EigenLayer welcomes mysterious rival: Lido co-founder and Paradigm secretly back restaking project Symbiotic

TechFlow Selected TechFlow Selected

EigenLayer welcomes mysterious rival: Lido co-founder and Paradigm secretly back restaking project Symbiotic

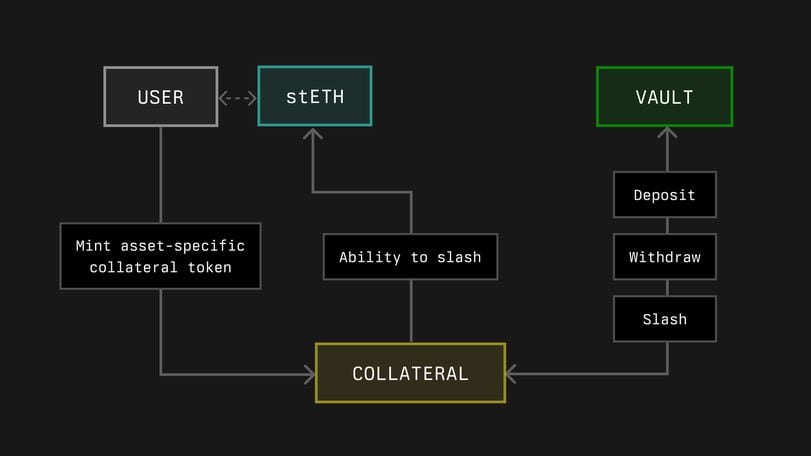

Users can deposit any asset based on the Ethereum ERC-20 token standard into Symbiotic.

By Sam Kessler, CoinDesk

Translation: Felix, PANews

Key Takeaways:

-

Lido’s co-founders — behind the dominant liquid staking protocol — along with venture firm Paradigm, are secretly backing a new company called Symbiotic, which aims to compete in the fast-growing “restaking” sector, according to知情人士.

-

The emergence of a well-funded restaking project could signal an upcoming battle set to redefine the DeFi landscape.

Co-founders of Lido, Ethereum’s largest liquid staking protocol, are secretly funding a competitor to EigenLayer. EigenLayer, a popular restaking protocol, has rapidly risen this year to become a powerful force in DeFi.

Symbiotic, as the project is known, has support not only from Lido co-founders Konstantin Lomashuk and Vasiliy Shapovalov via their venture fund Cyber Fund, but also from Paradigm — one of Lido’s key investors — according to several知情人士.

Internal Symbiotic documents obtained by CoinDesk show that the platform will allow users to “restake” popular assets like Lido’s stETH that are incompatible with EigenLayer natively. Developed by the team behind the Stakemind staking service, Symbiotic will be “a permissionless restaking protocol providing decentralized networks with flexible mechanisms to coordinate node operators and economic security providers.”

Marked “draft” and “confidential,” the documents have already prompted discussions among several emerging restaking ecosystem teams about integrating with Symbiotic — including for active validation services and liquid restaking offerings based on EigenLayer.

“The New Kid in Town”

Lido made waves in DeFi years ago by creating a protocol that allowed users to stake cryptocurrency on Ethereum (essentially locking it up), while still receiving a tradable token, “stETH.” The project proved immensely popular and is now the largest DeFi protocol on Ethereum, holding $27 billion in deposits. Its dominance has become so significant that some participants worry about operational risks stemming from Lido’s outsized influence.

Recently, however, Lido has struggled with declining market share as users shift assets to EigenLayer. EigenLayer allows users to restake Ethereum’s native ETH token to help secure other networks. It has become one of crypto’s most successful projects in recent years, attracting around $16 billion in deposits since opening to investors last year.

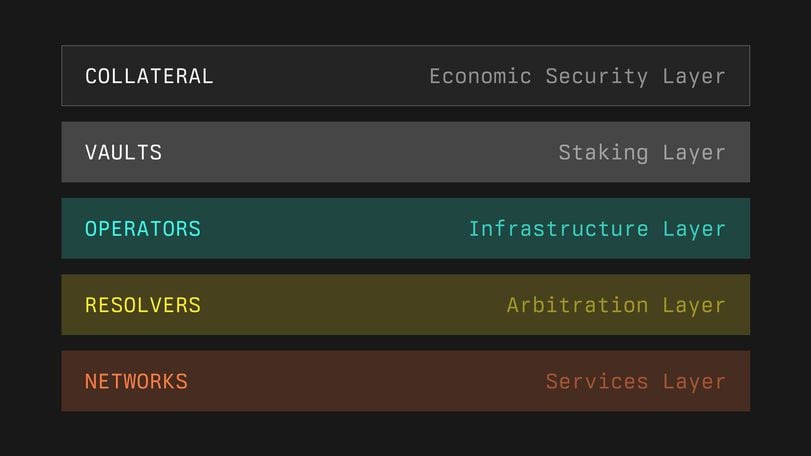

Like EigenLayer, Symbiotic will offer decentralized applications a solution known as Active Validation Services (AVS) to collectively ensure each other’s security. Users can restake assets held in other crypto protocols to help protect these AVSs — whether rollups, interoperability infrastructure, or oracles — in exchange for rewards.

A key difference between Symbiotic and EigenLayer is that users can deposit any asset based on Ethereum’s ERC-20 token standard directly into Symbiotic, meaning the protocol will be natively compatible with stETH and thousands of other ERC-20 assets. EigenLayer, by contrast, accepts only ETH.

Internal Symbiotic document screenshot obtained by CoinDesk, describing the protocol's "five interconnected components."

Ironically, several知情人士 said that when venture giant Paradigm approached EigenLayer co-founder Sreeram Kannan to invest in his project, he turned down their funding in favor of a16z. In response, Paradigm reportedly told Kannan they would invest in a competitor to EigenLayer instead.

Plenty of Room for Multiple Players

The emergence of a potentially strong rival to EigenLayer highlights how eager institutions and investors are to enter the restaking space as it becomes a focal point of industry discussion. Blockworks reported in April that another restaking startup, Karak, had raised funds from firms including Coinbase.

“There’s enough room in this space for more than one major player,” said an infrastructure operator planning to integrate with Symbiotic, speaking anonymously due to the project’s confidential status. “I think Uber and Lyft are a perfect example — the restaking market will be huge.”

Involvement from Cyber Fund — led by Lido co-founders — and Paradigm could give Symbiotic a strong advantage in challenging EigenLayer. It further suggests that those close to Lido view EigenLayer as a potential threat to Lido’s dominance.

While Lido remains Ethereum’s largest DeFi protocol, its strategy around restaking may determine whether (and how) it maintains its leading position in the staking arena.

Liquid restaking companies that channel user funds into EigenLayer have already begun eroding Lido’s stETH market. The two largest liquid restaking protocols, Ether.Fi and Renzo, recorded a net inflow of $625 million over the past 30 days. Meanwhile, Lido saw a net outflow of $75 million during the same period.

This week, members of the Lido DAO — the governance body that controls the Lido protocol — publicly proposed the “Lido Alliance,” a guiding framework for thinking about restaking. The proposal states: “The Lido DAO will identify and recognize projects that share similar values and missions and can positively contribute to the stETH ecosystem.” “Growing an ecosystem around stETH aligned with Ethereum helps decentralize the network.”

Although Lido has no direct connection to Symbiotic, the restaking firm funded by Lido co-founders closely aligns with the Lido Alliance framework. While EigenLayer accepts only ETH deposits, Symbiotic does not accept ETH at all. Instead, Symbiotic will allow users to deposit any ERC-20 token directly — such as Lido’s stETH.

Symbiotic project documents state: “Collateral in Symbiotic can include ERC-20 tokens, Ethereum validator withdrawal credentials, or other on-chain assets (like LP positions), with no restrictions on the blockchain where the positions are held.”

Discussions Around Restaking Projects

Screenshot of internal Symbiotic document obtained by CoinDesk titled: “Example of collateral using ERC20 tokens. When users deposit into vaults, the creation of collateral will be abstracted.”

Symbiotic’s approach to collateral ties into its ambition to be a “permissionless” protocol, meaning that applications built on the platform should have wide latitude in deciding how to extend it for their own use cases.

Mike Silgadze, co-founder of Ether.Fi, said in a Telegram message: “I’m excited about what they’re building. It looks interesting and innovative.” “They seem very focused on building something fully permissionless and decentralized.”

According to知情人士, another liquid restaking protocol, Renzo, is already discussing integration with Symbiotic post-launch.

Symbiotic has not yet released public information or confirmed a launch timeline, but four sources consulted for this article expect the platform to launch in some form by the end of this year.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News