A Perspective on Layer2 (3,4) from the Economics of Block Space

TechFlow Selected TechFlow Selected

A Perspective on Layer2 (3,4) from the Economics of Block Space

In the future stages of the "Jevons Paradox," when it comes to block space allocation, we may exist in a paradigm beyond Layers. The current obsession with blockchains is merely a symptom of the early phase.

Author: @mattigags, Zee Prime Capital

Translation: Helsman, ChainCatcher

A Tale of Block Space

This article has been in the making for nearly a year. Since the first draft, market conditions have changed dramatically, but the core themes and thesis have unfolded. After much discussion, we decided to revise and proceed with publication.

In this article, we will discuss:

-

What is block space?

-

Why does it matter?

-

Block space as a "Veblen good" vs. block space as a "Giffen good"

-

The "Jevons Paradox" of block space

-

The future of block space allocation

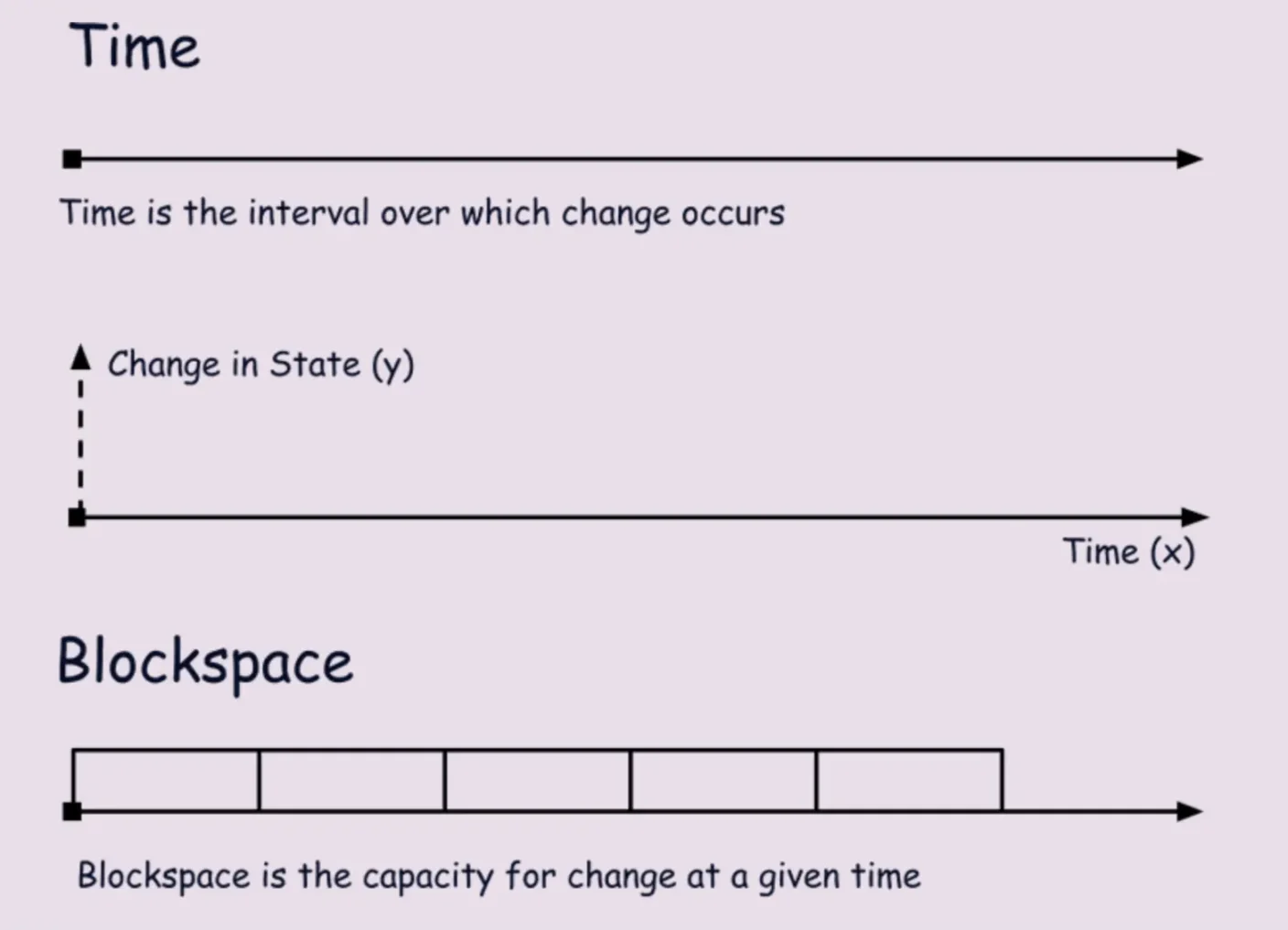

What Is Block Space?

Blockchains are also known as state machines. In computer science, "state" refers to the memory capacity of software. Today, the internet largely relies on private, closed-off state maintenance. Behind the walled gardens of websites and apps, our shared memory is controlled by gatekeepers.

Humans and machines constantly generate vast amounts of freely flowing information across the internet. As a result, trustworthiness and truth become scarce. Blockchains allow us to outsource our shared data storage to machines.

Truth becomes a matter of block finality, because block space is our time capsule. These memories are highly specific and expressionally constrained. Based on market participants' willingness to pay, they are uploaded into our "collective memory."

Dennis Nazarov described Web2 like this:

"The business model of internet services is based on monetizing state. State is a competitive advantage that must be defended through proprietary and closed services."

Blockchains are effectively dismantling applications' monopoly over state maintenance. Because blockchains can store only a limited amount of updates within a given time, the state machine auctions its storage capacity. This storage capacity is defined by block space.

Rob Habermeier sees block space as a critical component for emerging applications:

"Emerging applications rely on decentralized systems for payments, consensus, or settlement. Thus, the application layer is the primary consumer of block space. Like any business, applications and their developers should care about the quality and availability of goods in their supply chain."

Block Space as Fuel

Block space only becomes a reliable, credible coordination resource when it is organically scarce—or at least imbued with some sense of "urgency"—to activate market forces seeking to acquire it.

Just as the invention of refining crude oil into petroleum revolutionized energy, the invention of shared state-keeping/blockchains refines time into a standardized fuel: block space. Time is our crude oil, blockchains are the refineries, and applications are the gas stations. Together, they power a new information superhighway for value transfer.

Technology underpins society. As technology evolves, so does society. The future internet will run on block space, powering applications coordinated by state machines.

Mechanical clocks helped drive the Industrial Revolution by enabling universal coordination—think "9-to-5." Block space could similarly catalyze the next information revolution by providing universal coordination for value transfer. We are slicing time into block times and outsourcing accounting, thereby extending markets into areas previously unreachable by centralized ledgers.

Hayek defined markets as machines that record change and a price system that coordinates social resources and knowledge. Block space extends the market—it's an invention that enables resource coordination. It bundles trust with state, allowing us to compute and verify information without needing to trust the information itself.

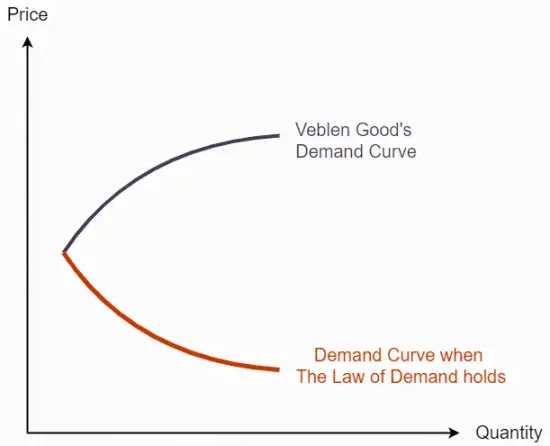

Block Space as a Veblen Good

Some revolutionary inventions begin as luxuries. Take timekeeping: 14th-century mechanical clocks were expensive to produce and maintain, accessible only to the wealthy. Just centuries later, pendulum clocks made timekeeping scalable and widespread.

Early automobiles were owned exclusively by the affluent. Electricity itself became a social fashion. Electrification transformed these luxuries into everyday essentials within just decades.

Today’s block space, though open to all users on-chain, still carries luxury-like attributes. During Ethereum’s gas spikes, using block space almost becomes a status symbol. Is today’s block space a Veblen good?

Investopedia summarizes Veblen goods as follows:

-

Veblen goods are those whose demand increases as their price rises;

-

They are typically high-quality, exclusive, and well-crafted, serving as status symbols;

-

They are often sought after by wealthy consumers who value conspicuous consumption;

-

Their demand curve slopes upward.

Demand for Ethereum block space can be seen as conspicuous consumption—and sometimes determines economic returns. Block space is the casino for innovators, while the market continues searching for new, highly practical, product-market-fit applications.

Within the Ethereum ecosystem, applications are gradually being replaced by cheaper alternatives on other blockchains or rollups, reigniting interest in appchains—applications running their own state machines. Despite lower costs elsewhere, expensive and valuable activity persists on Ethereum. Composable, high-yield products like Ethena, Pendle, and Gearbox, along with their vaults, solidify Ethereum’s block space much like a Veblen good.

For example, premium NFTs owe part of their high value to gas spikes during minting. Through endowment effects and initial costly reflexivity, these NFTs become the flywheel—growing increasingly valuable over time.

Whether during the 2024 memecoin craze or the 2021 NFT boom, increased “gambling” demand made block space globally desirable. Given ETH’s high cost per “lottery ticket” and SOL’s rapid wealth effect, Solana has become the Schelling point for memecoins.

Block Space as a Giffen Good

Not all block space is created equal. It comes with inherent class distinctions. Not everyone can afford Ethereum’s caviar. Some must settle for “rice” and “potatoes”—cheaper blockchains.

For non-premium block space, properties may resemble those of a “Giffen good.” A Giffen good is considered essential and non-luxurious, yet theoretically shares an upward-sloping demand curve—demand increases as price rises—similar to a Veblen good.

The theoretical existence of such goods stems from lack of substitutes and income pressure. A classic example: during the 1845 Irish famine, potato prices rose, yet demand increased. Higher-quality alternatives like meat or caviar were so out of reach that even these non-luxury staples became high-demand goods.

"Because Giffen goods are essential, consumers are willing to pay more for them, but this drains disposable income, making slightly better alternatives even less attainable. As a result, consumers buy even more of the Giffen good."

Thus, Ethereum’s block space shares similarities with other block spaces. If someone wants to participate in the meme economy, block space is an essential and urgent commodity. But ETH block space is an extremely expensive “lottery ticket.” Increased demand for block space was especially evident during the 2021 crypto bubble, continuing to attract capital speculation. As the crypto market enters a new bull cycle in 2024, more economic activity occurs outside Ethereum.

Will new block space continue to exhibit Giffen-like properties? Are new market participants priced out of Ethereum’s block space? What does this mean for the future of block space pricing?

I believe that as broader product-market fit emerges for block space, economic activity around it will increasingly display Veblen-Giffen characteristics—demand rising with price.

The Jevons Paradox of Block Space

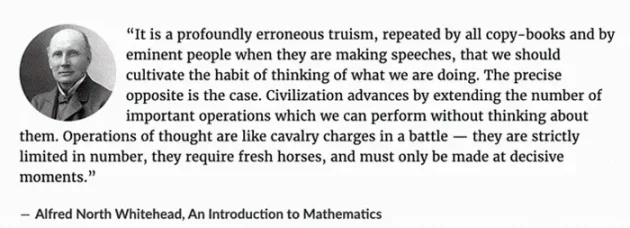

The "Jevons Paradox" is an economic phenomenon where increasing efficiency in resource use leads to greater overall consumption. In the 19th century, William Stanley Jevons observed that more efficient steam engines actually increased coal consumption. Could we eventually exhaust block space?

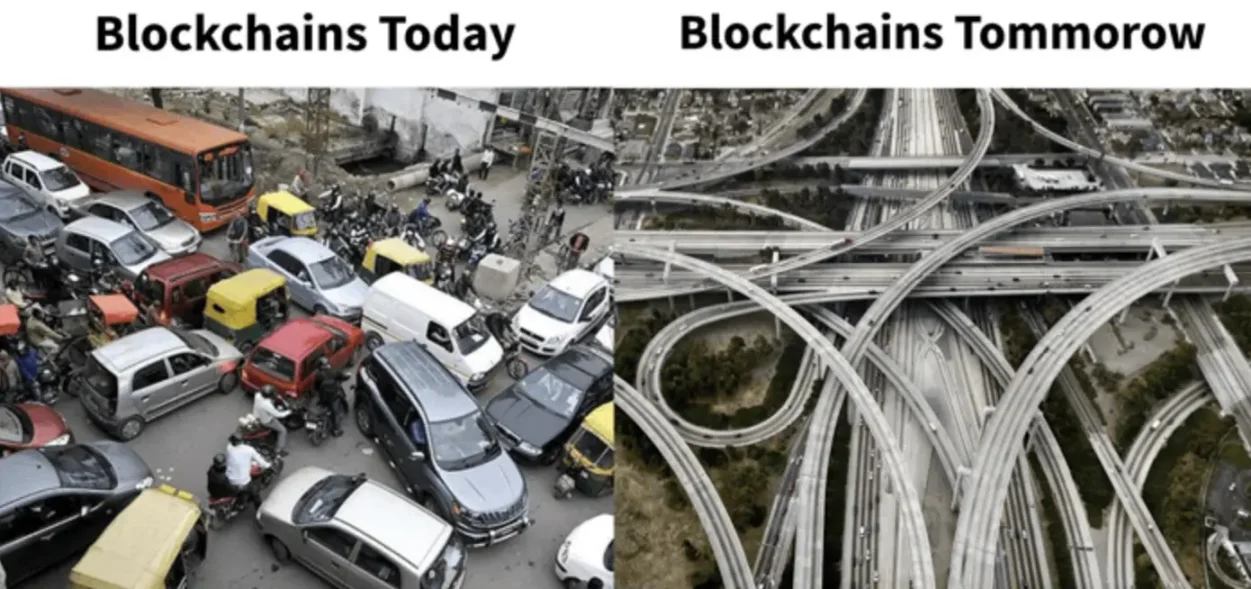

As more efficient block space emerges, demand for it will likely grow—especially as innovative applications fill blocks with information. It’s like widening roads but failing to reduce traffic congestion.

Block space won’t fully commoditize because its quality and state vary. Just as densely populated urban areas suffer worse traffic, we’ll encounter hubs of more expensive block space.

Increasing block space is simple—but it’s like building highways across a desert. Who wants to drive through the desert every day? So it’s not just about adding more block space; it’s about efficiently allocating high-demand blocks.

Schedulability > Scalability

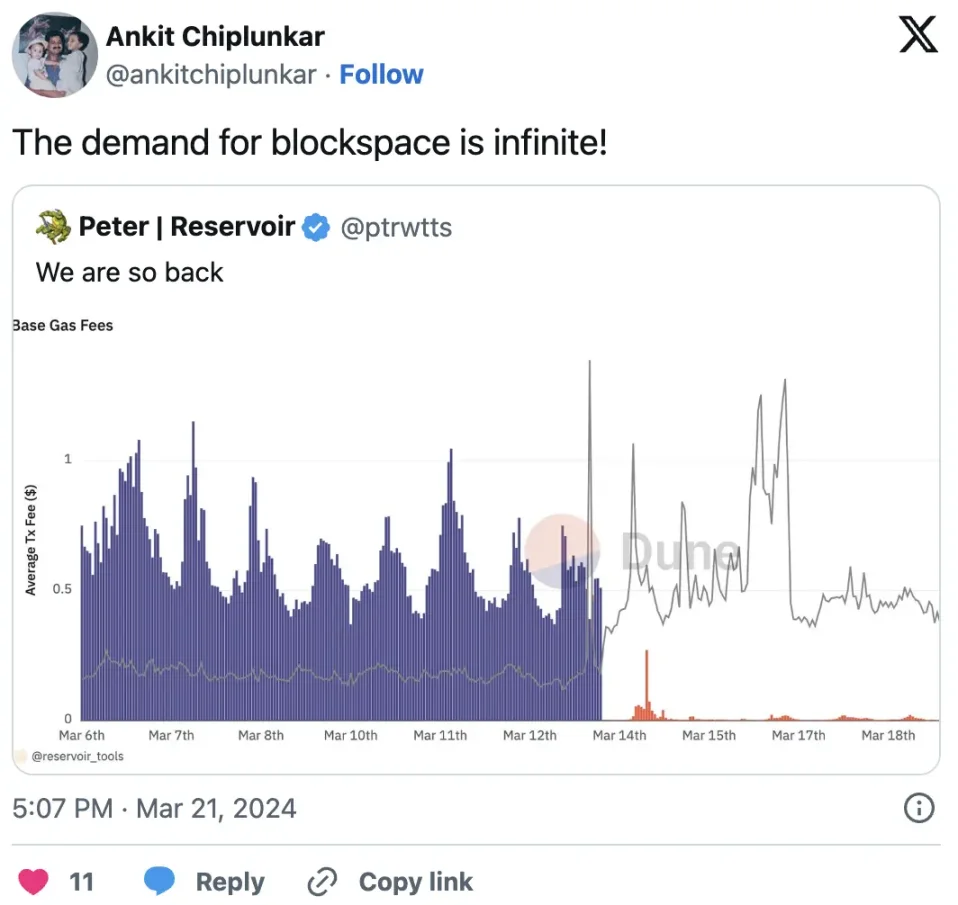

Global block space supply is increasing. When the crypto industry experiences active phases—often followed by mainstream media attention—we’re likely to see surges in global demand for block space.

During peak loads, demand spikes for both high-state (and high-quality) block space and cheap block space. More sophisticated market participants require guaranteed block space delivery. As certain transactions carry higher economic value, the schedulability of high-state block space becomes far more important than mere availability of any block space.

This is why block space may never become a pure commodity. Any useful future use case for blockchains will involve financial elements (distributed consensus isn’t free), so savvy participants will pay for transaction guarantees. Citadel traders and Robinhood users play different games; the rich use different banks than the middle class. Blockchain participants are no exception.

Efficiency in block space allocation is emphasized, aiming to “…maximize existing block space and ensure it’s always allocated to the most needed state machines: continuously generating and distributing global consensus resources to those who need them most. It’s a mission that never wastes.”

Today, we're stuck in an imbalanced L2(3,4) frenzy—each new rollup adds more block space. While potentially profitable short-term (for investors and founders), the long tail of isolated block spaces with highly unstable demand isn't a sustainable path to mass production and distribution of block space.

The reason? Applications need more comprehensive, stable environments for large-scale execution. The current block space market is fragmented and unpredictable. The scalability mindset of “add more block space” is like building more bridges between congested intersections without considering traffic lights or highway ramps.

This problem will likely be solved through market-based mechanisms. Block space, as a primitive, has already extended markets to many new use cases—but lacks a market of its own. Until block space has a proper market—including delivery guarantees and hedging instruments—its full potential may remain unrealized.

We’ve seen this before. In the 1970s, “godfather of hedge funds” Ray Dalio helped McDonald’s hedge chicken nugget input costs via futures—a then-novel invention—enabling stable costs and new product rollouts. Before, fluctuating costs made nuggets unviable.

Blocks themselves need markets—perhaps a real gas cost market or similar. Maybe the answer isn’t synthetic futures like in the example above, but we expect a more sophisticated block space allocation mechanism to emerge.

As demand for block space grows, so will demand for specific execution guarantees and global blockchain allocation—not just local chains. In a Jevons Paradox future, we may operate beyond the layered paradigm when it comes to block space allocation. Current blockchain obsession is merely a symptom of early-stage development.

Given crypto’s path dependency, dynamic design constraints, and unpredictable computational pricing, it’s hard to envision the endgame. Whether围绕 ideas like block space/gas exchanges, chain abstraction, or (Polkadot’s) core time model, these represent early thoughts beyond layered architectures.

What truly matters is block space and actual ownership of user-facing applications. Everything in between is investor-sponsored entertainment, destined to be abstracted away over time. This is how the industry transitions from entropy-driven value extraction to negative-entropy value creation dominated by applications.

Thanks to Ankit, Hasu, Rob, Luffi, and long_solitude for comments and feedback.

Along these lines, we’ve made strong investments in Lastic—a modular block space market and undisclosed chain abstraction project—supported Biconomy since 2020, and hold DOT.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News