The insane multi-chain universe, the insane OP Stack

TechFlow Selected TechFlow Selected

The insane multi-chain universe, the insane OP Stack

The Layer2 scaling battle has only just begun. What's your take on this silent war in the Layer2 arena?

Author: YBB Capital Researcher Ac-Core

Preface

The main narrative of ETH has shifted from Layer1 to Layer2. If you still perceive it through the lens of "one-click token issuance" via ERC-20, let’s broaden our imagination — a wave of “one-click chain deployment” is about to explode! Leveraging its unmatched ecosystem and consistently high TVL, Arbitrum has long led the war among Layer2s. But can this temporary victory last? Unlike Arbitrum Orbit’s additional Layer3 approach, OP Stack enables the creation of Layer2 chains as a “superchain.” This article will comprehensively analyze OP Stack architecture, ZK elements within OP, and Rollup security issues.

OP Stack Ushers in the "Superchain Universe"

YBB Capital Researcher Ac-Core Self-made

Where will the next bull market narrative begin? From high-performance Layer1s, stacked Layer3s, ZK-based Layer2s, or perhaps from OP Stack's superchains? This is an intriguing and thought-provoking question. As long as Ethereum doesn’t self-destruct, during the next bull run, the title of “Ethereum killer” will remain an insurmountable goal for all other public chains. Yet within this giant lie many overlooked core innovations — one of which is OP Stack.

What is OP Stack?

OP Stack can be understood as a set of open-source software components enabling anyone to build their own Layer2 blockchain on Ethereum using Optimistic Rollups. It moves most computation and storage off-chain while relying on Ethereum for security and finality. Technically, Optimism significantly reduces users’ on-chain fees. OP Stack consists of four main components:

-

Mainnet: OP Mainnet is a low-cost, fast Ethereum Layer2 network compatible with the Ethereum Virtual Machine (EVM);

-

Contracts: Smart contracts implementing OP Stack’s core logic and functions. These include the State Transition System (STS), Fraud Prover (FP), State Commitment Chain (SCC), and Canonical Transaction Chain (CTC);

-

Services: Provide data availability, synchronization, and communication between Layer1 and Layer2;

-

Tools: Facilitate development, testing, deployment, monitoring, and debugging of blockchains based on OP Stack.

Exceptional Openness:

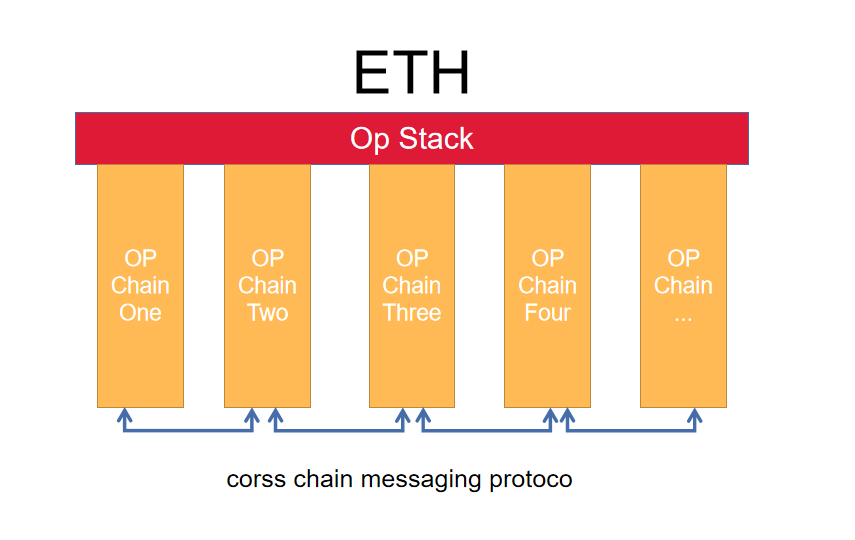

OP Stack aims to become infrastructure for modularly scalable blockchains, integrating various Layer2s into a single Superchain — transforming isolated Layer2s into an interoperable and composable system. Launching a Layer2 could become as simple as deploying a smart contract on Ethereum today, shifting the narrative from “one-click token issuance” to “one-click chain deployment.” In essence, Superchain is a horizontally scalable blockchain network sharing Ethereum’s security, communication layer, and developer toolkits.

YBB Capital Researcher Ac-Core Self-made

OP Stack (Over Powered Stack) will serve as the unified modular development stack behind the Superchain — a vast network of interconnected, communicative blockchains. The Optimism Collective oversees overall development and maintenance of OP Stack, supporting a shared open-source system for deploying new rollup networks. It also functions as a standardized open-source module suite. Doesn’t this sound like a Cosmos fully secured by Ethereum? While ETH and ATOM were once expected to complement each other, could OP Stack now emerge as a potential “Cosmos killer”? Let’s break down OP Stack’s definition further:

Modules are data units that any developer can plug into OP Stack. The “standardization” of this Superchain means consensus exists on module standards, allowing universal implementation. Full openness ensures free access for development, iteration, and message requests. Developers gain the ability to swap modules across different execution, consensus, settlement, and data availability layers of a chain.

Take dYdX leaving Ethereum for a Cosmos appchain — their motivation was greater modularity in their chain’s consensus layer. I see this as a positive trend, encouraging more independent DApps to choose suitable blockchains for development. Luna was representative, though ultimately destroyed due to external factors. Fortunately, OP Stack solves this issue by enabling easier code forking, allowing developers to abstract different blockchain components and modify them via pluggable modules.

OP Stack Design Principles:

-

Efficiency: Build anything with OP Stack and deploy blockchains with one click;

-

Simplicity: Leverage reusable code and ready-to-use dev kits to enhance security and reduce maintenance complexity, lowering entry barriers;

-

Scalability: The Optimism Collective will fully open-source OP Stack’s core code.

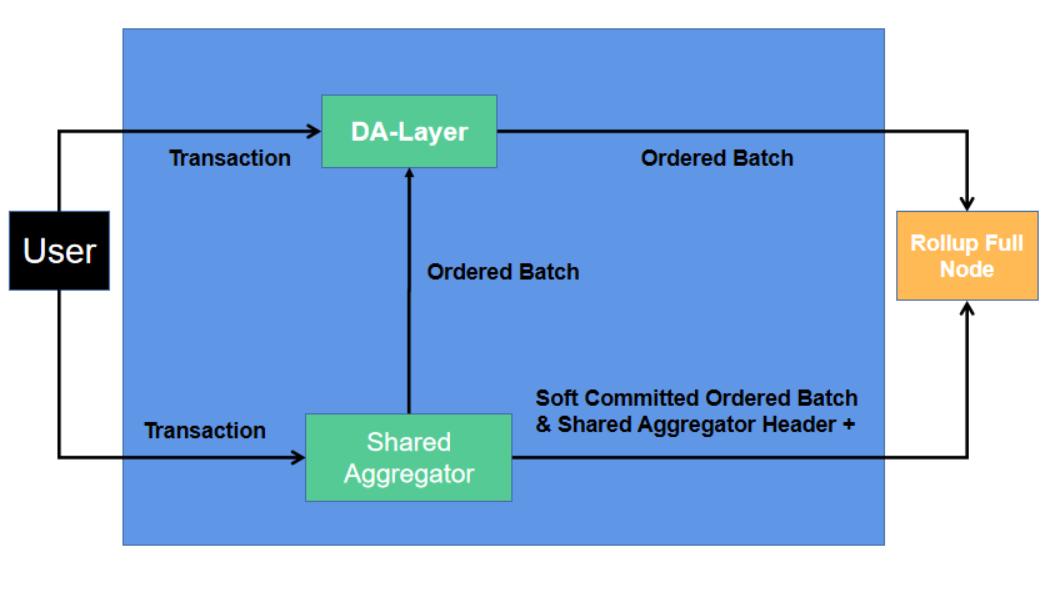

Architecturally, OP Stack can be divided into six layers from bottom to top: DA Layer (Data Availability), Sequencing Layer, Derivation Layer, Execution Layer, Settlement Layer, and Governance Layer. Each layer comprises modular API components that can be freely combined or decoupled. The most critical are the DA Data Availability Layer, Execution Layer, and Settlement Layer — forming OP Stack’s primary workflow.

-

DA Data Availability Layer: The source of raw data for OP Stack. Can use one or multiple data availability modules. Currently, Ethereum is the primary DA layer, but more chains may join in the future;

-

Execution Layer: The state structure within OP Stack, supporting EVM or other VMs. Enables Layer2 transactions initiated on Ethereum, adding extra Layer1 data fees per transaction — reflecting the total cost of publishing transactions to Ethereum;

-

Settlement Layer: Where Layer2 transaction data ends up after confirmation on Layer2 and sent to target blockchains for final settlement. Future integration of validity proofs like ZK could bridge gaps between chains, even connecting OP-based and ZK-based Layer2s.

OP Stack Rules:

YBB Capital Researcher Ac-Core Self-made

Ethereum’s infinite block space is key to large-scale applications, but this expansion brings fragmentation. Permissionless deployment introduces new challenges — currently, every new OP Stack chain grows independently without direct methods to share standards or improvements. Users and builders face significant hurdles: evaluating numerous distinct chains individually based on security, quality, and neutrality. To realize the Superchain vision, OP Stack must transform from isolated, fragmented block spaces into a unified chain collective dedicated to open, decentralized block space. The “Chain Rules” establish guiding principles for optimistic governance and the Superchain. Optimistic governance shifts from managing individual chains to managing shared standards across multiple chains, defining attributes required to be part of the Superchain while prioritizing user protection. Fundamentally, the “Chain Rules” represent a social contract (not legal), making active community discussion crucial. Their existence allows the Superchain to guarantee the following characteristics:

-

Ensure block space remains homogeneous, neutral, and open: Commitment to Chain Rules equals commitment to protecting users, developers, and stakeholders. Any chain, regardless of size, can credibly prove homogeneity, neutrality, and openness under optimistic governance if part of the Superchain;

-

Benefit from continuous improvement: Shared upgrades mean the Superchain always accesses the best technology without needing individual maintenance;

-

Provide better, more usable infrastructure: Since all chains in the Superchain credibly adhere to a standard, they can jointly ensure availability and economic efficiency of critical services like indexing and sequencing.

Thought-Provoking Questions:

Can OP Stack benefit OP itself?

What exactly is OP Token used for? If chains follow Basechain’s model and return some revenue to the Optimism Collective, then the “treasury” income would depend on its own “value,” creating narratives that feed back into token price — similar to how ATOM performs in secondary markets. This might be the current optimal solution. If more chains emulate Basechain’s revenue-sharing model, the Optimism Collective will ultimately benefit. Does this remind us of UNI? Both projects have strong fundamentals, yet their tokens lack utility beyond voting and governance. However, unlike UNI, current Layer2s face centralized sequencer issues. Even if Layer2 tokens are only used for leader selection (not consensus voting), the value of sequencing rights still accumulates to Rollup tokens.

Meanwhile, on July 25, the OP team released the Law of Chain proposal, aiming to standardize shared governance models and sequencers for all OP Stack chains, formalizing the “profit-sharing” model to bring broader benefits to the entire OP ecosystem (as mentioned in the OP Stack Rules section). Compared to Cosmos’ shared security model, this approach is remarkably similar.

Difference Between OP Stack and ZK Stack:

OP Stack: Multi-chain, Single Choice

As discussed earlier, OP Stack adopts a multi-chain model similar to Cosmos, but offers only one choice. Because OP Stack requires each chain to verify others’ transactions — otherwise, results must wait days on Layer1 — a single shared sequencer, centralized MEV distribution, and governance/contractual safeguards are the only way to achieve seamless interoperability across Optimistic Rollup chains.

ZK Stack: Multi-chain, Multiple Choices

Unlike OP Stack, ZK Stack supports multiple chains with multiple choices — customizable sequencers, independent MEV handling, protected by mathematics and code (note: OP Stack relies on contractual and governance protections). This is because if ZK systems adopt fixed shared or very limited thread sets, blind trust between chains via pure math alone would undermine the value of zero-knowledge proofs.

ZK Elements in OP Stack

YBB Capital Researcher Ac-Core Self-made

Because OP Stack is a completely open architecture, it makes zkvm, zkmips, zkwasm, zkevm possible within its ecosystem. But compared to “orthodox ZK,” these are merely novel ZK elements emerging in OP Stack. This leads us to wonder — perhaps a dream collaboration between OP Rollups and ZK Rollups may happen soon.

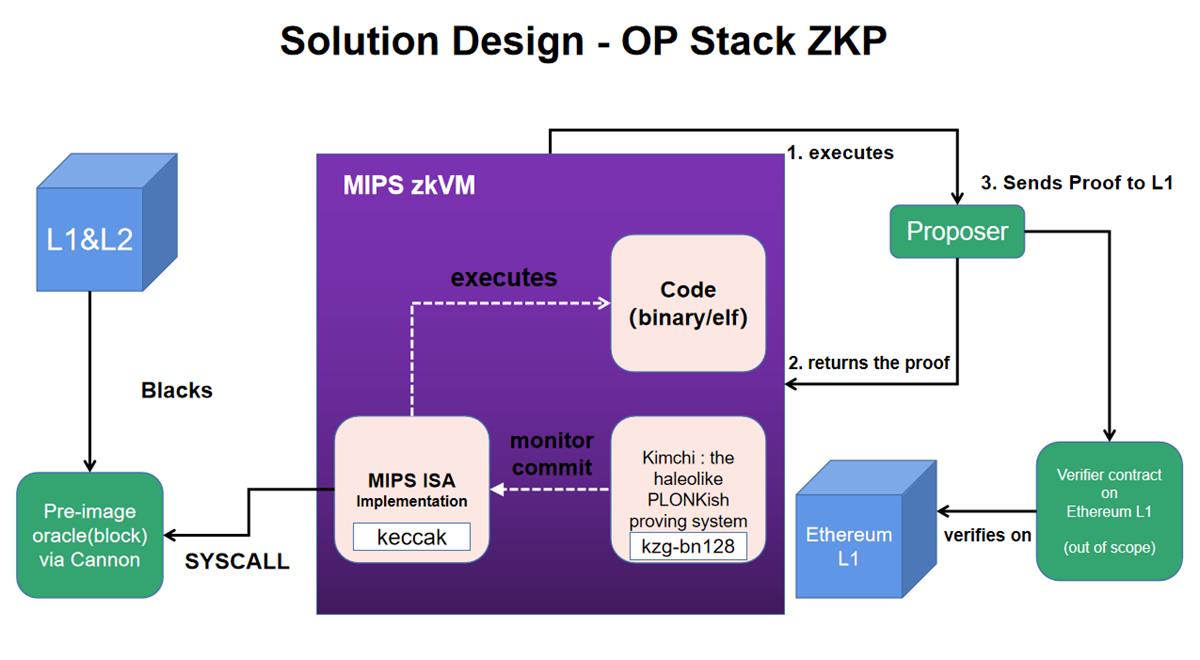

Implementing Zero-Knowledge Proof (ZKP) for OP:

According to recent updates, Mina’s team plans to implement zkmips vm on OP Stack using their own plonk system + kzg commitments + folding algorithm nova. While still an early-stage proposal with many immature aspects, it's highly worth exploring. The project’s mission is enabling secure, low-latency cross-chain communication between Layer2, Layer1, and various OP chains via zero-knowledge proofs. This is a ZKP targeting well-supported instruction set architectures (ISA), capable of proving Optimism fault-proof program behavior — laying the foundation for verifying any OP Stack-based blockchain system.

YBB Capital Researcher Ac-Core Self-made

Completing this task requires building a zero-knowledge proof (ZKP) system that uses ISAs supported by golang compilers (e.g., MIPS, RISC-V, WASM) to prove OP fault-proof programs. Additionally, the proof system must demonstrate state transitions between two blocks on a standard OP Stack chain, proving practical feasibility. Beyond proving standard ISA execution traces, support for fault-proof programs introduces additional requirements.

Specifically, the fault-proof program introduces the concept of a Pre-image Oracle, which uses special system calls to load external data into the program. Each Fault Proof VM must implement a mechanism where certain data hashes are placed at specific memory locations upon system call invocation, then the pre-image of that hash is loaded into memory for program use. The Pre-image Oracle also initializes the program’s initial input.

Attempts at Decentralized Sequencers:

On July 21, 2023, Espresso Systems announced that their proposal to build decentralized sequencer validation for OP Stack leader elections had been accepted, making them contributors to OP Stack and Superchain. Their main protocol, HotShot, is a high-speed consensus protocol allowing Ethereum validators to participate via re-staking, aiming to match the scale of Ethereum’s validator set. They’ve also developed the Espresso Sequencer, already integrated with full-featured ZK rollups, notably a branch of Polygon zkEVM.

What is Leader Election?

Leader election refers to the capability in distributed systems where different leaders take turns creating the next canonical state transition. In blockchains, leader election allows different block producers to generate blocks at different times. Leader election algorithms can be competitive or non-competitive.

Under Proof-of-Work, competitive leader election means many potential entities compete simultaneously to become leader. Non-competitive leader election means only one known leader exists at a given time. In Ethereum Gasper, non-competitive leader election implies only one known entity can act as leader at any moment, with no alternative contender able to assume leadership at that instant.

When separating proposer and builder networks (i.e., the block builder network only handles transaction ordering, while the proposer network only signs blocks), the single entity responsible for block production at any moment becomes many potential entities competing to create the most profitable block within that timeframe. Due to MEV, this competition inevitably returns.

Understanding the second-order effects of leader election mechanisms across different OP Stack chains is extremely difficult. For now, leader election as a mechanism is popular because it promotes more decentralized sequencing. However, note that this approach cannot guarantee absolutely decentralized sequencers, so caution is needed when addressing sequencer decentralization.

Are Rollups Really Secure?

How Ethereum Works:

Ethereum works by having every node store and execute every transaction submitted by users. This high level of security makes the network expensive, prompting the adoption of Rollup solutions for scalability. Simply put, Rollup = a set of Layer1 contracts + Layer2 network nodes, i.e., on-chain smart contracts + off-chain aggregators. Settlement, consensus, and data availability all rely on Ethereum, while execution is handled solely by the Rollup.

-

On-chain smart contracts mean the trust model relies on Ethereum smart contracts, borrowing Ethereum’s security;

-

Off-chain aggregators execute and batch-process transactions off-chain, compress large volumes of transactions, and eventually post them to Ethereum mainnet for faster, cheaper operations.

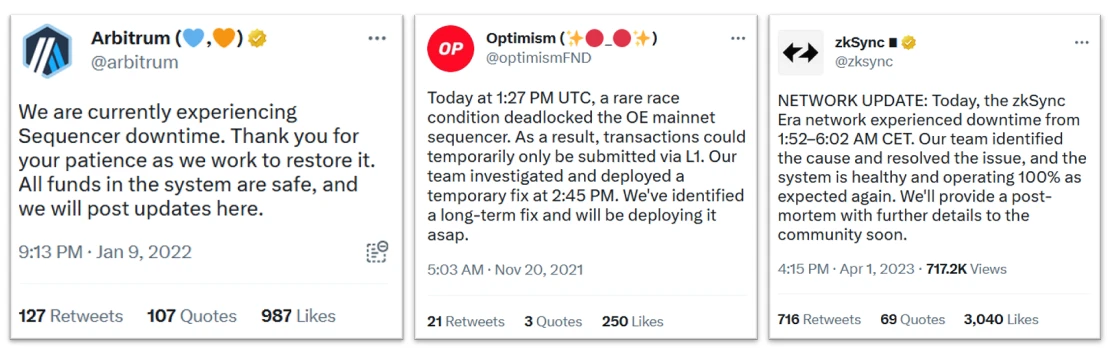

Layer2 network nodes consist of many components, with the sequencer being most critical. It receives transaction requests on Layer2, determines execution order, batches transactions, and sends them to the Rollup’s contract on Layer1. Note before proceeding: as shown in the reference image below, all current Ethereum Layer2 Rollups have centralized sequencers.

Image source: Official tweet screenshot

Centralized Sequencer Issues:

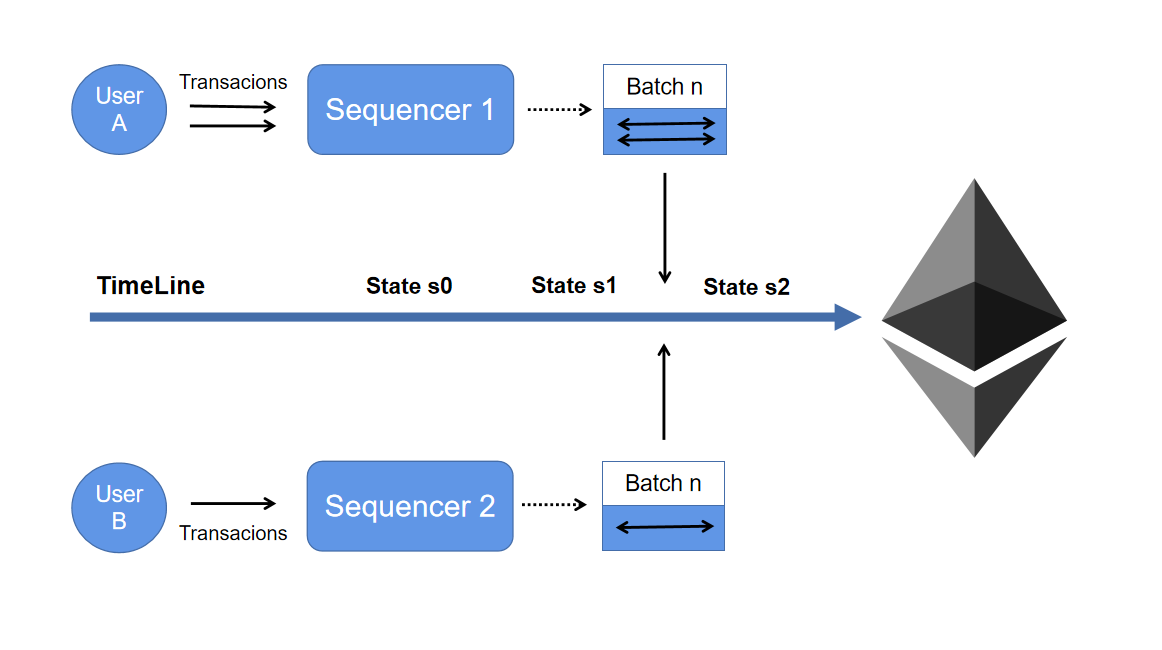

Layer2 full nodes can obtain transaction sequences in two ways: directly from the sequencer, or by reading batches sent by the sequencer to Layer1. The latter has stronger immutability. Since transaction execution changes the blockchain ledger state, to ensure consistency, Layer2 full nodes must not only receive transaction orders but also synchronize ledger states with the sequencer. Thus, the sequencer’s role involves not just sending transaction batches to the Layer1 Rollup contract, but also transmitting state update results (StateRoot/StateDiff) to Layer1. In simple terms, the sequencer processes and orders transactions into blocks added to the blockchain, batching transactions and publishing them to Layer1 smart contracts.

For Layer2 full nodes, obtaining the Rollup’s transaction sequence and initial StateRoot on Layer1 allows reconstruction of the Layer2 ledger and calculation of the latest StateRoot. Conversely, if the StateRoot computed independently by a Layer2 full node differs from the one published by the sequencer on Layer1, it indicates fraudulent behavior by the sequencer. Overall, Layer1 is more decentralized, trustless, and secure than Layer2’s own network.

OP Stack:

So here comes the question: Can Layer2 forge non-existent or incorrect transactions — for example, transferring Layer2 token assets to the sequencer operator’s address, then moving those tokens to Layer1 — thereby stealing user assets? The answer is: yes, technically feasible. Different Rollup types adopt varying approaches to mitigate such fraud risks.

Take Optimistic Rollup as an example — it allows Layer2 full nodes to submit fraud proofs demonstrating incorrect data published by the sequencer on Layer1. But for Optimism, which lacks fraud proofs, if it truly wanted to steal user assets via the sequencer, it could simply have the sequencer forge transaction instructions, transfer others’ Layer2 assets to its own address, and finally use the Rollup’s built-in Bridge contract to move stolen funds to Layer1.

To address this potential risk, current solutions rely either on community and social media oversight to form informal “consensus,” or on OP’s official credibility. Therefore, theoretically, OP Rollup security depends at minimum on having one honest Layer2 full node capable of submitting fraud proofs — aligning with the earlier point in “OP Stack vs ZK Stack”: OP Stack is multi-chain, single choice.

YBB Capital Researcher Ac-Core Self-made

ZK Stack:

Now let’s examine ZK Stack. In ZK rollup networks, there exist Prover nodes specifically tasked with processing transaction batches from sequencers and generating validity proofs. These validity proofs are verified by dedicated contracts on Layer1. Once a transaction batch and its corresponding StateRoot/StateDiff pass verification via the Verifier contract, the transaction achieves final confirmation. Unlike OP Stack, ZK rollups utilize Validity Proofs (in addition to Layer2 full nodes) to combat sequencer fraud. Official bridges in ZK rollups only allow withdrawals that pass validity proof checks — clearly more reliable from a security standpoint than Optimism. This corresponds to the earlier section stating: ZK Stack is multi-chain, multiple choices.

Theoretically, ZK rollup security is guaranteed by the Verifier contract on Layer1 — or said differently, finalized by Layer1 nodes. Compared to OP rollup’s reliance on at least one honest Layer2 full node capable of issuing fraud proofs, both inherit Layer1 (ETH) security. Strictly speaking, this may not hold perfectly true, but it remains the best available solution. Compared to other public chains, Ethereum’s years of development make its security unquestionably the most trustworthy.

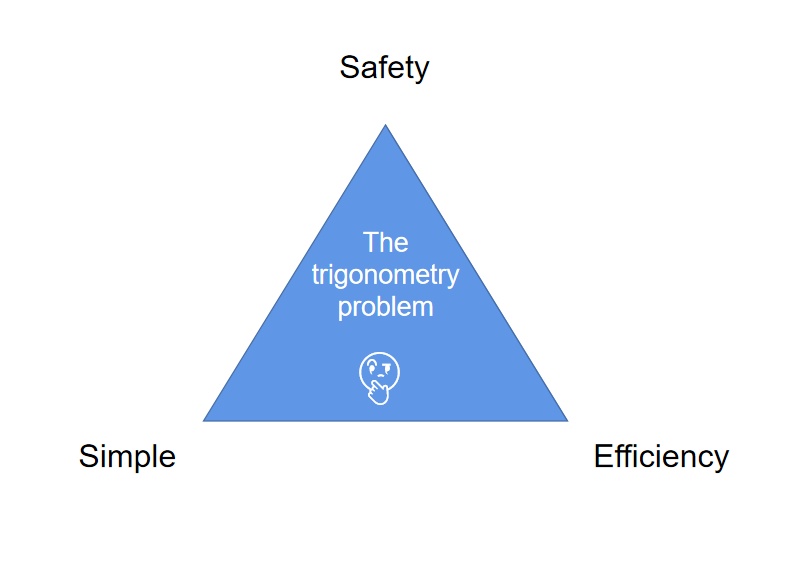

Like the blockchain trilemma, a product’s overall user experience seems to face a similar triangle: security, simplicity, efficiency. ZK Stack, trusting math and code to enhance security, greatly increases overall complexity compared to OP Stack. Hence, several familiar concerns about ZK persist:

YBB Capital Researcher Ac-Core Self-made

-

Latency Issue: ZK rollups must still solve latency in Layer2 nodes posting data to Layer1. Similar to shipping requiring packaging preparation, each data transmission from sequencer or prover to Layer1 incurs fixed costs;

-

Speed Issue: ZK rollups face slow validity proof generation. Though sequencers execute thousands of transactions per second, generating validity proofs for these may take hours;

-

Cost Issue: To reduce costs, many ZK rollup designs adopt “aggregating multiple proofs before sending them to Layer1.” This means provers don’t immediately send a proof after generation, but wait until several are ready, aggregate them, and submit together to the Layer1 Verifier contract;

-

Volume Issue: If transaction volume is too low, sequencers may delay posting data to Layer1. For instance, during inactive market periods, some Rollup networks might only send transaction batches to Layer1 every half hour.

Regarding better decentralized sequencer solutions, modularity may be the optimal path, as modularity enables greater customization. Current decentralized tools mainly fall into five categories:

- Single Sequencer & POA

- Based rollup

- DVT x Sequencer

- Shared Sequencer

- Bootstrap a New Sequencer Set

We believe these issues will be progressively resolved through technological advances. Examples include reducing validity proof generation time, Optimism’s promised release of a fraud proof system, and Ethereum’s Danksharding proposal drastically cutting Rollup data costs. The decentralized sequencer challenge will also be overcome, collectively offering effective solutions.

Conclusion: Narrative Direction

YBB Capital Researcher Ac-Core Self-made

Superchains and hyper-scaling remain focal points in scaling efforts. Although projects are still in early stages, they collectively strengthen Ethereum’s narrative power. We can already see OP Stack gaining significant traction, with prominent chains like Coinbase, opBNB, Zora, and Worldcoin lending strong brand credibility. Notably, on June 26, zkSync announced ZK Stack — a modular open-source framework for building custom ZK rollups — widely seen as zkSync’s countermeasure against OP Stack. On one side stands OP Stack with first-mover advantage; on the other, ZK Stack with mathematical superiority. In summary, any value created by Layer2 can accumulate into Rollup tokens. The Layer2 scaling battle has just begun — what’s your take on this silent war?

References:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News