Beyond Memecoins, Why You Should Pay Attention to Undervalued Liquid Tokens?

TechFlow Selected TechFlow Selected

Beyond Memecoins, Why You Should Pay Attention to Undervalued Liquid Tokens?

Then, look forward to the value discovery of Flow tokens.

Author: Kyle

Translation: Luffy, Foresight News

The case for liquid tokens is simple: I believe there's massive alpha in liquid token investing, while VC-backed token investing is already oversaturated.

Many solid companies are building in crypto, and they all have their own tokens—but they're not fairly priced.

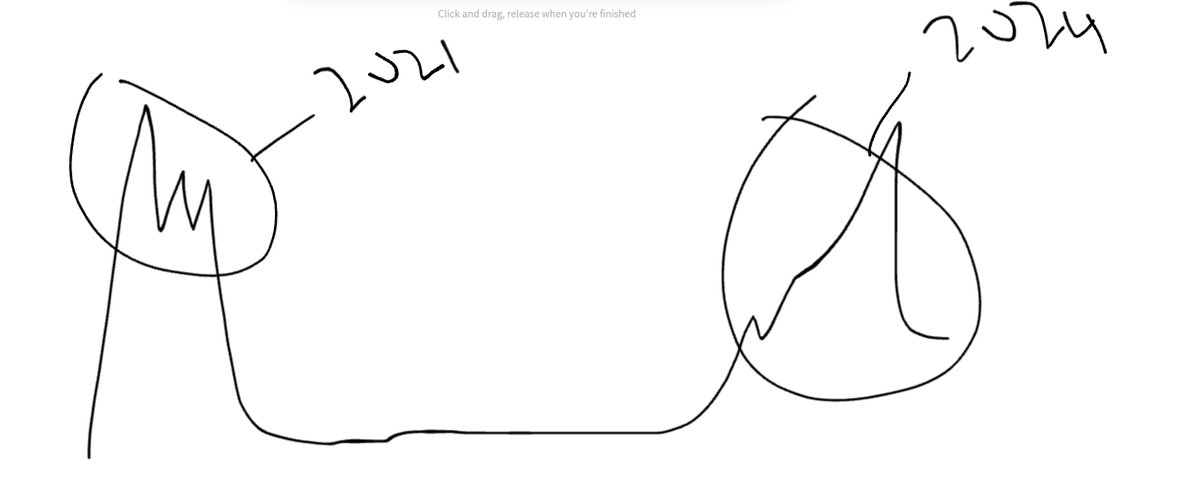

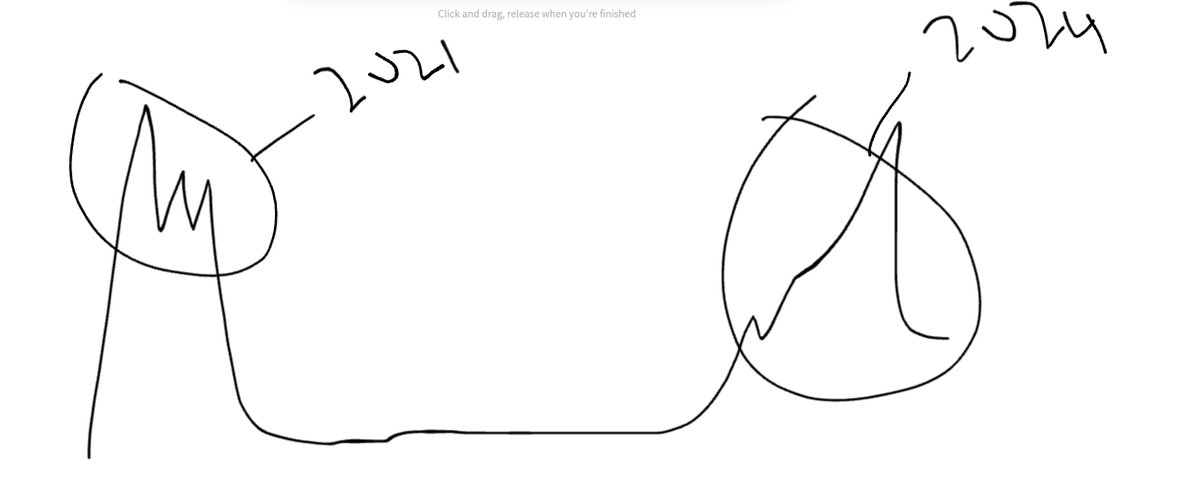

In 2021, valuations were primarily driven by dream-selling. I believe that post-2024, valuations will be driven by actually realizing those dreams.

SOL monthly chart

Solana is a prime example of this shift—three years later, people realized "maybe it wasn't all hot air."

If you're a fund, your opportunity lies in figuring out who’s actually building cool, real products. You might think, "Shouldn’t re-rating happen now?"—No.

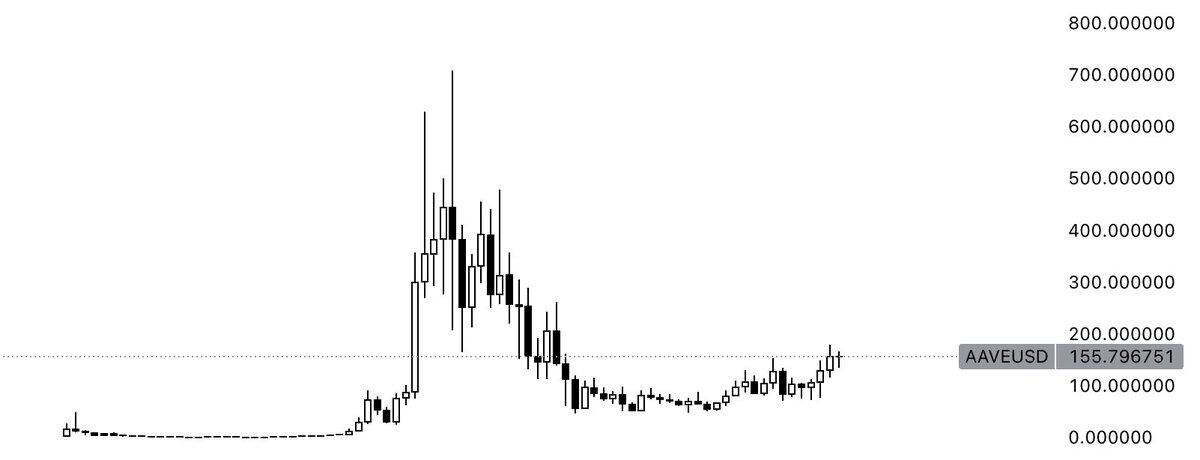

AAVE monthly chart

As Arthur noted in his latest piece on the DeFi revival, DeFi is severely undervalued and will continue growing over the coming years. The proof is in the pudding. In crypto, some very legitimate businesses are being overlooked—even those currently valued in the billions.

But the liquid market thesis isn't just about old tokens. There's a widespread belief that the liquid token space offers many opportunities, with asymmetric returns for teams truly building. A clear example is Banana Gun, highlighted in Theia Research’s article.

Banana Gun ranks 6th in revenue across all-chain protocols but 284th in market cap. This shows that some genuinely building projects remain deeply undervalued.

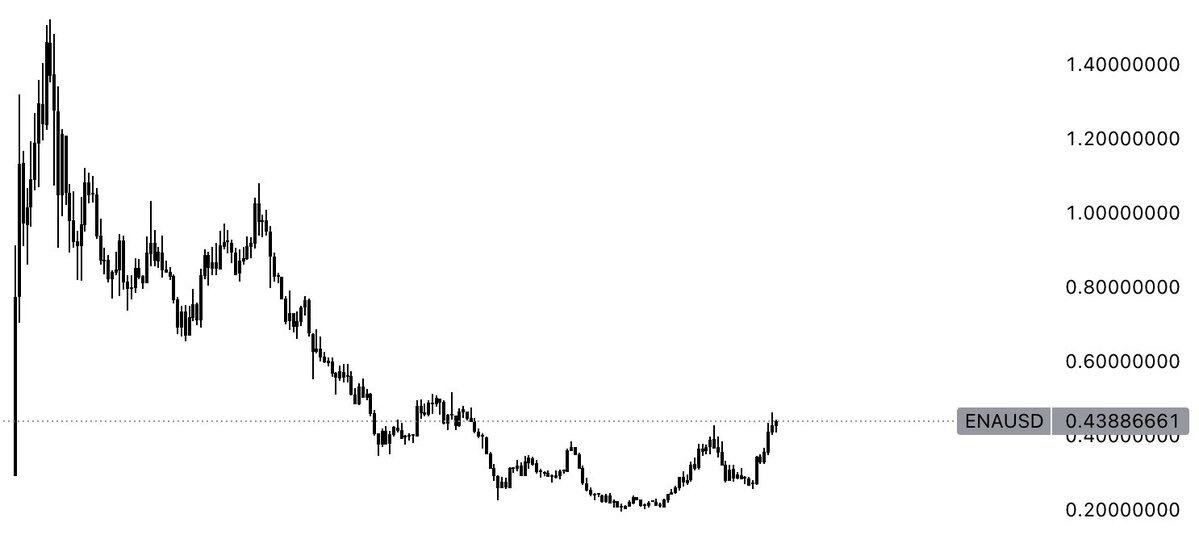

A more recent example is Ethena. You may disagree with the argument, but I want to make my point clear here: if you know where to look, there are incredible opportunities in the liquid token market.

This isn't just "oh, it's an AI token, go long," or "it's new, so the price will go up." The core idea is:

-

Some issued-token projects are severely undervalued

-

The market will increasingly focus on fundamentals

Below, I explain the opportunity in liquid tokens through four questions.

Question 1: Aren’t scams still the most profitable?

Yes. After all, it’s still crypto, and there’s still a "hype" factor. Things can get overvalued quickly, and I don’t doubt we’ll still see fraudulent scams pushed to astronomical prices (TRB being one example).

But if you look ahead to 2024, asset selection has become more important than ever, because people now understand how the "dream-selling" game works. No one will fall again for narratives like "putting the world on blockchain" or "yield farming 2.0."

In 2021, you could go long anything and make money; in 2024, you could ride trending narratives and profit. But in the coming years, you'll need to gradually shift from favoring fake scams toward backing legitimate projects.

Question 2: When will the market start paying attention?

I don’t know. I’m aiming where the puck is going, not where it is. Sometimes, though, it takes time for the puck to arrive. Still, we can already see signs—the market is starting to pay attention, and asset selection became critical in 2024.

Many seem to forget our end goal: bringing in TradFi capital. TradFi always demands justification: the reason they like Bitcoin is its emergence as "digital gold"—you might disagree, but the fact remains, fundamentals are what hold things together.

Anyone powerful enough to move markets needs fundamentals and wants to see real numbers.

At the same time, another issue with this thesis is that it requires bullish conditions (i.e., BTC rising), which we haven’t had over the past five months. That’s also why Memecoins have performed so well—they’re typically highly resilient to market volatility and operate in a completely different competitive arena (on-chain).

Question 3: Why not just buy Memecoins? Bro, Memecoins are enough

I agree with this view. Many readers might assume Memecoins represent the peak of hype. They’re not. I define hype as a gap between promises and delivery. With Memecoins, however, promise and delivery align: they promise nothing and deliver nothing. What do you expect from Popcat? Or Doge?

From this angle, you can build a "fundamental" framework for Memecoins—not based on annual earnings, but on other factors. Does it have cult-like community devotion? Does it have a meme that unites people? Etc.

But when there are 1,000 memes around the same animal, it becomes hard to tell the good from the bad. It’s not much different from having 100 different L1s or 100 different GameFi projects.

The strongest speculation builds on a core of truth—and for Memecoins, that core truth is "strong communities." This is entirely different from fraudulent projects selling dreams.

Memecoins and liquid tokens are two sides of the same coin, just at opposite ends of the spectrum. Some scammy projects achieve absurd valuations without delivering anything, yet make grand promises. At least Memecoins promise nothing—what you see is what you get.

You might disagree. I admit, I’m not betting on Memecoins. But if I had to choose between Memecoins and outright scams, I’d pick the former without hesitation.

No matter your take on the Memecoin supercycle, one thing is clear—it’s already happening.

Therefore, a barbell strategy combining Memecoins and liquid tokens makes sense: bet on memes with the strongest cult followings and tokens with the best products.

Question 4: What do fundamentals really mean?

All the examples I’ve given above share a common theme: "It earns a lot but trades at X—it should be higher." But I don’t think every fundamental argument must be framed this way. Fundamentals essentially mean: "There’s a logical case for why it should be worth more," and valuation is just one way to express that.

Beyond valuation, there are many ways to articulate this—but the key is that the argument is rooted in sound logic, not just "it’s a new token, bro."

Conclusion

TLDR: Some liquid tokens are doing incredibly cool things but haven’t been truly discovered yet. Go find them!

I divide the past year into three phases:

-

Phase 1 (Jan–Mar): Excitement. The bull market is really back! We still saw some hype, but far less than in 2021—more focus on projects actually doing things.

-

Phase 2 (Apr–Now): Memes! Memes! Memes! Nobody cares about altcoins anymore. As the old saying goes: buy when no one's paying attention, sell when everyone's talking.

-

Phase 3 (Coming Soon): Alternatives to Memecoins are emerging.

I look forward to discovering more raw gems: companies with strong fundamentals that remain severely undervalued.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News