Babylon Airdrop Deep Dive: TGE Approaching, Assessing the Airdrop Participation Value of the Leading BTC Restaking Project

TechFlow Selected TechFlow Selected

Babylon Airdrop Deep Dive: TGE Approaching, Assessing the Airdrop Participation Value of the Leading BTC Restaking Project

Idle funds participation may bring a small surprise in points value.

Author: Icefrog

Babylon, the leading project in the restaking sector, has registered its foundation account tonight, signaling that TGE is imminent. Below is an in-depth analysis of Babylon's project status and the value of participating in its airdrop.

1. Project Overview: Strong Team and Elite Investment Lineup

1.1 Founding Team

The project’s founding team has a strong academic background. Although there are many Chinese faces in the team, key management roles are primarily held by overseas professionals. Here is a brief introduction to the main founding members and core management.

David Tse (Co-founder): Top-tier academic credentials; member of the U.S. National Academy of Engineering and professor at the University of Chicago and Stanford University.

Mingchao (Fisher) Yu (CTO and Co-founder): Former lecturer at the Australian National University, later served as Senior Research Engineer and Lead Engineer at Dolby Laboratories.

Dong Xingshu (Chief Strategy Officer): Co-founder of RockX and Zilliqa, also Technical Partner at well-known VC IOSG Ventures.

Sankha Banerjee (Chief Protocol Economist): MIT graduate, previously worked at Nibiru.

Spyros Kekos (Community Lead): Previously served as Community Lead at exchange Gate.io.

Beyond these individuals, a closer look at the management team reveals that most core members have at least 3–5 years of relevant experience in their respective roles or have worked at notable projects or exchanges. This indicates that Babylon’s management team has substantial blockchain experience, contributing to more mature and industry-aligned operations.

Moreover, David Tse’s prestigious academic background gives external stakeholders full confidence in the project’s technical strength. Additionally, many core team members have investment backgrounds, meaning the project has ample access to investment resources—this is directly reflected in its funding achievements.

1.2 Investment and Funding Status

In terms of funding rounds, Babylon took a full year from Seed to Series A, but the pace and amount of financing surged rapidly between Series A and mainnet launch. This suggests the team carefully invested in testnet development during early stages before proceeding to further fundraising. The final funding round in May 2024 reached $70 million, with total raised capital amounting to $96 million—a highly impressive figure.

The investment lineup is exceptionally strong and diverse.

As shown in the image above, apart from top-tier traditional VC funds like Paradigm and Polychain, major exchanges including Binance and OKX are also directly involved.

On the individual investor side, notable participants include Ajit Tripathi (former FinTech Partner at ConsenSys), Ryan Fang (former Co-founder of Ankr), and Jia Yaoqi (founder of AltLayer).

Overall, the funding background is truly elite, encompassing various types and origins of investment funds, indicating that the project enjoys abundant resources across the board.

In summary, the project places significant emphasis on team experience and technical reserves, with a comprehensive and well-balanced setup—ambitious yet grounded. This ensures operational sustainability and long-term growth potential. From a funding perspective, the diverse range of VCs provides comprehensive support across multiple resource areas, not only reflecting strong confidence in the project’s sector but also signaling high future growth potential.

2. Project Advantages: Leveraging POW Security to Unlock BTC Liquidity

There have been numerous analyses about restaking and Babylon. In summary, several key consensus points reflect the project’s main strengths.

1. Focused on Activating Idle Assets in the BTC Network, Driving BTC Ecosystem Growth

BTC is BTC, and cryptocurrency is cryptocurrency. As BTC holds over half of all crypto assets, enabling BTC liquidity has long been a major challenge.

Due to security concerns, BTC holders find it extremely difficult to move BTC out of their wallet accounts. Under custodial models, private key exposure could lead to irreversible asset loss—an unacceptable risk for any BTC holder. Most prefer letting their BTC sit idle rather than taking even minimal risks. Furthermore, Bitcoin’s native lack of Turing completeness prevents secure cross-chain operations via smart contracts like Ethereum, so due to both this inherent limitation and network design flaws, BTC’s asset value remains highly disproportionate to its utility.

Babylon addresses this pain point by creating a trustless, self-custodial staking protocol. Simply put, users maintain control of their assets while achieving secure staking. Behind this mechanism, the staked BTC leverages Bitcoin’s POW computational power to enhance the security of various POS chains, creating mutual benefits. To achieve this, Babylon employs proprietary technology—a key reason for its broad market recognition.

2. Bitcoin Timestamps and Staking Protocol Are the Two Pillars of Technical Viability

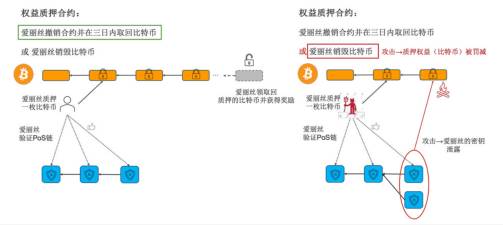

For POS chains, especially those using Byzantine Fault Tolerance mechanisms, two-thirds majority voting is typically required to confirm blocks. While slashing penalties help prevent fork attacks, such attacks remain nearly unavoidable without additional trust sources.

Hence, some POS chains tie security closely to stakeholder interests, resulting in very long unstaking periods. Babylon’s primary solution is to anchor POS chain block checkpoints onto the Bitcoin network. Due to POW characteristics, any attacker attempting a fork would generate a timestamp later than the legitimate chain. Bitcoin timestamps can thus effectively prevent long-range attacks.

A more vivid analogy: Bitcoin’s timestamp acts like a race timing system, recording every participant’s finish time. If someone attempts to falsify their time, Bitcoin will detect the inconsistency and reject it. Forcing such a change would require creating a longer chain than Bitcoin’s—which is nearly impossible due to cost. Another benefit of this technology is drastically shortened unstaking times on POS chains, along with stronger censorship resistance.

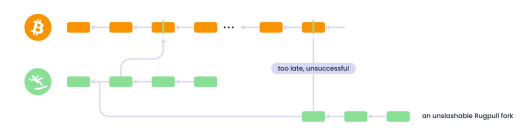

Regarding the specific staking protocol, the project uses remote staking—locking staked bitcoins within a contract on the Bitcoin chain. When a staker violates the PoS chain protocol, their staked BTC on Bitcoin can be slashed. This is achieved through Bitcoin covenant emulation, a technical enhancement based on Bitcoin’s UTXO model. While detailed technical aspects won’t be expanded here, the official path can be referenced as follows:

Through specific rules enabled by Bitcoin covenant technology, the entire process of BTC staking, unbonding, and slashing enforcement is secured.

3. Bridging BTC and Multiple EVM Chains, Enhancing Cosmos Ecosystem Security

To some extent, Babylon does not fall strictly under crypto asset staking, nor does it resemble Eigenlayer’s middleware security layer. Instead, it represents an innovative use case of cross-chain staking—its empowerment of POS chains relies not on Bitcoin assets themselves, but on the POW computational power of the Bitcoin network.

Since Babylon’s cross-chain communication and shared security stem from Cosmos, its novel approach to leveraging Bitcoin’s network security significantly boosts the Cosmos ecosystem. As a result, Cosmos chains are likely to actively embrace Babylon’s innovation, benefiting the entire ecosystem.

3. Development Prospects: Significant Potential but Also Major Challenges

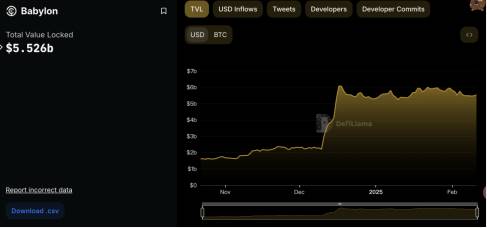

As the largest BTC restaking protocol currently, Babylon has secured over $5.5 billion in TVL, with 56,000 BTC staked. Compared to Bitcoin’s total supply of 21 million BTC, participation remains at just 0.26%. Even at a 1% adoption rate, TVL could grow over fourfold. This substantial headroom may explain why investors have committed such high funding.

On the downside, Babylon faces considerable challenges in gaining broader acceptance. Both POS chain adoption and BTC holder participation require sustained education and behavioral shifts. Particularly among large BTC holders, engagement tends to be more cautious.

Additionally, a critical factor to consider is the growing trend of Bitcoin ETFs and public companies accumulating Bitcoin reserves. This gradually concentrates BTC ownership within institutions and whales. For Babylon to increase participation further, it must develop more compelling solutions tailored to institutional and large-scale holders—requiring continued innovation and operational refinement.

4. Airdrop Opportunity and Risk Analysis: Participate with Idle Funds—Points May Deliver a Small Surprise

From prior analysis, we see that Babylon stands out in technology, funding, and team strength, with significant long-term upside. As the sector leader approaching TGE, is there value in participating in its airdrop? Further data analysis follows.

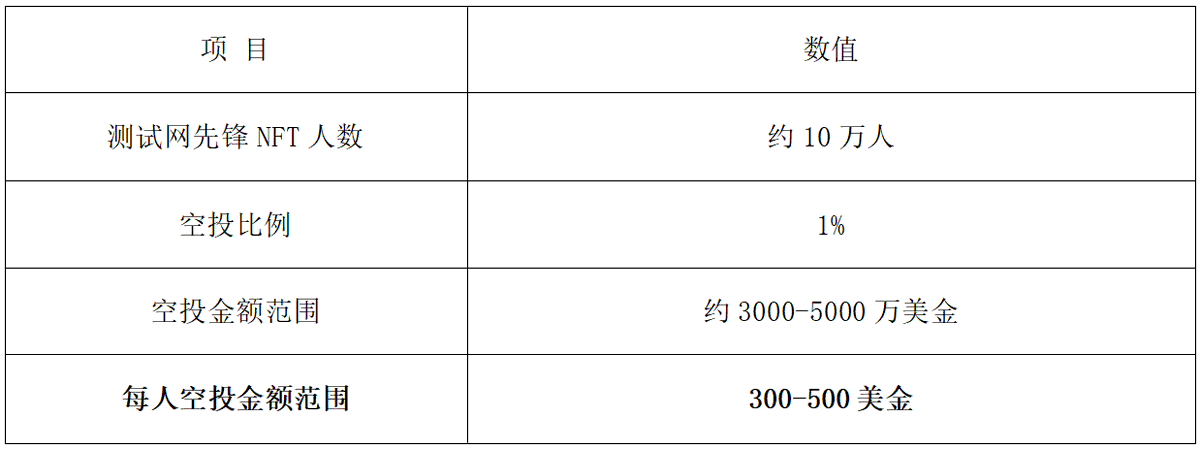

4.1 Testnet: Officially No Incentives, But Zero-Cost Participation Helps Avoid Missing Out

On January 8, the project launched its second testnet phase. Official documentation repeatedly emphasizes no rewards for testnet participation. However, given zero costs, light involvement is advisable to avoid missing potential future airdrops. Based on estimated allocations, if an airdrop occurs, early testnet participants might receive $300–$500 on average.

4.2 Mainnet Points: Solid Annualized Yield, Worthwhile for Idle Capital

Currently, earning airdrops is only possible by engaging with partner projects to accumulate points, which will later be convertible into tokens. Key staking projects include Lorenzo and Solv. Lorenzo accounts for 40% of total staking volume and is a well-funded project yet to launch its token.

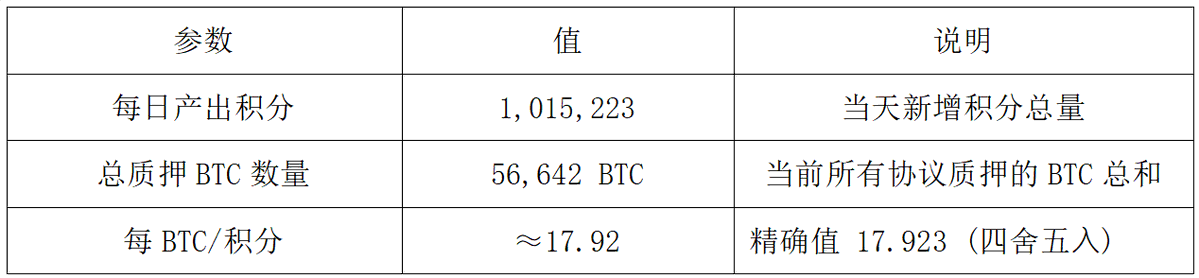

According to Dune dashboard data, current total points stand at approximately 130 million, growing by about 1 million points daily. Assuming TGE within one month, final points may reach around 160 million.

4.3 Point Value Calculation

Method 1: Daily point output divided by total staked amount (approximately 17.92 per day)

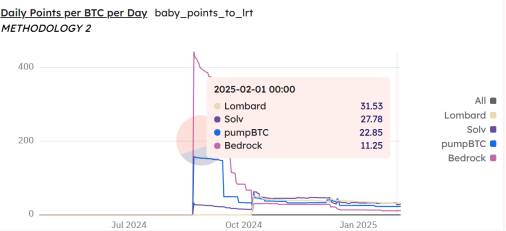

Method 2: Calculating points based on time-distributed supply (approximately 38.35 per day)

Time-based supply distribution (calculated by taking the ratio of LRT’s Babylon BTC deposits to total BTC deposits, then multiplying that ratio by the daily Babylon points issued; supply points are calculated by summing daily token supplies over a period)

Method 3: Simple ratio between protocol-earned Babylon points and the protocol’s total BTC balance (approximately 31.53 per day)

Using the three methods above, daily point outputs are: 17.92, 38.35, and 31.53 respectively.

4.4 Comprehensive Return Estimation

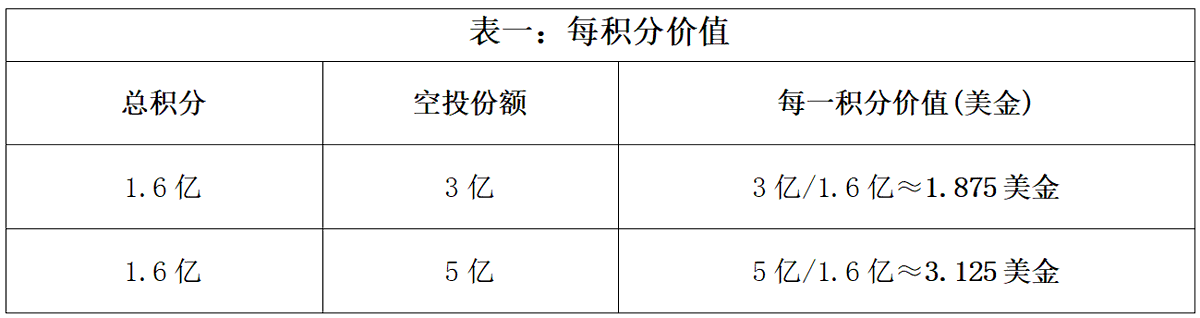

Given Babylon’s high staking volume and leading position, conservative post-launch FDV estimates range from $3–5 billion. Precedent exists for BTC restaking protocols issuing tokens—Solv Protocol allocated 7.65% for airdrops. To solidify its leadership, Babylon is expected to allocate around 10% (i.e., $300–500 million) for airdrops. (This is a conservative estimate due to poor market conditions; normal valuation would likely be $5–10 billion.)

Table 1: Value per Point

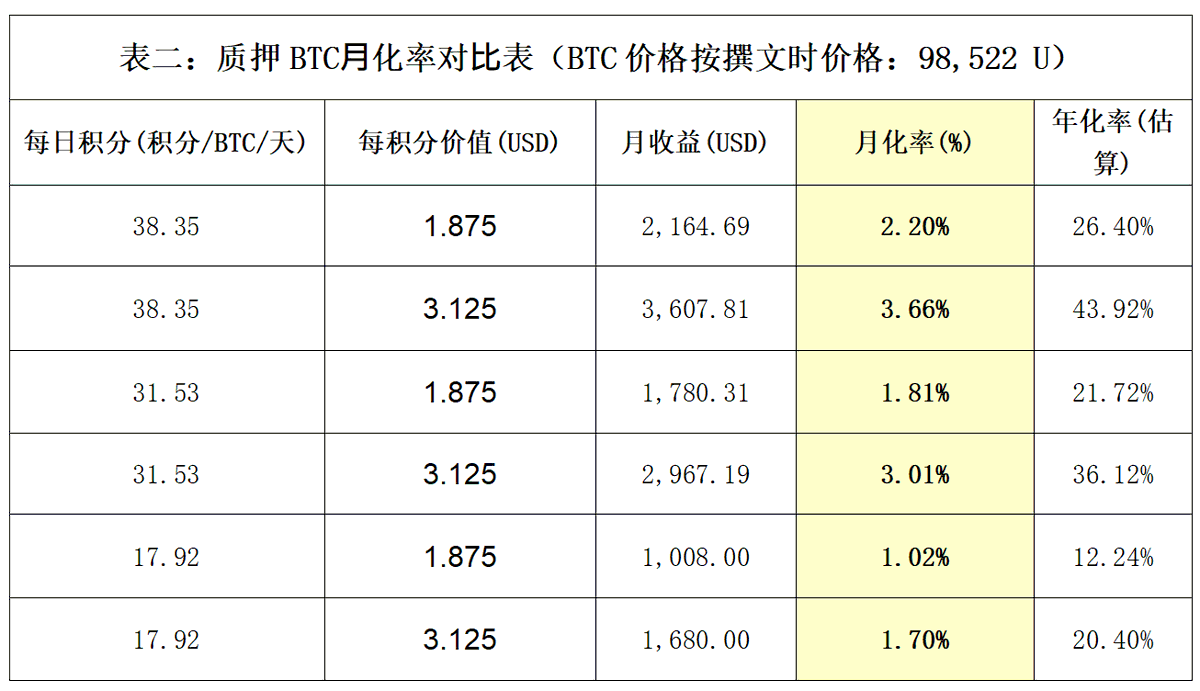

Table 2: Monthly BTC Staking Yield Comparison (BTC price at writing: $98,522)

Overall yield: Current monthly staking yield ranges from 1.02% to 3.66%, making it a solid option for those with idle BTC.

Main airdrop risks: Final timeline unknown, airdrop rules unclear—some potential risk remains.

In conclusion, as a VC-backed project with substantial funding, strong exchange support, and high sector potential, Babylon’s operations appear mature and progress steady. With significant growth prospects, the project is well-positioned to generate strong market interest post-TGE. Based on currently available information, participation still offers decent value—users can engage according to their own circumstances.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News