Data Chart Review: What Changed for Ethereum After the Cancun Upgrade?

TechFlow Selected TechFlow Selected

Data Chart Review: What Changed for Ethereum After the Cancun Upgrade?

Over the past few months, despite a significant increase in L2 profits, the ETH burn rate has declined, resulting in reduced value flow to ETH.

Author: ParaFi Capital

Translation: 1912212.eth, Foresight News

We’re diving deep into Ethereum’s evolution following EIP-4844, focusing on three key areas:

-

What's the latest on ETH burn trends?

-

How attractive are L2 networks?

-

What is the economic relationship between L2s and Ethereum?

After EIP-1559 and The Merge, there was excitement around ETH as a cash-flow-generating asset. Following those two initial upgrades, ETH supply did decline—by approximately 0.38% from September 2022 to April 2024. However, since then, ETH supply has been steadily rising again as the burn rate has slowed.

Over the past 12 months, ETH staking yield has trended downward, as the number of Ethereum validators increased by 79% over the past year while L1 transaction fees declined.

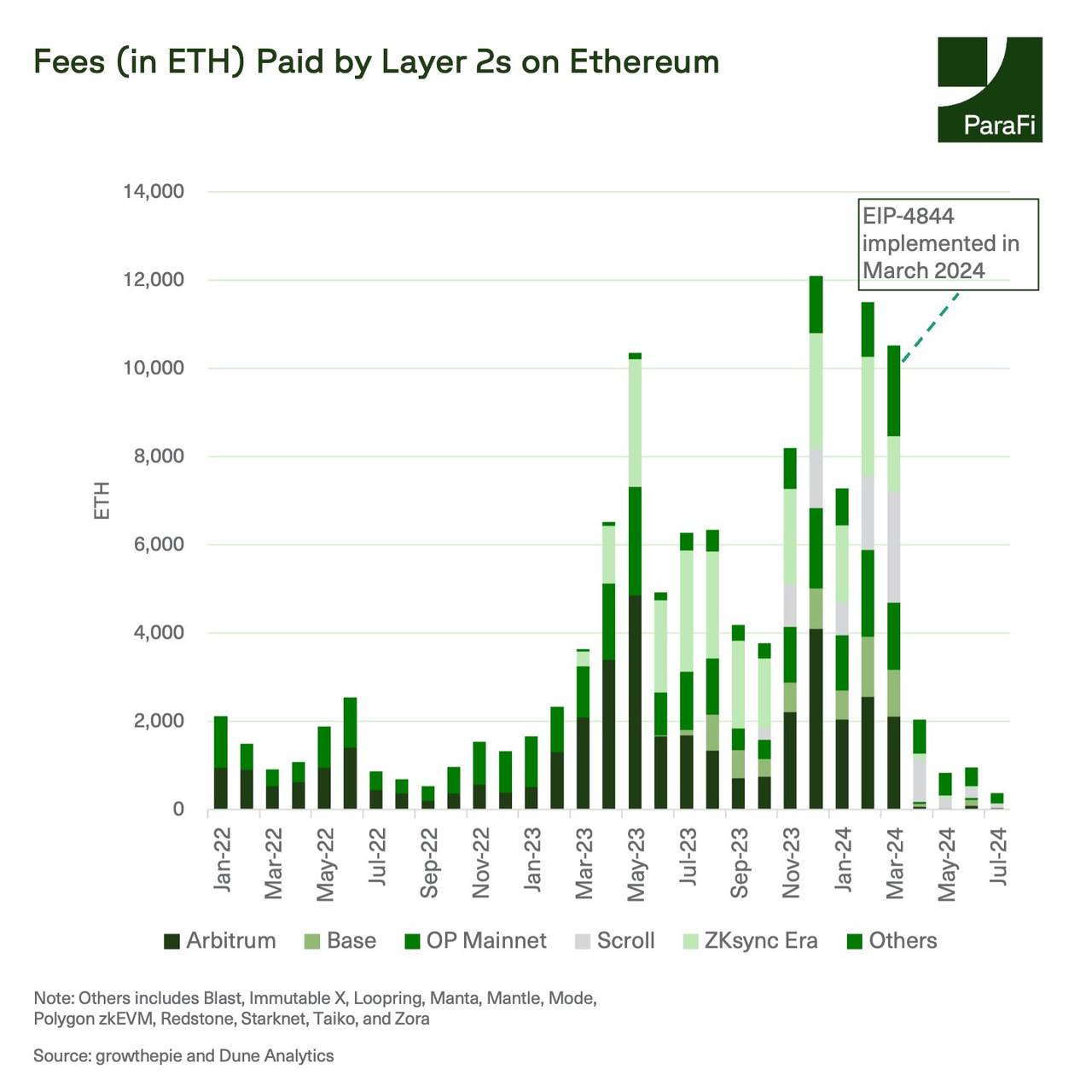

Although the burn pace has slowed, applications and protocols like Uniswap, Tether, 1inch, and MetaMask continue to drive the majority of gas consumption on Ethereum. In 2023, Arbitrum and ZKsync were major gas consumers, but their usage has dropped noticeably this year due to EIP-4844, which enables L2s to post data more efficiently and reduces their data storage costs.

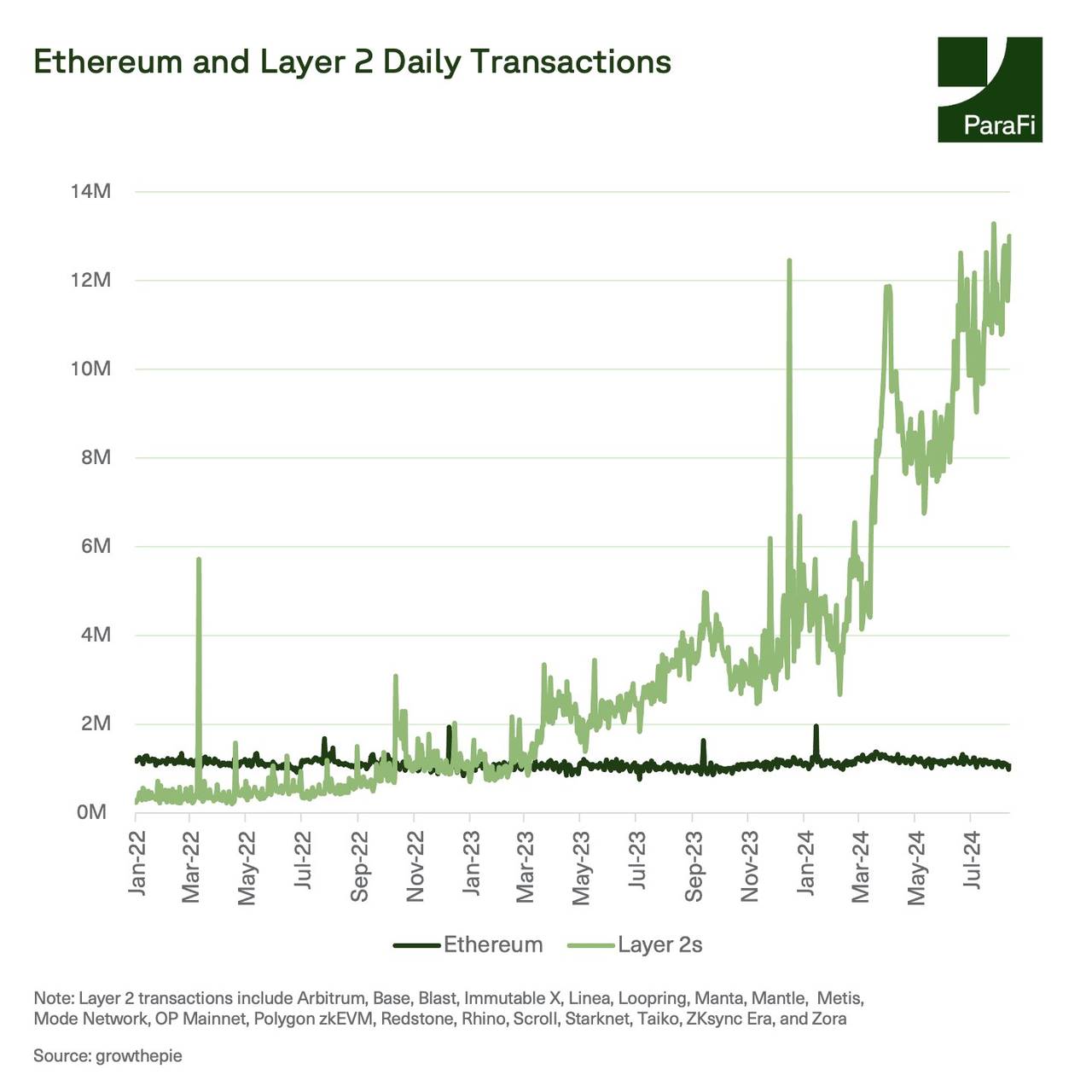

Over the past two and a half years, Ethereum’s transaction count has remained relatively flat, while total L2 transaction volume surpassed L1 by more than 10x in August 2024.

The growth in L2 activity can be attributed to the launch of new L2s and explosive expansion among existing ones. Since March, both Base and Arbitrum have seen daily transaction volumes exceed Ethereum’s. While this chart aggregates transactions across multiple L2s, each one provides alternative blockspace to Ethereum, highlighting the broader shift from L1 to L2.

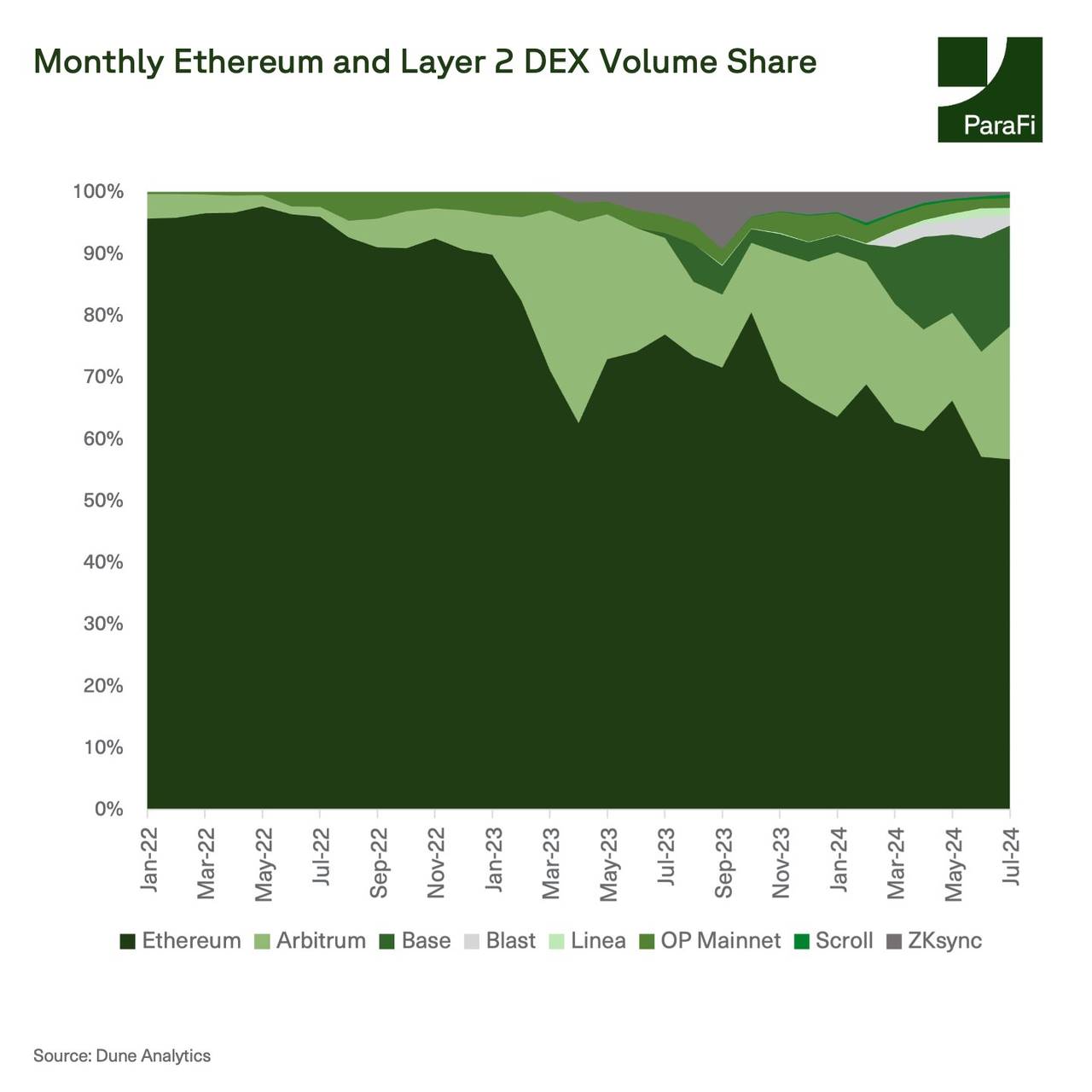

The growing prominence of Ethereum L2s is also evident in how they’ve drawn significant DEX market share away from Ethereum. After the EIP-4844 upgrade, L2s pushed Ethereum’s mainnet DEX share below 60%.

However, this also highlights the issue of liquidity fragmentation caused by the ongoing proliferation of rollup networks. Despite their success, these L2s now incur relatively low costs when posting data to Ethereum thanks to EIP-4844. Implemented in March 2024, EIP-4844 introduced a new data storage mechanism called “blobs,” a cheaper alternative to the previous calldata structure.

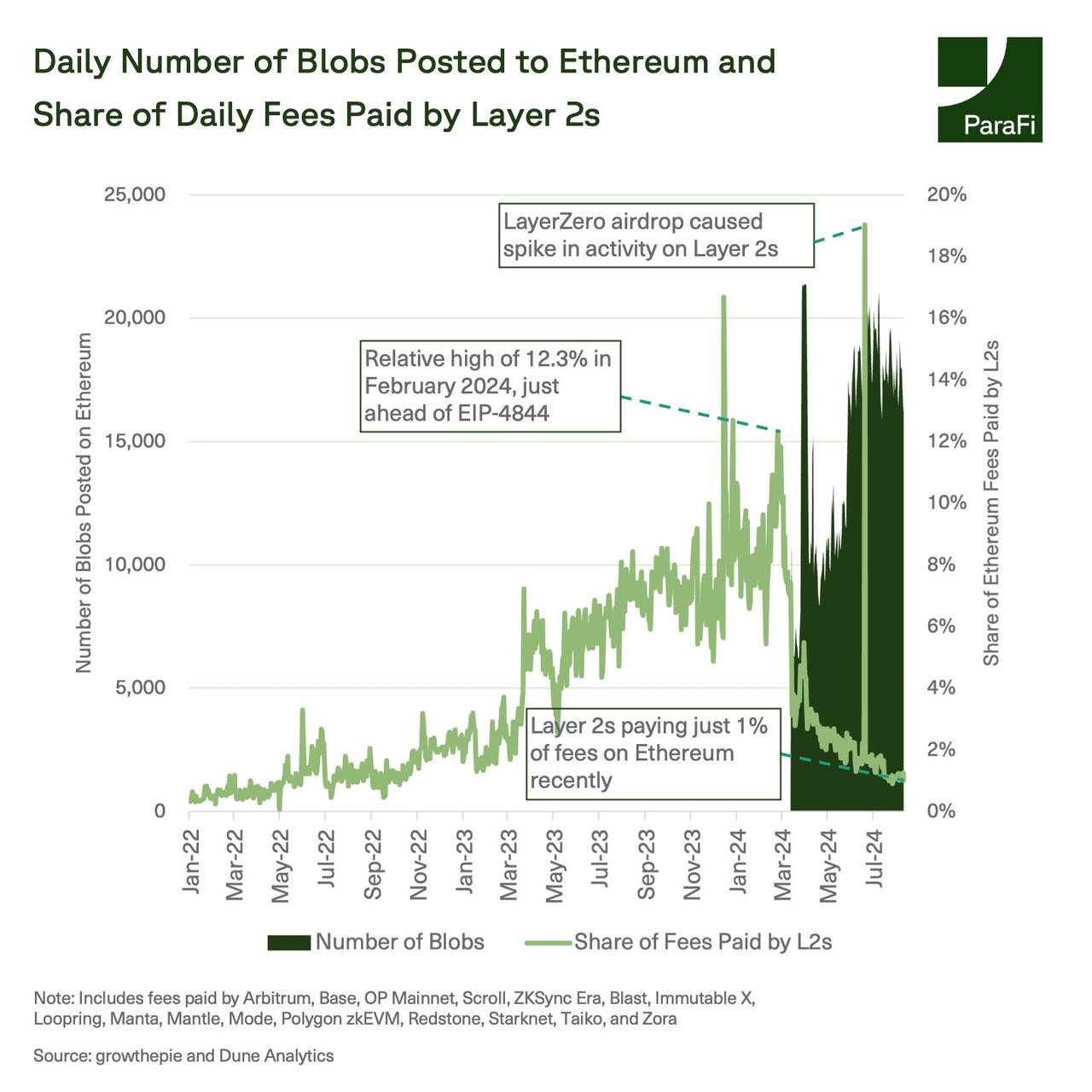

In March 2024, L2s paid over 10,000 ETH in fees to Ethereum—but by July, that figure had fallen to under 400 ETH, a drop of about 96%. As costs have decreased, L2s now contribute less to ETH burning and have also reduced gas fees on the mainnet.

Because L2s must publish large volumes of transaction summary data on-chain, they quickly adopted blobs. Since early June, Ethereum has seen at least 16,000 blobs posted per day. This has driven down the share of total fees paid by major L2s—from 12% in early 2024 to just 1%.

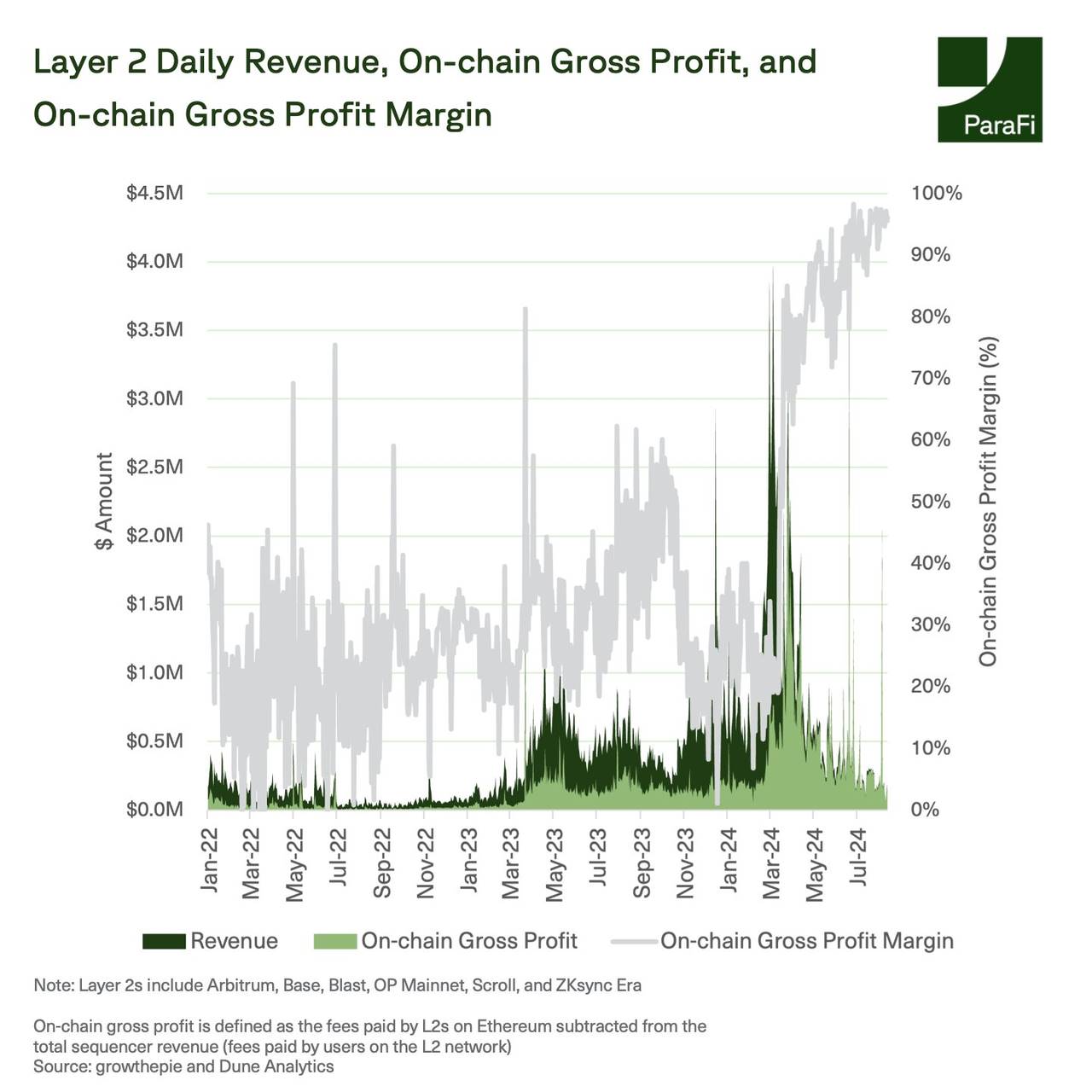

Since the implementation of EIP-4844, L2 operating margins have significantly improved. Although total sequencer revenue for scaling solutions (the sum of fees paid on L2 networks) has declined by an average of ~48% this year, operating costs have dropped by ~87%, meaning rollups now retain most of their revenue. Leading L2s now boast operating margins exceeding 90%, even after passing substantial cost savings to users. End users benefit too—on blob-using networks, fees have dropped by about 90% over the past year, with median transaction costs typically below $0.01.

EIP-4844 has had a clear impact on Ethereum L1.

Despite surging L2 usage, the direct financial benefits to ETH as an asset remain unclear. Over recent months, while L2 profitability has surged, the ETH burn rate has declined, reducing the amount of value flowing to ETH.

This leaves the Ethereum ecosystem with several important questions:

-

As L2 usage continues to grow, what role will L2 tokens play? How much value will they capture relative to ETH?

-

Are rollups capturing too much value relative to Ethereum? Or is this structure optimal for attracting more users and developers into the broader Ethereum ecosystem?

-

As more L2s launch, how will users and liquidity interoperate across these different networks?

-

With Ethereum mainnet fees now at historic lows, will we see developers reconsider deploying directly on L1, or will L2s remain more attractive?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News