How to reshape the staking model through Eigenlayer's restaking technology?

TechFlow Selected TechFlow Selected

How to reshape the staking model through Eigenlayer's restaking technology?

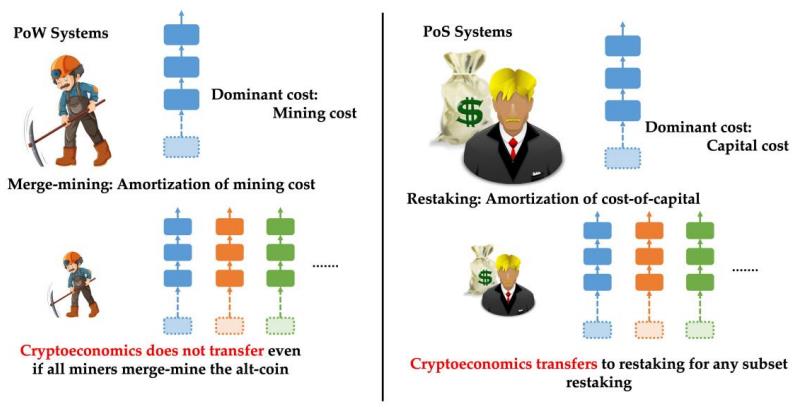

EigenLayer's restaking can be understood as merged mining in the POS domain, enabling dual rewards by validating both a primary and secondary chain that use the same hashing algorithm.

Eigenlayer has been long overdue for discussion. Over the past year, we've gradually covered most of the major LSD projects, but restaking hasn't been formally addressed yet—only briefly mentioned in our previous Polygon 2.0 analysis.

The purpose of staking is to allow users to lock up funds as collateral, become validators, and thereby secure a protocol while earning rewards. If a validator acts maliciously, their stake is slashed. Therefore, staking isn't only necessary for PoS chains; bridges, oracles, data availability (DA) layers, ZKPs, and other systems also require staking to ensure participant security—a concept formally known as AVS (Actively Validated Services).

For protocols, staking ensures security; for users, it generates yield. This creates a 1:1 relationship between capital and projects: each new project must bootstrap its own security from scratch by attracting user capital. However, users have limited funds, so protocols compete for this finite pool of staked capital, while users can only allocate their capital across a limited number of projects, earning correspondingly limited returns.

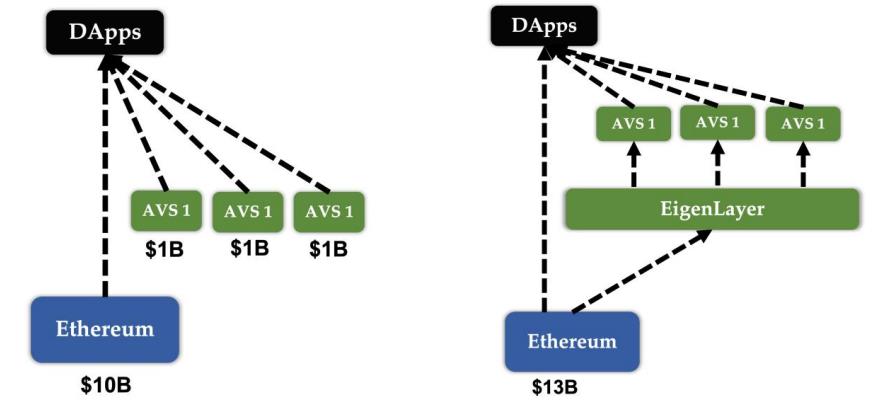

Restaking fundamentally establishes a shared staking pool, enabling a single deposit of capital to simultaneously secure multiple protocols—turning one fish into many meals—and transforming the capital-to-project ratio from 1:1 into 1:N. This allows users to earn amplified returns while reducing competitive pressure among projects for staking capital. For example, Ethereum currently secures around 28 million ETH, achieving strong security. Instead of forcing every new application to build its own AVS from scratch, they could instead inherit and share Ethereum’s existing security. As shown in the diagram below, this enables a chain: Ethereum → Eigenlayer → AVS → DApps.

Hence, many people initially assume restaking means reinvesting staking rewards to compound yields—an incorrect understanding.

However, Vitalik expressed concerns about this model in an article published in May titled "Don’t Overload Ethereum’s Consensus," linked below:

https://vitalik.ca/general/2023/05/21/dont_overload.html

As previously discussed, Ethereum’s envisioned endgame is to function as a lean base layer. Simplicity is paramount in this vision. Vitalik worries that restaking technologies like Eigenlayer might create cascading failures that directly compromise Ethereum's security. His stance is clear: you may experiment with such designs, but don’t expect Ethereum to bail you out via hard forks if things go wrong. The memory of The DAO incident still casts a long psychological shadow over him.

In contrast, Polygon takes a far more aggressive approach. We’ve discussed Polygon 2.0 extensively—their key move being the creation of a unified staking layer enabling native restaking to support multiple chains, achieve elastic resource allocation and scaling, and ultimately realize their goal of becoming a chain aggregator. I personally endorse this vision, especially given the growing fragmentation of liquidity as the number of chains increases.

Returning to Eigenlayer on Ethereum: the team has a classic engineering-academic background. Founder @sreeramkannan is a professor at the University of Washington and leads its blockchain lab. The project has raised $64.5 million from investors including Coinbase and Polygon—impressive credentials. Its first mainnet phase launched in June, progressing well. Data Availability (DA) is its most prominent use case, making EigenDA the first AVS deployed on Eigenlayer—a shared DA layer. Users stake ETH, allowing rollups to publish data on EigenDA for lower transaction costs and higher throughput.

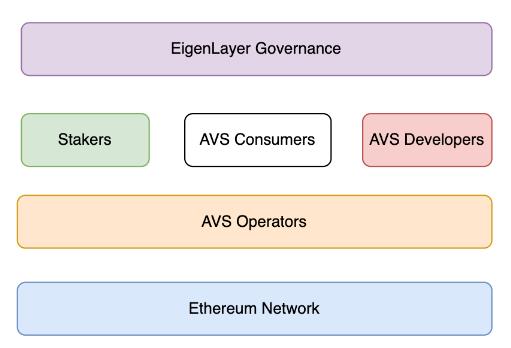

Eigenlayer’s architecture consists of four main layers: At the base is Ethereum, followed by a unified AVS layer. Above that are three roles: stakers, consumers, and developers. Stakers provide capital and earn yield; consumers are protocols requiring staking-based security; developers build custom security services on Eigenlayer. At the top sits Eigenlayer’s governance layer.

Ultimately, Eigenlayer feels like a SaaS platform building a marketplace for Ethereum-based staking security. B2B clients can purchase security services from Eigenlayer, which charges fees from AVS users and redistributes them to stakers.

Security primarily relies on slashing mechanisms to raise the cost of malicious behavior and reduce risks. If a staker is proven to have acted dishonestly while participating in an AVS, their stake will be slashed.

Additionally, there’s the risk of operators colluding to attack an AVS. This is mitigated through economic game theory: similar to PoS logic, suppose an AVS is secured by $8 million, with $2 million locked. An attacker would need to control over 50%—i.e., spend more than $4 million—to steal $2 million. As long as the cost of attack exceeds potential gains, the risk remains theoretically manageable. Emergency measures like restricting fund withdrawals can also serve as circuit breakers. Nevertheless, Eigenlayer’s whitepaper openly acknowledges Vitalik’s concern: “If actual losses occur, we cannot expect Ethereum to compensate affected parties via hard fork.” Frankly, this level of transparency is commendable—the team clearly outlines potential risks upfront.

Eigenlayer’s restaking can also be understood as merged mining within the PoS domain. In the PoW era, miners could simultaneously mine both mainchains and sidechains using the same hashing algorithm—“eating two meals from one fish”—but merged mining increased yield without inheriting security. In contrast, PoS introduces slashing: malicious actions on a sidechain (AVS) trigger stake penalties back on the mainchain (Ethereum), thus inheriting the mainchain’s security.

We won’t go into detail here on how to participate in Eigenlayer—tutorials are available in the official documentation for those interested:

https://docs.eigenlayer.xyz/restaking-guides/restaking-user-guide

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News