Everything You Need to Know About the Bitlayer Ecosystem

TechFlow Selected TechFlow Selected

Everything You Need to Know About the Bitlayer Ecosystem

Bitlayer has emerged as a frontrunner in the Bitcoin ecosystem, thanks to its unique BitVM implementation approach and its ability to attract liquidity and users.

Author: Revelo Intel

Compiled by: TechFlow

Over the past several weeks and months, Bitcoin’s status as an asset has declined from its 1970s-era position. Market participants have been waiting for the market leader to break through its all-time high (ATH), but this goal has not yet been achieved in Q2 2024. The competition among Bitcoin Layer 2 (L2) networks is intensifying, with Starknet announcing plans to launch their own Bitcoin L2 called Catnet. This initiative involves creating a custom signet and enabling the OP_CAT opcode; had this opcode not been removed during Bitcoin’s early development, Bitcoin could have supported smart contracts from the beginning. Meanwhile, Babylon, a project offering BTC staking and restaking services, is gaining increasing attention. The protocol is currently on testnet and recently raised around $70 million from firms including Paradigm.

Despite Bitcoin's price volatility, Bitlayer has emerged as a standout within the Bitcoin ecosystem due to its unique implementation of BitVM and its ability to attract liquidity and users. Since we first reported on this emerging protocol a few weeks ago, Bitlayer has shown significant growth. The team recently participated in GM Vietnam Blockchain Week and will appear at next month’s EthCC conference, actively promoting their work and the BitVM concept. Bitlayer’s median gas fee is currently quoted at $0.40, and the protocol’s total value locked (TVL) has nearly tripled to approximately $354 million. This positions Bitlayer second in TVL among Bitcoin-based chains, trailing only Merlin Chain. Notably, Merlin Chain’s TVL more than doubled in a single day last month. The Bitlayer ecosystem now includes over 100 decentralized applications (dApps).

Launched just weeks ago, Bitlayer has already demonstrated remarkable growth. Transaction volume on the chain has surpassed one million, with activity peaking alongside rising Bitcoin prices. In our previous report, we briefly introduced the Ready Player One airdrop program—a $50 million initiative for developers and protocol teams, with $20 million allocated specifically for leaderboard competitions. Since then, Bitlayer has launched a new $23 million Mining Gala event, which concluded earlier this week. In today’s article, we’ll take a closer look at some key participating projects in this campaign, which constitute a major portion of Bitlayer’s total TVL, user base, and overall activity.

Avalon Finance

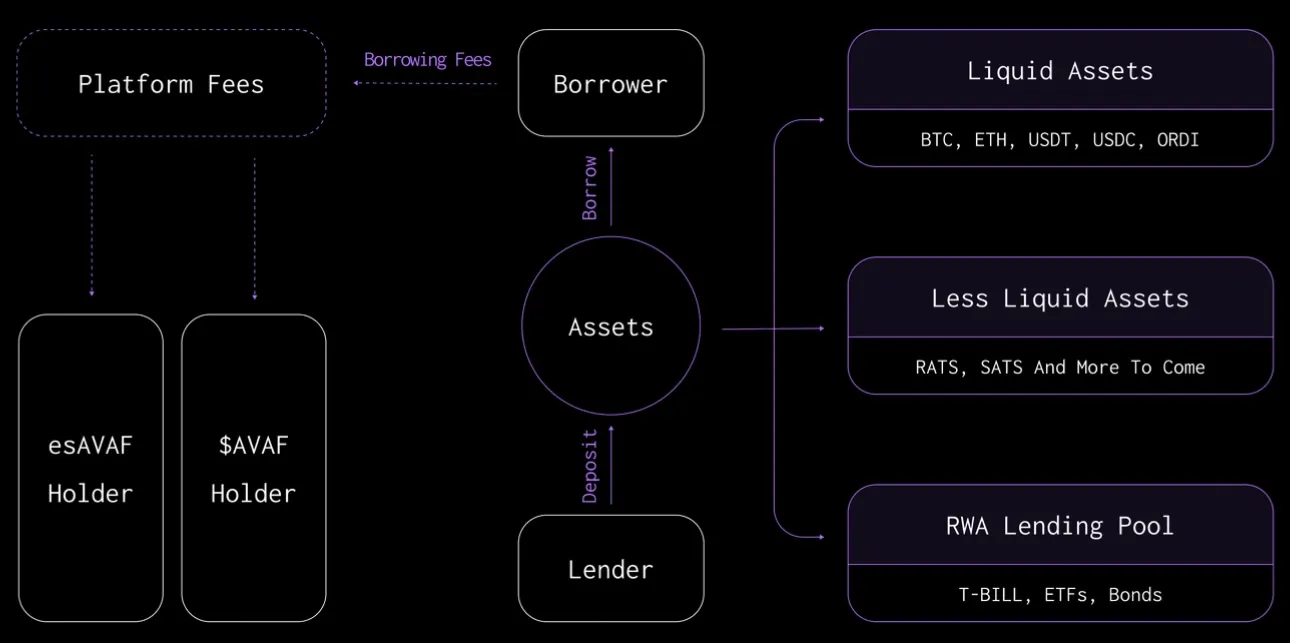

Avalon describes itself as the first "CeDeFi" lending market. The protocol boasts a TVL exceeding $120 million on Bitlayer, and its native tokens AVAF and esAVAF can be staked to earn protocol revenue and esAVAF rewards.

The modular protocol’s main product is its over-collateralized lending market, where users deposit funds into isolated pools to serve as collateral for borrowing. Both major and minor tokens can be deposited, but currently only Bitcoin is accepted as borrowable collateral. Nearly $86 million worth of WBTC has been borrowed so far, with total deposits reaching approximately $180 million. Deposits earn 2x points, while borrowing earns 6x points. As a result, the maximum borrowing cap of 1,300 WBTC is nearly filled, with utilization at around 43%. Borrowers can use up to a 60% loan-to-value ratio (LTV), face liquidation at 85% LTV, and incur a 10% liquidation penalty. Users can track their point accumulation on the project’s integrated leaderboard.

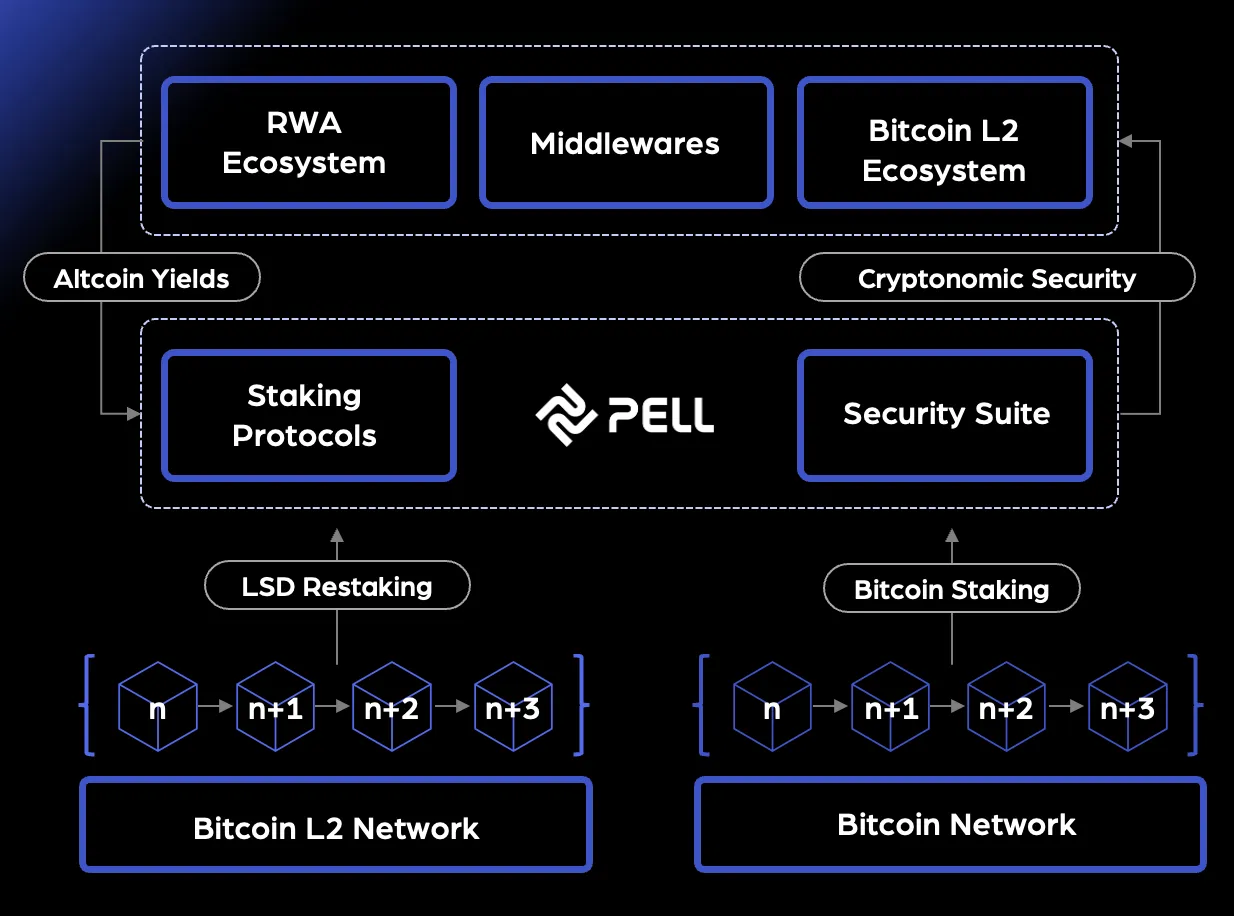

Pell Network

Pell Network has a TVL of approximately $95 million on Bitlayer. It provides a range of services for the emerging Bitcoin L2 market, including network security features, blockchain operational infrastructure, and yield enhancement. Pell Network also participates in Bitcoin restaking, aiming to diversify yields across Bitcoin L2s and enhance the security of these chains.

On Bitlayer, users can “restake” various assets to earn 15% Pell Points. In addition to WBTC, users can deposit various Bitcoin LSD tokens, with stBTC making up the majority of Bitlayer’s TVL. Additional point rewards are available for first-time protocol usage and extended deposit durations, along with bonus points from basic social engagement tasks.

On the backend, Pell Network aggregates native Bitcoin staking yields and LSD yields, creating a network where stakers can opt into validating newly built modules within the ecosystem.

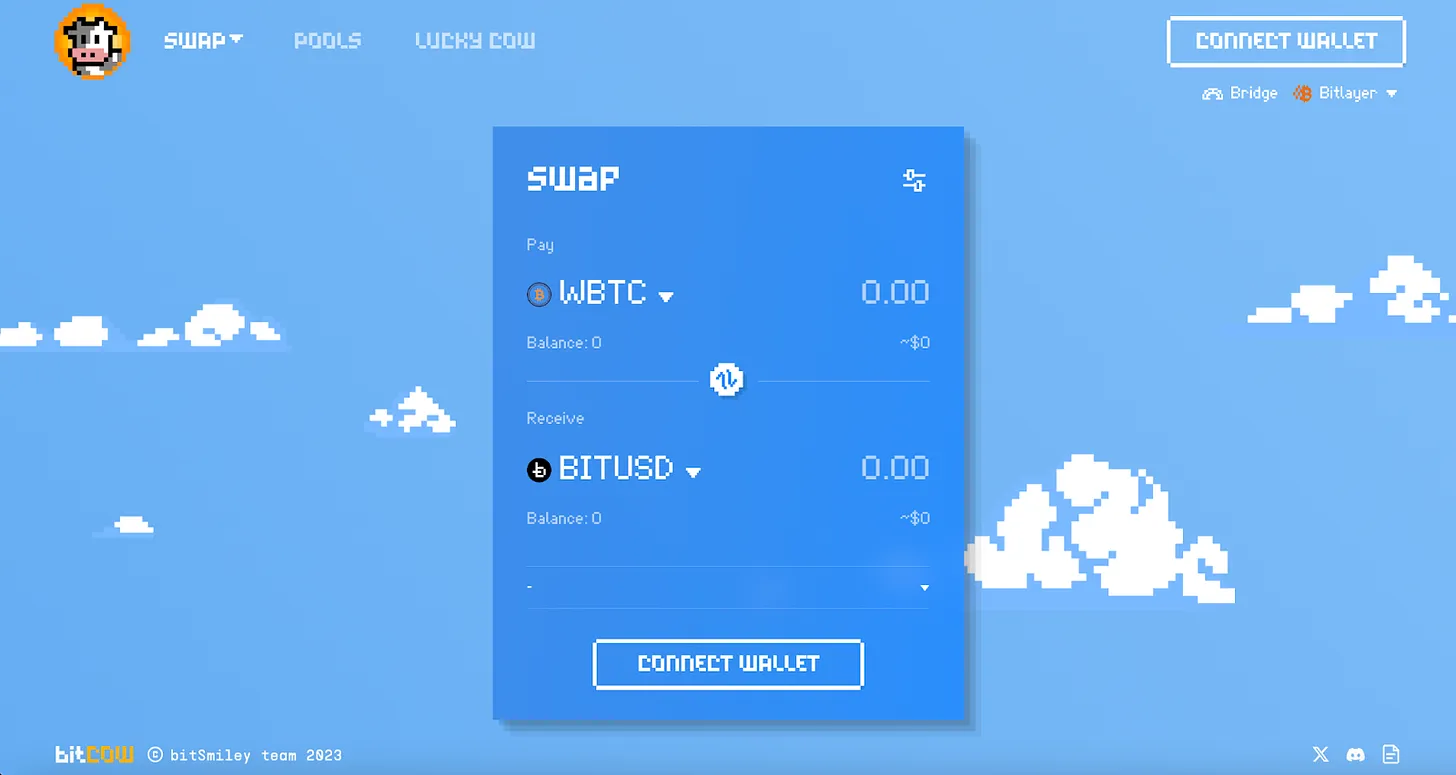

BitCow

BitCow ranks third in TVL on Bitlayer, with approximately $35 million in TVL. As an automated market maker (AMM), BitCow offers stablecoin swaps and concentrated liquidity services, specifically designed to serve the expanding Bitcoin L2 ecosystem. In its v1 version, BitCow provides stable swap services for stablecoins and LSD assets, maintaining minimal gas fees and maximizing capital efficiency. Equilibrium prices are also adjusted over time to account for gradually appreciating LSD assets.

BitCow’s V2 focuses on concentrated liquidity for volatile token pair swaps. Key features include auto-pricing, zero impermanent loss (IL), and transparent profit-and-loss reporting. Auto-pricing is enabled via external oracles, allowing for concentrated liquidity without requiring manual price range management. All liquidity for specific assets is automatically concentrated around the price determined by the oracle. This hybrid approach delivers higher returns for LPs while eliminating the complexity typically associated with managing concentrated liquidity protocols.

In its v2 version, BitCow also adopts a dual-token LP solution, where one side of the pair represents the volatile asset and the other represents a stablecoin. This allows volatile token LPs to retain ownership rights over their assets as their values fluctuate, while stablecoin LPs remain market-neutral and accumulate trading fees from the pool. Additionally, the protocol’s Trumeme feature enables users to create their own memecoins and provide initial liquidity on the testnet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News