Eigenlayer faces capital outflow after airdrop, with daily outflows significantly higher than pre-token announcement levels

TechFlow Selected TechFlow Selected

Eigenlayer faces capital outflow after airdrop, with daily outflows significantly higher than pre-token announcement levels

EigenLayer is the restaking platform with the largest security network, potentially becoming the most attractive option for new services seeking to bypass their own liquidity bootstrapping.

Author: Rebecca Stevens

Compiled by TechFlow

-

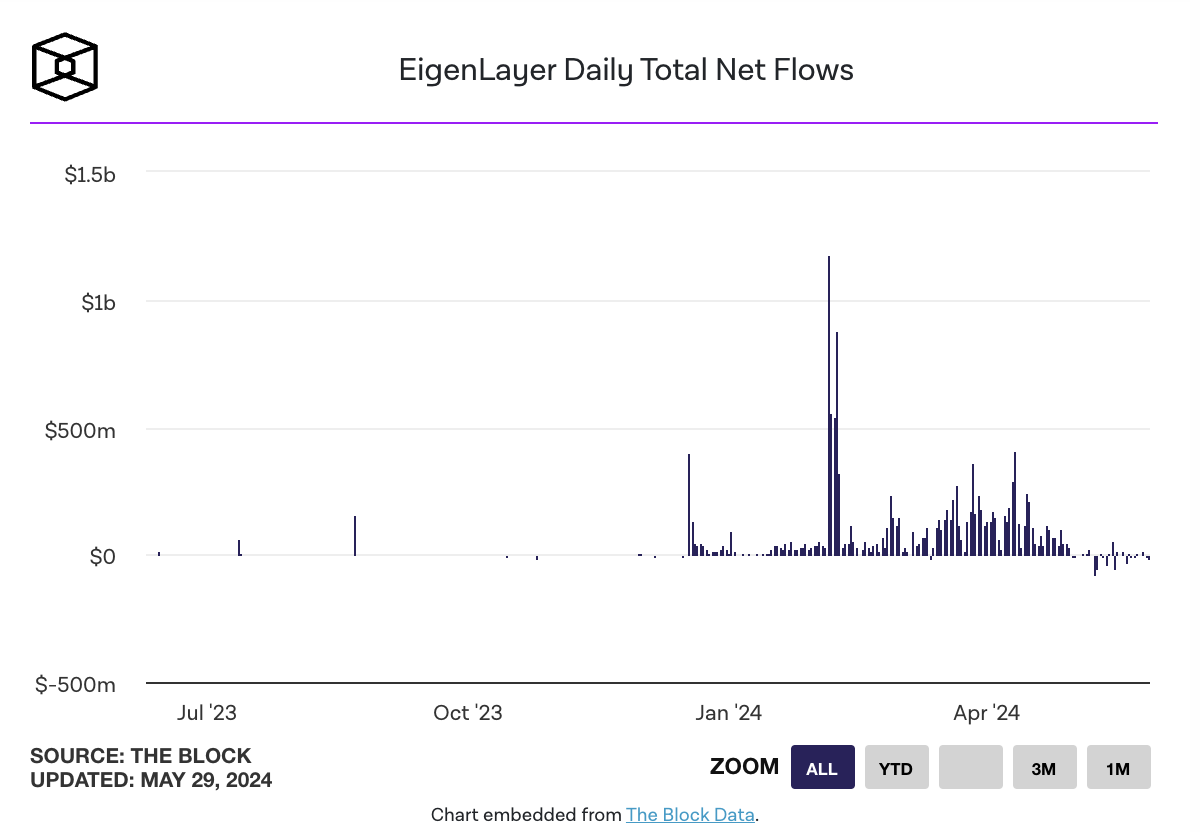

Since May 6, EigenLayer has experienced four days with daily net outflows exceeding $45 million, indicating significant capital leaving the platform.

-

This article is excerpted from The Block's Data & Insights newsletter.

A few weeks ago, we discussed the surge in queued withdrawals on EigenLayer following its EIGEN airdrop. While there were some controversies during the airdrop—including VPN restrictions and initial non-transferability of tokens—the Eigen Foundation eased concerns within days by expanding airdrop allocations and clarifying token unlock and transfer schedules.

Some users may have deposited into EigenLayer solely for the airdrop and exited contentedly after the snapshot, not just those dissatisfied with the initial EIGEN issuance.

We can now see the real impact of the spike in withdrawal queues. Since users must undergo a seven-day withdrawal period, actual fund outflows lag behind withdrawal initiations by about a week. On April 29, when EIGEN’s tokenomics were first announced, queued withdrawals spiked for the first time. However, starting May 6—after the seven-day holding period ended—actual withdrawals surged significantly.

However, beyond just withdrawals, we can now more clearly observe EigenLayer’s capital outflows. In mid-April, when EigenLayer launched its mainnet and lifted deposit restrictions on liquid staking tokens, there was a surge in new deposits. Therefore, increased withdrawals don’t necessarily pose major issues for restaking platforms.

So far, the pressure appears relatively manageable. Since May 6, EigenLayer has seen four days with daily net outflows exceeding $45 million, signaling substantial capital departures. However, compared to EigenLayer’s nearly $15 billion total value locked (TVL), these outflows remain negligible, meaning the amount of capital securing the restaking network remains largely unchanged.

Although days with net outflows have become more common since EIGEN’s launch, days with net inflows still occur—for instance, on May 15, the platform saw $57 million in inflows. While the initial withdrawal surge has eased, daily outflows remain higher than pre-token announcement levels.

Now that EigenLayer has launched its mainnet, it is positioned to pass additional yield to depositors. As the current restaking platform with the largest security network, it could become the most attractive option for new services seeking to bypass their own liquidity bootstrapping. Thus, EigenLayer is well-positioned to attract new services aiming to boost extra rewards for depositors—an advantage potentially strong enough to keep users’ funds within the protocol.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News