Where will LRTs go after the EIGEN airdrop?

TechFlow Selected TechFlow Selected

Where will LRTs go after the EIGEN airdrop?

"The entire Eigenlayer ecosystem is a venture capitalist's dream come true."

Author: hitesh.eth

Translation: TechFlow

LRTs offer users a simple interface to restake ETH and LSTs for additional yield. Now that the Points meta campaign around LRTs, EigenLayer, and over 10 AVSs has ended, we need to shift our focus toward LRTs like EzETH and eETH and consider how to generate extra returns on top of Ethereum’s native 3.21% staking yield.

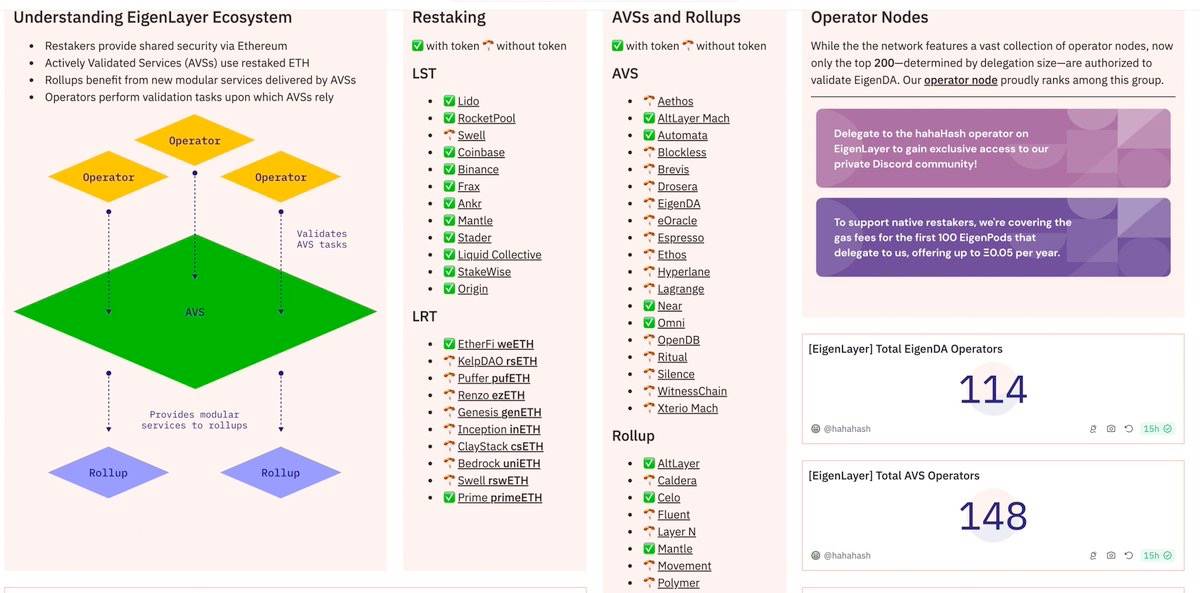

In EigenLayer’s design, AVS operators run hardware to perform computations and validations, delegating restaked ETH to AVSs—essentially web3 service protocols bootstrapped using EigenLayer’s economic security pool.

Since they borrow economic security from EigenLayer, they must pay fees, which translate into the promised additional yields.

In early stages, most AVSs struggle to gain project adoption, making revenue-sharing nearly impossible. Their only option is often to launch a token out of thin air.

Today, venture capital firms are blindly investing in AVSs, so I wouldn’t be surprised if some AVS tokens reach multi-billion dollar valuations at TGE.

Web3 service protocols like The Graph, Pyth, and Axelar allocate a certain percentage of their token supply for node rewards, with annual inflation dedicated specifically to these incentives. Supply allocations for node rewards typically range between 5–10%, but this becomes subjective when considering the scale of economic security they draw from EigenLayer. For instance, AXL has $750 million in economic security, whereas AVSs like Witness Chain and Lagrange have accumulated over $5 billion in economic security within less than a month.

Ideally, they should allocate more than 10% of their supply to fairly reward AVS operators, who would then share a portion of those rewards with restakers.

Initially, before these AVSs launched their Points programs, you could earn AVS points by depositing ETH into Renzo, Puffer, and EtherFi—and this will continue until we reach the saturation phase of the Points meta.

As for LRT tokens themselves, they currently only serve governance purposes. Unless they begin sharing fees or other revenues from stakers, there's little reason to buy these tokens.

The entire EigenLayer ecosystem is a dream come true for venture capitalists.

For retail investors, it’s purely about capital dilution in pursuit of marginal yield on ETH.

You can also optimize yields through other DeFi strategies, so only play this game if you fully understand the rules and risks involved.

Finally, the original author has compiled a comprehensive dashboard tracking EigenLayer’s operational status, providing real-time data on various LRTs, AVSs, and user metrics—an invaluable resource for readers following the EigenLayer ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News