Liquid Restaked Token (LRT): A New Ponzi Token Economics Script

TechFlow Selected TechFlow Selected

Liquid Restaked Token (LRT): A New Ponzi Token Economics Script

Liquid restaking tokens are opening a new chapter for DeFi.

Author: IGNAS | DEFI RESEARCH

Compilation: TechFlow

Last month, I shared bullish views on two emerging areas in DeFi: Liquid Restaked Tokens (LRTs) and Bitcoin DeFi.

Both are compelling and currently under development, but this article focuses primarily on LRTs—and I believe now is the perfect time to pay attention to them.

What Is Restaking? Key Points to Know

Restaking is a feature of EigenLayer, a middleware that allows you to stake your ETH across multiple protocols—called "Active Validation Services (AVS)"—simultaneously securing multiple networks/services with one stake.

These services typically handle their own security, including bridges, oracles, and sidechains, but we’ll soon see some wild new ideas and concepts emerge.

How It Works

EigenLayer acts as a cross-chain bridge, allowing you to "restake" your already-pledged ETH into various protocols—AVSs. You can choose to restake ETH directly or use liquid staking tokens like stETH, rETH, or cbETH.

Advantages

-

Capital Efficiency: Users can earn yields from multiple protocols using the same capital.

-

Enhanced Security: EigenLayer enables new protocols to leverage Ethereum’s existing security layer.

-

Developer Freedom: Saves developers time and resources in building new security layers.

Risks

-

Slashing Risk: Increased risk of losing staked ETH due to malicious activity.

-

Centralization Risk: If too many stakers move to EigenLayer, it could pose systemic risks to Ethereum.

-

Reward Dilution Risk: High yield competition between protocols may dilute staking rewards.

Restaking offers a way to maximize staking rewards and protocol security, but it also introduces its own set of risks, particularly around slashing and centralization.

Introducing Liquid Restaked Tokens (LRT)

There's one major downside to EigenLayer’s restaking model for DeFi: once your liquid staking tokens (LSTs) are locked on EigenLayer, they become illiquid. You can’t trade them, use them as collateral, or deploy them elsewhere in DeFi.

Liquid Restaked Tokens (LRTs) offer a solution by unlocking this liquidity and adding another layer of leverage to boost yields. Instead of depositing LSTs directly into EigenLayer, you can route deposits through liquid restaking protocols. This follows a logic similar to how we use Lido.

Key advantages of LRTs include:

-

Liquidity: Unlock previously staked tokens for use across DeFi;

-

Higher Yields: Boost returns via added leverage;

-

Governance Aggregator: DAOs or protocols manage restaking without manual intervention;

-

Compounding Rewards: Optimize yield while saving on gas fees;

-

Diversification & Risk Reduction: While direct restaking on EigenLayer limits you to one operator, LRTs allow delegation across multiple operators, reducing exposure to any single bad actor.

Why I’m Bullish on LRT

Liquid restaking is building a high-yield house of cards for early adopters.

-

LRTs deliver higher yields on ETH—the most valuable crypto asset. Thanks to LRTs, we can earn Ethereum staking yield (~5%) + EigenLayer restaking rewards (~10%) + LRT protocol token emissions (10%+). Before a real bull run hits, imagine earning 25%+ on ETH—it’s not far-fetched.

-

Airdrops: Potential airdrops from EigenLayer + AVS + LRT protocol tokens.

-

I believe the liquidity unlocked by LRTs—which would otherwise be trapped in EigenLayer—will create more leverage in DeFi, pushing up all TVL metrics and ETH price in a manner reminiscent of DeFi Summer 2020.

-

We’re still very early. EigenLayer is still in test mode with limited restaking capacity, so I believe the real fun begins when EigenLayer lifts caps and new AVSs requiring restaking go live.

Tokenomics and the Coming “LRT War”

Even though LRT protocol tokens haven’t launched yet, I believe there’s a latent game unfolding here.

The tokenomic outlook for LRT protocols looks highly attractive, and I expect them to evolve similarly to veTokenomics.

When new AVSs launch on EigenLayer’s pooled security, they’ll offer something valuable to attract restaked ETH. New tokens and compelling narratives will emerge. The first-mover AVS might attract more liquidity simply because options are fewer.

However, choosing which protocol to restake into takes time and expertise. Most users will gravitate toward AVSs offering the highest yields.

Compared to directly attracting users/TVL, new AVSs may find it more cost-effective to influence LRT protocols to route deposits their way. Buying LRT tokens to vote on where issuance goes could be more efficient than offering native token incentives.

For example, a new Bridge X launches and needs consensus-layer ETH secured. The Bridge X team could target EigenLayer restaking whales and retail investors with their own token rewards. But lobbying an LRT protocol that already holds large amounts of restaked ETH might be easier.

This dynamic, in turn, increases demand for LRT tokens—especially those successfully aggregating large volumes of restaked ETH.

Just like in the “Curve Wars,” we may see fierce competition among AVSs vying for DAO votes. But beware of the stories they sell—these tokens could be highly inflationary.

Protocols to Watch

Since we’re still early and EigenLayer is only beginning rollout, no LRT protocols are live on mainnet yet. If you're aiming for airdrops and need time to research, this is good news.

Some promising LRT protocols include:

Stader Labs

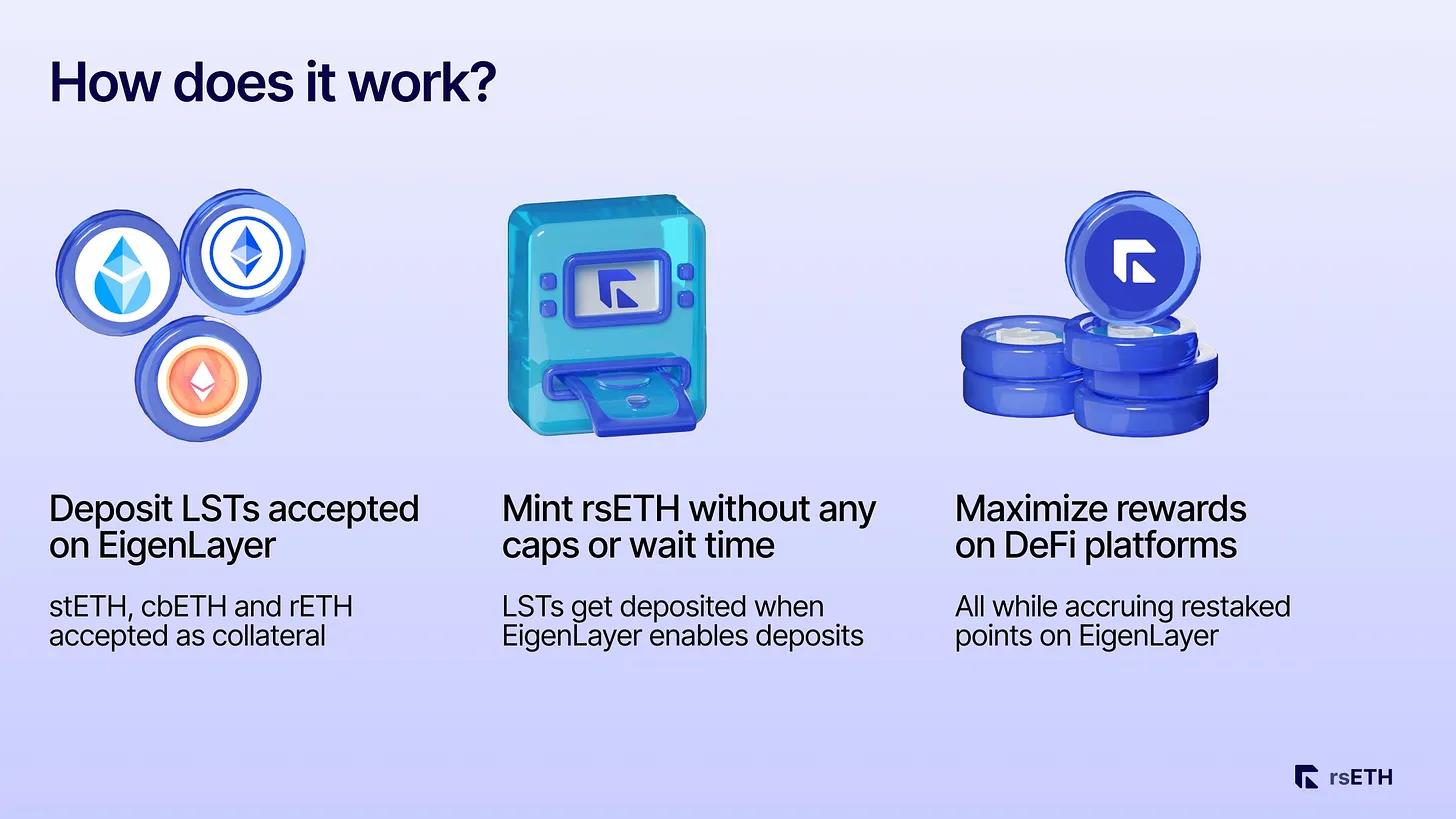

They’ve launched rsETH, backed by LSTs accepted by EigenLayer.

rsETH is currently on testnet. Moreover, Stader isn't just an LRT protocol. Two months ago, it launched ETHx, a liquid staking token that has already attracted $32 million in deposits. Although Stader entered the LST game relatively late, it’s positioning itself at the forefront of the LRT era.

Stader already has a token, SD, whose existence may rule out a future airdrop. However, as the LRT narrative gains momentum, SD could become an attractive bet.

Astrid Finance

Unlike Stader, Astrid offers two LRTs instead of one.

You can deposit stETH or rETH (LSTs) into pools and receive LRTs (rstETH or rrETH) in return. These pooled tokens are then restaked into EigenLayer and allocated across operators by the Astrid DAO.

Rewards are automatically compounded, and holders’ balances are rebalanced through balance adjustments.

InceptionLST

Another new protocol currently on testnet.

You deposit stETH or rETH to receive an LRT called inETH2.

Neither Astrid nor InceptionLST has a token yet, so interacting with them now could position you well for potential airdrops.

Finally, Lido and Rocket Pool may also expand into LRTs. I hope they don’t, as newer LRT projects offer greater upside potential.

My Game Plan

Here’s what I plan to do:

-

Learn: LRTs are new, so I’ll familiarize myself with various protocols and closely monitor EigenLayer updates.

-

Due Diligence: Before any protocol launches, I’ll test it. I’ll join their Discord channels and ask about roadmaps, upcoming upgrades, and overall strategy.

-

Market Dynamics: Real action starts once EigenLayer lifts deposit limits. Watch which LRT protocol captures the most TVL. I expect the LRT market to mirror the LST market, with one protocol potentially dominating up to 80% market share.

-

Risk Management: Protect my ETH principal with conservative exposure. Specifically, I’ll allocate no more than 5% of my total ETH holdings per protocol. I’ll avoid anything overly complex; after all, bugs, attacks, and exploits are inevitable.

-

Token Strategy: I’m betting on LRT governance tokens with compelling “Ponzi tokenomics” that can build self-sustaining flywheels. These tokens should offer attractive staking yields, real yield rewards, and voting power over which AVS receives restaked ETH. Additionally, they need low enough inflation to counteract any miner sell pressure.

-

Exit Strategy: When market euphoria peaks and everyone’s calling LRT governance tokens the new “metaverse” for “generational wealth,” I’ll cash out and recycle ETH. Ideally, sell in tranches during price rallies rather than all at once.

-

Review and Adjust: Hopefully, the market will bring things we haven’t seen before—stay alert, learn, and adapt. These are the best bets.

Risks: How It Could Collapse

Like any leveraged financial mechanism, liquid restaked tokens carry risks. We’re essentially stacking leverage—similar to early DeFi—making the system more vulnerable to market volatility and systemic failures.

Vitalik himself has warned that restaking could introduce complex scenarios endangering Ethereum’s security, such as slashing penalties originating from third-party chains. EigenLayer’s co-founders agree, noting that while restaking can serve low-risk purposes, unnecessary complexity that jeopardizes Ethereum’s security should be avoided.

Yet, if history teaches us anything, restaking may be overused—pushed to extremes by launching AVSs that don’t actually need access to Ethereum’s consensus layer.

Still, even if Ethereum remains secure, a flood of new AVSs and LRTs could dilute both capital inflows and attention across the sector, leading to collapse in their governance token prices.

So, there you have it—liquid restaked tokens are opening a new chapter for DeFi.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News