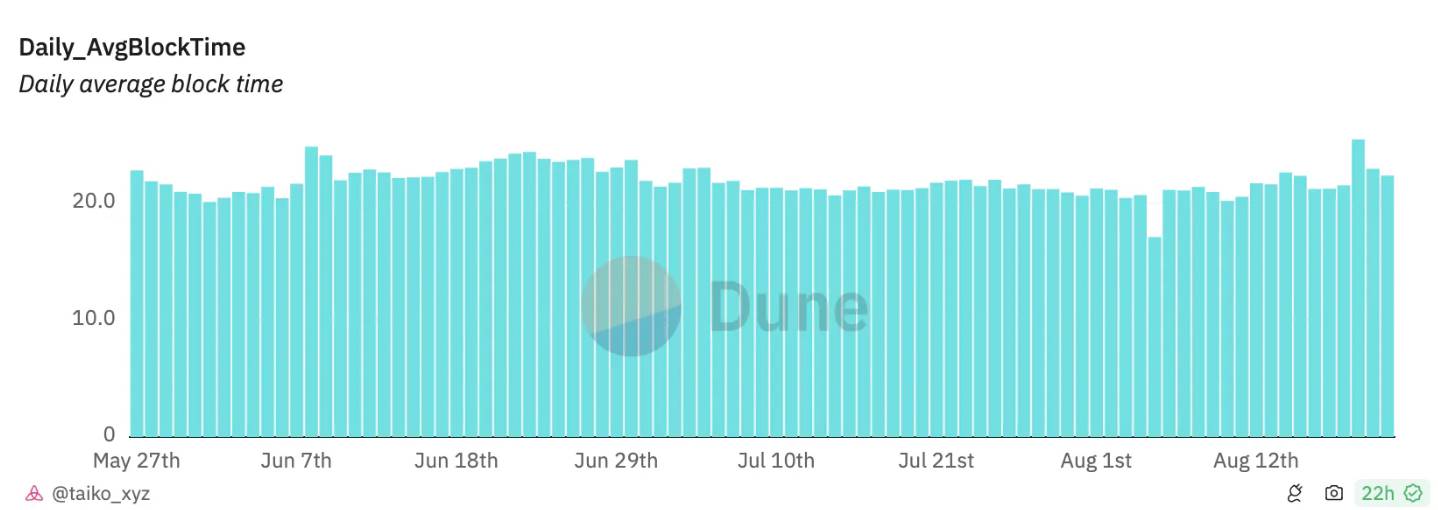

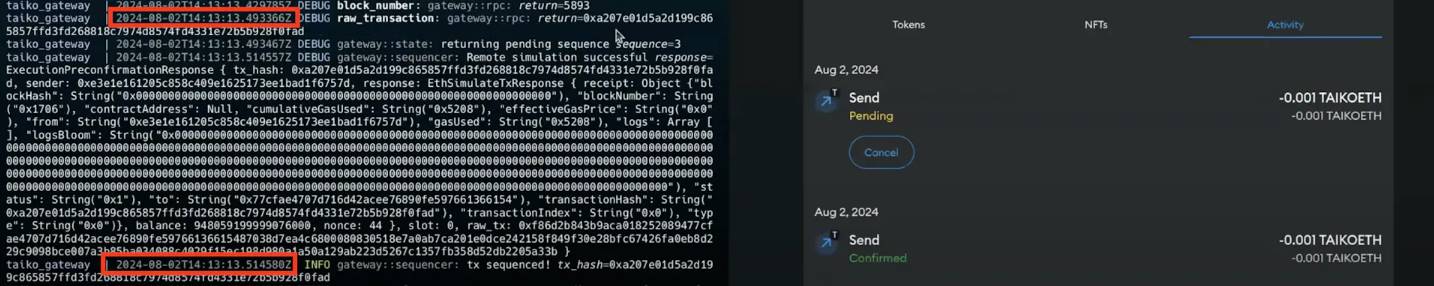

We discussed this issue in our article "Considerations for Rollup-Centric Design in Based Preconfirmations", but let’s briefly summarize. As mentioned, Based Rollups inherit Ethereum’s 12-second block time. This means a Based Rollup must send its data to L1 every 12 seconds via blobs (or calldata). If insufficient L2 transactions exist to fill a blob and cover L1 fees, the rollup operates at a loss. To avoid passing this cost to users, we initially absorbed it ourselves, spending substantial funds. Now, proposers’ average block times exceed 12 seconds (around 20 seconds) to ensure profitability.

These illustrate the challenges faced by Based Rollups, exemplified by Taiko’s case. In short, the main issues are block time and revenue constraints imposed by base fees—not centralized sequencers. You sacrifice revenue because sequencing is fully permissionless, and all your MEV flows to Ethereum, leaving no value capture from transactions (Spire Labs is developing a framework to improve revenue models for Based Rollups).

To solve UX and block time issues, we have two options:

-

Based preconfirmations

-

Faster block times on L1

Based Preconfirmations

Based preconfirmations simply use a subset of L1 validators to provide preconfirmations for L2 users. Currently, based preconfirmations are successfully running on the Helder testnet, enabling lightning-fast transactions on Taiko (20ms in Gattaca’s demo, compared to ~260ms on Arbitrum).

Demo of preconfirmations based on Titan

In based preconfirmations, you do not inherit Ethereum’s full liveness and security. Instead, you trust only a subset of Ethereum validators. Notably, these commitments come from current Ethereum proposers. Anyone can become a preconfirmation provider by staking a certain amount of ETH in a registration contract. We detailed how based preconfirmations work in a prior blog post—see here.

The space for based preconfirmations is still early and evolving. It faces threats similar to centralization in Ethereum block building, but ongoing research and new approaches will yield better architectures. We’ll soon share our preconfirmation design.

Faster Blocks?

No one would reject making Ethereum more user-friendly. Faster finality, shorter block times, and quicker transaction processing represent the ideal scenario for Based Rollups. As noted, L1 block time is currently the only bottleneck for becoming a Based Rollup. Faster L1 blocks mean faster Based Rollup blocks.

The main idea for faster L1 is adopting a consensus mechanism that reduces slot duration. Single Slot Finality (SSF) is one such mechanism under consideration—specifically Orbit SSF—where finality could occur within seconds per slot. Under current Gasper, finality takes two epochs—about 13 minutes. However, SSF has drawbacks, such as vulnerability to 33% inactivity leaks.

The key question is: if a faster L1 is always necessary, why spend four years of engineering effort on rollups instead of accelerating L1 itself? We’ve invested heavily in R&D on rollups, exploring various approaches. Even if consensus were reached today on shorter block times, implementation would take at least 2–3 years.

Ethereum has chosen a clear path—one that makes no compromise on decentralization and protects solo stakers. Clearly, faster blocks require changes to Ethereum’s consensus, which could reduce validator distribution. This is a crucial decision for the Ethereum community.

Conclusion

As rollups grow and proliferate, fragmentation and isolation have become serious problems. Thus, being a Based Rollup versus joining a shared sequencing layer represents a fundamental distinction. Shared sequencing layers offer fast finality and cross-chain composability but introduce new trust assumptions and potential points of failure, risking loss of network effects. Based Rollups leverage Ethereum’s existing infrastructure for block production but face challenges in block timing and revenue models. Nevertheless, they offer a genuine solution to liquidity fragmentation and full composability with L1.

The path forward likely lies in new solutions like based preconfirmations and faster L1 block times—overcoming the drawbacks of Based Rollups while staying aligned with Ethereum’s principles. The goal is to enhance user experience without compromising on Ethereum’s vision.

Creating a scalable, decentralized, and user-friendly ecosystem—true to Ethereum’s original mission.

The choice to build on Ethereum is not merely technical—it defines the direction of decentralized rollup “frameworks.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News