Reigniting the Liquid Restaking Token (LRT) Narrative: Seeking High-Potential Project Opportunities Amid Infinite Liquidity Matryoshkas

TechFlow Selected TechFlow Selected

Reigniting the Liquid Restaking Token (LRT) Narrative: Seeking High-Potential Project Opportunities Amid Infinite Liquidity Matryoshkas

Ride the wind to stack leverage when fortunes rise; scatter like birds and beasts when tides turn.

Author: David

On the eve of a potential approval for spot Bitcoin ETFs, this week's crypto market experienced a sharp flash crash.

Yet in the aftermath of panic, Ethereum ecosystem tokens like LDO and ARB quickly rebounded. Smaller Ethereum Layer 2 projects such as Metis even reached new highs—highlighting another angle: the market’s current capital is favoring the Ethereum ecosystem.

With most L2s already rallying and liquid staking protocols mostly offering only beta returns, what other narratives around Ethereum remain worth positioning for?

Don’t forget another grand yet still unrealized catalyst—re-staking and EigenLayer.

Re-staking—a concept derived from liquid staking—has gradually evolved into a "matryoshka doll" version of liquid staking tokens (LST): the liquidity re-staking token (LRT), driven by capital’s endless pursuit of efficiency and yield.

Beyond centralized exchanges (CEX), certain tokens related to the LRT concept have recently seen strong price increases.

It sounds familiar, but the logic might not be entirely clear?

In this article, we’ll help you quickly grasp the mechanics of re-staking and LRTs, and dive deep into lower-market-cap or yet-to-launch-token projects worth watching.

Review: Re-Staking and the Liquidity Matryoshka

Re-staking isn’t a new idea.

As early as June last year, EigenLayer introduced “re-staking” on Ethereum. It allows users to re-stake their already-pledged ETH or liquid staking tokens (LSTs) to provide additional security for various decentralized services on Ethereum, while earning extra rewards.

We won’t rehash EigenLayer’s technical details here—assuming readers already have basic familiarity. (Related reading: Analyzing EigenLayer, the Leader in Restaking: Business Logic and Valuation)

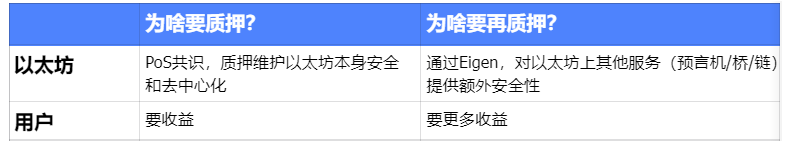

Instead, if you stop worrying about EigenLayer’s internal technicalities, the logic of liquid staking and re-staking becomes much clearer:

To put it simply:

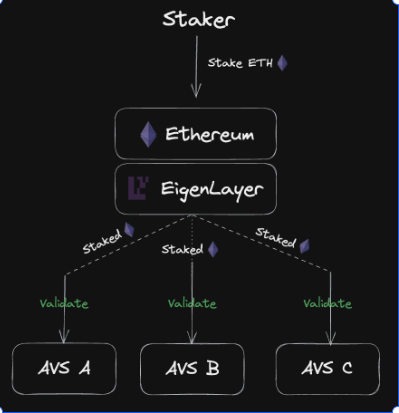

- For Ethereum, staking ensures security; re-staking ensures even more security;

- For investors, staking earns yield; re-staking earns even more yield.

So purely from an investment perspective, how exactly does this yield-generation method work today? The diagram below offers a minimalist understanding:

1. I have ETH, which I stake through an LSD provider like Lido;

2. I receive an LST (liquid staking token), such as stETH;

3. I re-stake my stETH into EigenLayer;

4. I earn yield from both Step 1 and Step 3.

Clearly, before EigenLayer existed, my LST could only generate one layer of yield. With EigenLayer, I now gain a second layer—making it theoretically risk-free.

However, within this mature re-staking process lies a critical issue: liquidity gets locked up.

Your LST, once re-staked into EigenLayer, loses the opportunity to generate yield elsewhere.

EigenLayer, as a re-staking layer, rewards your participation—but doesn’t grant you the same liquidity you had when holding the token directly.

In the capital-efficient world of crypto, liquidity never sleeps. Speculative markets reject the idea of tokens being fully locked without room for expansion.

Therefore, the current “staking → re-staking” yield model is imperfect.

To restore more liquidity and opportunities to tokens, LRTs (Liquidity Re-Staking Tokens) emerged. The concept is actually very simple—think of it as:

a collateral receipt.

I have ETH, so I can obtain an LST (e.g., stETH) via liquid staking. This stETH acts as a proof-of-collateral, showing “I’ve indeed staked ETH,” though my underlying asset remains ETH itself.

Similarly, if I hold an LST, I can re-stake it to receive a new receipt proving “I’ve re-staked stETH,” while my original asset is still just ETH.

This new receipt is essentially an LRT—Liquidity Re-Staking Token. You can use it for further financial operations like borrowing or lending, solving the liquidity lock-up problem in re-staking.

If the mechanism is still unclear, imagine a three-layer matryoshka doll.

You can extract an LST from ETH, then extract an LRT from the LST. When you hold all three layers, each can be used independently—for staking, re-staking, or other yield-generating strategies. Each nesting layer adds another opportunity to leverage liquidity for yield.

Now that Ethereum is back in focus, solving capital efficiency issues within EigenLayer’s re-staking framework may give rise to a new LRT narrative.

Which Projects Are Worth Watching?

Currently, LRT-related projects aiming to solve capital efficiency are gaining attention, with some seeing strong price performance.

But from a research-driven investment perspective, we’re less interested in fully priced-in projects like SSV. Instead, we focus on two categories:

- Projects with tokens and low market caps

- Projects without tokens

Low-Market-Cap Projects with Tokens

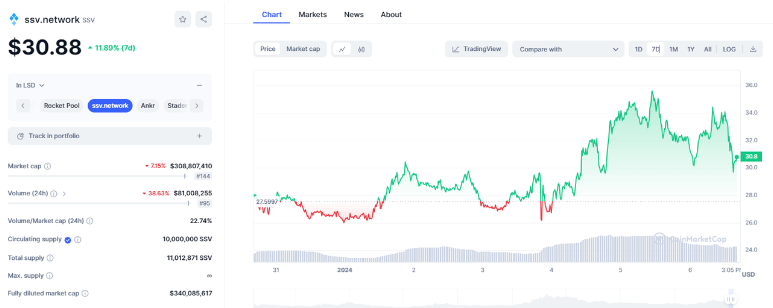

SSV Network ($SSV): Seamless Career Transition for Liquid Staking Projects

Liquid staking providers that already run staking businesses can naturally expand into re-staking—a seamless career upgrade.

This logic is clearly reflected in SSV.

On January 4, SSV announced its move into re-staking, enabling EigenLayer validators’ responsibilities to be distributed across SSV nodes. Leveraging SSV’s decentralized, non-custodial architecture enhances validator performance and security. This approach improves operational resilience, fault tolerance, and ultimately delivers higher yields and stronger safeguards for users.

Meanwhile, users can earn additional rewards atop their staked ETH assets.

Notably, SSV’s re-staking nodes are highly decentralized, currently collaborating with four operators: ANKR, Forbole, Dragon Stake, and Shard Labs.

Despite this, $SSV hasn’t shown significant price movement over the past week. Given its established reputation in liquid staking and its natural fit for re-staking, a ~$300M market cap seems modest—leaving room for upside as the re-staking narrative unfolds.

Restake Finance ($RSTK): First Modular Liquidity Re-Staking Protocol on EigenLayer

From its name alone, Restake Finance clearly focuses on EigenLayer-based re-staking.

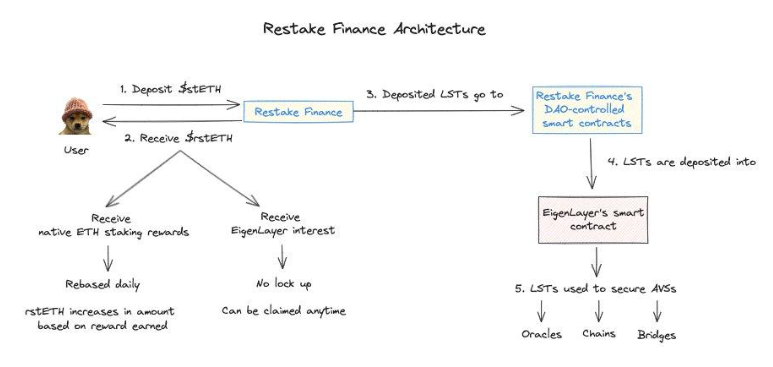

Building on the earlier explanation of LRTs, Restake Finance’s model is straightforward:

- Users deposit LSTs generated from liquid staking into Restake Finance;

- The protocol deposits these LSTs into EigenLayer and issues rstETH as a re-staking receipt;

- Users then deploy rstETH across DeFi to earn yield, while also accumulating EigenLayer reward points (given EigenLayer has not yet launched its token).

Image source: Twitter user @jinglingcookies

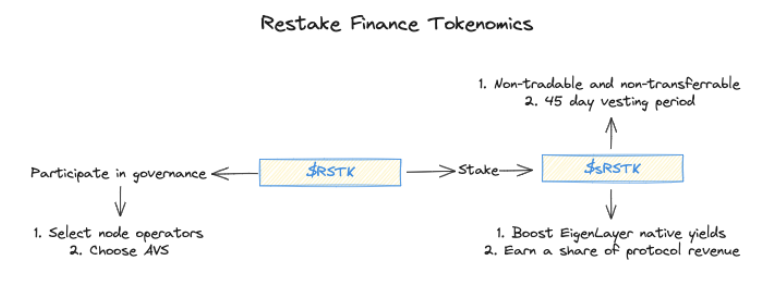

The project’s native token, $RSTK, built on Ethereum, serves governance, staking, and yield-enhancement functions:

Governance:

- $RSTK holders may participate in selecting node operators and AVSs, effectively contributing to Ethereum’s component-level security;

Yield enhancement:

- $RSTK can be staked to amplify rewards earned from EigenLayer. 5% of accumulated re-staking rewards will go to $RSTK stakers, along with a share of protocol revenue.

- Staking $RSTK yields $sRSTK, representing governance and revenue rights—non-transferable and requiring a 45-day unlock period upon redemption.

- $RSTK is designed as a proxy for EigenLayer’s success: as more AVSs join, adoption grows, yields increase, and protocol revenue rises—the value of $RSTK should follow.

Image source: Twitter user @jinglingcookies

Overall, the tokenomics lack novelty—mostly following classic models of staking for extra yield.

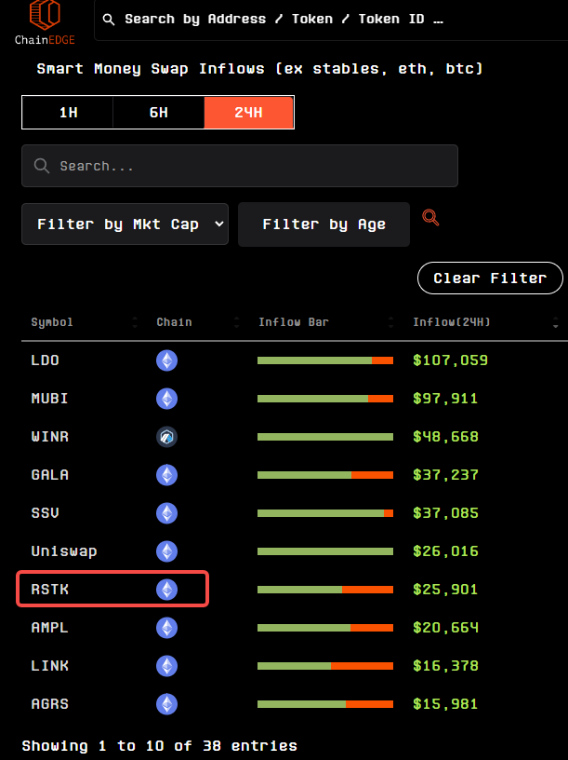

Yet in terms of price action, $RSTK has recently shined.

Since opening on December 20, $RSTK has surged nearly 20x at time of writing, reaching a market cap of just $38 million. Observations show consistent “smart money” accumulation over the past week.

Is $RSTK undervalued?

Consider that SSV Network, now also entering re-staking, holds a $330M market cap. If re-staking becomes a mainstream “career pivot” for liquid staking providers, $RSTK could have roughly 10x room to grow. Comparing to LDO would suggest even greater upside, but given LDO’s dominant position and core LSD advantages, that comparison is less realistic.

Thus, we believe long-term, there are few investable tokenized projects in the LRT space. “Seamless transition” plays by LSD providers offer mostly beta gains, whereas dedicated re-staking projects like RSTK deserve more attention.

Short-term, however, uncertainty around Bitcoin ETF approvals increases market volatility. From a research standpoint, waiting for clarity before seeking stable entry points may be wiser.

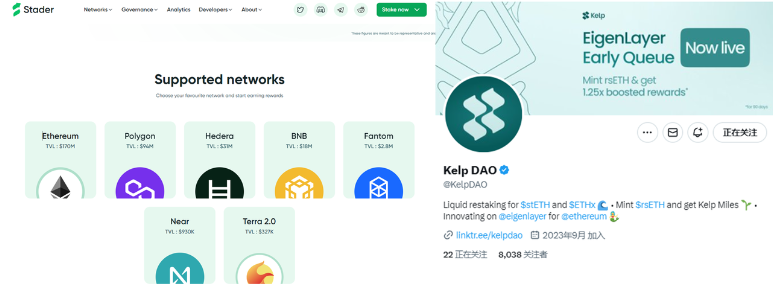

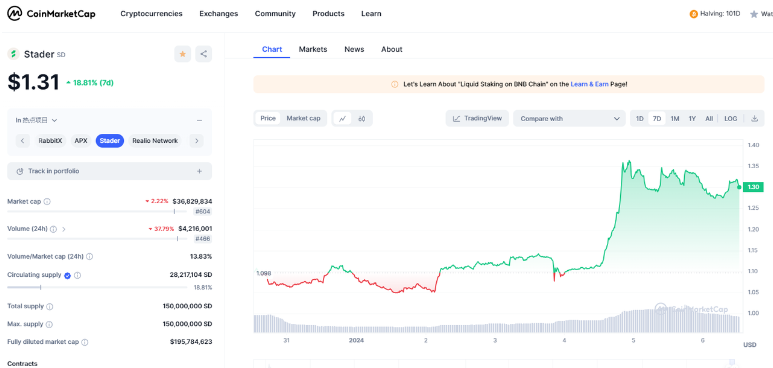

Stader Labs X KelpDAO ($SD): Empowering Newcomers in Re-Staking

Stader Labs isn't new—it rose to prominence during the post-Shanghai-upgrade liquid staking wave. Its edge? Multi-chain staking support. As seen on its website, it supports not only Ethereum but multiple L1s and L2s.

This multi-chain versatility makes its foray into LRT re-staking equally smooth.

Stader supports Kelp DAO, a group focused exclusively on liquidity re-staking. Their model mirrors Restake Finance:

Deposit stETH or other LSTs into Kelp DAO to receive rsETH, then use rsETH for further yield-generating activities. Integration with EigenLayer means users earn both EigenLayer points and retain LST yield, while unlocking liquidity via LRTs.

As Kelp DAO currently lacks a token, the closely associated Stader Labs token $SD becomes a key watchlist item.

$SD gained ~20% over the past week, with a market cap similar to $RSTK—around $35 million.

Unlike $RSTK, $SD represents a “revived old coin” gaining traction under the re-staking narrative. Given Kelp DAO handles the actual operations but hasn’t launched a token, future synergy—such as a potential airdrop—could boost $SD further.

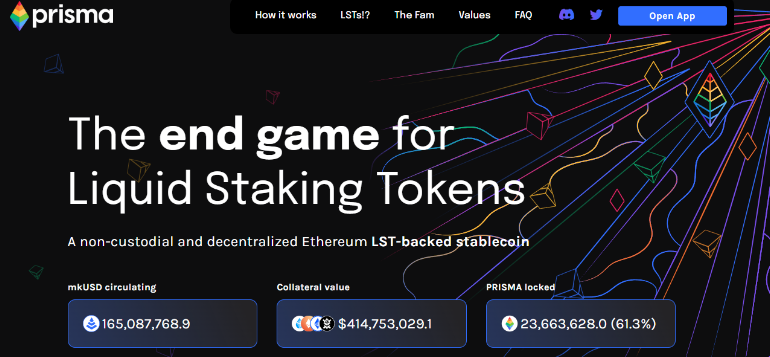

Prisma ($PRISMA): Not Fully LRT, But Another LSDFi Option

The above two tokenized projects directly tackle liquidity release on EigenLayer. But there are alternative approaches—one doesn’t need to tie directly to EigenLayer to unlock liquidity and generate yield. Prisma is a prime example.

Strictly speaking, Prisma isn’t an LRT project—it leans more toward LSDFi. (Related reading: Prisma Finance: Unlocking the Potential of Liquid Staking Tokens)

Prisma entered public view six months ago, notable for its elite backing:

Backed by founders of Curve Finance, Convex Finance, Swell Network, and CoingeckoFinance, with investments from Frax Finance, Conic Finance, Tetranode, OK Venture, Llama Airforce, GBV, Agnostic Fund, Ankr Founders, MCEG, and Eric Chen.

Though funding amount wasn’t disclosed, it’s safe to say top-tier DeFi projects are all represented.

Prisma’s method of unlocking LST liquidity:

- Deposit LSTs into the Prisma protocol;

- Mint mkUSD, a stablecoin;

- Use mkUSD across DeFi for yield farming, lending, etc., thus freeing up LST liquidity.

$PRISMA has been volatile over the past month—swinging over 100% between highs and lows—with recent solid weekly gains.

Its market cap sits around $17 million, making it highly sensitive to news and prone to rapid spikes or drops.

Given its stellar backers, why such a low valuation? While the LSDFi narrative is attractive, this doesn’t necessarily mean the project is undervalued. Consider these risks:

- Circulating market cap excludes locked tokens—about 22 million PRISMA tokens aren’t counted;

- Locked tokens can be withdrawn and dumped anytime, potentially impacting price;

- According to Twitter user @lurkaroundfind, “Brother Sun” holds 1/3 to 1/2 of PRISMA’s total TVL—a major concentration risk.

High volatility + small cap = potential trading opportunities.

Overall, PRISMA has a tiny market cap but elite backing and fits the LSDFi narrative. Transitioning to LRT later would require minimal effort—opening possibilities for strategic moves.

A reasonable strategy: allocate a small position to capture potential pump-and-dump gains.

Picasso Network ($PICA): Bringing Liquidity Re-Staking to Solana

If Ethereum-based LRT projects feel overcrowded, a viable Plan B is to explore similar narratives in the popular Solana ecosystem.

One such candidate is Picasso Network.

The project aims to support multiple L1s, primarily enabling cross-chain communication (IBC) between Polkadot, Kusama, and Cosmos ecosystems—and expanding to Ethereum and Solana.

However, Picasso is now targeting the gap in Solana’s liquidity re-staking sector, leveraging IBC to bring re-staking to Solana.

Operationally, Picasso is launching a Restaking Vault—technically complex, but think of Picasso as a Solana-native EigenLayer. Key steps:

- Via Picasso’s Solana<>IBC bridge, deploy a validator for Solana;

- Users re-stake LSTs from Solana liquid staking platforms (e.g., Marinade’s mSOL, Jito’s jSOL, Orca LP, Blaze’s bSOL) into the validator;

- Earn re-staking rewards while securing the network.

A potential upside: Solana’s staking rate lags behind Ethereum—around 8% of SOL remains unstaked, creating tailwinds for both liquid staking and re-staking.

Given Solana’s liquid staking projects previously rallied broadly, if Ethereum’s re-staking narrative gains momentum, capital may spill over into similar Solana plays.

Token-wise, $PICA nearly doubled over the past week, reaching a ~$100M market cap—higher than most Ethereum-based LRT projects. However, given Picasso’s broader IBC focus beyond just re-staking, direct comparisons are limited.

Considering Solana’s ecosystem hasn’t seen standout performers recently, Picasso could serve as a portfolio backup—monitor fund flows into Solana before acting.

Promising Projects Without Tokens

Beyond the above, several LRT-focused projects currently lack tokens but are actively pushing into re-staking.

Due to space constraints, we list them briefly—interested readers can explore their social media and websites for more details.

Puffer Finance: Lowering Validator Thresholds via Native Re-Staking

EigenLayer requires 32 ETH per validator for AVS operation—a high barrier for average users.

Puffer reduces this threshold to under 2 ETH, aiming to attract smaller validators.

Swell: From Liquid Staking to Re-Staking, Farming for Token Airdrops

Swell previously operated in Ethereum liquid staking and recently launched re-staking, allowing ETH deposits to mint rswETH.

With no token yet, prior LSD participation earned points—now re-staking adds more point-earning opportunities.

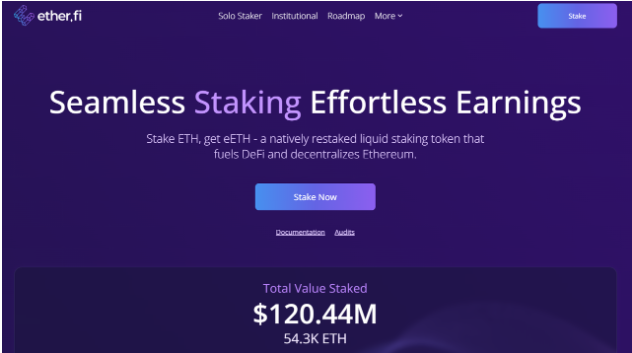

ether.fi: Delivering Seamless Re-Staking Experience

Functionally similar to Swell and Puffer, ether.fi now boasts around $120M in total staked TVL.

Several other projects exist but aren’t listed due to space. If LRT heats up, expect aggressive marketing from these non-tokenized players to attract re-staking—discovery is just a matter of time.

Conclusion

Finally, during this research, I asked myself: Is liquidity re-staking truly progress?

From Ethereum’s perspective, it strengthens security across projects via EigenLayer.

But from a practical standpoint, it feels more like speculative leverage created for liquidity. Leverage meaning: the underlying asset is still just one piece of ETH, but through token mapping and rights locking, multiple derivative receipts emerge—each layered atop the original.

At best, these derivatives supercharge liquidity during bull runs, fueling speculation;

At worst, interconnected protocols create systemic risk—if one large protocol fails (via hack or mismanagement), the fallout cascades.

Bullish? Stack layers. Bearish? Scatter like birds.

Ethereum opened a vast field. EigenLayer built a racetrack around it. For yield-hungry, risk-ready capital, all it needs is a reason to start running.

Liquidity never sleeps. Pleasing liquidity remains crypto’s eternal narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News