Crypto Morning Brief: ARB, AXS and other tokens set to unlock this week; "Bitcoin" search volume drops to yearly low

TechFlow Selected TechFlow Selected

Crypto Morning Brief: ARB, AXS and other tokens set to unlock this week; "Bitcoin" search volume drops to yearly low

Bitcoin search volume drops to yearly low, while Memecoin search volume surges.

Author: TechFlow

Yesterday's Market Dynamics

SpaceX Successfully Completes First Starship Recovery

During its fifth Starship test flight, SpaceX successfully used mechanical arms—nicknamed "chopsticks"—on the launch tower to catch the first-stage Super Heavy booster, achieving a key objective of this mission. More than two minutes after liftoff, the first stage separated from the Starship and began its return. Over six minutes after launch, the first stage was successfully caught by the chopstick-like arms on the launch tower. This marks SpaceX’s first attempt at recovering the first stage of Starship. The second stage will continue flying and is scheduled for a controlled splashdown in the Indian Ocean.

Data: ARB, AXS, EIGEN and Other Tokens Set for Weekly Unlock; ARB Unlock Worth ~$49.4 Million

According to Token Unlocks data, major token unlocks are expected next week for ARB, AXS, and EIGEN:

- Arbitrum (ARB): ~92.65 million tokens to be unlocked at 9 PM Beijing time on October 16, representing 2.56% of current circulating supply, worth approximately $49.4 million;

- Axie Infinity (AXS): ~9.25 million tokens to be unlocked at 9:10 PM Beijing time on October 14, representing 6.08% of current circulating supply, worth approximately $43.1 million;

- Eigenlayer (EIGEN): ~11.22 million tokens to be unlocked at 3 AM Beijing time on October 16, representing 6.01% of current circulating supply, worth approximately $43.9 million;

- Starknet (STRK): ~64 million tokens to be unlocked at 8 AM Beijing time on October 15, representing 3.30% of current circulating supply, worth approximately $26 million;

- Taiko (TAIKO): ~12 million tokens to be unlocked at 8 AM Beijing time on October 14, representing 14.99% of current circulating supply, worth approximately $18.7 million;

- ApeCoin (APE): ~15.6 million tokens to be unlocked at 8:30 PM Beijing time on October 17, representing 2.31% of current circulating supply, worth approximately $11.2 million.

Google Search Interest in “Bitcoin” Hits Yearly Low, While “Memecoin” Searches Surge

According to Cointelegraph, global Google search interest in the term "Bitcoin" reached its lowest level in a year during the week of October 12, 2024. On a scale where 100 represents peak popularity, interest dropped to just 33 by the end of the week. In contrast, searches for "memecoin" reached 77% during the same period, though it has not yet surpassed the all-time high of 100 recorded in late October 2023. However, Ki Young Ju, CEO and founder of CryptoQuant, believes that due to sustained market interest in these digital assets, memecoin search volume could rebound to previous record highs by the end of October 2024.

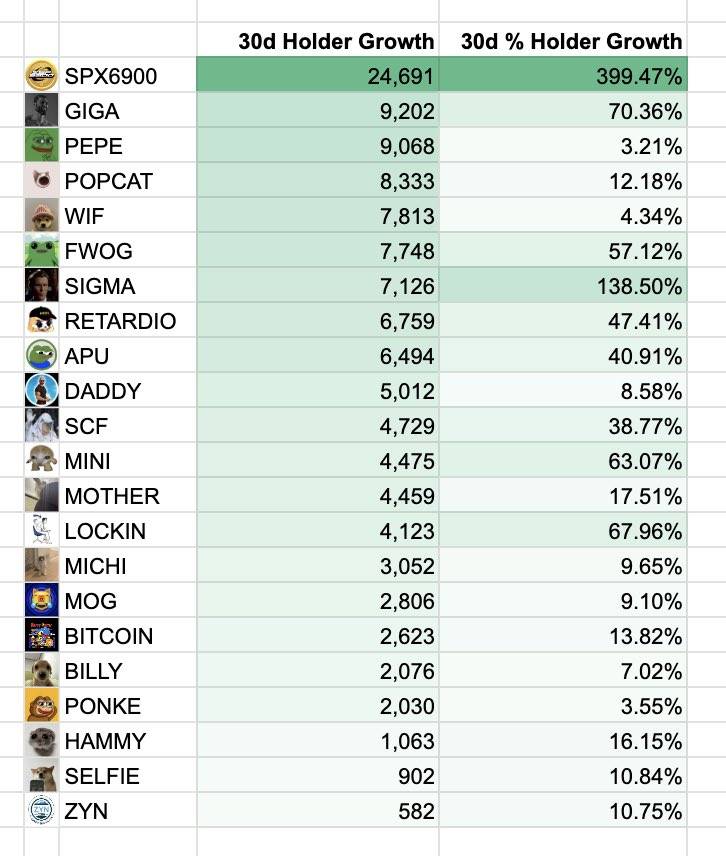

Top Memecoins by 30-Day Holder Growth: SPX6900, SIGMA, GIGA Lead

On October 14, data provided by MEME KOL Murad showed SPX6900 leading in 30-day holder growth rate, followed closely by SIGMA and GIGA. The detailed figures are as follows:

- SPX6900: Ranked first with a growth rate of 399.47%, adding 24,691 new holders;

- SIGMA: Second with 138.50% growth, adding 7,126 new holders;

- GIGA: Third with 70.36% growth, adding 9,202 new holders.

SUI Surpasses TON as Best-Performing Layer 1 Token Since Start of 2024

According to monitoring by trader ToreroRomero, SUI has surpassed TON to become the best-performing layer 1 token in terms of price performance since the beginning of 2024.

2024 Ranking of Most Crypto-Friendly Countries Released: Dubai, Switzerland, South Korea Top List

According to Socialcapitalmarkets, the 2024 ranking of the most crypto-friendly jurisdictions has been released. The top ten are: Dubai, Switzerland, South Korea, Singapore, United States, Estonia, Italy, Russia, Germany, and Brazil.

Dubai scored highest in regulatory clarity, zero capital gains tax, favorable corporate tax rate (9%), and affordable licensing fees, making it a premier destination for crypto businesses. Switzerland hosts 900 registered cryptocurrency companies and offers long-term investors an attractive 7.8% capital gains tax rate, playing a pivotal role in the global crypto ecosystem.

Mysten Labs CEO: Sui’s Gaming Device SuiPlay0X1 Is a “Software Game,” Not a Hardware Product

Evan Cheng, co-founder and CEO of Mysten Labs, the company behind the Sui blockchain, said in a May interview that crypto’s “ChatGPT moment” could happen at any time. In a recent Mainnet conference interview, Cheng reiterated that this moment has not yet arrived—but remains imminent. Regarding how Sui plans to lead this breakthrough, Cheng believes his blockchain has the greatest potential through catering to "disruptive developers" and conducting extensive experimentation.

One notable upcoming experiment is the SuiPlay0X1 handheld gaming device, now open for pre-orders and set for release in 2025. While some may view this as a hardware play akin to Solana’s Web3 phone, Cheng emphasizes it is fundamentally a software product. He stated: “This is a gaming device capable of running all Windows games. Its advantage lies in deep software and OS integration. Even for existing Web3 gamers, it’s a superior product thanks to software advantages. Hardware is almost commoditized—the magic and winning edge lie in the software experience.”

Sui Lending Protocol Scallop Reaches $100 Million in Total Transaction Volume

According to official announcements, Scallop, a lending protocol within the Sui ecosystem, has achieved a total transaction volume of $100 million. Scallop Swap can compare prices across four different aggregators and charges zero trading fees. A promotional trading campaign is currently ongoing with a prize pool of approximately $15,000. Previously, to celebrate native USDC going live on Sui, Scallop launched a promotion offering zero loan fees and free swaps.

AC: L2s as App Chains Are Illogical for Developers, Severely Underestimating Infrastructure and Compliance Costs

An

- Nearly no infrastructure support at deployment (e.g., stablecoins, oracles, institutional custody);

- No foundation or lab providing assistance;

- Centralized architecture vulnerable to attacks;

- Fragmented liquidity requiring bridges;

- Lack of user and developer communities;

- Time spent solving the above issues instead of focusing on apps and users;

- Elimination of network effects;

- Still suffers from long transaction confirmation times (some vendors unwilling to integrate);

- Developed in isolation (no collaborative teams).

App chains also severely underestimate the costs of infrastructure and compliance (browsers, custody, exchanges, oracles, bridges, toolkits, IDEs, on/off ramps, native issuance and integration, regulation, compliance). In 2024 alone, such costs have already reached $14 million, with a significant portion being recurring expenses.

Market Data

Recommended Reading

The Non-Trading Era of Cryptocurrency: Composing a Path Forward for Web3

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News