What kind of competitive landscape will ZK Rollup and Optimistic Rollup form in the future?

TechFlow Selected TechFlow Selected

What kind of competitive landscape will ZK Rollup and Optimistic Rollup form in the future?

After Optimistic Rollup gained momentum, ZK Rollup is now迎来its spring.

Produced by: TechFlow Research

Author: Rain Sleeping in the Storm

Following the rise of Optimistic Rollup, Zk Rollup is now entering its spring.

-

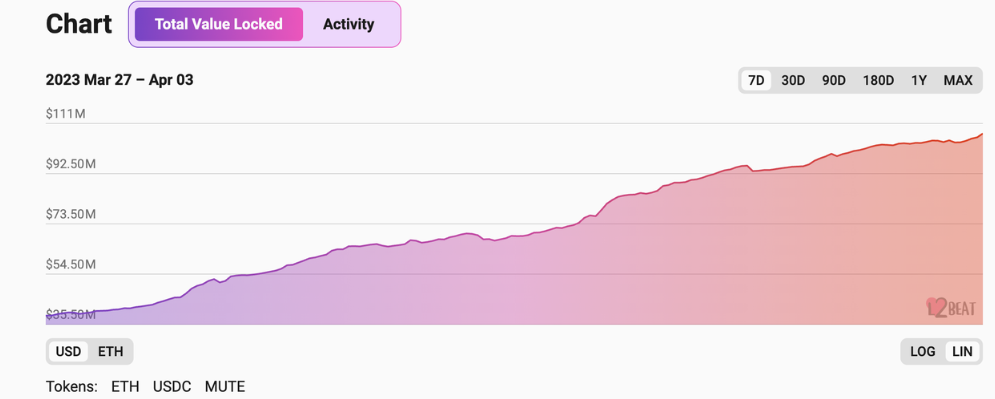

At a well-timed moment after the $ARB airdrop, Zksync announced the launch of its Era mainnet, leading to rapid growth in its TVL (Total Value Locked). According to data from L2BEAT, as of April 2, Era's TVL had already exceeded $100 million.

-

Another major event for ZK was Polygon officially launching the beta version of its zkEVM mainnet, with Ethereum co-founder Vitalik Buterin executing the symbolic first transaction.

From the perspective of airdrop hunters, the generous rewards from previous Layer 2 airdrops are attracting this group to widely enter the Zk Rollup ecosystem and participate in its protocols.

From the narrative hype standpoint, the release of the Optimism Rollup airdrop signals the short-term end of its narrative momentum. The market will now shift attention to newer trends—specifically, the newly launched ZK-based products emerging at this juncture.

Regardless, the broader crypto market remains optimistic about ZKP technology and the Layer 2 trend.

The advantages of ZKP-based Rollups over Optimistic Rollups include:

-

Faster speed and higher security: Optimistic Rollups using fraud proofs require trust assumptions and rely on honest nodes to verify transaction validity, whereas Zk Rollups only need to provide validity proofs to confirm transaction correctness.

-

Greater privacy: Leveraging ZKP technology, Zk Rollups ensure off-chain integrity, allowing provers to prove batch validity without revealing transaction details or requiring verifiers to re-execute all transactions before accepting new states.

However, because the EVM does not natively support ZK circuits, widespread adoption of Zk Rollups appears challenging. To lower the developer entry barrier, zkEVM has become the dominant paradigm in the Zk Rollup space. The core logic of zkEVM is that Zk Rollup solutions provide developers with an EVM-equivalent deployment environment, then translate code into a virtual machine compatible with ZK circuits to enable validity proofs supported by ZKP technology.

Underlying Concerns

Nevertheless, as the market embraces the ZK wave, Zk Rollups face new challenges:

Polygon zkEVM

When bundling transactions to send to Layer 1, it essentially involves a group of users crowdfunding fees to reduce individual costs. When there are many transactors, the shared cost naturally doesn’t burden Polygon much.

However, when transaction volume is low, costs cannot be evenly distributed, forcing Polygon to subsidize operations. This means if Polygon zkEVM lacks sufficient users, it must continuously absorb losses, creating significant financial pressure for the team.

Zksync Era

After a large influx of liquidity, Zksync attracted many users. Under this pressure, the zkSync Era mainnet experienced downtime, halting block production for approximately four hours.

According to the team’s post-mortem analysis, the issue stemmed from a database failure in the block queue, which stopped block production.

To prevent recurrence, Zksync added another layer of identity to its database monitoring agent, enabling it to continue functioning even during database failures.

In essence, both Polygon zkEVM and Zksync Era face the same core challenge: managing user demand and block sequencing.

-

On Layer 1, block ordering under incentive alignment has made MEV the standard solution for ordering games.

-

MEV technology on Layer 2, however, is still in early development.

Encrypted mempools may represent a promising direction for MEV—using ZKP technology to encrypt and decrypt user transactions while avoiding centralized censorship. Ultimately, encrypted mempools aim to ensure fair execution ordering.

The Renewed Vitality of Optimistic Rollup

Meanwhile, we must not overlook the strong resilience of Optimism.

Optimism has introduced OP Stack—a modular blockchain framework enabling developers to build highly scalable and interoperable blockchains. Coinbase has already launched a Layer 2 based on OP Stack. Additionally, voting for Optimism’s major Bedrock upgrade concluded on April 5.

Following Bedrock, Optimism will undergo a qualitative leap:

-

For developers: Improved EVM compatibility allows developers to migrate their dApps to Optimism with minimal code changes, addressing the long-standing issue of high deployment barriers.

-

For users: Faster deposits from Layer 1 to Layer 2 and lower data submission costs to Layer 1. The upgrade also introduces Cannon, a new interactive fraud proof system, reducing costs further.

-

For sequencers: Enables external teams to build a multi-client ecosystem with incentives, promoting decentralization and reducing single points of network risk.

-

For the ecosystem: Introduces diverse alternative proof systems including ZKP, no longer limited to fraud proofs alone.

Although Arbitrum is currently embroiled in controversy, the root cause lies in its lack of clear communication during early stages. Nevertheless, we cannot ignore the brand strength and influence Arbitrum’s ecosystem already possesses.

Currently, the Arbitrum ecosystem hosts over 262 protocols, including some of the most innovative DeFi projects. According to TokenTerminal data, it averages 164,000 daily active users over 30 days. In its 2023 outlook, Arbitrum stated it would focus on reducing fees, increasing TPS, and decentralizing validators, sequencers, and its DAO.

On the market side, Arbitrum plans to restart its Odyssey campaign and promote adoption of the Nova chain in social and gaming applications.

Conclusion

-

Viewing Layer 2 competition broadly, although ZK Rollup has long been a crypto buzzword, it has only recently gained massive attention. Currently, Zk Rollup strategies mainly involve launching new testnets/mainnets to attract more users and developer adoption.

-

Optimism, having fallen behind in competition with Arbitrum, needs to rapidly introduce superior products to recapture market attention.

-

Arbitrum, currently the temporary winner in the Layer 2 race, focuses more on market activities to strengthen its brand influence.

Overall, the competitive battleground between Optimistic Rollup and Zk Rollup centers on EVM equivalence, speed, and cost. At present, Optimistic Rollup holds a clear advantage in these areas.

-

As Steven Goldfeder, co-founder of Offchain Labs (Arbitrum’s development team), pointed out, he disagrees with the popular belief that "ZK Rollups can better replace Optimistic Rollups." zkEVM has yet to be fully realized in production environments, and currently, zk-Rollups are more expensive and less compatible than op-Rollups.

-

Conversely, ZK proponents argue that Zk Rollups offer equivalent security and higher capital efficiency (no challenge period required), and unlike Optimistic Rollups—which are constrained by fraud proofs and must execute on Ethereum—Zk Rollups face no such limitation.

This naturally leads us to wonder: Will Zk Rollup’s intense activity this year allow it to challenge Optimistic Rollup’s market share?

The answer is yes.

However, as Steven Goldfeder noted: “While many teams are steadily advancing zkEVM, it’s far from its ‘golden era’—any team pushing this narrative prematurely is harming the community.”

Pushing Zk Rollup adoption before zkEVM reaches maturity amounts to exhausting the ZK narrative.

We cannot accurately predict a project’s future trajectory based solely on technical superiority. Each Rollup project is leveraging its unique understanding of crypto technology and markets to compete for Layer 2 dominance. As discussed, differing starting positions lead to varied product and market strategies. Regardless, one thing is certain: Ethereum will ultimately emerge as the biggest winner.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News