Huobi Research Latest Report: Exploring Investment Directions in the AI+Crypto Sector

TechFlow Selected TechFlow Selected

Huobi Research Latest Report: Exploring Investment Directions in the AI+Crypto Sector

This article will provide an in-depth exploration of investment directions in the AI+Crypto sector, with a particular focus on innovations and developments at both the infrastructure and application layers.

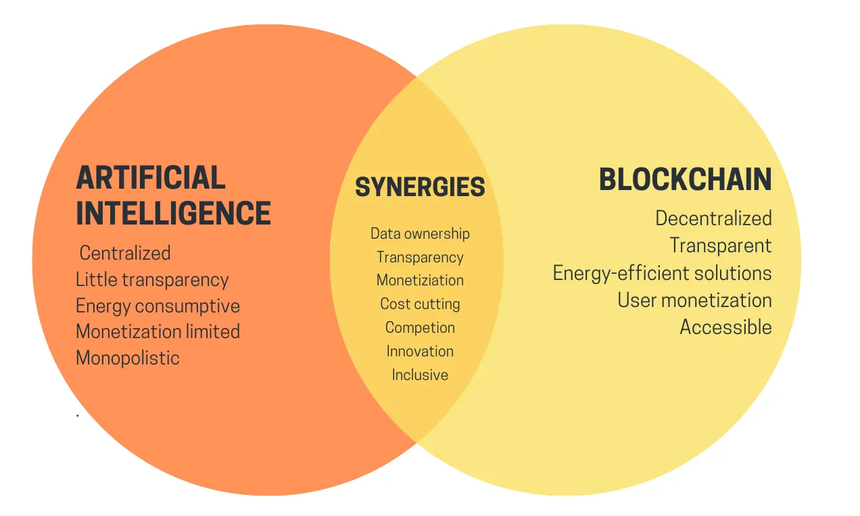

In recent years, with the rapid development of artificial intelligence (AI) and blockchain technology, the AI+Crypto sector has become a focal point for investors. Blockchain, with its characteristics of decentralization, high transparency, low energy consumption, and anti-monopoly, addresses the strong centralization and opaque processing inherent in AI systems. The convergence of these two technologies presents unprecedented opportunities.

According to Vitalik Buterin’s perspective, the integration of AI and blockchain can be categorized into four main types: AI as a participant in an application, AI as an interface to the application, AI as the rules of the application, and AI as the objective of the application. He suggests that AI's role in Crypto should be considered more from the angle of “applications,” including optimization of computing power, algorithms, and data.

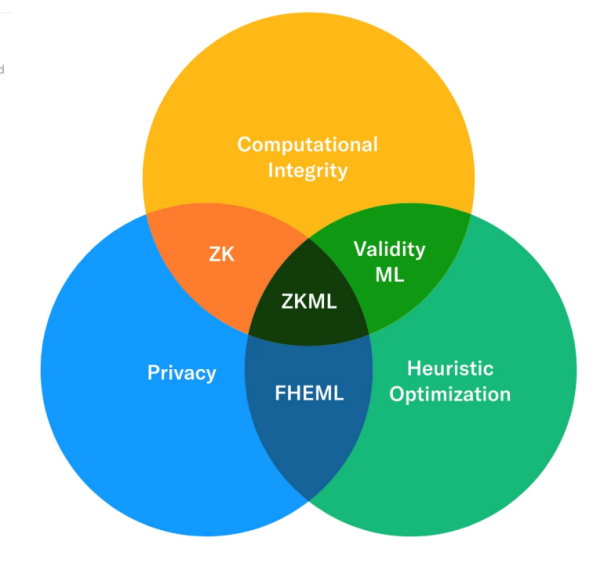

Huobi Research classifies Crypto's involvement with AI by application layers—infrastructure layer, execution layer, and application layer—each presenting unique exploration opportunities. For example, zkML technology combines zero-knowledge proofs and blockchain to provide secure, verifiable, and transparent solutions for AI agent behavior. Additionally, AI shows great potential at the execution level in areas such as data processing, automated dApp development, and on-chain transaction security. At the application level, AI-powered trading bots, predictive analytics tools, and AMM liquidity management play crucial roles within DeFi.

This article will explore investment directions in the AI+Crypto space, focusing on innovations and developments at both infrastructure and application levels, analyzing the prospects and challenges of combining AI with blockchain from mid- to long-term investment strategy perspectives.

This article was written by Huobi Research, currently part of HTX Ventures. HTX Ventures is the global investment arm of Huobi HTX, integrating investment, incubation, and research to identify the world’s most outstanding and promising teams. To date, HTX Ventures has supported over 200 projects across multiple blockchain sectors, some of which have been listed on the Huobi HTX exchange.

Key Directions in the AI Sector

Blockchain stands in stark contrast to artificial intelligence in terms of centralization, transparency, energy consumption, and monopolization. Based on these criteria and his own reflections, Vitalik categorizes applications combining AI and blockchain into four major categories:

-

Artificial Intelligence as a player in a game (AI as a participant)

-

Artificial Intelligence as an interface to the game (AI as an interface)

-

Artificial Intelligence as the rules of the game (AI as governance)

-

Artificial Intelligence as the objective of the game (AI as the goal)

Vitalik primarily views AI's role in Crypto through the lens of "applications." If we consider this from the perspective of productivity versus production relations, Crypto mainly provides new forms of production relations. From this standpoint, three key directions emerge:

– Optimizing computing power: providing distributed and efficient computational resources, reducing single-point failure risks, and enhancing overall computing efficiency.

– Optimizing algorithms: promoting open-source sharing and innovation of algorithms or models.

– Optimizing data: decentralized storage, contribution, usage, and security management of data.

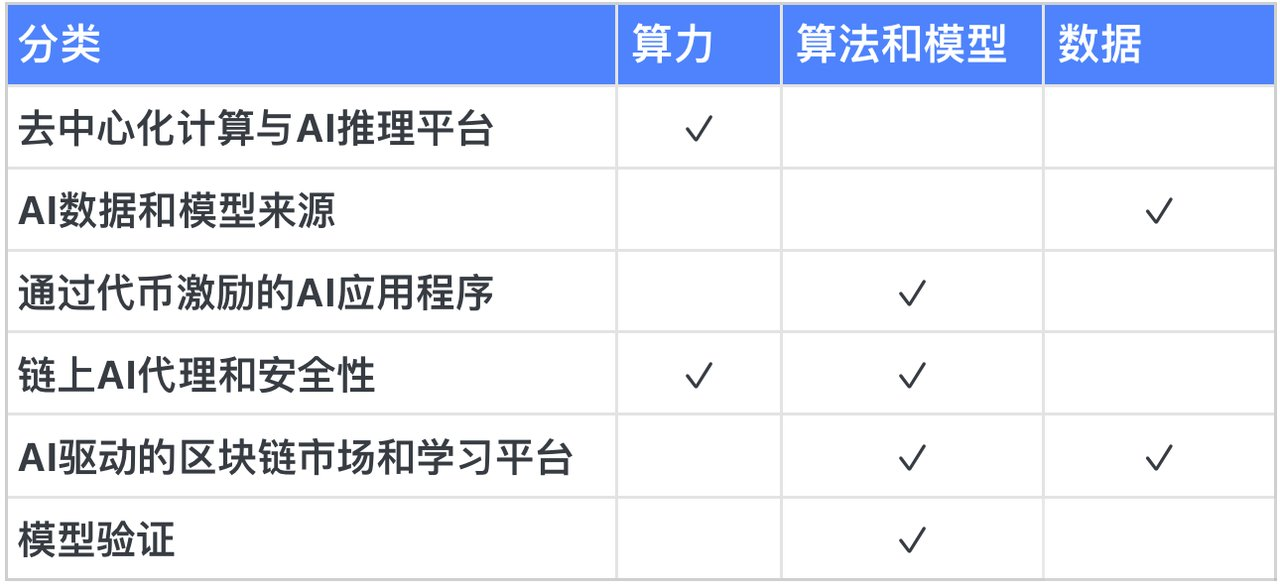

HTX Research believes that AI development can be broadly categorized into infrastructure, execution, and application layers based on general architecture. Accordingly, AI+Web3 projects can also be explored along these three dimensions. At the infrastructure layer, focus includes model training, data, decentralized computing power, hardware, and particularly the integration of zk techniques with machine learning (ML). At the execution layer, key areas include data processing and transmission, AI agents, zkML, and FHE (fully homomorphic encryption). At the application layer, primary focuses are AI+DeFi, AI+GameFi, metaverse, AIGC, memes, and blockchain-level services such as RAAS (Robotics as a Service), oracles, coprocessors, and UBI (Universal Basic Income).

Projects at the infrastructure and application levels are developing rapidly, including Io.net at the computing layer, Flock at the foundational model layer, ZeroGravity as blockchain infrastructure, Myshell for AI agents, and 0x Scope at the application layer.

The following directions warrant focused exploration:

1. zkML Direction

zkML technology integrates zero-knowledge proofs with blockchain to offer a secure, verifiable, and transparent solution for monitoring and constraining AI agent behavior. For instance, Modulus Labs uses zkML to prove to stakeholders that their AI has executed specific tasks while protecting personal privacy and commercial confidentiality.

As an intermediary between AI and blockchain, zkML proposes a framework to address privacy concerns related to AI models and inputs while ensuring verifiability of inference processes. It introduces novel methods—verifying private data using public models, or verifying private models using public data. By integrating machine learning capabilities, smart contracts gain greater autonomy and dynamism, enabling operations based on real-time on-chain data rather than just static rules. This innovation makes smart contracts more flexible and adaptable to diverse, even unforeseen, use cases.

Overview of Representative zkML Projects

The first table below summarizes promising zkML projects. The second image illustrates additional zkML initiatives.

2. Data Processing Direction

This primarily refers to breakthroughs in AI at the execution layer, especially those targeting blockchain data transmission and development (Dev) layers. Specific analyses are as follows:

a. AI and On-Chain Data Analytics

This direction involves leveraging AI technologies, particularly large language models (LLMs) and deep learning algorithms, to deeply mine on-chain data and extract richer insights. For example, Web3 Analytics applies AI to analyze on-chain data, revealing market trends and user behaviors, helping users understand on-chain transactions and market dynamics.

b. AI and Automated dApp Development

This area focuses on DevOps infrastructure projects. AI-driven automation tools can onboard more developers, thereby enriching the ecosystem. Some AI-powered development tools help developers write smart contracts faster and automatically correct errors, while others enable drag-and-drop dApp programming.

c. AI and On-Chain Transaction Security

This primarily involves deploying AI agents on blockchains to enhance the security and trustworthiness of AI applications. These AI agents can autonomously perform tasks such as transactions, data analysis, and decision-making. Deployment on blockchain ensures their operations are transparent, traceable, and tamper-resistant, improving system-wide security. AI can also detect and defend against malicious attacks and data breaches through real-time monitoring and intelligent analysis, safeguarding transaction integrity and data security.

• Project Example:

SeQure is a security platform that leverages AI for real-time monitoring and analysis, promptly detecting and defending against various malicious attacks and data leaks, ensuring stability and security of on-chain transactions.

3. AI+DeFi Direction

The most significant integration of AI at the application layer lies in AI+DeFi. Key directions to watch include:

1. AI-Powered Trading Bots

These bots execute trades quickly and accurately, analyzing market data, news sentiment, and price movements to make instantaneous trading decisions—often outperforming human traders.

2. Predictive Analytics

While predicting cryptocurrency market volatility remains challenging, AI-driven analytical tools are increasingly becoming vital, offering reliable forecasts of market trends and potential price movements.

3. AMM Liquidity Management

For example, when adjusting Uniswap V3’s liquidity ranges, integrating AI enables protocols to intelligently optimize liquidity placement, thereby enhancing the efficiency and profitability of automated market makers (AMMs).

4. Liquidation Protection and Debt Position Management

By combining on-chain and off-chain data, liquidation protection strategies can be implemented more intelligently, ensuring debt positions remain protected during market fluctuations.

5. Complex DeFi Structured Product Design

When designing vault mechanisms, financial AI models can replace fixed strategies. Such strategies may involve AI-managed trading, lending, or options, increasing product intelligence and flexibility.

4. AI+GameFi Direction

AI applications in GameFi projects primarily aim to enrich gaming experiences and expand innovation possibilities. Key directions include:

1. Game Strategy Optimization:

AI can learn players’ habits and strategies, dynamically adjusting game difficulty and mechanics to deliver personalized and challenging experiences. Through deep learning and reinforcement learning, AI can evolve autonomously, better adapting to player needs and preferences.

2. In-Game Asset Utilization and Management:

AI helps players manage and trade virtual assets more effectively. Using smart contracts and automated trading strategies, players can maximize asset utilization—automating buying, selling, leasing, and borrowing of in-game assets to optimize returns.

3. Enhanced Game Interaction:

AI can create smarter, more responsive non-player characters (NPCs). Leveraging natural language processing (NLP) and machine learning (ML), NPCs can interact with players in a more natural and fluid manner, significantly improving immersion and user satisfaction.

Potential Investment Strategies Across Time Horizons

– Short-term: Focus on the earliest落地 domains of AI in Crypto, such as conceptual AI applications and meme coins. Rationale: The mainstream AI community will continue generating new hotspots throughout the year. Each upgrade from major Web2 companies like NVIDIA or OpenAI ignites renewed interest in the AI sector, drawing in fresh capital and driving emotional momentum in the market.

– Mid-term: The integration of AI Agents with Intents and smart contracts will be a highlight. Once successful, AI Agents could extend smart contract capabilities, forming a new blockchain paradigm of ledger + contract + AI, surpassing Ethereum’s original narrative of ledger + contract.

– AI Agent is a niche direction endorsed by Vitalik. An AI Agent is an autonomous AI entity capable of perceiving its environment, processing information, making decisions, executing actions, and altering its surroundings. Currently at the forefront of AI research, AI Agents represent one of the closest paths to mass adoption at the application layer.

– From a storytelling perspective: AI Agent is the sexy, captivating young woman; GPU cloud computing power is the steady, mature middle-aged entrepreneur; and AI large models integrated with DA layers are the disheveled, brilliant scientist.

– Long-term: Despite skepticism from Web2 AI leaders toward Crypto-based AI efforts, the integration of AI with zkML technology will ultimately reshape the Crypto landscape.

References

- Twitter: https://twitter.com/FinanceYF5/status/1772434625387717055

- Web3 Caff: https://twitter.com/Web3Caff_Res

- Twitter Vitalik: https://twitter.com/VitalikButerin

Appendix:

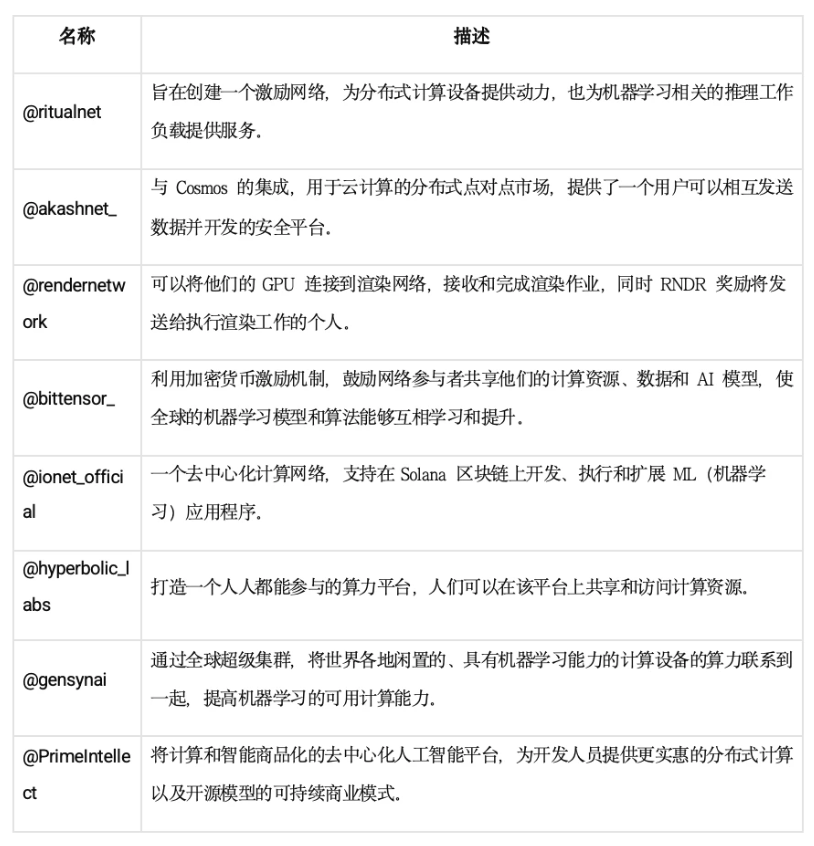

List of Decentralized Computing and AI Inference Platforms

These platforms leverage crypto incentives to share and utilize idle computing resources globally.

List of AI Data and Model Source Projects

These projects emphasize data authenticity, transparency, and traceability, using crypto-economic models to incentivize data contributions (for end-users) and model development (for developers and enterprises).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News