TON Ecosystem Landscape: Uncovering On-Chain Star Projects and Future Opportunities (Part 2)

TechFlow Selected TechFlow Selected

TON Ecosystem Landscape: Uncovering On-Chain Star Projects and Future Opportunities (Part 2)

Through detailed data analysis and case studies, demonstrate TON's outstanding performance and immense potential in the fields of decentralized finance, NFTs, gaming, and beyond.

Authored by: WolfDAO

Following the first article "In-Depth Analysis of TON Chain: Unveiling the Core Power of a Future Blockchain Giant," this piece serves as the second installment in the TON ecosystem series. Due to its length, the report is divided into upper and lower parts released simultaneously. The [upper] part analyzes the overall development and risks within the TON ecosystem; the [lower] part focuses on the most influential flagship projects on-chain, examining their innovative features and future opportunities. Through detailed data analysis and case studies, we will showcase TON's outstanding performance and immense potential in decentralized finance (DeFi), NFTs, gaming, and other fields.

Before We Begin

Before diving into specific project analyses, we strongly recommend readers review the following sections of this专题 report:

Part One "In-Depth Analysis of TON Chain: Unveiling the Core Power of a Future Blockchain Giant" for a comprehensive understanding of TON’s fundamentals;

Part Two "The全景 View of the TON Ecosystem: Discovering On-Chain Star Projects and Future Opportunities" to gain an in-depth overview of the entire TON ecosystem;

And stay tuned for the upcoming Part Three "TON Chain’s Path to Compliance and Risk Assessment: Coexisting Prospects and Challenges," which will provide a thorough examination of TON’s legal compliance and potential risks.

Below is the content of Part Two – Lower Section:

Where Are TON’s Opportunities?

Over the past few quarters, the TON ecosystem has consistently demonstrated rapid growth within the global blockchain landscape. Spanning 19 distinct sectors—including centralized exchanges (CEX), decentralized exchanges (DEX), wallets, NFT collections, and games—TON has not only achieved significant technological advancements but also continuously expanded its application scenarios through pioneering projects. This chapter will deeply analyze the development dynamics of leading projects within the TON ecosystem, exploring how these initiatives achieve balanced ecological growth in a highly interconnected and thriving blockchain environment.

DeFi Leader: Ston.fi (DEX)

Overview of Ston.fi

Ston.fi is a decentralized exchange (DEX) built on the TON ecosystem. It operates under a Request-for-Quote (RFQ) model and utilizes Hashed Time-Locked Contracts (HTLC). By eliminating third-party intermediaries, the platform enhances reliability and ensures transaction security. The project offers a simple, secure, and time-efficient solution for asset swaps across different blockchains.

Features of Ston.fi

-

Elimination of Third Parties: Ston.fi operates under an RFQ model using HTLCs, significantly improving transaction reliability and security by removing third-party involvement. Users can conduct peer-to-peer transactions directly on the platform, avoiding unnecessary intermediary risks.

-

Cross-Blockchain Asset Exchange: Ston.fi provides a simple, secure, and efficient solution to facilitate asset transfers between different blockchains. This not only improves interoperability within the TON ecosystem but also makes cross-chain transactions more convenient and efficient.

-

Gas-Free Transactions: Ston.fi enables gas-free transactions, reducing users’ transaction costs and simplifying operational processes. This feature further lowers entry barriers, attracting more users into the TON ecosystem.

-

Telegram Integration: Ston.fi uniquely integrates with Telegram, allowing users to manage and execute asset trades directly through the Telegram platform. Leveraging Telegram’s massive user base, Ston.fi enhances user convenience while increasing user stickiness and activity levels across the broader TON ecosystem.

Ston.fi TVL Market Performance

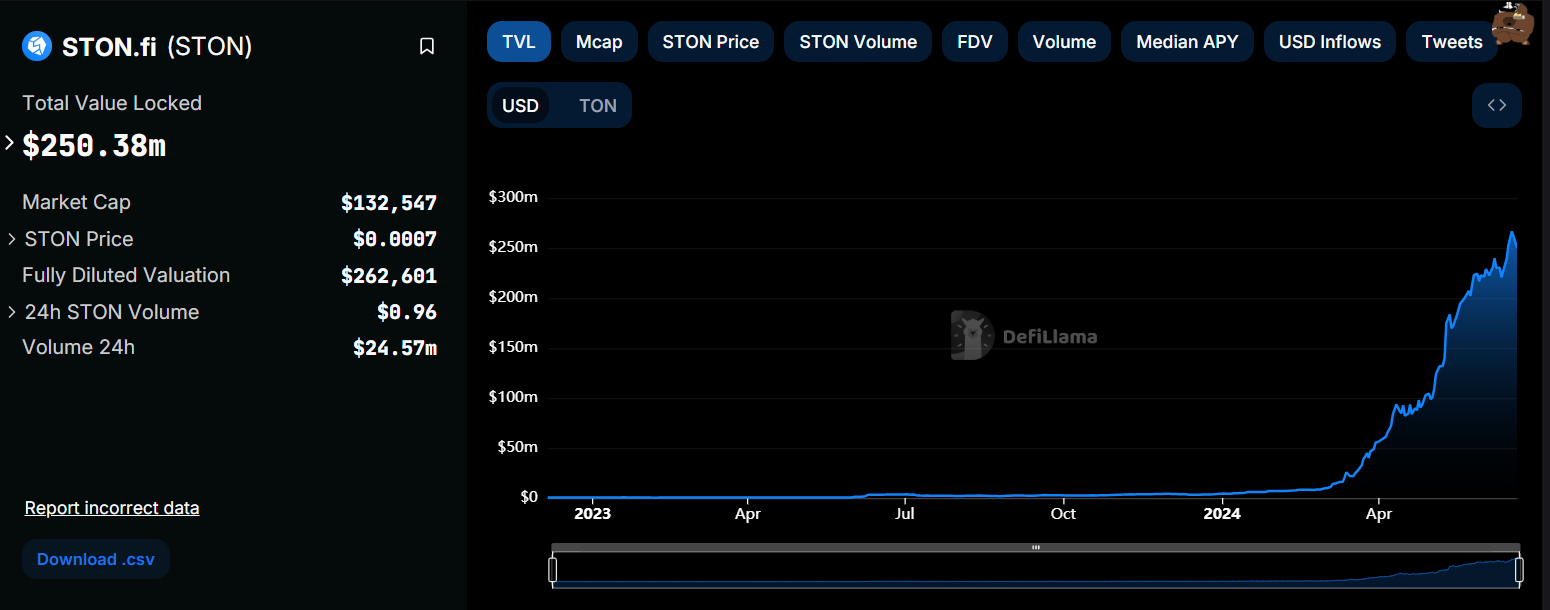

Ston.fi is currently the largest DEX on the TON ecosystem, with a TVL reaching $250 million USD as of June 20, representing an 80% increase over the past month. Its 24-hour trading volume remains around $20 million USD. These figures do not yet align with TON’s current market cap and still have considerable room for growth compared to mainstream DEXs like Raydium.

Ston.fi TVL (Source: Defillama)

According to the chart, Ston.fi’s TVL has shown significant growth over recent months, especially during Q2 2024. This upward trend reflects strong support and confidence from users and capital toward the TON ecosystem. Additionally, reaching a peak of $250.38 million in a short period demonstrates the project’s ability to rapidly scale and attract investment.

Ston.fi Transaction Analysis

Ston.fi is currently the largest decentralized exchange (DEX) within the TON ecosystem. As of June 20, 2024, its total value locked (TVL) reached $250.38 million, marking an 80% increase over the previous month. Ston.fi’s 24-hour trading volume stands at approximately $24.57 million.

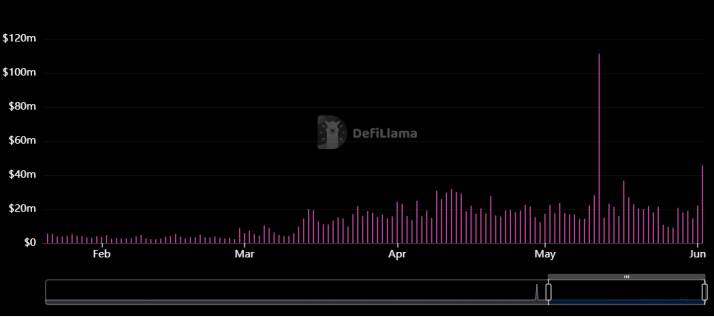

Ston.fi Daily Trading Volume (Data Source: Defillama)

Ston.fi’s daily trading volume experienced notable growth throughout 2024, currently stabilizing between $20 million and $30 million per day. While there is still room for improvement, this volume indicates solid foundations in terms of market adoption and user engagement when compared to other leading DEXs. However, further expansion is needed to compete with top-tier DEX platforms.

Trading Pairs Supported by Ston.fi

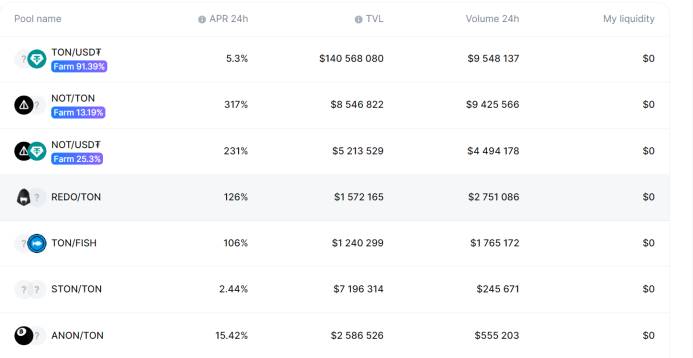

Currently, Ston.fi supports a limited number of trading pairs, primarily focused on TON/USDT, NOT/TON, and NOT/USDT, which exhibit high liquidity and strong market demand. Although other pairs have lower TVL and trading volumes, they still attract some users due to high annualized yields.

Market Position and Development Outlook

Ston.fi currently has a market cap of $132.547 million and a fully diluted valuation (FDV) of $262.601 million. These figures underscore its significant role within the TON ecosystem. Nevertheless, compared to the broader cryptocurrency market and top-tier DEXs, Ston.fi still has room to grow in terms of liquidity and daily trading volume.

Analysis shows that Ston.fi is expanding rapidly and accumulating substantial assets, indicating it remains in a high-growth phase. Going forward, if it can further improve user experience, deepen liquidity pools, and attract more users and capital, Ston.fi could solidify its leadership position within the TON ecosystem and carve out a meaningful presence in the wider DEX market.

Lending Protocol Leader: EVAA Protocol

EVAA Overview

EVAA Protocol is the premier lending protocol on the TON blockchain, enabling users to lend and borrow assets on TON. The protocol employs an isolated lending pool system, establishing separate pools for specific assets such as TON, Bitcoin, or Ethereum, preventing market risk from spreading across pools and thereby creating a more efficient and secure lending environment.

Product Features of EVAA

-

Native TON and Wrapped Assets: Supports both native TON assets and their wrapped versions, enhancing liquidity and offering users diversified options.

-

DAI-Type Stablecoin: Offers a DAI-like stablecoin product, increasing liquidity and utility for TON users without reliance on U.S.-based entities, ensuring international accessibility.

-

DAO Integration: Implements community governance via DAO mechanisms, allowing protocol economic policies and development directions to be collectively controlled and decided by community members, enhancing transparency and fairness.

-

EVAA SDK: Provides an EVAA SDK, enabling developers to customize stablecoins, rebase tokens, farming applications, and even build decentralized exchange (DEX) interfaces based on EVAA, supporting broader financial innovation and application development.

Technical Features of EVAA

-

Decentralization and Core Function Integration: The EVAA protocol is fully decentralized and leverages core TON functionalities—sharding technology and decentralized storage—to ensure data security and sustainable scalability.

-

Efficient and Scalable Design: Thanks to TON blockchain’s fast and scalable nature, the EVAA protocol can handle large transaction volumes, meeting users’ high-frequency borrowing and lending demands.

-

Isolated Lending Pool System: Independent lending pool design effectively prevents the spread of market risks, offering greater flexibility and financial safety.

-

Deep Integration with Telegram (TWA): Leveraging Telegram’s vast user base, EVAA simplifies onboarding, enabling millions of Telegram users to seamlessly access and use the platform.

EVAA TVL Market Performance

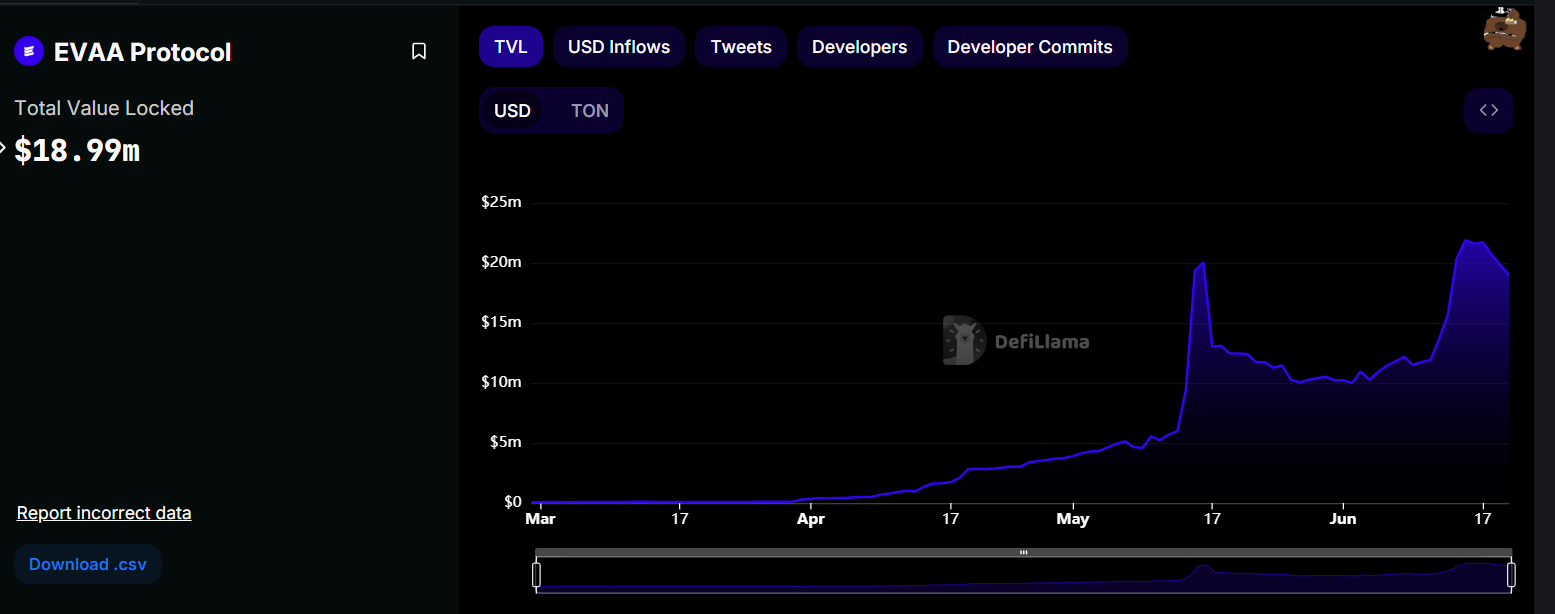

As of the latest data on June 20, EVAA Protocol’s total value locked (TVL) reached $18.99 million, an increase of 90% compared to one month prior. Within the TON ecosystem, EVAA Protocol now ranks seventh in TVL. According to the chart, TVL has shown clear volatility and rapid growth trends.

EVAA Protocol On-Chain TVL Source: Defillama

From the chart, EVAA Protocol’s TVL showed relatively steady growth from March to May. However, starting mid-May, TVL began rising sharply, peaking near $25 million by mid-June before slightly pulling back, remaining around $19 million—a notably high level.

EVAA Market Development

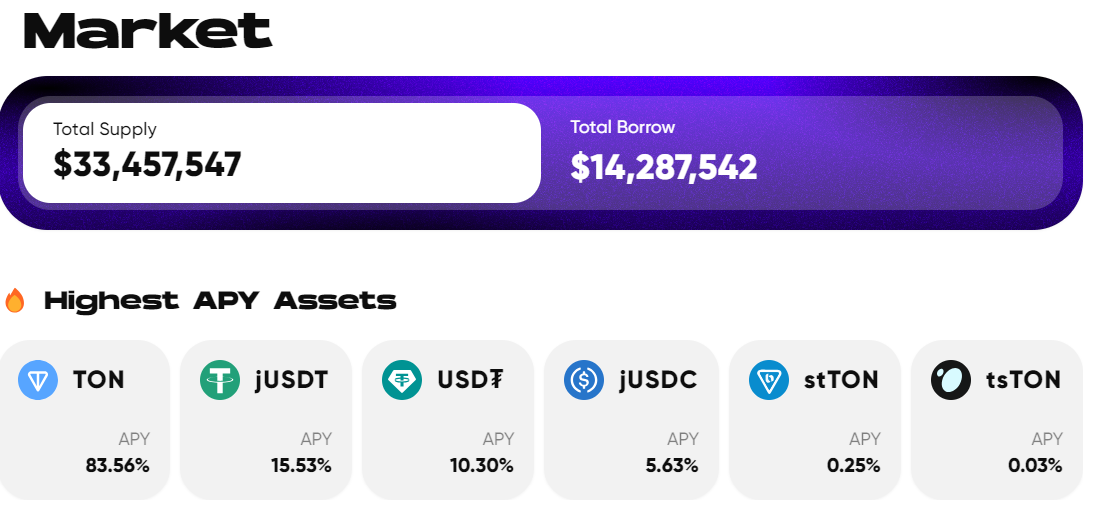

According to official market data provided by EVAA, the platform’s total supplied assets and borrowed amounts are as follows: total supply of $33,457,547 and total borrows of $14,287,542. These figures indicate strong liquidity and user demand, particularly in lending activities, reflecting high recognition and reliable funding backing in the market.

Additionally, among the highest APY (annual percentage yield) assets offered by EVAA, TON reaches an APY of 83.56%. Such high-yield assets highlight EVAA’s competitive edge in delivering attractive returns, drawing investors and users to allocate assets. High APYs drive more users and capital inflows, further strengthening the platform’s liquidity and scale.

EVAA Market Status Source: EVAA Official Website

Characteristics of EVAA’s Market Development

1. Diversified Asset Selection:

-

EVAA offers multiple asset types (e.g., TON, USDT, USDC), catering to diverse investor needs and expanding its user base.

-

Diverse yield structures: A wide range of APYs accommodates users with varying risk preferences and investment strategies, increasing platform appeal and user retention.

2. User Attraction and Platform Growth Potential:

-

EVAA’s ultra-high APY assets (e.g., 83.56% for TON) attract significant investor interest, boosting user numbers and competitiveness in the crowded crypto market.

-

High-yield publicity generates additional awareness, bringing in more potential users.

3. Implied Advantages in Risk Management:

-

Alongside high-APY assets, EVAA also offers lower-APY options (e.g., stTON and tsTON). This differentiated pricing strategy balances risk, meets varied user preferences, and strengthens overall platform stability.

EVAA demonstrates strong liquidity, high yields, diversified asset offerings, and robust risk management capabilities in the crypto lending market, securing a favorable competitive position. This enables it not only to attract initial investors but also retain long-term users and foster continuous platform growth. With exceptional performance in liquidity and returns, EVAA presents compelling advantages in the market. Investors and users stand to benefit from the high-quality services and lucrative asset allocation opportunities offered by the EVAA platform.

Stablecoin Leader Project: Aqua

Aqua Overview

Aqua Protocol is a decentralized finance platform aiming to introduce a stablecoin protocol on the TON blockchain. Unlike centralized stablecoins, Aqua provides decentralization and censorship resistance, offering users a secure and transparent alternative to meet their financial needs. By leveraging multiple collateral options such as TON coins and liquid staking token derivatives (LST), Aqua enhances TON’s liquidity and expands DeFi opportunities for users within the TON ecosystem.

The stability of AquaUSD as a stablecoin is maintained through 200% over-collateralization, liquidation mechanisms, arbitrage opportunities, and an AquaUSD premium suppression mechanism. These factors work together to ensure AquaUSD’s value stays close to $1.

Features of Aqua Protocol

-

Over-Collateralization: Each AquaUSD is backed by at least $1.50 worth of Toncoin or liquid staking token derivatives (LST), guaranteeing a minimum collateral ratio of 150%, ensuring stability.

-

Peg Stability Mechanism: Maintains price stability of AquaUSD through fixed exchange rates, market arbitrage, partial liquidations, and debt ceiling limits that restrict excessive AquaUSD issuance.

-

Censorship Resistance: AquaUSD is a fully decentralized, censorship-resistant, transparent, and fair stablecoin developed by the Aqua Protocol.

How Aqua Works

-

Deposit: Users deposit Toncoin or liquid staking token derivatives as collateral into the platform.

-

Borrow AquaUSD: Users mint AquaUSD against their deposited collateral.

-

Spend AquaUSD: Users can utilize AquaUSD across various DeFi protocols while still earning potential interest on their deposited collateral.

Aqua Protocol Fees

-

Annual Borrowing Rate: The annual loan rate in the Aqua Protocol may vary depending on market conditions. Interest is calculated daily. Currently, Aqua offers a unique 0% rate to attract new users.

-

Minting Fee: When users take out loans via the Aqua Protocol, they pay a fee of up to 0.5% based on the loan amount.

-

Loan Repayment Fee: Repaying a loan in the Aqua Protocol requires a minimum fee of up to 0.5%.

Currently, Aqua is still in testing phase and the product has not officially launched.

Staking Leader: TonStakers

TonStakers Overview

TonStakers is a liquid staking protocol built on the TON blockchain, designed to lower the barrier to entry for staking by allowing users to stake as little as 1 TON. Users who stake through TonStakers don’t need to worry about infrastructure maintenance and can earn consistent staking rewards. TonStakers has been certified by CertiK as the safest liquid staking protocol on TON.

TonStakers actively participates in the TON blockchain’s staking process, earning rewards by processing transactions and creating new blocks. Users deposit their TON tokens into TonStakers’ liquid staking pool, after which these tokens are added to the main staking pool to generate higher staking yields. Generated rewards are distributed to users approximately every 18 hours.

Additionally, TonStakers maintains a dedicated pool that allows users to instantly convert their tsTON holdings back into TON without waiting for the validator lock-up period to end. This mechanism significantly enhances liquidity, providing users with a more convenient and flexible staking experience.

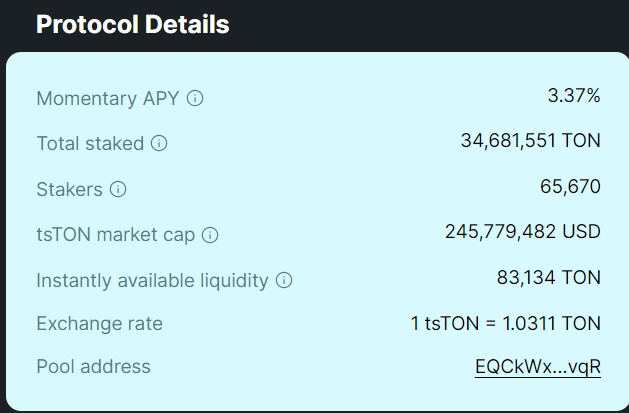

TonStakers TVL Market Performance

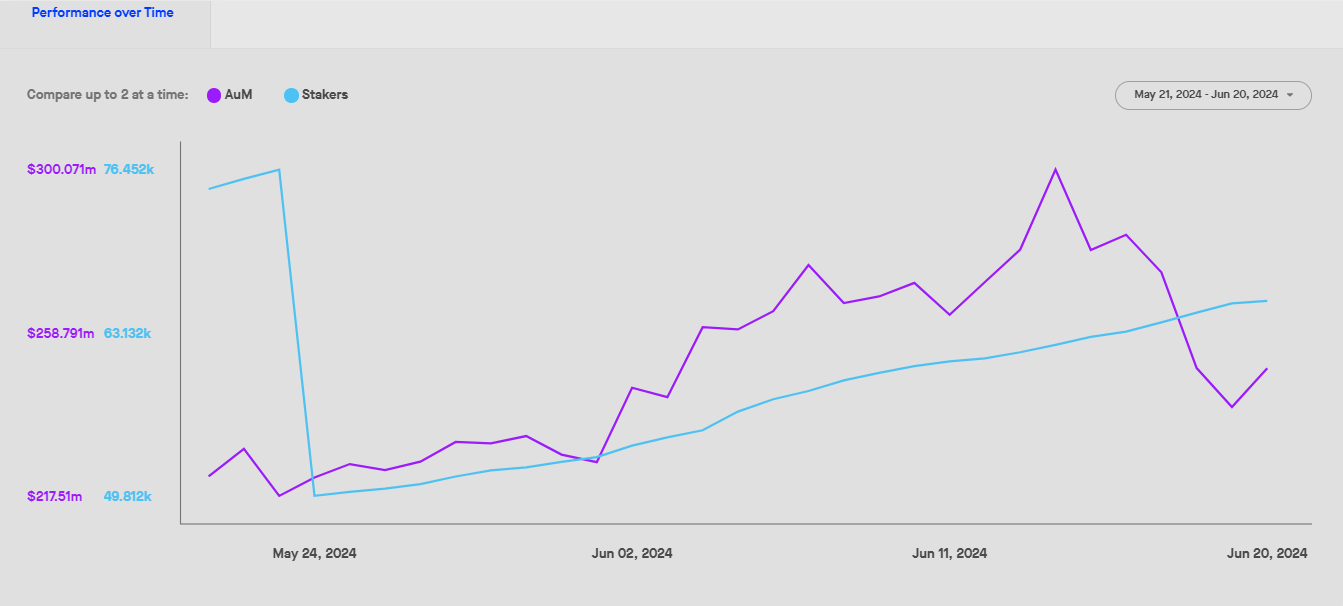

TonStakers is currently the third-largest project by TVL in the TON ecosystem, with a total value locked (TVL) of $245.7 million, achieving a 300% growth rate over the past three months, demonstrating remarkable momentum. The total number of users participating in staking is 65,670, maintaining a steady growth trajectory.

TonStakers TVL Historical Performance Resource: StakingRewards

From January 3, 2024, to June 4, 2024, TonStakers’ total value locked (AuM) experienced rapid growth. In just five months, TonStakers’ TVL increased by approximately fivefold, with the number of staking participants also growing nearly fivefold. This indicates TonStakers’ strong appeal in attracting users and capital. The rapid growth in locked value also reflects increasing user confidence in both the TON ecosystem and the TonStakers project itself.

Protocol Details Source: Tonstakers Official Website

Judging from key metrics such as total value locked, annualized yield, and total staked amount, TonStakers not only delivers solid returns to users but also continues to expand its market share and user engagement. Going forward, as the TON ecosystem evolves, TonStakers is poised to maintain its leading position in the staking sector.

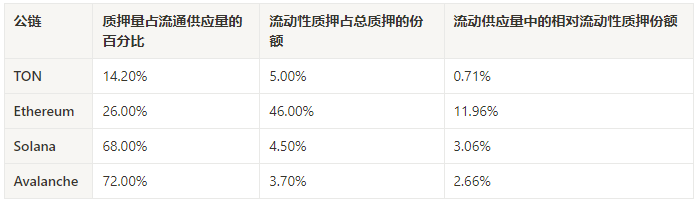

Public Chain Staking Data Comparison

According to the latest data analysis, although TON’s staking volume has recently risen, its staking ratio and protocol fee-sharing ratio remain low, limiting TonStakers’ growth potential.

First, in terms of staking ratio, TON’s staking ratio is only 14.20%, significantly lower than competitors. For example, Ethereum’s staking ratio is 26.00%, Solana’s is 68.00%, and Avalanche’s reaches 72.00%. This indicates that overall staking participation on TON still needs substantial improvement. Moreover, although TON holds a 5.00% share in the liquid staking market, its relative weight is only 0.71%, far below Ethereum’s 11.96%. Liquid staking allows users to maintain liquidity while staking their tokens—a mechanism widely adopted on competing chains—meaning TonStakers faces significant competitive pressure in this area.

TonStakers’ APY (annual percentage yield) is relatively low, and both its TVL (total value locked) and number of stakers have significant room for growth. High-APY, high-TVL public chains like Jito continue to attract more users and capital. Therefore, TonStakers needs to further optimize its yield model and boost staking returns to attract broader participation.

TonStakers holds strong growth potential on the TON chain but must continue strengthening efforts in staking ratios, APY, and user experience to secure a place in the fiercely competitive market.

Bridge Leader: Orbit

Orbit Overview

Orbit Bridge is an essential cross-chain communication protocol within the TON ecosystem, possessing notable functional and technical advantages. It enables seamless asset transfers between different blockchains, adding greater liquidity and interoperability to the entire blockchain ecosystem.

Project Features of Orbit

1. Cross-Chain Asset Transfer

-

Seamless Transfer: Orbit Bridge supports seamless asset transfers across multiple blockchains, ensuring users can complete cross-chain transactions without complex operations or high fees.

-

Multi-Chain Support: As of April 2024, Orbit Bridge supports Klaytn, Polygon, Ethereum, Wemix Mainnet, and Orbit Chain, facilitating smooth transfer of assets from these chains onto the TON network. This multi-chain support greatly expands TON ecosystem’s influence and user base.

2. Decentralization and Security

-

Fully Decentralized: Orbit Bridge uses a completely decentralized transfer process, avoiding risks associated with centralized platforms and ensuring transparency and security in cross-chain operations.

-

Consensus Mechanism: Its consensus-based transaction validation ensures public verification of every transfer, preventing single points of failure and potential security vulnerabilities through distributed node agreement.

3. Liquidity and Ecosystem Effects

-

Enhanced Liquidity: Orbit Bridge increases asset liquidity within the TON ecosystem, allowing users greater freedom in asset allocation and movement across different blockchains.

-

Lowered Barriers: Orbit Bridge simplifies operations for new blockchain users, reducing technical hurdles and learning curves, thus attracting more participants into the TON ecosystem.

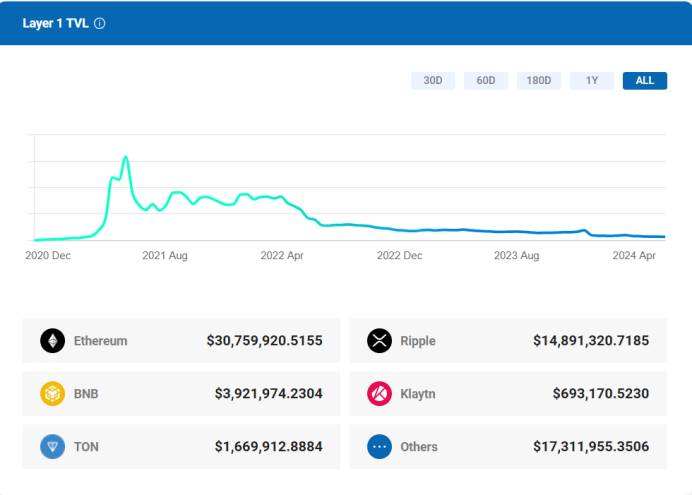

Orbit TVL Market Performance

As the most commonly used cross-chain platform on TON aside from Tonbridge, according to Layer1 TVL comparison data, as of June 2024, the value locked on Orbit Bridge for TON was $1,669,912.8884—far below major chains like Ethereum, BNB, and Ripple, and even less than relatively niche chains like Klaytn.

Total TVL Across Chains on Orbit Bridge Source: Orbit Bridge Official Website

Possible factors affecting TON’s performance on Orbit Bridge include:

-

Ecosystem Development Stage: The TON ecosystem is relatively young, with many DeFi projects and user communities still in early development stages. This results in weaker cross-chain demand compared to mature chains that have operated for years.

-

User Behavior Characteristics: As previously mentioned, a large portion of TON users are concentrated in community mini-games like Notcoin, where their on-chain activities are primarily recreational rather than financial. This reflects that TON users focus more on non-financial applications and functions.

-

Overall Market Competition: Compared to dominant chains like Ethereum and BNB, which offer richer ecosystems and broader use cases, TON temporarily struggles to achieve higher TVL on cross-chain platforms. Additionally, Ripple’s widespread use in traditional financial payment solutions contributes to its larger locked value on cross-chain platforms.

-

Limited Cross-Chain Demand: Cross-chain bridge demand is closely tied to on-chain activity and ecosystem maturity. Currently, cross-chain demand on TON is relatively limited, and much of it may already be satisfied by TonBridge, leaving Orbit Bridge with lower locked value.

Development Tool Launchpad Leader: Tonstarter

Tonstarter Overview

Tonstarter is the first launchpad platform built on The Open Network (TON), designed to provide tokenized venture capital for promising projects, enabling teams to raise funds in a decentralized, secure, and user-friendly environment. The Tonstarter platform not only helps teams secure funding but also assists investors in building strong communities around products, services, and development.

Currently, Tonstarter has over 150 angel investors and VCs, more than 20,000 investors active in its IDO Telegram bot group, and a community exceeding 55,000 members.

Tonstarter Funding Approach

1. Fundraising

Tonstarter helps teams and projects successfully launch on the TON blockchain:

-

Private Club: Connects projects with individual investors, offering customized investment plans.

-

VC Network: Links projects with venture capital firms and funds to secure greater financial support.

-

TonStarter Joint Ventures: Directly invests TonStarter’s own capital into entrepreneurs’ projects, providing comprehensive support.

2. Consulting Services

Leveraging expertise in business building, tokenomics, and go-to-market strategies, the Tonstarter team provides comprehensive consulting services to entrepreneurs:

-

Technical Support: Offers network development support for integrating with TON and Telegram, ensuring smooth project launches.

-

Tokenomics: Helps design and optimize project tokenomics to ensure sustainable token models.

-

Network Resources: Connects projects with key players within the ecosystem, providing extensive networking opportunities.

-

Introduction Services: Organizes introductions to market makers, exchanges, and auditors to enhance project visibility.

3. Public Relations and Marketing

Tonstarter helps projects attract audiences and ensure successful launches through the following methods:

-

Community Launches: Leverages over 50,000 active TON community members for project promotion.

-

Telegram Advertising: Accesses in-app Telegram campaigns to boost project exposure.

-

KOL Connections: Utilizes a KOL database for precise marketing outreach.

-

Marketing Tools: Assists in creating high-quality marketing materials to strengthen promotional impact.

4. Organizing IDOs and Airdrops

Tonstarter provides strong IDO and airdrop support for entrepreneurs to attract users and capital in early stages:

-

Development Tools: Offers essential development tools and platforms to help projects operate smoothly within the TON ecosystem.

-

Developer Engagement: Evaluates and improves developer adoption of these tools and platforms.

-

Success Stories: Showcases successful applications built using these tools and platforms to boost investor confidence.

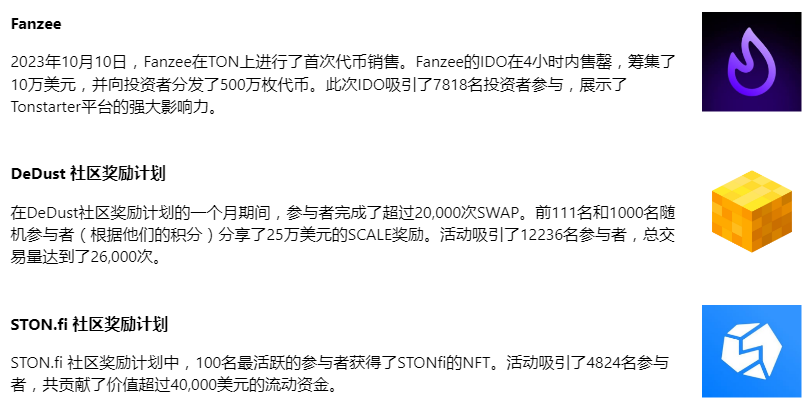

Successful Project Case Studies

Gaming Platform Leader – JetTON

JetTON Overview

JetTON Games is the most popular gaming platform on TON, deeply integrated with Telegram Messenger. This integration combines gaming with familiar social interactions, not only enhancing user gaming experiences but also promoting social engagement—players can easily share progress and achievements with friends, significantly improving user experience. JetTON Games leverages TON’s advanced blockchain technology to deliver secure, transparent, and high-performance services, which are crucial for online gaming environments.

JetTON Project Features

1. Security and Transparency

JetTON Games leverages the decentralized nature of the TON blockchain to ensure the security and transparency of every transaction. The use of smart contract technology further enhances the fairness of the gaming platform, preventing cheating and fraudulent behavior.

2. High Performance

The high throughput and low latency characteristics of the TON blockchain enable JetTON Games to handle a large number of concurrent users and transactions, ensuring smooth and stable gameplay. This is especially important for online gaming, where players enjoy a seamless experience.

3. Diverse Game Types

-

Slot Machines: 3,900+

-

Strategy Games: 290+

-

Card Games: 300+

JetTON Community Development Performance

As of June 2024, JetTON Games’ Telegram channel has nearly 500,000 users, with extremely high community activity. According to data from Alphagrowth, JetTON Games has seen significant user growth over the past few months:

JettonGame Follower Trend Chart Source: Alphagrowth

-

User Growth Trend: JetTON Games saw a noticeable surge in users in early April, increasing from 183,000 to over 200,000. Afterward, the number fluctuated slightly but remained on an upward trajectory.

-

Active Users: In mid-May and early June, user numbers surged again, reaching a peak of nearly 480,000. This indicates strong attractiveness and retention among its user base.

-

Community Interaction: Through deep integration with Telegram, JetTON Games effectively leverages social media advantages to increase user interaction and engagement, further boosting community activity and stickiness.

Meme Token Leader: Notcoin

Notcoin Overview

NotCoin is an innovative game based on the Telegram platform where users earn in-game virtual currency by tapping on a coin image. NotCoin aims to attract a broader mainstream audience into the cryptocurrency space by simplifying token handling and removing technical barriers.

Within less than two months, Notcoin—the game and token integrated as a Telegram mini-app—has attracted over 30 million users on Telegram, introducing a new wave of mainstream adopters to the crypto space.

Platform Features of Notcoin

1. Simple and Easy to Use

NotCoin’s simple interactive design allows users to participate without needing deep technical knowledge. Users simply tap the coin image within Telegram to receive rewards. This straightforward approach drastically lowers the barrier to entry.

2. Broad User Base

Within less than two months, NotCoin has attracted over 30 million users on Telegram. This rapid user growth highlights NotCoin’s immense potential in attracting mainstream users and bringing a fresh wave of adoption to the cryptocurrency field.

3. Social Interaction

As part of a Telegram mini-app, NotCoin leverages Telegram’s powerful social features. Users can share their gaming progress with friends, invite others to join, and earn extra rewards through social interactions. This social component not only enhances user experience but also increases user retention and engagement.

Positive Impacts of Notcoin

1. Driving Cryptocurrency Adoption

Through its simple user experience and broad social interactions, NotCoin has successfully attracted a large number of mainstream users into the cryptocurrency space. For many new users, NotCoin may be their first exposure to and use of cryptocurrency, thereby driving wider adoption and application of digital assets.

2. Strengthening the TON Ecosystem

NotCoin’s success has brought a large influx of new users and heightened activity to the TON ecosystem. This not only boosts TON’s visibility but also attracts more developers and projects to build and deploy on TON, further enhancing the vitality and competitiveness of the TON ecosystem.

Market Performance of Notcoin

According to CMC data, Notcoin’s daily trading volume surged to a record high, increasing by over 220% and surpassing $4.5 billion, making it the fourth-highest traded cryptocurrency. Notcoin’s price rose over 323% in the past week, hitting a historic high of $0.02896 on June 2.

Notcoin has received strong support from the TON Foundation, Binance, and other TON ecosystem projects. Continuous empowerment efforts aim to eliminate valuation bubbles. If TON continues to develop in the future, Notcoin has the potential for another breakout.

Notcoin Price Trend Chart Source: CoinMarketCap

According to the latest data from CoinMarketCap, since NotCoin’s listing on Binance, its market performance has significantly improved, mainly reflected in price and trading volume changes:

-

Price Increase: NotCoin’s price saw a significant rise after listing on Binance. As shown in the chart, NotCoin’s price climbed from $0.01026 on May 20 to a peak of about $0.025 at the beginning of June. This price surge reflects strong market demand and confidence in NotCoin.

-

All-Time High: NotCoin’s price increased by over 323% in the past week, reaching an all-time high of $0.02896 on June 2, 2024.

-

Price Volatility: Although NotCoin’s price pulled back from its early June peak, it generally remained above $0.016, showing certain market stability and support.

-

Surge in Trading Volume: After launching on Binance, NotCoin’s daily trading volume increased significantly. Its daily volume surged by over 220%, exceeding $4.5 billion, making it the fourth most traded cryptocurrency.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News