Interpreting the New AI Agent Contender Talus: How Does the "Old and New Combination" Create Differentiation?

TechFlow Selected TechFlow Selected

Interpreting the New AI Agent Contender Talus: How Does the "Old and New Combination" Create Differentiation?

Talus is an AI public blockchain platform based on the Move language.

By 1912212.eth, Foresight News

The convergence of AI and crypto needs no introduction—numerous projects have emerged across niches such as computing, data analysis, and agents, with many achieving notable performance in secondary markets. Today, however, our spotlight is on Talus, an early mover in the AI agent space. At the end of February this year, Talus Network raised $3 million in funding led by Polychain Capital, with participation from dao5 and others.

Recently, a co-founder of Delphi Labs stated that AI agents will drive the next wave of cryptocurrency adoption. As these agents grow increasingly sophisticated, users will rely on them more and more to manage their financial lives—a shift comparable to the historical transition from physical banks to online banking.

As Talus releases its official whitepaper, Foresight News unpacks what you need to know about this new player in the AI agent arena.

What Is an AI Agent?

With so many buzzword-driven products flooding the market, how can we identify genuine AI agents? In short, they are AI-powered systems capable of autonomously performing tasks to assist users. Key characteristics include automation, environmental perception, decision-making, learning and adaptation, and interactivity.

Of particular note is "proactiveness"—the most critical trait and core logic behind understanding AI agents. In contrast, blockchain smart contracts can only execute passively, lacking proactive capabilities.

As one co-founder of Space and Time aptly put it: cryptocurrency is like cash, blockchains are like cash registers, DApps resemble POS machines, and AI agents act as cashiers.

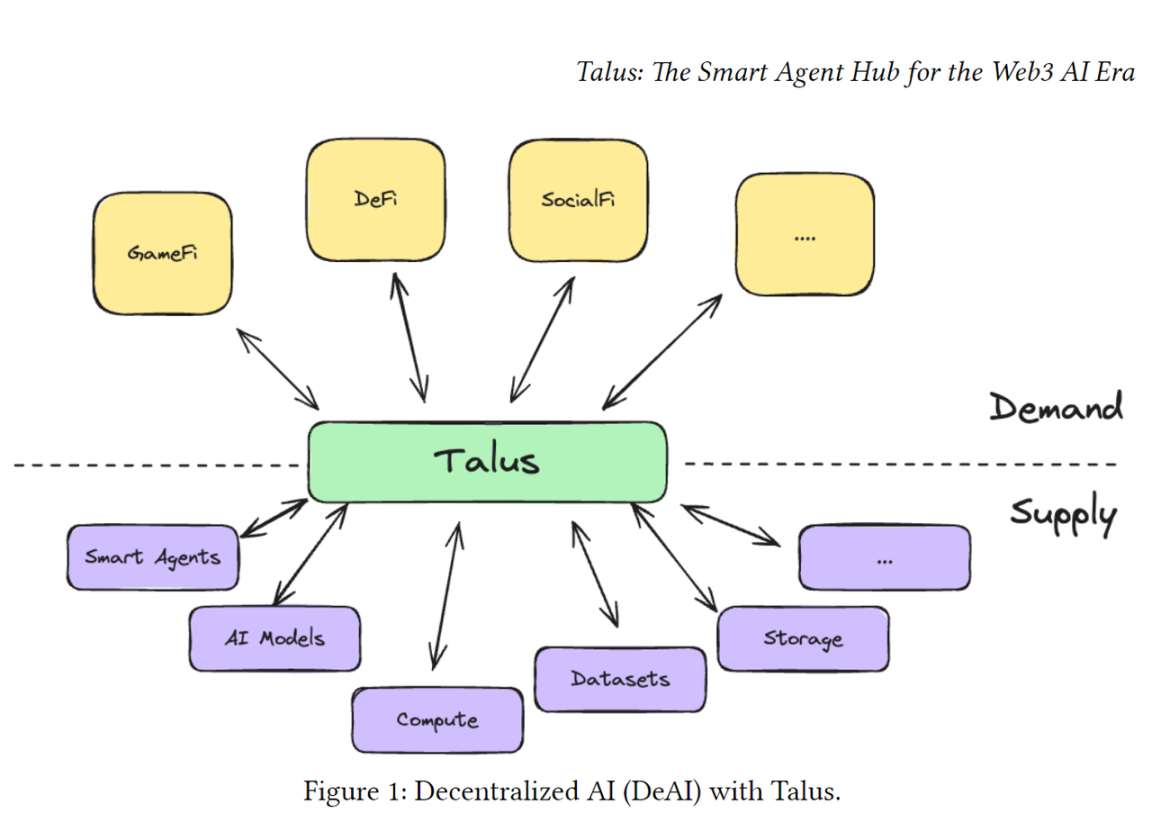

Talus: An AI Public Chain Platform Built on Move

Talus is a public blockchain platform for AI built using the Move programming language. Designed for high performance and optimized specifically for AI use cases, it enables AI agents to interact and transact within the system. Participants in the Talus ecosystem can build a new economy of AI applications based on a universal protocol for accessible resources.

Talus’ AI agents offer functional support and optimization across multiple domains. For instance, they can provide wallet analytics tools and real-time transaction monitoring to enhance asset management experiences. In DeFi, they can optimize liquidity management, automate on-chain portfolio adjustments, improve capital efficiency and returns, and support automated asset management and governance decisions in DAOs.

These examples represent just a fraction of potential applications. Whether you're an everyday user or researcher, developer or project manager, Talus' AI agents have something to offer.

A Hybrid Architecture: Combining the Best of Old and New

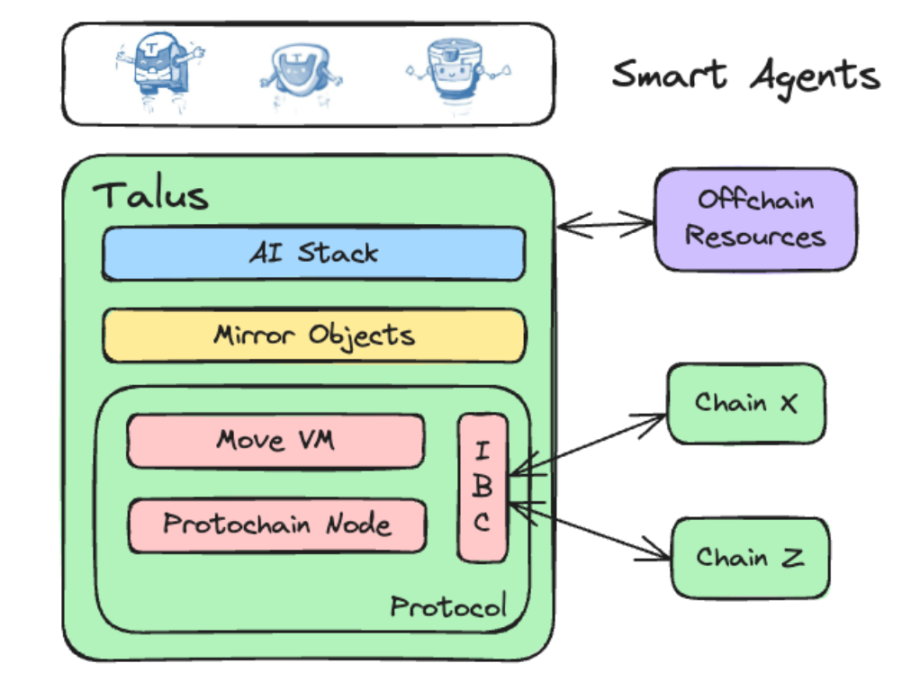

Talus’ layered architecture combines two approaches: selecting superior components from existing technologies and developing innovative solutions from scratch.

At the base layer lies the protocol stack. Protochain, Talus’ PoS node, is powered by Cosmos SDK and CometBFT. Cosmos SDK has proven flexible, robust, and high-performing, and together with CometBFT delivers secure and scalable infrastructure. Additionally, Talus strategically adopts Sui Move as its smart contract language, leveraging Move’s strengths in performance, security, and programmability—including strong guarantees for on-chain logic safety, object modeling, and high throughput.

Talus also highlights benefits from using Cosmos SDK, particularly IBC (Inter-Blockchain Communication), which enhances AI agent functionality across multiple dimensions: interoperability, cross-chain atomicity, scalability through sharding, and improved security and isolation.

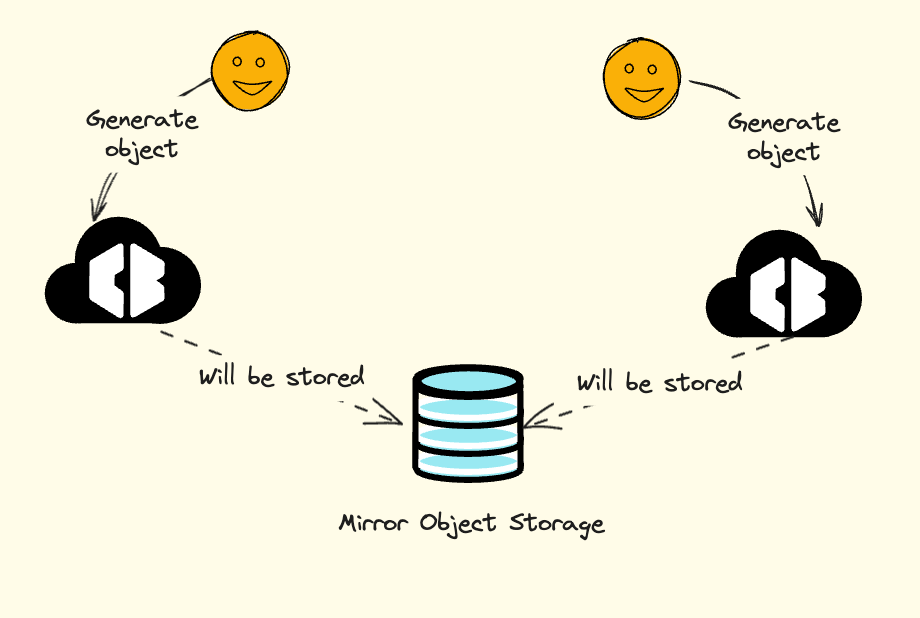

Above the protocol layer sits Mirror Objects. While the name may sound abstract, the concept is intuitive: they are off-chain representations of on-chain entities—like reflections in a mirror.

Mirror Objects serve as a bridge between resource-intensive AI operations and the on-chain environment, since direct AI computation on-chain is infeasible due to computational demands. Core functions of Mirror Objects include unique representation of resources, tradability of off-chain assets, ownership attribution, and verifiability.

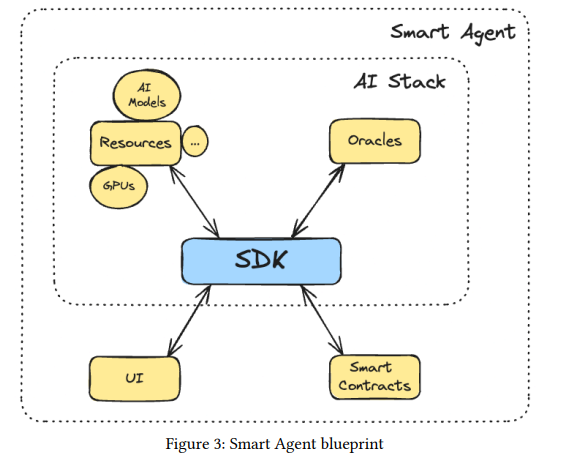

On top of Mirror Objects lies the AI Stack, used primarily to create intelligent agents via the Talus SDK. This stack integrates off-chain components, resources, and oracles. The Talus SDK comprises multiple libraries, data models, and ready-to-use smart contracts for building intelligent agents. The Talus AI Stack allows developers seamless access to essential off-chain resources.

At the top of the entire architecture are the intelligent agents themselves—designed to perform specific tasks or make decisions on behalf of users. Equipped with AI capabilities, they can perceive their environment, analyze information, and take appropriate actions to achieve predefined goals.

Token Utility

Talus will launch its native token, TAI, which serves several key functions: powering AI agent usage, purchasing and trading resources, staking for network security and consensus, and governance participation. Resource providers—those contributing computing power, data, or models—earn TAI tokens. For developers, TAI simplifies access to these resources, enabling faster project scaling.

While TAI's utility aligns closely with other AI-related tokens, specific details will be revealed by the team in due course.

Concrete Use Cases

Portfolio Management

Talus enables intelligent portfolio management at significantly lower cost, effort, and trust requirements than human management. By guiding an agent on your investment goals and risk tolerance, it can calculate optimal decisions to rebalance portfolios, diversify holdings, and uncover new opportunities.

Smart Oracles

Agents can function as smart oracles, transmitting off-chain price data—especially valuable for illiquid or hard-to-price assets like watches, collectible cards, or real estate. On-chain agents can automatically analyze markets to determine valuations in a decentralized, trustless manner.

Natural Language User Experience

AI models leverage natural language processing to understand user intent and intelligently execute actions based on context, market analysis, user goals, and risk preferences. Tasks range from simple requests like “Buy $100 worth of Bitcoin this week at the best price” to complex ones such as “Rebalance my portfolio to capitalize on the meme coin bull run.”

AI-Enhanced Insurance

Intelligent agents can automate numerous insurance operations, including managing policies in open smart contracts, collecting premiums, disbursing payments from decentralized treasuries, assessing claims, detecting fraud, and performing actuarial calculations.

Smart Wallets

Agents can be embedded directly into wallets, making them more powerful and autonomous. These wallets can learn user behavior to automate payment scheduling, initiate or request payments as needed, proactively monitor for fraud, reject scam transactions, and flag suspicious activity.

Decentralized Credit Scoring

Agents with access to on-chain data can fairly and accurately assess creditworthiness. They can dynamically adjust interest rates and repayment schedules based on changing balances and financial behaviors, resulting in a transparent, verifiable credit system.

On-Chain Fund Management

Agent-based fund managers can drastically reduce management fees. They can allocate assets, monitor markets, conduct sentiment analysis, and read whitepapers and reports. Agents can even be trained as domain experts in specific industries, markets, or projects—democratizing access to advanced investment strategies.

MEV Optimization

Smart agents embedded in order books and liquidity pools can reshape how transactions are ordered and processed. AI can predict future block values far more effectively than today’s simulation-based methods, allowing MEV strategies to maximize ecosystem-wide value while minimizing exploitation and negative impacts on individuals.

Transaction Optimization

Agents can automatically route transactions in a far more dynamic way than current bots. Whether owned by users or DEXs, they can analyze swap paths in real time to minimize fees and maximize returns—for both individuals and the broader ecosystem.

Content Moderation

Agents can handle tedious content moderation tasks on decentralized social networks. They can detect AI-generated spam, scams, and abusive content in real time. The integration of on-chain posts, accounts, and moderation creates a fairer, more open internet.

Continuous Auditing

Auditing today is inefficient, time-consuming, expensive, and prone to human error. AI agents trained in software principles and project objectives can continuously monitor smart contracts and codebases to detect vulnerabilities and unintended changes. They can even respond to newly discovered exploits in other projects to preemptively identify and patch weaknesses.

Game Testing

Game testing is a crucial part of game development, where players help identify bugs through gameplay. This process can be automated—accelerated and made cheaper—using AI agent players. These agents can be customized to simulate various skill levels, language proficiencies, and incentives, ultimately leading to better games.

Conclusion

In the fiercely competitive AI landscape, how will Talus differentiate itself and stand out? Ecosystem development, community engagement, and technical innovation are all pivotal areas. The timing and scale of incentive programs, partnerships, and strategic expansions will ultimately shape Talus’ influence and success.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News