Deconstructing: Why OP is the Top Choice for DeFi Protocols?

TechFlow Selected TechFlow Selected

Deconstructing: Why OP is the Top Choice for DeFi Protocols?

Almost overnight, everyone was talking about Optimism.

Written by: Route 2 FI

Compiled by: TechFlow

Everyone is talking about Optimism. Coinbase has just announced the launch of a new L2 blockchain called "Base," built on the $OP Stack. So this article will introduce you to:

-

What Optimism is;

-

Why $OP is the preferred choice for DeFi;

-

Some high-potential DeFi protocols;

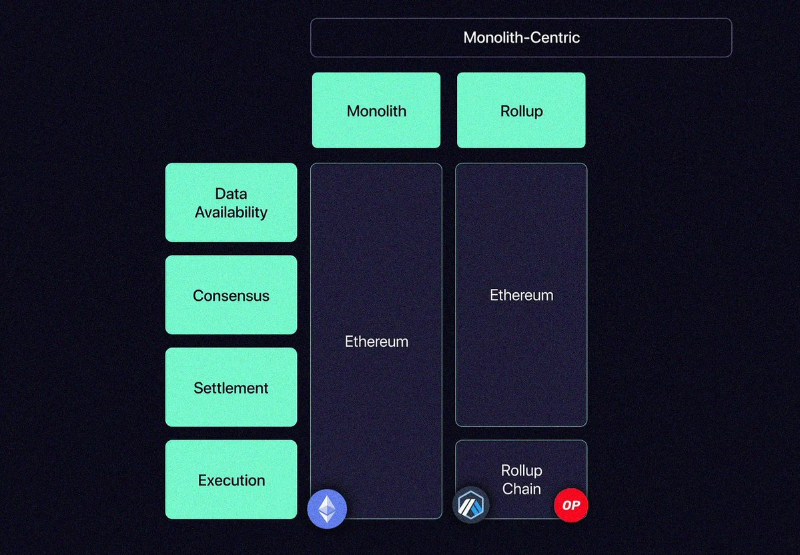

What Is Optimism?

Optimism is one of the leading Layer 2 solutions on Ethereum. With numerous DeFi advancements occurring on L2s, Optimism is undoubtedly at the forefront.

Like Arbitrum, Optimism uses Optimistic Rollups to increase transaction throughput and reduce gas fees. Developers can build scalable and efficient applications atop Ethereum while benefiting from the network's existing infrastructure.

Yesterday, Coinbase announced the launch of a new L2 blockchain named "Base," built on the $OP Stack, offering a secure, low-cost, and developer-friendly way for anyone to build decentralized applications anywhere.

This collaboration aims to upgrade the Optimism mainnet, Base, and other L2s into an initial Superchain. The vision is for the Superchain to grow into a vast network that maximizes interoperability, shares decentralized protocols, and standardizes its core primitives.

What Makes Optimism the Top Choice for DeFi?

$OP focuses on compatibility with Ethereum. Any Ethereum dApp can easily integrate with Optimism and benefit from its scalability and reduced gas fees. This has led many popular dApps and DeFi protocols to migrate onto $OP.

Optimism has existed on mainnet for some time and has been battle-tested by several well-known projects, including Uniswap, Synthetix, and MakerDAO.

With upcoming major network upgrades, activity within the Optimism ecosystem is expected to reach new heights soon.

DeFi TVL on Optimism increased by 41% last month, second only to Arbitrum. Let’s take a look at some interesting DeFi protocols:

Velodrome

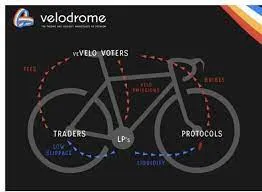

Velodrome is the largest and fastest-growing DEX on Optimism.

In a sense, it’s a hybrid of Curve, Convex, and UNIV2, combining multiple protocol layers into one centralized platform.

The exchange features an innovative liquidity pool called the Velocity Pool, where liquidity providers earn trading fees and yield from their staked assets.

Velodrome also rewards users for participating in the ecosystem through its native token, $VELO.

Velodrome enables many popular protocols such as Lido and Frax to incentivize liquidity for their token holders.

Velodrome’s TVL has grown exponentially since the beginning of 2023 and now exceeds $277 million.

Synthetix

Synthetix is a decentralized synthetic asset protocol that allows users to mint and trade various derivatives via synthetic tokens known as "Synths".

Synthetix is at the forefront of the DeFi movement, with the potential to create a large-scale real-world asset tokenization market on Ethereum.

Sonne Finance

Sonne Finance is the first fully transparent and decentralized peer-to-peer lending solution.

Since the start of 2023, Sonne Finance’s TVL has steadily risen. It has also become one of the largest bribers on Velodrome.

Other Notable DeFi Protocols to Watch

Toros

Toros Finance is a DeFi platform that allows users to earn yield through Dynamic Vaults.

Perpetual Protocol

Perpetual Protocol is an on-chain perpetual futures DEX with deep liquidity and strong composability. With $17 million in TVL, Perpetual stands out in the Optimism ecosystem.

PikaProtocol

Pika Protocol is a perpetual swap platform allowing users to trade forex and cryptocurrencies with up to 100x leverage and near-zero slippage. Pika Protocol uses an automated market maker model that requires minimal liquidity to facilitate trades.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News