In-Depth Analysis of Pendle: Fundamentals and Investment Rationale Behind Its Strong Rise

TechFlow Selected TechFlow Selected

In-Depth Analysis of Pendle: Fundamentals and Investment Rationale Behind Its Strong Rise

Pendle currently depends on the development of the LRT sector, but the LRT sector alone still has multiple levels of growth potential.

Authored by: MIIX Capital

*This research report was completed in early March 2024 and revised in early April 2024

1. Report Highlights

1.1 Investment Thesis and Narrative

Crypto yield trading can be highly profitable, but actual returns realized by investors are uncertain due to market volatility driven by numerous factors within the crypto ecosystem, making future yields difficult to predict accurately.

Various yield protocols enable investors to benefit from future earnings, yet many established protocols have flaws that may significantly reduce returns. Pendle introduces an improved approach to yield trading aimed at optimizing investor returns, aspiring to become the "Uniswap of interest rate markets."

Key investment highlights include:

-

Large market potential. Interest rate swaps dominate institutional derivative markets, with interest rate derivatives accounting for 80% of the derivatives sector, and interest rate swaps alone representing 80% of that segment—making it an extremely large-volume market. However, on-chain this space has only recently been introduced by Pendle and remains in its earliest stages.

-

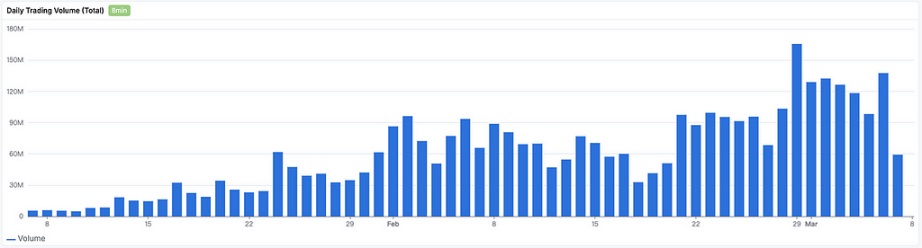

Pendle's overall performance metrics are strong, with record-breaking highs in trading volume, TVL, and token price.

-

Growing institutional demand for staking. Banks, hedge funds, mutual funds, ETF issuers, and ETF brokers all face the need to hedge interest rate risk as they enter the staking space.

-

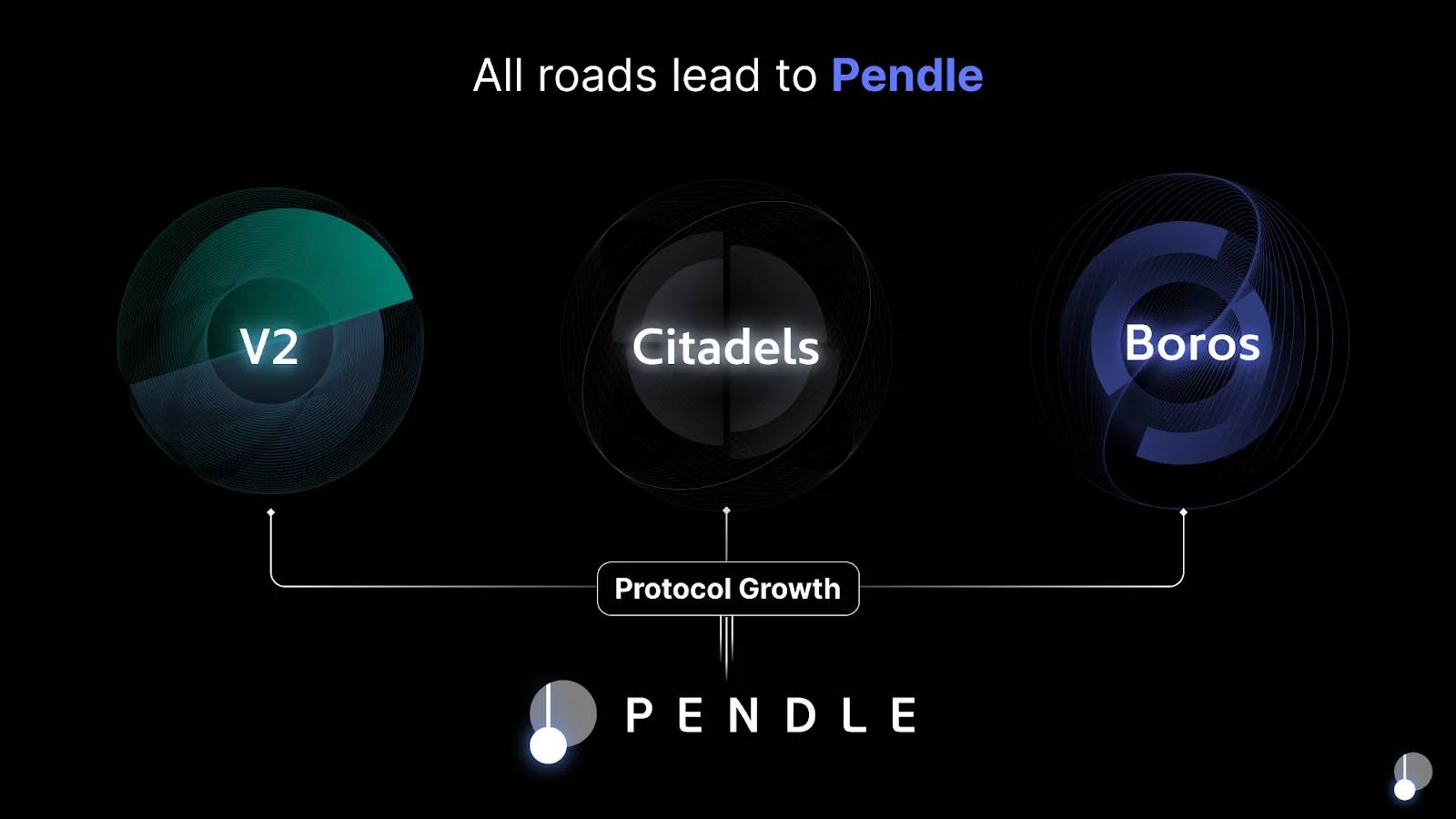

Pendle’s v3 version will bring traditional interest rate swap products on-chain, opening access to a market measured in tens of trillions, creating significant expectations around Pendle’s future performance.

-

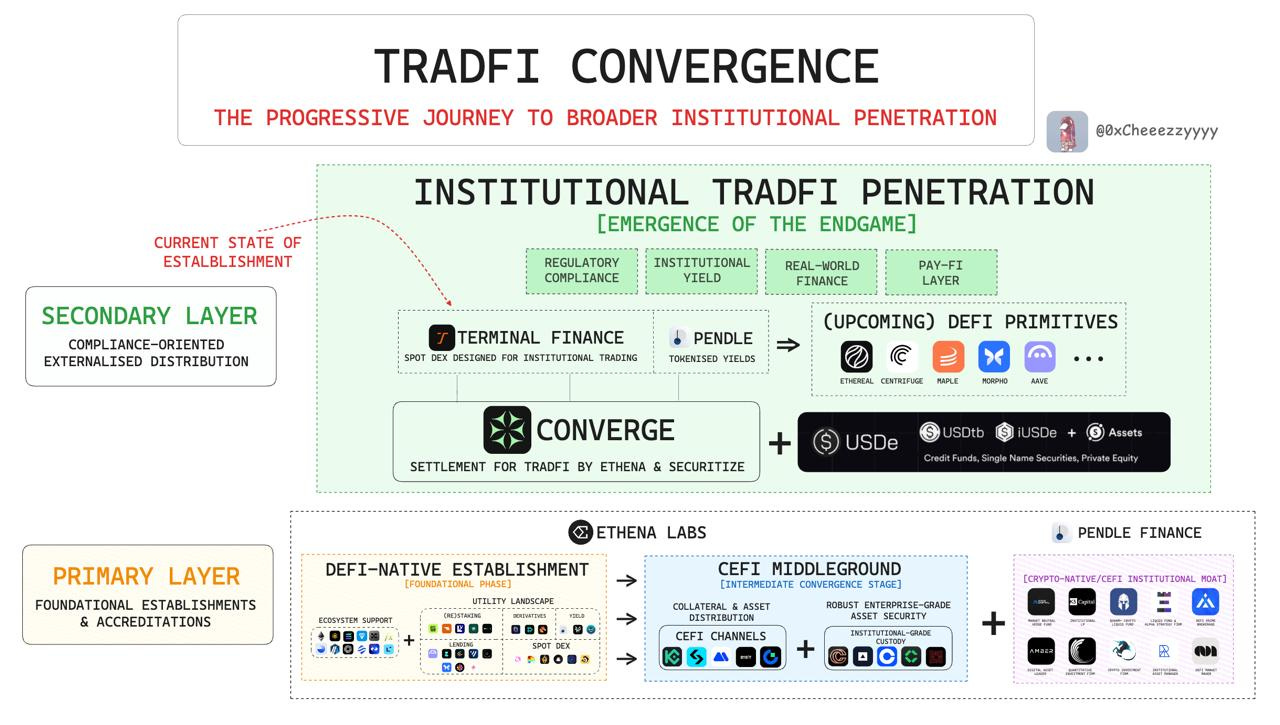

While currently dependent on the LRT (Liquid Restaking Token) sector, which still has multiple-fold growth potential, Pendle may gradually reduce its reliance on LRT over time. Fundamentally, it targets the broader interest rate swap market, requiring institutional participation to diversify its asset base.

1.2 Valuation Overview

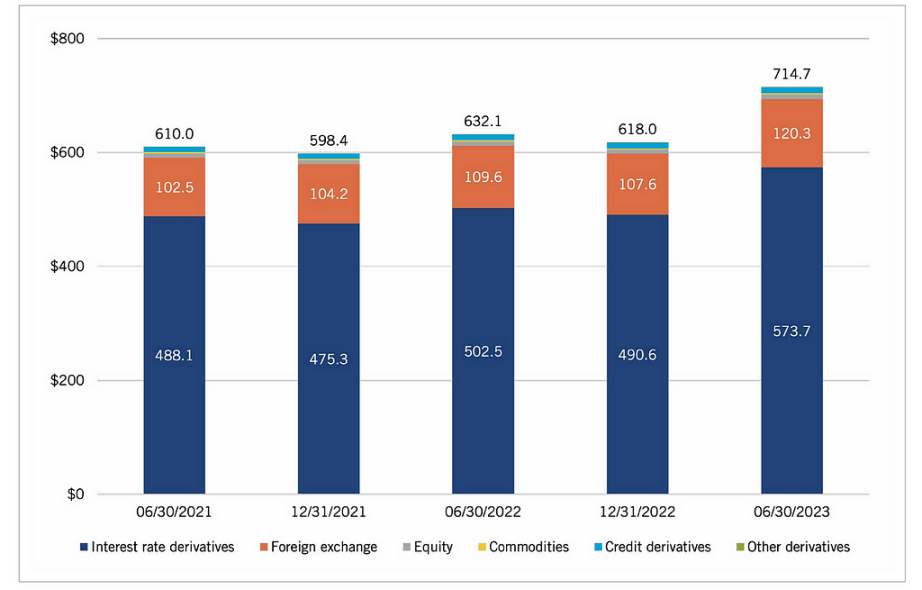

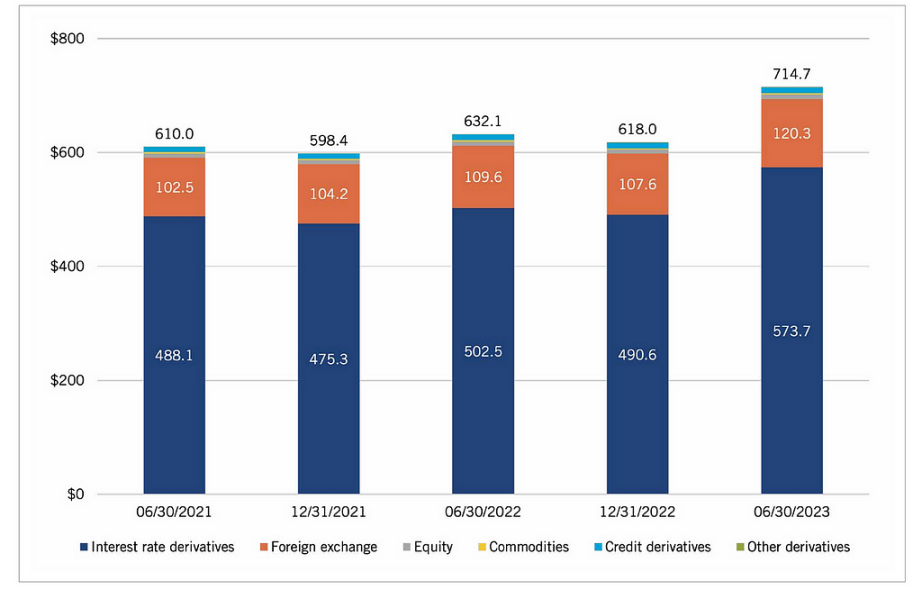

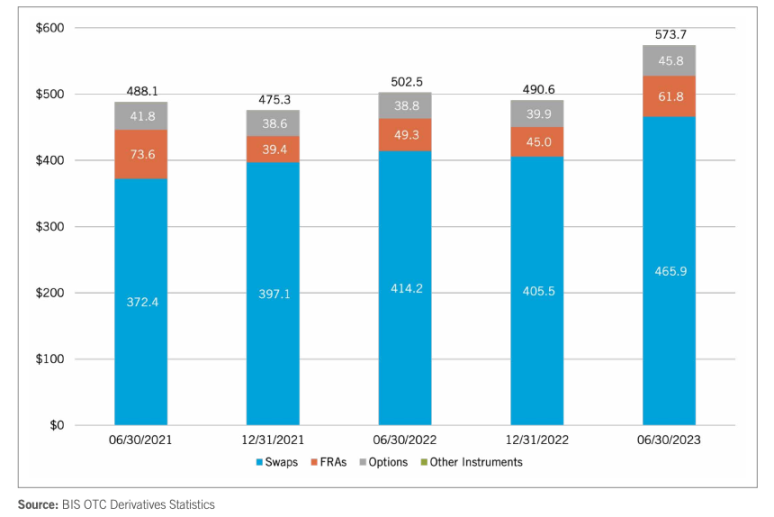

In TradFi, interest rate derivatives dominate the derivatives market. As TradFi continues evolving, the total size of the derivatives market is steadily increasing. As of June 2023, the global derivatives market reached $714.7 trillion in notional value, with interest rate derivatives accounting for $573.7 trillion—80.2% of the total.

On-chain interest rate derivatives remain in the very early stage of development. With staking gaining traction in TradFi, demand in this area is expected to surge.

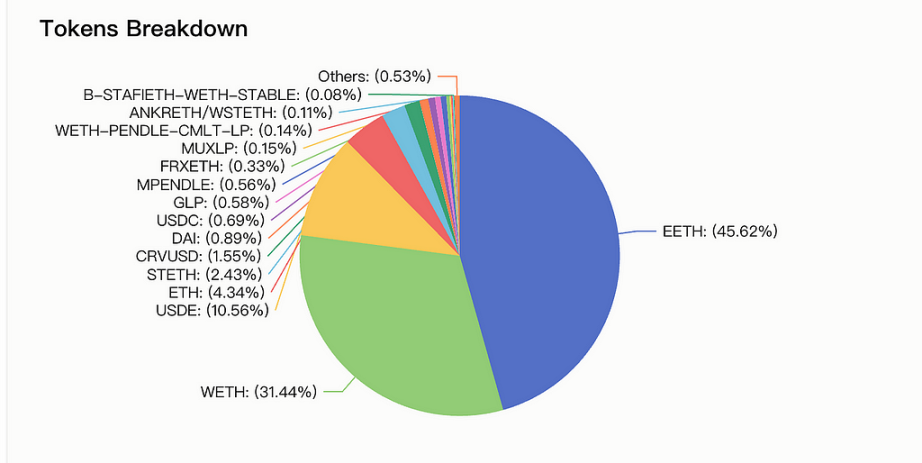

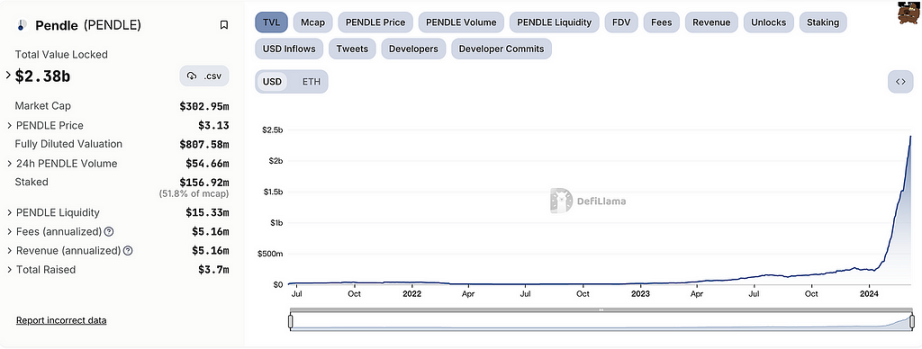

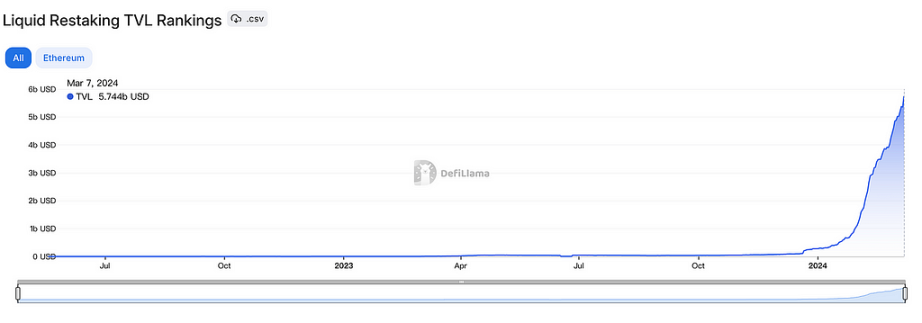

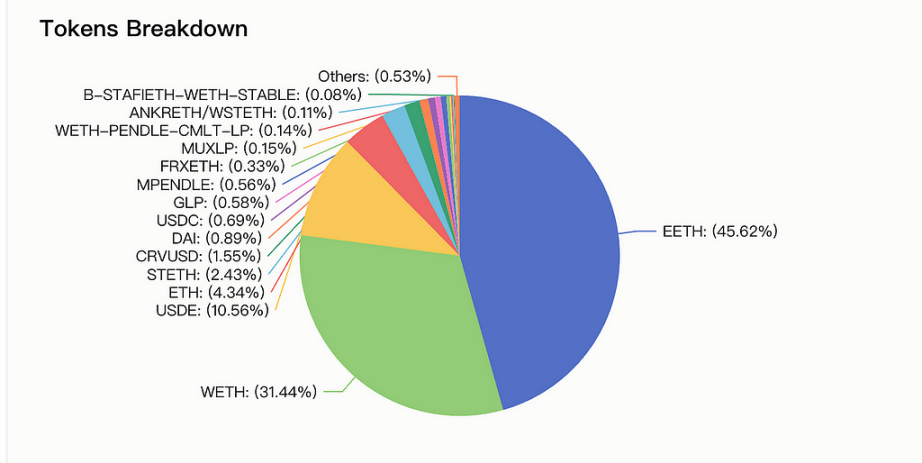

Pendle’s token price has already surpassed previous highs, suggesting upside potential may no longer be constrained. Its primary underlying supported tokens are LRTs. If the current total market cap of LRTs stands at $5.7 billion, and Pendle’s TVL reaches $2.37 billion—including major tokens such as EETH (from ether.fi) and WETH—this provides a solid foundation.

If the overall TVL of LRT projects increases fivefold, Pendle’s TVL could also grow five times. Combined with the anticipated introduction of traditional interest rate markets on-chain in 2024 and increased TradFi adoption driving demand for yield smoothing and risk hedging via Pendle, the project’s upside potential becomes even greater.

1.3 Key Risks

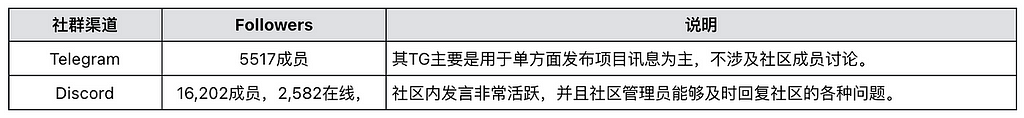

Smart contract risks: although Pendle has undergone audits by multiple firms, vulnerabilities could still exist, potentially leading to full loss of funds.

Failure of ETH spot ETF approval could significantly impact the future trajectory of staking within TradFi.

Under extreme market conditions, Pendle may face unknown risks.

Pendle currently relies heavily on the LRT sector; failure to expand its business scope may lead to single-point exposure.

Due to the large number of token types, liquidity across long-tail assets may be severely insufficient, causing liquidity concentration issues. This could fail to meet complex arbitrage needs of certain institutions—a long-term challenge.

2. Project Fundamentals

2.1 Business Scope

Pendle is a blockchain project focused on yield tokenization, enabling users through its platform to lock in the future yield of their crypto assets and receive returns upfront. This innovative approach not only offers crypto holders a new source of income but also brings enhanced liquidity and flexibility to interest rate markets. Pendle leverages smart contract technology to enable these functions, allowing users to participate in markets in a decentralized and secure manner.

2.2 Founding Team

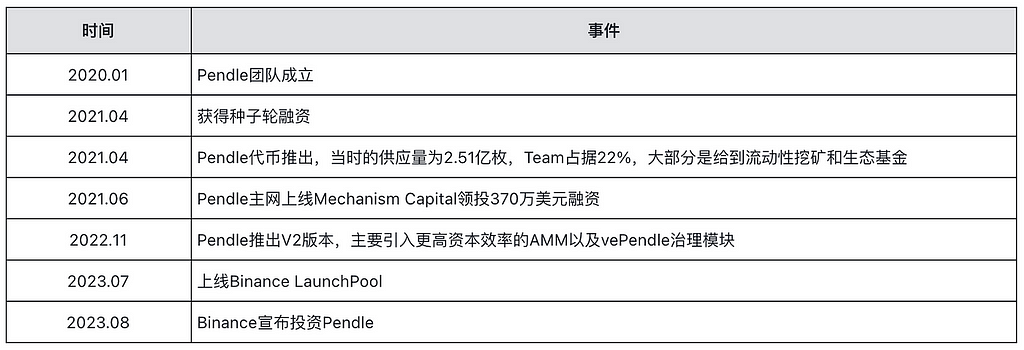

Founded in 2021, Pendle’s team is based in Singapore and Vietnam, with approximately 20 members listed on LinkedIn.

TN Lee (X: @tn_pendle): Co-Founder. Previously part of the founding team and head of business at Kyber Network, then worked at RockMiner, a mining company operating about five mines. In 2019, founded Dana Labs, focusing on custom FPGA semiconductor solutions.

Vu Nguyen (X: @gabavineb): Co-Founder. Former CTO at Digix DAO, a real-world asset (RWA) project specializing in physical asset tokenization. Co-founded Pendle with TN Lee.

Long Vuong Hoang (X: @unclegrandpa925): Engineering Lead. Holds a Bachelor’s degree in Computer Science from National University of Singapore. Joined NUS as a teaching assistant in January 2020, served as a software engineering intern at Jump Trading in May 2021, joined Pendle as a smart contract engineer in January 2021, and was promoted to Engineering Lead in December 2022.

Ken Chia (X: @imkenchia): Head of Institutional Relations. Holds a bachelor’s degree from Monash University. Previously interned in investment banking at CIMB, Malaysia’s second-largest bank, then worked as an asset planning specialist in private banking at JPMorgan Chase. Entered Web3 in 2018 as COO at an exchange, and joined Pendle in April 2023 as Head of Institutions, responsible for institutional markets—including proprietary trading firms, crypto funds, DAOs/protocol treasuries, and family offices.

2.3 Investment Background

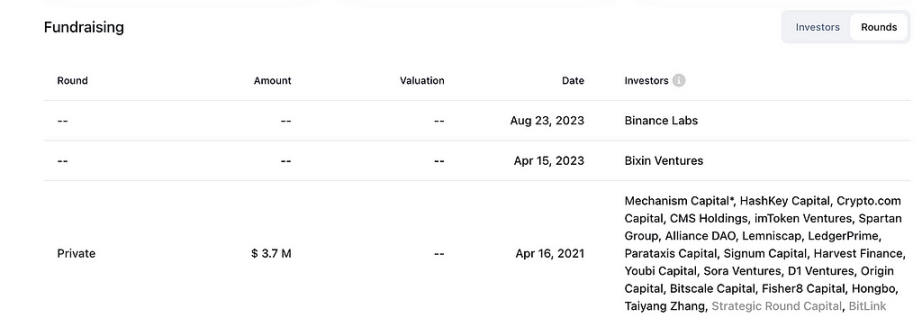

Major investors in the project include Mechanism Capital, HashKey, Bixin Ventures, and Binance Labs.

On-chain data reveals additional investors including Spartan, Arthur Hayes, Hashkey, Alliance DAO, and FalconX.

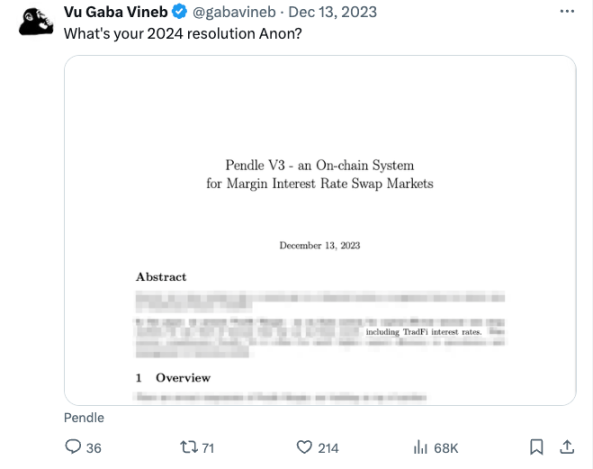

2.4 Development Roadmap and Milestones

According to co-founder Vu Nguyen’s tweet, Pendle’s V3 version is scheduled for release in 2024 and will incorporate traditional financial interest rate derivatives, likely generating strong interest from TradFi participants. Specific implementation details are not yet disclosed.

3. Product and Business Operations

3.1 Official Website Data (as of February 2024)

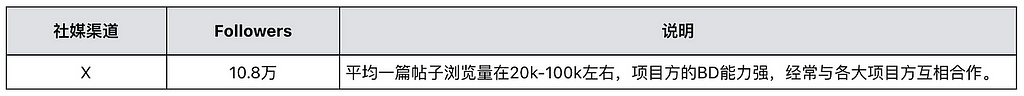

3.2 Social Media Metrics

3.3 Community Data

4. Project Analysis

4.1 Codebase

The product’s codebase has been audited by multiple auditing firms.

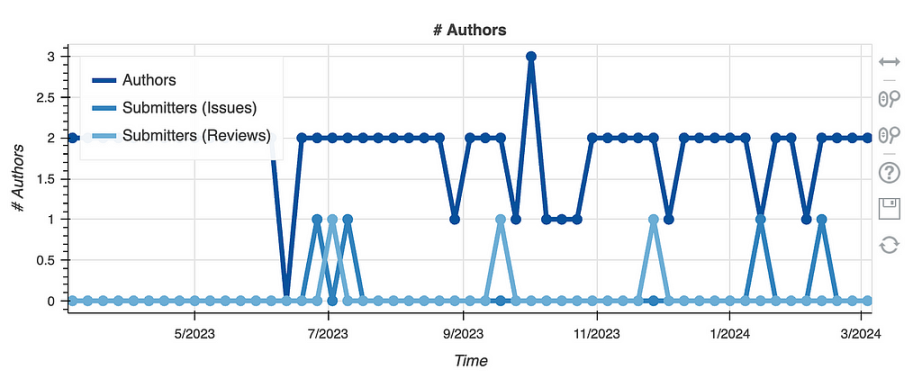

Development activity remains consistent, with stable developer engagement.

4.2 Product Overview

Pendle is a permissionless yield trading protocol enabling users to execute various yield management strategies. Pendle operates through three core components: yield tokenization, Pendle AMM, and vePendle.

Yield Tokenization

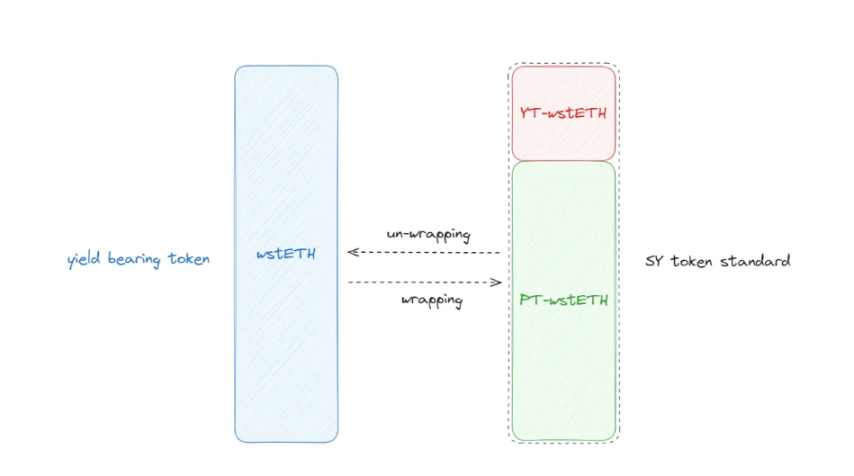

Pendle innovatively tokenizes yield-bearing assets into SY tokens following the ERC-5115: SY Token standard. For example, stETH is wrapped into SY-stETH, then split into two components: PT (Principal Token) and YT (Yield Token).

-

PT tokens earn no yield but can be redeemed 1:1 for the underlying asset upon maturity.

-

PTs resemble PO (principal-only) securities or zero-coupon bonds in TradFi.

-

YT tokens represent the yield of the asset up to the maturity date.

-

YTs are analogous to IO (interest-only) securities in TradFi.

Pendle AMM

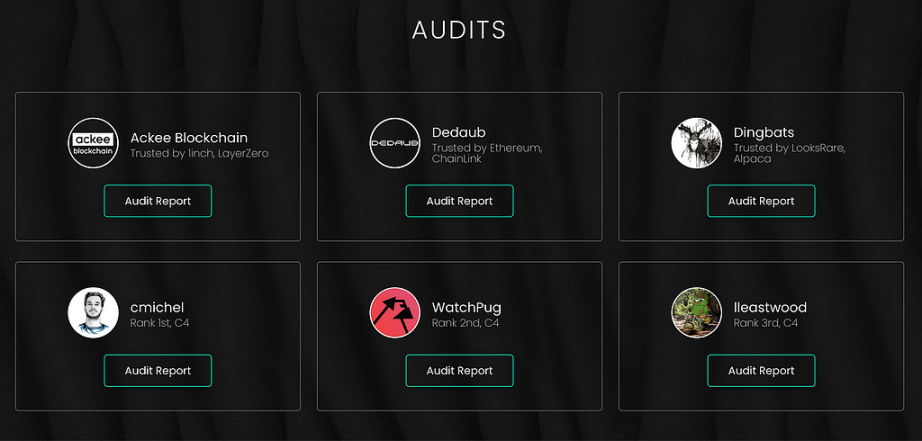

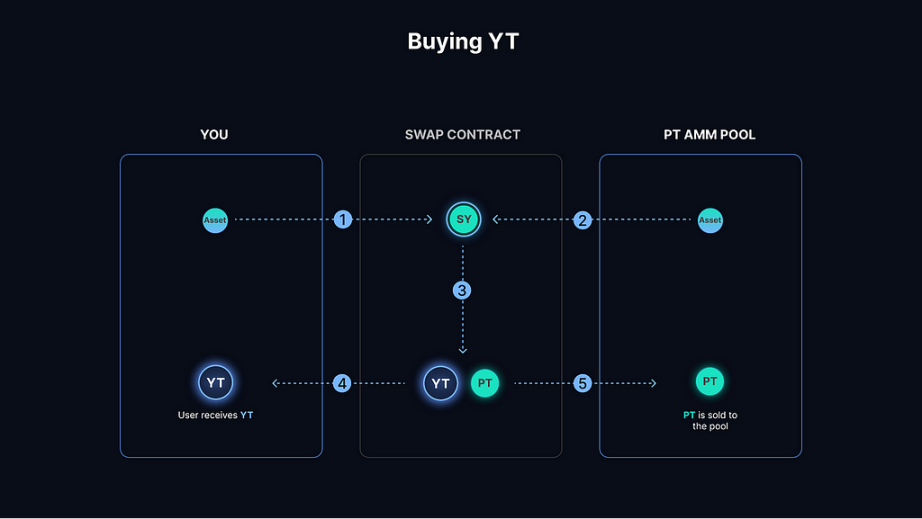

Both PT and YT can be traded via Pendle’s AMM—the core engine of the protocol. On Layer 2, Pendle uses Redstone as its oracle. The AMM enables efficient DeFi yield trading: traders seeking fixed income buy PTs, while those bullish on yield purchase YTs. The process for buying a yield token (YT) for a specific period is illustrated below:

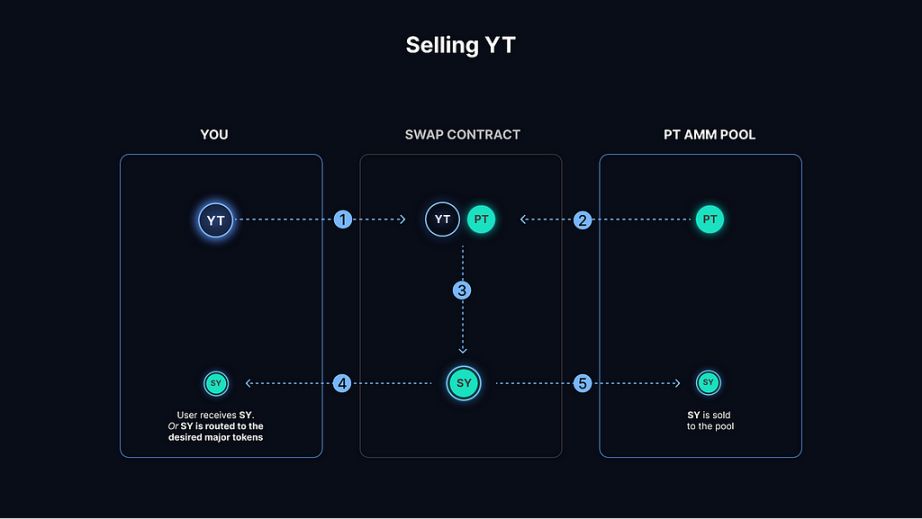

For users wishing to sell YT tokens, the process is as follows:

SY tokens act as intermediary assets in swap pools. Therefore, liquidity providers must supply YT-SY or PT-SY pairs. SY represents a standardized yield token compatible with a wide range of asset classes. This standardization enhances investor appeal by offering greater flexibility and access to more assets, potentially attracting more participants and improving liquidity—hence the choice to use SY as the intermediary in LP pools.

Liquidity providers earn returns through several channels:

-

Swap fees generated by the pool

-

PENDLE token incentives

-

Protocol incentives from the underlying asset (e.g., $COMP, $AAVE)

By separating the yield component (YT) from the principal (PT), Pendle allows investors to independently trade and manage these two elements. This separation mechanism introduces unique pricing dynamics:

-

Separation of future yield: when purchasing a PT, you forgo any yield during the holding period, as that yield has already been tokenized into YT and may be owned by others. Thus, PT prices reflect this missing yield and typically trade at a discount to the full value of the underlying asset. However, the YT only reflects yield over a defined period.

-

Time value and risk considerations: investors buy discounted PTs expecting their value to rise over time and converge toward the underlying asset’s value at maturity. This expectation accounts for time value and the risk of holding until redemption.

Consider a simplified example illustrating how a PT (Principal Token) eventually converges to the price of its underlying asset (ST).

Assumptions: Underlying Asset (ST): A bond currently valued at $100 with a 5% annual yield, one year until maturity. Initial PT Price: Due to the separation of one year’s yield (represented by YT), the PT initially trades at $95.

Process: Yield Separation: On Pendle, the bondholder separates yield and principal, creating PT and YT. Since YT captures all expected yield over the period, the PT trades at a discount reflecting the absent yield. Time Elapses: As the bond approaches maturity, the PT’s value increasingly reflects the expected return of principal at redemption. Value Convergence: As maturity nears, the PT’s market value gradually rises, reflecting the expectation that holders will redeem it for the full face value of the bond. If the bond’s par value is $100, the PT should theoretically converge to $100.

Outcome: At maturity, PT holders can redeem their tokens for $100 in principal. Though initially purchased at a discount (e.g., $95), the PT’s value appreciates over time, ultimately reaching the full value of the underlying asset—$100. In trading, market participants speculate or hedge on future yields: selling YT smooths out future yield curves, locks in gains early, or expresses bearishness on future rates; buying YT signals bullishness on future yields. Buying PT implies a belief that yields will decline, allowing acquisition at a discount.

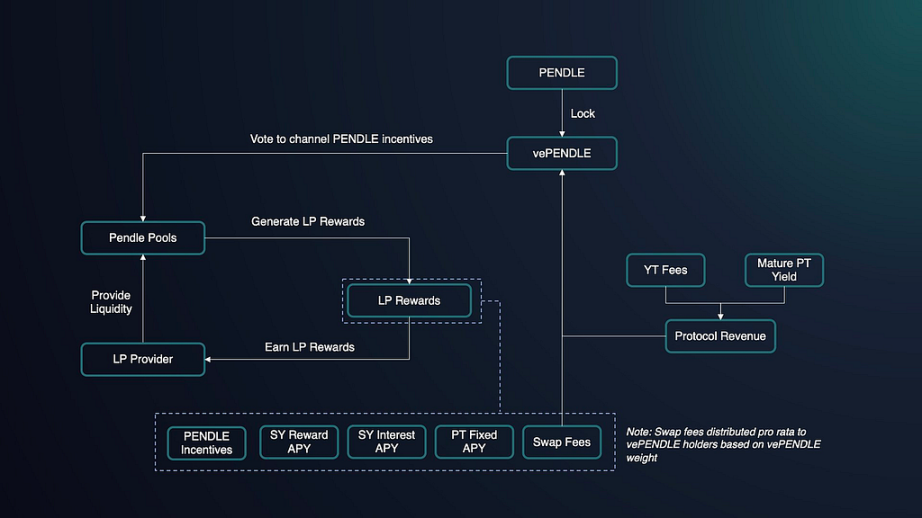

vePendle

Bringing TradFi-style interest rate derivatives on-chain for universal access, vePendle serves as Pendle’s governance system:

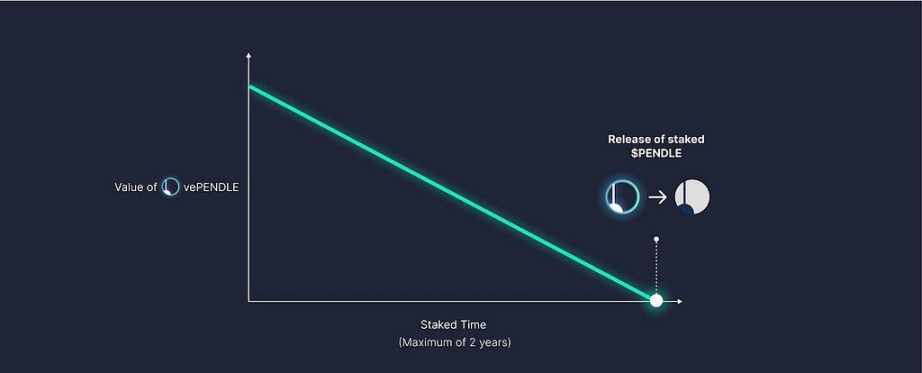

-

The longer PENDLE is locked, the higher the corresponding vePendle value.

-

vePendle value decays over time, but locking duration can be extended to offset decay.

-

More vePendle means greater voting power. After voting for a pool, holders are entitled to 80% of that pool’s swap fees.

-

vePendle holders also receive a share of protocol revenue derived from swap fees and YT fees.

4.3 Ecosystem Development and Data

Due to the existence of ST tokens, Pendle’s ecosystem includes:

Penpie: A DeFi platform launched by MagPie, providing yield and vePendle incentives for Pendle users.

Equilibria: Converts idle PENDLE into ePENDLE and stakes it via ePENDLE vaults to earn yield.

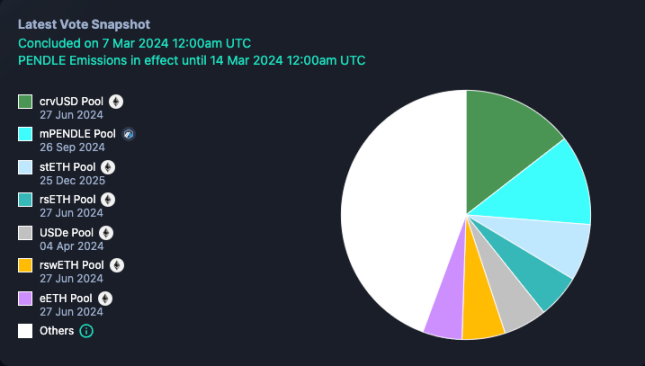

The chart above tracks PNP and EQB locked on Penpie and Equilibria, along with their ownership of Pendle’s governance token (vePendle). It shows the level of control held by vlPNP and vlEQB holders over the Pendle protocol. These holders direct how vePendle votes are allocated in governance proposals and weight measurements.

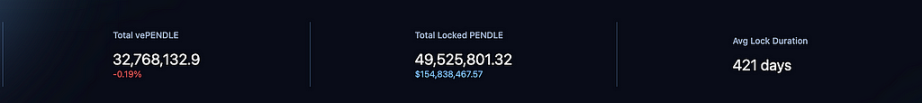

Penpie holds approximately 12 million vePendle, while Equilibria holds about 7.7 million vePendle. With a total of 32.7 million vePendle in circulation, Penpie controls roughly 36.7% of Pendle’s governance, and Equilibria controls about 23.5% (data as of March 2024).

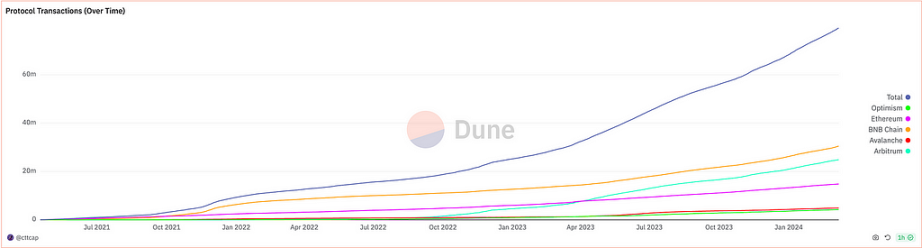

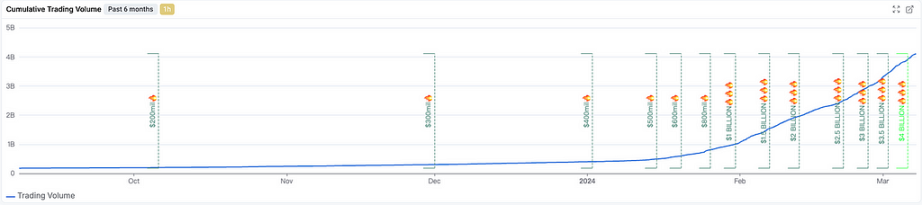

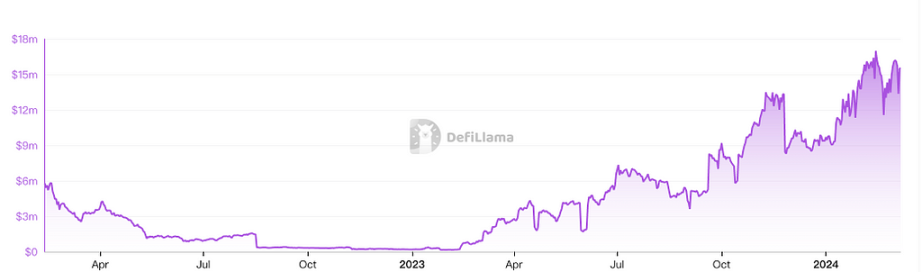

Transaction count and volume on Pendle show consistently positive growth, indicating rising market demand for interest rate derivatives as LSD, LSDFi, LRT, and restaking sectors evolve. As of March 7, 2024, cumulative trading volume exceeded $4 billion and continues to trend upward.

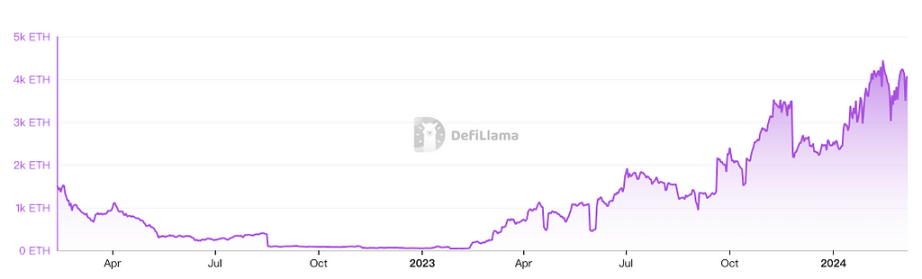

Regarding TVL, the project maintains its own AMM pools supporting swaps among SY, PT, and YT tokens. Both coin-denominated and USD-denominated TVL are trending upward.

With growing momentum in staking, demand for Pendle is expected to increase further—especially with institutional participation. Many institutions are now discussing Ethereum staking yields, generally believing that after ETH spot ETF approval, TradFi entities can earn active on-chain yields from staking ETH while charging custody fees to depositors.

This creates substantial demand for interest rate swap products like Pendle. Given its dominant position in the on-chain interest rate space, the integration of traditional interest rate products on-chain is a natural next step. Institutions will thus gain the ability to conduct interest rate derivative operations on-chain—unlocking a potential market with hundreds of trillions in transaction volume.

Currently, Pendle’s pool liquidity is steadily improving.

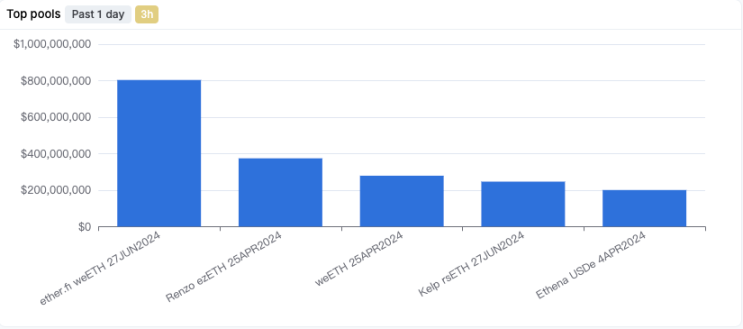

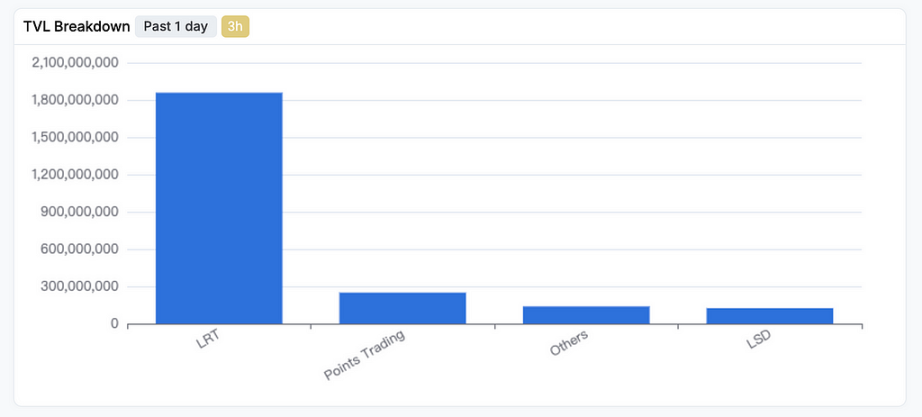

Most pools are currently centered around LRT-sector projects. With upcoming LRT token launches and continued growth in the staking sector, this space is poised to become a major industry focus with high growth rates. As leading LRT projects continue expanding their TVL, Pendle—which primarily supports LRT pools—will benefit directly.

4.4 Market Size and Potential

Interest rate derivatives (IDRs) represent the highest-volume category within derivatives. Derivatives are securities whose prices depend on or derive from one or more underlying assets, with values determined by fluctuations in those assets. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates, and market indices.

In TradFi, interest rate derivatives dominate the derivatives market. As TradFi evolves, the overall derivatives market continues to grow. By June 2023, the total notional value of derivatives reached $714.7 trillion, with interest rate derivatives accounting for $573.7 trillion—80.2% of the total.

Among interest-based derivatives, there are three main subcategories: interest rate swaps, forward rate agreements (FRAs), options, and other instruments. Within traditional IDR markets, interest rate swaps account for approximately 81.2% of market share.

In TradFi, interest rate swaps are primarily institution-driven and involve extremely large transaction volumes. An interest rate swap is a financial derivative allowing two parties to exchange interest payment obligations—typically between fixed and floating rates. Interest rate swaps are widely used in financial markets, with key participants including:

-

Banks and financial institutions: Use swaps to manage interest rate risk, adjust interest rate profiles on balance sheets, and optimize capital efficiency. Financial institutions also use them for arbitrage and hedging.

-

Corporations: Use swaps to hedge against changes in borrowing costs. For example, if a company anticipates rising rates, it might enter a swap to pay a fixed rate and receive a floating rate, locking in its interest expenses.

-

Investors and hedge funds: Use swaps as investment tools or risk management strategies—profiting from interest rate predictions or hedging interest rate exposure in other investments.

-

Governments and public agencies: Use swaps to manage debt portfolio costs and risks. Swaps help better align funding needs with debt servicing costs while reducing the impact of rate fluctuations.

-

Central banks: While not routine, central banks may occasionally participate in swap markets to influence short-term rates as part of monetary policy.

In traditional finance, interest rate derivatives are the largest category of derivative trading, with interest rate swaps capturing 82% of the IDR market. In contrast, on-chain interest rate swaps remain in the earliest developmental phase. Pendle, as the leading project, specializes in on-chain interest rate swaps for Ethereum.

With increasing institutional adoption—particularly from Grayscale, JPMorgan, and BlackRock showing interest in Ethereum staking—significant arbitrage opportunities emerge in TradFi, highlighting Pendle’s strategic relevance in the current landscape.

Current yield-tokenizable assets and their market caps:

-

Ethereum liquid staking tokens (e.g., wstETH): Approximately 26% of ETH is staked, all of which can be tokenized. The total TVL of LSDs currently stands at $59.7 billion.

-

Tokens representing lending protocol positions (e.g., Compound or Aave): For instance, DAI staked in Compound becomes cDAI, which carries its own APY. This stable yield market is vast, with lending protocol TVL around $34.3 billion.

-

LP tokens (e.g., GMX’s GLP): Whether GMX or GLP, any staked position carries its own yield. Almost all DeFi projects offer yield on LP tokens.

-

Liquid restaking tokens (LRTs) and restaking tokens: As of now, EigenLayer, Renzo Finance, and others collectively hold $17 billion in TVL.

Overall, the ceiling for this sector is extremely high. As traditional institutions progressively enter the space, demand for Pendle will naturally strengthen.

Potential institutional use cases include:

-

Fixed-income generation, e.g., earning fixed yield on stETH;

-

Bullish yield exposure, e.g., betting on rising stETH yields by purchasing more YTs;

-

Earning higher returns without additional risk, e.g., providing liquidity using your stETH.

For example, during the EigenLayer restaking cycle, as more users join, future yields are likely to decline. At current high-yield levels, users can sell YTs to lock in high APY early. From an institutional perspective, they can also lock in stETH staking yields to hedge against declining on-chain activity and falling yields.

5. Token

5.1 Total and Circulating Supply

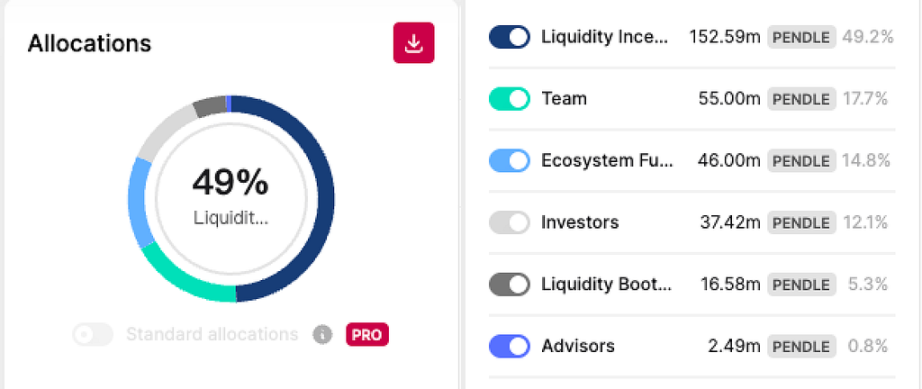

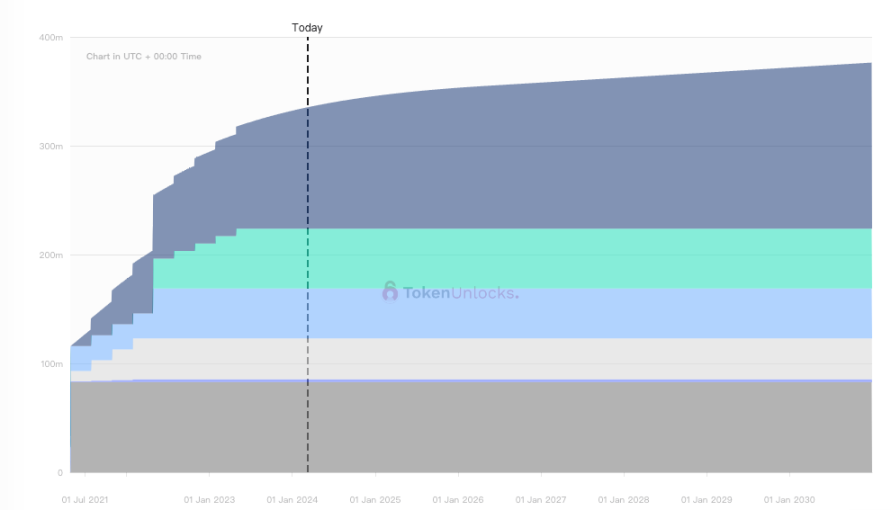

As of March 7, 2024, according to Coingecko, the total token supply is 258,446,028, with 96,950,723 currently in circulation. The current market cap is $298 million, with an FDV of $790 million. Liquidity incentives account for 49.3% of the total supply, the team holds 17.7%, and investors hold 12.1%.

Liquidity incentives are expected to continue until the end of 2030, with the official assumption of a 2% annual inflation rate, decreasing by 1.1% weekly until April 2026. The token release schedule is shown above. We estimate that by May 1, 2025, approximately 270 million tokens will be in circulation. Overall supply growth is moderate, unlikely to negatively impact token price during a bull market.

5.2 Tokenomics

PENDLE tokens are primarily used for governance and staking, known as vePendle. By utilizing vePENDLE, token holders unlock enhanced utility features.

The value of vePendle is proportional to the amount and duration of PENDLE staked. vePENDLE value decays over time. vePENDLE holders vote and direct reward flows to different pools, effectively incentivizing liquidity in the pools they support.

Pendle charges a 3% fee on all yield generated by YTs. Currently, 100% of this fee is distributed to vePENDLE holders, with no portion retained by the protocol. Additionally, vePENDLE voters are entitled to 80% of swap fees from the pools they vote for, forming the voter APY. The chart above shows recent voting distribution, with the crvUSD pool receiving approximately 44% of votes. As of March 7, 2024, a total of 49.52 million PENDLE tokens are locked, with 32.76 million vePendle tokens issued, averaging a lock-up period of 421 days.

5.3 Market Performance and Outlook

Pendle’s primary liquidity pools are LRT-focused, so analysis centers on LRT-based tokens.

These are LRT tokens, built upon restaking and LSD tokens. The restaking market currently holds $11 billion, while LSDs hold $55.1 billion—both growing alongside ETH price appreciation, LSD sector expansion, and increasing institutional adoption of staking, broadening the overall market opportunity.

Currently, LRT tokens represent a $66 billion market opportunity. For Pendle, this means massive growth potential within the LRT space alone. Beyond that, Pendle also supports yield-generating tokens like those from Compound, and will soon introduce off-chain interest rate swap products via Pendle v3, launching this year.

From a price trend perspective, Pendle’s token movement aligns with developments in the staking sector. The token has reached new all-time highs, yet its market cap remains only $300 million (price $3.11), with a fully diluted valuation of ~$800 million. By May 2025, due to vesting mechanics, the effective FDV will be closer to $300 million—suggesting substantial upside potential.

5.4 Profitability Forecast

Pendle’s token price has broken past highs, suggesting upside potential may be unbounded. Its primary underlying assets are LRTs. If the current total LRT market cap is $5.7 billion, and Pendle’s TVL is $2.37 billion—including major tokens like EETH (from ether.fi) and WETH—this forms a solid base.

If the overall TVL of LRT projects grows fivefold, Pendle’s TVL could also increase five times. Combined with the planned 2024 launch of traditional interest rate markets on-chain and growing TradFi demand for yield smoothing and risk hedging via Pendle, the project’s upside potential becomes even greater.

6. Value Assessment

The project is maturing, but the team continues refining its economic model, enhancing liquidity, and exploring ways to bring traditional interest rate swaps on-chain. We believe Pendle has the potential to become the Uniswap of the interest rate derivatives space—a market far larger than spot markets due to dominant institutional participation and massive trading volumes.

Its competitive advantage lies in being the undisputed leader in on-chain interest rate derivatives, with a self-sustaining ecosystem and absolute dominance in a nascent sector.

In the medium to long term, not only will on-chain spot markets thrive, but staking and restaking sectors will also grow rapidly. With increasing institutional interest in TradFi, on-chain derivatives markets will accelerate—and Pendle remains the only viable solution today.

7. Conclusion

Pendle is a blockchain project focused on yield tokenization, enabling users to lock in the future yield of their crypto assets and receive returns upfront. This innovative approach not only provides crypto holders with a new income stream but also introduces greater liquidity and flexibility to interest rate markets. Pendle achieves this through smart contract technology, enabling decentralized and secure market participation.

Key investment highlights for Pendle include:

-

Massive market potential. Interest rate swaps are primarily institutional products dominating the derivatives space, with interest rate derivatives taking 80% of the derivatives market and interest rate swaps alone capturing 80% of that. Trading volumes are enormous, yet on-chain this space has only just begun with Pendle leading in a very early stage.

-

Strong overall performance metrics—trading volume, TVL, and token price have all hit new all-time highs.

-

Growing institutional trend into staking—banks, hedge funds, mutual funds, ETF issuers, and ETF brokers all require interest rate risk hedging tools.

-

The v3 version will bring traditional interest rate swaps on-chain, opening access to a multi-trillion-dollar market. We look forward to Pendle’s future performance.

Although Pendle currently depends on the LRT sector, which still has multiple-fold growth potential, it may gradually reduce its LRT dependency over time. Fundamentally targeting the entire market’s interest rate swap space, Pendle requires institutional participation to diversify its asset base—indicating a strong mutual dependency between Pendle and institutions. This makes it a highly valuable investment opportunity, warranting close attention from investors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News