Opinion: In crypto venture capital, what matters is seizing the narrative advantage early

TechFlow Selected TechFlow Selected

Opinion: In crypto venture capital, what matters is seizing the narrative advantage early

The cryptocurrency market focuses on project visibility rather than cash flow; the optimal investment strategy is to anticipate topic areas likely to gain popularity in the next one to three quarters, rather than pursuing traditionally defined "contrarian investments" in stagnant projects.

Written by: @reganbozman

Translation: Baicai Blockchain

In venture capital circles, the widely accepted view is that profits are made by holding contrarian yet correct positions.

However, in crypto venture capital, this view is absolutely wrong—the only thing that matters is whether you can anticipate the direction of market sentiment ahead of time.

Below are some messy thoughts on what we might call the memetic economy:

1. Contrarian Investing

In venture capital, being logically correct is usually not enough—if many other investors hold the same view, the market will price it in.

This view more or less applies the efficient market hypothesis to private markets.

Let’s take B2B enterprises as an example for deeper analysis—they are the largest category in venture capital and also the easiest to value.

Typically, venture-backed B2B companies:

(a) have few tangible assets, and

(b) are growing rapidly.

Therefore, we can assume their valuations are based on future cash flows.

Clearly, this isn’t always true—in booming markets or sectors, investors are willing to pay higher prices for a given set of cash flows—but I believe this directional logic holds.

A “contrarian investor” is someone who opposes or rejects prevailing opinion. Thus, in venture capital, being contrarian essentially means identifying the biggest gap between market expectations of a startup’s future cash flows and its actual future cash flows.

When you hear seasoned VCs on podcasts recounting how they discovered a $10 billion company early on, there’s often a story about how the company’s first funding round was poorly received.

The investor made the right contrarian bet. In practice, there are several ways to make contrarian VC investments:

(a) Invest in overlooked geographies or verticals.

(b) Know something others don’t.

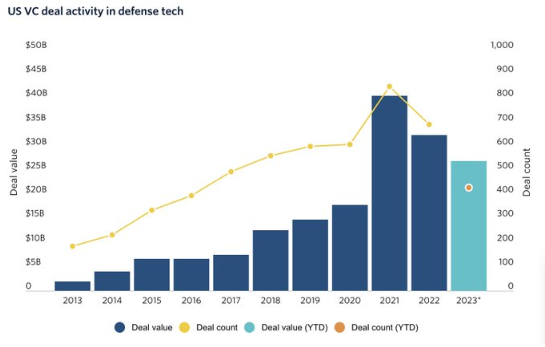

I think option A is much easier than option B, hence far more common. For instance, defense tech has long been out of favor among investors.

If you foresaw the sector’s growth potential, you would have been handsomely rewarded. There are many reasons people dislike it—limited customer base, extremely difficult sales cycles.

As the sector’s potential becomes clearer, more players enter, increasing competition. It’s probably harder to generate returns now than back in 2017 or when Anduril raised its seed round.

Deals are more expensive, companies face more competitors, etc.

In venture capital, being “right” typically means a liquidity event occurs—a company goes public (IPO) or gets acquired.

If you invest at the seed stage, you usually (though not always) need large funds to follow on afterward, since scaling a company typically requires substantial capital.

All these market participants focus, more or less, on future cash flows.

Of course, there are exceptions.

Certain intellectual properties (IPs) may not currently be profitable—or may never be.

Acquisitions can be strategic rather than purely financial.

But overall, CREAM—Cash Rules Everything Around Me.

If you make a contrarian seed investment in an under-the-radar industry and turn out to be right, sometimes that niche becomes red-hot.

For example, Anduril is likely to become a $10 billion company, and seed investors will earn solid returns.

For this reason and many others, defense tech is becoming increasingly popular. Yet popularity isn’t a prerequisite for profitability.

If you back an agricultural machinery SaaS company in Iowa whose annual recurring revenue (ARR) reaches $100 million, someone will acquire it—and you’ll earn strong returns.

You don’t need Iowa or ag-machinery SaaS to become trendy.

Take Kaspi.kz, a fintech app from Kazakhstan that went public last year with a $20 billion market cap.

That was an excellent outcome for early investors.

Kazakhstan may still be an inactive market for venture capital, but Kaspi generates billions in annual revenue—so it doesn’t matter.

2. Differences Between Crypto and Traditional Markets

Many people ride their Rivians from Sand Hill Road or Wall Street into crypto and fail spectacularly because these markets operate differently:

-

Different market participants

-

They value different things

If you’re making seed-stage venture investments in startups, you care about:

-

People who can increase the value of your stake (later-stage VCs)

-

Potential acquirers (exit liquidity)

-

Public market investors willing to buy shares upon listing

If a company generates cash flow, that represents a massive opportunity. But if you’re making seed-stage venture investments in crypto, you care about:

-

Those who can increase the value of your asset (later-stage VCs)

-

Retail investors willing to buy tokens in open markets (exit liquidity)

While there are some later-stage investors, they’re few in number.

Over the past twelve months, only 11 funds led or co-led funding rounds exceeding $10 million.

Later-stage VCs are extremely scarce.

This makes token performance in public markets far more critical, because crypto startups cannot remain private for a decade like traditional VC companies.

Given the relatively small growth-stage capital markets in crypto, public market participants become even more important.

Yes, some institutions trade crypto, but excluding Bitcoin (BTC) and Ethereum (ETH), what percentage of tokens do you think is held by retail investors?

Over 80%.

Therefore, your ultimate liquidity comes from retail investors.

Whatever you do at the seed stage, you must ensure, more or less, that retail investors will be excited to buy your token in open markets.

This source of final liquidity represents a fundamentally different market from traditional venture capital.

This leads to the second key difference between crypto and venture capital: What does the crypto market value?

Here’s a hint—it’s not cash flow.

The crypto market values attention. What does attention mean?

It means you’re part of the current narrative.

It means the crypto community is talking about you.

It means retail investors want to own your token.

It means your community is creating fun memes.

It means other projects want to form “partnerships” with you.

Look at DEPIN and $HNT. Being an industry leader helps embed you into the narrative—arguably more important than actual cash flow. Maybe this won’t be how these markets operate forever, but it’s how they function today.

You can easily observe this via DEPIN Ninja, or by reviewing the top 100 tokens on Coingecko and looking for correlations between FDV (fully diluted valuation) and cash flow. But none exist.

Earlier, I mentioned that in venture capital, success in an unconventional category doesn’t require the category itself to become trendy.

If a company generates stable cash flow, investors will notice. Obviously, this logic doesn’t apply in a market that doesn’t value cash flow.

In an attention-based market, you absolutely need your invested category to become popular at some point.

Therefore, the best venture strategy is to try to predict the evolution of narratives. What does “anticipating narratives early” mean? Getting in before everyone else.

This is somewhat contrarian, but not entirely. It means attention hasn’t arrived yet—not that attention has arrived and been rejected.

3. Summary

Let’s return to the definition of a “contrarian investor”: someone who opposes or rejects prevailing opinion.

In today’s crypto market, true contrarian investing would mean backing stagnant ecosystems like Polkadot, Tezos, and ICP. That’s likely a great way to lose money. Most experienced market participants avoid this because they know it’s a poor strategy.

Crypto markets value attention and highly reward novelty.

Therefore, deploy capital into areas you believe will achieve consensus within 1–3 quarters.

There are exceptions—buying SOL after the FTX collapse and supporting Solana companies wasn’t popular. Hats off to those who did.

They were rewarded.

But I suspect that if you started deploying capital into SOL or the Solana ecosystem early in Q3, adjusting for risk, you might have achieved similarly strong results, as such trades became more consistent within the venture landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News