Understanding SatLayer: A restaking protocol based on Babylon, emulating Eigenlayer to seek returns while enhancing security protection

TechFlow Selected TechFlow Selected

Understanding SatLayer: A restaking protocol based on Babylon, emulating Eigenlayer to seek returns while enhancing security protection

The idea that liquidity never sleeps continues to be implemented in the BTC ecosystem.

By: TechFlow

Bitcoin's ecosystem remains one of the few market highlights currently.

With Babylon’s mainnet launch, Bitcoin network gas fees surged again yesterday, briefly exceeding 800 satoshis per byte. There were three primary reasons for this spike:

Staking, staking, and more staking.

As a major BTC staking protocol, Babylon triggered a staking arms race upon its mainnet release. Various LSD protocols within the Bitcoin ecosystem—such as Solv, Lorenzo, Bedrock, and Pump BTC—have been competing fiercely to attract idle BTC deposits into their platforms for yield generation.

Beyond yield, the technical or narrative significance of staking lies in leveraging BTC’s security to enhance the security of PoS chains—an approach analogous to ETH’s role in the Ethereum network.

Clearly, wherever there is staking, restaking will follow: taking LSTs (liquid staked tokens) and turning them into LRTs (liquid restaked tokens) to further secure additional applications—precisely the EigenLayer model.

This approach is now becoming a growing trend within the Bitcoin ecosystem.

Yesterday, Satlayer, a BTC restaking project built on Babylon, announced it had raised $8 million in a pre-seed funding round. The round was co-led by Hack VC and Castle Island Ventures, with participation from Franklin Templeton, OKX Ventures, Mirana Ventures, Amber Group, Big Brain Holdings, CMS Holdings, and others. Anonymous angel investors from firms including aPriori, Custodia Bank, LayerZero, Manta Network, Magic Eden, Sui, and Pendle also joined the round.

The name “Satlayer” gives strong hints: “Sat” refers to satoshis, the smallest unit of BTC, while the full name clearly echoes “Eigenlayer.”

Bringing restaking to Bitcoin’s ecosystem—using BTC-backed LRTs to secure more applications—signals the beginning of an escalating “matryoshka doll” war around BTC assets.

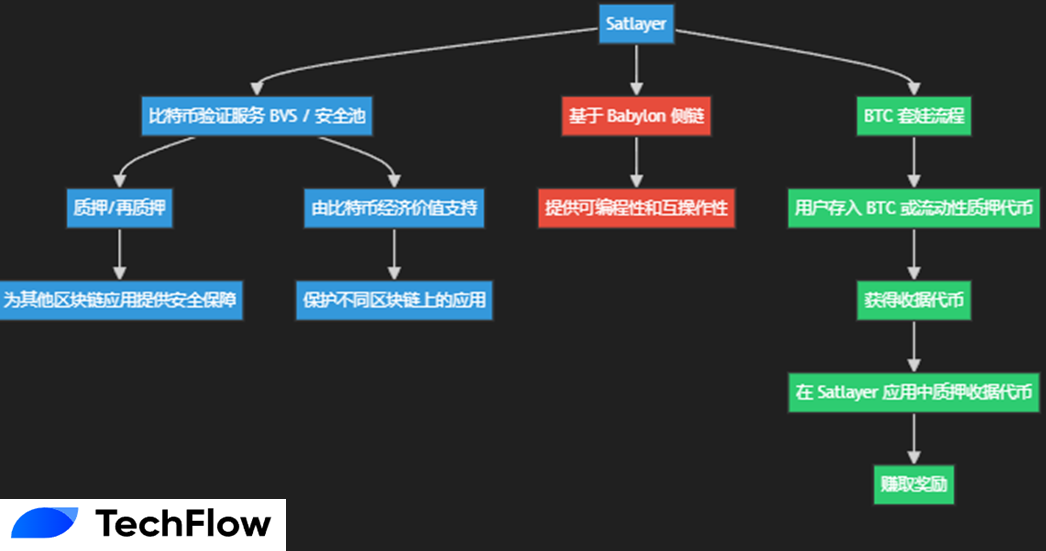

You Have AVS, I Have BVS

Satlayer’s design bears notable similarities to Eigenlayer.

By introducing restaking, Eigenlayer expanded utility for ETH holders—but more importantly, introduced Active Validation Services (AVS): enabling developers to create customized validation services secured by ETH’s vast economic security and restaked assets.

Satlayer brings this concept to Bitcoin by introducing Bitcoin Validation Services (BVS)—allowing BTC holders to provide security for other blockchain applications through staking and restaking.

Notably, these protected applications may run on entirely different blockchains, all leveraging Bitcoin’s economic value to boost their own security.

Beyond the technical narrative, the core idea remains using layered staking structures (“matryoshka dolls”) to justify deeper capital deployment in pursuit of higher yields.

Thus, Babylon—the sidechain solution designed for Bitcoin—provides Satlayer and similar platforms with essential programmability and interoperability. The possibilities for BTC-based derivative assets are far from exhausted.

In practice, here’s how the Satlayer “matryoshka” process works:

By deploying a suite of smart contracts on Babylon, Satlayer enables its core functionality. Users deposit their BTC or liquid staked tokens (e.g., Wrapped BTC, Liquid Staked BTC) into Satlayer and receive receipt tokens representing their deposits. These receipt tokens can then be further staked within Satlayer applications to begin earning rewards.

This mechanism creates a security pool backed by Bitcoin’s economic value—one that can protect diverse applications running across multiple blockchains.

Matryoshka Dolls Chasing Yield

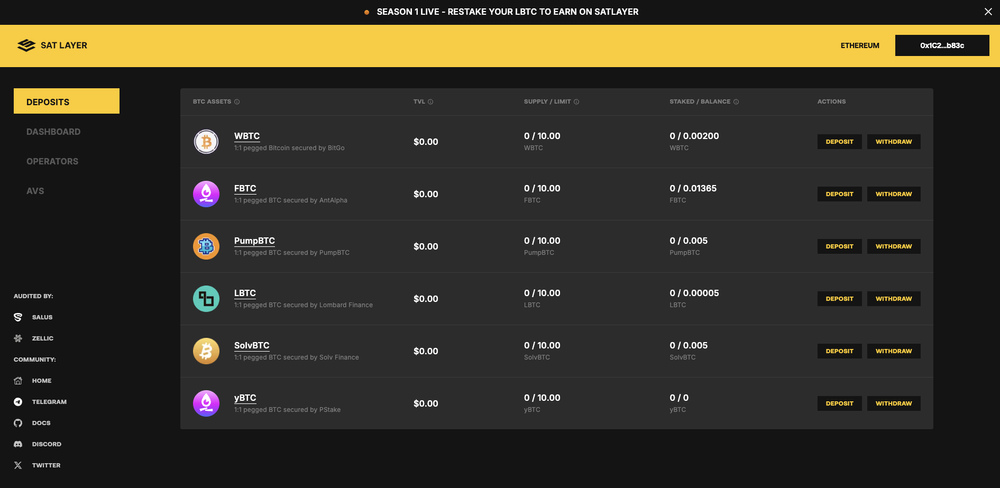

Through SatLayer, users can now restake both BTC and Bitcoin liquid staking tokens from platforms such as Solv Protocol, Lombard, Bedrock, pStake, and PumpBTC to secure BVS.

Clearly, restaking benefits every participant along the chain—for now:

-

Liquid Staking Token (LST) Platforms: LST platforms gain new yield opportunities for deposited BTC. Users benefit from innovative staking methods offering enhanced returns.

-

BVS Platforms: By restaking BTC via Satlayer, BVS platforms achieve stronger security and unlock access to previously unavailable features.

-

Babylon Ecosystem: Satlayer supports Eigenlayer-style AVS capabilities, further expanding Babylon’s functional scope.

-

BTC Stakers: For Bitcoin holders, Satlayer offers a way to earn extra rewards by locking BTC within the system.

After all, nobody turns down yield.

According to the current version of the project’s website, Satlayer currently accepts deposits in LST forms such as wBTC, FBTC, PumpBTC, LBTC, SolvBTC, and yBTC, offering varying yields.

Additionally, the project has launched its Season 1 Epoch 1 deposit campaign, starting at 00:00 UTC on August 23, 2024, lasting two weeks, with a deposit cap of 100 BTC for the first season.

Users must connect their wallets, join the Discord server, and follow the project’s X account before depositing assets—clearly signaling strong promotional intent.

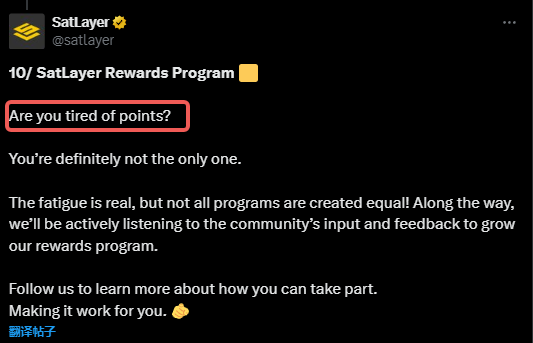

Notably, the project may not rely solely on the traditional “deposit-to-earn-points-for-future-airdrops” model. Its official X account has acknowledged community fatigue with point farming and expressed willingness to actively gather feedback to shape its reward program.

However, specific details of the plan await further official announcements.

Overall, the principle that “liquidity never sleeps” continues to drive innovation in the BTC ecosystem. Where there is staking, restaking follows—layer upon layer, amplifying yields. Yet, smart contract risks and other challenges remain ever-present.

Amid limited market highlights, active participation coupled with cautious execution remains the right approach in this Schrödinger’s bull market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News