A Brief Analysis of the Main Theme of This Bull Market: The Dual Resonance of AI and Memecoins

TechFlow Selected TechFlow Selected

A Brief Analysis of the Main Theme of This Bull Market: The Dual Resonance of AI and Memecoins

The left-wing approach to asset issuance is Memecoin, while the right-wing approach is RWA and VCcoin.

Author: 0xLoki

The main theme of this cycle has become fairly clear:

1/ Memecoins and AI are the definitive core narratives

This year's memecoins are fundamentally different from previous ones. They’ve moved beyond the "pump-and-dump shitcoin" mentality and now parallel the DeFi narrative of 2020—representing a new paradigm for asset issuance. All infrastructure and services depend on asset issuance, with memecoins forming the left-wing approach, while RWA and VCCoins represent the right-wing.

The left-wing path presents a global opportunity, whereas the right-wing offers more structural plays—such as the revival trend in DeFi, exemplified by the "evil triumvirate" of ENA+Sky+Morpho, and visible business growth in legacy protocols like Curve and AAVE. Additional structural opportunities exist in BTCfi, CeDefi, and Payfi.

Therefore, I remain bearish on ETH. Currently, ETH can only support secondary narratives. While Coinbase stands to benefit significantly from the primary trends, it feels less like a united front (e.g., "Three Heroes vs. Lü Bu") and more like the "Eighteen Warlords against Dong Zhuo," each with their own agenda. It’s highly likely that ETH will underperform—losing to BTC on the upside, to Solana in the mid-tier, and even to DeFi blue chips on the downside.

2/ The impact of Western policy narratives has only just begun

During the campaign phase, narratives around Trump and Musk have already shown immense potential. Two bigger catalysts lie ahead: ① official inauguration and ② the replacement of the SEC chair. Meanwhile, ETH and MSTR have effectively taken over Grayscale’s role from the last cycle, and more corporations and sovereign nations are beginning to accumulate crypto. This cycle will be even larger than 2020.

The West’s transparent long-term bull run continues.

Given these internal and external drivers, the importance of ecosystems is now crystal clear. I won’t dwell on those with strong or second-tier consensus. Instead, let’s examine two ecosystems still flying under the radar:

3/ Bittensor Ecosystem

I recommend checking out Vitlik’s recent interview. Though unrelated to ETH, it offers fascinating insights on AI centralization and authoritarian monopolies, along with visions for future AI coexistence. On the memecoin front, ACT is clearly the big beta play; for altcoins, the answer is equally clear—true crypto-native AI must be deAI or Fair AI, which makes Bittensor >> Worldcoin.

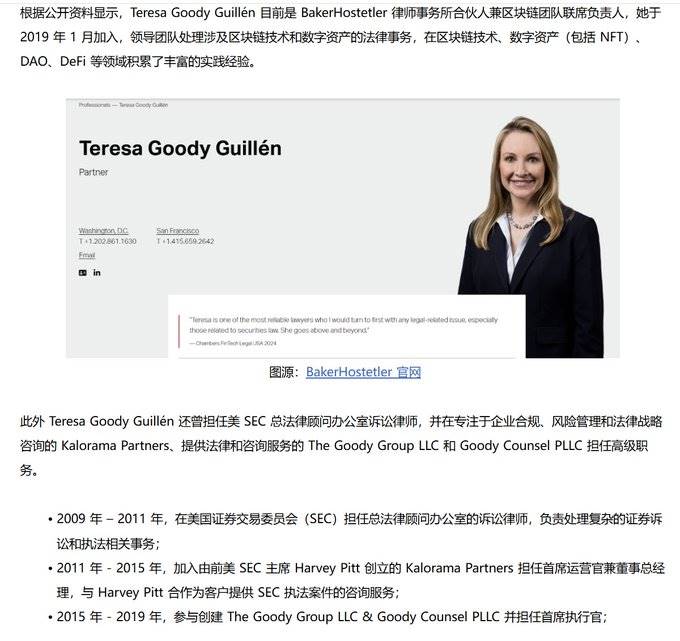

Notably, last week it was reported that Teresa Goody Guillén, co-head of BakerHostetler’s blockchain practice and legal partner to Bittensor’s first subnet Masa, is the leading candidate for the next SEC chair. In the week since this news broke, while BTC has pulled back, $MASA has still surged around 30%.

4/ Near Ecosystem

As the saying goes: one step ahead gets you meat, ten steps ahead gets you shit. Near fits this perfectly. When Solana memecoins first took off earlier this year, Near quickly followed, producing notable projects like Black Dragon and One Dragon. Near’s founder @ilblackdragon also attended NVIDIA’s AI conference.

But for a while afterward, both memecoins and AI cooled down. Now that the memecoin and AI wave has finally arrived—reaching Solana, Base, SUI, and BNBChain—Near’s community is left with graves overgrown by three-meter-tall grass.

Yet there’s good news: a mystical rule holds true. From DeFi to X2E, then NFTs and inscriptions, Near always manages to catch the very last train and grab the final warm bite. Chains later than Near usually miss everything entirely. Near is the kind that arrives late but still eats well—an ecosystem that makes moves and thinks big. Just checked: memecoin @dragonisnear, whose grave had three meters of grass, and inscription @inscriptionneat, with five meters, both still sit at ~$7M market cap with excellent exit liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News