IOSG: Why Did We Invest in ether.fi? What Is the Future Trajectory of LRT?

TechFlow Selected TechFlow Selected

IOSG: Why Did We Invest in ether.fi? What Is the Future Trajectory of LRT?

Despite intense competition, LRT remains the preferred investment direction in the EigenLayer ecosystem's primary market.

Author: Jiawei Zhu, IOSG Ventures

Recently, there has been significant discussion around EigenLayer’s restaking and LRT (Liquid Restaking Token), with users speculating on potential airdrops across various protocols. Restaking has become the hottest narrative in the Ethereum ecosystem. This article briefly discusses my thoughts and perspectives on LRT.

The Underlying Logic of LRT

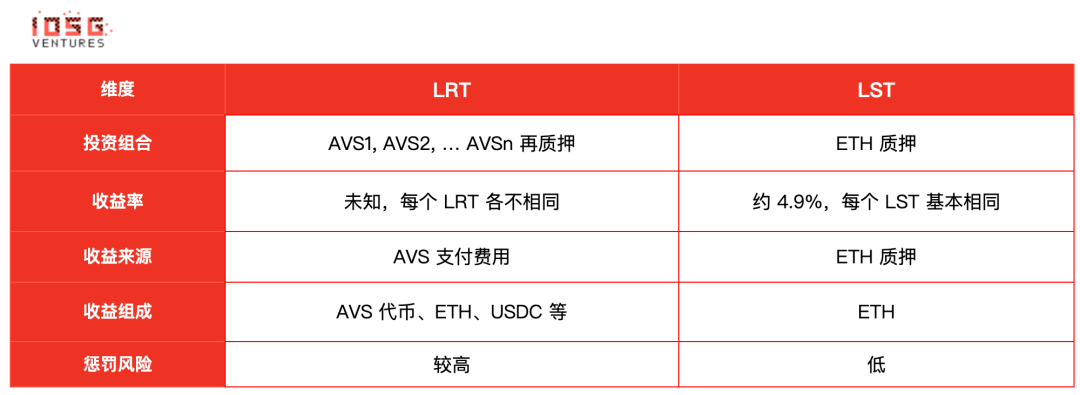

LRT is a new asset class emerging from the multi-sided market围绕 EigenLayer. Similar to LST in purpose, LRT aims to "unlock liquidity." However, due to differences in underlying assets, LRT is more complex than LST, exhibiting diversity and dynamic characteristics.

From an ETH-denominated perspective, if staking ETH via LST is analogous to a money market fund, then LRT, as an asset manager, can be seen as a fund-of-funds for AVSs. Comparing LST and LRT provides a quick way to understand the foundational logic of LRT.

Source: IOSG Ventures

1. Portfolio Composition

While LST involves only one type of investment—staking ETH—LRT offers diverse portfolios by allocating capital across different AVSs to provide economic security, each carrying distinct risk levels. Different LRT protocols adopt varying capital management approaches and risk preferences. At the capital management level, LST represents passive management, whereas LRT embodies active management. LRT may offer multiple strategies tailored to different tiers of AVSs (e.g., EigenDA versus newly launched AVSs), aligning with users’ return/risk profiles.

2. Yield, Sources, and Composition

The yield, its sources, and composition differ between LST and LRT:

-

LST currently yields a stable ~4.9%, derived from rewards at both the Ethereum consensus and execution layers, denominated entirely in ETH.

-

LRT yields are uncertain but primarily come from fees paid by AVSs, potentially consisting of AVS tokens, ETH, USDC, or a combination thereof. Based on our conversations with several AVS teams, most reserve several percentage points of their total token supply for incentives and security budgets. For AVSs launching before issuing a token, payments may be made in ETH or USDC depending on circumstances. (Thus, restaking can essentially be viewed as staking ETH to mine third-party project tokens.)

Given that returns are often tied to AVS tokens, which carry higher volatility than ETH, APRs will fluctuate accordingly. Additionally, AVSs may experience rotation in participation over time. All these factors introduce uncertainty into LRT yields.

3. Slashing Risk

ETH staking incurs two types of slashing penalties: Inactivity Leaking and Slashing (e.g., missing block proposals or double voting), governed by highly deterministic rules. With professional node operators, correctness rates can reach approximately 98.5%.

In contrast, LRT protocols must trust that AVS software is correctly implemented and agreeable regarding slashing conditions to avoid unexpected penalties. Given the wide variety of AVSs—most being early-stage projects—this introduces inherent uncertainty. Moreover, AVSs may modify their rules during development, such as adding new features. From a risk management standpoint, considerations include whether the AVS slasher contract is upgradeable and whether slashing conditions are objective and verifiable. As agents managing user funds, LRT protocols must carefully evaluate these aspects when selecting partners.

That said, EigenLayer encourages full audits of AVS code, slashing conditions, and interaction logic with EigenLayer. It also maintains a multisig-based veto committee to conduct final reviews of slashing events.

Rapid Short-Term Growth of LRT

Source: EigenLayer

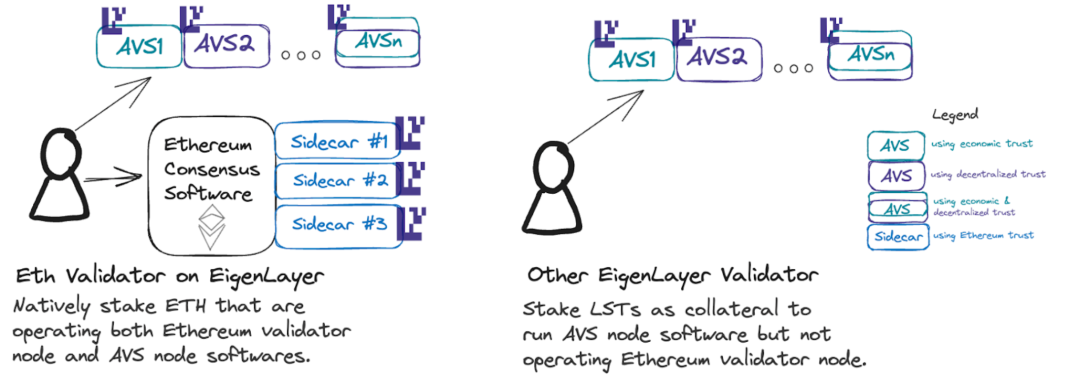

EigenLayer adopts a phased rollout for LST restaking while imposing no restrictions on Native Restaking. Limiting LST may serve as a form of hunger marketing, but more importantly, it drives growth in Native Restaking. By restricting LST, users seeking restaking must turn to third-party LRT protocols offering Native Restaking, significantly boosting LRT protocol adoption. Currently, ETH flowing into EigenLayer through LRT accounts for about 55% of EigenLayer’s total TVL.

An implicit benefit is that Native Restaking enables Ethereum Inclusion Trust—the third trust model promoted by EigenLayer alongside Economic Trust and Decentralization Trust. This means validators not only commit to Ethereum through staking but can also run AVSs and make commitments to them. Many such commitments relate to MEV. One use case is “future block space auctions”—for instance, oracles needing to deliver price feeds within specific time windows, or L2s required to publish data to Ethereum every few minutes, could pay proposers to reserve future block space.

Competitive Landscape of LRT

First and foremost, DeFi integration is a key battleground among LRT protocols, as it determines how effectively unlocked liquidity can be utilized.

As mentioned earlier, although theoretically AVSs should calculate the economic security needed to meet certain thresholds, most current AVSs allocate portions of their token supply for incentives. Due to rotating participation and changing AVS offerings, coupled with incentive dependence on AVS token prices, LRT assets face far greater uncertainty compared to LST (which enjoys a relatively stable “risk-free rate” and favorable ETH price expectations). Consequently, LRT assets struggle to achieve the status of a “hard currency” like stETH within mainstream DeFi protocols.

After all, as staking protocols, LRTs will first be judged by DeFi platforms based on liquidity and TVL, followed by brand reputation and community strength. Liquidity particularly manifests in withdrawal timelines. Typically, exiting via EigenPod takes seven days, after which exiting ETH staking itself requires additional time. Protocols with larger TVL can build better liquidity—for example, Etherfi’s Liquidity Pool Reserve enables fast withdrawals (i.e., eETH → ETH).

However, discussing mainstream DeFi integration ahead of EigenLayer’s mainnet launch remains premature, as many variables remain unknown.

Elsewhere, Ether.fi recently tweeted about a meme token $ETHFIWIFHAT, fueling speculation about a potential token launch. Swell is building a zkEVM L2 using Polygon CDK, EigenDA, and AltLayer, adopting its LRT rswETH as gas. Renzo focuses on cross-chain integration across Arbitrum, Linea, and Blast. We expect each LRT protocol to roll out unique differentiation strategies going forward.

Nevertheless, both LST and LRT are relatively homogeneous. While LRT allows more room for innovation compared to LST, even novel ideas introduced by one LRT can quickly be copied by competitors. I believe sustainable moats lie in strengthening TVL and liquidity. Currently, Etherfi leads in both metrics. Assuming all LRT protocols fulfill their airdrop promises, Etherfi would have a stronger advantage in attracting new capital. (Notably, institutional adoption matters too—30% of Etherfi’s TVL comes from institutional users.)

Post-airdrop, the LRT landscape could completely reshuffle, with intensified competition for users and capital among LRT protocols (e.g., once Etherfi distributes its airdrop, some funds might immediately migrate elsewhere). Until EigenLayer fully launches its mainnet and AVSs begin generating revenue, LRTs lack strong user stickiness.

Sustainability of LRT

The sustainability of LRT ultimately reflects the sustainability of the EigenLayer system itself. While ETH staking rewards will persist indefinitely, AVS-generated yields may not. A common question arises: given the current $11B TVL, how can EigenLayer sustainably deliver matching yields (e.g., 5% annually)? I offer the following points:

-

Although EigenLayer reached $11B TVL—surpassing AAVE—before mainnet launch, post-airdrop, its TVL will likely undergo mean reversion. Thus, short-term yield requirements aren’t as pressing.

-

Secondly, individual AVSs offer varying yields, durations, and volatilities, and stakers have diverse risk-return preferences. Market-driven dynamics naturally emerge—increased ETH staked in a particular AVS lowers its yield, prompting reallocation to other AVSs or protocols. Therefore, one cannot simply calculate required yields as a fixed percentage of total TVL.

-

From a medium- to long-term perspective, the sustained growth of the EigenLayer ecosystem hinges on demand—specifically, sufficient AVSs willing and able to pay for economic security, which depends on their own business viability. Beyond the initial 12 partners like AltLayer, numerous AVSs have announced collaborations, and dozens more are reportedly queuing for integration. Of course, this also depends on AVS quality, token performance, and incentive design—factors too early to assess definitively.

Conclusion

Finally, here are my views on the future landscape of LRT:

1. Despite fierce competition, LRT remains the preferred investment direction within the EigenLayer ecosystem for early-stage investors. Investing in AVSs within EigenLayer should follow middleware investment logic—it doesn’t change just because they use EigenLayer to bootstrap; only the implementation differs. Dozens or even hundreds of AVSs may eventually build on EigenLayer, making the AVS concept commonplace. The node operator space is already dominated by established players. In contrast, LRT sits closer to end-users, acting as an abstraction layer between users and EigenLayer, combining staking and DeFi attributes. As asset allocators, LRTs wield greater influence in the ecosystem. Within broader EigenLayer ecosystem investments, we also monitor developer tools, anti-slashing key management, risk management, and public goods.

2. Currently, the ratio of LRT vs. LST participation in EigenLayer restaking stands at roughly 55% and 45%. We anticipate that as EigenLayer matures, the liquidity-unlocking advantage of LRT will become more apparent, potentially shifting the balance toward 70%-30% (assuming conservative whales and institutions continue holding stETH passively). That said, risks associated with LRT cannot be ignored—due to nested asset structures, systemic risks such as depegging under extreme market conditions must be monitored. Long-term, we hope to see robust growth of AVSs within the EigenLayer ecosystem, providing LRT with a relatively stable foundation and yield structure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News