Narrative Upgrade: The New Hype Focus

TechFlow Selected TechFlow Selected

Narrative Upgrade: The New Hype Focus

The narrative upgrade track is an emerging concept that goes beyond individual project transformations, encompassing a much broader scope.

Author: Frontier Lab

Introduction

Since 2024, the cryptocurrency market has entered a bull market phase, with investment opportunities continuously emerging. Historical data shows that the crypto market often exhibits alternating rallies—typically, BTC leads the upward trend for the entire industry before other tokens follow.

However, unlike previous cycles, most altcoins have performed relatively weakly in this bull run.

Despite BTC’s year-to-date gain of 70.86% in 2024, the majority of altcoins failed to outperform BTC, with some even declining. Taking leading projects from major sectors as examples:

-

ETH (leader in public chains): +55.65% YTD in 2024;

-

ARB (leader in ETH-L2 sector): -37.81% YTD in 2024;

-

LDO (leader in LSD sector): -34.84% YTD in 2024;

-

STX (leader in BTC-L2 sector): +30.46% YTD in 2024;

This rare phenomenon can be explained from both macroeconomic and cryptocurrency-specific perspectives:

-

Macroeconomic perspective: The Federal Reserve has maintained a high interest rate environment at 5.25%, creating uncertainty around risk capital returns, resulting in fewer new investors compared to previous bull markets.

-

Cryptocurrency industry perspective: A significant increase in supply, with consistently high monthly token unlocks, has made investors cautious.

Although the overall cryptocurrency market has been underwhelming, there are notable bright spots. For instance, meme coins and AI-related tokens have outperformed Bitcoin this year, drawing significant investor attention. Additionally, certain tokens focused on "narrative upgrades" in crypto assets have been largely overlooked by most investors—but these narrative upgrade concept tokens could become new focal points for market speculation this year.

Definition of the Narrative Upgrade Sector

The narrative upgrade sector is an emerging concept that extends beyond single-project transformations to encompass a broader scope.

At its core, this concept involves comprehensive project upgrades and reforms that revitalize a project and restore its competitiveness. Specifically, narrative upgrades can be achieved through changes in storytelling, adjustments to fundamental logic, business model enhancements, launch of innovative products, token mechanism redesigns, mergers with other projects, or even full brand rebranding.

In short, any project that introduces transformative initiatives to reshape its identity can be considered part of the narrative upgrade sector. This concept injects new vitality into project development and opens new pathways for industry advancement. As such, the narrative upgrade sector will likely become one of the key directions for future project evolution and play a significant role going forward.

Advantages of the Narrative Upgrade Sector

Established user base: Most projects within the narrative upgrade sector have typically experienced at least one bull and bear market cycle, giving them stable communities and user groups. In contrast, new projects usually require time to build their own communities and cultivate loyal users. The existing consensus around narrative-upgraded projects makes it easier for markets to accept their new transformations.

Higher market trust: Teams behind narrative upgrade projects tend to be more stable. Having operated over long periods, they possess deeper understanding of user preferences and market dynamics. Compared to new projects, established teams are more trusted by the market and users. New teams need time to establish credibility and recognition.

Stronger resource integration: After prolonged operation in the crypto market, these projects accumulate various resources—including capital backing, relationships with market-making teams, and access to advanced operational strategies—advantages that new projects cannot easily match.

Greater experience: Beyond operational strengths, success in the crypto market requires deep understanding of market dynamics. Experienced teams are better positioned to seize opportunities at different market timing points.

While the idea of “chasing new, not old” is widely circulated in the crypto space, many legacy projects continue to thrive precisely because they possess unique advantages developed over time—especially those teams that have weathered both bull and bear markets. Their ongoing commitment to innovation provides momentum for token price appreciation.

Classic Cases

Vanar Chain

Before narrative upgrade

Vanar Chain was originally Terra Virtua, founded by Gary Bracey and Jawad Ashraf. Terra Virtua launched its mainnet in 2018, initially aiming to build a metaverse-based public chain project—a subscription-based VR (virtual reality) and AR (augmented reality) content platform supporting cryptocurrency payments. It belonged to the public chain and metaverse category.

After narrative upgrade

First narrative upgrade: In 2020, Terra Virtua executed its first narrative upgrade. With the NFT issuance boom sweeping the crypto market, Terra Virtua adapted quickly, adding an NFT service platform on top of its metaverse business, transforming itself into a digital collectibles (NFT) platform.

Second narrative upgrade: In 2023, Terra Virtua underwent a second upgrade—renaming itself Vanar Chain and replacing its original token TVK with VANRY. Users holding TVK could swap their tokens 1:1 for the new VANRY token. This upgrade went beyond just name and token changes—it also evolved the core business. Building on its metaverse and NFT foundation, Vanar introduced GameFi elements, allowing users to interact in immersive metaverse lounges, unlock games, and earn rewards like Virtua XP and free collectibles.

Third narrative upgrade: In 2024, Vanar Chain completed its third narrative upgrade by announcing a partnership with AI giant NVIDIA. It integrated multiple AI solutions into its product suite, including AI-powered IP tracking for brands, AI analytics for creators, AI-enhanced authentication, and AI-assisted DApp creation and review. By incorporating NVIDIA technology into the Vanar platform, developers gained tools to build advanced AI solutions, adding a strong AI narrative to Vanar’s portfolio.

In summary, through three narrative upgrades, Vanar Chain has transformed from an initial metaverse public chain into a multi-narrative project spanning metaverse, NFT, GameFi, and AI. Vanar Chain has effectively stayed relevant across every major crypto narrative wave, keeping itself in the spotlight of market discussions.

Narrative Upgrade Effect

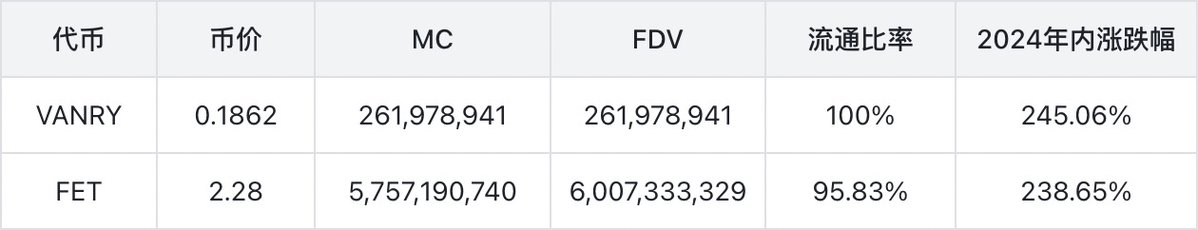

Although Vanar Chain spans metaverse, NFT, GameFi, AI, and public chain sectors, it currently emphasizes AI and public chain narratives. Therefore, we select FET, another project bridging AI and public chain narratives, for comparison.

Beam

Before narrative upgrade

Beam originated as Axie 420, founded in July 2021 by Marco van den Heuvel, Tommy Quite, and Mark Borsten. Its initial goal was to enable players from low-income countries to participate in Axie Infinity. In September 2021, it rebranded to Merit Circle, expanding its focus beyond Axie Infinity to include other popular games and metaverse platforms. Merit Circle operated as a game guild similar to YGG, establishing scholarship programs and a SubDAO model—essentially functioning as a large-scale gold-farming workshop where it funded players and took a revenue share. It belonged to the guild segment within the GameFi sector.

After narrative upgrade

In 2022, the crypto market entered a bear phase, causing sharp declines in token prices and GameFi revenues. If Merit Circle had stuck to its original scholarship and SubDAO models, it would not only have been outperformed by YGG across operations but also risked collapse during the crypto winter. Thus, in 2022, Merit Circle decisively initiated a transformation.

Starting in 2022, Merit Circle began restructuring its DAO framework and repositioning itself as a comprehensive gaming DAO. It divided the DAO into several divisions: Investment, Studio, Gaming, and Infrastructure (the Beam gaming chain built on Avalanche). The original MC token was swapped 1:100 for the new BEAM token.

-

Investment: Funded by $100 million in USDC raised on Copper, an investment committee formed under MIP-2—comprising Flow Ventures LP, Sergei Chan, CitizenX, and Maven11—oversees investments. Portfolio holdings listed on the treasury include USDC, blue-chip cryptocurrencies, NFT assets, and equity/stake in blockchain gaming projects. This division now serves as Merit Circle's primary revenue source.

-

Studio: Acts as the creative engine of the DAO ecosystem, collaborating with both internal and external non-web3 projects. Key components include: Grants (research and development grants), Edenhorde NFT Collection (art by illustrator Andy Ristaino, lore written by author/historian Celia Blythe), and Merit Circle Tactile—a community-focused NFT project offering 650 physical merchandise boxes containing wearable items (T-shirts, hoodies, scarves, hats). NFT holders receive these boxes via two-stage distribution targeting proposal creators, contributors, and Edenhorde NFT holders.

-

Gaming: Promotes partner games to attract users; offers educational tutorials on popular blockchain games; provides early access to games for the Merit Circle community, rewarding players with NFTs, raffles, and other incentives upon task completion.

-

Infrastructure: The flagship product is the Beam gaming chain built on Avalanche. Per MIP-28, the original MC token was converted to BEAM at a 1:100 ratio. While the Merit Circle name remains associated with Beam network and BEAM branding, BEAM will serve as the gas and staking token for the Beam chain. Games are already being launched on the Beam chain.

In conclusion, Merit Circle has evolved from a simple game guild into a comprehensive gaming industry platform integrating primary market investments, co-development, game distribution channels, and infrastructure development. This strategic pivot has significantly broadened its business scope and enhanced profitability.

Narrative Upgrade Effect

Now that Merit Circle has become a full-stack gaming industry chain, we compare it with XAI, another gaming-focused chain.

Fantom

Before narrative upgrade

Founded in December 2019, Fantom positioned itself as a public chain. At the time, rising congestion and high gas fees on Ethereum created demand for scalable alternatives. Fantom aimed to address scalability and transaction limitations by offering a fast, low-cost solution for dApp developers and DeFi users.

After narrative upgrade

On May 18, 2024, members of the Fantom community proposed a series of governance proposals regarding the Sonic Network—marketed as the “Sonic Upgrade.”

The Sonic Upgrade includes: launching a new L1 chain called Sonic Network, which uses parallel EVM architecture to dramatically increase TPS from 30 to over 2,000, greatly enhancing developer and user experience with seamless interactions; reducing node storage requirements by over 90%, accelerating block synchronization; enabling cross-chain bridging between the new chain and Ethereum L2s to attract more liquidity; and issuing a new native token S, allowing users to swap FTM for S at a 1:1 ratio.

In summary, while Fantom did not change its core narrative, this upgrade represents a qualitative leap in performance and positions it firmly within the parallel EVM赛道.

Comparison with peer projects

Post-upgrade, Fantom becomes a parallel EVM public chain. We compare it with SEI, another parallel EVM chain:

Other Projects

Nervos Network

As a public chain project, Nervos Network was initially designed to solve scalability constraints faced by traditional networks like Bitcoin and Ethereum. Nervos is a layer-1 protocol using Proof-of-Work (PoW) consensus and supporting smart contract development, along with a suite of layer-2 scaling solutions for high-volume use cases. Its native token (CKByte or CKB) allows users and developers to claim proportional storage space on the Nervos blockchain based on holdings.

On February 13, 2024, Nervos Network announced RGB++, marking a strategic shift—from being a general-purpose L1 like Bitcoin and Ethereum to focusing exclusively on Bitcoin layer-2 expansion, leveraging its strengths to specialize in Bitcoin L2 scaling.

CKB delivered an outstanding performance in 2024, surging from $0.00397 at the beginning of the year to a peak of $0.0379—an increase of over 900%.

Arweave

Arweave began as a decentralized data storage protocol, optimized for permanent, long-term storage through its unique proof-of-access mechanism and token economic model. Since February 2024, Arweave launched Arweave AO, fundamentally shifting its narrative from decentralized storage to that of a public chain. Arweave AO offers low fees, high-speed computation, permanent data storage, and highly favorable conditions for contract deployment and state management, giving Arweave a strong competitive edge among public chains.

AR delivered a stellar performance in 2024, rising from $9.64 at the start of the year to a high of $49.55—a 414% gain.

Sector Risks

Projects undergoing narrative upgrades often do so in response to stagnation or loss of competitiveness in their original sectors. While such upgrades may temporarily re-engage market attention, they also carry long-term risks.

-

Narrative upgrade projects may appear improved only superficially without truly resolving underlying issues. It remains unclear whether teams have demonstrated capability in overcoming past challenges. Thus, these projects face substantial developmental risks.

-

Even after transformation and gaining some market attention, projects may fail to meet expectations, facing continued rejection or indifference from the market.

Therefore, when conducting research and investment analysis in the narrative upgrade sector, investors must think deeply and conduct comprehensive evaluations—to ensure that new changes genuinely address prior problems and enable sustainable growth. It's also crucial to recognize that market acceptance of new narratives may remain limited, necessitating thorough due diligence.

Conclusion

Narrative upgrade sector projects refer to those that rapidly gain market attention and capital support by changing original narratives, project logic, or business models; launching revolutionary products; reforming tokenomics; merging with peer projects; or possibly renaming themselves. These projects typically benefit from broad consensus, stable teams, rich resources, and extensive experience—enabling rapid price appreciation, enhanced brand visibility, and a return to competitive relevance.

However, such projects often emerge from periods of failure or obscurity, leading to market skepticism about their future. Investors may doubt their potential due to past underperformance, questioning whether they can sustain progress and overcome previous challenges.

As a result, narrative upgrade projects are easily overlooked. Nevertheless, their potential remains significant—revamped legacy projects often deliver surprising token price performances, breathing new life into the market. Hence, these projects deserve greater market attention and are poised to see more entries in 2024.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News