IOBC Capital: Why Are Optimistic Rollups Less Secure Than ZK?

TechFlow Selected TechFlow Selected

IOBC Capital: Why Are Optimistic Rollups Less Secure Than ZK?

Fraud proofs + interactive proofs.

Vitalik said in 2021:

In general, my own view is that in the short term, optimistic rollups are likely to win out for general-purpose EVM computation and ZK rollups are likely to win out for simple payments, exchange and other application-specific use cases, but in the medium to long term ZK rollups will win out in all use cases as ZK-SNARK technology improves.(总的来说,我自己的观点是,在短期内,Optimistic Rollups可能会在通用EVM计算方面胜出;而ZK Rollups可能会在简单的支付、交易和其他特定用途的应用场景中胜出。但随着ZK-SNARK技术的改进,中长期来讲ZK Rollups会在所有应用场景中胜出。)

The most prominent ZK Rollup projects today have not yet launched their tokens, such as zkSync, StarkEX, StarkNet, Aztec, while among the two leading Optimistic Rollups, Optimism’s token is already listed and actively traded on major exchanges. Recently, with factors like interest rate hikes priced in, ETH2.0 approaching, and the sell-off pressure from OP airdrops largely digested, OP has shown strong price performance. Given this impressive market performance, many people naturally wonder: what exactly makes OP inferior to ZK?

Let me first list several key differences between Optimistic Rollup and ZK Rollup:

-

First, security: ZK Rollup is superior to Optimistic Rollup. zk Rollup submits new states to L1 along with cryptographic proofs, inheriting L1's security guarantees. In contrast, Optimistic Rollup does not include proofs when submitting new states to L1. When TVL grows large enough, miners could be bribed to exclude fraud proofs from blocks, increasing the risk of theft;

-

Second, scalability: ZK Rollup outperforms Optimistic Rollup. The practical throughput ceiling for Optimistic Rollup is around 500 TPS, whereas ZK Rollup exceeds 2000 TPS, with StarkEx reaching up to 9000 TPS;

-

Third, verifiable finality: ZK Rollup is better than Optimistic Rollup. zk Rollup achieves very short finality times—for example, zkSync finalizes within 10 minutes—while Optimistic Rollup requires a minimum of one week. This results in significantly lower capital efficiency for Optimistic Rollup;

-

Fourth, EVM compatibility: Optimistic Rollup is currently better than ZK Rollup. Optimistic Rollup is EVM-compatible, allowing existing Ethereum Layer1 DApps to migrate quickly and easily. As a result, Optimistic Rollup-based Layer2 projects currently rank high in TVL. However, this advantage will likely diminish as zkVM technology advances.

To understand why Optimistic Rollups are less secure and less capital-efficient than ZK solutions, we need to examine how Optimistic Rollups work. Let’s take Arbitrum Rollup as an example:

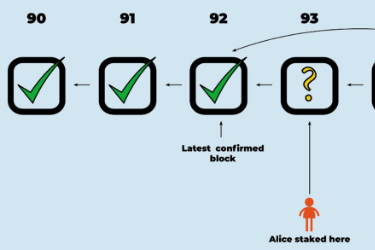

Arbitrum Rollup is an Optimistic Rollup. Its basic architecture is shown in the diagram below:

Arbitrum operates as a Layer2 protocol for Ethereum. EthBridge serves as the ultimate source of truth for events occurring on the Arbitrum chain and must maintain the chain’s Inbox and Outbox. Arbitrum’s execution environment is the AVM (Arbitrum Virtual Machine), which takes design inspiration from the EVM and remains largely unchanged in many aspects, enabling Arbitrum to support programs written or compiled for the EVM. Offchain Labs developed ArbOS as the operating system for Arbitrum. ArbOS provides an EVM-compatible execution environment for smart contracts, meaning EVM-compatible DApps can run directly on it—allowing seamless migration of DApps from the Ethereum mainnet.

All transactions on the Arbitrum Rollup chain are recorded on the Rollup chain itself. Executing transactions on Arbitrum still requires ETH gas fees, though they are significantly cheaper than on Layer1. Only raw transaction data is submitted to the Ethereum chain, while contract computation and storage occur on the Arbitrum Rollup chain. Optimizing transaction compression to minimize data published on Ethereum is crucial for reducing costs and increasing throughput on Layer2. For simple transfer transactions without calldata, benchmarks show Arbitrum can handle up to 4,500 transfers per second.

How is consensus achieved?

Arbitrum Rollup is an optimistic rollup, meaning it assumes all participants are honest by default. Therefore, no validity proof is required when assertions are published. Instead, it relies on a fraud proof mechanism to ensure correct consensus on the Layer2 network.

Arbitrum’s Fraud Proofs: When an assertion is published on-chain, the validator making that assertion must post a bond. During a challenge window, anyone who believes the assertion is incorrect can also post a bond to challenge it. Throughout the challenge period, the asserter and challenger engage in an interactive protocol, with on-chain contracts acting as referees. Eventually, the referee determines which party made a false claim and penalizes them by confiscating their bond.

So how does Arbitrum resolve disputes during the challenge period?

The core is Interactive Proving. This approach involves breaking down disputes into finer details to identify the critical point of disagreement, which is then adjudicated by a Layer1 Referee (L1裁判).

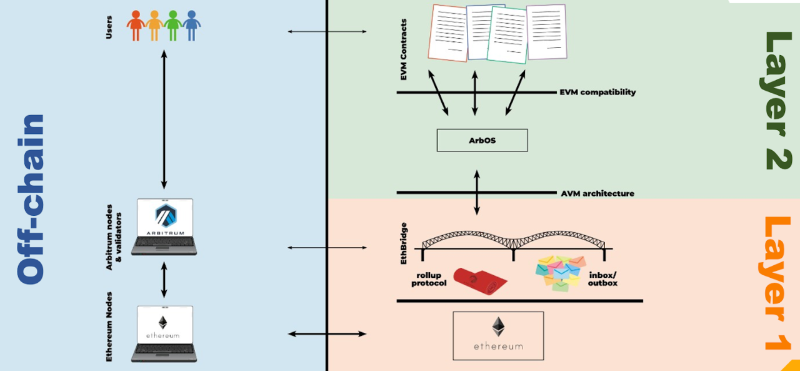

For example: Suppose Alice submits an assertion (claiming 93 is correct), but Bob disagrees and challenges her (claiming 95 is correct). If Alice’s assertion covers N execution steps, she publishes two sub-assertions, each covering N/2 steps, whose combination reproduces her original N-step assertion. Bob then selects one of these N/2-step assertions to challenge. Now the scope of the dispute is halved. This process continues iteratively, halving the dispute at each stage, until only a single execution step remains in contention. At that point, the L1 referee resolves the dispute by checking the actual operation of that instruction and verifying whether Alice’s claim about it was accurate.

The difference between Arbitrum’s interactive proving and Ethereum Layer1’s transaction re-execution is this: Re-executing a transaction requires simulating the entire transaction on-chain, whereas interactive proving allows Alice and Bob to narrow the dispute down to a single step, so the L1 referee only needs to simulate one step. This also highlights a key difference between Arbitrum and Optimism—Optimism re-executes the entire disputed transaction using the EVM.

From the above, we can see that the reason Optimistic Rollups are less secure and less capital-efficient than ZK solutions lies fundamentally in their different proof mechanisms.

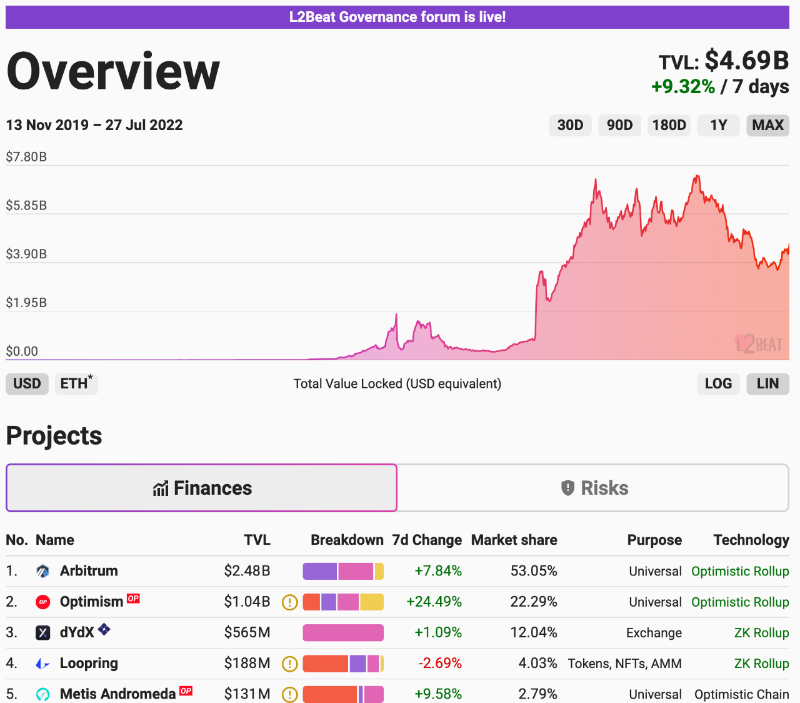

Returning to the original goal of scaling, compared to Ethereum L1 performance, Optimistic Rollup has already achieved the primary objective of scaling. Moreover, thanks to its EVM compatibility, Optimistic Rollup has seen solid development. On the Layer2 TVL leaderboard, the two leading Optimistic Rollup projects—Arbitrum and Optimism—rank in the top two, with TVLs of $2.48B and $1.04B respectively. The Arbitrum ecosystem hosts 249 protocols across 21 categories, while Optimism supports 179 projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News