Bitlayer Ecosystem Project Overview: The Future of Bitcoin Layer2 and Ecosystem Development

TechFlow Selected TechFlow Selected

Bitlayer Ecosystem Project Overview: The Future of Bitcoin Layer2 and Ecosystem Development

This article provides a brief analysis of Bitlayer and presents views on Bitlayer and BTC Layer2.

Author: Eureka Partners

Outlook for Bitcoin Layer 2

Bitcoin was initially conceived as an electronic payment system. For security and stability, its non-Turing-complete scripting language limits complex computation capabilities, making Bitcoin more of a "digital gold" used primarily for value storage. As ecosystems on public chains like Ethereum and Solana exploded in growth, developers have been exploring ways to unlock the trillions of dollars in dormant assets within the Bitcoin ecosystem. However, existing solutions such as sidechains and the Lightning Network face technical limitations, leading to lukewarm adoption.

In 2023, the Ordinals protocol sparked an inscriptions boom that expanded new asset forms within the Bitcoin ecosystem, further prompting market discussions around Bitcoin’s scalability and programmability. A series of new Layer 2 solutions—such as Merlin and B² Network—have emerged, leveraging programmability to build DeFi applications like swaps, lending, and liquidity mining, thereby expanding use cases within the Bitcoin ecosystem.

Currently, most Layer 2 projects bridge liquidity into the Ethereum ecosystem and rely on coupling with Ethereum to participate in DeFi and other on-chain scenarios. However, many withdrawal bridges are essentially multi-signature bridges, where shared asset management introduces trust risks and fail to allow users to withdraw assets in a trustless manner at any time. For many BTC holders, there is little incentive—and even less confidence—to bridge BTC assets into the Ethereum ecosystem for uncertain returns, especially since capital security underpins all potential gains. Therefore, an ideal Bitcoin Layer 2 should inherit Bitcoin's security properties while building a scalable, programmable on-chain financial infrastructure.

Bitlayer Emerges as a Promising Core Layer 2 Solution

As a leading BTC Layer 2, Bitlayer adopts a layered virtual machine (LVM) architecture combining zero-knowledge proofs (ZKP) and optimistic verification (OP) mechanisms to support a wide range of computational tasks. Additionally, through innovative OP-DLC and BitVM bridge technologies, Bitlayer has built a dual-channel, two-way pegged asset bridge that inherits the security of Bitcoin Layer 1.

Bitlayer’s core technological innovations lie in adopting the latest BitVM computing paradigm and OP-DLC bridge.

Compared to other Bitcoin Layer 2 solutions, Bitlayer aims to address three core challenges, offering corresponding solutions:

-

Trustless Two-Way Peg — By integrating OP-DLC with the BitVM bridge, Bitlayer proposes a novel model beyond traditional multi-sig setups, enabling trustless bidirectional asset transfers between Bitcoin mainnet and Bitlayer.

-

Layer 1 Verification — Security is inherited from Bitcoin via BitVM.

-

Turing-Completeness — Supports multiple virtual machines and provides full compatibility with the Ethereum Virtual Machine (EVM).

Token Airdrop (Ready Player One)

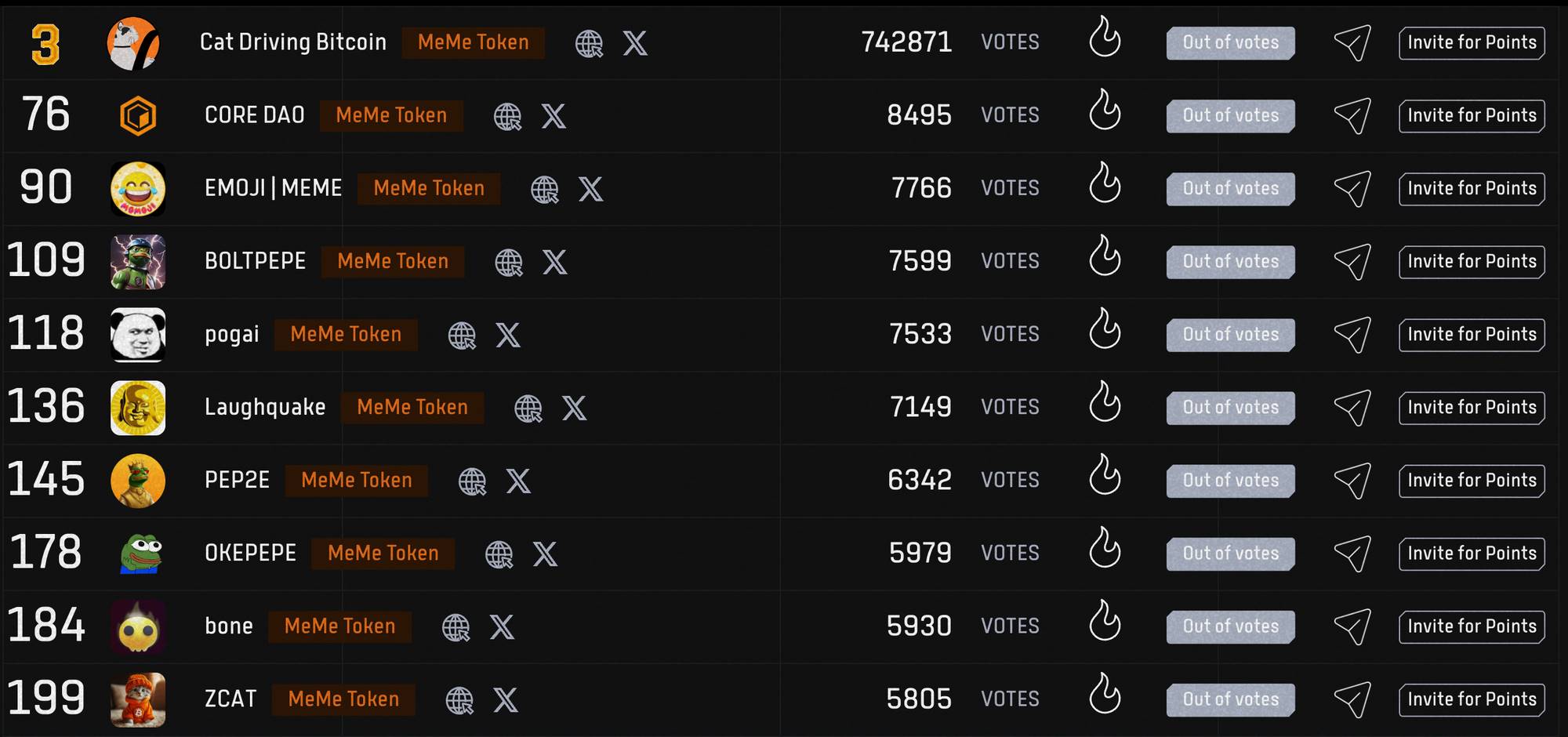

Beyond underlying technology, ecosystem vitality is crucial for a blockchain’s long-term success. To encourage projects—including DEXs, wallets, NFT marketplaces, lending platforms, LSD protocols, bridges, and stablecoins—to build on Bitlayer, on March 29, Bitlayer officially launched a series of ecosystem incentive programs. The first phase, “Ready Player One,” will distribute $50 million worth of native chain tokens to ecosystem builders and projects. According to official data, over 800 projects have already signed up. Before voting ends on May 10, users can actively vote to earn “Ready Player One” activity points. Meanwhile, participating project teams can accumulate popularity points to improve their rankings on the Bitlayer leaderboard, increasing their chances of receiving developer airdrops and grants.

Overview of Native Projects in the Bitlayer Ecosystem

Definition of "native": Projects exclusively targeting Bitlayer; cross-chain or multi-chain projects are excluded. Top 30 projects on the leaderboard.

Pumpad

Pumpad is a native launchpad project on Bitlayer. According to the team, Pumpad serves as a one-stop launchpad in the BTC ecosystem for issuing VGA assets based on IPOS standards. After issuance, Pumpad helps issuers automatically add liquidity to DEXs and deploy automated market maker protocols. In essence, Pumpad is a full-lifecycle issuance platform—not just an IDO provider.

Pumpad introduces two key concepts:

1️⃣ IPOS: Initial Pump Offering Standard refers to a comprehensive IDO service package, including mechanisms and market cap management, allowing projects to manage pre- and post-launch operations with minimal operational overhead.

2️⃣ VGA: Value-Growing Asset Building means that all assets issued on Pumpad follow IPOS rules to prevent rug pulls and unauthorized withdrawals, while also generating commission revenue through this model.

At present, specific details about these two concepts remain limited. Additionally, Pumpad introduces Pump Points to reward loyal and active users, which may later be used for airdrops of Pumpad’s own platform token or priority listing rights.

Specifically, Pumpad has two main business areas:

1️⃣Launchpad: Pumpad supports various issuance models, including oversubscription lotteries, weighted allocations, and first-come-first-served IDOs.

2️⃣ Airdrop: The Airdrop module allows users to claim incentives, and project teams can customize campaigns to target different user types.

As of May 10, Pumpad ranks 19th on the Bitlayer Dapp Leaderboard and leads its category. No other launchpads on Bitlayer appear to have received attention or retweets from official channels, indicating Pumpad’s strong legitimacy. Its first partnered project is $CBD—a meme coin discussed below—forming a powerful alliance between “No.1 Meme + No.1 Launchpad,” potentially creating significant mutual traffic growth.

Official Twitter: https://twitter.com/pumpad_io

Macaron

Macaron is the first native DEX on Bitlayer. It offers users a suite of tools—liquidity farming, staking rewards, trade-to-earn, and airdrops—to enhance yield generation.

With support from Bitlayer’s technology and ecosystem, the Macaron team consistently focuses on product excellence, aiming to make Macaron DEX safer, cheaper, and faster. As a native DEX, Macaron will serve as a trading hub for both Bitlayer-native assets and mainstream BTC assets, offering the following advantages:

1️⃣ Industry-Leading Security: Utilizing multi-sig protocols and other technologies, Macaron ensures round-the-clock fund protection.

2️⃣ Advanced AMM Algorithm: Macaron’s proprietary AMM algorithm enables lightning-fast trades, high liquidity, minimized slippage, and optimized yields.

3️⃣ Liquidity Provider Rewards: Users providing liquidity receive rewards calculated and distributed based on fees collected. These incentives help sustain and improve the trading experience.

4️⃣ Trade-to-Earn: Macaron’s revolutionary trade-to-earn program allocates a portion of governance tokens as rewards to traders.

5️⃣ Low Gas Fees: Thanks to Bitlayer’s superior base-layer performance, Macaron delivers low transaction fees, fast confirmations, and seamless trading.

6️⃣ Seamless User Experience: With advanced AMM algorithms and robust features, Macaron offers users a CEX-like experience, including smooth trading and liquid staking.

Macaron offers a comprehensive incentive program comprising an points system, Macaron NFTs, and native DeFi yields—including trade rewards, LP incentives, and staking bonuses. The points system consists of social and DeFi points, each earned differently and redeemable for mainnet tokens at varying rates. Macaron NFTs are PFP-style collectibles granting future airdrops, governance rights, and other benefits. Native DeFi yields come from trading, staking, or adding liquidity on Macaron. For more information, follow Macaron’s official social media.

As of May 10, Macaron ranks 2nd on the Bitlayer Dapp Leaderboard, behind only the stablecoin bitSmiley. It has gained 49.2k Twitter followers, reflecting strong community interest.

Official Twitter: https://twitter.com/macarondex

Cat Driving Bitcoin ($CBD)

Cat Driving Bitcoin ($CBD) is a native meme token on Bitlayer, featuring cat-and-driving-themed visuals aligned with Bitlayer’s overall branding. According to the team, $CBD aims to disrupt meme economics by building MEME CBD—an ambitious, modern, skyscraper-filled Bitcoin world. $CBD strives to become the largest community-owned asset on Bitlayer, helping position Bitcoin as humanity’s best financial asset. It is already followed by official accounts of Bitlayer and Macaron.

As of May 10, $CBD ranks 3rd on the Bitlayer Dapp Leaderboard—the top meme project. Comparing it to $BONE, which ranked 9th in the meme category and was followed by bitSmiley and Bitlayer, $BONE grew to 12.2k followers and surged tenfold within 24 hours of listing. Given this precedent, $CBD’s potential should not be underestimated.

In terms of tokenomics, unlike $BONE—which allocated most tokens to bitSmiley testnet users—$CBD adopts a broader airdrop model: 70% airdropped, 20% for liquidity, and 10% to the treasury.

Based on current information, $CBD will airdrop to four types of users:

1️⃣ Holders of Bitlayer Helmet NFTs who have completed cross-chain interactions

2️⃣ Holders of BTC-related assets who recently executed BTC transactions

3️⃣ Active participants in community initiatives, such as voting and co-building

4️⃣ Holders of other Bitlayer ecosystem assets

Notably, $CBD airdrops are not conducted directly by the project team but via Pumpad. Among the eligibility criteria, ownership of the Bitlayer Helmet NFT currently offers the clearest participation path. Further airdrop rules will be announced via official social media.

Official Twitter: https://twitter.com/catdrivebitcoin

TrustIn Finance

TrustIn Finance is a permissionless lending protocol native to Bitlayer, powered by a Bitcoin-security-equivalent Layer 2 solution built on BitVM.

Key design elements include:

1️⃣ Floating Interest Rates: Lender and borrower rates are determined by market utilization, optimizing returns while safeguarding pool liquidity.

2️⃣ Risk Isolation: To simplify the protocol and enhance security, TrustIn Finance isolates asset pools by underlying collateral to prevent cascading defaults and mitigate systemic risk.

3️⃣ Reserves: A portion of borrowing interest is allocated as reserves based on a reserve factor, serving as a buffer against potential bad debt.

4️⃣ Early Contributor Incentives: TrustIn Finance aims to grow with all participants and reward contributors. Specific mechanisms will be detailed in future announcements.

TrustIn Finance plans to launch a points-based incentive program soon, where users earn points by depositing or interacting with assets. These points will serve as a key metric for future governance token airdrops, distributed proportionally among point holders. More details are available via TrustIn Finance’s official social channels.

As of May 10, TrustIn Finance ranks 6th on the Bitlayer Dapp Leaderboard, closely trailing Nekoswap, with 38.1k Twitter followers.

Official Twitter: https://twitter.com/TrustIn_Finance

Nekoswap

Nekoswap is the first native decentralized exchange on Bitlayer for runes and tokenized cross-chain assets.

$RNeko will be the first rune-based token launched on Nekoswap. NekoSats promises a fair launch—only 2% of $RNeko is held by the team, with all remaining tokens airdropped and added to liquidity pools. Additionally, Nekoswap plans to explore mapping methods to enable circulation between Layer 1 and Layer 2 rune assets, though alternative approaches may be adopted if technical costs are too high. Token holders will enjoy benefits such as permanent share of trading fee revenues.

Nekoswap is actively under development, without a formal website or documentation yet. The project aims to become a fully community-driven, fair, transparent, and decentralized exchange featuring swap, liquidity pools, farms, launchpad, and rune trading. Future decisions on chain integration, deployment, and development will be made through community input via voting and AMAs. More updates will be shared on official social media.

As of May 10, Nekoswap ranks 4th on the Bitlayer Dapp Leaderboard with 23k Twitter followers.

Official Twitter: https://twitter.com/NekoSwap

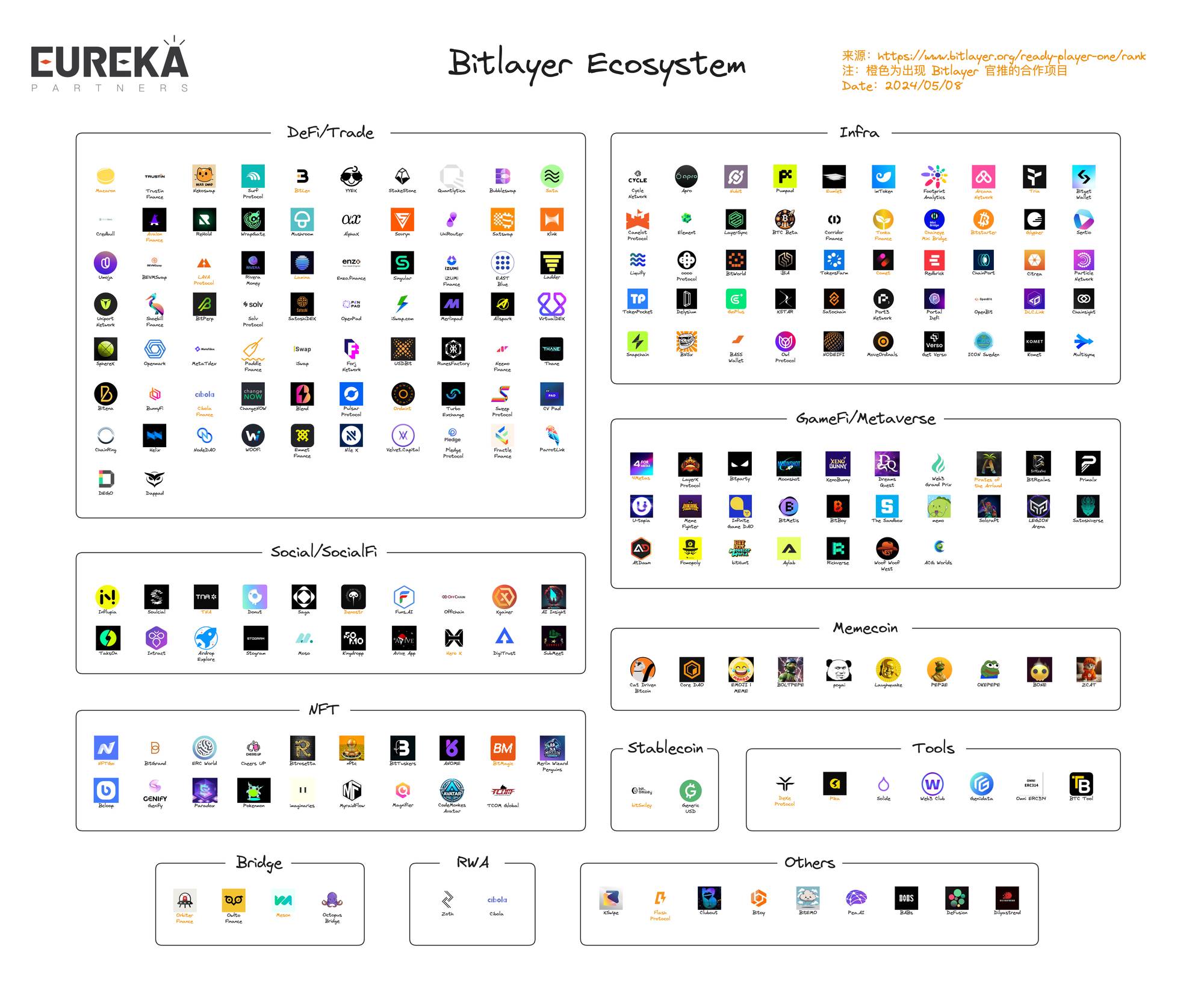

The Ecosystem Puzzle

On March 29, Bitlayer launched its ecosystem incentive program, pledging $50 million to reward early builders and contributors. As of this article’s publication date (May 10), over 280 projects have deployed on Bitlayer.

Clearly, Bitlayer’s ecosystem is rapidly expanding, attracting increasing numbers of projects. This gives Bitlayer a significant edge in the competitive BTC Layer 2 landscape.

Where Is the Endgame for Bitcoin Layer 2?

In the fiercely competitive Bitcoin Layer 2 space, we identify three core architectural approaches: rollup-based (emphasizing Layer 1 verifiability), sidechain-based (emphasizing maturity), and client-side validation (emphasizing native Layer 1 data availability).

The market has yet to crown a winner. However, we believe Bitcoin’s greatest value lies in the security of its Layer 1. Thus, whether a Layer 2 can inherit this security is critical. While client-side validation ensures ledger records are anchored on Layer 1, it inherently imposes trust burdens on users. Rollup-based designs, by contrast, maximize Layer 1 verifiability while using modular architectures to keep user trust assumptions manageable. From this perspective, rollup-based solutions are ultimately poised to outperform the others.

Among rollup-based approaches, Bitlayer stands out for its comprehensive design. By leveraging BitVM, Bitlayer emphasizes Bitcoin’s verifiability and enhances the DLC bridge with fraud proofs to ensure oracle reliability. Although current bridge designs still require some external trust in oracles, its security is nearly equivalent to a native “rollup” bridge.

Moreover, Bitlayer’s ecosystem momentum has peaked under expectations set by the leaderboard token airdrop. A growing number of native projects—including DEXs, permissionless lending protocols, and memes—are joining the ecosystem. To date, Bitlayer has attracted over 280 projects.

At this early stage of the bull market, Eureka Partners maintains an optimistic yet cautious outlook on the overall development of Bitcoin Layer 2. Despite current weak market conditions, we believe that when liquidity improves, market enthusiasm will re-emerge in the Bitcoin ecosystem—including Bitcoin-related assets and Layer 2 platforms. At that point, Bitlayer will undoubtedly be an ecosystem impossible to ignore.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News