10,000-Word Analysis of the Web3 Payment Sector: The Future of Global Payments

TechFlow Selected TechFlow Selected

10,000-Word Analysis of the Web3 Payment Sector: The Future of Global Payments

This article will take you deep into the various business scenarios and projects within the Web3 payments industry.

Written by: @Floraaa_upup

Supervised by: @CryptoScott_ETH

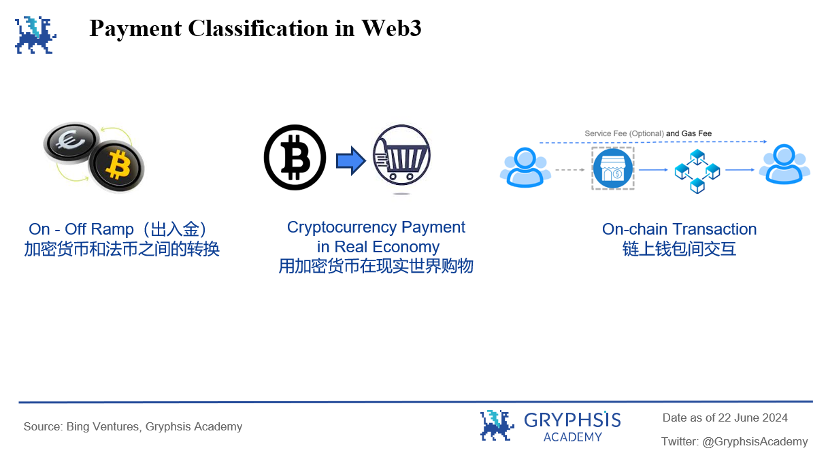

Payments are a key scenario in the cryptocurrency ecosystem, with tens of thousands of on-chain and off-chain crypto payments occurring daily. A new cryptocurrency typically appreciates due to its practical payment use cases, making payments an important bridge connecting the Web2 and Web3 worlds.

In the Web3 payments business, some earn substantial profits by providing payment channels, while others focus on developing more secure wallet technologies. So, how exactly does fund transfer work in the Web3 world? This article will take you deep into various business scenarios and projects within the Web3 payment industry.

1. Traditional Payment Industry Enters Web3

In August last year, PayPal announced the launch of its USD-pegged stablecoin "PayPal USD" for transfers and payments. In April this year, financial infrastructure platform Stripe stated that stablecoin payments would be integrated into its payment suite within weeks and begin supporting USDC payments by summer. In June, Mastercard unveiled its first peer-to-peer transaction infrastructure, Mastercard Crypto Credential, enabling cross-currency cross-border payments on blockchain for users in Latin America and Europe. Why have traditional payment giants been aggressively entering the Web3 payment sector in recent years?

1.1 What Is the Traditional Payment Process?

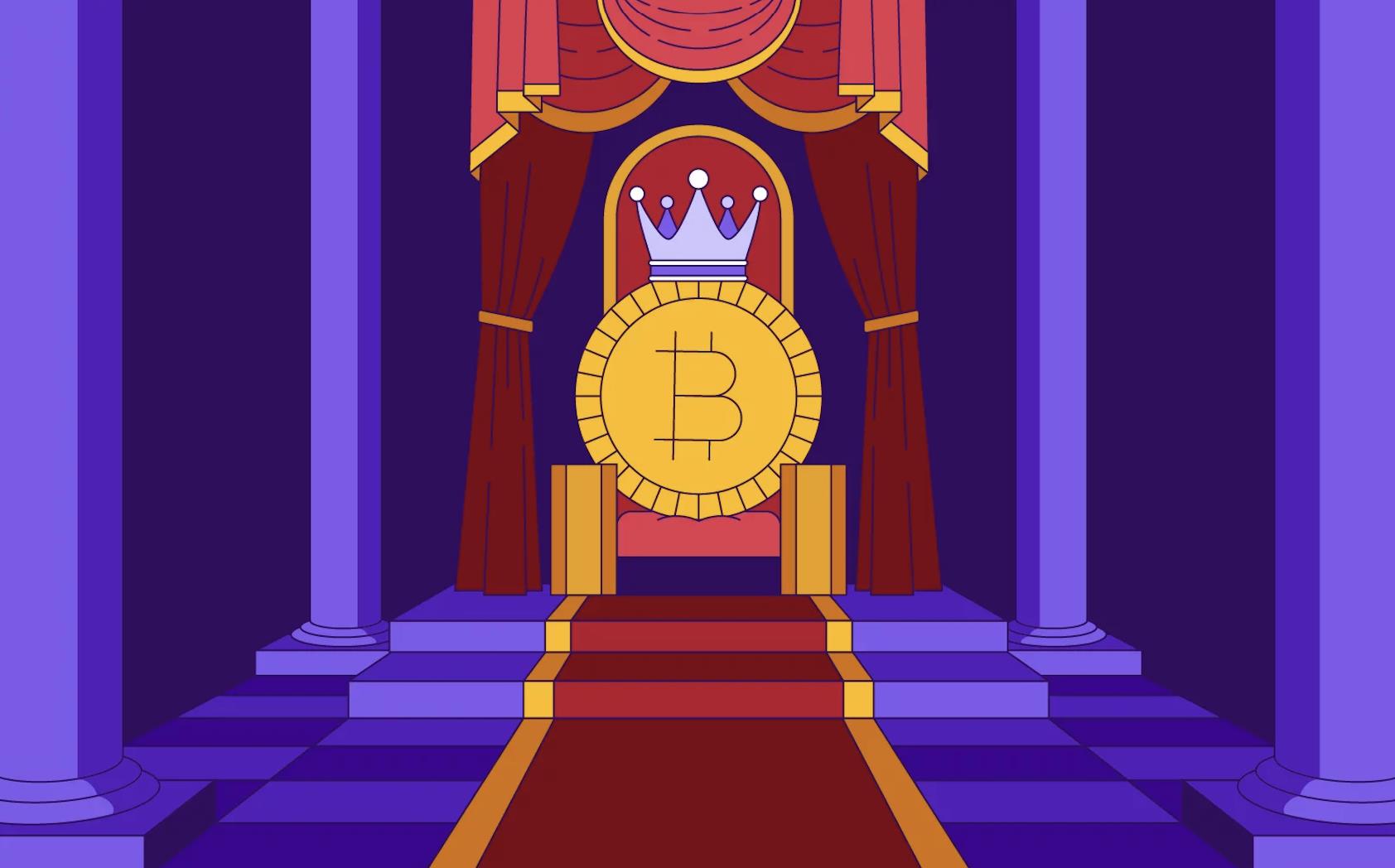

Before revealing the reasons, let's first understand what payments are. At its core, payment is the movement and transfer of funds. In traditional payment industries, users complete fund transfers through cash, card/bank transfers, or third-party payments. Completing a cross-border payment usually requires support from multiple participants. Taking card-based payment as an example, here’s a brief introduction to the participants and the cross-border payment process.

-

Cardholder (User/Buyer): The user selects goods/services at a merchant and initiates payment.

-

Merchant: Merchants need to integrate with a payment service provider's gateway to receive and process payments.

-

Payment Service Provider: Offers services such as payment gateways and processing. User payment information is sent via the gateway to initiate payment requests. Some providers also offer acquiring services.

-

Acquiring Institution: A bank or financial institution partnering with merchants. It receives payment requests, forwards them to card networks, and handles clearing and settlement after authorization.

-

Card Network (e.g., MasterCard, VISA): Global network processing payment card transactions. It receives payment requests from acquirers, sends authorization requests to issuers, forwards responses back, ensuring transactions are approved.

-

Issuing Bank: Receives authorization and payment requests from card networks, verifies user identity and account status, authorizes or rejects transactions, and disburses funds upon approval.

-

Settlement: The final stage involving fund transfer from the user’s account to the merchant’s account. Typically coordinated by acquirer and issuer, actual fund transfers may go through interbank clearing networks.

The above payment process demonstrates clear responsibilities, high maturity, wide acceptance, relative security, and advantages in large-scale transactions in traditional cross-border payments. However, there are also limitations:

-

Long payment processing times: Due to multiple parties involved, international card network-based cross-border payments usually require at least T+1 days to complete—meaning funds reach the merchant’s account no sooner than T+1 day, resulting in weak immediacy.

-

Multi-layered fee structures: With many stakeholders involved, fees are layered. For instance, credit card transactions incur separate charges from acquirers, banks, and card networks.

-

Limited transparency and time-consuming traceability: If a card is fraudulently used, it typically takes several business days to trace and query the transaction.

-

Reliance on traditional banking: Slow technological development means traditional banking systems struggle to meet emerging payment demands.

-

These limitations have driven innovation, ushering us into a new era of Web3 payment chains.

1.2 Why Are Traditional Industries Entering Web3 Payments?

Given the maturity of traditional payments today, why are giants increasingly turning their attention to Web3?

1.2.1 Substantial Industry Profits

Mastercard reported a net profit of $11.2 billion in 2023 (with about 33,400 employees), while Tether, the issuer of stablecoin USDT, had a net profit of $6.2 billion in 2023 with only around 100 employees. Comparatively, wealth generated per employee far exceeds that of traditional payment industries, as does return on investment.

1.2.2 Intense Competition and High Operational Costs Drive New Business Exploration

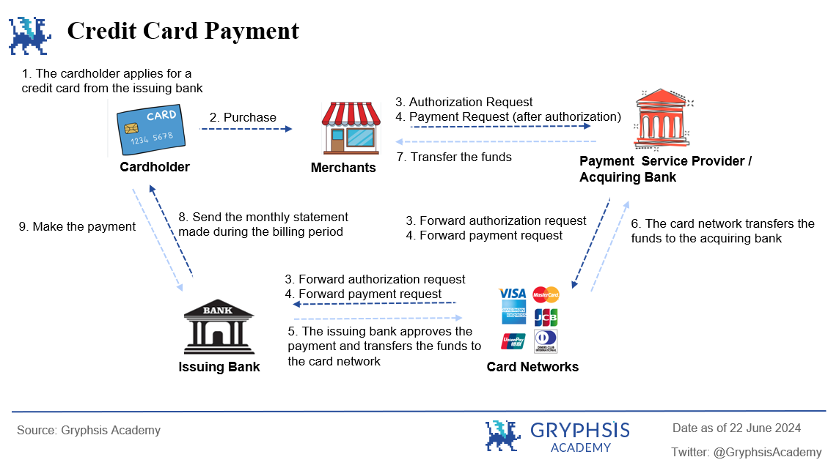

From the chart, we see that from 2018 to 2023, cryptocurrency adoption grew at a compound annual rate of 99%, vastly outpacing traditional payment methods’ 8% growth. During this period, cryptocurrency adoption growth exceeded that of major U.S. payment giants.

In 2022, facing intense competition and relatively high operating costs (operating expenses accounted for 70.8% of gross profit in 2022), PayPal began focusing on cryptocurrency businesses. Cryptocurrency operations are becoming increasingly significant in PayPal’s overall revenue.

Within a year, crypto-related operating expenses rose from $800 million to $1.2 billion—an increase of 50%. Net profits related to cryptocurrencies increased from $700 million to $1.1 billion—a 57% rise. Increased operational spending reflects PayPal’s ongoing commitment and confidence in this area, including investments in technology upgrades, security measures, and market expansion.

Significant profit growth not only highlights cryptocurrency profitability but also proves PayPal’s effective operational strategy in the crypto market and optimism about future growth potential. Thus, PayPal has strong motivation to continue exploring new opportunities.

1.2.3 Bitcoin Halving and Bitcoin ETF Compliance Bring Greater Recognition and Payment Demand

Bitcoin halving and ETF compliance have brought greater recognition and payment demand to the crypto industry. The halving event reduces the creation rate of new bitcoins, increasing scarcity and expectations for value appreciation, attracting widespread market attention. The launch of Bitcoin exchange-traded funds provides traditional investors with low-barrier, convenient investment avenues, boosting market confidence. Anticipated rollouts of Ethereum ETFs further spark interest in the Ethereum ecosystem and innovative applications. These factors collectively drive more people to understand and participate in Web3 payments.

Additionally, growing deposit/withdrawal needs fuel demand for fiat-to-crypto conversion services (deposit/withdrawal refers to converting between fiat and crypto). These services are accessible via centralized exchanges, independent deposit/withdrawal payment providers, crypto ATMs, and POS machines supporting crypto payments. These channels enable users to easily convert between fiat and crypto, promoting broader application and adoption of cryptocurrencies.

1.2.4 Advantages of Blockchain-Based Payments and Demand for Payment Diversity

Microsoft started accepting Bitcoin for its online Xbox Store in 2014; Twitch, Amazon’s leading game streaming platform, accepts Bitcoin and Bitcoin Cash for its services; Shopify, a top overseas e-commerce platform, supports Bitcoin payments through integration with processors like BitPay. Leading companies across industries accepting crypto payments demonstrate that Web3 payments are creating new possibilities.

-

Reduced Exchange Rate Risk

Cross-border e-commerce often involves transactions across multiple currencies, carrying certain exchange rate volatility risks. Using cryptocurrencies for purchases can reduce such risk since they avoid currency conversion losses.

-

Lower Transaction Costs

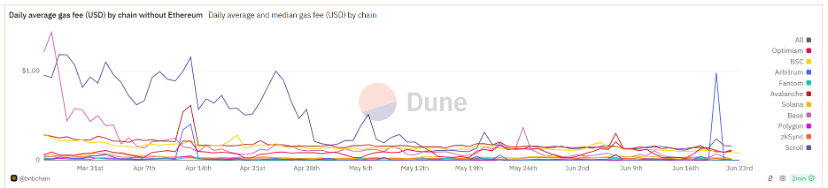

Traditional cross-border payments typically come with high transaction fees and layers of institutional involvement. In contrast, crypto transaction fees are usually cheaper because they eliminate intermediaries like banks or other financial institutions. On-chain payments only require a network fee, which is generally low. If processed through a payment provider (like Coinbase or BitPay), there is an additional service fee. Compared to traditional payment institutions' layered charges, this significantly reduces fees for high-volume cross-border e-commerce. For example, traditional cross-border payments might incur 3–5% fees, whereas crypto payments can lower this below 1%. Given higher Ethereum mainnet transaction fees, innovations on alternative blockchains aim to achieve even lower network costs. As shown below, transaction network fees depend on network congestion rather than amount size. Therefore, large on-chain cross-border payments may cost less than $0.50 in fees, greatly reducing payment costs.

Source: dune @bnbchain

-

Enhanced Payment Security

Blockchain’s decentralized and distributed ledger features make every transaction publicly transparent and immutable once recorded. This reduces possibilities of fraud and hacking. Due to blockchain transparency, trust levels increase for both merchants and consumers. Consumers know their payment information is secure, while merchants face reduced risks of fraud and chargebacks.

-

Access to Global Markets

Using cryptocurrencies for payments bypasses restrictions of international banking systems, enabling faster completion. Additionally, crypto transactions operate 24/7 without holiday or working-hour constraints. Many consumers worldwide who cannot use traditional payment methods on cross-border platforms can instead use cryptocurrencies.

1.2.5 Tax Avoidance Motivations

Both crypto industry enterprises and individual investors are attracted by tax benefits. For example, Portugal does not tax personal crypto gains; Singapore imposes no capital gains tax on cryptocurrencies; Bermuda, with its secure, transparent regulatory environment and the Digital Asset Business Act, attracts token issuers, crypto custodians, and blockchain R&D firms, becoming a hub for digital assets and innovative technologies.

Since 2019, Bermuda’s government has accepted tax payments, utilities, and other administrative fees in USDC form. Moreover, due to decentralized network systems, Web3 transactions inherently bypass many centralized institutions and banks, avoiding conventional tax procedures. Hence, some digital asset companies distribute bonuses in stablecoins.

1.2.6 Local Currency Depreciation Drives Capital Preservation Needs

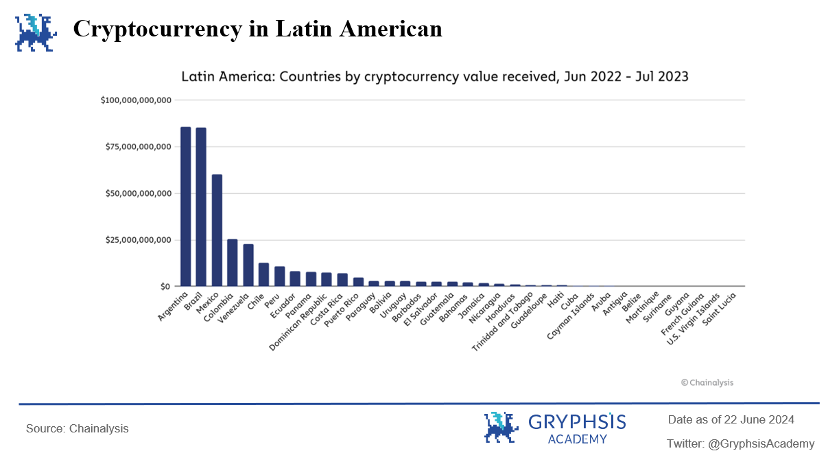

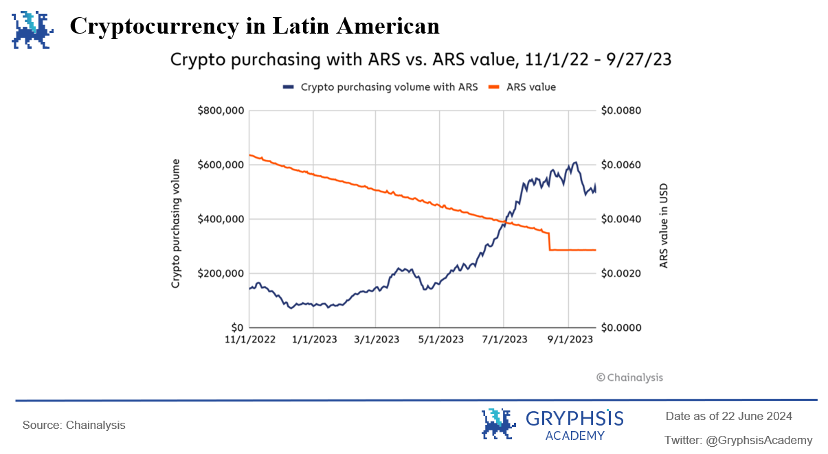

Argentina has faced economic struggles for decades, with periodic extreme currency depreciation damaging residents’ savings and complicating daily financial activities. Consequently, Argentina is one of Latin America’s most active crypto markets. In 2023, Argentina’s inflation rate reached 211.4%. According to Chainalysis data, approximately 10.9%—about 5 million people (out of 45.8 million total population)—use cryptocurrencies for daily payments.

To protect against peso depreciation, Argentinians immediately convert peso-denominated salaries into USDT or USDC upon receipt—nearly everyone knows the USD-peso exchange rate. Similarly, Turkey is another rapidly developing crypto region. Thus, where legal frameworks allow, areas experiencing currency depreciation become places where crypto acts as “hard currency,” facilitating easier deployment of crypto-related payment businesses.

1.2.7 Political Objectives Through Payment Channels

For the United States, cryptocurrencies serve as political campaign tools. Trump prominently promoted pro-crypto stances during the current U.S. election, criticizing Biden administration hostility toward crypto. He encouraged supporters to donate via Coinbase Commerce, driving popularity of Trump-themed meme coins, which showed notable price movements ahead of late-June debate events.

For Venezuela, cryptocurrencies are weapons against authoritarianism. During the 2020 pandemic, Guaidó-led interim government used cryptocurrencies to directly aid doctors and nurses in the country. Maduro regime corruption and control over banks made normal international aid delivery difficult. This program assisted 65,000 medical workers—doctors earning only $5 monthly at the time—each receiving $100 via crypto payments. Thus, decentralized crypto payments effectively supported local democratic movements.

2. What Is Web3 Payment?

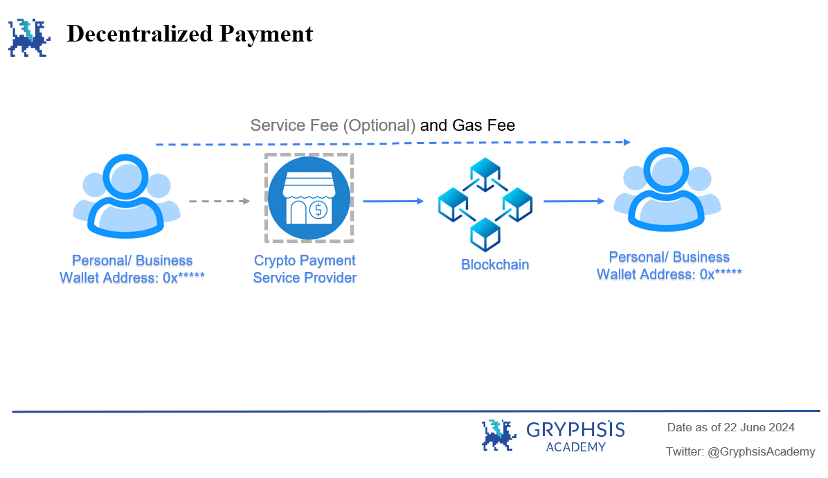

Web3 payments rely on blockchain technology. Once you have the recipient’s “wallet address,” cryptocurrencies can be transferred across blockchain networks, allowing instant viewing and tracking—enabling decentralized peer-to-peer payments. This approach solves issues in traditional payments such as low transparency, long settlement times, and high costs from multiple intermediaries.

2.1 Market Size

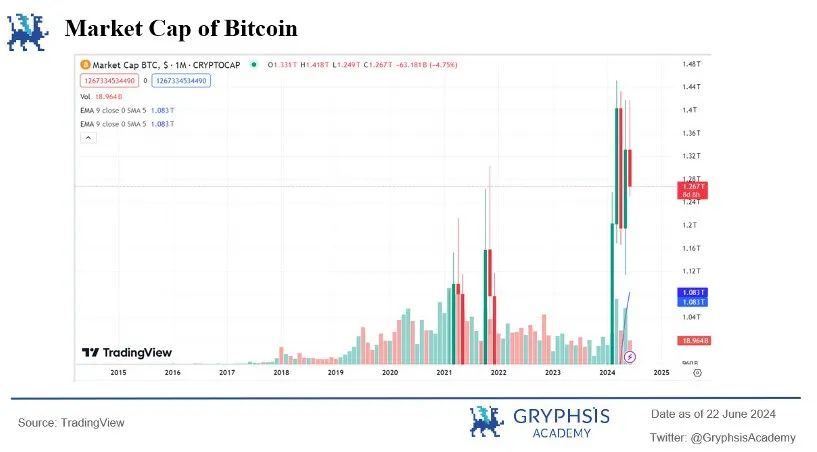

With BTC ETF approvals, Bitcoin halving, and expected ETH ETF launches, more countries are regulating crypto payments, drawing increasing individual and institutional capital into the crypto market. As of June 23, Bitcoin’s market cap reached $1.27T, while Ethereum reached $15.2B.

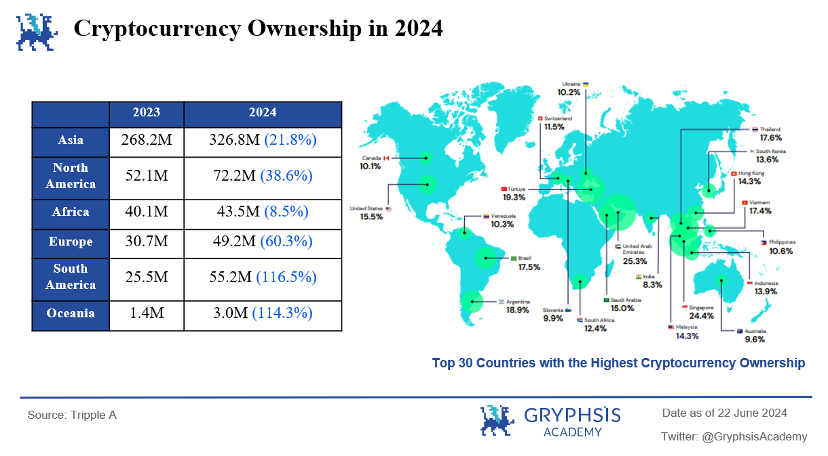

According to Triple A reports, global crypto ownership penetration reached 6.9% in 2024, with approximately 560 million people holding crypto—up 33% from 420 million last year. Asia leads in total crypto holders, while South America and Oceania show fastest adoption growth (116.5%). Dubai has the highest national crypto ownership penetration at 25.3%. Combined with its financial free zones and favorable tax policies (no income or capital gains taxes), this explains why Dubai has become headquarters for many exchanges and crypto firms recently.

Therefore, whether in regions with highest ownership rates or fastest-growing adoption, relaxed regulations and real-world transaction needs provide excellent opportunities for exploring and developing crypto payments.

-

From a business perspective, well-known brands in traditional sectors like Starbucks, Coca-Cola, Tesla, and Amazon have embraced cryptocurrencies. Mainstream market adoption and consumer familiarity with crypto are gradually rising. This year, more traditional enterprises accept cryptocurrencies, expanding their payment options. Ferrari now partners with BitPay to accept Bitcoin, Ethereum, and USDC payments in the U.S., planning to extend this option to Europe and other regions early in 2024. In Singapore, Grab users can now use Bitcoin, Ethereum, SGD stablecoins, USDC, and USDT to book rides and order food. When B2B industry leaders adopt crypto payments, it not only validates the crypto industry itself but, backed by their credibility, opens doors for C-end users to access crypto payments.

-

From a user perspective, in 2021, Binance—the world’s largest crypto exchange—had only 3 million registered users. By June 2024, Binance’s user count surged to 200 million, with daily trading volume reaching $189 billion. This remarkable growth shows increasing participation in crypto usage, indicating crypto payments are becoming a vast blue ocean.

-

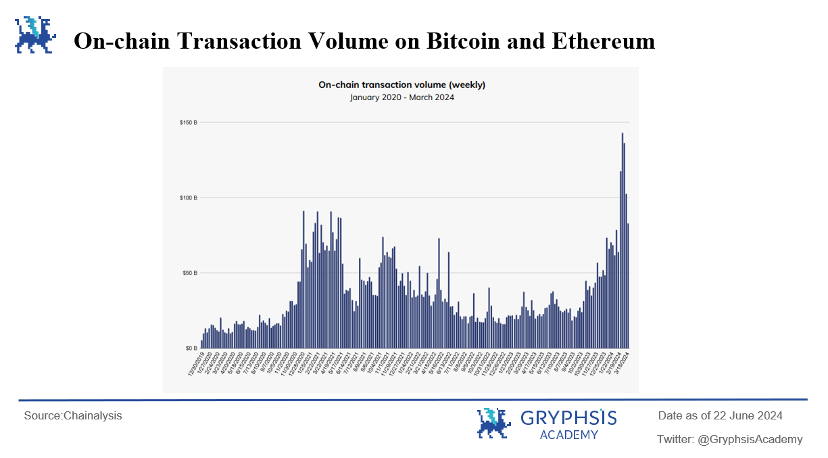

From a on-chain data perspective, from January 2020 to March 2024, on-chain transaction volume and activity steadily increased. Driven by a series of positive developments, these metrics repeatedly broke historical highs, approaching the $150 billion threshold.

In the Web3 space, many project teams and exchanges recognize the upward trend and huge opportunities in crypto payments, accelerating applications for regional payment licenses, expanding card issuance and other businesses linking Web3 payments with real economies, while speeding up construction of exchanges and on-chain wallets.

Recently, Coinbase announced a self-custody wallet platform integrating asset and identity management, buying, sending, swapping, NFTs, and transaction history—providing users easier on-chain transaction access. This not only offers greater convenience for Coinbase’s user base but also becomes a key component of the Onchain Summer initiative, further advancing Web3 payments.

3. Classification of Web3 Payment Scenarios

3.1 First Category: Deposit and Withdrawal

3.1.1 Deposits

Definition:

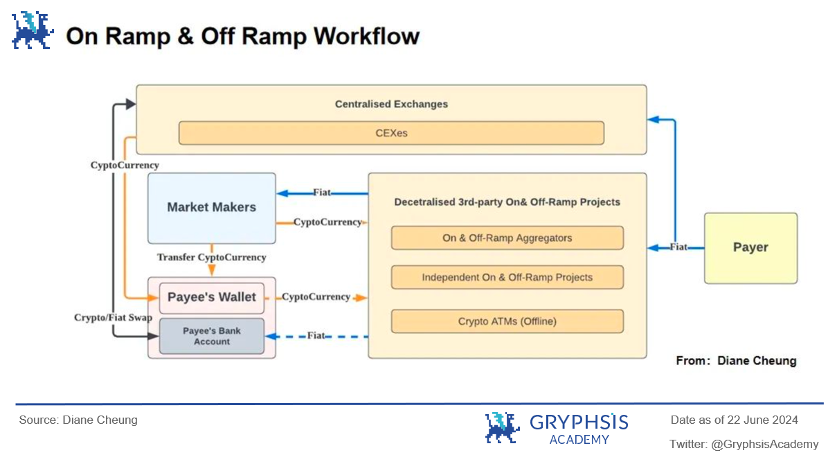

Refers to converting fiat currency (e.g., USD, EUR) into cryptocurrencies—a gateway into the crypto economy. Payers transfer fiat to centralized exchanges or third-party decentralized deposit/withdrawal platforms. Centralized exchanges directly convert fiat into crypto and send it to on-chain wallets; third-party decentralized platforms use market makers to exchange crypto—once the market maker receives fiat, equivalent crypto is sent to the payer’s on-chain wallet.

Here, market makers are typically crypto-friendly banks (e.g., defunct Silvergate Bank, Silicon Valley Bank, Signature Bank). After bank failures, more stablecoin issuers (Tether, Circle) and payment providers (BCB Group) assumed liquidity provider roles.

Deposit Methods:

-

Centralized Exchanges: Users complete KYC, create accounts, and purchase crypto using fiat via bank accounts, credit cards, or e-wallets.

-

Peer-to-Peer Platforms: Directly connect buyers and sellers for fiat-to-crypto conversion. Funds are typically held in escrow until both parties fulfill agreed actions.

-

Over-the-Counter Desks (OTC): Facilitate direct large-scale crypto trades between buyers and sellers, commonly used by institutional investors or high-net-worth individuals.

-

Decentralized Crypto Wallets: Most common type is self-custody wallets, giving users full control over their crypto without third-party involvement.

Entities Involved in Deposits:

Centralized exchanges, third-party decentralized deposit/withdrawal platforms, banks, liquidity providers (crypto-friendly banks, stablecoin issuers, payment providers)

Fee Structure:

-

Payment channel fees: Charged by credit card issuers, PayPal, Apple Pay, etc.

-

Fiat-to-crypto exchange rate fees: USD and USDT are usually not exactly 1:1 (intermediaries profit from this spread).

-

Network fees (Gas fees required when transferring from self-custody wallets to other addresses)

3.1.2 Withdrawals

Definition:

Opposite of deposits, withdrawals refer to converting cryptocurrencies back into fiat currency. Users sell their holdings, exchange them for traditional currency, then withdraw to bank accounts or other payment methods—essentially exiting the crypto economy.

Entities Involved in Withdrawals:

Centralized exchanges, third-party deposit/withdrawal platforms, banks/card providers, liquidity providers (crypto-friendly banks, stablecoin issuers, payment providers)

Withdrawal Methods:

-

Centralized exchanges, P2P platforms, OTC, crypto wallets

-

Crypto debit cards (virtual or physical): Debit cards linked to crypto wallets or platforms convert crypto to fiat for regular spending.

Fee Structure:

-

Transaction fees: Service providers (exchanges or third-party platforms) may charge fees for withdrawal operations.

-

Crypto-to-fiat exchange rate fees: Currency conversions (e.g., USD to EUR) may incur exchange losses.

-

Bank fees: Receiving banks may charge fees on deposited funds.

3.2 Second Category: Using Cryptocurrencies to Purchase Goods or Services in the Real Economy (Independent Card Payments, Third-Party Payment Platforms)

3.2.1 Independent Card Payments (Virtual/Physical Cards)

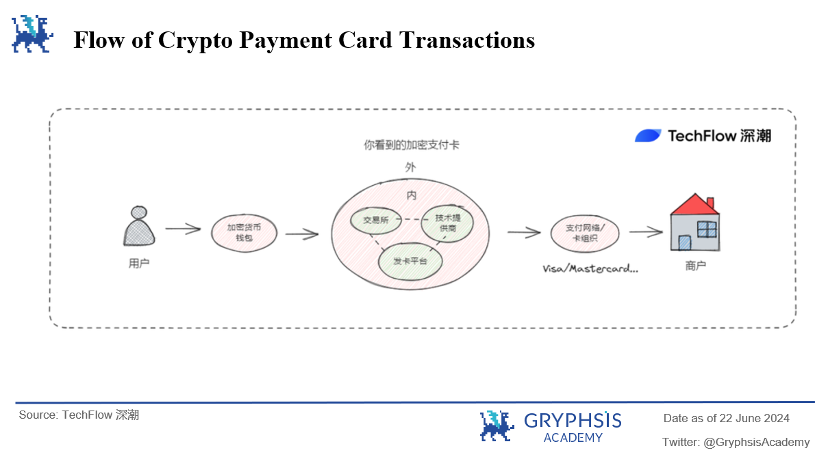

Traditional payment card providers or Web3-native payment card issuers support crypto usage in the real economy. There are four main entities: virtual/physical card technology service providers, issuers (traditional or Web3-native), and card networks.

Currently, the most popular offerings are mostly crypto prepaid debit cards: No need to link existing bank accounts—simply pre-load crypto converted to fiat onto the card.

Entity 1: Virtual/Physical Card Technology Service Providers

Issuing credit and debit cards was historically a banking monopoly in Web2, requiring high technical and licensing barriers. But in the crypto payment card space, it's different.

Card issuing tech providers offer “issuing-as-a-service” solutions. When users see a crypto card bearing a Visa logo, behind the scenes it’s a collaboration between the issuer and tech provider. The provider’s API integrates with payment networks like Visa and Mastercard, and establishes partnerships across the industry chain, offering real-time transaction authorization and fund conversion services.

Card issuers simply need to call the provider’s API or SaaS solution under compliant regulation or license conditions to issue and manage crypto credit/debit cards.

* Tech providers often hold multiple regional licenses, providing essential security technology, payment processing systems, user interfaces, and supporting crypto card issuance, currency conversion, payments, transaction monitoring, and risk control.

Entity 2: Traditional Payment Card Providers

Visa partnered with Web3 infrastructure provider Transak to launch crypto withdrawals and payments via Visa Direct. Users can directly withdraw crypto from wallets like MetaMask to Visa debit cards, convert crypto to fiat, and spend at any of the 130 million Visa-accepting merchants. Thus, traditional payment card providers enjoy absolute advantages: historically accumulated payment licenses, brand credibility, massive user and merchant traffic, and substantial capital strength.

Entity 3: Web3 Payment Card Providers

Hardware wallet makers Onekey and Dupay launched virtual and physical cards last year, enabling mainland Chinese users to subscribe to OpenAI ChatGPT. Their business model primarily earns card issuance and transaction fees, with different tiers having varying limits and fee standards. Beyond native Web3 payment card providers, major exchanges have developed additional revenue models beyond transaction and issuance fees.

For example, Binance’s crypto payment card offers BNB cashback on spending—similar to real-world “cash back.” Crypto.com’s card allows staking different amounts of platform token CRO to waive issuance fees and gain other payment privileges. Exchanges leverage their own user traffic, brand credibility, and natural post-trade withdrawal consumption scenarios to expand card issuance into more C-end payment use cases.

This logic works because exchanges already have post-trade withdrawal payment scenarios. Compared to traditional card providers, exchange users have lower education costs for crypto payments. From a usability standpoint, users can seamlessly interact between their exchange app and card within the existing product matrix, greatly improving user experience switching between platforms for transfers and top-ups.

Entity 4: Card Networks

Visa and Mastercard license their networks to tech providers, earning profits through partnerships. More crypto payment card transactions and overseas transactions mean higher fees collected—the larger the transaction amounts, the greater the revenue. Thus, they don’t need to issue cards themselves; leveraging their payment networks and credit card brand credibility allows them to earn “licensing fees.”

Evaluation:

Although roles differ in the card issuance value chain, each participant has logical strengths. For instance, virtual/physical card tech providers target SaaS business—once licenses and technology are secured and Web3 ecosystem transaction channels aggregated, this model becomes replicable and effortless, serving broad audiences. They can not only support native Web3 issuers but also expand into other payment domains using compliance and technical advantages. Native Web3 issuers can outsource technology to earn spreads on crypto trading or card payment fees, easily reach more native Web3 communities, and benefit from lower customer acquisition costs among crypto-savvy users. Traditional card providers or giants possess capital reserves, the widest user bases, and strong brand credibility—making it easier to gain recognition from virtual card users, non-crypto users, and earn B2B licensing fees from payment service providers.

3.2.2 Third-Party Payment Platforms

Traditional/Web3-related third-party payment platforms expand deposit/withdrawal and crypto payment services, enabling cryptocurrency usage and consumption in the real economy. Below are two platforms with distinct advantages: Revolut App naturally extends from traditional fiat exchange and card payments into fiat-crypto conversion, while Binance Pay, backed by the largest crypto exchange Binance, naturally has consumption demand, forming a closed loop of crypto deposit, trading, withdrawal, and spending.

Revolut: UK-founded fintech company and neobank established in 2015, offering transfer and payment services with over 40 million global users. In March 2024, Revolut launched Revolut Ramp, allowing users via partnership with MetaMask developer Consensys to buy crypto directly in their wallets and trade between platforms and Revolut accounts without extra fees or restrictions. Meanwhile, linking Revolut cards to users’ crypto accounts enables automatic crypto-to-purchase-currency conversion during payments within the traditional payment app.

Binance Pay: Shopping platforms can choose from multiple cryptocurrencies to purchase gift cards (ranging from tens to hundreds of dollars) for various retail brands and games, enabling real-economy consumption. For example, Coinbee:

Source: @Coinbee

3.3 Third Category: Native Blockchain Payment Scenarios (On-Chain Payment Scenarios)

On-chain payments also stem from specific Web3 payment demands, typically arising during project participation or transactions.

-

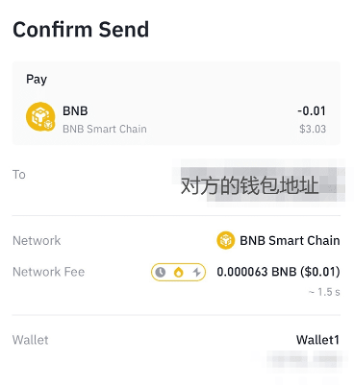

Payments and Transfers: Web3 wallets (e.g., Binance Web3 Wallet) offer peer-to-peer payment and transfer functions. With just the recipient’s wallet address, cross-space transfers occur within minutes for a small network fee (Network Fee/Gas Fee). Users can quickly and cheaply transfer assets globally.

Source: @binance

-

DeFi / NFT: Users interact with DeFi apps via Web3 wallets to perform crypto lending, borrowing, liquidity mining, etc. Users also buy and trade NFTs and other digital assets.

-

DEX: Web3 wallets enable users to trade cryptocurrencies on DEXs, which don’t rely on centralized order books but use smart contracts for trade matching.

-

Cross-Chain Interactions: Multi-chain wallets support asset transfers across different blockchains, enabling interoperability between ecosystems.

-

GameFi: In GameFi, Web3 wallets can purchase virtual goods, land, or other in-game assets.

-

Social Networks and Content Creation: Web3 wallets support content creation and monetization on decentralized social platforms, along with receiving tips and making payments.

4. Payment-Related Projects

4.1 Project One: Stablecoin Project PayPal PYUSD

In August 2023, PayPal launched its first stablecoin PYUSD, issued by Paxos, which regularly provides proof of reserve assets. PYUSD runs on Ethereum (now also available on Solana). Pegged 1:1 to the U.S. dollar, it can be exchanged within the PayPal ecosystem. Supported by U.S. dollar deposits, short-term U.S. Treasuries, and similar cash equivalents, PYUSD ensures stability unaffected by other crypto volatility.

Use Cases: Primarily used for gaming, remittances, and as a payment medium on Web3 platforms and decentralized exchanges. Currently limited to U.S. users, with trading pairs available on Coinbase. Due to limited supported blockchains and geographic reach, PYUSD’s application scope remains narrow.

-

Transfers: Users can make zero-fee transfers using PYUSD.

-

Payments: PYUSD used for goods settlement.

-

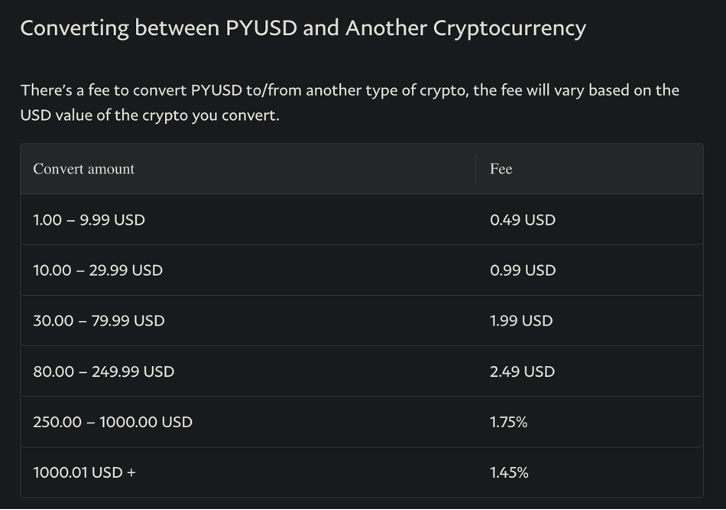

Converting Cryptocurrencies: PYUSD can be swapped with other PayPal-supported cryptos, with fees ranging from 1.45% to 4.9%—relatively high. Also, due to current Ethereum-only support, network fees for stablecoin withdrawals are very expensive.

Source: @Paypal

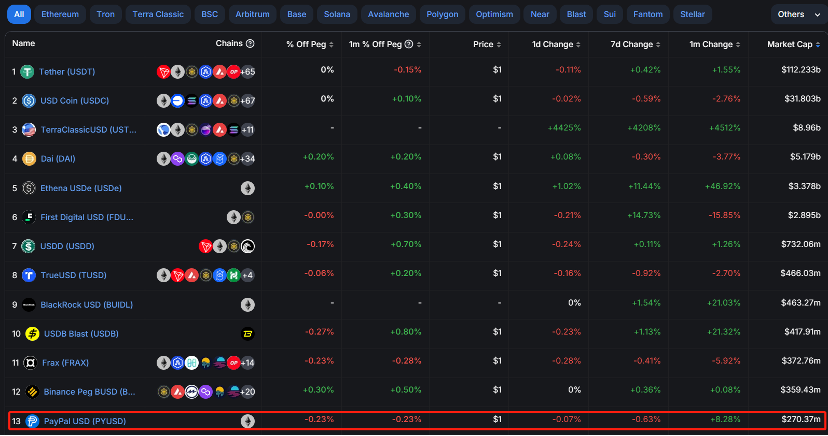

Market Cap: PayPal-issued stablecoin currently has a market cap of $270.37M, ranking 13th among stablecoins. Total stablecoin market cap is $170.2B, so PayPal’s share is 0.15%. Tether dominates with 65.9%. This shows that even payment giants face challenges gaining quick dominance in crypto markets due to late entry, limited blockchains, geographic restrictions, and narrow use cases. However, PayPal is actively expanding—now live on Solana—with goals to list PYUSD on major exchanges for broader circulation and compatibility between Web3 and Web2 ecosystems.

source: @Defilama

4.2 Project Two: Peer-to-Peer Payment Infrastructure Mastercard

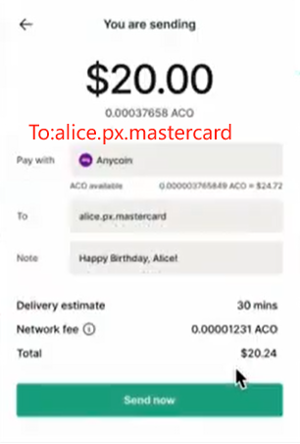

Mastercard launched Mastercard Crypto Credentials, its first peer-to-peer pilot transaction in partnership with exchanges. Its feature replaces long blockchain addresses with aliases. This new system aims to simplify crypto transactions for exchange users, providing a more user-friendly P2P transfer method.

Pilot Scope: Primarily in Europe and Latin America—including Argentina, Brazil, Chile, France, Guatemala, Mexico, Panama, Paraguay, Peru, Portugal, Spain, Switzerland, and Uruguay—users can conduct domestic and cross-border transfers across multiple currencies and blockchains. These locations were chosen due to relatively relaxed crypto environments and strong demand from Latin American countries facing currency depreciation.

Partner Exchanges: Real-time transaction functionality enabled by exchanges like Bit2Me, Lirium, and Mercado

Source: @Mastercard

Usage Steps: Exchanges first perform KYC according to Mastercard Crypto Credential standards. Users then receive an alias to send/receive funds across all supported exchanges. When initiating a transfer, Mastercard Crypto Credentials verify if the recipient’s alias is valid and whether their wallet supports the digital asset and relevant blockchain. If the receiving wallet doesn’t support the asset or blockchain, the sender is notified and the transaction stops—protecting both parties from potential fund loss. Finally, enter the amount and confirm with a mobile verification code.

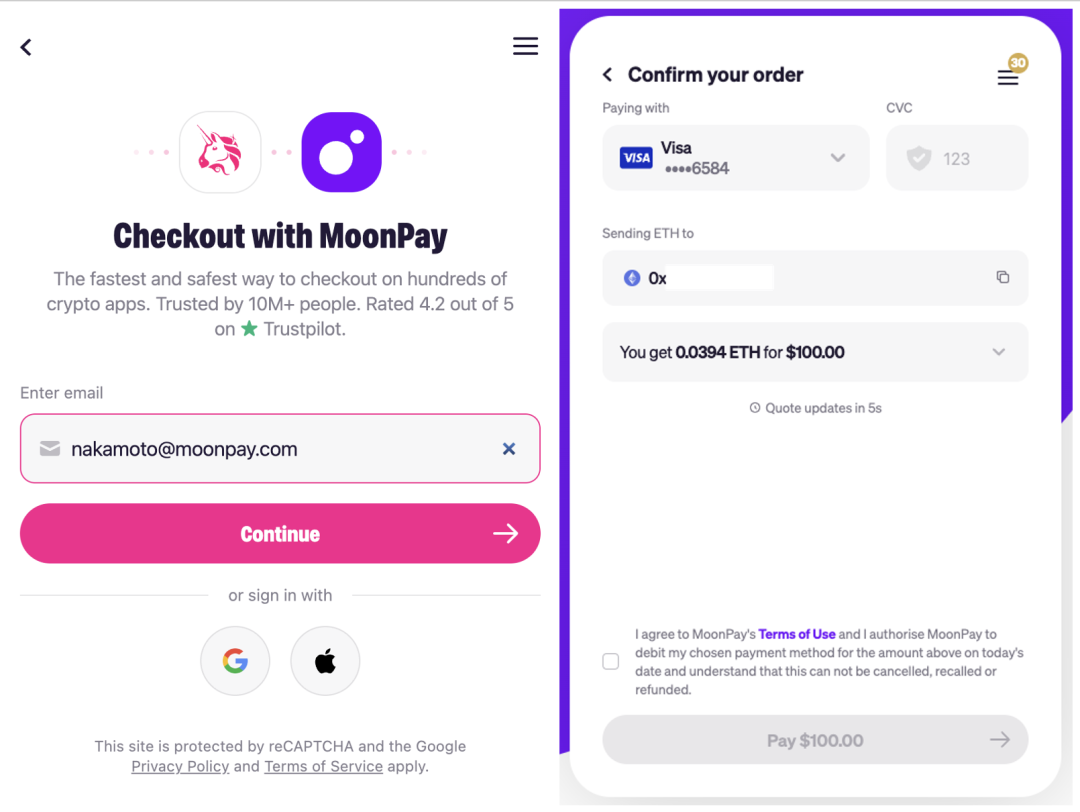

4.3 Project Three: Deposit/Withdrawal Payment Infrastructure MoonPay

Founded in 2019, MoonPay positions itself as "PayPal for Web3." Now one of the few companies licensed and compliant across all U.S. states via MTL license—essentially a crypto service provider focused on deposits and withdrawals.

MoonPay provides APIs and SDKs, enabling developers to integrate its services into Web3 applications, connecting with centralized exchanges and wallets to offer deposit/withdrawal services.

Users can also purchase NFTs and other digital assets on the MoonPay app or through various Web3 exchanges like Coinbase, OpenSea, MetaMask, and Bitcoin.com. Currently serving over 15 million individual users.

Latest update: MoonPay has now been integrated into PayPal, allowing U.S. users to buy over 110 cryptocurrencies using existing PayPal balances or bank cards.

-

Funding History: Raised $555 million in seed round led by Tiger Global Management and Coatue Management, valuing the company at $3.4 billion. Investors include Justin Bieber, Maria Sharapova, Bruce Willis—60 in total.

-

Login Channels: MoonPay platform (KYC), partner centralized exchanges and wallet providers (including MetaMask, Bitcoin.com, OpenSea, Uniswap, Sorare, etc.)

source: @Moonpay

-

Business Scope

○ Deposit/Withdrawal: MoonPay enables individuals to buy or sell cryptocurrencies with fiat. Offers deposit services for 126 cryptos in 34 fiat currencies across 100+ countries, and withdrawal for 22 cryptos. Supports credit/debit cards, EUR/GBP/USD bank transfers, PIX, Yellow Card, and other local payment methods.

○ Crypto Trading Platform: MoonPay provides a secure non-custodial crypto trading platform allowing users to swap different cryptos without fees. Users connect crypto wallets (e.g., Trust Wallet, Ledger, MetaMask, Rainbow, Uniswap, Exodus) to MoonPay for cross-chain swaps. In deposit/withdrawal, MoonPay focuses on building relationships with large projects (exchanges and wallets) to establish traffic portals and acquire users, while Alchemy Pay emphasizes expanding diverse local payment channels and strengthening localized product capabilities.

○ Enterprise Crypto Payments: MoonPay supports multiple enterprise-level crypto payment methods. Users can embed APIs into enterprise apps, supporting payment methods from Visa and Mastercard credit cards to wire transfers, bank transfers, and Apple Pay. MoonPay employs a 50+ member anti-money laundering monitoring system, fraud engine, and anti-fraud stack to handle credit card refunds, fraud, or disputes for enterprise clients.

○ NFT-Related Services:

-

MoonPay Concierge Service: Premium NFT purchasing and custody services for high-net-worth clients. Close partnerships with Yuga Labs help promote blue-chip NFTs like BAYC and CryptoPunks to celebrity clients.

-

NFT Checkout: Partnerships with OpenSea, Magic Eden, ENS, Sweet.io, etc., allow users to buy/sell NFTs using credit/debit cards, Apple Pay, Google Pay—no prior crypto purchase needed.

-

HyperMint: Self-service infrastructure and Web3 API via no-code platform, mainly for creators and brands. Enables users to:

i. Write, design, and deploy smart contracts

ii. Create, manage, mint, and sell tokens to end-users

iii. Channel funds, royalties, and distribute NFTs at scale

-

MoonPay’s Business Model:

○ Fees, Service Charges, NFT Minting/Concierge Fees: MoonPay earns by taking a cut of total transactions. Main transaction types are buying/selling crypto and NFTs, charging service fees, commissions, and NFT minting fees. Charges 4.5% fee for credit card crypto purchases, 1% for bank transfers (minimum $3.99)—not user-friendly for small, frequent transactions. For NFTs, charges 4.5% (minimum $0.50); high-net-worth users also incur premium service fees.

○ Exchange Rate Spreads: Earns revenue from fiat-crypto exchange rate spreads during deposits/withdrawals and crypto purchases/sales.

○ API Integration Fees: Provides APIs allowing third-party platforms and developers to integrate crypto purchasing functionality. May charge integration or subscription fees to partners for API access and service utilization.

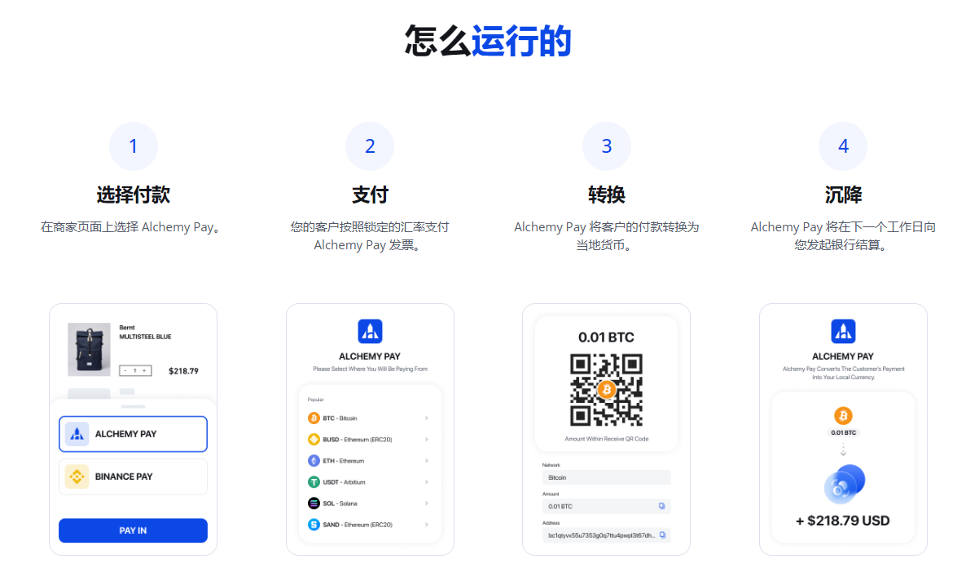

4.4 Project Four: Payment Solutions Provider Alchemy Pay

Founded in 2017 in Singapore, Alchemy Pay is a crypto payment gateway serving enterprises and individuals. Supporting payments in 173 countries/regions, primarily focused on Southeast Asia—distinguishing it from MoonPay’s service scope. Due to varying economic levels and dominant payment methods across Southeast Asian nations, aggregating diverse payment methods poses higher requirements. Alchemy Pay offers one-stop payment solutions.

Recently, Alchemy Pay invested in LaPay UK Ltd, obtaining an FCA-regulated authorized payment institution license. It also partnered with Hong Kong Victory Securities to offer virtual asset trading and advisory services, particularly targeting new spot Bitcoin and Ethereum ETFs. This shows Alchemy Pay’s responsiveness to market trends and proactive service expansion.

Funding Background: Completed $10 million funding at $400 million valuation, with participation from DWF Labs.

-

Alchemy Pay’s Business:

a. Fiat-Crypto Deposit/Withdrawal:

Provides channels for depositing/withdrawing and buying crypto. Currently supports withdrawing sold crypto into bank accounts in over 50 fiat currencies. Unlike MoonPay’s stronger presence in Western markets, Alchemy Pay operates in Southeast Asia and Latin America where e-wallet payments dominate, requiring integration of more payment channels to actively explore developing markets and improve user experience. B2B clients mainly integrate APIs for deposit/withdrawal functionalities.

b. Payment Gateway:

Enterprise-grade payment gateway: Alchemy Pay offers online payment and banking solutions within regulatory frameworks, enabling traditional and Web3 enterprises to manage multi-fiat accounts and facilitate fiat-crypto conversions. Both payers and recipients can choose to pay with crypto or fiat. Additionally, Alchemy Pay offers customized crypto collection services for large enterprises.

Source: @Alchemy Pay

Personal Payments: Accepts all popular global and local payment methods, including debit cards, credit cards, bank transfers, mobile wallets, etc.

Source: @Alchemy Pay

c. Crypto Card Issuance Technical Solution:

Alchemy Pay virtual card is a Mastercard prepaid card, allowing users to directly recharge U.S. dollars into the issuer’s virtual card using multiple cryptocurrencies

-

Currently supported currencies: USDT, USDC, ETH, BTC, and merchant platform tokens

-

Supported networks: Trc20, Bep20, Erc20, Sol, Bitcoin, Polygon

-

Current supported card BINs: 558068 (Mastercard), 531847 (Mastercard), 404038 (Visa)

Source: @Alchemy Pay

Partnership Model: Card issuers collaborate with Alchemy Pay, which generates custom-branded credit cards for merchants. Supports users recharging USD amounts directly using USDT and platform tokens for spending, with remaining balances instantly convertible back to crypto wallets.

Use Cases: Spendable globally on all online platforms accepting Mastercard (e.g., Amazon, eBay), and compatible with Apple Pay for offline store payments.

-

Alchemy Pay’s Business Model

○ Transaction fees for personal and enterprise deposit/withdrawal, fiat-crypto exchange rate spreads

○ API integration service fees for traditional and Web3 enterprises

○ Card issuance technology service fees

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News