Babylon War in full swing, Bedrock takes the lead: Can uniBTC spark a BTC LRT boom?

TechFlow Selected TechFlow Selected

Babylon War in full swing, Bedrock takes the lead: Can uniBTC spark a BTC LRT boom?

As the Babylon mainnet launch further unlocks BTC LRT potential, Bedrock may play a key role in the second growth curve of LRT.

Last night, a thrilling Gas War unfolded in the Bitcoin ecosystem:

Babylon officially launched its Bitcoin staking mainnet and initiated the first phase of staking activities, sounding the battle cry. At once, major derivative LRT protocols based on Babylon sprang into action, competing fiercely for the initial 1,000 BTC staking quota. During the intense over-one-hour-long battle, Bitcoin network transaction fees surged to as high as 1,000 satoshis per byte. Many KOLs across social media commented:

"Tonight will definitely be sleepless — it hasn't been this lively in ages!"

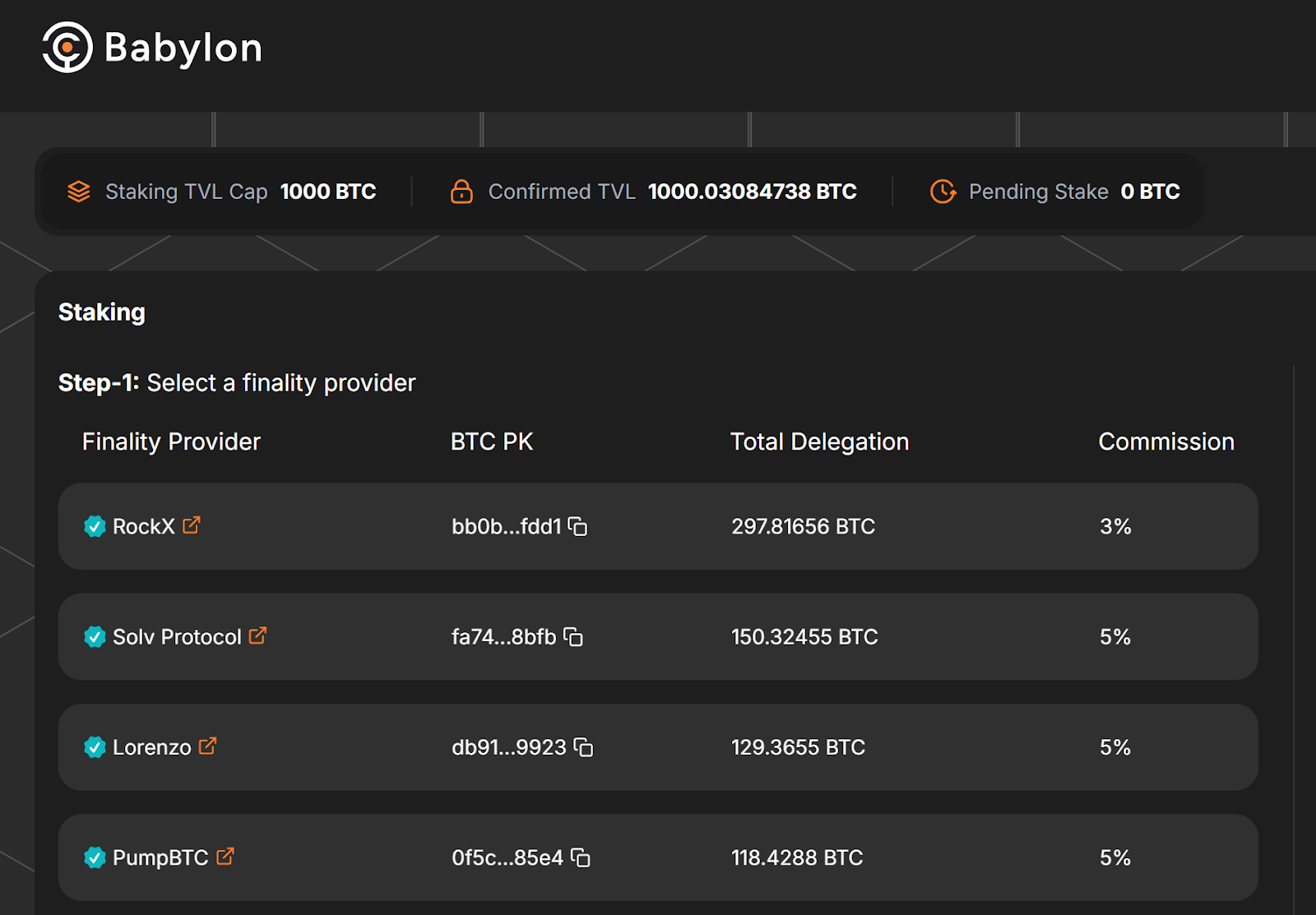

Once the staking cap was reached and each protocol displayed their "spoils of war," Bedrock (RockX) sparked widespread discussion as the top performer. According to the Babylon staking dashboard:

Bedrock secured 297.8 BTC, capturing nearly 30% of Babylon's initial total staked amount.

Image Source: Babylon Staking Dashboard

As the undisputed victor in this Babylon staking quota battle, community attention has increasingly focused on Bedrock. After preliminary research, many have gained stronger confidence in Bedrock’s potential to lead the BTC LRT explosion:

On one hand, Bedrock completed a funding round in May this year. While the specific amount wasn’t disclosed, the list of backers includes prominent institutions and industry leaders such as OKX Ventures, LongHash Ventures, Comma3 Ventures, and Fisher Yu, co-founder of Babylon.

On the other hand, prior to mainnet launch, Babylon announced a technical partnership with Bedrock to build liquid staked Bitcoin (uniBTC) on Babylon, aiming to introduce the service before Babylon’s mainnet goes live. This allows users to earn staking rewards while maintaining Bitcoin liquidity and participating in other DeFi activities.

What makes Bedrock so compelling that it not only dominated this Babylon quota race but also attracted top-tier capital and full support — both financial and operational — from Babylon?

This article dives into Bedrock, exploring its operational mechanisms, ecosystem strategy, and recent developments to uncover its unique positioning, core advantages, and future potential within the LRT space.

Image Source: Twitter @Bedrock_DeFi

Amid Fierce Competition, How Did Bedrock Take the Lead?

Before delving into specific preparations, let’s clarify two key questions:

1. Was securing a share of Babylon’s 1,000 BTC first-phase staking quota truly worthwhile?

The answer is clearly yes.

Firstly, staking (and restaking) is a central narrative of this cycle. Leveraging Bitcoin’s unmatched security and $1.5 trillion market cap, Babylon is seen as a key driver for the second growth curve of LRT.

Secondly, the intensity of the Babylon War made it nearly impossible for average users to participate directly. As a result, market attention gradually shifted toward third-party restaking protocols. We know that in previous Cap 1 and 1+ Bitcoin restaking campaigns, Bedrock quickly hit its 400 BTC limit. The opening of Cap 2 pre-staking on August 21 at 12:00 Beijing time similarly drew strong community participation. For protocols like Bedrock, securing more quota means more BTC can be staked via Babylon, delivering greater staking and points rewards to users.

2. Was the competition really that fierce?

This question hardly needs answering — on-chain data speaks volumes.

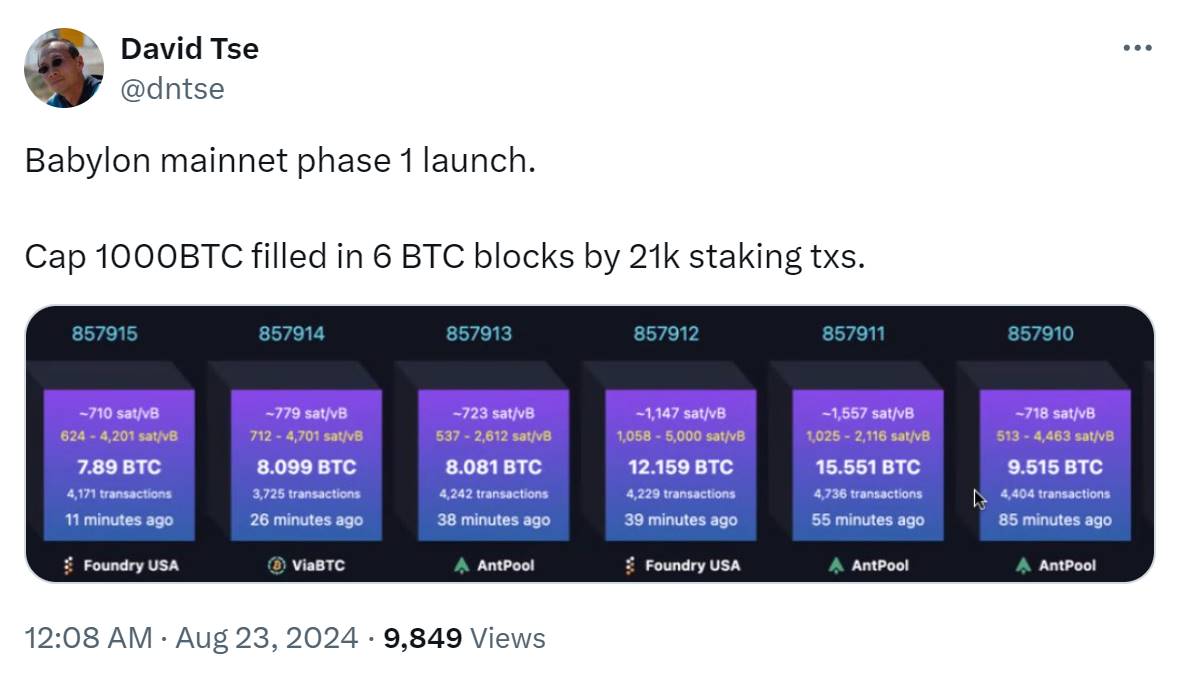

David Tse, co-founder of BabylonChain, shared a screenshot of on-chain data on Twitter last night, illustrating the frenzy caused by Babylon’s first-phase staking event. The image shows:

During Babylon’s first-phase staking period, starting at Bitcoin block height 857910, Bitcoin gas fees skyrocketed from around 0.03 BTC to a peak of 15.55 BTC — an increase of over 100x.

Image Source: Twitter @dntse (BabylonChain Co-founder)

The staggering numbers underscore just how fierce the competition was, proving that securing a desirable quota required thorough preparation. Bedrock, which captured nearly 30% of the staking quota, clearly had the most convincing preparation strategy.

Looking back at Bedrock’s past work and social media content, we see that having深耕 in the staking (restaking) space for years, Bedrock anticipated this Babylon War well in advance and began preparations early.

First, deep data analysis and data-driven decision-making are core principles guiding Bedrock’s operations. As the saying goes, “know yourself and know your enemy, and you’ll win every battle.” Since this Babylon staking event was entirely on-chain, Bedrock conducted comprehensive and in-depth analysis of Bitcoin network data well before staking began. They built understanding around key issues and formulated detailed contingency plans to maximize participation while controlling costs — a critical foundation for Bedrock’s success.

Second, Bedrock’s extensive experience in DeFi and staking/restaking gives it better foresight and preparedness for intense competition. Typically, high-demand projects like Babylon inevitably face congestion and single-point failures. We observed during this Babylon War that many infrastructures buckled under pressure, with transactions failing to send and automated strategies collapsing. Immediately after Babylon’s announcement, Bedrock began optimizing its existing infrastructure to address these issues, significantly reducing the risk of congestion.

Most importantly, security is paramount — especially when participating in popular projects where human error can easily occur. From day one, Bedrock deployed a comprehensive suite of security mechanisms to eliminate any risk of human error, ensuring user assets could only ever flow to the official Babylon staking address. This allowed Bedrock to focus confidently on bidding without worrying about security breaches.

These thorough preparations enabled Bedrock to navigate the Babylon War with remarkable composure. Securing the top spot in quota allocation gives Bedrock greater room to enhance Babylon-related earnings for its users. The "quota grab" frenzy lasted just over an hour, but beyond that, Bedrock has maintained consistent observation and research in the LRT space for years. It is precisely this long-term dedication that highlights Bedrock’s advantages in market positioning, technical capability, and ecosystem development.

Prosperity Amid Concerns: EigenLayer Sparked the LRT Craze — But Is It Losing Steam?

LRT has been a hot narrative in this cycle, with EigenLayer igniting the first wave of excitement: according to DefiLlama data, EigenLayer’s TVL once peaked above $20 billion. Many in the community say: if you haven’t participated in EigenLayer, you haven’t truly experienced this cycle.

Yet following the hype, as EigenLayer’s TVL has steadily declined in recent months, concerns beneath the surface of LRT’s prosperity begin to emerge — evident from the development trajectory of Ethereum-based LRT:

Take EigenLayer as an example. The three goals of LRT are: first, sharing Ethereum’s security to empower AVSs; second, further unlocking liquidity; third, providing users with richer yields. This logic relies not only on effective node operation and AVS support but also on fully automated and secure smart contracts to ensure liquidity.

However, several issues exist in practice:

First, current LRT involves significant manual processes rather than being fully executed by smart contracts. This undermines true DeFi-level security and leads to notable delays during unstaking, making it easy to deposit but hard to withdraw.

Second, much of the TVL in many protocols isn’t genuinely on-chain and therefore lacks real liquidity.

Most critically, regarding the user-focused issue of yield, Ethereum’s staking returns are relatively low. Many protocols attempt to mask insufficient node-side earnings by promising uncertain future DeFi gains.

As a Bitcoin security-sharing protocol, Babylon is seen as a pivotal force driving the second growth curve of LRT.

This stems partly from the immense potential of BTCFi: Bitcoin, the world’s largest cryptocurrency by market cap, possesses the strongest economic security. However, PoW itself doesn’t generate yield, and due to Bitcoin’s performance and programmability limitations, most of its $1.5 trillion in value remains idle. Holders are eager for more sophisticated and advanced BTCFi applications. If we extrapolate from the scale of ETHFi relative to Ethereum’s total value, BTCFi could reach a $300 billion market.

It also stems from the revolutionary changes Babylon brings to BTC LRT: through Bitcoin timestamps and staking, Babylon enables previously non-stakable BTC to become stakable. This not only provides native PoS risk-free yield to BTC holders but also allows other PoS chains to share Bitcoin’s security foundation, opening up new frontiers for BTCFi.

As mainnet approaches, Babylon has systematically advanced its preparations, the most crucial of which is securing reliable node operators as core carriers of LRT — avoiding past pitfalls and delivering higher-quality services. In this light, Bedrock’s May investment from Babylon’s co-founders and subsequent technical collaboration appear both logical and natural.

Image Source: Bedrock Twitter @Bedrock_DeFi

Babylon x Bedrock: Launching the Second Phase of LRT Growth

Behind the close collaboration between Babylon and Bedrock lies not only a bridge built by Bedrock’s heavyweight founding team but also Bedrock’s proven foresight and high-quality product execution in the LRT space.

A year ago, Bedrock launched uniETH, already showcasing the team’s ability to anticipate and optimize challenges in the LRT space:

As an institutional-grade liquid restaking token built on EigenLayer, uniETH helps users select optimal validator nodes and maximize returns. To tackle the “easy in, hard out” dilemma, Bedrock is the only ETH protocol supporting only native ETH and achieving full smart contract automation. uniETH supported unstaking from day one, and all smart contracts underwent multiple security audits. Over the past year, more than 10,000 ETH have been successfully staked and unstaked.

Additionally, Bedrock’s uniIOTX is now the largest staking gateway on IOTX. Over the past year, uniETH and uniIOTX have achieved over $200 million in TVL. These strong results attracted significant attention, including from Babylon, which was actively seeking high-quality node operator partnerships.

In fact, the relationship and interaction between Babylon and Bedrock go back years — as far as five years ago.

As widely known, Bedrock originated from RockX. Founded in 2019 by Zhuling Chen and Xinshu Dong, RockX has long specialized in staking, managing over $2 billion in staked value and serving more than 150,000 registered users.

Zhuling Chen holds a Master’s degree in Engineering from MIT and previously served as co-founder of Layer1 blockchain aelf, with multiple successful blockchain startups under his belt. Xinshu Dong holds a PhD from the National University of Singapore, has led national cybersecurity projects, and co-founded Zilliqa and RockX. He is now a core member of Babylon.

In numerous public events, Bedrock team members have engaged in deep discussions with Babylon founders Fisher Yu and David Tse on the long-term evolution of LRT, even assisting Babylon multiple times as partners in testnet setup and core module planning.

Thus, when Bedrock announced its expansion into Bitcoin ecosystem restaking, Fisher Yu, co-founder of Babylon, chose to invest as an angel investor. Furthermore, the two parties established a technical partnership to launch the BTC LRT token uniBTC.

Notably, this funding round also included support from professional asset managers such as OKX Ventures, LongHash Ventures, and Amber Group — reflecting strong institutional trust and security validation for Bedrock.

Image Source: Twitter @Bedrock_DeFi

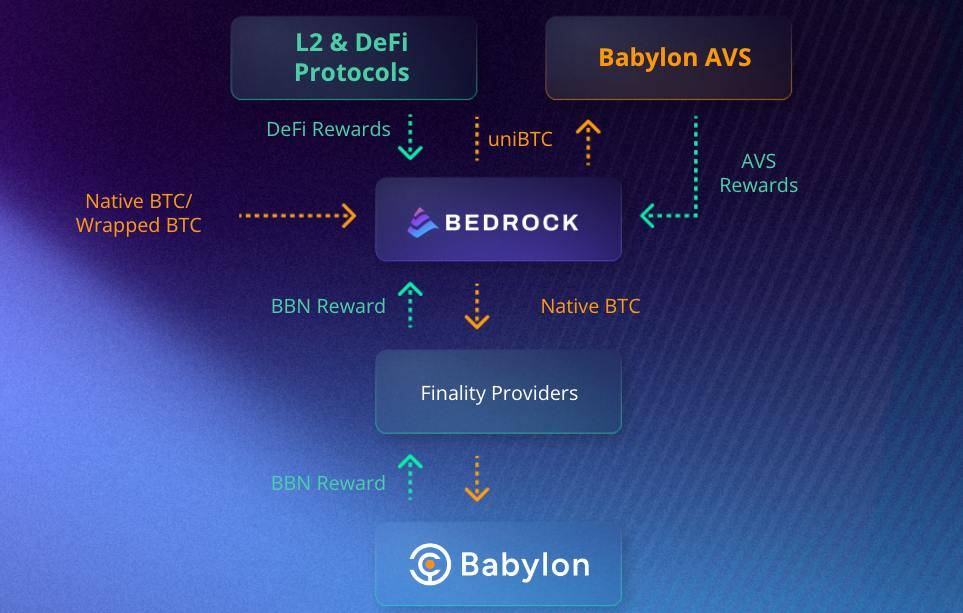

Given Bedrock’s years of experience in staking, sharp market insight, and forward-looking vision for the LRT space, Babylon believes this collaboration will better realize the vision of “LRT’s second growth phase,” namely:

- Robust Security and Full Smart Contract Automation: Leverages Bitcoin’s strongest security via Babylon while further enhancing safety using trusted Wrapped BTC frameworks. The entire staking/unstaking process is executed on-chain via open-source smart contracts that have undergone multiple security audits.

- Strong Decentralization: Native BTC security is further protected through third-party custody, managed collaboratively by multiple large external DeFi teams. Multi-sig contracts add another layer of security.

- High Liquidity and Diversified Yield Streams: Enables “multiple uses from one asset” through rich DeFi integrations. LRT tokens are tradable and support unstaking, giving users greater autonomy.

Now, let’s dive into how this works in practice by examining the operational mechanics of uniBTC.

Building a Rich DeFi Ecosystem Around uniBTC: Unlocking Liquidity and Yield

For ordinary users, Babylon enables native BTC staking. However, direct participation in BTC native restaking locks up liquidity and exposes users to technical hurdles such as PoS slashing, uptime requirements, time locks, and contract risks. Moreover, what about other BTC-pegged tokens (like wBTC, BTCB, or other Wrapped BTC variants)? How can they participate?

Through Bedrock’s liquidity restaking solution uniBTC, users can participate effortlessly while retaining liquidity.

Compared to other LRTs, uniBTC benefits from Babylon’s technical support, resulting in superior compatibility. More importantly, uniBTC aims to support the most diverse range of assets, chains, and DeFi use cases, offering users broader participation options and enhanced yields — making uniBTC a preferred choice.

Regarding supported assets, Bedrock’s goal is simple: no matter which chain your BTC assets are on or in what form, you can stake them 1:1 to mint uniBTC. Different Wrapped BTC tokens from across the ecosystem can be used to obtain uniBTC, with uniBTC’s value backed by a diversified asset base — reducing reliance on any single token: Currently, Bedrock supports asset minting of uniBTC from ecosystems including Ethereum (wBTC/FBTC), Optimism (wBTC), Merlin (BTC/MBTC), Bitlayer (BTC/wBTC), and B² Network (BTC/wBTC). As ecosystem partnerships accelerate, Bedrock will continue expanding asset support.

When users deposit Wrapped BTC into Bedrock, those assets go into an on-chain multi-sig vault secured and jointly managed by Bedrock and several trusted major DeFi entities, enhancing decentralization and fund security. The entire staking/unstaking process is executed on-chain via smart contracts, which are open-source and have undergone multiple security audits. The total supply of uniBTC can be verified and checked via Etherscan.

Image Source: Bedrock Medium

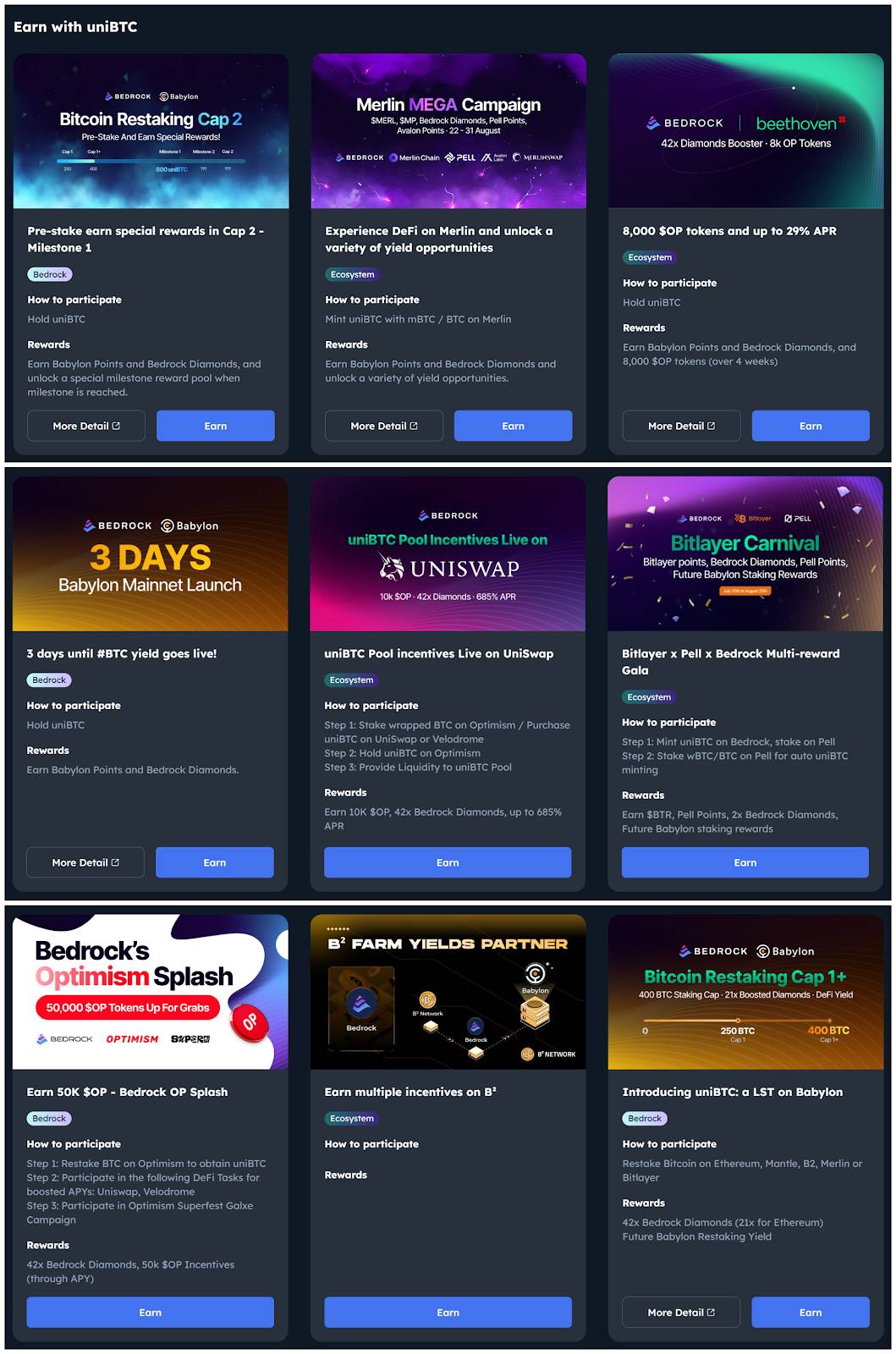

After holding uniBTC, Bedrock aims to unlock additional utility through a broad and rich DeFi ecosystem — maximizing liquidity and generating diverse on-chain yields:

First, users who mint uniBTC earn multi-tier Diamond rewards from Bedrock. As tangible representations of Bedrock’s ecosystem rights, Diamonds can be redeemed for tokens and various ecosystem benefits in the future. Users can also accelerate Diamond accrual by linking their X (Twitter) account or inviting friends.

Simultaneously, Bedrock stakes the equivalent amount of BTC into Babylon, earning Babylon rewards and积分 for users, with 100% of Babylon积分 going directly to stakers.

Beyond base yields, uniBTC holders gain access to an unprecedented breadth of DeFi opportunities. With years of深耕 in staking/restaking, Bedrock has cultivated strong partnerships across Bitcoin, Ethereum, and other ecosystems — delivering richer yield structures and awakening BTCFi’s growth potential by bridging dormant Bitcoin capital with vibrant DeFi across Ethereum and beyond.

Currently, multiple reward programs are live across the Bedrock ecosystem, including Merlin, Pell, and B² Network in the Bitcoin ecosystem; Beethoven X, Velodrome, and UniSwap in the OP ecosystem; and FBTC in Mantle — guiding users deeper into the ecosystem while offering efficient ways to earn. By minting uniBTC, users unlock Bedrock Diamonds, Babylon积分, and additional yield opportunities from ecosystem partners. Bedrock’s official website has also launched a Discover page to help users stay updated on campaign news.

Image Source: Bedrock Website

Although unstaking functionality for uniBTC is not yet available (expected to launch in September), secondary market liquidity is supported. Users can trade uniBTC on secondary markets based on their risk preferences. uniBTC is now live on Optimism and will soon integrate with Optimism-based DEXs and liquidity protocols like Velodrome, offering holders lower gas fees, faster transactions, deeper liquidity pools, and richer yield strategies.

Going forward, Bedrock will continue expanding ecosystem collaborations, adding more DeFi use cases for uniBTC and providing users with broader participation avenues and yield opportunities.

Conclusion

Liquidity and yield are central concerns for crypto participants. As demand for liquidity and returns grows, LRT — designed to unlock liquidity and deliver richer yields — is becoming an enduring topic in the DeFi landscape.

Sustainable growth in any sector depends on new narratives emerging. For LRT, Babylon enables Bitcoin assets to do more than store value and facilitate payments — they can now be staked to secure PoS networks and earn rewards. The introduction of BTCFi, with its multi-trillion-dollar market potential, presents a fresh wave of opportunity for LRT. In the foreseeable future, LRT is poised for a second phase of rapid growth.

Babylon’s mainnet launch is considered one of the most unmissable events in the 2024 crypto calendar. As a key partner of Babylon, the community widely expects Bedrock to perform strongly around the launch, drawing increased users and capital into its ecosystem.

Although Bedrock is still in the early stages of expanding BTC LRT, its strengths are evident across multiple dimensions — team composition, funding strength, industry experience, forward-looking understanding of LRT, and high-quality product delivery. All point to genuine growth potential. Additionally, Bedrock’s deep, almost “firstborn”-level collaboration with Babylon enhances its technical fit for BTC LRT and grants it greater visibility.

With Babylon’s mainnet launch set to unlock further BTC LRT potential and upcoming pre-staking phases like Cap 2, Bedrock is likely to play a pivotal role in LRT’s second growth curve. The future looks bright — stay tuned for more from Bedrock.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News