TON: The Essential Chain for Telegram to Become the WeChat of Web3

TechFlow Selected TechFlow Selected

TON: The Essential Chain for Telegram to Become the WeChat of Web3

Backed by Telegram's nearly 900 million monthly active users, the public blockchain TON has stood out from the crowded multichain landscape due to its deep integration with Telegram.

Authors: Ian, Vivi, Betty, Xinwei, Severin, Momentum Capital

In recent years, we have witnessed the emergence of various Layer 1 blockchains such as Ethereum, Polygon, Solana, and Aptos, most of which are pursuing high performance and EVM compatibility. However, apart from Ethereum, which has maintained continuous innovation through an active developer community and user base—spawning groundbreaking applications like Uniswap and Aave—other blockchains mostly keep replaying the same script: copying existing DeFi "trinity" products, attracting users and traffic from other chains via airdrops and high APYs, launching tokens on exchanges, building ecosystems, and driving up their native token prices. Chains become homogenized, products become repetitive, and user bases along with capital are largely "hired" through rewards or airdrops, making it impossible for real innovation to meet actual user needs. During bull markets, these blockchains appear prosperous due to bubble effects; yet when bear markets arrive, the tide recedes and reveals who’s been swimming naked.

Recently, whether in ZK, account abstraction (AA), or Layer 2 solutions, there's a growing trend toward chasing technology over tangible products, recycling familiar narratives—new bottles for old wine—and achieving a certain level of hyper-competition. Moreover, liquidity fragmentation across L2s is becoming increasingly severe.

In this sea of red competition among public chains, what’s not lacking is high performance or compelling narratives—but rather genuine users who truly need to use blockchain. TON, a blockchain backed by Telegram’s nearly 900 million monthly active users, stands out from the crowded field thanks to its deep integration with Telegram. With vast global user and developer reach, Telegram is no longer content being just a social messaging platform. Through an expanding suite of products (DApps) and integrating payments into everyday life scenarios, it aims to transform into a super app similar to WeChat. If Telegram is the WeChat of Web3, then TON is its indispensable underlying blockchain.

Recent Highlights of TON

In February, Telegram founder Durov openly announced the official sales channel for TON tokens in his personal channel, further solidifying the implicit but clear relationship between TON and Telegram.

Telegram Ads Platform Using TON

The Telegram advertising platform will officially open to advertisers in nearly 100 new countries, allowing channel owners in these regions to earn 50% of the revenue generated from ads displayed in their channels.

Officially, to ensure fast and secure ad payments and withdrawals, TON Blockchain will be exclusively used. The platform will share ad revenue with channel owners, creating a virtuous cycle where content creators can cash out their Toncoin or reinvest it to promote and upgrade their channels.

Fish

The first meme coin on TON, fairly launched with over 22,000 holding addresses, currently valued at $47M, surged 14x in March, and has partnered with several projects including TonRaffles, Tonano, Tap Fantasy, RoOLZ, and Catizen.

Telegram to Go Public Soon

According to the UK Financial Times, Telegram founder Pavel Durov revealed that Telegram now has 900 million active users and is approaching profitability, generating hundreds of millions in revenue annually, with plans to go public either this year or next. The U.S. could be a potential listing location. In the IPO, Durov stated that Telegram may consider offering stock allocations to loyal users.

Telegram has raised about $2 billion in debt financing, including a $1 billion bond issued in 2021 and additional bonds of $750 million and $270 million last year. If the company goes public before the end of March 2026, bondholders will be able to convert their senior unsecured debt into equity at a discount of 10% to 20% off the IPO price.

Introduction to TON

The Open Network (TON), formerly known as Telegram Open Network, was created by Telegram in 2018 to build a powerful and scalable blockchain platform. Its token $Grams completed the highest-funded ICO in history. However, due to SEC allegations of conducting unregistered securities offerings, Telegram team agreed in 2020 to pay an $18.5 million fine and returned funds raised during the ICO, subsequently abandoning the Telegram Open Network project.

Afterward, the Telegram Open Network was continued by a community called NewTON. In May 2021, the community voted to rename the long-running testnet 2 as Mainnet; NewTON Community became the TON Foundation, a non-profit organization supporting and developing TON; and Telegram Open Network was renamed The Open Network.

Currently, the TON Foundation is the main force driving TON’s development. It protects community interests by supporting initiatives aligned with the mission of an open network, while fostering TON project growth without controlling the technology itself. The TON Foundation currently has over 50 members, more than half from Russia, Ukraine, and neighboring countries, spanning business development, engineering, marketing, finance, and legal fields. Most employees have prior experience at VK and Telegram. Notably, Andrew Rogozov, a core founding member of TON Foundation, was the former CEO of VK.com—the social network founded by Telegram’s founder in Russia—where Durov himself served as the first CEO. Other notable members include Bill Qian, former head of M&A at Binance and Binance Labs, and John Hyman, former chief investment advisor at Telegram.

Development Status and Current State of TON Chain

TON aims to provide easy-to-use tools and reliable, stable infrastructure to make mass adoption easier. Although TON listed on exchanges back in 2021 and later rolled out key infrastructure and features such as TON Pay, Storage, DNS, and cross-chain bridges (official bridges support TON/ETH and BSC), it wasn’t until July last year—when bots like Unibot and Bananagun gained popularity—that TON began drawing widespread attention. At the Token 2049 event in September, Telegram officially announced its partnership with TON and launched TON Space, a self-custodial crypto wallet integrated within Telegram, marking a peak moment for TON. Since then, TON’s price rose from $1.2 in August last year to $3.8 (a 215% increase), entering the top 20 by market cap and emerging as a standout performer even amid a bear market. Now, despite some cooling in hype, as the only blockchain officially supported by Telegram and backed by Telegram’s 900 million active users, TON is set to unfold a completely different narrative—distinct from the usual race among existing chains focused on performance (TPS), MEV compatibility, and storytelling—by emphasizing payments, social interactions, mini-programs, and more.

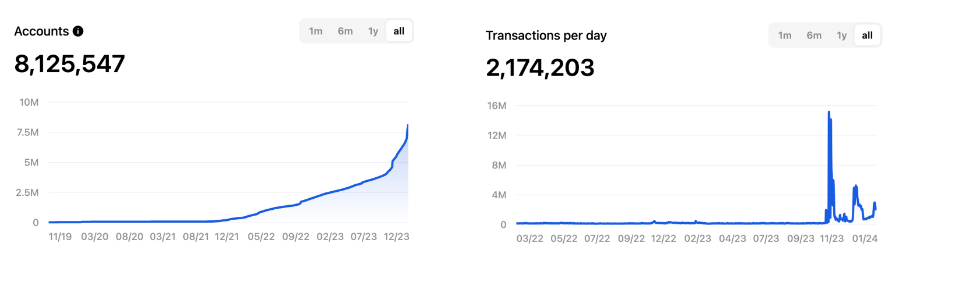

As of March 20, 2024, TON has 301 validators, with a total of 440 million $TON staked under PoS across 29 countries. The number of on-chain accounts continues to grow steadily, reaching 8.12 million. According to official information from the Dubai conference, TON achieved a 2.5x growth in active user addresses over the past year, with daily transaction volume averaging around $220,000. Currently, TON’s TVL stands at $53.43 million, with 13 projects listed on DefiLlama. Beyond the TON chain, TON also includes TON Storage—a decentralized file storage system; TON DNS—which assigns human-readable names to accounts, smart contracts, services, and nodes; TON Pay—a micropayment channel enabling instant off-chain transactions; and TON Proxy—an anonymizing proxy service for hiding TON node IP addresses. Though TON has existed for five years, its grand vision has only just begun unfolding, and exploration by developers and users within this ecosystem is gradually accelerating.

Tokenomics

The initial supply of $TON was 5 billion tokens, with mining fully completed by June 28, 2022. $TON has no hard cap and grows at approximately 0.6% annually (~3 million tokens). After Telegram settled with the SEC in 2020, all circulating $TON tokens were placed in a special Giver smart contract available for anyone to mine, resulting in 98.55% of tokens being distributed through early PoW mining, leaving only 1.45% with the team. Unlike most early L1 tokens dominated by large capital holders, $TON is widely held by early miners, leading to a more decentralized distribution. To address concentration issues among early miners, in February last year, the TON community proposed freezing 1.08 billion $TON (~21% of total supply) across 171 inactive early wallets for 48 months. Including this frozen portion, TON’s total market cap would rank within the top 10 cryptocurrencies. After transitioning from PoW to PoS post-mining completion, the annual 0.6% inflation (~3 million tokens) is allocated to reward validators securing the network, though misbehaving validators risk having their stakes slashed. According to insights shared at the Dubai conference, TON intends to increase staking rewards to boost overall staking rates.

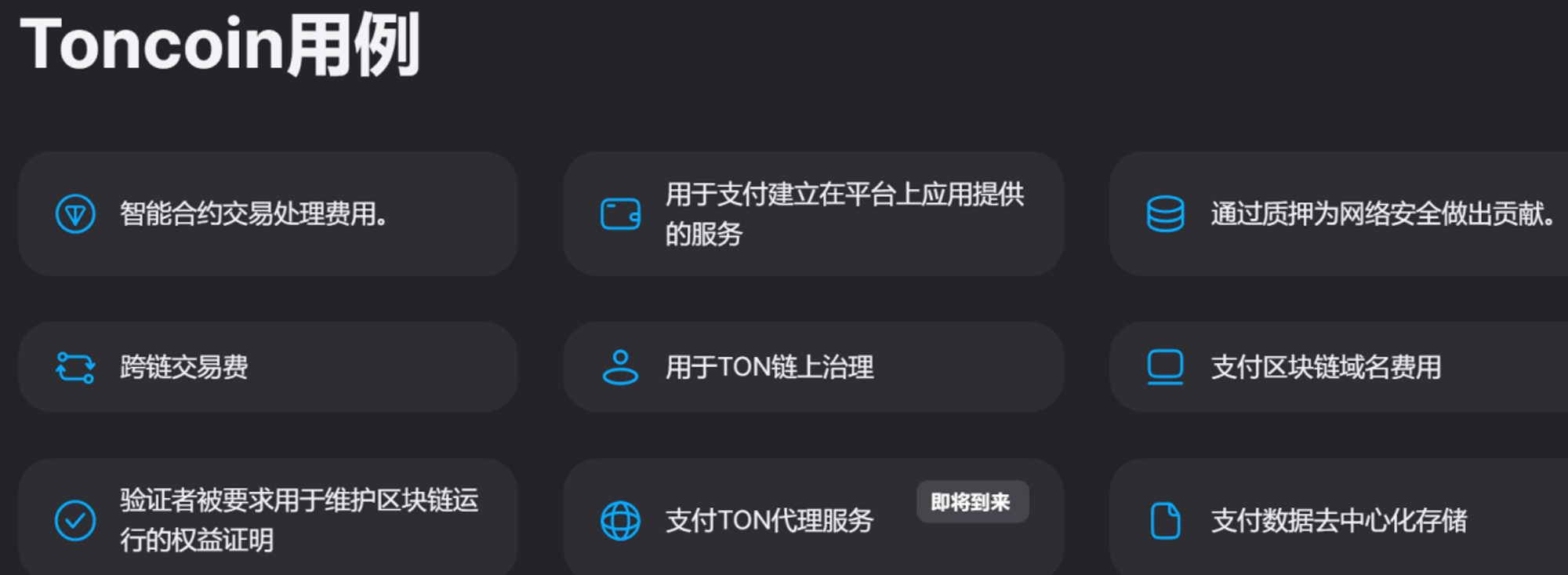

$TON serves multiple use cases, including transaction fees on the TON chain, staking, and cross-chain transactions. Future uses may extend to paying for TON Proxy services. $TON also functions similarly to fiat currency within Telegram, and its application within Telegram deserves particular attention. For instance, $TON can offer discounted rates for Telegram Premium subscriptions. Users can directly purchase $TON via credit card in the Telegram Wallet and then use $TON to buy virtual goods like anonymous accounts. Statistics show that $50 million worth of anonymous accounts sold out within one month of launch, accumulating $130 million in sales to date—highlighting significant payment potential for $TON. In the future, $TON might also be used for Telegram promotions, and advertising services could accept $TON as payment.

Additionally, $TON may eventually become deflationary as network usage increases. In June last year, the TON Foundation proposed introducing a burn mechanism: 50% of transaction fees generated from activities such as on-chain transactions, domain name auctions, and phone number auctions on the TON network will be used to burn $TON.

$TON Token Analysis

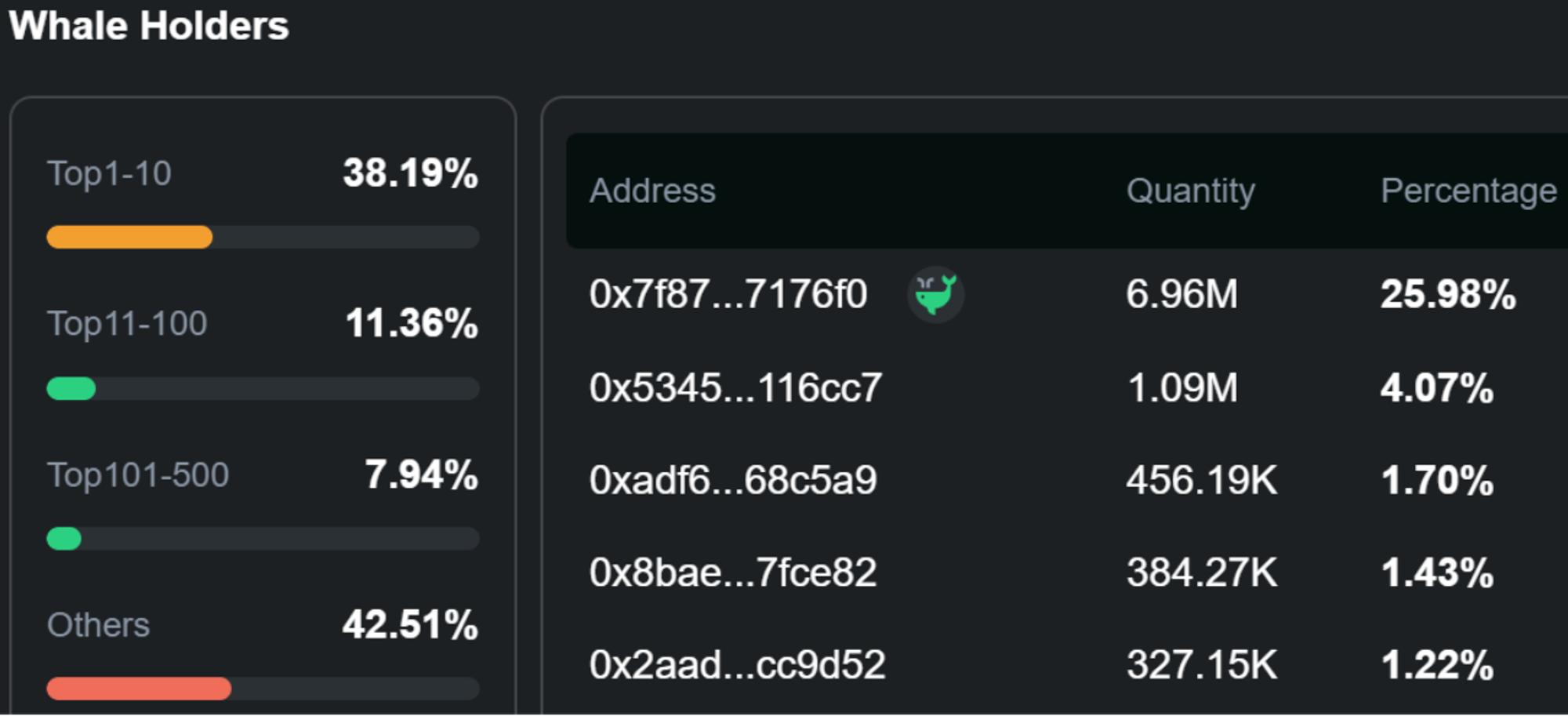

As of March 20, 2024, $TON has a total supply of 5.104 billion, with 3.469 billion in circulation, priced at $3.8 per token, FDV of $19.276 billion, market cap of $13.101 billion, ranking #13 globally. It is already listed on major CEXs including Bybit, OKX, Kucoin, Bitget, and Binance Futures. $TON has become the highest-ranked token not yet listed on Binance Spot. Given sufficient growth in visibility and user traffic, TON would likely become a top candidate for future Binance Spot listings. From a distribution perspective, the top 10 wallets hold 38% of total supply, while the top 100 wallets hold 49%, indicating relatively dispersed holdings and avoiding excessive pressure from institutional or project-team dumps. Additionally, TON launched the TON Believers Fund, locking over 1.317 billion $TON (~25% of total supply). The TON Believers Fund allows any $TON holder to donate or lock tokens for five years: two-year lock-up followed by three-year vesting, with donated tokens distributed as rewards starting in year three. Based on public data, 10.54% of tokens were donated to the TON Foundation by the community in 2022.

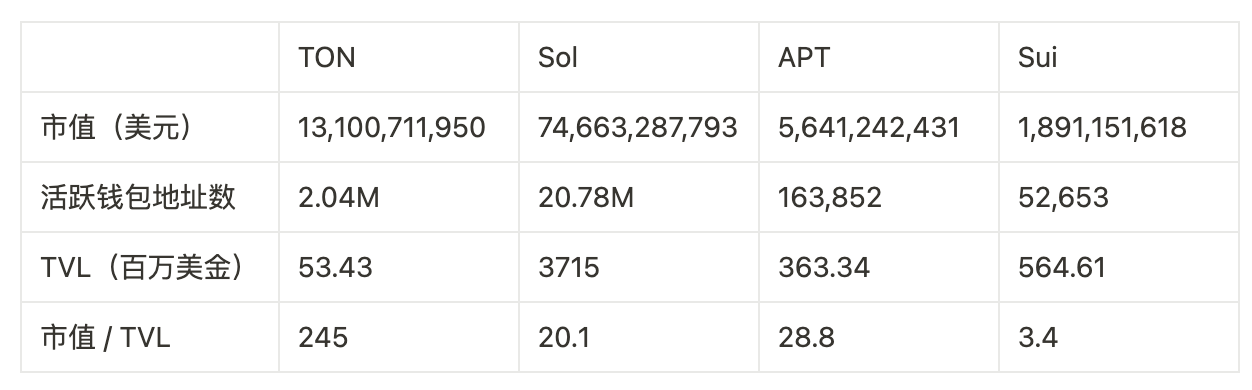

Compared to other mass-adoption-focused public chains, evaluating TON using conventional metrics like “market cap / TVL” suggests TON may be overvalued. However, as discussed below, TON’s value cannot be assessed using traditional L1 valuation models. Instead, it should be evaluated through the broader narrative of TON’s integration with Telegram—considering metrics like transaction volume and protocol revenue from DApps. Mass adoption cannot rely solely on DeFi’s profit-driven appeal, as evidenced by the declining TVL seen in chains like Avalanche and Fantom during bear markets. The key lies in low-barrier usability, integration with high-frequency daily-life scenarios, and massive traffic access points. This is precisely TON’s core competitive advantage—its deep integration with the Telegram ecosystem. The user experience enabled by TON and Telegram far surpasses most Web3 products. Comparable valuations could reference Web2 platforms like WeChat and WhatsApp, which offer similar ecosystem experiences. From this standpoint, TON’s current valuation of ~$7–8 billion remains undervalued. While we remain optimistic about TON’s long-term prospects and immense potential, achieving 5–10x returns on $TON likely requires waiting for the next major bull market.

Telegram's Grand Vision for Web3: TON's Central Role

Telegram Possesses Native Web3 DNA

Telegram is a cloud-based free instant messaging app founded in 2013 by Nikolai and Pavel Durov, founders of VK—one of Russia’s leading social media platforms. Telegram’s commitment to free speech and privacy protection has attracted a global user base, with over 1.3 billion registered users and nearly 800 million monthly active users (MAU). Telegram’s lenient content policies and regulatory environment have made it a critical hub for crypto—nearly every Web3/crypto project maintains a Telegram group for announcements, updates, and community engagement. Group activity on Telegram has become a key metric for measuring a project’s marketing strength. Over half of the largest Channels and Groups on Telegram are related to crypto content (as shown below, the two biggest groups on Telegram are both crypto-related). More importantly, according to the TON Chinese Channel, Telegram hosts over 37,000 active crypto communities.

Due to regulatory pressures, many real users migrated from Slack and WeChat groups to Telegram, giving rise to diverse service demands beyond simple chat—such as news, announcements, and large transfer alerts. Telegram responded promptly by enhancing its emoji system, launching Story video sharing, and introducing blockchain-powered anonymous login via virtual numbers (+888 prefixes). Furthermore, inspired by WeChat’s success as a multifunctional social platform serving broad audiences, Telegram seeks to evolve from a communication protocol into a social platform and ultimately into a large-scale integrated super app.

Moreover, Telegram’s open-source nature, rich APIs, and extensive database make it highly developer-friendly, attracting numerous developers to build apps on the platform.

From the above discussion, it is evident that Telegram has accumulated a vast, active user and developer base—laying the foundation necessary to build its own blockchain or even a unique, closed-loop blockchain kingdom. Combined with Telegram’s founder’s support for blockchain and desire to monetize Telegram via blockchain, TON and Telegram bots naturally emerged.

Telegram’s Web3 Triad: Wallet, DApp/Bot & TON

Wallet

WeChat’s success stems not only from its social features but also its financial capabilities—we can use WeChat for money transfers, split bills, ride-hailing, train ticket booking, online shopping, and recharging, covering countless aspects of offline and online life. In China, one can leave home with just a smartphone running WeChat. Internet network effects allow user counts to grow quadratically. Similarly, many crypto enthusiasts frequently use Telegram as a core communication tool with communities. As the crypto world expands, network effects amplify here too—Telegram has become an essential communication tool for both crypto users and projects, subtly evolving into a Web3 version of WeChat.

Just as mobile internet adoption in China relied heavily on WeChat Pay and Alipay, Web3 must develop from attracting new users toward mass adoption through entry points—crypto wallets—that are simple and secure! Such a wallet should not only enable free trading of digital assets like most existing wallets but, more importantly, link seamlessly with fiat currencies, allowing users to easily convert between fiat and crypto. The emergence of Telegram’s built-in non-custodial wallet @Wallet enables users to access and use @Wallet directly within the Telegram interface without leaving the app—perfectly meeting Web2 users’ needs. Its convenience and simplicity lower the entry barrier and learning curve for new Web2 users, positioning it as the preferred gateway for Web2 users entering Web3. Moreover, since @Wallet runs on mobile Telegram apps, and people spend more time on phones than PCs, @Wallet quietly shifts Web3 from desktop to mobile. No existing Web3 social solution solves the fundamental problem: requiring users to download another app—which is often the hardest step in mass adoption. The core logic behind Telegram’s built-in wallet is eliminating the need to install extra apps. It inherits trust from Telegram itself, making the final step simpler.

What features does @Wallet offer? @Wallet is Telegram’s built-in non-custodial wallet, similar to Alipay or WeChat Pay, accessible directly within Telegram chats without password input. Users can buy, receive, trade, and send cryptocurrencies via bank cards and easily pay for Telegram products and services using $TON, $USDT, or $BTC via Telegram bots. Additionally, @Wallet may evolve into a Telegram version of Yu’e Bao, integrating assets like government bonds to offer flexible cash management and wealth-building features.

In September last year, Telegram launched TON Space—a self-custodial version of @Wallet—directly integrated into the @Wallet interface within Telegram. Third parties cannot access user assets, and users can settle payments directly within TON Space without redirecting to third-party platforms, enhancing security, privacy, and Telegram’s own crypto-financial attributes. Unlike MetaMask or Trust Wallet, TON Space allows users to recover wallets using email or Telegram account credentials in addition to seed phrases, offering greater convenience and safety. Currently, TON Space resembles MetaMask, allowing users to receive, send, swap tokens, and view NFT holdings. However, opening DApps directly from TON Space is not yet supported but planned for future release. According to the team, TON Space will support integration with TON-based projects, enabling users to connect their Telegram accounts to TON ecosystem apps. The official version of TON Space is expected to launch in November outside restricted regions like the U.S. To help manage multiple wallet addresses, TON Space plans to support multi-address functionality. Additionally, TON will support transferring and displaying NFT collections, fulfilling Telegram users’ social needs. Considering information density, Telegram offers higher information immersion than WeChat, with denser private traffic—this will drive deeper integration between TON Space and Telegram’s payment and social scenarios, enabling finer-grained, high-density transmission of value, traffic, and information.

As discussed above, wallets serve as the traffic gateway for Telegram’s Web3 ambitions. But once users are onboarded, they need engaging experiences—just like replicating Telegram’s existing Web2 DApps in Web3 format. This gave birth to Telegram Mini Apps (tApp Centre) and Telegram Bots.

Telegram Mini Apps (tApp Centre) and Telegram Bots

Telegram Mini Apps are web applications running inside Telegram Messenger, introduced by the TON Foundation to meet user needs in gaming, content sharing, and productivity tools. They can be accessed easily from Telegram chats or group conversations. Telegram Mini Apps come in three main types—bots, games, and web apps—and fall into four functional categories: management, Web3, utilities, and gaming. Telegram Bots are automated programs operating via Telegram chat interfaces, allowing users to obtain information, market data, and interact with smart contracts—all without leaving Telegram.

At this point, readers may wonder how Telegram Mini Apps relate to Web3. These Mini Apps can be built using TON’s infrastructure and deployed via Telegram Bots for user access within Telegram. Developers benefit from reduced development difficulty, faster timelines, and access to TON grants, while gaining immediate exposure to Telegram’s massive user base—enabling rapid monetization through in-app purchases, subscriptions, or ads.

Telegram Bots act as the bridge between Telegram and these Mini Apps. With cumulative transaction volume exceeding $190 million by July last year and daily peaks reaching $10 million, the Bot sector demonstrates strong demand and real user engagement. From a user perspective, bots simplify actions like DEX trading, sniping airdrops, tracking specific wallet trades—all achievable with minimal effort directly within Telegram.

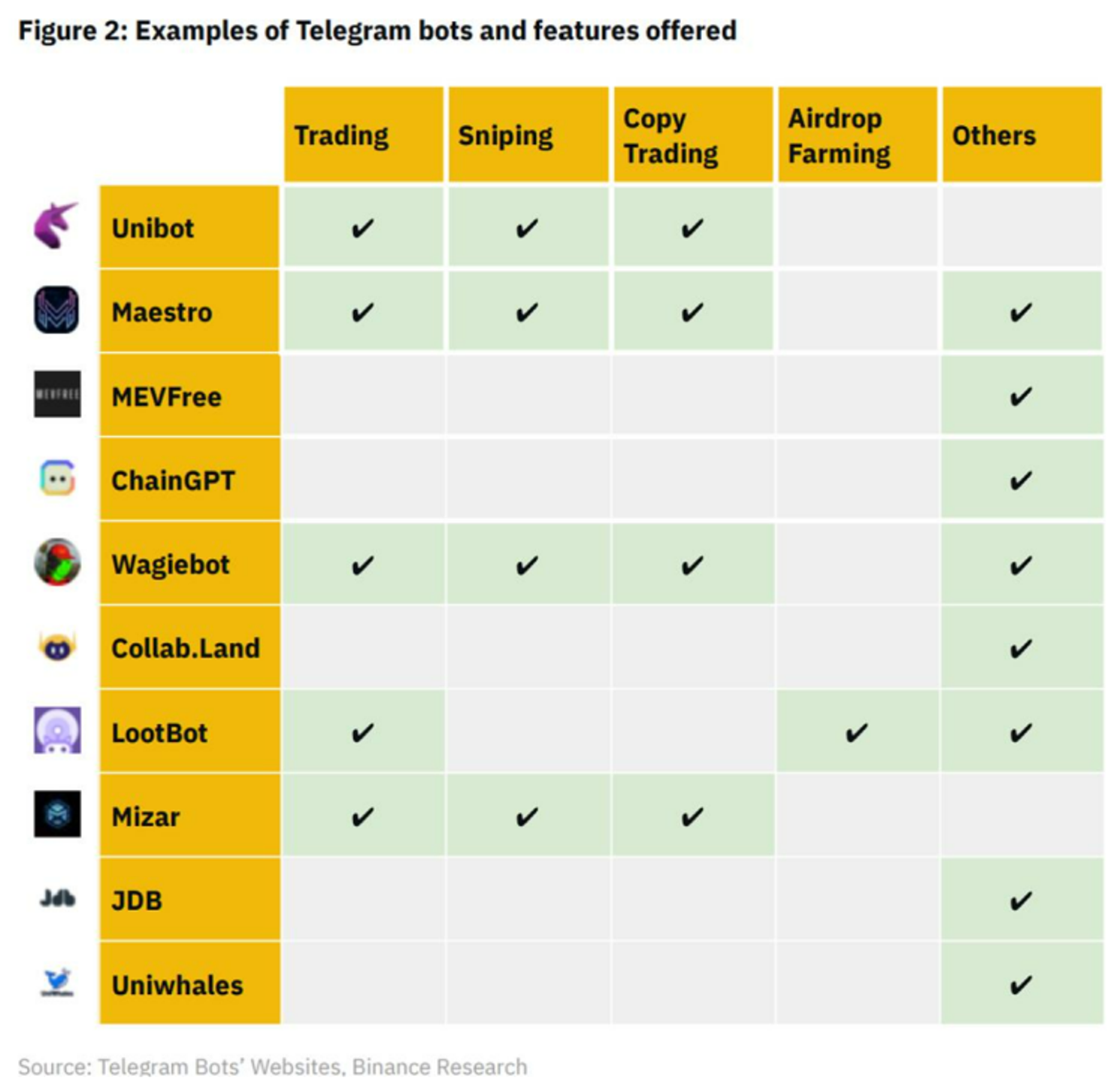

Current primary functions of Telegram Bots include:

1) Trading: Directly buying and selling tokens;

2) Airdrop Sniping: Monitoring new token launches and setting automatic buys;

3) Copy Trading: Mimicking other traders’ moves;

4) Airdrop Farming: Automatically performing tasks to maximize airdrop eligibility;

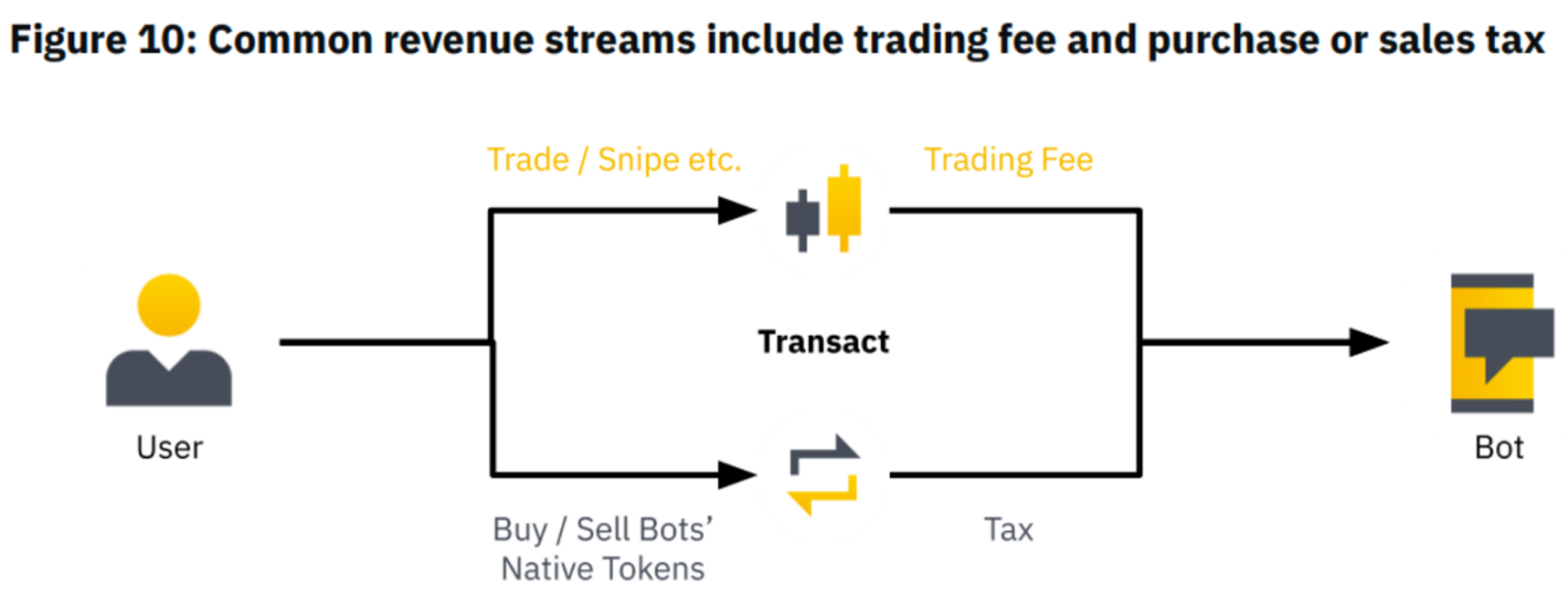

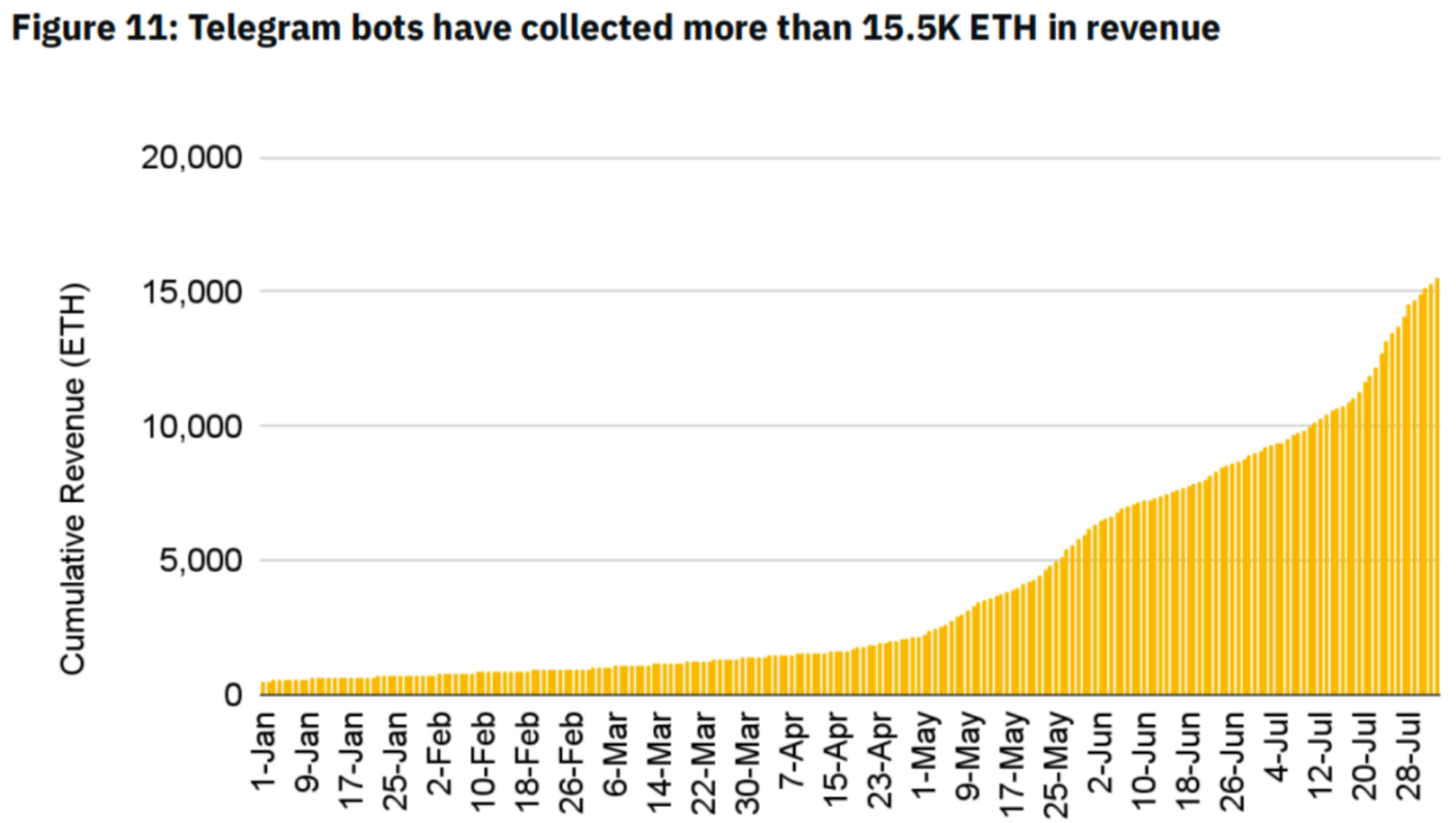

5) Finding optimal liquidity pools for specific tokens. According to Binance Research, Telegram bots generate revenue through trading fees and “taxes” on token trades. By July last year, Telegram bots had collected over 15,000 ETH (~$28.7 million) in revenue.

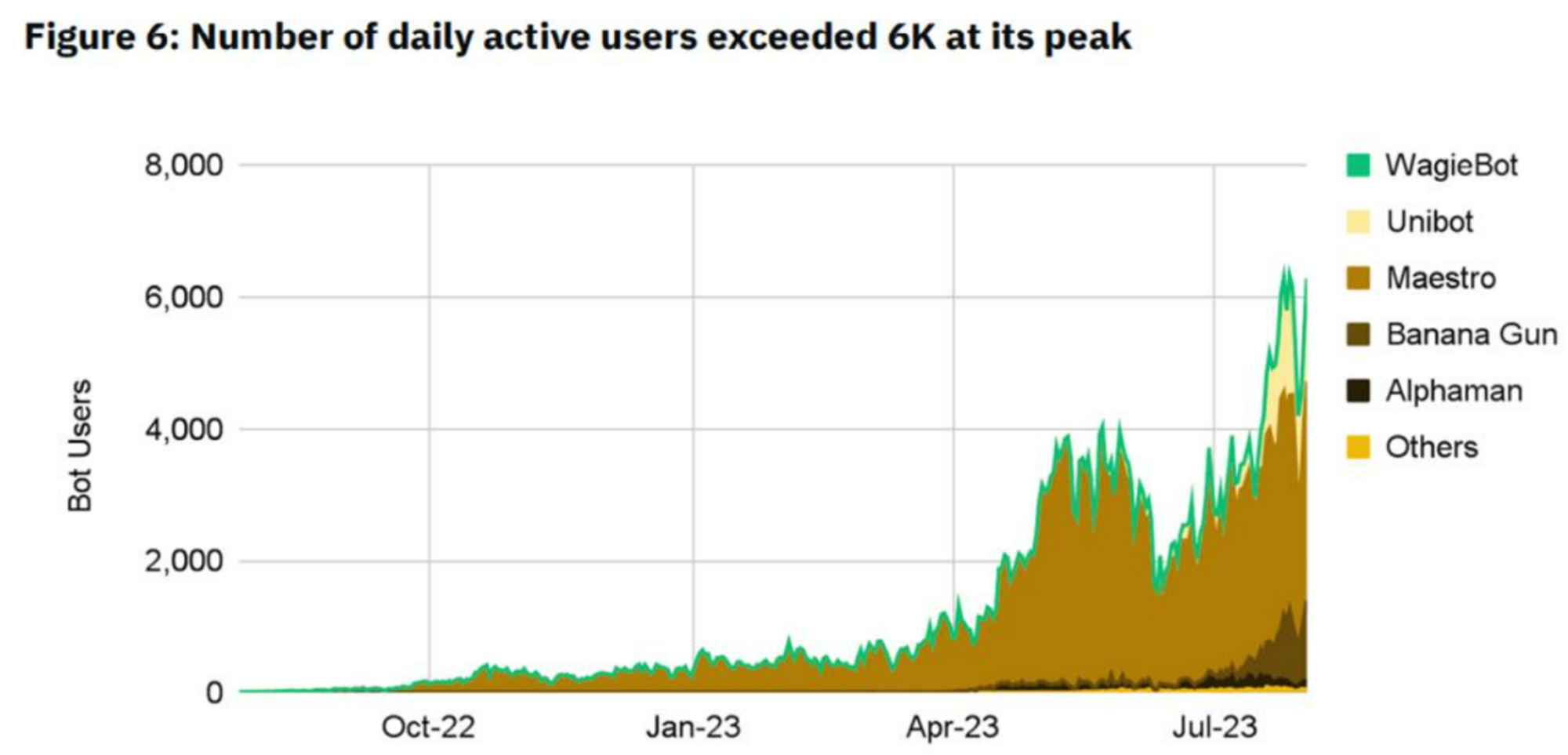

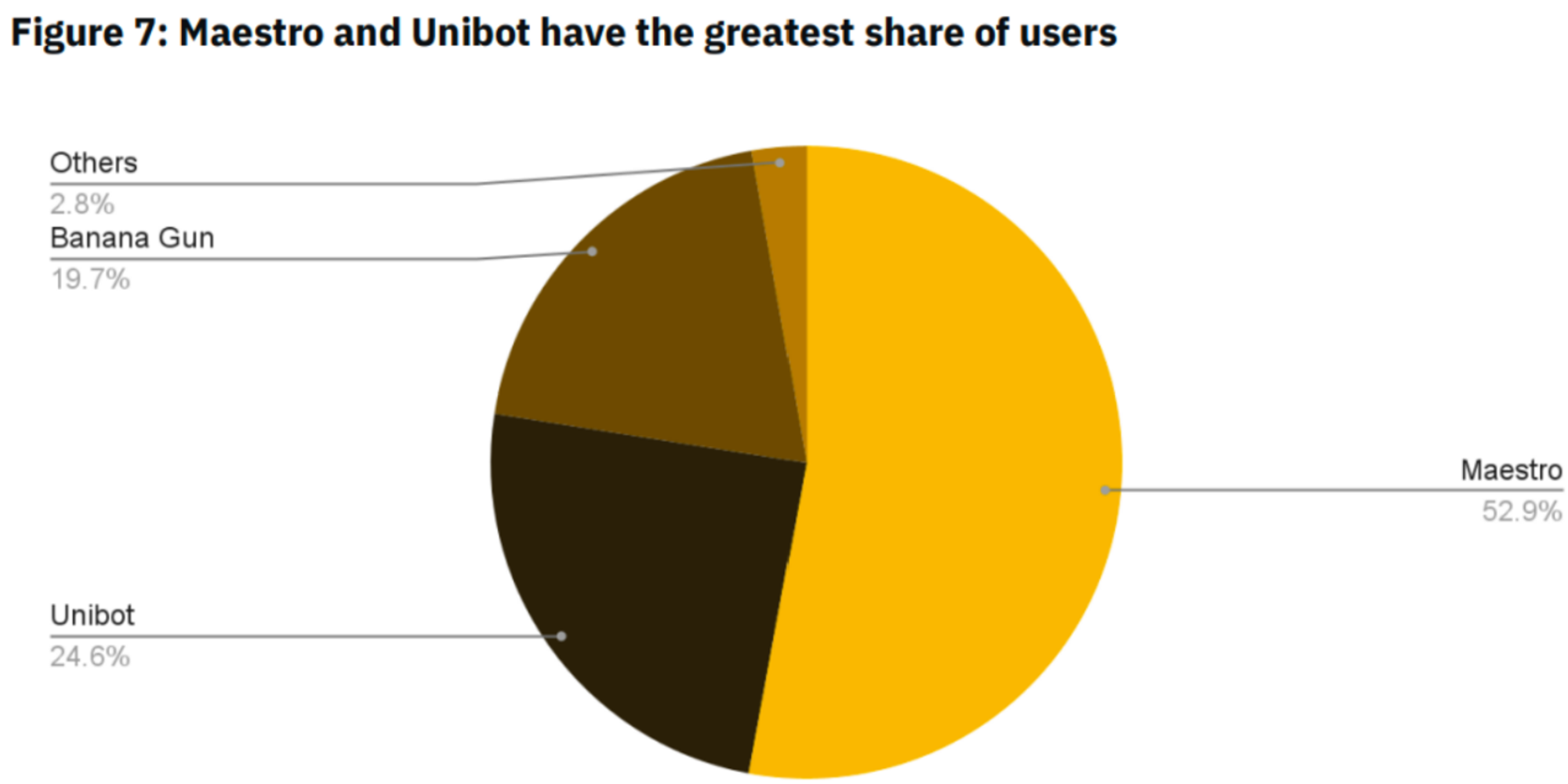

According to Binance Research, Telegram bots reached a peak of over 6,000 daily active users in July last year, with Maestro (~2,000–3,000 DAU) and Unibot (~1,700 DAU) being the most popular.

However, using Telegram bots carries inherent risks regarding security and privacy:

1) Like all Web2 apps, Telegram accounts face theft risks, and logging into bots requires no password, exposing bots to account compromise;

2) When transacting via bots, bots gain access to private keys, posing leakage risks;

3) Like all crypto projects, bot interactions expose wallets to smart contract risks;

4) Many users hesitate to send funds to bots.

Despite these risks, compared to existing DeFi frontends, Telegram bots offer a friendlier, more convenient user experience addressing substantial real-world demand. Backed by Telegram’s 800 million daily active users, the bot ecosystem holds immense potential. The use of TACT language and Blueprint framework lowers development barriers, fueling rapid proliferation of bot projects. The “Investment Opportunities – Bot” section below will analyze investment potential in the Telegram Bot space.

TON: Telegram’s Sole Supported Blockchain

Since inception, TON has maintained close ties with Telegram, with Telegram leadership showing unwavering support—for example, Telegram CEO Du Rove publicly stated he owns $TON in a July declaration last year.

(from public social media)

At the TOKEN2049 conference in Singapore last September, Telegram announced it will fully rely on TON as its blockchain infrastructure. $TON and its Web3 ecosystem will enjoy promotional advantages and priority access to Telegram’s global ad platform, Telegram Ads. The goal is to nurture and promote a TON-centric Web3 ecosystem within Telegram and integrate the Telegram wallet into an all-in-one platform meeting every user need.

Readers may ask: if Telegram bots already offer convenient Web3 access, why do we still need TON? Bots primarily serve as traffic conduits, linking users to DApps. As a TON Foundation representative noted, TON empowers developers to create products addressing real needs, deployable directly on Telegram. As a public chain, TON provides development tools and infrastructure, while DApps built on TON can be used within Telegram—creating a powerful flywheel effect. In short, TON enhances DApp usability. For example, using a TON wallet to open Telegram Mini Apps boosts user confidence. TON introduced TON Connect, a modern cryptographic standard allowing one-click login to services and apps via TON wallets—ensuring private keys never leave users’ devices, protecting privacy. Using TON Connect reduces concerns about entering private keys when using bots, thereby boosting bot and mini-app adoption. On the other hand, $TON offers Telegram a path to decentralization-based monetization. Given historical sensitivities, limited revenue streams (relying on founder funding and ~$1.2 billion raised through two bond issuances), Telegram seeks decentralized commercial avenues. Additionally, $TON gives individuals technological means to protect rights and freedoms, adding new dimensions to user communications atop transactions. For example, in July last year, the TON Foundation introduced encrypted messaging on the TON chain, using end-to-end encryption so only sender and receiver can view messages, costing 0.006 $TON per message. TON’s infrastructure and financial attributes are indispensable components of Telegram’s Web3 blueprint.

The Triad

As Halil Mirakhme, COO of @Wallet, clearly pointed out when discussing competitors like Signal, @Wallet’s edge lies in being supported by a platform like Telegram that fosters crypto-related social interaction and discussion. The seamless integration of Wallet, DApp/Bot, and TON creates a complete, closed-loop Web3 experience for Telegram users: starting with information exchange in Telegram groups/channels, moving to token trading via Telegram Mini Apps and Bots, and finally participating in TON ecosystem projects via @Wallet and TON Space.

Thus, we can envision Telegram’s grand Web3 landscape: Wallet acts as the gateway for Web2 users entering Web3; DApps capture and retain traffic; Bots bridge Wallet and DApps, simplifying operations; TON provides infrastructure, while $TON enables monetization. DApps developed on TON, in turn, empower Telegram, forming a powerful flywheel. The synergy of Wallet, DApp/Bot, and TON delivers a simple, convenient, censorship-resistant, and externally uncontrolled Web3 experience for users, while providing developers a fast-track platform to reach vast audiences with Web3 mini-DApps. Together, they enable Telegram to become not just a network, but a decentralized digital nation—with its own economy, citizens, digital property rights, currency, free market, communication infrastructure, and many other services.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News