LRT Wars: Earning AVS Rewards Amid Volatility

TechFlow Selected TechFlow Selected

LRT Wars: Earning AVS Rewards Amid Volatility

With an increasing number of restaking platforms emerging, who has truly calculated users' returns and platform interests clearly and transparently?

Author: 0xresearcher

Preface: Bitcoin has rebounded to $70K, market volatility is intensifying, and restaking is back in investors' spotlight. The most profitable moments in crypto always come when risks are low and returns are high—this is when you go all-in. In this article, I’ll guide you through the staking and restaking landscape and calculate and compare yields across leading projects.

1. Introduction to LST and LRT

What is LST:

Liquid Staking Tokens (LSTs) are tokens users receive via liquid staking protocols like Lido, such as stETH.

Behind LSTs: PoS network security and staking yield.

What is LRT:

Users delegate their LSD-ETH assets (like stETH) to liquid restaking protocols. These protocols deposit the LSD-ETH into EigenLayer for restaking on behalf of users and issue a collateral token known as an LRT (Liquid Restaking Token).

*Restaking was first introduced by EigenLayer.

2. LRT Reward Data Overview

Renzo was the first (and nearly exclusive) protocol to announce and distribute EigenLayer's latest reward cycle data.

Let’s look at the numbers:

"Between August 15 and October 8, 2023, ezETH generated 769.01 ETH (593,727.31 EIGEN) in restaking rewards.

ezEIGEN generated 1,731.05 EIGEN from October 1 to October 8 alone—a one-week period."

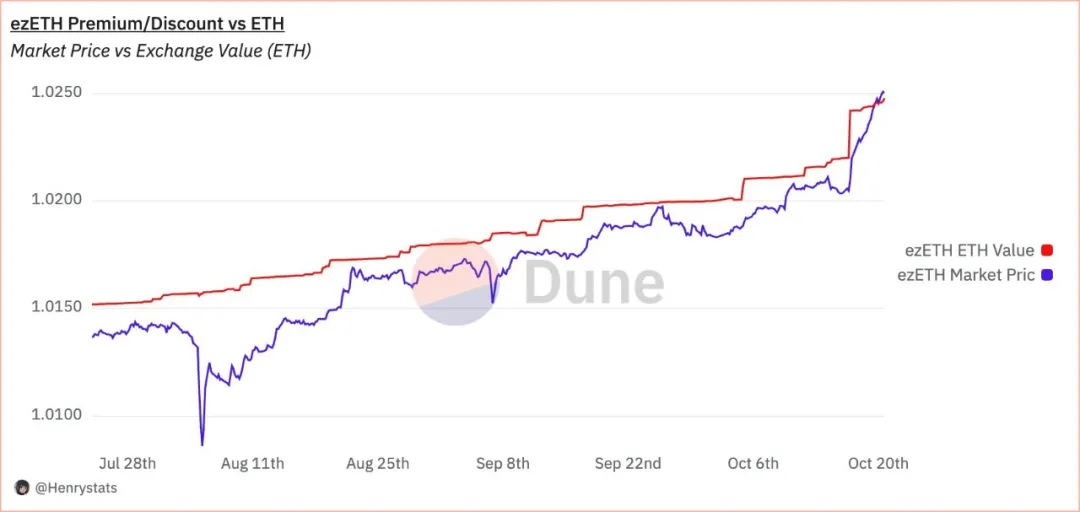

During the period from August 15 to October 8, 2023, users earned over $2 million in restaking rewards via EigenLayer. These rewards were automatically compounded directly into user accounts. Meanwhile, ezETH's price rose from 1.0224 to 1.0242 and now trades at a 0.043% premium. Over $2 million in restaking rewards have been distributed and continuously reinvested. Thanks to automatic compounding, rewards are allocated directly to user wallets without manual claiming, greatly enhancing user experience.

3. Advantages of LRT Restaking

1. High Restaking Ratio

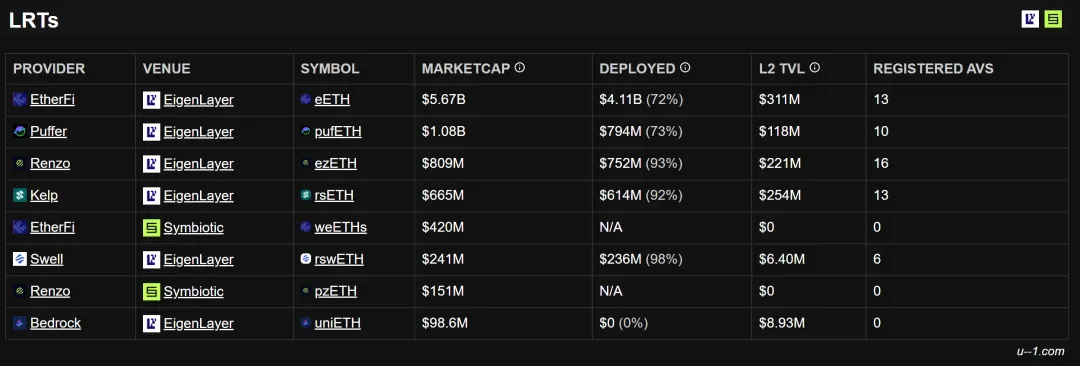

As shown in the third-party data above, Swell, Renzo, and Kelp lead significantly among EigenLayer protocols in terms of restaking ratio. Compared to Puffer (73%) and EtherFi (72%), their total restaked TVL proportion is much higher, maximizing AVS reward earnings.

2. Automatic Compounding

Traditional restaking involves complex processes, high gas fees, and tedious manual management. Using EigenLayer as an example, users typically need to select operators via the EigenLayer App, manage risks, and manually claim and handle rewards. Additionally, EIGEN stakers face long withdrawal periods and frequent tax events. For most users, this process is both time-consuming and labor-intensive.

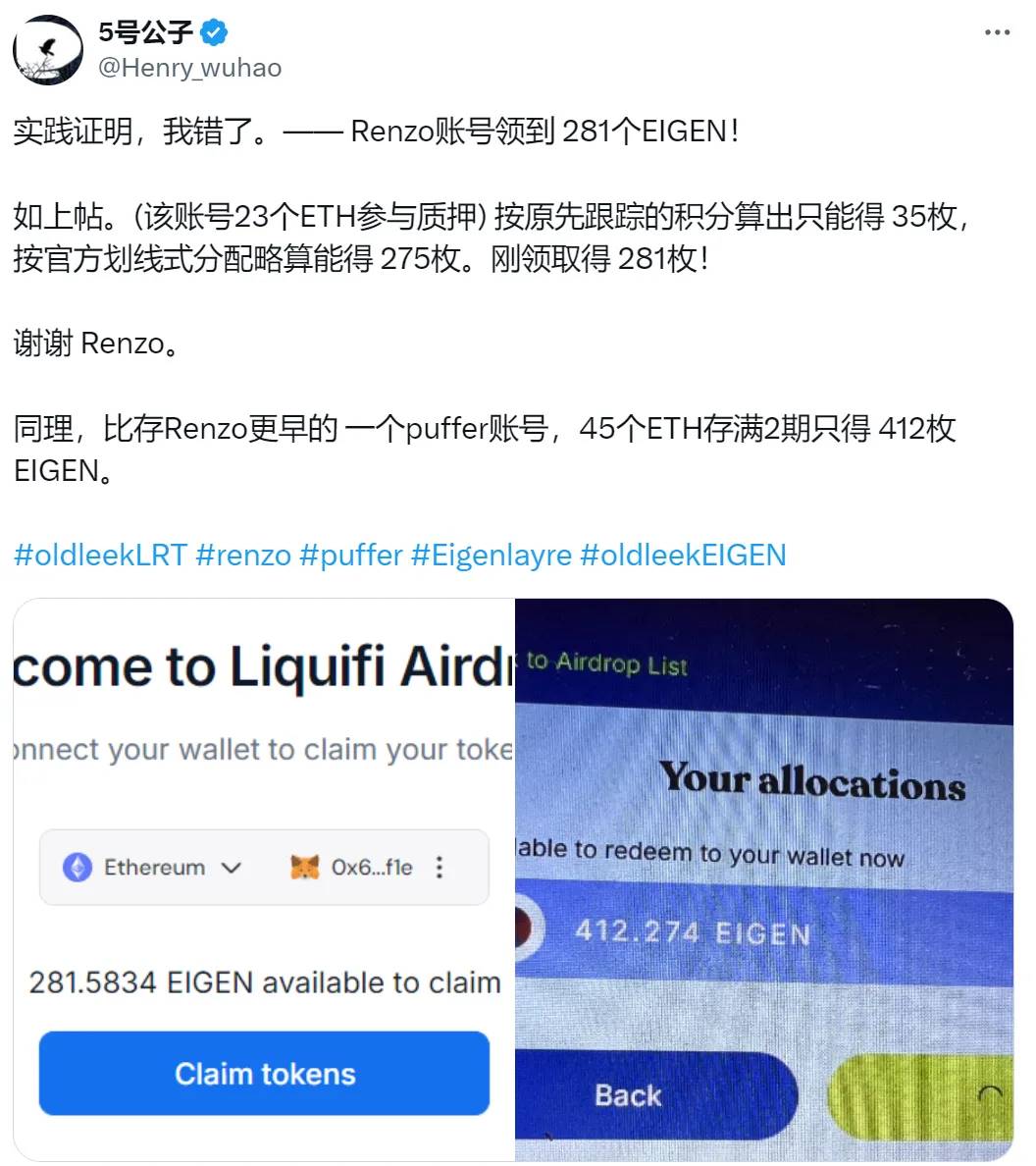

$ezEIGEN addresses these pain points with an automated solution. By automatically managing operators and AVS (Actively Validated Services), $ezEIGEN significantly reduces user burden. It automatically claims rewards weekly and reinvests them, lowering gas costs and increasing overall yield. Perhaps due to this (and more!), we see such heartfelt expressions from the community.

4. LRT Yield Efficiency Calculation

EigenPods serve as the interface between Ethereum validators and EigenLayer, enabling UniFi AVS to slash validators who violate pre-confirmation commitments. As the number of EigenPods increases, so does the gas cost for claiming rewards. Renzo operates only five EigenPods, keeping its weekly gas expenses within the hundreds of dollars. In contrast, protocols like EtherFi may run thousands of EigenPods, spending up to 35 ETH per week on gas. With fewer EigenPods, Renzo not only cuts gas costs but also ensures efficient reward distribution.

Additionally, AVS rewards are distributed weekly, further enhancing user participation value and payout frequency.

In summary, Renzo goes beyond basic staking or restaking services by offering professional operational support and technical services for AVS, including network management and node operations. Therefore, it’s entirely reasonable that Renzo stands out in AVS reward competition thanks to its high restaking ratio, automatic compounding, lower gas costs, and efficient use of EigenPods.

Now let’s compare Renzo and EtherFi:

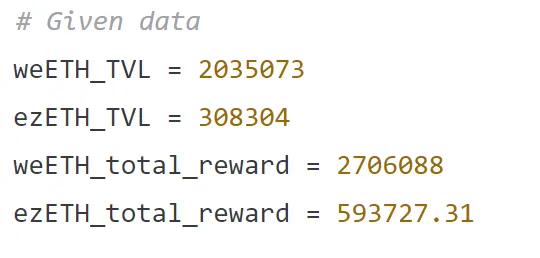

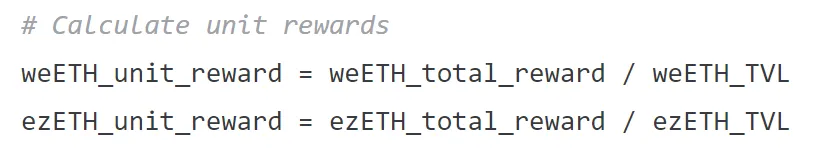

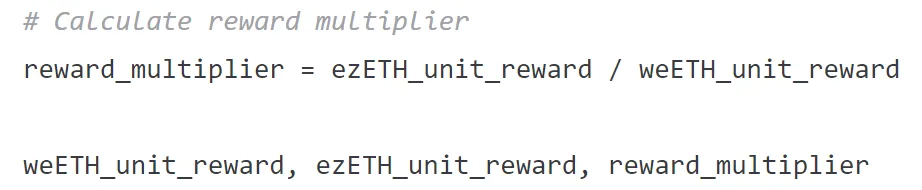

TVL and Restaking: According to EtherFi’s latest tweet announcing reward distribution, its initial restaking rewards included 2,478,088 EIGEN plus 500K ETHFI available for claim. ezETH stakers received 593,727.31 EIGEN, while weETH stakers received 2,478,088 EIGEN—superficially, weETH stakers got 4.17x more. However, when factoring in TVL to assess per-unit yield, let’s do the math.

Based on calculations, each unit of weETH earned 1.33 EIGEN, while each unit of ezETH earned 1.93 EIGEN. Thus, ezETH users received 1.45x more per-unit rewards than weETH users. Despite EtherFi’s large headline reward amount, actual per-unit returns are underwhelming.

Renzo’s Automatic Compounding vs. EtherFi’s Manual Claiming: Renzo’s auto-compounding mechanism saves users significant gas fees. Users don’t need to manually claim rewards—all earnings are automatically reinvested. In contrast, EtherFi requires users to manually claim rewards, resulting in higher gas costs and reduced net returns.

Gas Fee Issue: Since EtherFi users must manually claim rewards—especially on the Ethereum network—they face high gas costs. Renzo’s auto-compounding eliminates this cost, allowing users to earn and reinvest rewards without paying any gas fees.

5. LRT Incentive Rules Comparison

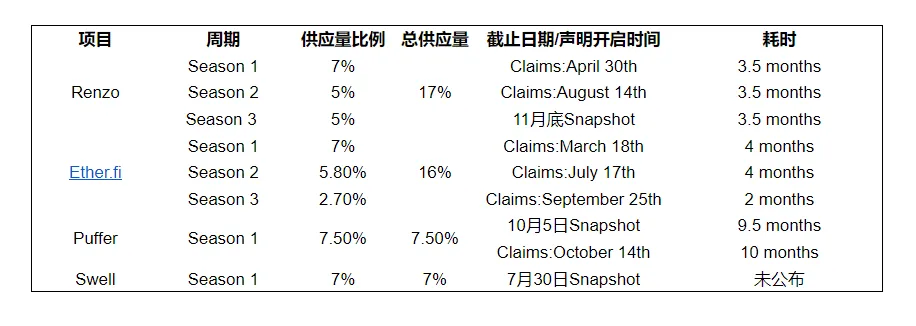

As the EigenLayer-based restaking sector continues to evolve and market share becomes increasingly consolidated, users focused on "airdrop farming" rather than staking yields already have a clear picture of their potential returns. Let’s examine the current state of the sector through incentive structures.

Clearly, each project’s incentive design has unique strengths:

Short Expected Duration: Ether.fi and Renzo have the shortest incentive cycles. Compared to Puffer’s first season lasting nearly 10 months, users spend less time participating and can earn rewards faster on Ether.fi and Renzo.

Token Allocation Expectations: Puffer offers the highest single-season distribution ratio at 7.5% among all projects. However, considering market dynamics and restaking efficiency, Puffer appears to offer only paper wealth. In contrast, Ether.fi and Renzo seem more sincere in their incentives.

Long-Term Participation Potential: In today’s volatile market, projects enabling sustained participation and profitability are optimal. Renzo’s season lasting 10.5 months and Ether.fi’s 10-month year-end push are excellent choices for long-term engagement.

6. Future Outlook for the Restaking Industry

Currently, protocols built on EigenLayer remain in early stages. Ultimately, one or two players will likely dominate the market. Whichever protocol sustains growth and establishes an absolute lead over second and third place will probably emerge as the leader. Each bull market brings new narratives—Lido stood the test of time and became dominant in staking. Who will be the next “Lido” in the restaking space?

With an ever-growing number of restaking platforms, which ones truly align user returns with platform interests in a transparent and rational way? This is a sector that requires time to validate, yet time is precisely what users lack most. How to filter out subpar projects in this market? Everyone has their own set of evaluation metrics—I refrain from making any biased recommendations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News