Positioning for the Cancun upgrade: OP or ARB, which is the better choice?

TechFlow Selected TechFlow Selected

Positioning for the Cancun upgrade: OP or ARB, which is the better choice?

On L2, the larger and more diverse the user base, the lower the difficulty for people to achieve collaboration on L2.

Author: Alex Xu

In 2023, the Cancun upgrade is undoubtedly one of the most critical industry events following the Shanghai upgrade, and L2 projects benefiting from it are among the key sectors we have been closely tracking this year.

According to current information, the Cancun upgrade—containing EIP-4844—is expected to occur between October 2023 and January 2024. Meanwhile, the token prices of two leading L2 projects, Arbitrum (hereafter ARB) and Optimism (hereafter OP), both reached new highs in the first half of the year before undergoing significant pullbacks. This may still present a favorable window for positioning.

Of course, judging by market capitalization, OP’s circulating market cap has consistently hit new highs since the beginning of 2023, while ARB has remained in a consolidation phase at lower levels. In this article, I attempt to analyze the following topics:

-

The value source and business model of L2s

-

A comparison of competitiveness and operational data between OP and ARB

-

How the Cancun upgrade will significantly improve L2 fundamentals

-

Potential risks associated with OP

The views expressed below represent my interim assessment as of publication and focus primarily on commercial analysis rather than technical details of L2s. The article may contain factual inaccuracies, opinions, or biases and should be used solely for discussion purposes. Feedback from fellow researchers and investors is welcome.

1. Value Source and Business Model of L2s

1.1 Value Source and Moats of L2s

L2s offer products similar to L1s: stable, censorship-resistant, and open blockspace, which can also be viewed as a specialized form of on-chain cloud service. Compared to L1s, the main advantage of L2 blockspace is its lower cost. For example, OP’s average gas fee is only 1.56% of Ethereum’s.

Because blockspace is a specialized cloud service, it serves niche demands—not all internet services require operation on L1 or L2. However, financial services, which face numerous constraints and lack transparency in the traditional world, find rich application scenarios on blockchains.

The demand from service builders and users for L2 blockspace ultimately determines the upper limit of an L2’s value.

Like L1s, L2s can build moats based on network effects.

The larger and more diverse the user base on an L2, the easier it becomes for participants to collaborate, enabling novel service models to emerge. Each new user joining and staying on the L2 network increases its potential value to all other users. This positive feedback loop strengthens the ecosystem.

In the Web3 world, the strength of network effects for L1s and L2s ranks just below that of dominant stablecoins like USDT. The more established an L1 or L2, the higher its barriers to entry—and thus, the higher valuation premium it typically commands.

1.2 Profit Model of L2s

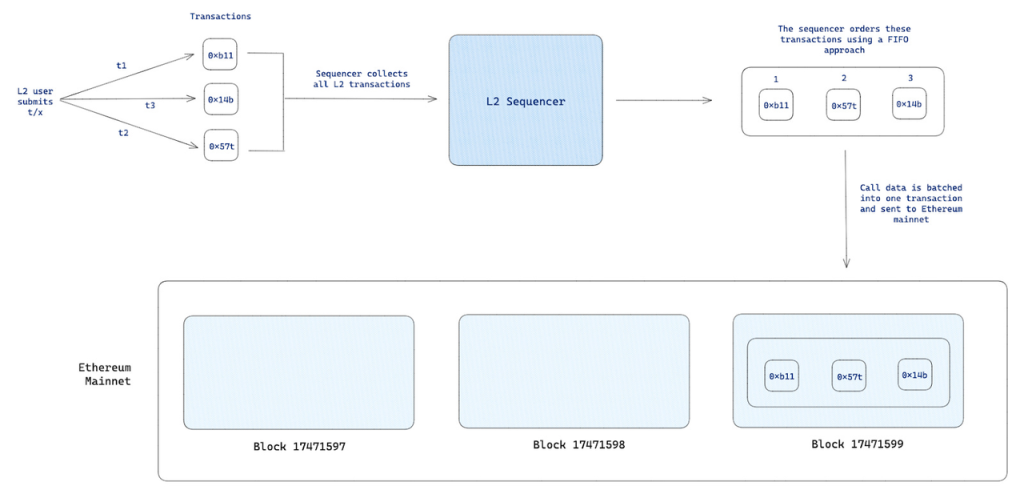

The profit model of L2s is straightforward: they purchase storage space from a trusted DA (Data Availability) layer to back up their L2 data (enabling recovery in case of failures), and charge users for cheaper blockspace services. Their profit equals: (L2 fees collected—including base fees and MEV revenue) minus (cost paid to the DA provider).

For instance, both OP and ARB use Ethereum—the most decentralized and trustworthy L1—as their DA layer. They pay Ethereum gas fees to store compressed L2 data on-chain. Their revenue comes from gas fees paid by users (including regular users and developers) when using their L2, plus MEV income. After subtracting the DA cost, what remains is gross profit.

It's called "gross" profit because it does not yet account for other project expenses such as salaries, ecosystem incentives, marketing costs, etc.

The role of sequencers in the L2 operational workflow

The L2 sequencer handles fee collection and payments to the L1, and profits accrue to the sequencer. Currently, both OP and ARB operate centralized sequencers controlled by their official teams, so profits go into the official treasury. However, centralized sequencers pose high single-point-of-failure risks. Both OP and ARB have committed to eventually decentralizing their sequencers.

Decentralized sequencers will likely operate under a PoS mechanism: validators must stake native L2 tokens (e.g., OP or ARB) as collateral. Failure to perform duties results in slashing. Regular users can either run sequencers themselves via staking or use third-party staking services like Lido, where professional operators handle sequencing and uploading. Stakers receive most of the sequencer rewards—90% in Lido’s model.

When this happens, ARB and OP tokens will gain economic utility beyond governance alone.

1.3 ARB vs OP

OP’s Competitive Advantages

Since its launch, ARB has consistently outperformed OP across various L2 metrics. Given the network effects described earlier, ARB—as the leading L2—should command a higher valuation multiple.

However, this began to change after OP introduced its Superchain strategy in February 2023 and aggressively promoted OP Stack.

OP Stack is an open-source L2 tech stack allowing any project to quickly deploy its own L2 at minimal development cost. Superchain is OP’s envisioned future: L2s built on OP Stack, thanks to architectural consistency, can achieve secure, efficient, atomic-level communication and asset transfers—similar to Cosmos’ “Interchain” concept. This interconnected network is called Superchain.

After the launch of OP Stack and Superchain, Coinbase was the first major adopter, announcing in February that its L2 Base would be built on OP Stack. Base officially launched on August 10. With Coinbase’s endorsement, OP Stack gained increasing traction: Binance launched opBNB, Paradigm-backed NFT project ZORA, Loot ecosystem project Adventure Gold DAO, Gitcoin-supported Public Goods Network (PGN), top options protocol Lyra, popular on-chain analytics dashboard Debank, and even former L1 Celo adopted OP Stack for their L2 solutions.

Previously, L2s served end-users of their blockspace. With Superchain and OP Stack, OP expanded its customer definition to include L2 operators—transforming from a 2C business (with developers counted as C) into a 2B2C model. This creates new sources of value and moats for OP:

-

Multi-chain network effects: Expands the concept of “network” from a single chain to a multi-chain ecosystem. Chains within the Superchain interconnect via standardized OP Stack for seamless fund and information transfer. L2 operators drive user acquisition and operations, growing the total user base. As the overall population grows, every individual user and each L2 gains greater value from being part of the network.

-

Economies of scale: Fixed infrastructure costs (e.g., upgrades and maintenance of OP Stack) are borne by OP, but feedback and improvements from other users enhance the quality of OP Stack. This reduces per-chain maintenance, upgrade, sequencer, and indexing costs, increasing attractiveness to future adopters.

-

Shared interests: Brings more Web3 industry giants into the OP ecosystem. With aligned incentives, OP gains stronger support in technology, users, developers, and investment.

By evolving from a single-chain ecosystem to an interconnected chain network, OP benefits not only from growth in total chain users and developers, but its mainnet metrics are now catching up to—and in some cases surpassing—ARB’s once-dominant figures:

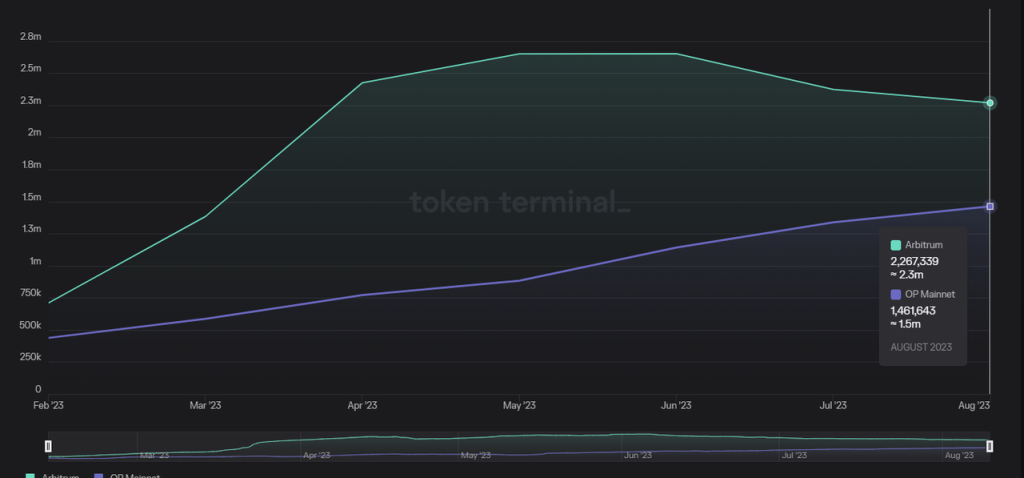

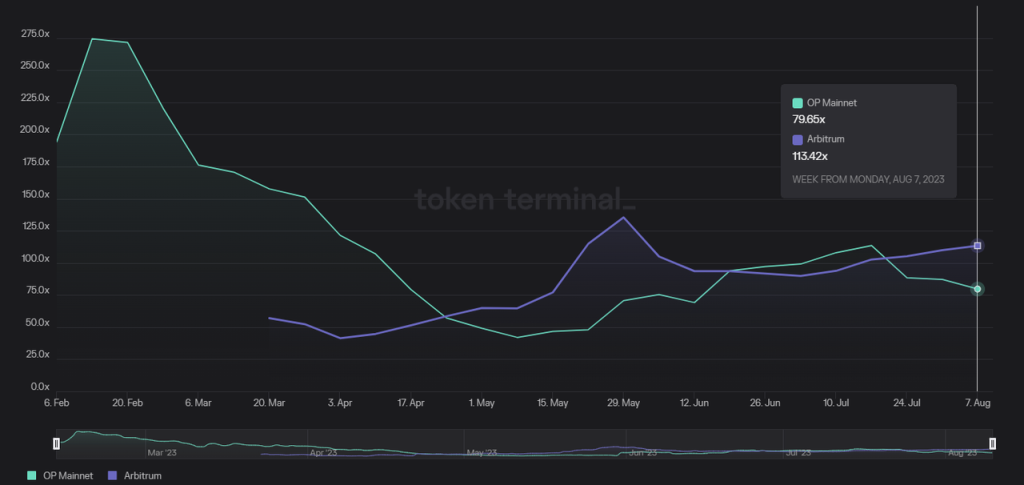

a. Monthly Active Addresses: OP/ARB weekly active addresses rose from 32.1% to 73.6%

Source: TokenTerminal

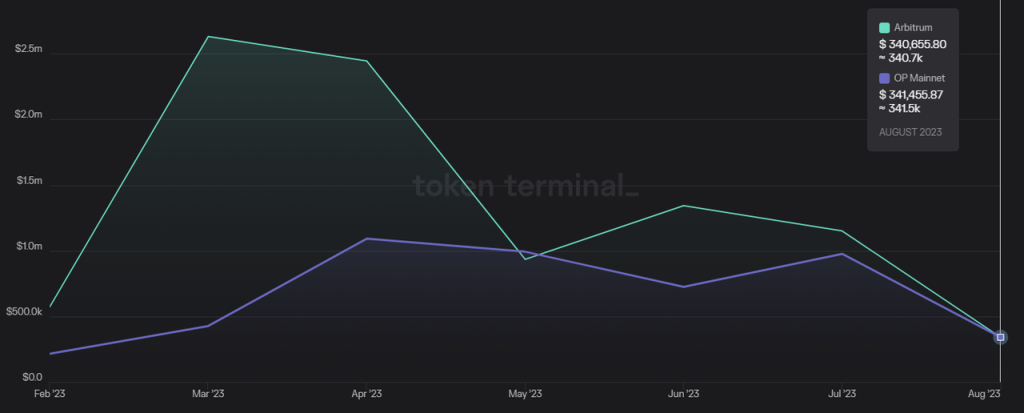

b. Monthly L2 Profit: OP/ARB L2 profit increased from 16.4% to 100.2% (surpassing ARB)

Source: TokenTerminal

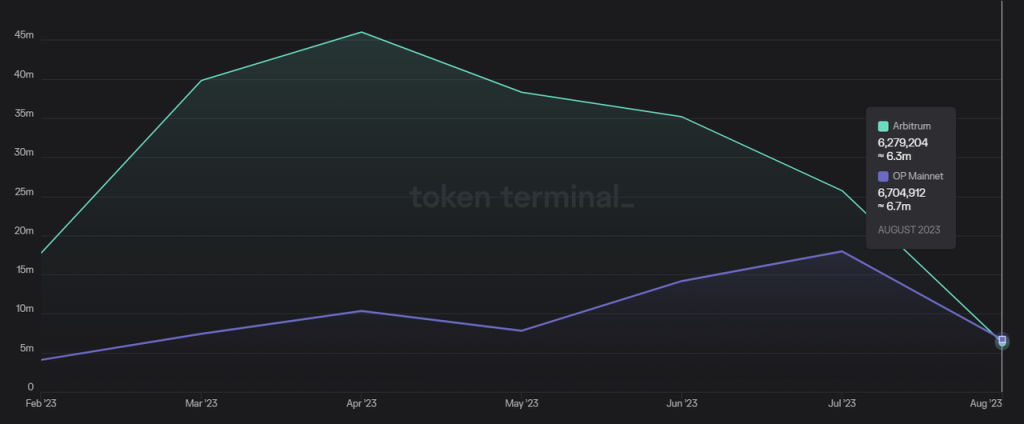

c. Monthly Interactions: OP/ARB monthly interactions rose from 22.4% to 106.5% (surpassing ARB)

Source: TokenTerminal

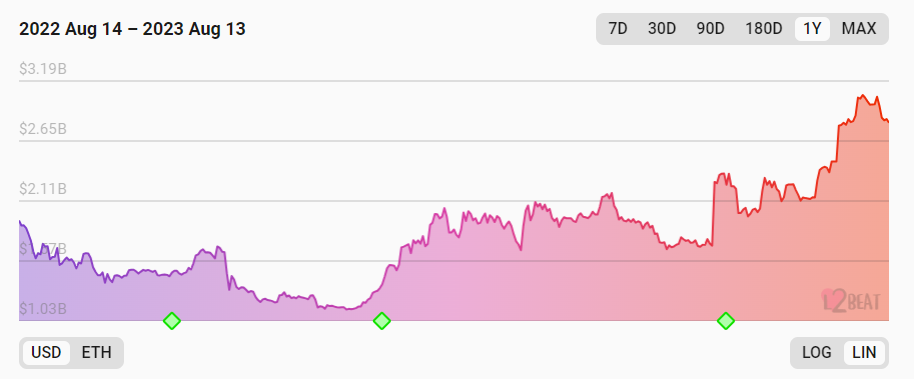

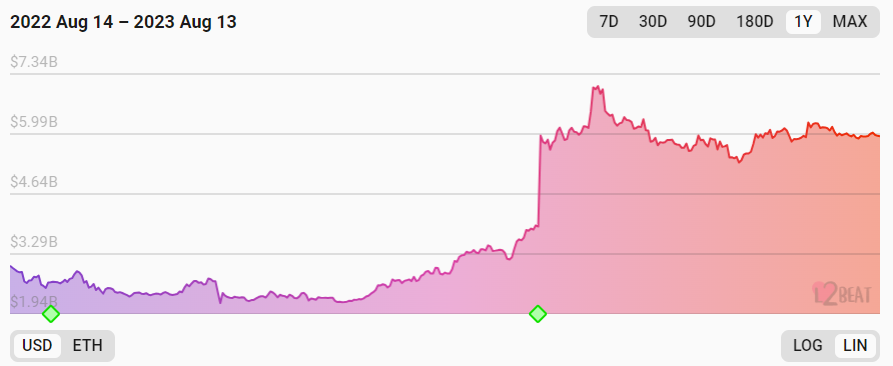

d. On-chain Funds (TVL): OP/ARB TVL ratio improved from 1/3 to 1/2

OP’s TVL was around $200M in March, now approximately $300M

ARB’s TVL was around $600M in March (peaked at $700M), currently still around $600M

Source: https://l2beat.com/

Valuation Comparison Between OP and ARB

As OP’s operational metrics rapidly improve, its relative valuation versus ARB is becoming increasingly attractive.

P/E Ratio (Circulating Market Cap / Annualized L2 Profit): Based on the past week’s revenue, OP’s P/E has dropped below 80, while ARB’s stands at 113—even though OP’s price has performed strongly recently and its circulating supply has steadily increased.

Source: TokenTerminal

Rapid Growth of New Forces in OP’s Ecosystem

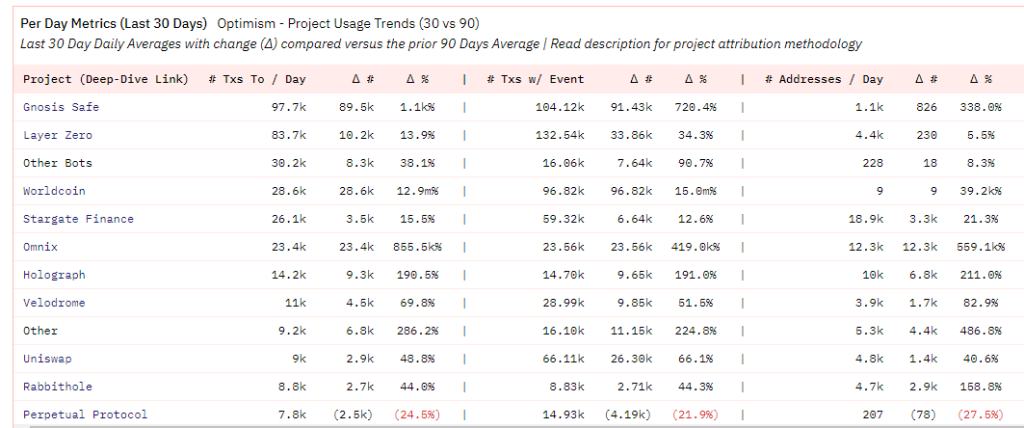

OP’s narrowing gap with ARB stems partly from internal ecosystem recovery, but is driven more significantly by new partners joining the OP ecosystem. For example, among the top transaction generators on OP over the past 30 days, Gnosis Safe contract operations rank first and Worldcoin ranks fourth.

Source: https://dune.com/optimismfnd/Optimism

In fact, much of Gnosis Safe’s activity comes from Worldcoin’s team. By late June, the World App had already deployed over 300,000 Gnosis Safe accounts—a result of migrating World App accounts to the Optimism mainnet.

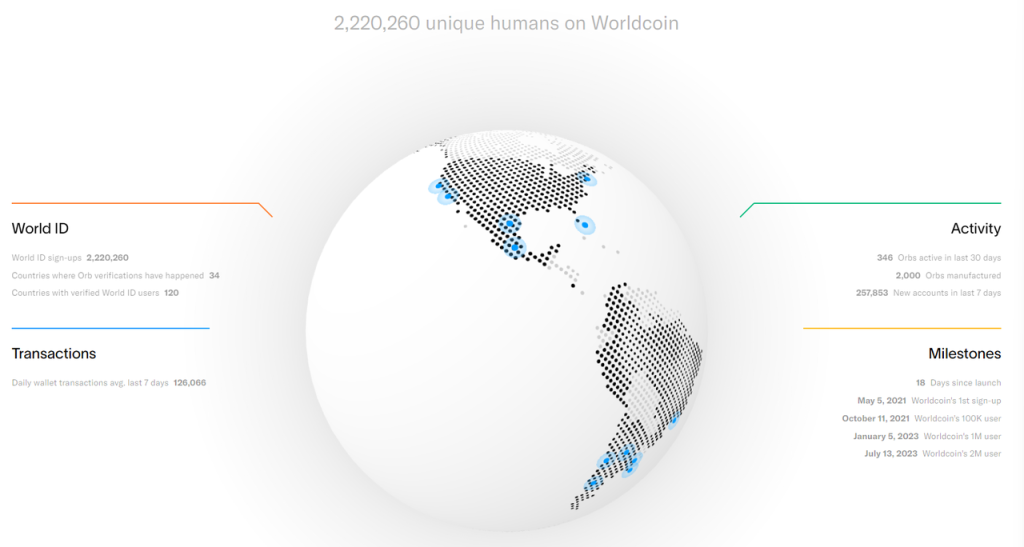

According to Worldcoin’s official website on August 11, it now has over 2.2 million registered users, created 257,000 new accounts in the past week, and averages 126,000 daily transactions—about 21% of the combined daily transaction volume on OP and ARB mainnets.

Source: https://worldcoin.org/

Currently, Worldcoin has only migrated its ID system and token to the mainnet. It plans to develop app-chains based on OP Stack, potentially bringing even more active users and developers.

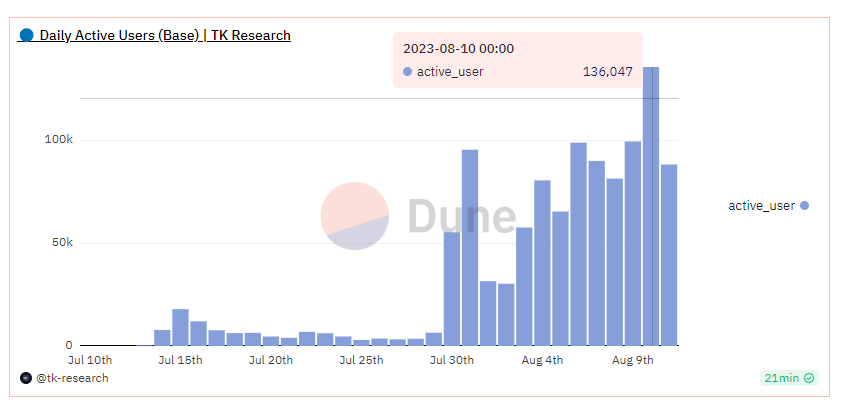

Beyond Worldcoin’s contribution, Coinbase’s Base—the first and largest OP Stack supporter—has shown strong post-launch growth. On August 10, Base recorded 136,000 active addresses, nearly matching ARB’s 147,000.

Source: https://dune.com/tk-research/base

Among all smart contract platforms (L1s and L2s), this figure ranks behind only Tron (1.5M), BNB Chain (1.04M), Polygon (0.37M), and Arbitrum (0.14M). Interestingly, Base’s first viral application upon launch wasn’t a typical DeFi or meme coin, but friend.tech—a social application—adding to the surprise.

ARB’s Challenges

ARB’s challenge lies in the fact that although it operates a strong L2 mainnet (Arbitrum One) and a high-performance Arbitrum Nova, it also launched Orbiter—an L3 stack designed to compete with OP Stack. However, at a time when L2s are still emerging, few projects are willing to position themselves as L3s relying on Arbitrum One as their DA layer. Projects with strong industry resources (users, developers, IP content) tend to prefer building L2s, which offer higher valuation ceilings and broader user targeting.

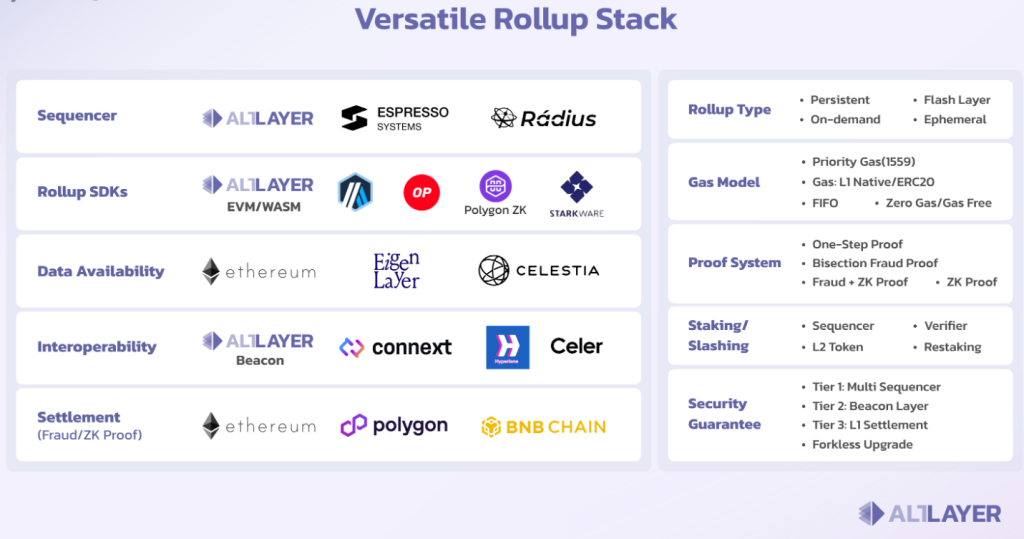

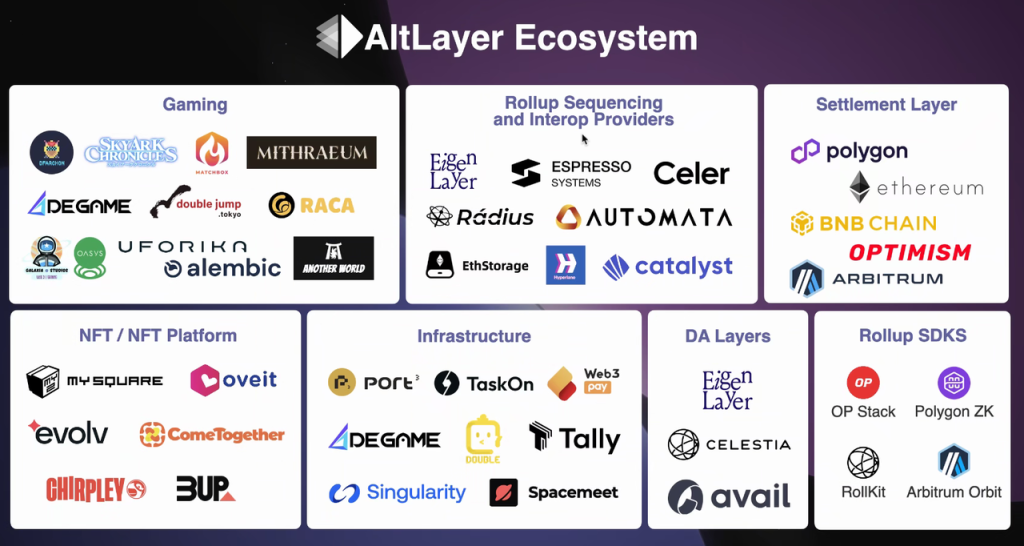

In the smaller rollup market, Arbitrum’s Orbiter faces competition from RaaS (Rollup-as-a-Service) platforms like AltLayer. These platforms offer low-barrier, low-code rollup construction and operation solutions, integrating various modular components available in the market so users can mix and match like LEGO bricks.

AltLayer’s modular RaaS offering

Within the rollup menu offered by RaaS providers, Arbitrum’s Orbiter is merely one option. Small users might compare alternatives and opt for a cheaper L2 solution instead of defining themselves as an L3.

Under these conditions, while Arbitrum One maintains slight lead over other L2s in standalone metrics, its overall market share among L2 users is rapidly declining as many new and existing users migrate to OP-based and hybrid L2s.

Overall, OP’s strategy—leveraging an open-source L2 suite to generate network effects through B2B2C partnerships—appears commercially superior to Arbitrum’s single-chain dominance model. If ARB doesn’t adjust its strategy soon, its status as the leading L2 could be at risk.

2. How the Cancun Upgrade Improves L2 Fundamentals

2.1 Current Valuation Estimates for ARB and OP

We estimate current valuations of ARB and OP based on their revenue over the past three months and current token prices.

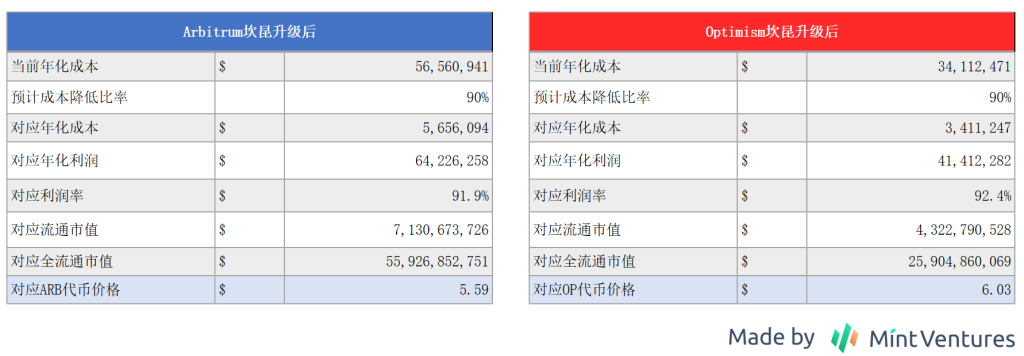

Assuming the P/E ratio remains unchanged, and that the Cancun upgrade reduces L1 costs for ARB and OP by 90% (EIP-4844 is expected to cut L2’s L1 costs by 90–99%; we take a conservative estimate—see references), while L2 fees remain constant, projected token prices would be:

The reduction in L1 costs directly boosts profits and thus increases valuations.

2.2 Impact of the Cancun Upgrade on L2 Valuations

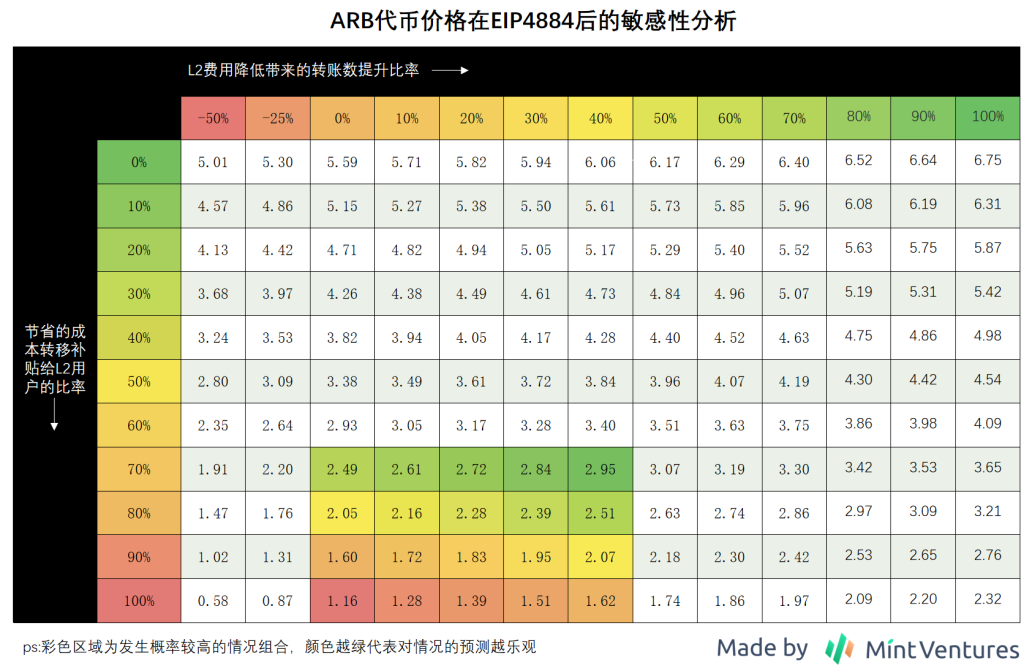

Of course, after the Cancun upgrade lowers L1 costs, both ARB and OP will likely reduce their L2 fees accordingly. Therefore, two additional variables must be considered in our valuation model:

1. What proportion of cost savings will ARB and OP pass on to users via lower L2 fees?

2. How much will reduced L2 fees increase transaction volume?

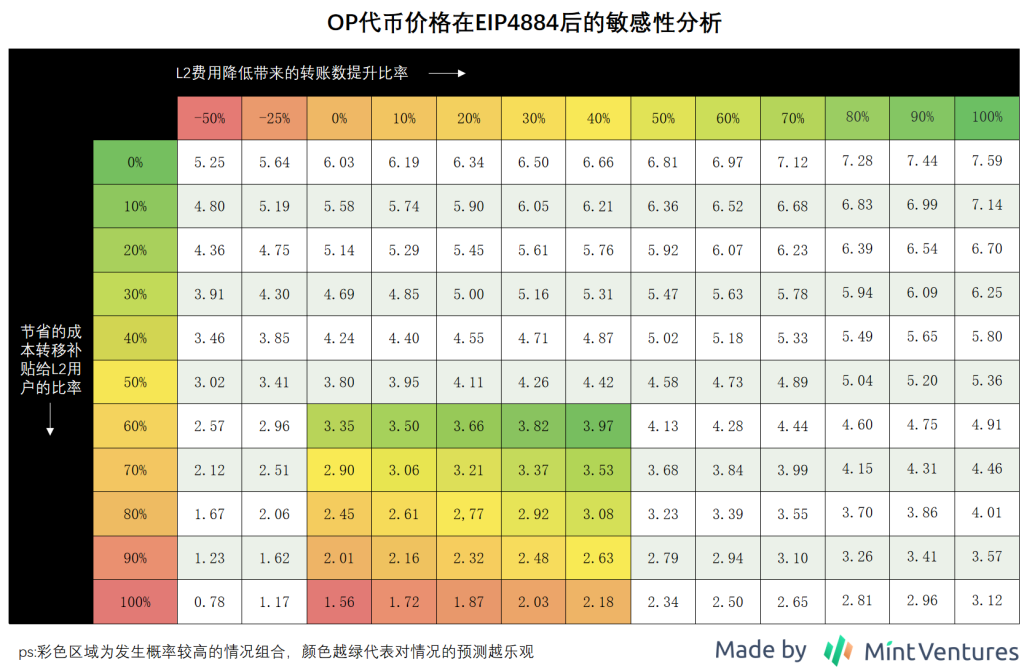

Again assuming constant P/E multiples, I simulate post-upgrade token prices for ARB and OP based on varying assumptions about cost-pass-through rates and resulting transaction growth:

The core logic behind these two price estimation tables is:

1. The lower the proportion of cost savings passed to users, the higher the L2 operating profit;

2. The greater the increase in transaction volume due to lower fees, the higher the L2 operating profit;

Moreover, since OP’s current gas fees are roughly 30–50% lower than ARB’s, OP has more room to retain cost savings post-upgrade. Thus, I estimate OP will pass 60–100% of savings to users, while ARB will pass 70–100%.

Based solely on the impact of the Cancun upgrade on OP and ARB standalone chains, both appear to have similar upside potential from current prices.

However, this sensitivity analysis is relatively mechanical. Key unaccounted factors include:

-

The above estimates are based on current P/E ratios, which already reflect market expectations for the Cancun upgrade

-

At the time of the upgrade, OP will have issued more tokens; assuming constant market cap, this implies a lower token price

Nevertheless, the underlying principle holds: the higher the L2 operating profit, the greater the intrinsic value of its token and the more likely it is to command a higher market valuation. The Cancun upgrade brings clear marginal improvements to L2 projects, both in cost efficiency and on-chain activity.

3. Potential Risks for OP

As discussed above, OP has evolved from a single-chain L2 to an interconnected L2 ecosystem via the Superchain narrative and broad adoption of OP Stack. By leveraging B2B2C partnerships, OP brings in more ecosystem participants, creating stronger long-term network effects, economies of scale, and alliances of shared interest—making it a superior business model compared to ARB. Additionally, OP mainnet metrics have consistently caught up to and even surpassed ARB’s in recent months, while other OP Stack L2s like Base grow rapidly, further eroding ARB’s market share.

Considering that both OP and ARB mainnet tokens have similar expected price appreciation from the Cancun upgrade, but OP benefits from the compelling Superchain narrative, OP currently appears to be the better investment choice.

However, competition in the L2 space remains fierce. Key risks for OP include:

3.1 ARB May Open Its L2 License and Compete for Total L2 Network Population Using a Strategy Similar to OP

Currently, Arbitrum uses a Business Source License (BSL), meaning other projects wishing to use Arbitrum Stack for their rollups must either obtain formal authorization from Arbitrum DAO or Offchain Labs (Arbitrum’s developer), or build an L3 on top of Arbitrum One. However, due to OP Stack’s rapid expansion and surge in user base over recent months, the Arbitrum community is feeling pressure. On August 8, ARB team member stonecoldpat initiated a governance forum discussion inviting community input on “conditions and timing for granting code usage licenses to partners,” including:

-

Understanding community sentiment toward licensing Arbitrum code to partners

-

Discussing whether additional conditions should be attached to licensing

-

Establishing an evaluation framework for license approval

-

Short- and medium-term roadmap

- Short-term: identify qualified partners eligible for licensing

- Medium-term: establish clear standards so any qualified partner can receive a license

The thread summarized official feedback received, noting:

"Not licensing the Arbitrum software stack to major strategic partners appears to be a strategic misstep. This hesitation could actually harm the Arbitrum ecosystem."

"We’ve received no feedback suggesting the Arbitrum Foundation shouldn’t license its tech stack to strategic partners. Most concerns focus on licensing criteria, attached conditions, and allowing DAO input in the process."

Given this, Arbitrum’s strategic shift toward an OP-like model seems inevitable. It will soon enter the “interconnected L2” market competition, posing direct challenges to OP Stack’s current momentum.

On August 9, Andre Cronje, co-founder and architect of Fantom Foundation, said in an interview with The Block that they are considering Optimism’s L2 solution, evaluating both OP Stack and Arbitrum Stack. In my view, Fantom—a former top-tier L1—is unlikely to operate as an L3 on Arbitrum. When AC refers to “Arbitrum Stack,” he likely means an L2 implementation.

But the question remains: how long will it take Arbitrum’s community to reach consensus and begin issuing licenses? By then, how many core customers will remain available? The longer the delay, the more partners will join OP Stack, putting ARB at a disadvantage.

3.2 Intensifying Competition in the L2 Services Market

Beyond ARB and OP, ZK-based L2s are rapidly advancing or preparing for launch—such as ZKsync (with impressive metrics despite possible bubble from airdrop farmers), Linea (backed by Consensys, whose MetaMask has 30M monthly active users and Infura supports over 400K developers), and highly anticipated Scroll. Additionally, RaaS platforms like AltLayer offer modular, low-threshold assembly and operational services for rollups, positioning themselves upstream of OP Stack and threatening OP’s ecosystem pricing power.

AltLayer’s product and customer ecosystem

3.3 Can Value from the Superchain Ecosystem Be Captured by the OP Foundation and OP Token?

Currently, OP token lacks direct value capture mechanisms. Among OP Stack adopters, only BASE has committed to donating 10% of its L2 profits to the OP Foundation. Other partners have not made similar pledges. Real validation of OP’s value capture may only come after the decentralized sequencer protocol launches, when we can observe how widely OP is accepted as staking collateral. If all OP Stack chains adopt OP-based decentralized sequencers, strong demand for OP tokens will emerge, completing the value loop. Otherwise, if each L2 maintains its own sequencing standard or runs proprietary nodes, OP will fail to capture value and intra-ecosystem synergy will weaken.

3.4 Valuation Risk

As noted earlier, my calculation of OP’s price uplift from the Cancun upgrade assumes the post-upgrade P/E ratio remains unchanged. Since the Cancun upgrade is one of the most anticipated events of the year, OP’s current P/E likely already reflects this expectation to some extent. Pessimists might even argue that the current P/E has fully priced in—or even overpriced—the upgrade’s benefits.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News