Murad Interview: The Memecoin Super Cycle Will Create Billionaires

TechFlow Selected TechFlow Selected

Murad Interview: The Memecoin Super Cycle Will Create Billionaires

Murad believes the future trend will be a close integration between altcoins and communities.

Compiled & Translated: TechFlow

Guest: Murad Madhov

Podcast Source: Decypher Podcast

Original Title: The Memecoin Supercycle Will Mint Billionaires - Murad | Ep 14, Murad | Memecoin

Release Date: October 2, 2024

Background Information

Murad Madhov is an entrepreneur and investor who has proposed a unique theory: the next top-performing assets will be memecoins—cryptographic assets based on internet memes. He believes these assets will create millionaires, multimillionaires, and even billionaires.

Reality: Why Altcoins Are Failing

-

Murad discusses the current state and future of altcoins. Since 2016, his focus within cryptocurrency has increasingly shifted toward altcoins as he sought to understand their essence. Murad points out that nearly all altcoins listed on Binance are underperforming, with only two exceptions.

-

Murad emphasizes that the crypto industry is not primarily a technology-driven field but rather an asset-generating and speculative one. He notes that building a community takes time—at least a year. The success of an altcoin depends on whether it can make ordinary people wealthy. He also suggests that the relationship between altcoins and cryptographic utility tokens is more adversarial than simply competitive.

The Significance of Meme Coins

-

Murad further elaborates on his views about altcoins, arguing they are not just cultural phenomena but symbols of communities. He highlights that the success of altcoins lies in how they evolve and adapt to market demands. Reflecting on the history of the crypto space, he references the first Oscar wave in 2014 and the ICO boom in 2017, both of which contributed to the rise of altcoins.

-

He analyzes current market shifts, noting that many DeFi projects now launch at high valuations, making it difficult for retail investors to access truly promising opportunities. Murad stresses that retail investors are increasingly realizing that the token itself—not the software—is the product. He maintains that the crypto industry remains fundamentally focused on asset creation, with technology serving merely as a byproduct.

Future Trends

-

Murad believes the future trend will be the deep integration of altcoins with communities. He argues that only those altcoins capable of continuous evolution and adaptation to changing markets will succeed. Market dynamics, he says, are influenced not only by internal industry factors but also external forces, requiring a combined analytical approach.

The Rise of Memecoins: Ushering in a New Era of Crypto

-

Murad delves deeper into the ascent of memecoins, calling it a "post-software" phenomenon. He observes that markets have already seen memecoins like Doge, Pepe, and SafeMoon reach astronomical market caps, proving their value does not rely on tangible products. Murad contends this demonstrates that software or platforms were never the core product of crypto projects.

-

He notes that many venture-backed projects currently trading at $7 billion valuations generate only around $500 in daily revenue, underscoring that their worth stems not from cash flows but from what he calls "mimetic premium."

-

Murad presents a controversial view: all altcoins are essentially memecoins—just more complex versions. He explains that if a token serves neither as a store of value nor distributes income, then it qualifies as a memecoin.

Community and Token Value

-

Murad emphasizes that the real product is the community and the token—not the software itself. This perspective, he argues, allows for a fresh analysis of the entire crypto universe, beyond just memecoins or technical projects. While founders and VCs often claim regulatory constraints prevent them from distributing income, Murad suspects this is frequently motivated by self-interest.

-

He warns that once income distribution begins, investment bankers will use Excel models to estimate fair value—likely arriving at figures far below current market prices. Therefore, Murad asserts that any project without cash flow or profit-sharing should be considered a memecoin, offering a new lens through which to interpret the crypto market.

Outlook on the Industry’s Future

-

In the conversation, the host mentions his father's interest in DeFi, sparked by its appearance of legitimate financial infrastructure, implying DeFi brings some form of value proposition to the crypto space.

-

Murad responds that while he sees memecoins as the new wave, this doesn’t mean capital inflows into the industry will decrease. On the contrary, the rise of memecoins could attract even more investors and funding. He believes the crypto sector still holds potential for growth and innovation.

The Importance of Memecoins and Cultural Communities in Crypto

-

Murad underscores the impact of memecoins on crypto utility tokens, describing it not as an attack on crypto technology but as a “vampire attack” on crypto tokens. He notes that many DeFi protocols—Uniswap being a prime example—can function perfectly well without a native token. This suggests the best product doesn't necessarily need a token, and conversely, the best tokens don't require a functional product.

-

Murad believes retail investors are increasingly recognizing that all tokens—whether backed by technology or mere meme imagery—are essentially gambling tables in a casino. He observes that people are beginning to question why they should pay for a table already valued at $10 billion, instead of creating a new one where everyday individuals can get rich. In his view, memecoins are reenacting the 2016–2017 ICO boom, driven fundamentally by human motivation and desire.

The Power of Community and Culture Building

-

Murad stresses that strong communities are the key drivers behind token performance. A powerful community functions almost like a “cult,” where members' loyalty and passion restrict supply, creating a “diamond hands” effect. Even as prices rise, community members are reluctant to sell because their identity and sense of belonging make holding more appealing than exiting.

-

He notes that such communities grow when ordinary people achieve wealth. Historically, successful crypto projects have built robust followings by enabling investors to profit. Bitcoin, Ethereum, Solana, and meme tokens like Shiba Inu and Dogecoin attracted massive numbers of retail holders who gained substantial returns—leading them to emotionally identify with these assets.

Token Distribution and the Wealth Effect

-

On the topic of airdrops, Murad points out that airdrops are one-time events, and most recipients eventually sell them for ETH or stablecoins. Unlike the lasting wealth effect seen in successful memecoins, he argues that memecoin success stems from dynamic token distribution. Over time, ownership concentrates among core believers. As small-cap tokens grow into mid-caps, the majority of supply ends up in the hands of die-hard supporters—giving these tokens immense upside potential during demand surges.

-

Murad adds that true “cult” communities must endure market volatility. Only after surviving multiple sharp downturns can a community prove its resilience and staying power. These trials strengthen conviction among holders, enabling rapid price appreciation when demand returns.

Memecoin Trends in the Crypto Market

-

Murad highlights his investment philosophy in today’s crypto market, particularly his focus on memecoins. He argues that memecoins significantly outperform other token categories, especially relative to Bitcoin.

-

Murad notes that despite Bitcoin attracting significant institutional investment, over the past year only 42 tokens outperformed BTC—13 of which were memecoins. This pattern clearly signals a broader market trend.

Performance of Memecoins

-

Murad points out that memecoins have shown exceptional market performance, delivering returns that far exceed other token types. He notes that over the past 40 weeks, whenever Bitcoin corrected, memecoins led the rebound. This consistent pattern reflects sustained enthusiasm among retail investors.

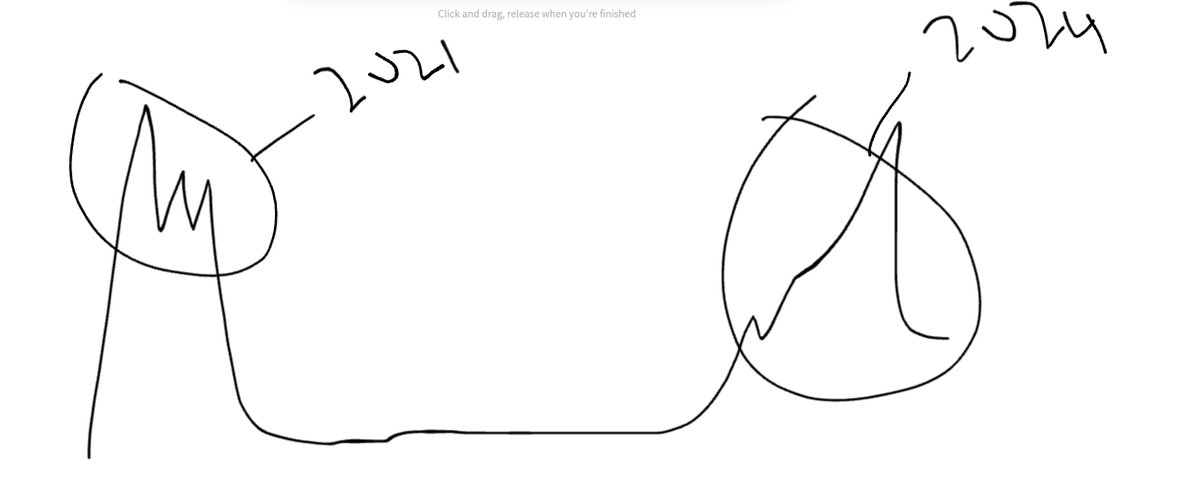

Future Market Trends

-

Murad believes that if future market cycles mirror past ones, the top-performing tokens of 2024 will continue to shine in 2025. He observes that historically, certain sectors or tokens surge in the third year of each cycle—for instance, Ethereum and Ripple in 2016, DeFi and NFTs in 2020—all achieving massive gains later in their respective cycles.

Social Psychology and Investment Behavior

-

Murad emphasizes that investor behavior is heavily influenced by social psychology. He notes that retail investors often mimic the actions of peers or family members who’ve profited from memecoins. This mimetic effect drives more participants into the memecoin market, fueling upward price pressure.

-

As more retail users enter, they tend to seek investments similar to those that succeeded around them—further amplifying the memecoin frenzy. He expects 2025 to be a breakout year for both memecoins and AI-related tokens, potentially witnessing parabolic growth.

Ethereum and Solana: The New Casinos

-

Murad explains why he specifically focuses on memecoins built on Ethereum and Solana. He describes these platforms as “casinos” within the crypto ecosystem, having accumulated vast wealth and user bases over previous cycles.

The Ecosystems of Ethereum and Solana

-

Murad emphasizes that Ethereum and Solana succeeded by attracting large numbers of users and investors. He characterizes Ethereum as a “mega casino,” having served as the primary medium during the 2016–2017 ICO boom and continuing to play a central role in the rise of DeFi and NFTs. This transformed Ethereum from a blockchain platform into a full-fledged economy where users engage in diverse transactions and investments.

-

Solana follows a similar path, building its ecosystem by drawing in memecoin and DeFi activity. Murad believes emerging blockchains like Aptos and Sui aim to replicate Ethereum and Solana’s success, positioning themselves as new forms of “value storage.”

Meme Coins as User Acquisition Tools

-

Murad notes that many new blockchain platforms are using memecoins to attract users. Memecoins incentivize participation, boosting transaction volume and liquidity. While platform teams hope memecoins will increase their native token value, Murad observes that most such efforts are driven by teams or VCs—not organic, grassroots communities.

The Importance of “Idle Wealth”

-

Murad further explains the concept of “idle wealth”—referring to the large amounts of capital held by investors on Ethereum and Solana. He argues that convincing these investors to allocate just 5% or 10% of their holdings to memecoins could unleash massive capital inflows into this sector.

-

In contrast, Murad pays less attention to chains like Tron and Aptos, believing they lack sufficient idle wealth and total value locked (TVL). This makes it harder for them to attract capital, relying instead on exchange listings or cross-chain transfers—which introduce friction.

-

Murad's view underscores the unique position of Ethereum and Solana in the crypto market and how their ecosystems enable them to draw users and funds via memecoins. He sees these platforms as dominant “casinos” whose strong user bases and idle capital will continue to benefit future market trends. Meanwhile, he remains cautious about newer blockchains, believing they need substantially more user adoption and capital to achieve comparable success.

The Evolution of Memecoins: From Banks to Memes in an Instant

-

In this segment, Murad discusses the value and future trajectory of memecoins, highlighting the shift between traditional finance and crypto markets and how it shapes memecoin development.

Valuation of Memecoins and Their Relationship With Blockchains

-

Murad notes that while a memecoin’s valuation may sometimes surpass that of its underlying blockchain, this is usually coincidental. He believes blockchain choice matters in early-stage valuations (e.g., under $300 million), as the “idle wealth” on these chains can accelerate memecoin growth. However, as markets mature, the link between memecoin value and its base chain may weaken.

The Impact of Centralized Exchanges

-

Murad predicts that by mid-2025, many top-performing memecoins will list on centralized exchanges, boosting their circulation and mainstream acceptance. Platforms like Robinhood are rising in prominence, allowing users to buy memecoins directly via traditional bank accounts—bypassing the complexity and fees of blockchain transactions. This streamlined experience could bring a new wave of retail investors into the memecoin space.

Optimal Risk-Reward Range

-

Murad discusses his preferred market cap range: $5 million to $200 million. He believes this range offers better risk-reward ratios. While large-cap memecoins may continue rising, he sees greater opportunity in mid-cap projects. He advises against investing in low-market-cap memecoins due to their higher risk and volatility.

Classification of Memecoins

-

Murad divides memecoins into two categories: “PvP” (player versus player), involving fast trading and speculation; and “PvE” (player versus environment), focused on community-building and long-term investment. He personally favors the latter, prioritizing sustainable community development over short-term flipping.

Holding Strategy and Outlook

-

Murad plans to hold nearly all his memecoins for the next 14 months, reassessing only around October or November 2025. He anticipates a memecoin supercycle and promotes the idea of a “belief supercycle,” urging investors to stop short-term trading and instead focus on community building and long-term holding.

Accelerationism and the Dynamics of Memecoins

-

Murad dives deep into the accelerating pace of memecoin creation, the importance of community building, and his investment strategy. He argues that the current market environment fuels rapid memecoin growth and reshapes the risk-reward calculus for investors seeking winners.

The Accelerated Production of Memecoins

-

Murad introduces the concept of “memecoin accelerationism,” highlighting the explosive daily emergence of new memecoins. He predicts we may soon see hundreds of thousands of new memecoins created every day. This saturation makes identifying genuine winners increasingly difficult, as attention and capital are diluted across countless new projects.

The Importance of Community

-

Murad stresses that building a strong community typically takes at least a year. Established communities (“cults”) hold a competitive edge because they offer stronger support and loyalty. He prefers investing in memecoins with solid existing communities rather than chasing newly launched ones.

Shifting Risk-Reward Dynamics

-

Murad notes that as the market evolves, the risk-reward profile of small-cap memecoins is declining, while that of established, community-driven memecoins is improving. In the past, low-market-cap projects offered higher upside; now, larger-cap memecoins present better growth opportunities. He prefers projects with lower prices but active, engaged communities.

Avoiding Cabals

-

Murad discusses the prevalence of “cabals” in the memecoin market—small groups that manipulate prices for profit. He opposes such centralized manipulation and favors decentralized, organically grown memecoins. He wants his investments to undergo fair, transparent price discovery without artificial interference.

Navigating the Memecoin Industry

-

Murad discusses future trends in the memecoin space, especially how to find investment opportunities amid intensifying competition. As more players enter, retail investors face growing challenges—but he believes focusing on authentic communities and culture can lead to success.

Challenges for Retail Investors

-

Murad believes many retail investors speculating on memecoins will suffer losses before realizing that memecoins with strong foundational communities (“cults”) are superior investments. He advises skipping small-cap projects altogether, given their extremely low success rate—about 95% are unlikely to generate profits.

Identifying Authentic Communities

-

Murad emphasizes widespread fraud in the memecoin space, particularly noting that most influencers do not act in investors’ best interests. He estimates 99% of influencers manipulate markets, leveraging their reach to pump and dump memecoins. He recommends developing a checklist to identify genuine projects—looking for fair token distribution, organic community engagement, and multi-dimensional strength.

Future Trends in Memecoins

-

Murad predicts that future memecoins will move beyond simple jokes and animal themes toward more complex and serious subjects. He views memecoins as “tokenized communities,” expecting tokens to emerge around virtually every concept—including individual words, numbers, and sentences. In such a saturated landscape, only a few truly meaningful memecoins will stand out.

The Rise of Movement Coins

-

Murad introduces a new category—"movement coins"—tokens that represent more than just communities; they embody philosophies or beliefs. He believes the most successful future memecoins will be those that evoke intense emotional responses. He calls this the “belief supercycle,” envisioning such tokens becoming elevated symbols of cultural movements and ideologies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News