Bitlayer is launching a token: a scythe of收割 or the dawn of BTCFi?

TechFlow Selected TechFlow Selected

Bitlayer is launching a token: a scythe of收割 or the dawn of BTCFi?

The issuance of $BTR is not the end of the story, but the starting gun.

Author: Oliver, Mars Finance

When a star project—Bitlayer—touting titles such as "the first BitVM-based Layer 2" and "backed by Wall Street giant Franklin Templeton"—officially announced its upcoming token generation event (TGE) for $BTR, market sentiment turned complex and divided. On one hand, there was anticipation fueled by top-tier capital endorsement and grand technological narratives; on the other, widespread fatigue and skepticism lingered after the ordinals boom had crashed and countless "meme L2s" collapsed in disarray.

This raises a sharp question everyone wants answered: Is Bitlayer launching its token now merely to execute a polished "harvest" while Bitcoin's ecosystem still retains some warmth, or does it genuinely possess the capability and capital to sound the charge for a new bull market in an ecosystem that appears dormant?

To answer this, we must look beyond surface-level noise and dive into its technical core, strategic blueprint, and even the thinking of its co-founder Kevin He—a serial entrepreneur who has weathered multiple market cycles and built ecosystems with over $10 billion in TVL. His perspective may offer crucial clues.

Bitlayer’s Three Aces—Technology, Economic Model, and Execution

Bitlayer is not a reckless speculative venture. Its competitive edge rests on three tightly interlinked strengths: solid technology, a clear economic model, and proven execution capability.

Technological Edge: Pioneering Security Narrative Based on BitVM At its core lies a groundbreaking application of the BitVM paradigm, returning to fundamental security principles. Co-founder Kevin He points out that BitVM is essentially an Optimistic Rollup based on Bitcoin. The elegance lies in the evolving community consensus—shifting from difficult attempts to build complex virtual machines on Bitcoin toward the viable path of directly verifying zero-knowledge proofs (ZK Proofs). This means challengers need only verify a deterministic ZK proof on the Bitcoin mainnet to adjudicate fraud. This shift drastically reduces implementation difficulty and brings two fundamental advantages: It requires no upgrades to the Bitcoin protocol, operating instead on existing technologies like Taproot; simultaneously, through on-chain verification, it firmly anchors Layer 2 security to the Bitcoin mainnet, overcoming the traditional trade-off between security and programmability. As the first team in the industry to explicitly build a bridge and Layer 2 based on BitVM, Bitlayer has formed strategic partnerships with major mining pools such as AntPool and F2Pool, securing support from nearly 40% of Bitcoin's hash power. This ensures that challenge transactions will be prioritized during fraud disputes—an existential advantage unmatched by other teams.

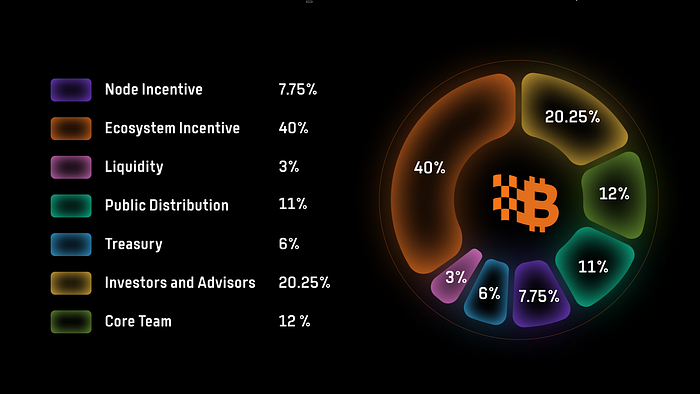

Economic Model Edge: Thoughtfully Designed $BTR Tokenomics This reflects not just strategic intent but also a clear roadmap from "story valuation" to "earnings valuation." The total supply of $BTR is fixed at 1 billion tokens, with its distribution strategy clearly focused on long-term ecosystem development and incentives.

Massive Ecosystem Incentives: As much as 40% of the token supply is allocated to ecosystem incentives. This substantial "war chest" signals Bitlayer’s intention to invest heavily in guiding and nurturing its ecosystem, aiming to attract developers and users in the fiercely competitive L2 landscape.

Clear Token Utility: $BTR serves multiple core functions: staking to secure the network, participating in on-chain governance to shape the protocol’s future, and a critical fee-switch mechanism. This mechanism can eventually direct a portion of protocol revenue toward rewarding stakers or buybacks and burns, directly linking token value to network economic activity.

Execution Edge: Experienced Team and Top-Tier Backing Even the grandest vision requires a capable team to realize it. Kevin He’s track record itself serves as a powerful trust signal: he previously led a team that achieved four million daily transactions and over $10 billion in TVL on the HECO chain. This mature, nearly sixty-member team, backed by elite investors such as Framework Ventures, ABCDE Capital, and Franklin Templeton, forms a solid foundation for turning Bitlayer’s vision into reality.

The Battlefield Behind the Grand Narrative—The Real Temperature of the Bitcoin Ecosystem

Bitlayer’s ambitious goals must be tested on real ground. That battlefield—the Bitcoin ecosystem—is currently in a post-hype “sage mode,” yet far from dead. It presents a complex, multi-layered picture where ice and fire coexist.

As Kevin He observes, there is a notable temperature difference between Eastern and Western perceptions of the ecosystem. The Chinese-speaking community, having set overly high expectations during the ordinals craze, now generally feels pessimistic after the tide receded. Meanwhile, the Western market remains relatively active. He argues that BTC ecosystem vitality cannot be simply measured by Ethereum standards. The uniqueness of the BTC ecosystem lies in the fact that massive financial activities—such as lending and derivatives trading—have long existed off-chain. The real opportunity lies in securely and efficiently migrating these trillions of dollars in off-chain activities onto the blockchain. This is the true frontier of BTCFi, and the current bottleneck is inadequate infrastructure.

Although the热度 of ordinals and runes has cooled, they served as a successful "stress test," leaving behind two valuable legacies: They proved demand with real money, demonstrating the market’s strong desire to issue and trade assets on Bitcoin; at the same time, they exposed the bottlenecks, making it clear to all that Layer 2 solutions are essential for ecosystem growth.

Thus, during this period of market calm, true builders have not paused. A fierce "infrastructure race" is quietly unfolding across multiple fronts.

At the protocol layer, innovation continues to deepen. After a two-year wait, the RGB protocol has finally launched on mainnet, representing the direction of native smart contracts. The BRC 2.0 upgrade aims to bring EVM compatibility to the vast universe of BRC-20 assets. Additionally, native protocols like SAT 20, which have been under development for two years, have now launched their mainnet SatoshiNet.

At the application and infrastructure layer, competition is equally intense. Various Layer 2 solutions are accelerating delivery. Beyond Bitlayer, Fiamma—the Bitcoin bridge built on BitVM 2—has already launched on mainnet, joining the race for trust-minimized cross-chain solutions. Native L2s like Spark, focused on payments and settlements, are also making steady progress.

At the asset and market level, the ecosystem is not entirely frozen. Veteran Bitcoin NFT collections such as NodeMonkes have recently shown strong signs of recovery. In the runes space, while flagship $DOG has underperformed, several other runes have performed well over longer timeframes, and $DOG’s listing on major exchanges like Kraken marks growing recognition of rune assets.

In summary, today’s Bitcoin ecosystem is not lifeless—it has entered a phase of separating truth from illusion and strengthening fundamentals. Bitlayer is entering precisely at this moment when builders are competing fiercely, bringing its unique technical approach and strong capital backing.

Harvest or Dawn? The Answer Lies in Execution Details

We can now more clearly answer the initial question. Is Bitlayer here to "harvest"? That risk is real. BitVM is a cutting-edge and extremely complex technology, facing significant execution risks. Moreover, in a market where competitors like Merlin Chain have already captured massive TVL through aggressive airdrops, competition is exceptionally fierce.

Yet, the possibility of Bitlayer becoming a "new hope" is also coming into sharper focus. This hope is no longer based on vague dreams but built upon a series of solid pillars:

-

Clear Roadmap: It has a well-defined plan progressing from market validation to secure implementation and ultimately to building a high-frequency trading environment.

-

Pragmatic Business Model: It starts with serving institutional and user demand for yield-generating applications, rather than creating artificial demand.

-

Reliable Leadership: Guided by a battle-tested leader, the project gains credibility in execution capability.

-

Security Philosophy Aligned with Bitcoin’s Spirit: Its extreme pursuit of trust minimization is most likely to win the ultimate trust of Bitcoin’s core community and long-term holders.

The launch of $BTR is not the end of the story, but the starting gun. That massive 40% ecosystem incentive fund will serve as fuel for Bitlayer to execute its three-phase roadmap. The final answer does not lie in the token price at TGE, but in whether Bitlayer can reliably deliver on its technical promises and wisely deploy this "war chest" to cultivate a thriving ecosystem capable of migrating Bitcoin’s off-chain value on-chain.

For us observers, Bitlayer’s journey will serve as the best benchmark for determining whether the Bitcoin ecosystem can complete its perilous leap from "digital gold" to "programmable financial infrastructure."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News