Eigenlayer: Introducing the New Paradigm of "Smart DeFi" and Reviewing 10 Potential Use Cases

TechFlow Selected TechFlow Selected

Eigenlayer: Introducing the New Paradigm of "Smart DeFi" and Reviewing 10 Potential Use Cases

By leveraging trustless off-chain computation and data, smart DeFi enables smarter decision-making.

Author: EigenLayer Research

Translation: TechFlow

Ethereum launched Maker in December 2017, ushering in the era of decentralized finance (DeFi). Soon after, Uniswap and Compound went live, building a new economic ecosystem around ETH and ERC20 tokens. Since then, we've witnessed the rapid growth of on-chain finance—concentrated liquidity has improved capital efficiency, perpetual contracts ("perps") have evolved continuously, and innovations like flash loans have emerged, which are impossible in traditional finance.

However, we seem to have hit a bottleneck. Since "The Merge," automated market maker (AMM) liquidity providers (LPs) have lost over $700 million in miner extractable value (MEV). Derivatives exchanges have centralized risk management and order books to improve efficiency. Moreover, we cannot offer personalized lending services, provide better interest rates for low-default-risk users, or easily offer fixed-rate loans with fixed terms.

Many of these issues stem from Ethereum's limitations as a finite state machine. It is constrained by gas fees, a 12-second block time, and an inability to natively receive off-chain data. Modular architectures offer a path forward—by offloading heavy computation and integrating external data without sacrificing Ethereum’s core security.

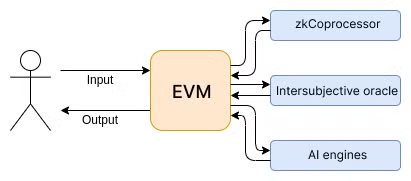

If the EVM acts as glue allowing developers to write arbitrary business logic, what should these coprocessors look like? While Vitalik refers to them as precompiles or opcodes, we need a broader solution. We need coprocessors capable of handling tasks that are too computationally expensive or impractical for Ethereum’s finite state machine—and crucially, these coprocessors must be verifiable.

Figure: Modified from Vitalik’s Glue & Coprocessor Architecture

Developers have long built efficient, specialized services, but verifiability changes everything. This is where EigenLayer adds value: it provides infrastructure to create decentralized networks of node operators who can economically run your custom node software.

We call these decentralized networks Active Validated Services (AVSs), which significantly reduce the cost of building verifiable, trustless services.

The convergence of DeFi and AVSs unlocks a powerful set of new use cases:

-

Trustless Off-Chain Computation (Coprocessors): Perform heavy computations off-chain and return results on-chain at minimal gas cost, secured via zero-knowledge proofs or cryptoeconomic guarantees. Imagine free limit orders—or even AI model calls—all verifiable and decentralized.

-

Trustless Off-Chain Data (Verifiable Oracles, zkTLS): Securely bring real-world data—such as prices, volatility, real-time liquidity, or even sports data—into DeFi.

-

Going Further: Auction networks, policy layers, decentralized order books—AVSs expand DeFi into previously unreachable domains.

We refer to this new paradigm as Smart DeFi, as it brings real-time adaptability and personalization to decentralized finance. By leveraging trustless off-chain computation and data, Smart DeFi enables smarter decision-making. In this article, we explore 10 use cases demonstrating its potential.

Exchanges

Exchanges are central to DeFi, yet less than 15% of spot trading and only 6% of derivatives trading occur on-chain. Smart DeFi has the potential to close this gap, making decentralized exchanges (DEXs) more competitive against off-chain exchanges.

-

VIP Tiers: Volume-Based Fee Discounts

Centralized exchanges offer tiered fees based on trading volume—not just to foster loyalty, but also to subsidize market makers, enabling tighter spreads and better prices for retail traders, ultimately driving more volume to the exchange.

Implementing volume-based fees on DEXs is challenging. To calculate a trader’s volume, a DEX must:

-

Dynamically compute trading volume

-

Store and update each trader’s volume

-

Tracking 30-day rolling volume adds complexity, requiring historical data storage and computation.

-

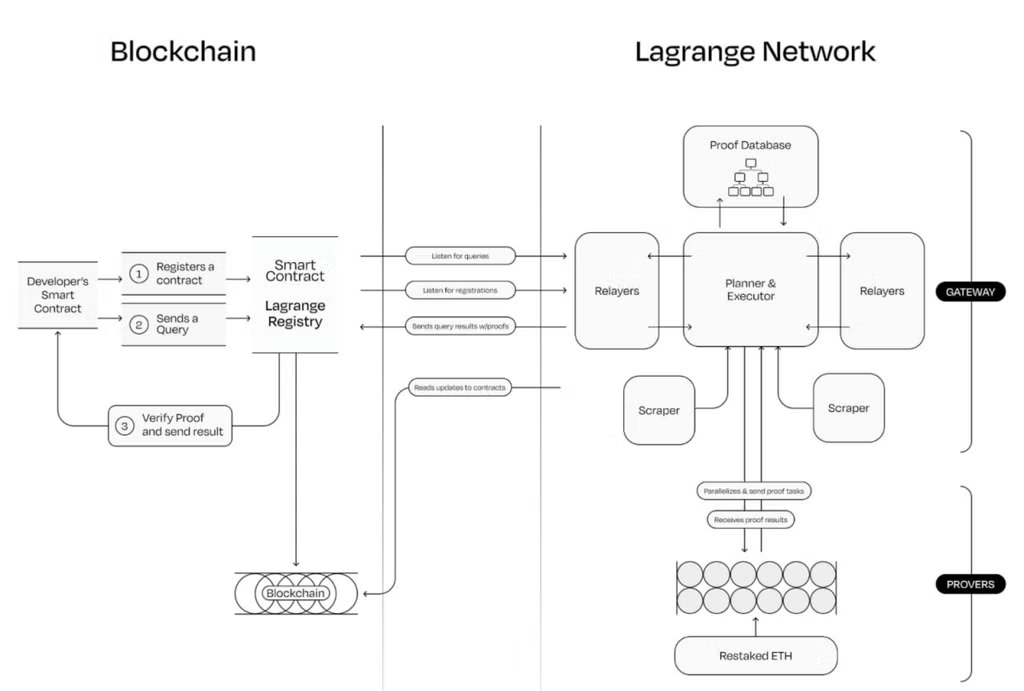

Both approaches are prohibitively expensive on-chain. However, by outsourcing computation to coprocessors like Lagrange or Brevis, we can verifiably compute a trader’s volume per transaction.

How does it work?

-

The coprocessor indexes and stores partial blockchain data in a queryable relational database.

-

An AMM (or Uniswap hook) smart contract invokes the coprocessor to execute a SQL query calculating the trader’s fee volume over a given period.

-

The coprocessor returns the verified result to the AMM via callback, along with a zero-knowledge proof confirming the computation was performed on historical blockchain data.

Figure: How on-chain contracts interact with zkCoprocessor Lagrange

2. Dynamic and Asymmetric Fees for AMMs

Loss-versus-Rebalancing (LVR) is a key issue affecting LP profitability in AMMs. LVR arises from price discrepancies between continuously trading off-chain exchanges and on-chain AMMs, which trade every block—or roughly every 12 seconds on Ethereum mainnet. Significant changes can occur within a single block, and arbitrageurs exploit inter-exchange price differences at the start of the next block.

To improve LP profitability, AMMs can adopt dynamic and asymmetric fees:

1. Dynamic Fees: Adjust fees based on market volatility. LPs typically underperform during high volatility. Increasing fees during volatile periods protects LPs from adverse trades, while lowering fees during stable periods stimulates volume. This reduces fragmentation across fee tiers and improves the LP experience. See this basic proof-of-concept.

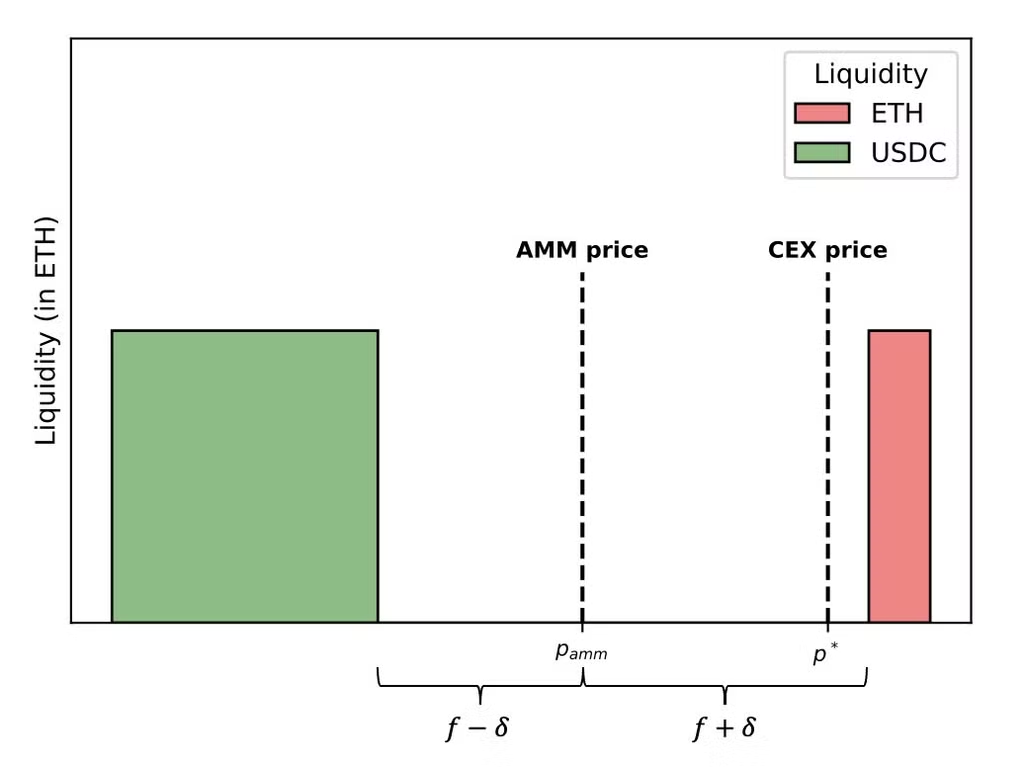

2. Asymmetric Fees: Inspired by Alex Nezlobin, asymmetric fees adjust spreads using external price data. For example, if ETH is priced at $1,000 on a DEX and $1,050 on a CEX, the AMM could buy at $980 and sell at $1,060 instead of maintaining a symmetric spread around the DEX price, better reflecting true market conditions.

Figure: From Alex Nezlobin’s Twitter thread

In both cases, AMMs require reliable external data—such as CEX prices or volatility—to adjust fees. Traditional oracles pose risks: centralized operators may fail or deliver stale data. In contrast, zkTLS (web proofs) offers a superior solution. By cryptographically verifying data directly from web servers, zkTLS eliminates reliance on third parties, delivering real-time, tamper-proof data so AMMs can securely compute dynamic and asymmetric fees—whether on-chain or via coprocessors.

3. Auctions to Reallocate MEV to AMM LPs

Another way to enhance LP profitability involves not just off-chain computation, but a decentralized auction network. Currently, searchers compete in auctions to place their transactions at the front of blocks. Arbitrage profits go to searchers, builders, and proposers—not to LPs or traders. Instead, AMMs could auction the right to trade first through a liquidity pool. If bidding is competitive, most LVR losses would be recaptured. These proceeds could be distributed proportionally to base LPs, reducing overall arbitrage and enabling tighter spreads. Sorella is developing this as a Uniswap v4 hook.

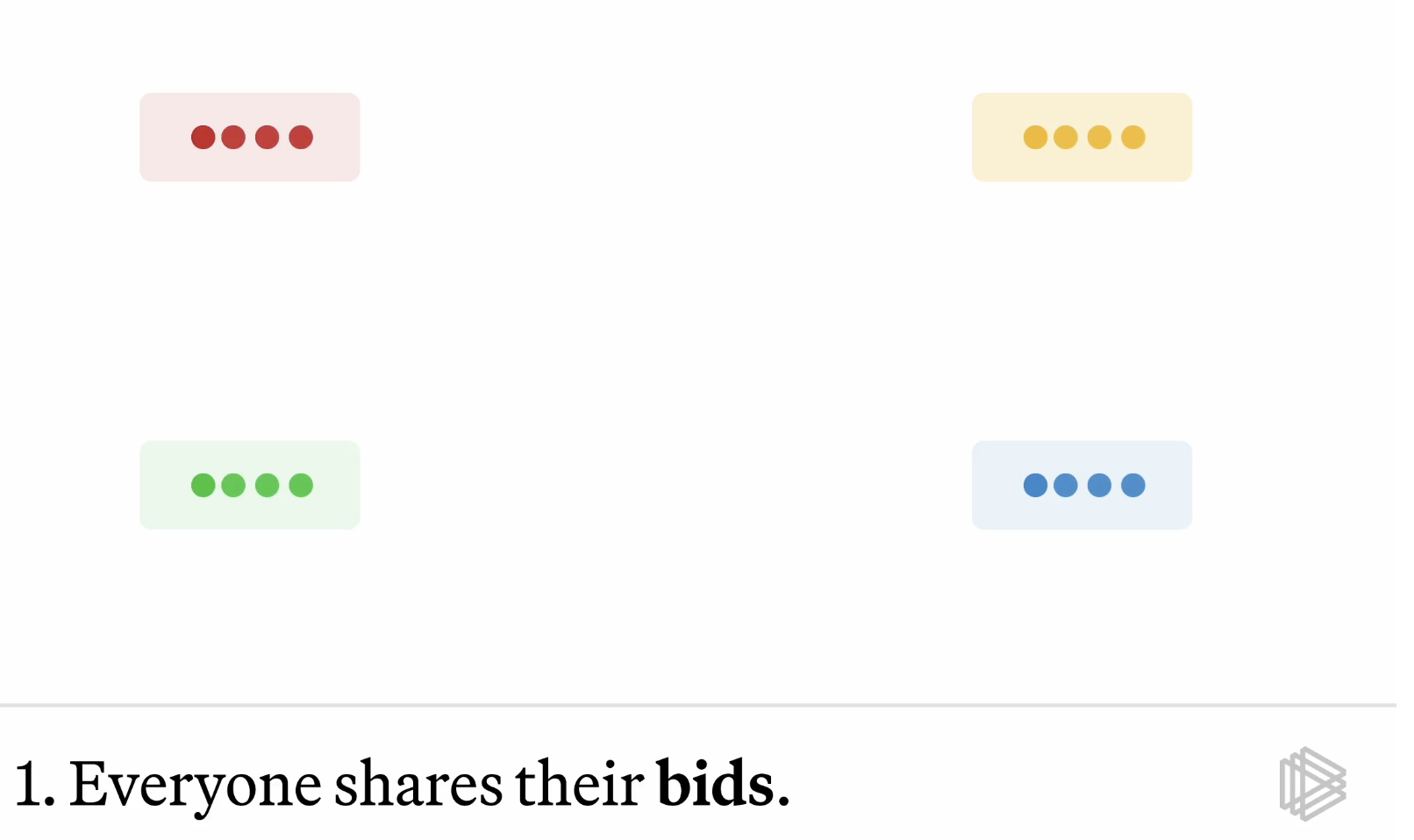

The challenge lies in running a low-latency, censorship-resistant auction. On-chain auctions are too complex and costly—each bid consumes gas. A block could be filled before a winner is selected, preventing completion. While a centralized entity could run the auction off-chain, this contradicts DeFi principles and gives them last-look advantages, enabling value extraction.

The solution is a decentralized group of operators jointly running a leaderless auction, removing dependence on any single party and ensuring process integrity. Operators select winning bids and return proceeds to LPs.

Figure: From Paradigm’s Leaderless Auction

Derivatives

While most derivatives are traded on exchanges, Intelligent DeFi unlocks unique applications for this asset class. Let’s dive in!

4. Advanced Margin Systems

Currently, traders cannot express cross-asset views—like SOLETH or cross-trades—without severely limiting leverage. Most perpetual DEXs linearly calculate margin based on a trader’s total open positions across assets.

For example, if I deposit $10,000 and take a $50,000 long on ETH and a $50,000 short on BTC, this counts as 10x leverage. But this risk profile differs significantly from someone simply going long $100,000 on ETH—these accounts shouldn’t be treated equally. Ideally, traders should be able to leveraged exposures beyond 5x on ETHBTC without such strict constraints.

The issue stems from limited on-chain computation. Specifically, systems must consider collateral per spot asset, position per perpetual asset, unrealized PnL, initial and maintenance margin requirements per perpetual, and correlations and delta hedging. This becomes especially critical as DEXs expand into multiple asset types, including options and perps.

By using coprocessors to perform more complex calculations for account margin factors, DEXs can build customized risk engines tailored to user needs. This enables more flexible delta-neutral strategies and ensures liquidations occur only when truly necessary.

For greater flexibility, coprocessors can dynamically adjust margin requirements in real time, factoring in liquidity from major CEXs and open interest per pool.

Figure: Aevo relies on a centralized risk engine to evaluate worst-case market scenarios, offering more reasonable margin parameters for high-volume traders. Coprocessors offer a unique, decentralized alternative. Source: Aevo Documentation

5. Pricing for Options AMMs

Automated market makers (AMMs) for derivatives, especially options, are exciting yet controversial. Some argue they cannot be accurately priced; others believe derivatives suit only high-volume assets, where order books are more effective. Still, Panoptic, Deri, and others maintain AMMs are optimal for providing liquidity, including for options.

For options AMMs to succeed, a key enabler is off-chain data—volatility, historical prices, and real-time market signals. Additionally, off-chain computation is essential for advanced pricing models like Black-Scholes. Integrating external data with on-chain trading mechanisms is critical to accurate pricing, reduced slippage, and higher capital efficiency for options traders.

Lending

Lending protocols face unique challenges, and artificial intelligence (AI) combined with off-chain computation can enable smarter, more flexible solutions.

6. AI-Powered Parameter Systems

Currently, governance teams of protocols like Aave and Compound manually update lending market parameters. Typically, risk firms like Gauntlet run model-based simulations and recommend adjustments to base rates, collateral factors, and liquidation thresholds. During severe events, they may suggest delisting or freezing certain assets.

This approach has two major flaws:

-

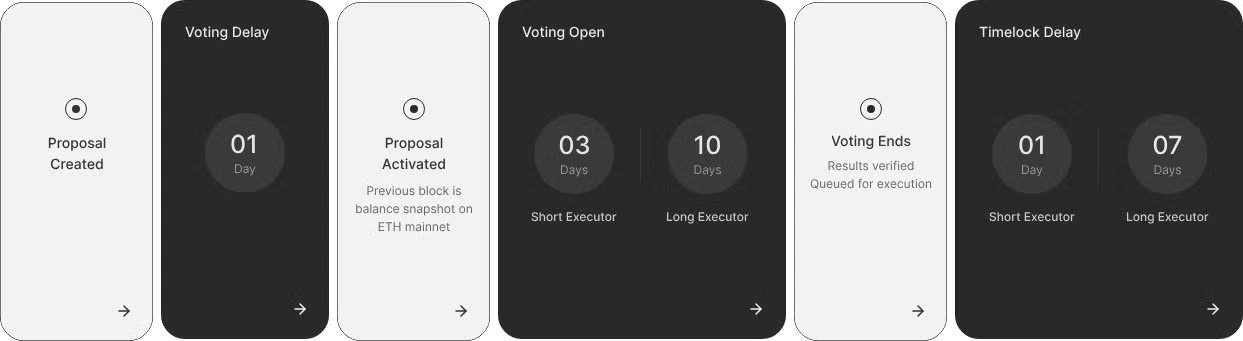

High latency. When I served as an Aave DAO delegate, proposals took at least a week to pass.

-

Governance members often lack sufficient information or engagement when voting on lending parameters. The recent Compound governance attack is a prime example.

Figure: Per Aave’s documentation, governance takes at least 5 days

Morpho and Euler v2 have taken important steps forward by modularizing risk management, allowing anyone to launch their own lending instance. Users can choose where to deposit based on curators’ track records and reputation. This greatly reduces parameter update times.

But in an ideal system, parameters update automatically in real time, responding to on- and off-chain liquidity shifts. AI-based models can simulate various scenarios, predict, and prevent worst-case outcomes. These models rely on AI-specific coprocessors like Ritual, Sentient, Hyperbolic, Ora, and Valence, which process vast datasets off-chain—factoring in volatility, liquidity shifts, and risk correlations—then publish verifiable results on-chain.

7. Customized Loans via Account History and Liquidation Risk

In traditional finance, creditworthy borrowers get better loan terms. In DeFi, all borrowers receive identical terms regardless of risk profile or credit history. While this model has benefits, I believe DeFi can combine the best of both: fair, trustless loans for everyone, while offering better terms—like lower collateral requirements or favorable rates—to repeat borrowers with strong credit histories and low liquidation risk.

Without differentiation, DeFi lending protocols cannot offer personalized terms to low-risk borrowers. This lack of personalization limits potential gains for repeat users and leads to inefficient lending markets.

Personalized lending first requires an anti-Sybil solution to ensure only verified users access better terms. Solutions like WorldCoin or Coinbase Verify can prevent bad actors from repeatedly exploiting the protocol with toxic debt.

Once a borrower is verified, the protocol can collect on-chain data to build a liquidity profile, including:

-

Current and historical loan records

-

Repayment history on past loans

-

On-chain net worth and outstanding debts

-

NFT holdings (if the lending protocol partners with NFT projects for preferential terms)

The protocol could even examine other addresses linked to the same identity for a fuller picture.

Finally, a coprocessor can assess liquidation risk and generate customized collateral factors and interest rates, ensuring tailored loan terms for each borrower.

8. Compliant Privacy Mixers

In August 2022, the U.S. Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash for facilitating money laundering. Yet privacy is a fundamental right with legitimate uses: people should be able to transfer funds to other accounts or friends without revealing their full transaction history. The problem is that existing privacy mixers cannot distinguish between legitimate users and malicious actors. This lack of compliance makes them targets for sanctions and hinders broader adoption.

What if we could create a privacy protocol that only accepts compliant funds? Such a protocol would manage risk and follow regulations, attracting privacy-conscious users. However, determining compliance requires diverse on- and off-chain data—a non-trivial task. Ideally, smart contracts could invoke an API that approves only valid transactions, ensuring compliance.

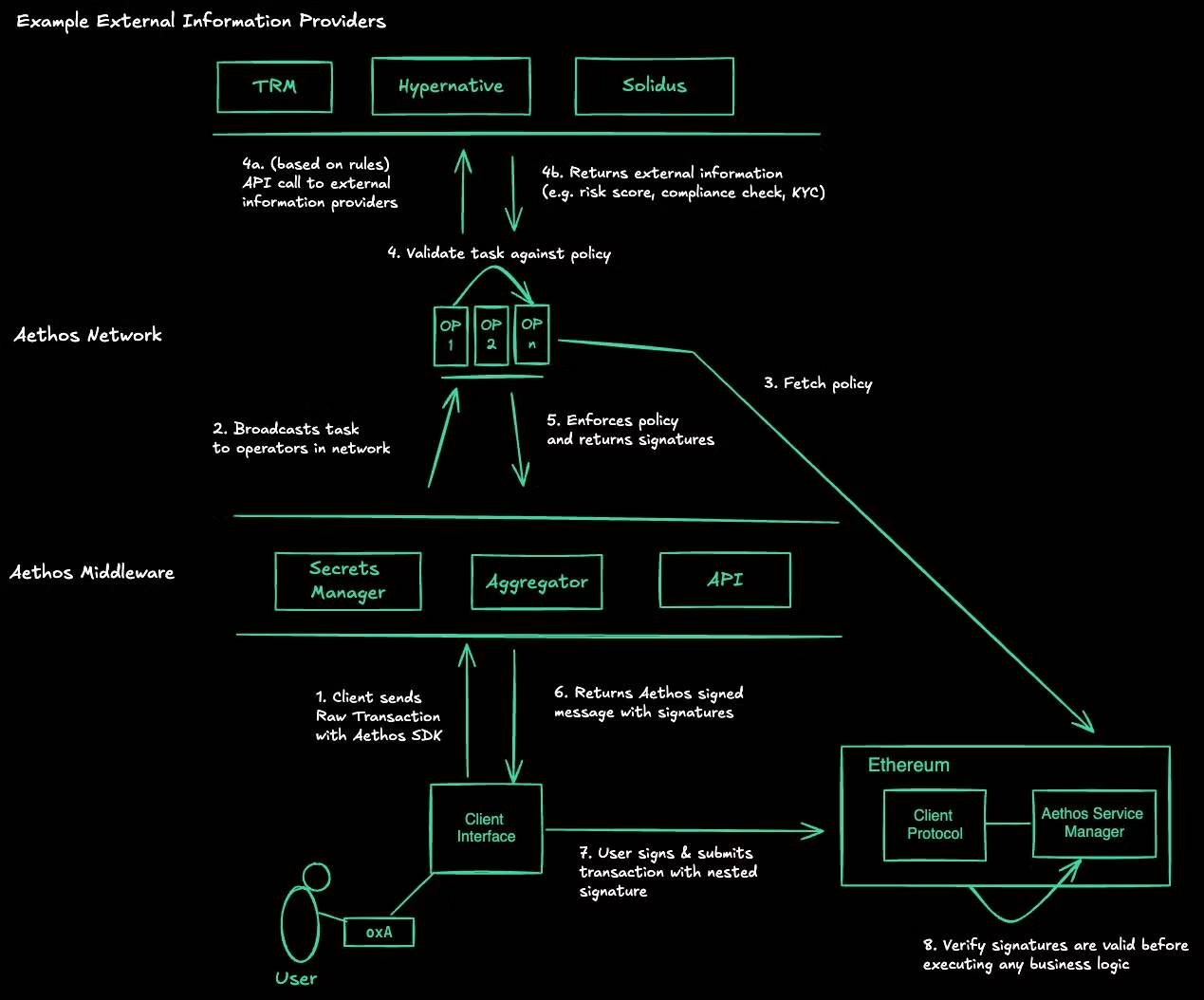

Aethos is a policy layer aiming to achieve this. It allows developers to enforce rules at the smart contract level, ensuring transactions comply with specific regulatory policies. For example, a compliant privacy mixer could impose transaction limits, time locks, and block deposits or withdrawals from OFAC-sanctioned addresses or those linked to DeFi hacks.

Figure: From Aethos Documentation

Integrating real-time, rule-based policies into smart contracts ushers in a new era of institution-friendly DeFi—one where compliance and DeFi values no longer conflict.

9. Automated Rebalancing Yield Protocols

DeFi offers abundant yield opportunities across various assets and protocols—staking, restaking, lending, AMM liquidity pools, real-world assets (RWAs), and more. User risk preferences vary widely, tied to protocol types, chains (Ethereum, Solana, etc.), asset denominations, and external market risks. Faced with so many choices, some traders use yield protocols to automate fund allocation.

Figure: So much yield, not financial advice, from DeFiLlama

These protocols can use AI models to optimize yield across sources. Developers set predefined risk parameters—such as limiting exposure to any single protocol to 15%, or avoiding protocols with TVL below $100 million—and the AI model rebalances portfolios to meet these criteria while maximizing returns.

Further, AI models can create personalized yield strategies for each user, based on their on-chain activity and preferences gathered via short questionnaires. This level of personalization—once unimaginable—is now within reach thanks to AI scalability.

In the background, AI-driven coprocessors monitor and rebalance portfolios. They only act when yield gains outweigh gas costs, ensuring efficient, data-driven portfolio management.

10. Hyper-Precise Incentive Programs

Incentives are core to crypto and DeFi. The true DeFi Summer began in 2020 with Compound’s introduction of liquidity mining. By rewarding specific user behaviors, protocols drive growth and engagement.

As the space matures, protocols seek more precise targeting, often turning to off-chain logic. AMMs might focus incentives on active LPs. NFT and prediction markets might reward liquidity near the order book midpoint. Lending protocols might encourage non-revolving borrowers to draw at least 20% of their interest.

With coprocessors, protocols can define complex reward conditions and distribute rewards in real time. This moves beyond increasingly unpopular points systems, giving users certainty in reward payouts and reducing the protocol’s capital cost. Gearbox has already started using Lagrange’s coprocessor for multi-asset rewards with varying payout mechanisms. By increasing incentive efficiency, DeFi can sustain growth while rewarding the most valuable behaviors.

Conclusion

The fusion of DeFi and AVSs will spark a new financial revolution. From MEV-recapturing AMMs to real-time policy enforcement in privacy protocols, these use cases represent just a fraction of DeFi’s potential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News