Awakening Bitcoin's dormant liquidity: Why you should pay attention to Babylon?

TechFlow Selected TechFlow Selected

Awakening Bitcoin's dormant liquidity: Why you should pay attention to Babylon?

Babylon Chain's TVL is expected to grow by 2,047% within 232 days, potentially adding $1.3 billion to its value.

Author: LSTMaximalist

Translation: TechFlow

In the first quarter of 2024, restaking protocols emerged as the biggest winners, with TVL (Total Value Locked) surging by 1068%, while liquid staking continues to dominate the DeFi (decentralized finance) sector, holding nearly $56 billion in TVL.

This far exceeds other sectors such as lending ($33.91 billion), bridges ($25.67 billion), and decentralized exchanges (DEXs) ($22.01 billion).

Notably, liquid staking’s share of total TVL has grown by nearly 30% over the past three months, or more than 73% year-on-year.

Key Takeaways:

-

Babylon Chain allows BTC holders to stake Bitcoin, enhancing PoS (Proof-of-Stake) network security while maintaining full control over their assets.

-

Babylon Chain expands security via staking, specifically designed for the Bitcoin ecosystem, similar in concept to EigenLayer's approach.

-

Due to Bitcoin’s lack of smart contract support, Babylon Chain employs a trust-minimized, self-custodial staking architecture.

-

Babylon Chain’s TVL is projected to grow by 2047% within 232 days, potentially adding $1.3 billion in value.

-

With rapid adoption expected, Babylon Chain is poised to become a leader in the blockchain space, enabling new application development on its platform.

Babylon Chain pioneers a breakthrough innovation in crypto—Bitcoin staking

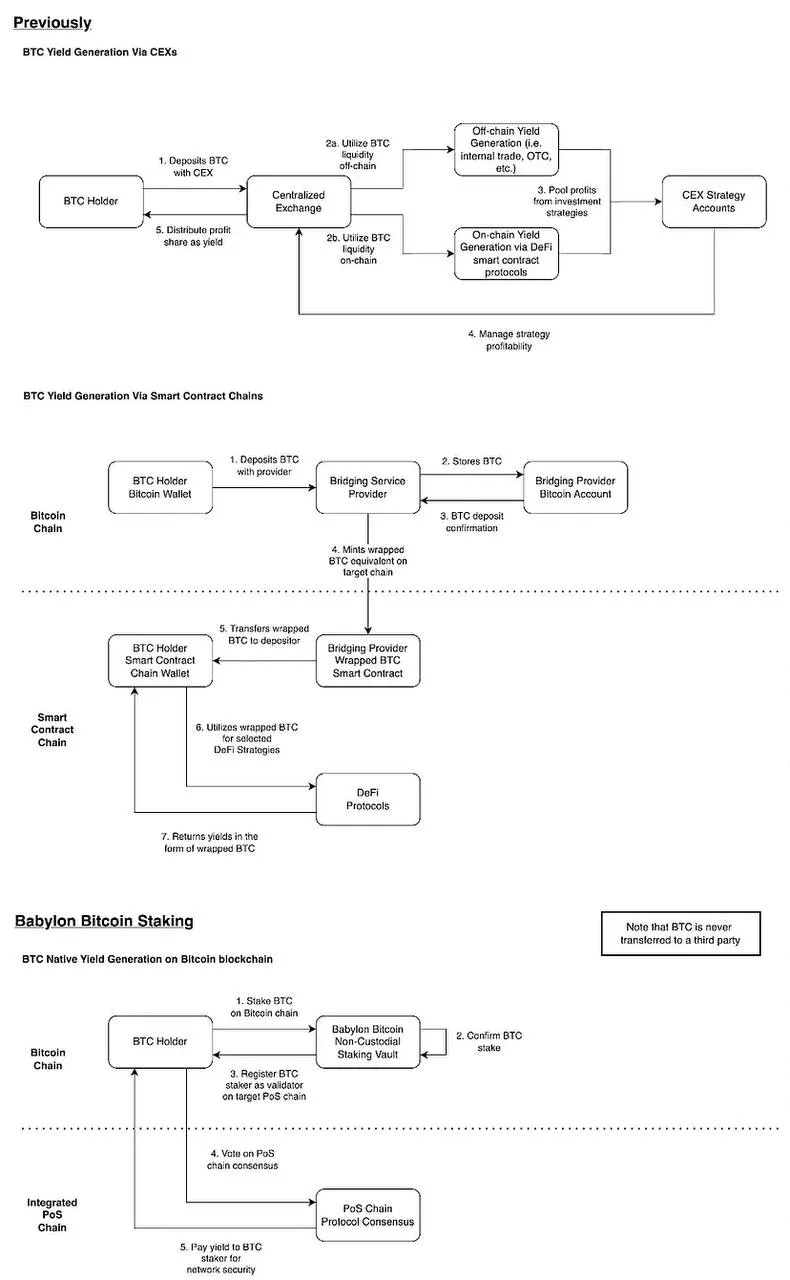

EigenLayer gained significant traction in the Ethereum ecosystem by allowing ETH and liquid staking token holders to re-stake their assets, thereby securing various applications while earning additional rewards. Similarly, Babylon Chain introduces Bitcoin staking, enabling BTC holders to secure PoS networks and earn rewards without relinquishing control of their assets. However, due to Bitcoin’s lack of native smart contract capabilities, Babylon’s architecture and applications differ from EigenLayer’s, reflecting the unique requirements of the Bitcoin ecosystem.

Babylon Chain infrastructure source: rockx.com

Babylon Chain Highlights

Babylon Chain is designed as a suite of versatile protocols aimed at extending Bitcoin’s security to other blockchain networks, particularly those operating under PoS mechanisms. At its core, Babylon includes two foundational protocols:

-

Bitcoin Staking Protocol: This protocol enables Bitcoin holders to stake their assets in a trust-minimized and self-custodial manner, providing economic security to decentralized systems—especially PoS networks—without requiring third-party custody or bridging assets to another chain. This setup ensures PoS networks benefit from Bitcoin’s value stability, while BTC holders earn staking rewards while retaining full control over their assets.

-

Security Enforcement in PoS Protocols: To maintain security and accountability, Babylon ensures that at least one honest validator observes each PoS block and its associated signatures before any client disconnects. This mechanism allows honest validators to detect and prove any security violations, thus preserving network integrity by swiftly addressing and penalizing malicious behavior.

The Trillion-Dollar Crown: Bitcoin’s Liquidity Advantage

Current Market Conditions

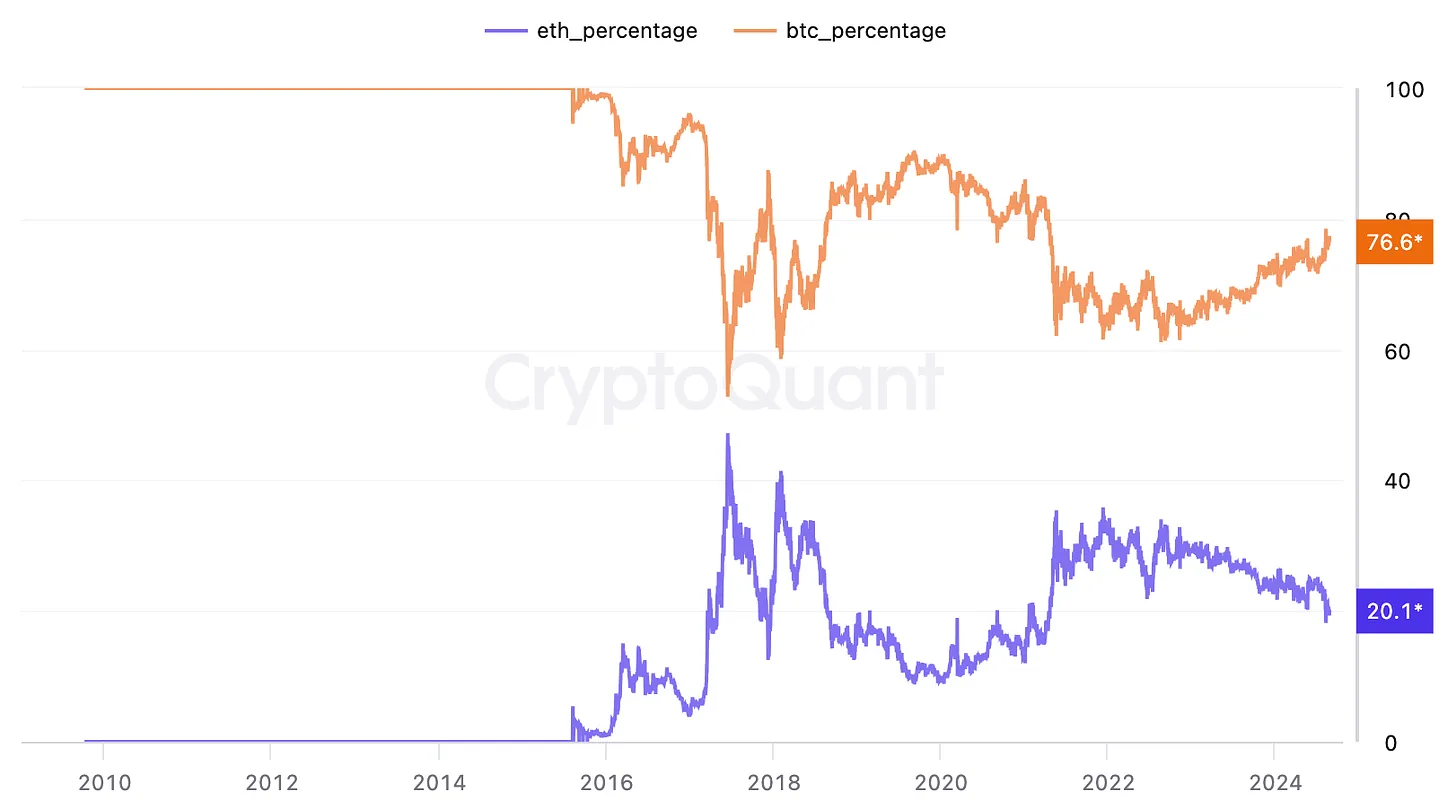

Bitcoin’s market dominance relative to Ethereum (ETH) has surged to a 40-month high of 78.5%, continuing to account for over half of the entire cryptocurrency ecosystem’s market capitalization. This shift highlights stronger investor preference for Bitcoin, while Ethereum has yet to capture similar attention.

The upward trend in Bitcoin’s dominance began at the end of 2022, driven by growing speculation around Bitcoin (BTC) ETFs. After approval, inflows increased significantly. In contrast, speculation surrounding ETH ETFs and their potential approval has not reversed this trend. Low figures reported in ETH ETF filings indicate limited demand.

Historically, major events such as the ICO boom and the 2021 market peak have influenced these dynamics. Ethereum may require a similarly impactful event to alter this trajectory.

Source: Cryptoquant

Bitcoin Outperforms Ethereum on On-Chain Metrics

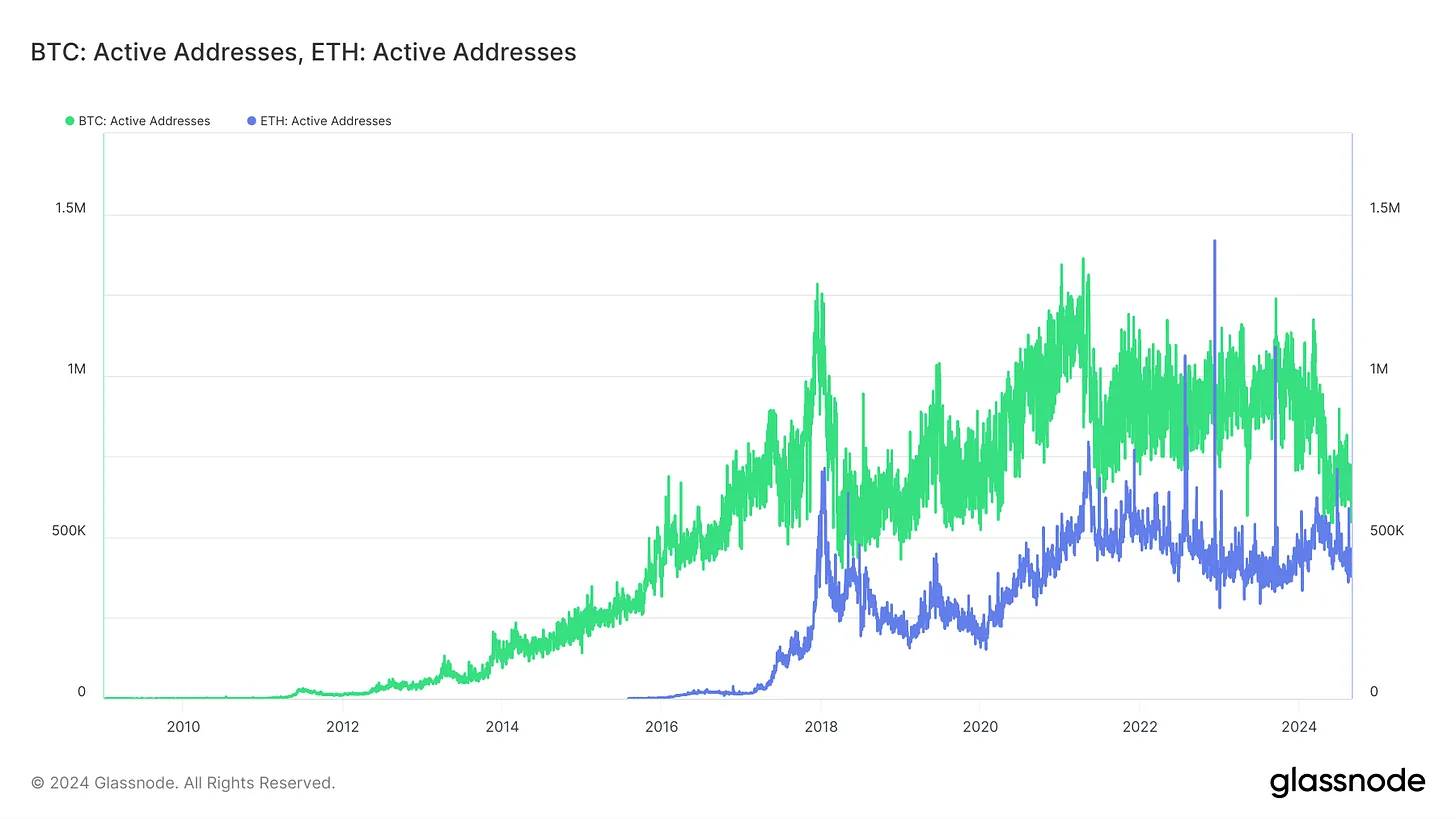

The chart shows that Bitcoin consistently leads in active address count, having long maintained an edge over Ethereum. Despite occasional fluctuations, Bitcoin’s network activity has remained stable, notably spiking sharply around 2017 and sustaining a high, steady level ever since.

The sustained growth and stability in active addresses demonstrate Bitcoin’s strong and loyal user base, consistent transaction flow, and solidify its position as the leading cryptocurrency. In contrast, while Ethereum has made progress, its active address count is more volatile, fluctuating with trends like ICOs and DeFi booms.

This clear difference further underscores Bitcoin’s consistent dominance in user engagement and network stability, reinforcing its role as the backbone of the crypto space.

BTC vs ETH active addresses. Source: glassnode

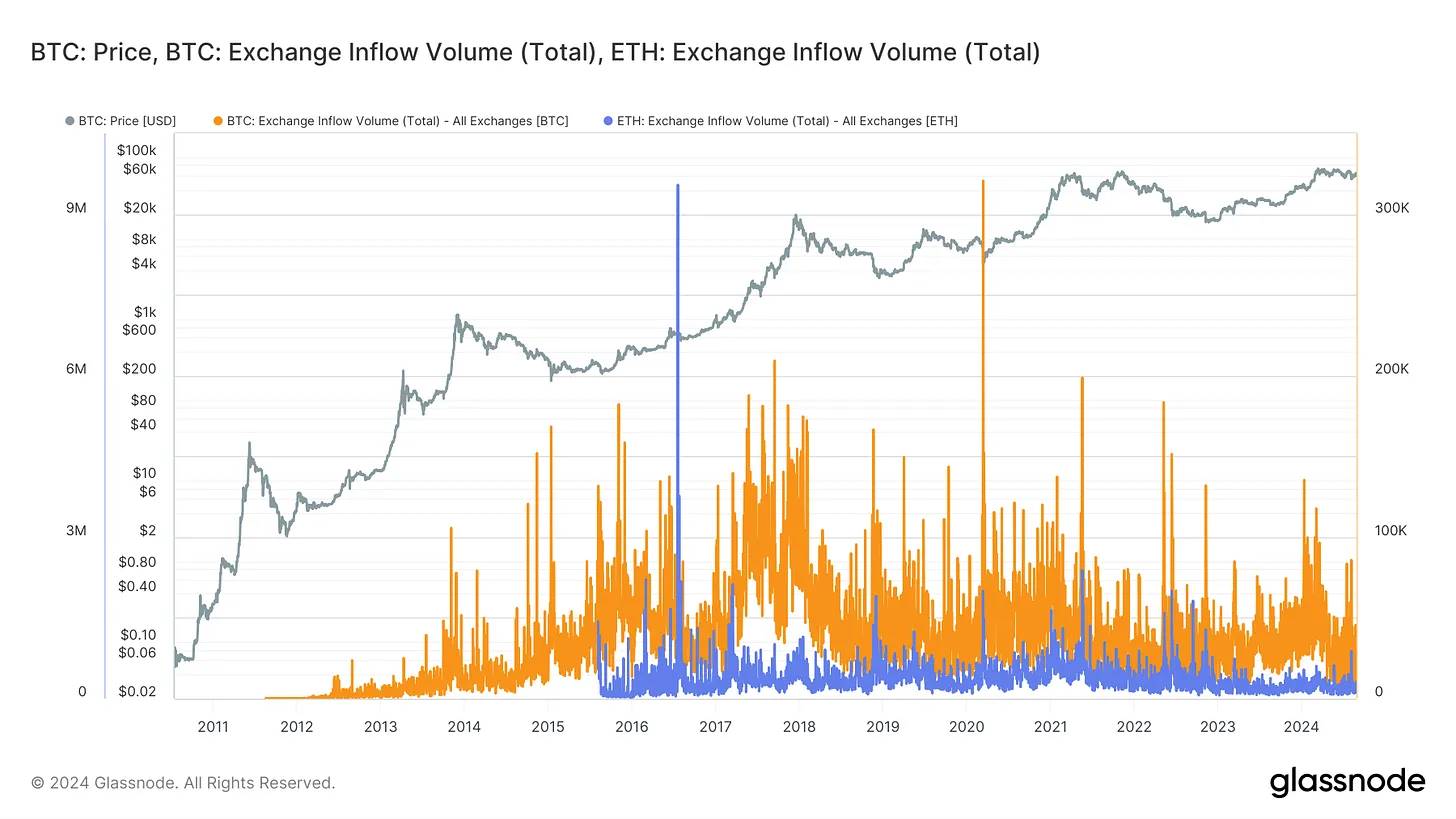

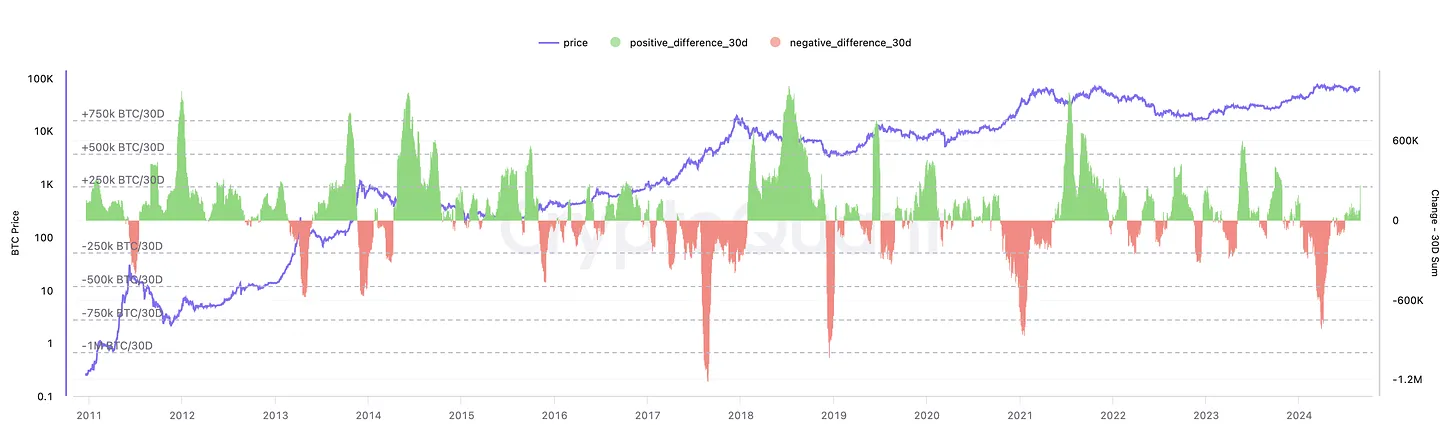

When analyzing BTC, inflows are especially pronounced during key market events, such as the 2017 bull run and the 2020–2021 market surge. These activity peaks highlight Bitcoin’s superior performance in market capitalization and liquidity, making it the preferred asset during periods of heightened market movement. The scale and frequency of Bitcoin’s inflows reflect its role as the primary store of value within the cryptocurrency ecosystem, particularly during speculative trading and market euphoria.

In comparison, Ethereum’s inflows, while notable, are relatively modest and tend to concentrate during specific phases of network expansion, such as the 2017 ICO boom and the 2021 DeFi surge. During these periods, Ethereum saw increased network activity as new projects and decentralized financial applications attracted capital. However, the inflow volumes during these events, though impactful, do not match Bitcoin’s massive scale. This disparity highlights Bitcoin’s enduring appeal to a broader investor base and its status as a more liquid and stable asset.

BTC vs ETH exchange inflows. Source: glassnode

Have you realized that there’s idle liquidity within Bitcoin?

We’ve seen how DeFi protocols on Ethereum, especially in liquid and restaking markets, have transformed network growth and security. Now, we’re witnessing a similar evolution unfolding on the Bitcoin blockchain. Although Bitcoin operates on PoW, Babylon is opening doors for investors to discover opportunities within the Bitcoin ecosystem and begin earning yield from BTC.

Industry Market Capitalization

Global Cryptocurrency $2.17 trillion | DeFi $76 billion | Liquid Staking $24.6 billion | Bitcoin $1.2 trillion | Ethereum $311.55 billion

Last updated August 27, 2024. Source: Coinmarketcap

As shown in the chart below, long-term Bitcoin holders still hold over 70% of the supply. Current levels are quite low given market conditions, suggesting many of these holders may want to generate yield from their passive holdings—just as has already happened on the Ethereum network. The key difference here is market cap: Bitcoin’s is approximatelythree times that of Ethereum, creating vast room for opportunity creation.

Over the past 30 days, long-term holders increased their holdings by 262,000 BTC. They now control 14.82 million BTC, representing 75% of total supply

Source: cryptoquant

All current DeFi protocols are built on the Ethereum blockchain, but the emergence of Babylon Chain will change this status quo.

The first testnet on the network was successful, allowing us to anticipate potential outcomes upon mainnet launch—and results have proven promising.

The table below shows some metrics from the protocol during the first few hours after network launch.

Metrics & Values

Number of Participants ~12,700 | BTC Staked (Total) 1,000 BTC | Time to Reach Staking Limit Over 3 hours | Maximum Stake per Participant 0.05 BTC | Minimum Stake per Participant 0.005 BTC | Average Transaction Fee During Staking Over 1,000 satoshis/byte | Median Transaction Fee in USDT Over 130 USDT (~0.002 BTC) | Total TVL Accumulated Within 3 Hours ~$60 million (1,000 BTC) | Total Funding $96 million | Valuation (Latest Funding Round) $800 million | Exclusive Reward Points per Bitcoin Block 3,125 points per BTC block | Investors Paradigm, Polychain, HashKey Capital, IOSG Ventures, Amber Group, Galaxy Digital, Binance Labs, Hack VC, OKX Ventures, ABCDE Capital.

Babylon Chain is EigenLayer’s application on the Bitcoin blockchain

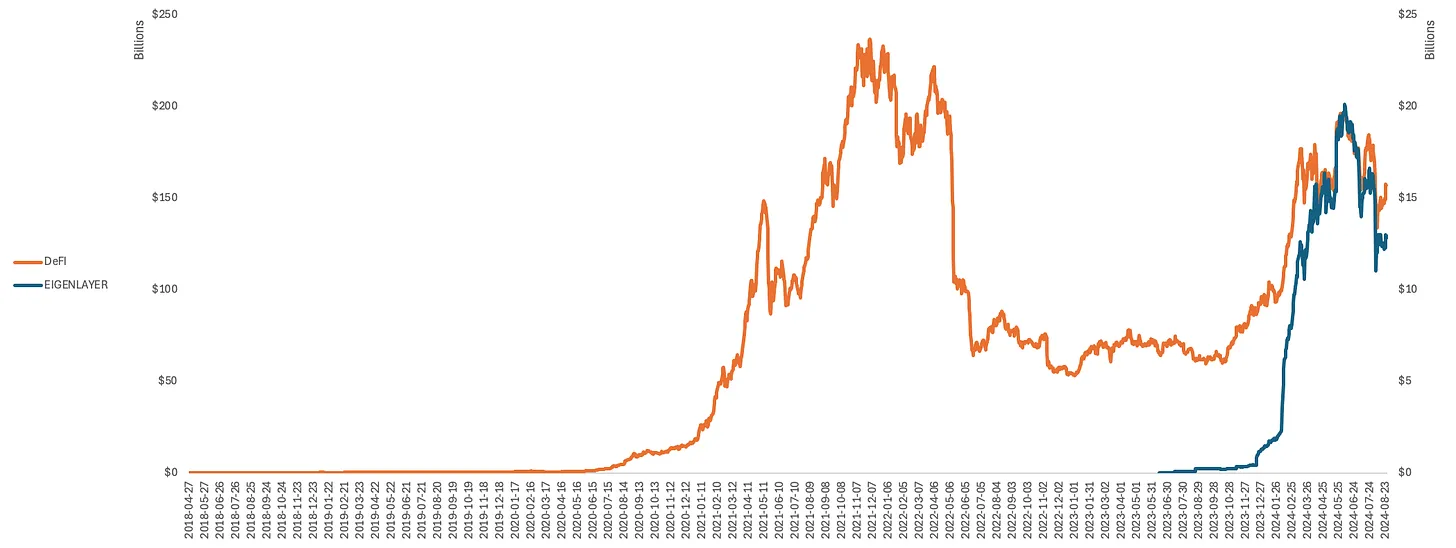

LRTs (Liquid Restaking Tokens) on Ethereum via EigenLayer have been game-changers. The protocol’s growth has been impressive, reaching the same market value as the entire DeFi industry in a short time—even before its last peak.

Chart showing TVL evolution in DeFi and EigenLayer protocols

Source: Defilama

What do these two protocols have in common?

Both protocols offer yield-generating opportunities for investors. Moreover, Babylon Chain is a pioneering project that enhances the security of Proof-of-Stake (PoS) blockchains by allowing Bitcoin holders to earn returns from otherwise idle BTC. This approach leverages Bitcoin’s value to support and protect the economic security of these networks.

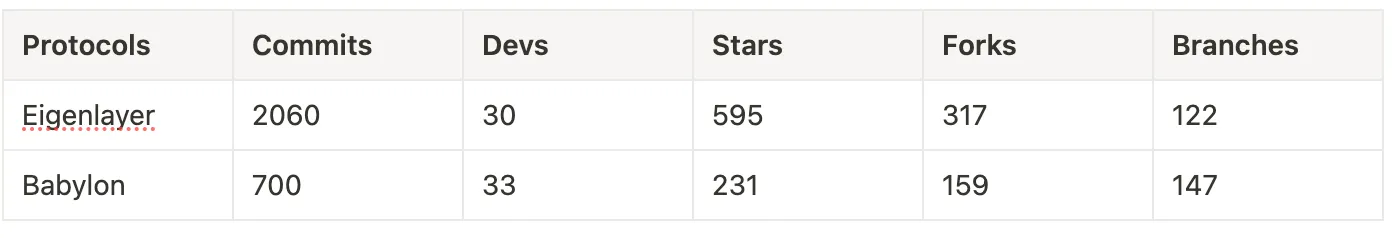

Development Activity

GitHub data metrics comparison

Babylon Chain launched just one week ago, yet interest in the project is already comparable to that of EigenLayer. This is a positive signal, indicating that at this early stage, the project is attracting even more attention than EigenLayer itself. Source: babylon.labs

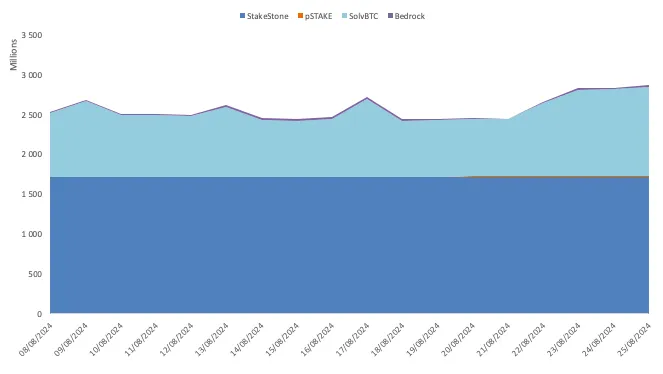

## Promising LRT and LST Protocols on Bitcoin

Total Value Locked (TVL) of pStake, Solv, and StakeStone: $1.51 billion

Protocol Breakdown

-

pSTAKE Finance

Earning yield on Bitcoin should be simple, secure, and low-risk. With four years of experience in liquid staking and carefully designed yield strategies, pSTAKE Finance enables individuals and institutions to maximize their BTC utilization within the BTCfi ecosystem.

pSTAKE Finance is a Bitcoin yield and liquid staking protocol backed by Binance Labs.

Through pSTAKE Finance, users can liquidly stake their BTC to earn rewards from Babylon’s trustless BTC staking.

Additionally, the protocol offers a yield-bearing Bitcoin token (yBTC) mechanism that deliversautomated compounding BTC returns, similar to cToken models like wstETH. This mechanism will operate in the background through various yield strategies, starting with Babylon’s BTC liquid staking.

-

TVL: $2.94 million

-

Weight: 0.19%

-

Source: kucoin.com

Future Features - pSTAKE v2 Launch

-

Solv

-

TVL: $1.048 billion ($187 million restaked)

-

Weight: 69.19%

-

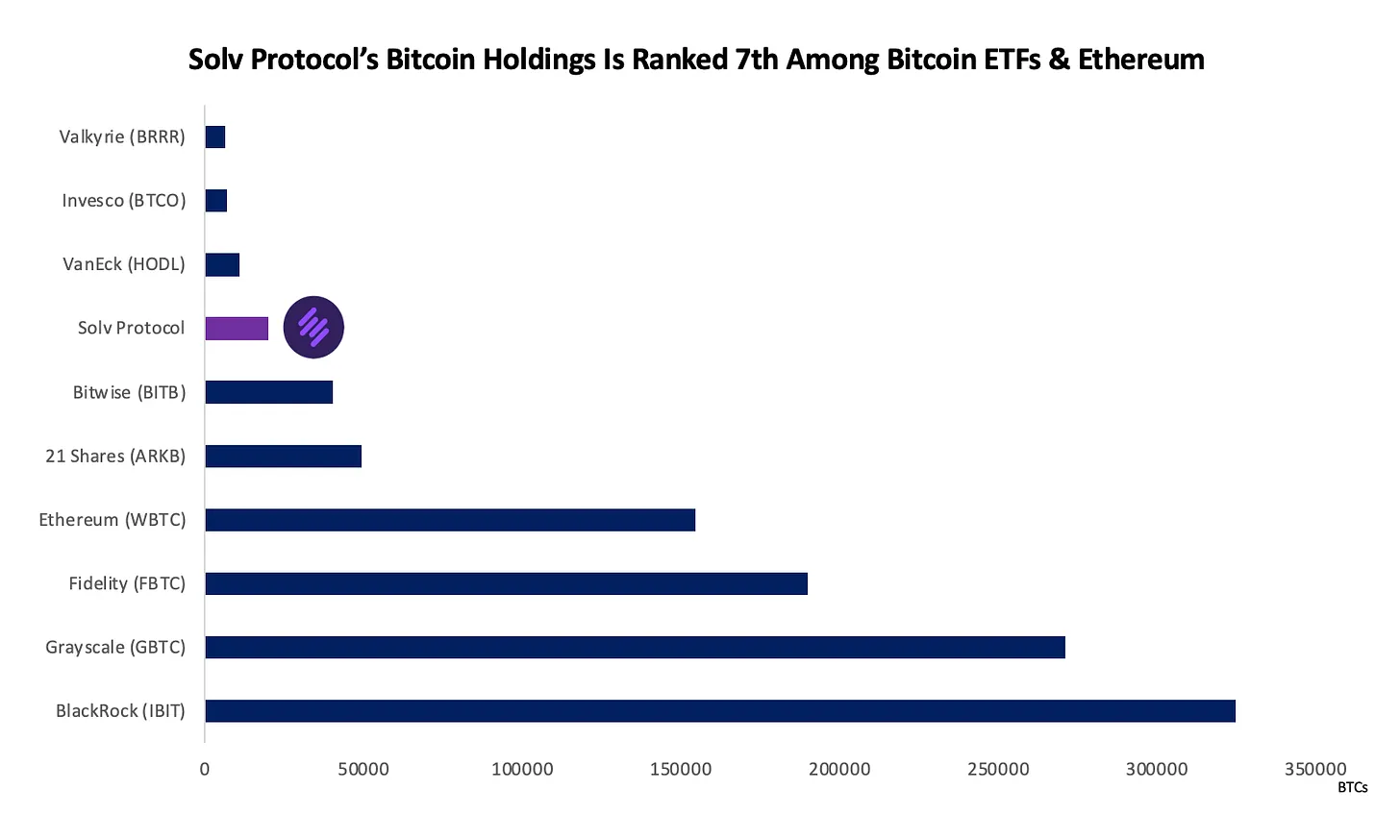

Solv offers an alternative to Bitcoin liquid staking tokens, sharing Bitcoin’s economic security with PoS chains through Babylon’s innovative approach. SolvBTC Babylon is designed for the upcoming Babylon mainnet launch. In less than four months since SolvBTC’s launch, over 19,000 BTC have been staked on Solv—surpassing the BTC holdings of some entire chains and even certain Bitcoin ETFs. (See chart below)

Data as of April 30, 2024

Source: Solv.docs

Essentially, pSTAKE and Solv serve different niches in the crypto space: pSTAKE is a dedicated protocol for Bitcoin staking and yield generation, whereas Solv provides broader DeFi solutions.

-

StakeStone (Bitcoin staking coming soon)

StakeStone is a cross-chain liquidity infrastructure building STONE / STONEBTC as liquid ETH / BTC assets backed by an adaptive staking network. Simultaneously, it is establishing a multi-chain liquidity market based on STONE, leveraging liquid ETH to provide more use cases and yield opportunities for STONE users.

While the protocol does not currently offer Bitcoin staking, it plans to launch this feature soon. Currently, it remains in the testnet phase, so limited data is available. However, given the protocol’s success on the Ethereum network, expectations for its Bitcoin staking functionality are equally high.

-

TVL: $440 million (locked on the Ethereum blockchain)

-

Weight: 29.09%

-

-

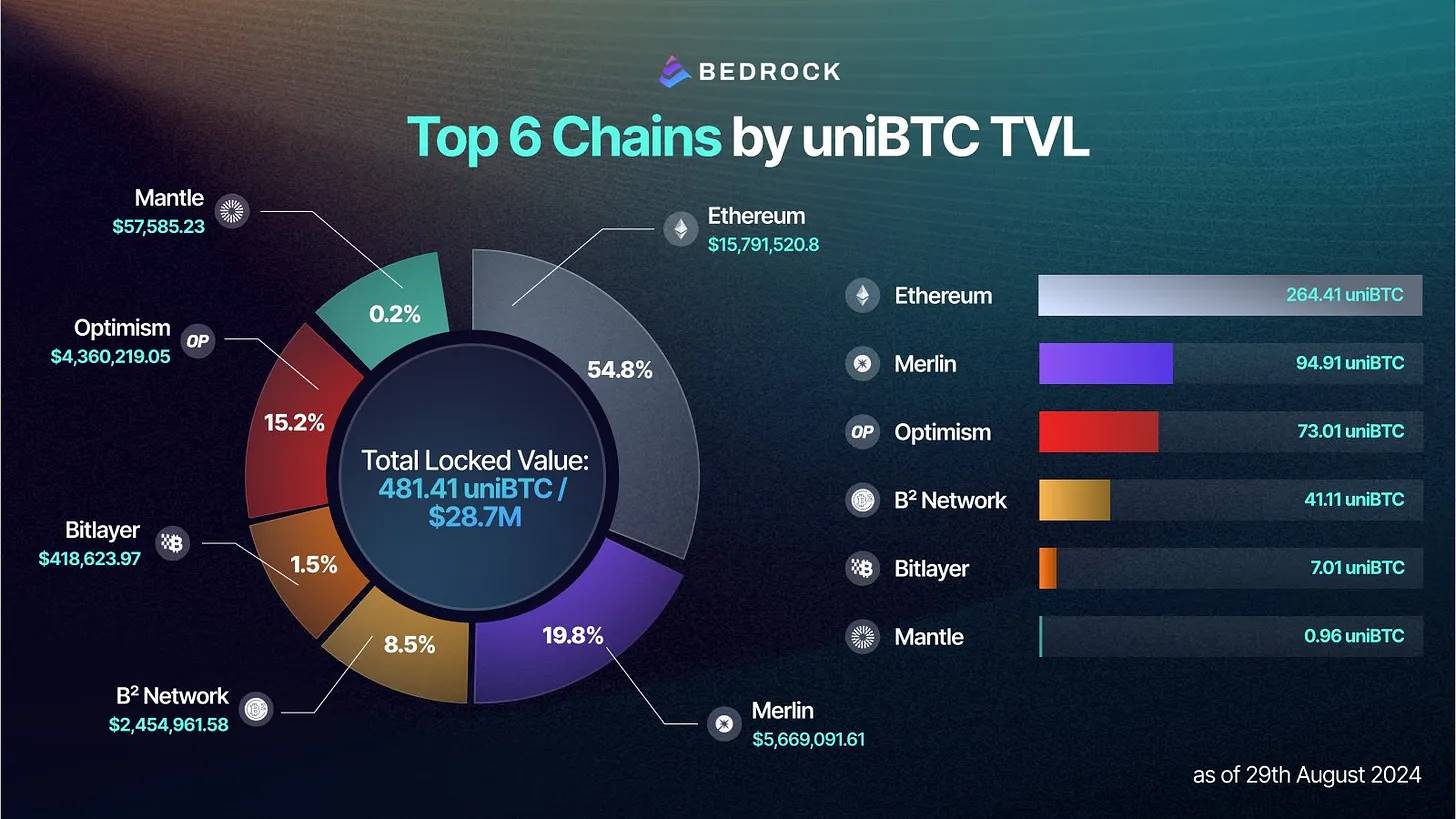

Bedrock

-

TVL: $23.85 million

-

Weight: 1.54%

Bedrock is a multi-asset liquid restaking protocol supported by RockX’s non-custodial solution.

When wBTC tokens are deposited into Bedrock, the corresponding BTC is staked in real-time onto the Babylon network. This process can occur via one of two methods currently under development:

1. Proxy Staking: Using a proxy mechanism, wBTC tokens are staked on the Ethereum network, while the corresponding BTC is staked on the Babylon network by a trusted party. This method enables flexibility and interoperability between the two networks.

2. Direct Conversion: Alternatively, wBTC tokens can be immediately converted into BTC tokens and then directly staked onto the Babylon network. This method ensures seamless and instant conversion and staking without relying on centralized custodial wallets.

Both methods aim to facilitate smooth transitions of assets between the Ethereum and Babylon networks, enabling efficient and secure staking operations

Source: Bedrock

In the early stages of testnet or mainnet launches, many blockchain protocols typically incentivize early users through airdrops and other rewards. This approach serves two main purposes: boosting protocol value by attracting initial users and building a dedicated community, while also offering additional benefits to network participants. Early users often receive airdrops, tokens, or other forms of compensation, which may increase in value as the network grows. These incentives are crucial for early decentralization, ensuring broad token distribution and encouraging diverse user participation. As a result, the ecosystem becomes more robust and resilient, giving users the chance to participate in the network, earn financial returns, and contribute to the early success of new applications or Layer 2 solutions on existing blockchains.

Source: Defilama

Together, these three protocols represent approximately $1.5 billion in locked value on the network. However, given their current stage of maturity, the landscape for liquid staking on Bitcoin still holds substantial room for growth and expansion. This suggests we are only scratching the surface of what’s possible in this domain.

Bright Prospects Ahead

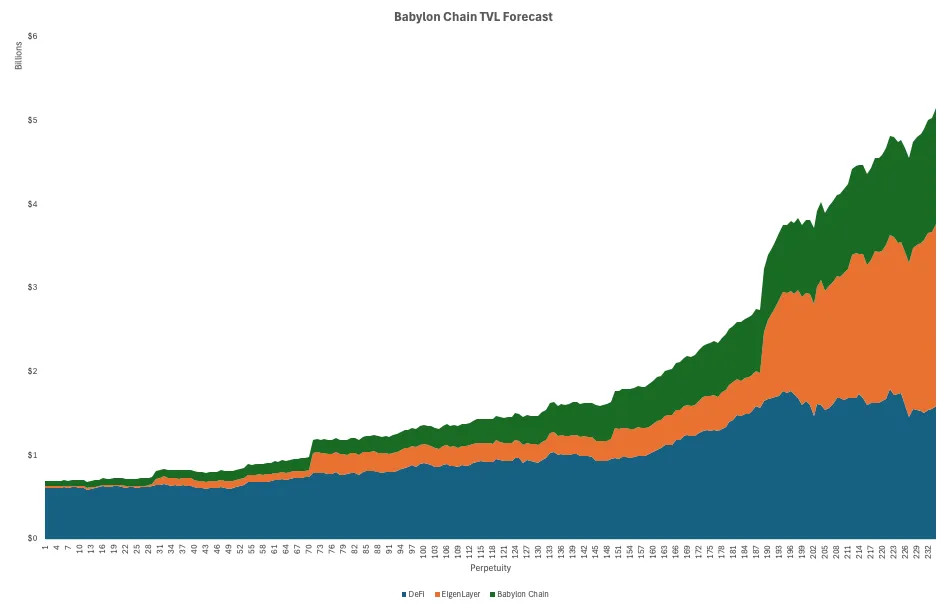

Looking ahead, we calculated the network’s growth rate and compared it to EigenLayer, normalizing for returns. The results show significant growth potential and a strong likelihood of exponential expansion.

By focusing on key metrics such as Compound Annual Growth Rate (CAGR) to project Babylon Chain’s growth trajectory. This method captures the project’s expected return rate, smoothing out market volatility and providing a clear picture of its compounded growth over time.

The chart illustrates the projected Total Value Locked (TVL) for DeFi, EigenLayer, and Babylon Chain in billions of dollars, with each layer’s TVL calculated based on inter-layer differences. DeFi, represented by the blue layer, shows steady growth reaching about $1 billion, while EigenLayer, shown in orange, significantly increases the total, contributing approximately $2 billion. Babylon Chain, depicted in green, demonstrates rapid growth in later stages, ultimately pushing the total TVL beyond $6 billion.

Specifically, Babylon Chain is expected to grow by approximately 2047% within 232 days, implying a substantial $1.3 billion increase in TVL, indicating that Babylon Chain could emerge as a leader, surpassing both DeFi and EigenLayer in TVL—a reflection of growing adoption and confidence in its innovation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News