Exploring Bitcoin Layer-2: Deception or a New Paradigm?

TechFlow Selected TechFlow Selected

Exploring Bitcoin Layer-2: Deception or a New Paradigm?

See a demand, fill a demand—if the market wants onions cooked in a certain way or in certain dishes, they’ll provide it.

Author: Duncan

Translation: TechFlow

While runes are stealing the spotlight, Bitcoin developers are hard at work—building a Frankenstein-like monster atop the world’s most trusted blockchain. Given how many forms Bitcoin can take, you might think Bitcoin Layer 2s are more of a venture capital gimmick than a financial frontier.

But dear reader, please note: Bitcoin is far richer than people realize.

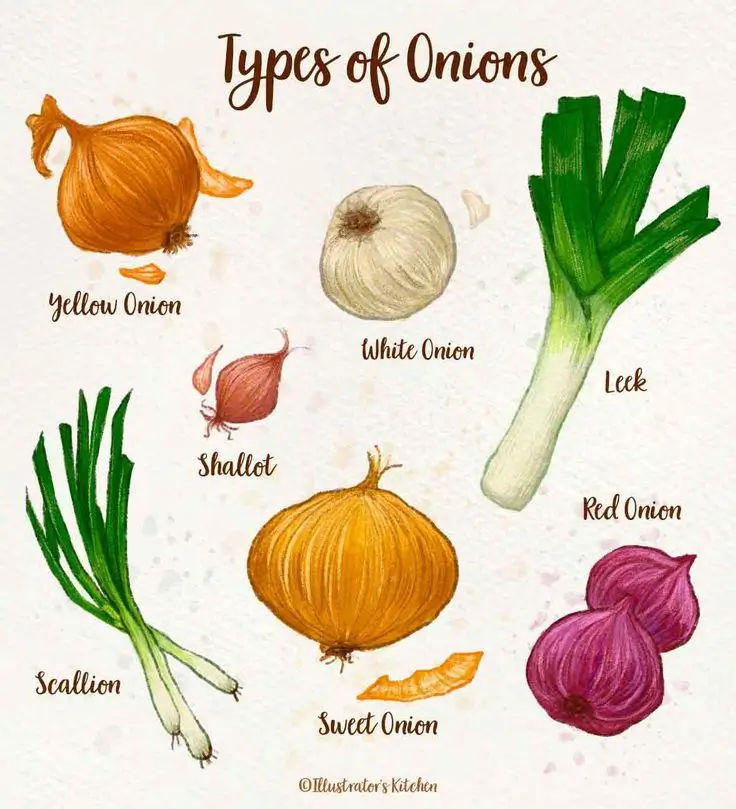

Example? Alright. Bitcoin is like an onion—layered and complex.

Currently, there's L2—a rising narrative promising to bring Bitcoin into decentralized finance and deliver lucrative returns. But like onions, different varieties matter, as does preparation. Will high-end tech attract new users, or only new holders?

What's the Problem with Layer?

When we think about Layer 2 in blockchain development, scalability comes to mind: How do we make Bitcoin faster, better, stronger? Bitcoin is somewhat slow, and its primary utility beyond value storage is peer-to-peer money transfer. When discussing Layer 2, we're talking about using Bitcoin meaningfully—such as in smart contracts—with reasonable transaction times and clean execution.

This functionality already exists on Ethereum Layer 2s like Optimism and Arbitrum, which batch transactions and roll them back to the mainnet. Bitcoin L2 developers have creatively borrowed these concepts, implementing them with varying degrees of complexity.

At a macro level, the concept is identical: Bitcoin L2s aim to empower Bitcoin for broader applications.

How Developers Are Preparing Bitcoin Layer 2

Imagine cooking an onion. It can enhance flavor, play a supporting role, or be the centerpiece. For Bitcoin L2s, developers also ponder how best to use Bitcoin—keep it simple, or build a fully customized solution?

It turns out solutions vary greatly in technical approach. Fortunately, I’ve compiled a menu highlighting some key options.

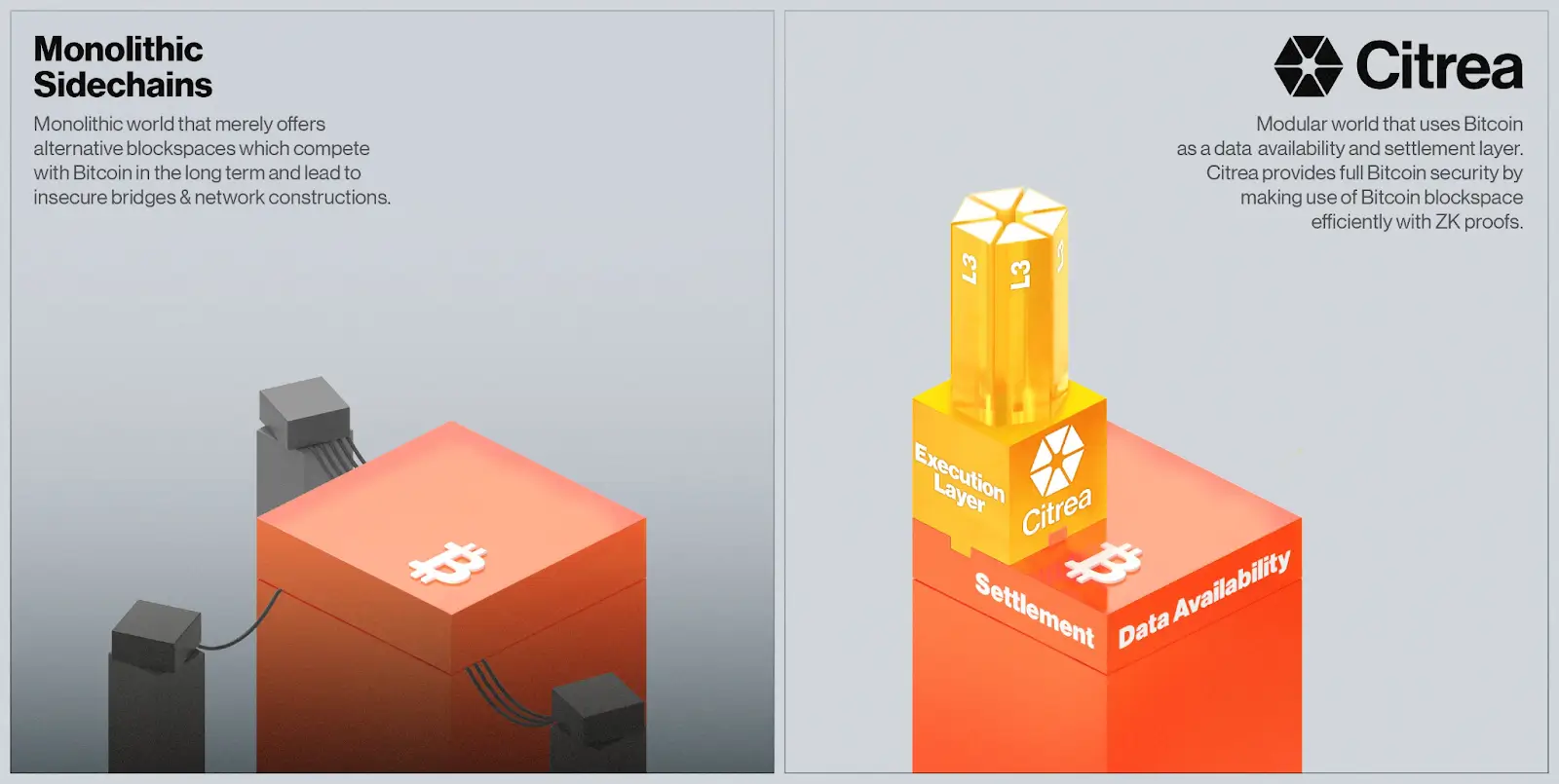

Short and Sweet: Citrea

In the short-and-sweet category, I present Citrea. Other solutions I include here are Stacks, Build on Bitcoin (BOB), and SatoshiVM. Their focus is core to Layer 2: blockspace scalability and smart contract usability. Sounds sophisticated—but not too wild.

Citrea is a zero-knowledge (ZK) rollup designed to scale Bitcoin’s blockspace. As a rollup, it inherits Bitcoin’s security and uses BitVM to batch transactions on Bitcoin and verify validity proofs.

Citrea also features a two-way peg between Bitcoin and itself, and achieves EVM compatibility via BitVM, enabling Turing-complete off-chain smart contract processing on Bitcoin.

Notably, Citrea is a rollup—not a sidechain—just as garlic and onions belong to the same family but are distinct. Its goal is scaling blockspace rather than transaction throughput; that is, focusing on efficient blockchain data storage rather than the number of transactions processed on L2.

In Citrea’s case, validity proofs are inscribed onto Bitcoin, allowing transaction batches to be rolled up easily. A key distinction: these inscriptions are verified optimistically—all transactions assumed valid unless proven otherwise—and fraud prevention counters invalid transactions.

So where does ZK come in? First, transaction data isn’t posted directly to Bitcoin—only inscriptions are. This preserves some user privacy on Citrea and other Bitcoin L2s using similar paradigms.

Second, Citrea and Bitcoin are connected by a trust-minimized bridge enabling two-way pegging, where withdrawals require valid ZK proofs. Citrea uses ZK-STARKs—Zero-Knowledge Succinct Non-interactive Arguments of Knowledge—to recursively verify batch proofs within lightweight clients.

This sounds like “onion flavor is controlled by sulfenic acid”—nonsense to average users. Many technical details matter, but practically, the appeal lies in simplicity.

If we view Citrea as another rollup—like zkSync, Arbitrum, or Optimism—it makes all the fancy ingredients easier to digest. Of course, it’s not exactly the same, especially technically; this is just a loose analogy for comparison. Imagine using native Bitcoin on Citrea without handing it over to third parties—just trusting open-source code. That’s a powerful draw.

Custom-Made: Bison

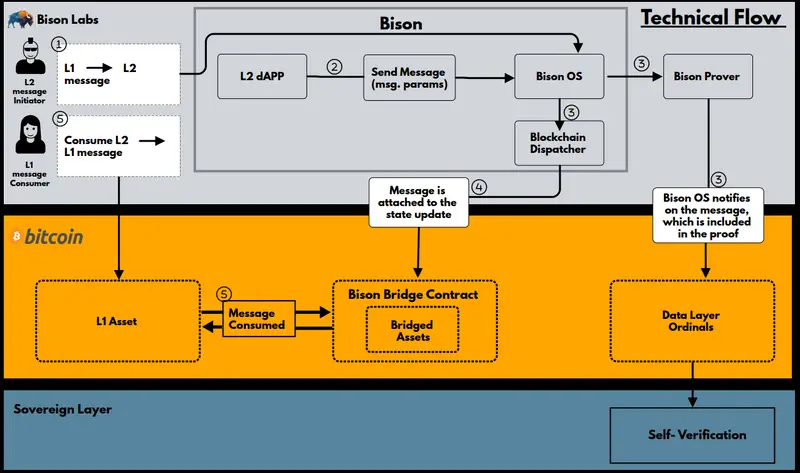

Some teams take a different approach when using native Bitcoin. Indeed, many solutions rely on EVM to achieve their DeFi vision. Bison Labs tackles this through its Bison suite: Bison Network, Bison OS, and Bison Prover.

Bison offers its own analogy: Bison is to Bitcoin what Starknet is to Ethereum. Like Citrea (and others), it leverages Bitcoin inscriptions as a data availability layer, enhancing immutability and simplifying on-chain data access. They also use the ZK-STARK (Zero-Knowledge Scalable Transparent ARguments of Knowledge) method for rollups.

Bison Network includes built-in components for rollup and smart contract functionality: L2 dApp logic, sequencer, token contracts, and bridging contracts. Essentially, Bison represents an advanced form of “native Bitcoin DeFi,” not relying on EVM to handle operations.

From a culinary perspective, Bison suggests adding raw onion to dishes instead of frying in olive oil every time—“because it tastes better.”

There’s a Spider in Your Dish: Botanix

Other teams take radically different approaches to leverage native Bitcoin. If you’re after novelty, Botanix fits the bill—proposing proof-of-stake (PoS) on its own Layer 2. Yes, it’s new.

Bitcoin-based PoS differs from other PoS networks, which distribute yield via inflation, block rewards, or both.

In Botanix, holders lock their Bitcoin and earn fees from base transaction fees, priority fees, and “downward fees” when users bridge from Botanix back to Bitcoin. Theoretically, Botanix has zero base block rewards. This means Botanix benefits significantly from higher user adoption.

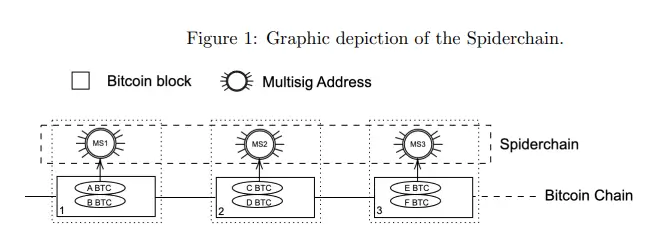

Botanix secures locked Bitcoin within an architecture called the “Spiderchain.”

The Spiderchain is “a continuous series of multi-signatures among Botanix Orchestrators,” which act as full nodes of the Botanix protocol. With each Bitcoin block, a new multi-sig is created among randomly selected active Orchestrators.

Orchestrators cannot access Bitcoin in a multi-sig unless they obtain majority signatures—determined by the amount of Bitcoin they stake. They must control one-third of staked Bitcoin. This security model implies greater decentralization leads to enhanced security as more Orchestrators join.

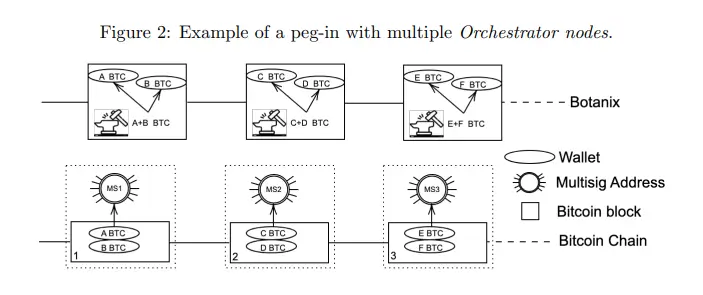

Critically, Bitcoin is “native” on the Spiderchain. All Bitcoin stored in Botanix’s EVM portion is synthetic. When user Alice bridges from Bitcoin to Botanix, her Bitcoin is locked on the Spiderchain, and she receives synthetic Bitcoin for use on Botanix EVM.

When she wants to bridge back, synthetic Bitcoin is burned, and her original Bitcoin is returned from the Spiderchain. These are known as “peg-in” and “peg-out,” maintaining a strict 1:1 supply ratio.

Botanix is truly unique—like eating a spider? I don’t know. Might be disgusting—or the tastiest thing I’ve ever eaten. What I do know is, it’s definitely cooked with onions.

Where Do They Overlap?

At this point, you might wonder: Are we talking about onions again? Yes—the article is full of onion analogies.

Similarly, several key components appear across multiple Bitcoin L2 solutions. The most notable commonalities are the use of BitVM and inscriptions as a data availability layer.

Technically, BitVM enables fraud proofs on Bitcoin. Computations via BitVM are validated simply—similar to optimistic rollups—but incorporate elements typically found in ZK rollups, such as obscured transaction details and trust-minimized bridging.

You’ll also notice most L2 solutions leverage EVM compatibility to harness smart contract capabilities and tap into Ethereum’s existing developer pool.

You may spot differences, such as whether a solution uses a token. For example, Merlin Chain, Map Protocol, and SatoshiVM each have their own tokens. These aren’t necessarily used as gas and serve various purposes.

So, Does This Actually Matter?

Well, it depends on what dish you're preparing, right? Raw onion, sautéed onion, fried onion… you get the idea. At the heart of all this Layer 2 discussion is technology—which matters, yes, if you're cooking or even eating the cooked dish. But for the average user, maybe not so much.

What does this mean for your portfolio? It likely boils down to user experience. If Citrea feels clunky—even though I find it straightforward—people might avoid it. Bison and Botanix might seem overwhelming but could deliver revolutionary UX in practice.

But even user experience is its own science. Again, it’s like asking whether people prefer raw, sautéed, fried, or roasted onions: markets will evolve where demand exists.

Ultimately, Bitcoin L2s represent attempts at broader user adoption. Where demand lies, products will follow. If people enjoy cooking onions with spiders, who am I to judge?

Alright, admittedly, I’ve said enough about onion analogies. Let me summarize—without onions.

Complex technologies simplify over time, leading to better user understanding (and thus better experiences). Sometimes, however, you need more complex solutions. Any form of adoption generally benefits your portfolio.

When your portfolio grows, technology shines: adoption drives continuous improvement, spawning new—and potentially complex—solutions. Typically, where crypto gains more attention, development support increases. In other words, your portfolio stands a better chance of succeeding.

But we’re talking about Bitcoin. People assume these portfolios will succeed. What interests us is whether the technology will be adopted. In the L2 context, we see Bitcoin used as currency in diverse environments.

Yet we should ask ourselves: Is the idea of Bitcoin as a store of value or market hedge too deeply ingrained to seriously consider otherwise?

Initially, I thought this would mainly attract those wanting to increase Bitcoin holdings. The question always is: Who will take the first step? For early adopters, the risk could pay off handsomely. For most, Bitcoin will continue fulfilling its current role—value storage and risk hedging.

Again, see demand, fill demand. If the market wants onions cooked in certain ways, in certain dishes, they’ll exist. Whether they’re widely consumed is another matter.

Conclusion

Personally, I’m intrigued by native solutions like Bison. I believe solutions like Botanix have market fit, and the ideal intersection between them may exist somewhere.

I think there’s sufficient market interest to justify development—certainly. But I expect it will remain a small fraction of Bitcoin’s total market cap. Ultimately, I see Bitcoin L2s tied to Bitcoin’s potential relationship, though their connection to Ethereum is more intriguing.

But here’s the real key: While Bitcoin L2s are still incubating, they’re striving to become truly independent ecosystems. Meanwhile, we should keep watching how these projects evolve and what value they bring to crypto and blockchain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News