Restaking returns to the spotlight: How is the liquidity of LRTs faring?

TechFlow Selected TechFlow Selected

Restaking returns to the spotlight: How is the liquidity of LRTs faring?

Expected liquid restaking to be a winner-takes-all market structure, where liquidity brings more liquidity.

Author: Kairos Research

Translation: TechFlow

Key Takeaways:

-

LRTs may integrate with centralized exchanges and introduce market makers to the risks/returns of providing liquidity in these centralized venues.

-

The liquidity of liquidity restaking tokens (LRTs) is not remarkably strong; overall liquidity is acceptable, but each individual LRT has greater nuances. These differences will only grow over time as long-term delegation strategies diverge.

-

With the exception of EtherFi, none of these LRT providers have enabled withdrawals.

-

Liquidity restaking is expected to follow a winner-takes-all market structure, where liquidity begets more liquidity.

Body:

EigenLayer's first AVS officially launches on mainnet.

Today, EigenLabs’ data availability AVS—EigenDA—is launching on mainnet, formally marking the beginning of the restaking era. While EigenLayer’s marketplace still has a long way to go, one trend is already clear: liquid restaking tokens (LRTs) will be the primary pathway for restakers. Over 73% of all EigenLayer deposits are made through LRTs—but how liquid are these assets? This report dives into that question and explains the nuances surrounding EigenLayer.

Introduction to EigenLayer and Liquid Restaking Tokens (LRTs)

EigenLayer enables ETH to be reused at the consensus layer through a new cryptoeconomic primitive called “restaking.” ETH can be restaked on EigenLayer in two main ways: via native ETH restaking or by using liquid staking tokens (LSTs). The restaked ETH is then used to secure other applications known as Active Validation Services (AVS), allowing restakers to earn additional staking rewards.

The primary complaint users have about staking and restaking is the opportunity cost of staked ETH. This issue is resolved for native ETH staking via liquid staking tokens (LSTs), which act as liquid receipt tokens representing the amount of ETH users have staked. The LST market on Ethereum is currently worth approximately $48.65 billion, making it the largest DeFi sector. Today, LSTs account for around 44% of total Ethereum staking. As restaking gains traction, we expect the liquid restaking token (LRT) sector to follow a similar—or even more aggressive—growth trajectory.

While LRTs share some characteristics with LSTs, they differ significantly in purpose. The ultimate goal of every LST is essentially the same: stake users' ETH and provide them with a liquid receipt token. However, for LRTs, the end goal is to delegate users’ staked representation to one or more operators who then support a basket of AVSs. Each individual operator can choose how to allocate their delegated stake across various AVSs. Therefore, the operators to whom an LRT delegates its stake have significant implications for overall activity, operational performance, and the security of restaked ETH. Finally, proper risk assessment must also be conducted for the unique AVSs supported by each operator, as slashing risks may vary depending on the services provided. Note that slashing risk is essentially zero during the early stages of most AVSs, but over time we will gradually see the “training wheels” removed as the staking market becomes increasingly permissionless.

Editor’s note: “Training wheels” refer to protective measures introduced during initial phases to avoid or reduce risk. As participants gain experience and capability, these safeguards are gradually removed, making the system or market more open and free.

Despite structural risk differences, one similarity remains constant: LRTs reduce the opportunity cost of restaking capital by offering liquid receipt tokens that can serve as productive collateral in DeFi or be exchanged to shorten withdrawal periods. The latter point is particularly important because one of the key advantages of LRTs is avoiding the traditional withdrawal period—EigenLayer’s standalone withdrawal period is seven days. Given this core principle of LRTs, we anticipate natural net selling pressure on them due to such low entry barriers but high exit barriers. Therefore, the liquidity of these LRTs will be their lifeline.

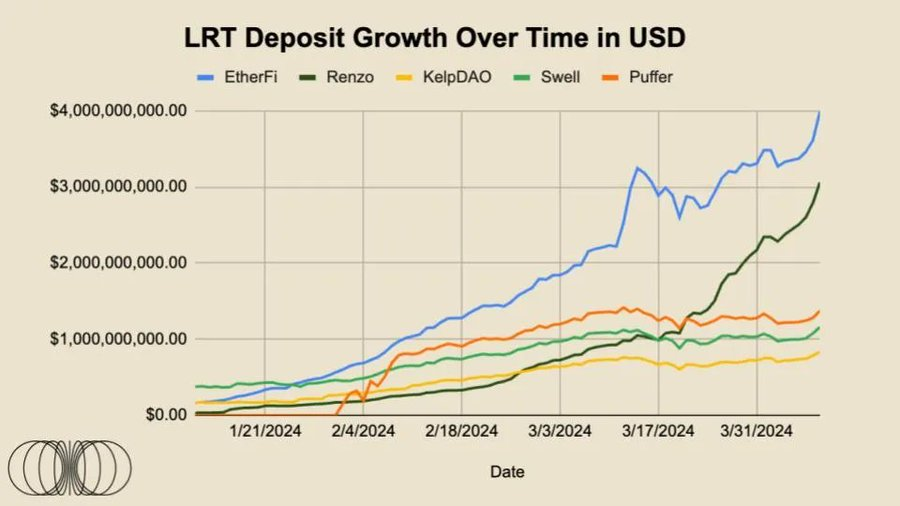

Thus, as EigenLayer’s total value secured continues to climb, it’s crucial to understand the drivers behind protocol growth and how those factors will influence inflows and outflows in the coming months. At the time of writing, 73% of EigenLayer deposits are made via liquid restaking tokens. To put this in context: on December 1, 2023, LRT deposits were approximately $71.74 million. Today, April 9, 2024, they have grown to about $10 billion—an astonishing increase of over 13,800% in less than four months. However, as LRTs continue to dominate restaking deposit growth on EigenLayer, several important considerations remain:

-

Not all LRTs consist of the same underlying assets

-

LRTs’ long-term delegation of stakes to AVSs will differ, though differences are minimal in the short term

-

Most importantly, liquidity profiles vary significantly among different LRTs

Given that liquidity is the most critical advantage of LRTs, much of this report will focus on the last point above.

Speculation around Eigen Points has greatly fueled the current bull run in EigenLayer deposits, with the assumption that this will translate into some form of airdrop distribution for a potential EIGEN token. Currently, no AVS rewards are being distributed, meaning there are no incremental yields on these LRTs beyond natural staking rewards. To sustain and grow the $133.5+ billion total value secured, the AVS market must naturally find equilibrium between the incremental yield demanded by restakers and the natural price AVSs are willing to pay for security.

For LRT depositors, we’ve already seen EtherFi’s massive success in launching its ETHFI governance token airdrop, currently valued at around $6 billion. Considering all the above factors, capital flows could gradually increase following the launch of EIGEN and other anticipated LRT airdrops.

However, in terms of reasonable yield, users may struggle to find higher returns within the Ethereum ecosystem outside of EigenLayer. There are several interesting yield opportunities in the Ethereum ecosystem. For example, Ethena is a synthetic stablecoin backed by staked ETH while also holding hedged short positions in ETH futures. The protocol currently offers an annualized yield of approximately 30% on its sUSDe product. Additionally, as users become more familiar with interoperability and cross-chain bridging, yield chasers might look elsewhere, potentially driving productive capital outflows from Ethereum.

Although complex, we believe it's reasonable to assume that aside from potential EIGEN token airdrops to restakers, there won’t be any larger incremental staking yield events. Furthermore, large, blue-chip AVSs that have raised funds at multi-billion dollar valuations in private markets may also distribute their tokens to restakers. Thus, it can be assumed that after these events, a certain proportion of ETH will flow out of EigenLayer deposit contracts via withdrawals.

Given EigenLayer’s seven-day withdrawal cooldown and the fact that the vast majority of funds are restaked via LRTs, the fastest exit route will be converting your LRT back into ETH. However, liquidity characteristics vary widely among different LRTs, and many LRTs may not allow large-scale exits at market prices. Moreover, at the time of writing, EtherFi is the only LRT project that has enabled withdrawals.

We believe that if an LRT trades below the price of its underlying asset, it could trigger a painful arbitrage cycle for restaking protocols. Imagine an LRT trading at 90% of its underlying ETH value—market makers/arbitrageurs could buy the LRT and proceed with redemption, assuming ETH price is hedged, expecting roughly 11.1% net profit. According to basic supply-demand dynamics, LRTs are more likely to face net selling pressure, as sellers may avoid the seven-day withdrawal queue. Conversely, users seeking to restake might immediately deposit their ETH, so purchasing LRTs on the open market offers no benefit compared to simply holding ETH.

By the way, we expect that once multiple AVSs go live with in-protocol rewards and slashing fully implemented, the decision to exit or continue restaking will ultimately depend on the incremental yield offered through restaking. We personally believe many people underestimate the incremental yield provided by restaking. But that’s a topic for another day.

Data Tracking

This month’s data section begins below, tracking the growth, adoption, and liquidity status of the top five LRTs, along with any notable news we believe deserves attention.

LRT Liquidity and Trading Volume

Although staking via LSTs and LRTs offers more key advantages than traditional staking, these benefits are almost entirely negated if the LRTs themselves lack sufficient liquidity. Liquidity refers to “the efficiency or ease with which an asset can be converted into cash without affecting its market price.” LRT issuers must ensure adequate on-chain liquidity so that large holders can exchange receipt tokens in pools where the ready asset value is nearly 1:1.

Each existing LRT has very unique liquidity characteristics. For multiple reasons, we expect this situation to persist:

-

Certain protocols will receive early-stage investor and user support for their LRT liquidity

-

Liquidity will be incentivized through subsidies, token emissions, on-chain bribery systems, or expectations of upcoming events like “points” programs

-

Some protocols will have more sophisticated, centralized liquidity providers who maintain their LRTs close to peg levels despite relatively low total dollar liquidity

-

Note that concentrated liquidity only functions within a narrow price range; any price movement beyond the selected range can significantly impact pricing

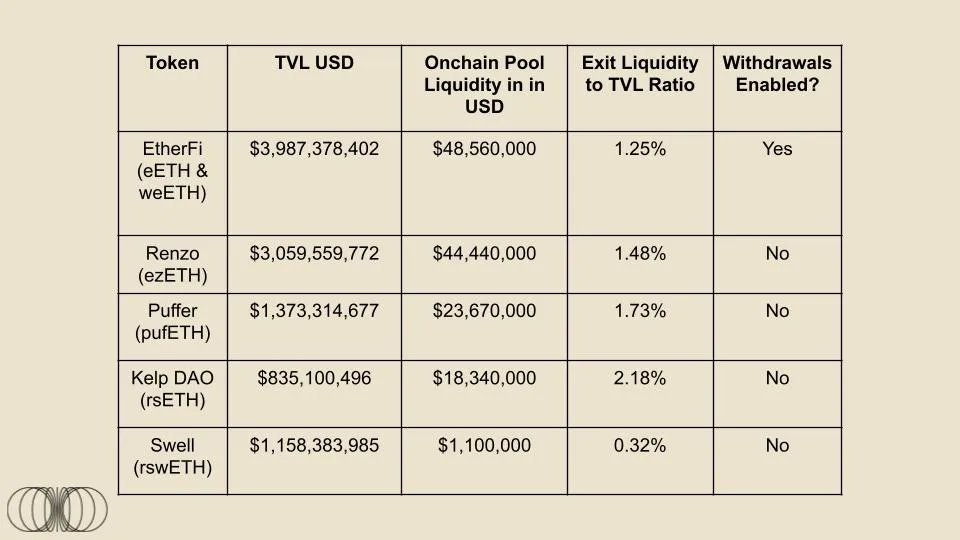

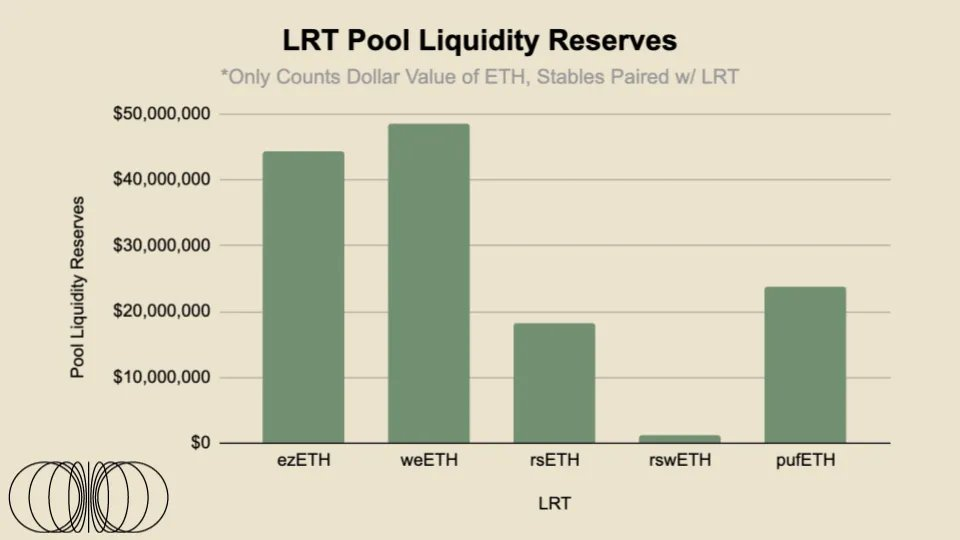

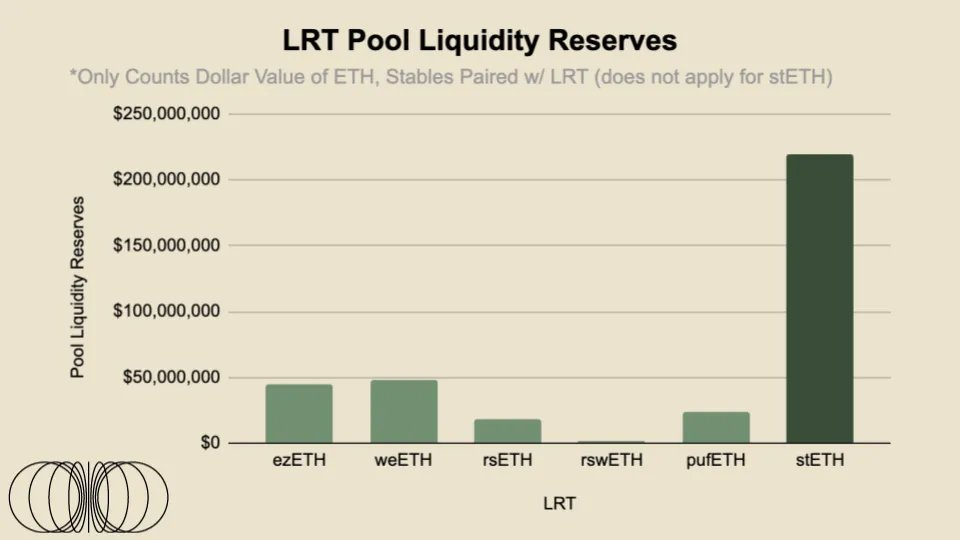

Below is a very simple analysis of on-chain pool liquidity for the top five largest LRTs on Ethereum mainnet (+ Arbitrum). Exit liquidity refers to the cash-like USD value in LRT liquidity pools.

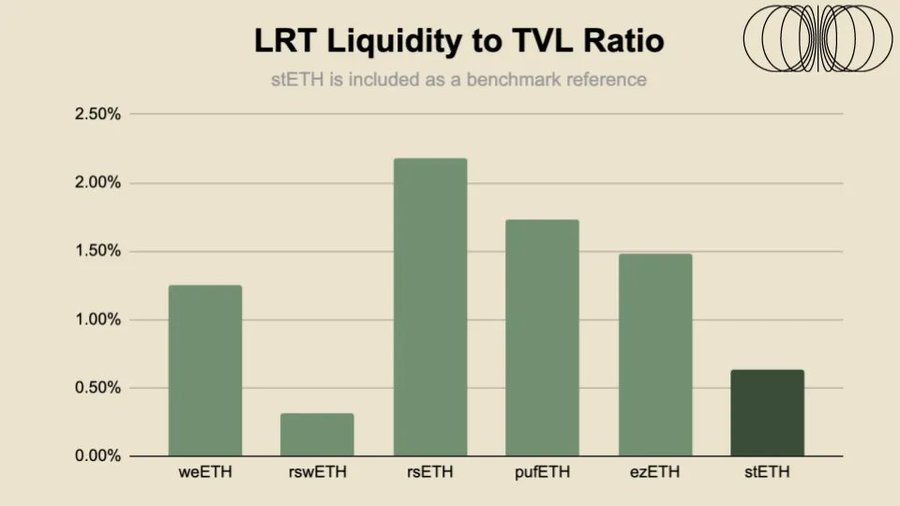

Across the top five largest LRT pool liquidities, over $136 million in liquidity is available, spread across Curve, Balancer, and Uniswap. However, to better understand how liquid each LRT truly is, we will apply a liquidity-to-market-cap ratio to each asset.

Compared to the top LST—stETH—the LRT liquidity ratios are not overly concerning. However, given increased restaking risks and EigenLayer’s added seven-day withdrawal period on top of Ethereum’s unlock queue, LRT liquidity may be even more critical than LST liquidity. Additionally, stETH trades on several major centralized exchanges managed by professional HFT firms handling order books, meaning stETH’s liquidity extends far beyond what is visible on-chain. For instance, on OKX and Bybit, there is approximately over $2 million in ±2% order book liquidity. Therefore, we believe LRTs may also explore this path—integrating with centralized exchanges and introducing market makers to the risks/returns of providing liquidity in these centralized venues. In next month’s article, we’ll dive deeper into stable pool liquidity, x*y=k liquidity, and the allocation of concentrated liquidity across top LRT trading pairs.

LRT Peg Data

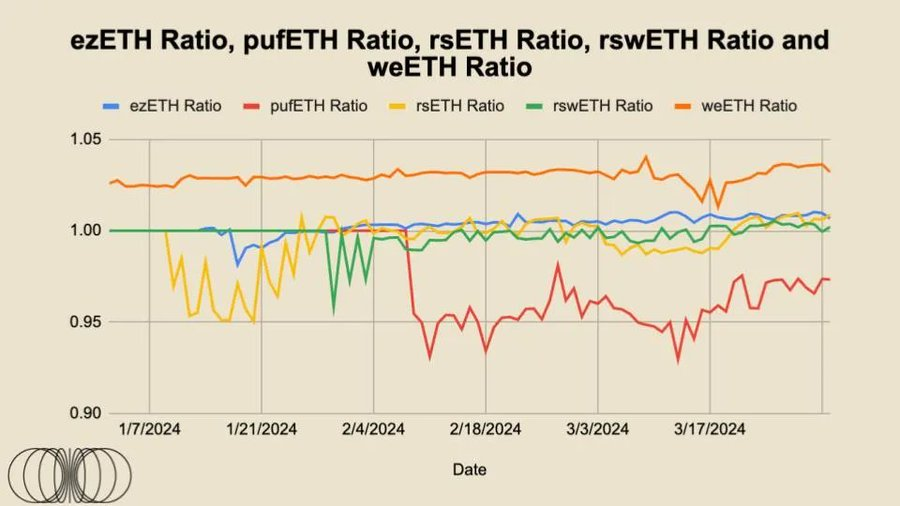

As shown in the chart above, rsETH, rswETH, and ezETH trade relatively close to the 1:1 parity with ETH, with slight premiums. Given that these tokens are non-interest-bearing—unlike stETH, which automatically compounds staking rewards reflected in its token price—this makes sense. This is why 1 wstETH currently trades at approximately 1.16 ETH. Theoretically, over time, “fair value” should continue increasing, determined by time * staking rewards, which would then reflect in rising fair values of these tokens.

The peg of these LRTs is crucial because they essentially represent the level of trust market participants have in the projects, directly determined by the capital committed or by arbitrageurs willing to trade these premiums and discounts to maintain the tokens’ trading “fair value.” Note that all these tokens are non-rebasing, meaning they do not automatically compound but instead trade based on redemption curves.

As seen, for ezETH and weETH—the two most liquid LRTs—their trading has remained relatively stable over time, mostly aligned with fair value. The reason EtherFi’s ezETH slightly deviates from fair value is primarily due to its governance token launch, prompting opportunistic airdrop farmers to swap out of this token, followed naturally by other market participants engaging in trades to arbitrage away the discount. We may see a similar event occur after Renzo launches its governance token.

KelpDAO’s rsETH initially traded at a discount relative to fair value upon launch but has steadily returned to parity over time.

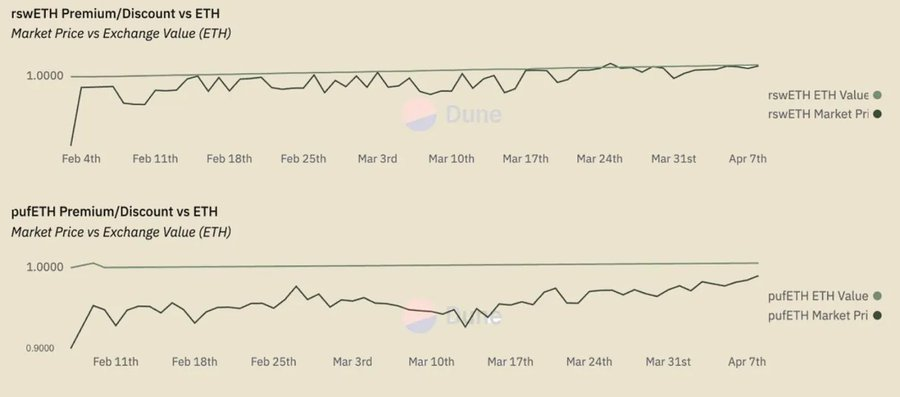

As for rswETH, it traded below its fair value for most of the time, but recently appears to have reached parity. Among all these LRTs, pufETH stands out as the main outlier, trading consistently at a discount. However, this trend seems to be ending, as it moves toward aligning with the fair value of its underlying assets.

Once again, with the exception of EtherFi, none of these LRT providers have enabled withdrawal functionality. We believe ample liquidity combined with users’ ability to withdraw at any time will offer strong appeal to market participants, meaning a significant portion of liquidity needs to be drawn from across the entire DeFi ecosystem.

LRTs in the Broader DeFi Ecosystem

Once LRTs become further integrated into the broader DeFi ecosystem—especially lending markets—the importance of their peg will significantly increase. For example, taking today’s money markets as reference, LSTs (particularly wstETH/stETH) are the largest collateral assets on Aave and Spark, with supplies of approximately $4.8 billion and $2.1 billion respectively. As LRTs achieve deeper integration into the broader DeFi ecosystem, we expect these figures to eventually surpass those of LSTs, especially as broader market understanding of risk and product structures improves and long-term credibility increases over time. Additionally, both Compound and Aave have governance proposals to include Renzo’s ezETH.

However, as previously mentioned, liquidity will remain the lifeblood of these products, ensuring both the breadth and depth of their DeFi integration and long-term viability. We’ve already witnessed how LST de-peg events can trigger cascading chaos—click here to read more.

Final Thoughts

Although stETH gained early advantages and dominates due to first-mover advantage, the series of LRTs discussed in this report were largely launched around the same time, all with strong market momentum. We expect this to be a winner-takes-all market structure, as power laws apply to most liquid assets—in simple terms, liquidity begets liquidity. This is why Binance continues to dominate CEX market share despite various controversies and turbulence.

In conclusion, the liquidity of liquid restaking tokens is not remarkably strong. Overall liquidity is acceptable, but each individual LRT has greater nuances, and these differences will only grow over time due to divergent long-term delegation strategies. From a mental model perspective, first-time users might find it easier to think of LRTs as collateral ETFs. Many will compete for the same market share, but in the long run, allocation strategies and fee structures may determine the winners. Furthermore, as products become increasingly differentiated, liquidity will become even more critical due to withdrawal timelines. In crypto, seven days can sometimes feel like a month in real time, given that global markets operate 24/7. Finally, as these LRTs begin integrating into lending markets, pool liquidity will become even more important, as liquidators will only accept risks commensurate with the liquidity profile of the underlying collateral. We believe incentive mechanisms may play a significant role here, and we look forward to studying different token models after other LRT providers potentially conduct airdrops.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News