A Comprehensive Analysis of Arbitrum and Its Ecosystem: Why It Leads the Layer 2 Race

TechFlow Selected TechFlow Selected

A Comprehensive Analysis of Arbitrum and Its Ecosystem: Why It Leads the Layer 2 Race

The deep reasons behind Arbitrum's advantageous position in the Layer 2 competitive landscape.

Original author: Xiao Jing, Bixin Ventures

In this article, we focus on Arbitrum's current development, analyze its technical advantages and ecosystem progress, and explore the deeper reasons behind its leading position in the Layer 2 competitive landscape. We believe that with a robust ecosystem of builders and continuous innovation, Arbitrum will continue to grow rapidly in the Layer 2 race for the foreseeable future and maintain its leading edge.

Overview

Arbitrum is an Ethereum-based Layer 2 scaling solution designed to allow developers to easily run EVM-compatible contracts and scale Ethereum protocols. Currently, the platform does not issue a native token since it supports trading of Ethereum-based assets.

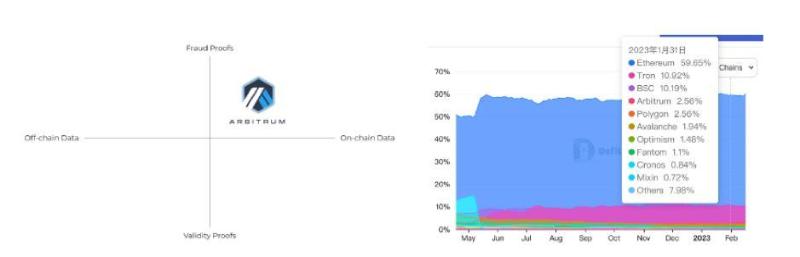

According to DefiLlama data, after January 31, Arbitrum’s TVL surpassed Polygon to rank fourth and has continued to widen the gap, consolidating its position. Projects such as the recently popular Treasure DAO ecosystem (Magic, The Beacon, etc.) and GMX—whose fees once exceeded those of Ethereum—are built on Arbitrum. As a representative Layer 2 platform, Arbitrum has attracted numerous high-profile projects through its technological and ecosystem advantages, drawing significant attention from investors.

Team Background

The development team, Offchain Labs, was co-founded by Ed Felten, a former White House technology official and Princeton University computer science professor, along with Princeton PhD students Steven Goldfeder and Harry Kalodner.

Offchain Labs Funding Information

Development Timeline

January 2021: DeFi Demo launched on testnet

May 2021: Testnet deployment

September 2021: Mainnet launch of Arbitrum One, accompanied by a $120 million Series B funding round

August 2022: Launch of upgraded Nitro version

February 2023: Development team announced plans to launch a new programming language, Stylus, for Arbitrum One and Arbitrum Nova later this year

Highest TVL Among Layer 2 Protocols, High Transaction Activity

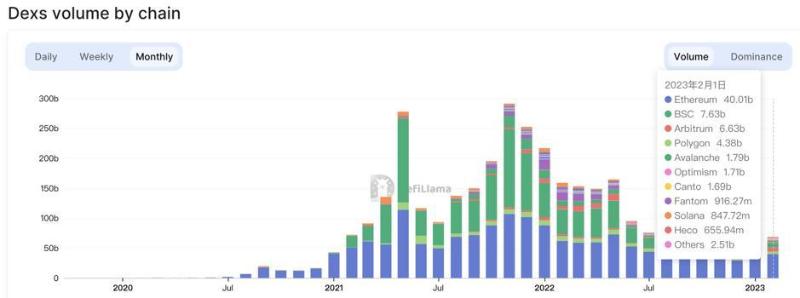

(Arbitrum ranks third across all chains in DEX trading volume)

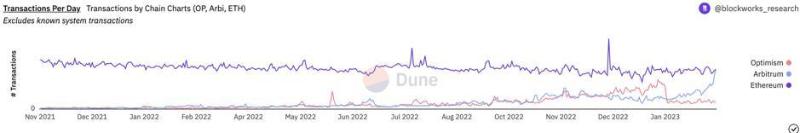

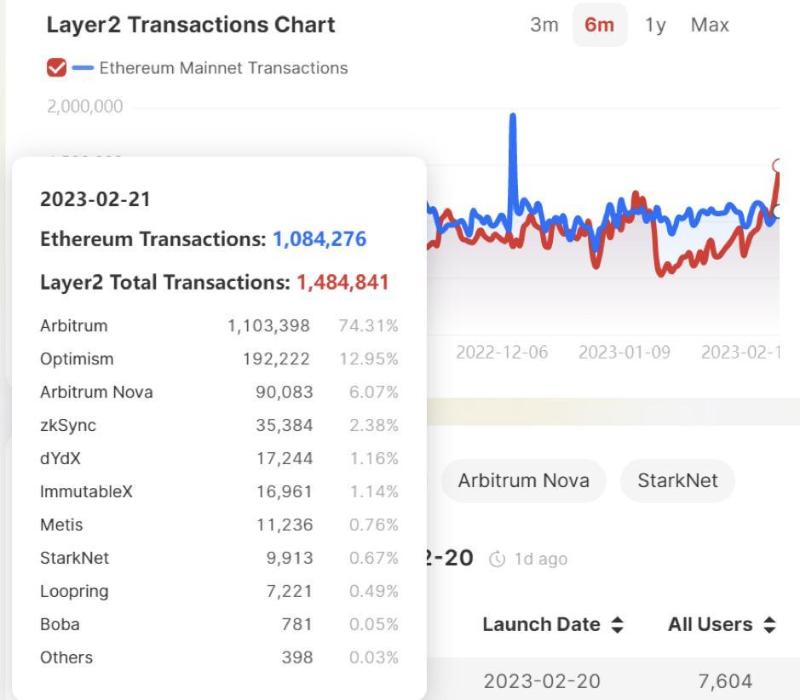

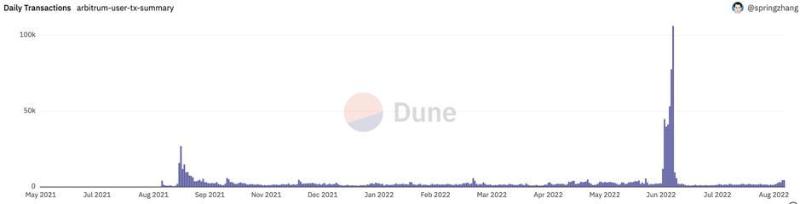

(Arbitrum’s daily total transaction count briefly surpassed Ethereum mainnet)

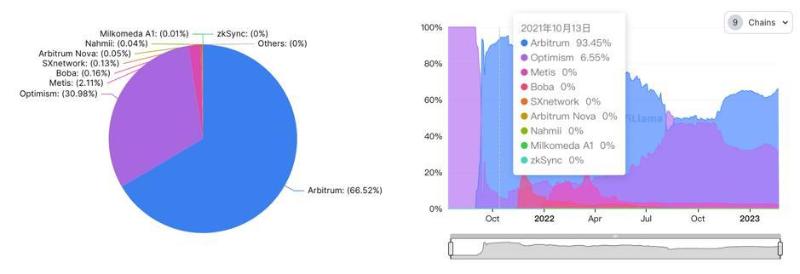

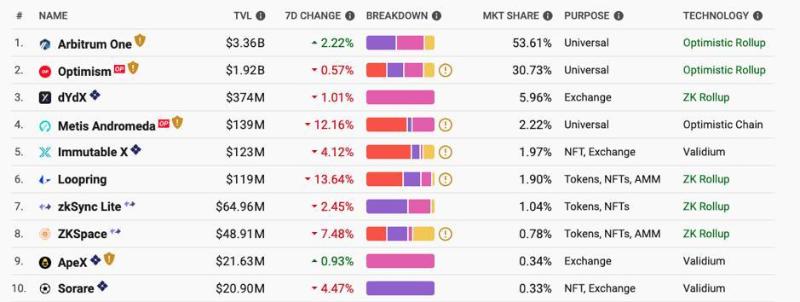

(Arbitrum holds a significant advantage among Rollup-based competitors)

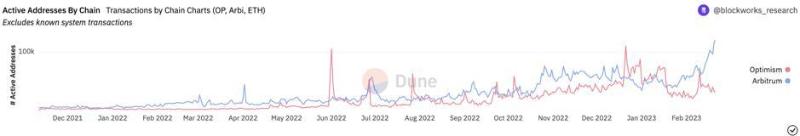

(Arbitrum’s on-chain active address count continues to rise, reaching four times that of Optimism)

(On February 21, Arbitrum's transaction throughput surpassed Ethereum mainnet; source: Dune)

Overall, Arbitrum’s current metrics are highly favorable.

Significant Year-on-Year Growth in Volume, Liquidity, and Traffic

After Optimism launched its token, it experienced rapid TVL growth in the short term; prior to that, Arbitrum held over 53% of the TVL share in the Layer 2 sector. Reviewing recent historical data, we can draw clear conclusions from overall trends.

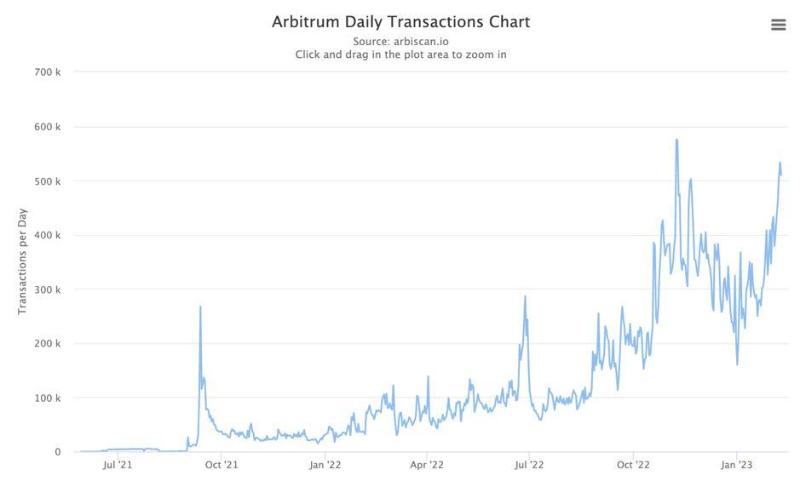

Firstly, Arbitrum One’s daily transaction volume increased by 600% year-on-year. Since early February, Arbitrum One has processed 40–50% of Ethereum’s transaction volume, reducing average costs by nearly 97% compared to L1.

(Source: Arbiscan)

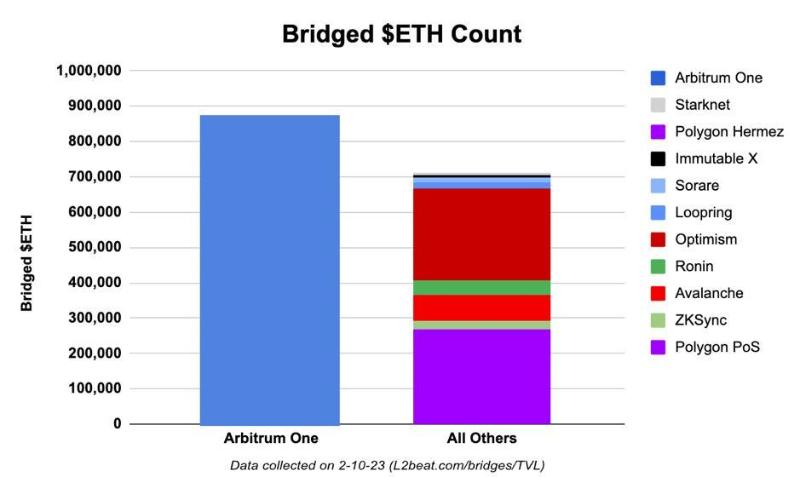

Additionally, liquidity on Arbitrum continues to grow. Currently, 87,000 ETH have been bridged to Arbitrum—more than the combined total of all other major scaling solutions. DeFi TVL grew 39% over the past month, while DEX trading volume increased 46% week-on-week.

(Source: l2Beats)

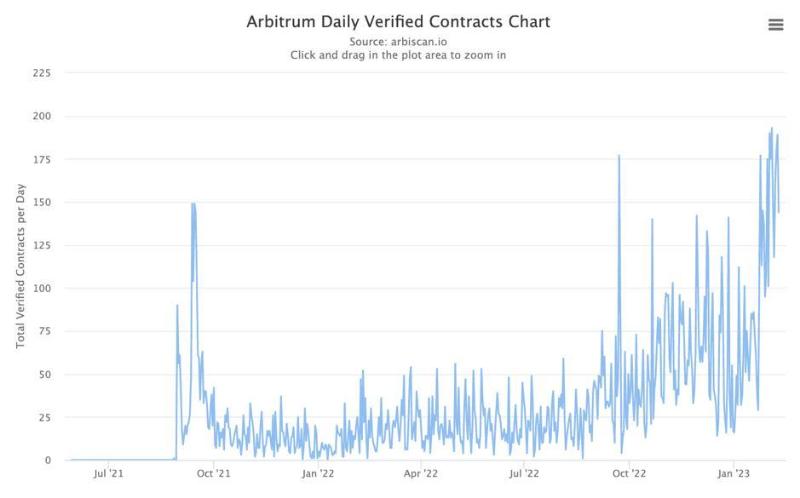

Meanwhile, verified contracts on Arbitrum grew over 50% quarter-over-quarter last quarter.

(Source: Arbiscan)

Technical Analysis

The Nitro upgrade drove rapid growth in liquidity and users, and the upcoming new programming language will further accelerate this trend.

Arbitrum’s ecosystem includes two public chains: One and Nova. The former refers to Arbitrum in the narrow sense, while the latter, based on AnyTrust technology and launched on August 10, 2022, suits high-frequency interactions and cost-sensitive use cases (e.g., GameFi, SocialFi). Their key difference lies in data storage location—Nova uses a Data Availability Committee (DAC) to significantly reduce costs. This analysis focuses primarily on Arbitrum One.

Currently, Arbitrum has released 28 versions on GitHub, progressing from testnet phases (Alpha, Beta) to Arbitrum V1.4. The latest version, Nitro, was introduced in August.

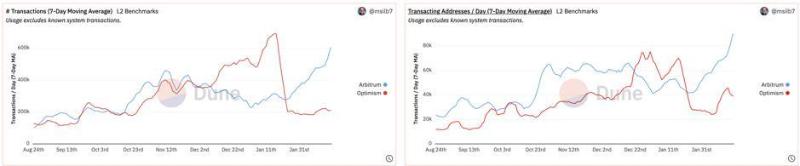

After completing the Nitro upgrade in September 2022, Arbitrum pulled ahead of Optimism in daily active users and transaction volume.

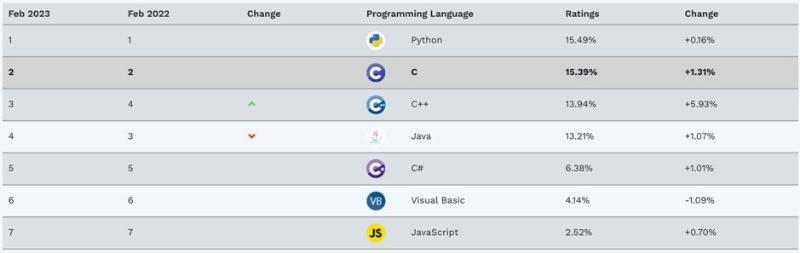

Moreover, the development team recently announced that the new programming language Stylus will be launched this year, enabling developers to build using Rust, C, and C++—three of the most widely used programming languages globally. This proposition is more compelling than Near’s appeal to JavaScript developers.

(Source: GitHub)

Binary Reduction of Proof Nodes for Cost Efficiency and Performance

Currently, blockchain scalability follows two main approaches:

Improving base-layer performance—horizontal scaling—via larger block sizes, higher parallelization, or sharding, as seen in monolithic chains, sidechains, or app-specific chains.

Modular blockchains—vertical scaling—offloading execution or other functions off-chain and verifying results on L1.

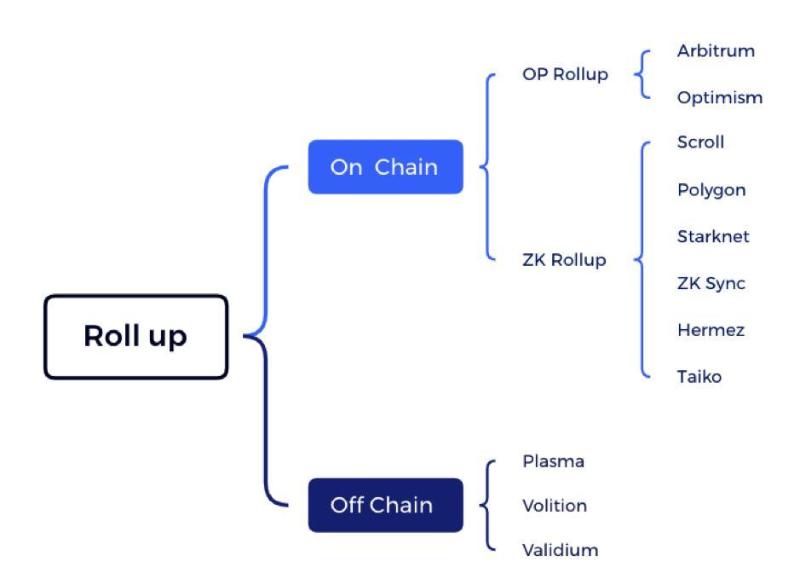

Vertical scaling for Ethereum is dominated by Rollups, which represent today’s mainstream Layer 2 solutions. ZkSync, StarkNet, Optimism, and Arbitrum all adopt the Rollup approach. However, ZK Rollup platforms like zkSync and StarkNet still face immature contract deployment methods. Meanwhile, Optimism’s Optimistic Rollup, which relies on fraud proofs, suffers from slow withdrawal times.

(Source: MoleDAO)

Compared to Optimism, Arbitrum implements minor improvements by applying binary search to dispute resolution, proving only specific nodes rather than entire transactions. Additionally, Arbitrum Nova employs the more efficient AnyTrust technology, which assumes minimal trust—that at least two DAC members are honest—greatly reducing transaction costs.

Furthermore, Arbitrum supports non-EVM contracts within its EVM-synchronous execution environment and allows custom precompiles to reduce costs. Nitro’s WASM-based design creates significant structural advantages for EVM+ innovation, enabling simultaneous development of both Rust and Solidity contracts on Arbitrum even before full ZKEVM implementation.

Layer 2 Competitor Analysis

(Source: l2beats)

In the Layer 2 space, the primary technical paths are Optimistic Rollups ("Op-series") and Zero-Knowledge Rollups ("ZK-series"). Compared to its peers, Arbitrum holds clear advantages.

First, in terms of user experience, Op-series platforms like Arbitrum and Optimism are fully compatible with Ethereum and can be used directly via MetaMask, giving them an edge over ZK-based zkSync and StarkNet. Secondly, their first-mover advantage has enabled them to attract high-profile projects with strong community followings—such as Sushi—potentially creating durable ecosystem moats.

By contrast, ZK-series solutions face greater technical complexity, lack EVM equivalence, and have underdeveloped ecosystems, resulting in long development cycles. In the current environment, achieving a narrative comparable to that of a standalone L1 chain remains difficult. While ZK infrastructure progress is worth watching, and ZK may ultimately prevail in fundamental efficiency, the Op-series currently presents a more attractive investment opportunity.

Within the Op-series, EVM equivalence, low development barriers, and rapid maturation of applications have created effective ecosystem barriers. A closer look at the Arbitrum vs. Optimism comparison reveals:

From the data, Arbitrum has overtaken Optimism in transaction count and active addresses this year, establishing an upward trend in both metrics and TVL. While Optimism has launched its OP token (currently used only for governance), the prospect of a future Arbitrum token makes it more intriguing for profit-driven Web3 participants.

(Source: Dune)

Why is there strong token speculation? Without a token, relying solely on gas fee revenue (if any) would be unsustainable. Evidence from competitors reinforces this view—Optimism has already launched its token, and StarkNet has announced token plans, heightening expectations for an Arbitrum token launch.

Overview of High-Quality Ecosystem Projects

The prosperity of an on-chain ecosystem is the ultimate measure of a chain’s value, with projects, developers, and users serving as its core components. This section introduces leading projects and strategies across various sectors on Arbitrum to illustrate the vibrancy and maturity of its ecosystem.

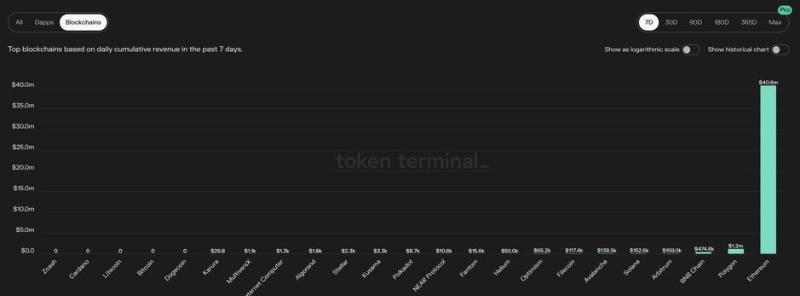

(Arbitrum ranks fourth in weekly on-chain revenue, behind only ETH, Polygon, and BNB Chain; source: TokenTerminal)

As previously noted, Arbitrum’s ecosystem consists of two chains: Nova, suited for gaming and social applications, and One, ideal for DeFi and NFTs. Let’s begin with DeFi.

GMX

Noticing Arbitrum’s strong performance during the bear market, many top-tier DeFi projects—including Uniswap, SushiSwap, Aave, Curve, and gTrade—have expanded to or migrated onto the chain. Much of Arbitrum’s DeFi ecosystem revolves around GMX, the number one DeFi application by TVL across all chains.

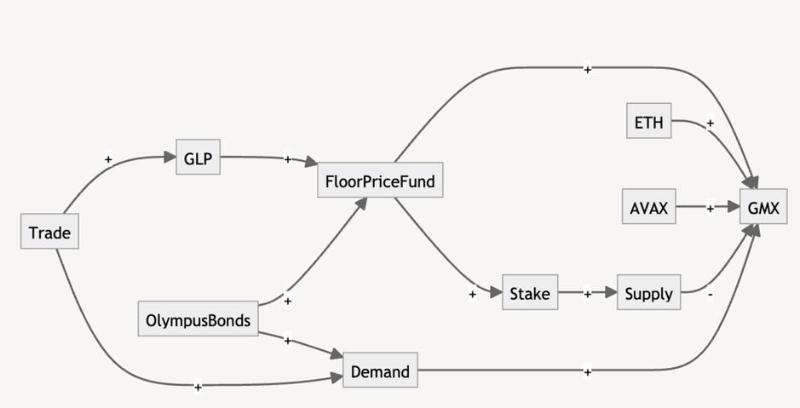

GMX is a decentralized derivatives trading platform on Arbitrum and Avalanche, supporting up to 30x leverage and no KYC requirements. Its tokenomics are carefully designed, as illustrated below:

Staking GMX earns users unvested GMX tokens, multiplier points, and ETH/AVAX rewards. Detailed reward information is available here.

30% of fees from swaps and leveraged trades are converted into ETH/AVAX and distributed to staked GMX holders. Distribution is based on net fees after deducting referral rewards and keeper network costs (~1% of total fees).

GMX maintains a floor price fund in the form of ETH and GLP. The GMX/ETH liquidity pool belongs to the protocol and generates fees that are converted into GLP and deposited into the floor price fund. 50% of funds received via Olympus bonds go to the floor price fund; the other 50% supports marketing.

The floor price fund ensures GLP liquidity and provides a stable stream of ETH rewards to GMX stakers. When the fund grows and its value per GMX supply falls below market price, it is used to buy back and burn GMX tokens, thereby pegging GMX’s minimum price to ETH and GLP. (It may also be used for bug bounties when necessary.)

Uniswap’s GMX liquidity gradually increases as the GMX price rises. Funds are held in a multisig wallet shared with XVIX and Gambit migrations.

Maximum supply is projected at approximately 13 million. Any minting beyond this cap is subject to a 28-day timelock, applicable only during new product launches or liquidity mining campaigns. All changes require prior governance voting.

As the ecosystem expands, GMX’s products have inspired developer innovation around GLP, including Rage Trade, GMD, Jones DAO, and PlutusDAO.

Rage Trade

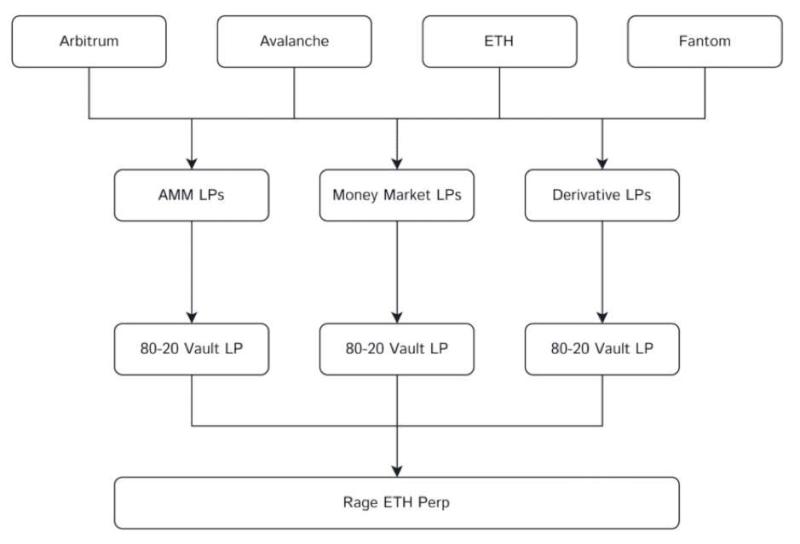

Rage Trade is a perpetual futures protocol built on the Arbitrum ecosystem and has confirmed plans to launch a token. The platform integrates DeFi liquidity from other chains via its Omnichain recycled liquidity mechanism and offers 80-20 Vaults. The 80-20 Vault strategy allocates 80% of funds to yield-generating activities within the protocol and 20% to provide liquidity. Another product line involves stablecoins: Rage Trade implements a tiered model where Risk-On (Aave + Uniswap) executes GLP hedging strategies, while Risk-Off lends USDC to Risk-On to amplify scale.

(Source: Rage Trade)

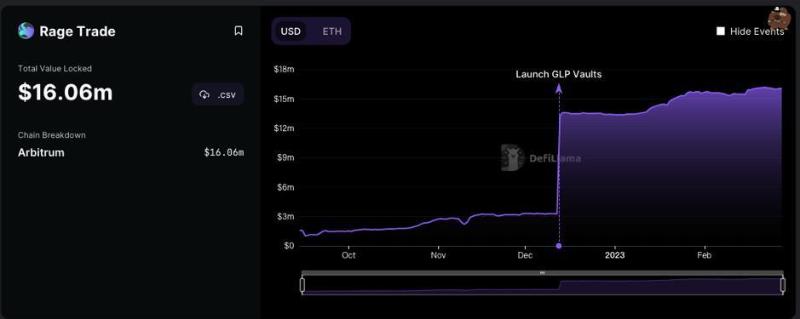

Currently, Rage Trade’s Total Value Locked (TVL) stands at $16.06 million, with an average APY of 7.48%. The protocol has not yet issued a token.

(Source: DefiLlama)

GMD

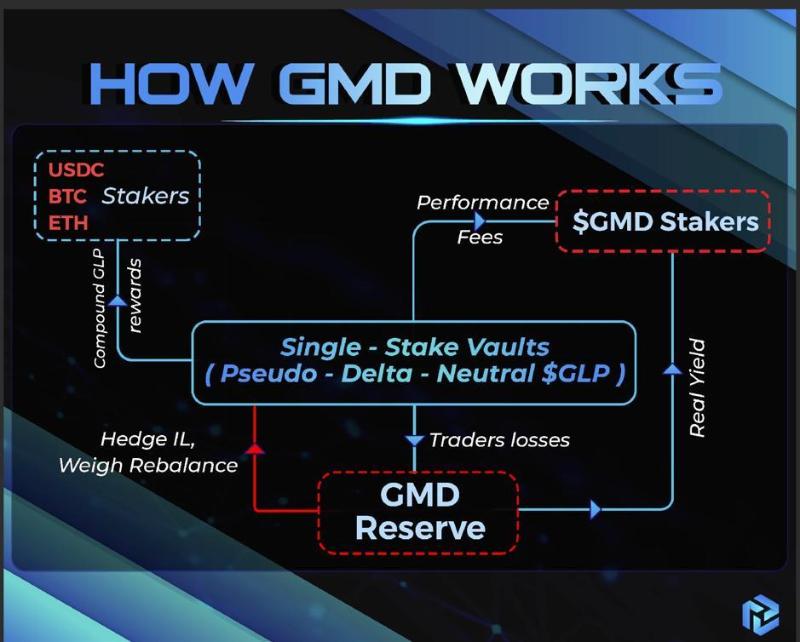

GMD is a yield optimization and aggregation platform centered on GMX’s GLP token. Users deposit assets into delta-neutral vaults to purchase GLP, and generated yields are distributed to stakers. GMD’s mechanism is simple: it offers single-asset staking vaults for USDC, BTC, and ETH, and its delta-neutral strategy maintains asset allocations matching those of the GLP basket. Average vault APR is 20%, with all vaults nearly fully subscribed. GMD compensates users with its native governance token in case of impermanent loss risks.

(Source: GMD Official)

Currently, GMD’s TVL is approximately $7 million.

On February 27, GMD announced the launch of a new Launchpad, pledging rigorous due diligence for all applying projects.

(Source: DefiLlama)

Jones DAO

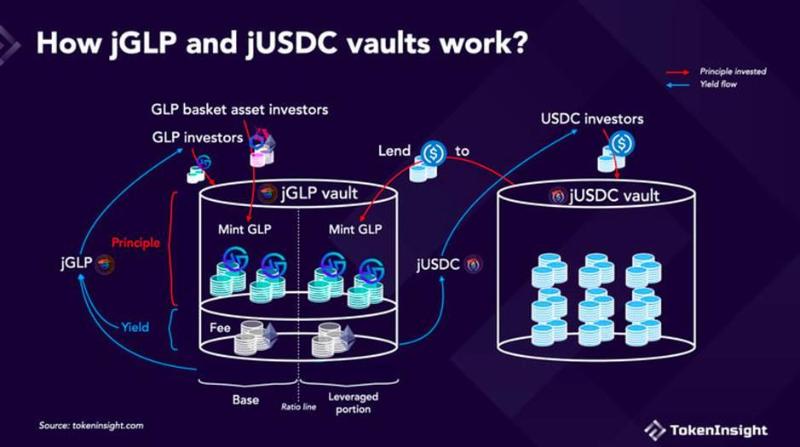

JonesDAO is a yield-generation protocol on Arbitrum that enables participants to earn returns through options protocols. The jGLP and jUSDC pools are key components of JonesDAO’s yield strategies and hold dominant positions in the GLP market.

In these pools, USDC investors deposit into the jUSDC pool, whose treasury lends USDC to the jGLP treasury (which mints GLP and generates fees). Simultaneously, GLP and basket asset holders deposit into the jGLP treasury to mint GLP and generate fees. These fees, along with GLP liquidity mining rewards, increase jGLP value, benefiting GLP investors. Fees also boost jUSDC value, rewarding USDC holders.

(Source: Jones DAO)

(Source: TokenInsight)

PlutusDAO

PlutusDAO is a governance aggregator for Dopex and JonesDAO—dubbed the “governance black hole” of Layer 2. It accumulates governance tokens from projects like Dopex and JonesDAO, issues pls-series receipts to users, and generates returns via vote-buying, staking, and reinvestment. Due to its high governance token concentration, PlutusDAO itself becomes a target for vote-buying by other projects. Additionally, PlutusDAO operates a GMX GLP vault, offering a 20% APR in plvGLP with PLS subsidies.

Treasure DAO

DAOs represent communities of developers, investors, and users, forming the most dynamic part of the ecosystem. The most influential DAO on Arbitrum is TreasureDAO, supported by Offchain Labs.

TreasureDAO is often likened to Nintendo in Web3. Originally a Loot project that migrated from Ethereum mainnet in October 2021, it has undergone over a year of expansion and rebranding, attracting many NFT OGs and regaining broad attention. Trove Marketplace, BridgeWorld, and MagicSwap are core infrastructures in the TreasureDAO ecosystem. TreasureDAO has also incubated The Beacon, a breakout game, unleashing strong developer activity—all closely tied to the MAGIC token.

(Over the past two months, Magic has risen from a low of $0.5 to $2.0)

Arbitrum Ecosystem Development: Emphasis on Community and Strong User Incentives

At this stage of development, Web3 largely relies on airdrops or airdrop expectations to attract users. The Odyssey campaign is one of Arbitrum’s key initiatives to onboard users and energize its ecosystem.

The Odyssey campaign had two phases and is currently paused, with plans to relaunch at an appropriate time this year. Phase One began in April, with users voting to select 14 qualifying projects for subsequent interaction tasks. Phase Two started mid-May, originally planned for seven weeks with two project tasks launched weekly, each awarding an NFT. Completing 12 out of 15 NFTs would earn users a commemorative NFT designed by Tubby Cats founders Ratwell & Sugoi. However, due to overwhelming popularity causing gas spikes (briefly exceeding mainnet swap fees), Arbitrum decided to pause the event.

Despite operational challenges, the campaign demonstrated Arbitrum’s responsive community engagement and strategic awareness. Although interrupted, it generated massive attention and buzz. Given Arbitrum’s strong current performance, a relaunched Odyssey campaign is likely to attract even broader participation—presenting both a stress test for chain performance and security, and a major growth opportunity.

(Source: Dune)

Arbitrum Outlook for 2023

In its SmartCon 2022 presentation, Offchain Labs stated that Arbitrum will continue expanding decentralization—including validators, sequencers, governance, and software upgrades—while further reducing fees and increasing TPS. The Odyssey campaign is expected to restart this year, and the Nova ecosystem (social, gaming) will continue to be nurtured, with emphasis on decentralizing validators, governance, software authorization, and sequencing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News