With nearly 90% of projects launching below offering price in 2025, mindlessly farming tokens is just giving away money

TechFlow Selected TechFlow Selected

With nearly 90% of projects launching below offering price in 2025, mindlessly farming tokens is just giving away money

The best airdrops often reward early, deep engagement rather than just brief interactions.

Author: DeFi Warhol

Translation: TechFlow

Crypto airdrops are often seen as "free money," but experienced "farmers" know that not every airdrop is worth spending gas fees and effort on. Over the past 5 to 7 years, I've participated in dozens of airdrops—some earned me six-figure gains, while others yielded nothing.

The key lies in careful evaluation. In this report, I'll try to establish a framework for assessing airdrop potential.

I propose an objective method for determining whether an airdrop opportunity is worth pursuing or should be skipped entirely. I'll combine real-world examples (from Uniswap’s legendary airdrop to recent Layer 2 airdrops) with quantitative benchmarks to help professional crypto users—and even venture capital firms—identify high-return, low-risk airdrop opportunities.

Key Factors in Airdrop Evaluation

Evaluating an airdrop's potential isn't about guessing or blindly following trends—it's a structured analytical process. We can break it down into several key criteria, each focusing on a critical aspect of risk or return:

-

Protocol Fundamentals and Narrative

-

Token Distribution and Tokenomics

-

Eligibility Criteria and Sybil Resistance Mechanisms

-

Effort, Cost, and Risk-to-Reward Ratio

-

Market Environment and Timing

-

Liquidity and Exit Strategy

Next, we’ll dive deeper into each factor, including what questions to ask and why they matter.

Protocol Fundamentals and Narrative

Before touching testnets or transferring funds across chains, first assess the project itself. Airdrops aren’t magical freebies—their value stems from the success of the underlying protocol.

Does the project solve a real problem or just chase trends?

A strong use case or innovative technology (e.g., a new scaling solution or unique DeFi primitive) suggests the token may retain value after initial hype fades. For example, Arbitrum, as a leading Ethereum Layer 2 solution, achieved real user adoption even before launching its token, giving participants confidence in the potential value of its airdrop. In contrast, many copycat projects without unique value saw their prices crash immediately post-launch as farmers dumped tokens.

Is there a compelling narrative or market trend?

Narratives drive crypto markets. From 2023–2024, themes like modular blockchains, restaking, and ZK-rollups attracted massive investor attention. A project aligned with a hot narrative (like Celestia, a modular data network) might see explosive demand for its token due to narrative momentum. However, narratives can lose steam quickly (and they do). I prefer projects backed by technical substance.

Are users and developers genuinely active?

Checking on-chain data and community channels is crucial. High testnet activity, a vibrant Discord community, and regular developer updates are positive signals. Even better if usage isn’t purely speculative. For instance, Blur (an NFT marketplace) combined gamification with its airdrop, demonstrating explosive growth and genuine trading volume—indicating organic appeal beyond short-term “speculative farming.”

Strong fundamentals and an engaged user base are foundational to a project’s success. No clever airdrop design can sustain token value long-term if the protocol itself is weak.

I’ve learned this the hard way. In 2022, I spent months farming various Layer 1 (L1) testnets that never attracted real users. Those tokens, even when eventually launched, had no market demand and crashed over 90%.

In short, if I’m only interested in a project because of an airdrop, I pause and reconsider.

Token Distribution and Tokenomics

Token design is another critical component. This includes total airdrop supply, distribution rules, vesting schedules, and implied valuation. Key points I focus on include:

-

User Allocation (percentage of total supply)

-

Value Capture

-

Vesting and Lockup Mechanisms

-

Fully Diluted Valuation (FDV)

-

Pre-TGE Market Dynamics

-

Distribution Fairness

User Allocation

How big is the slice of the pie going to users?

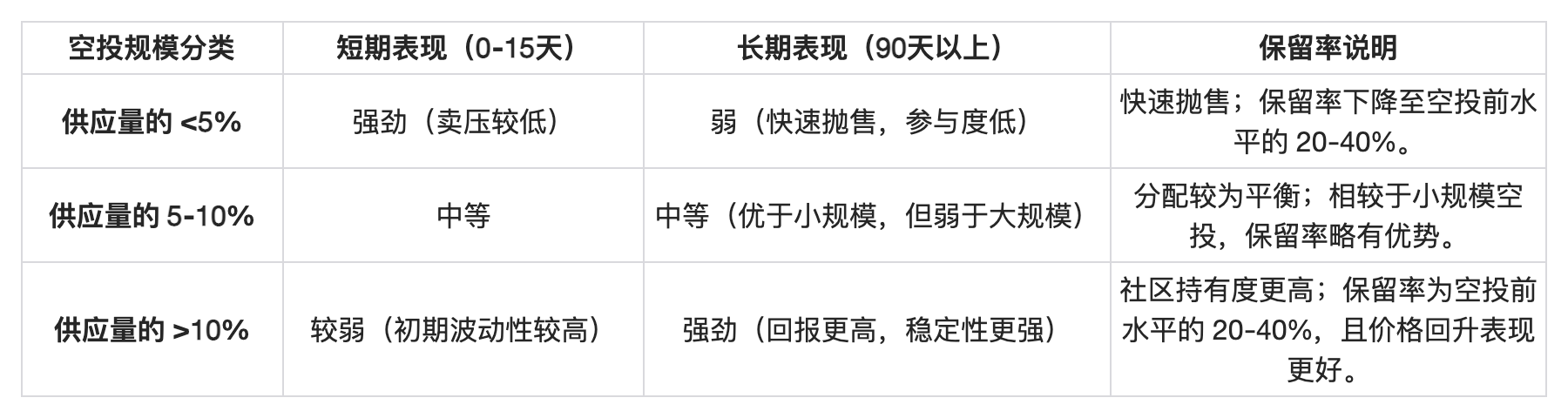

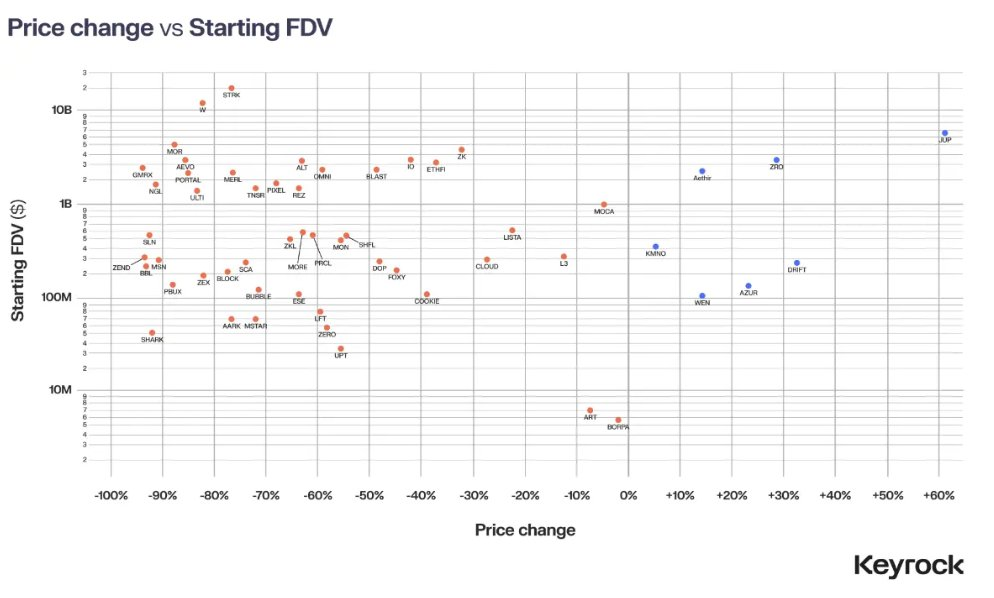

The percentage allocated to users in an airdrop is crucial. Airdrops that give users a meaningful share tend to build stronger communities and even support token price. From experience, airdrops allocating more than 10% of total supply typically perform better and have higher user retention, while those below 5% often get dumped quickly. For example, Uniswap’s famous 2020 airdrop gave 15% of $UNI supply to users—worth around $6.4 billion at its peak. This not only helped Uniswap build a loyal governance community but also provided strong support for its token value.

In contrast, some 2024 airdrops offered minimal allocations to users, with most tokens held by insiders. Users typically dump their small shares quickly, causing prices to never recover. Celestia allocated about 7.4% of $TIA to its “Genesis Drop” (for testnet participants and early adopters), while Arbitrum’s March 2023 airdrop distributed about 11.6% of supply. Both allocations were large enough to give users a sense of ownership. If only a tiny fraction of supply goes to the community, I treat it as a red flag for potential sell-off pressure.

2024 Crypto Airdrops with Low User Allocations and Insider-Dominated Distributions

Value Capture

What role does the token play? How does it capture value?

Not all tokens benefit from protocol success—this is a fatal disconnect in many airdrop projects.

Some tokens are governance-only, like $UNI or $DYDX. If the decentralized autonomous organization (DAO) controls substantial cash flows or system parameters, governance can create long-term defensible value. But in low-fee or passive protocols, governance often becomes symbolic influence. When protocol upgrades don’t align with token holders’ interests, markets quickly discount “governance-only” tokens.

Other tokens, like $HYPE or $GMX, tie token value to revenue—via staking, buybacks, or native yield (real or synthetic). These offer “farmers” an option: earn the airdrop and hold an income-generating asset. I prefer airdropped tokens with active economic roles—not just governance badges—but ones participating in fee sharing, inflation rewards, or protocol throughput.

Lockup and Vesting Mechanisms

Are airdropped tokens immediately liquid, or locked/vested?

For “farmers,” immediately tradable tokens are usually better (I can sell and lock in profit right away). If tokens are non-transferable or time-locked, you’re effectively forced into being a “long-term holder”—which I jokingly call “the result of failed short-term speculation.”

A cautionary tale is EigenLayer’s $EIGEN airdrop in 2024. Users farmed points for a year, but couldn’t transfer tokens upon launch—angering farmers who couldn’t cash out.

We generally avoid airdrops requiring long lockups or veToken models unless I have extreme confidence in the project’s long-term value. My strategy is to preserve optionality—I want the freedom to sell early. A guiding principle: “No protocol is 100% secure, so no airdrop should assume I’ll hold 100% forever.”

Fully Diluted Valuation (FDV)

Estimate FDV (total supply × expected market price) at token launch.

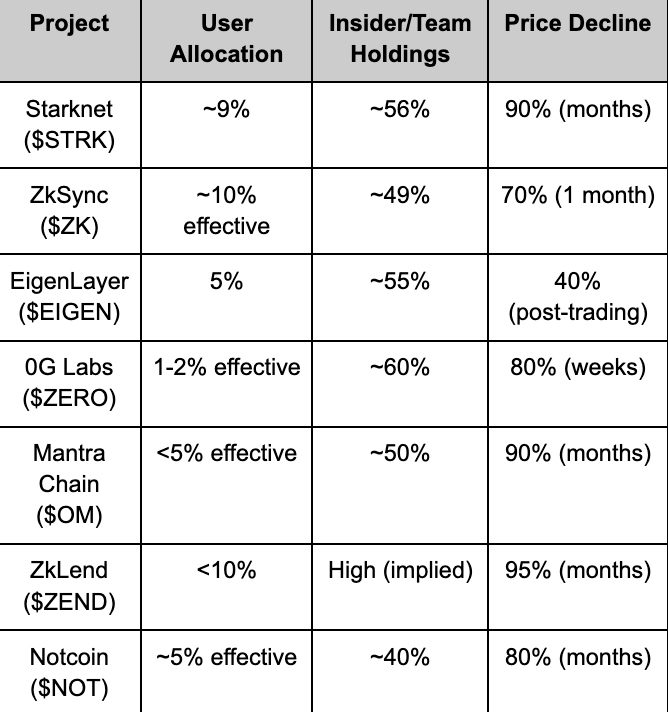

An excessively high FDV can kill a token’s price; remember, airdrops don’t create “magic” that defies valuation logic. In 2024, many airdrops launched with sky-high FDVs, only to crash 50–80% within two weeks.

A study of 62 airdrop projects found that 88% of tokens dropped in price within 15 days, often due to unrealistic initial pricing.

I look for a margin of safety: if similar projects are valued at $500M, but this one implies a $5B valuation, proceed with caution. Conversely, if the project is strong and initial market cap is reasonable, that’s often a bullish signal.

Also consider liquidity: will the token list on major exchanges or have deep decentralized exchange (DEX) liquidity? Without sufficient liquidity to absorb sell pressure, even strong projects can face heavy dumping. Among the few 2024 airdrops that retained value beyond the first month, deep liquidity and reasonable FDV were common traits.

Pre-TGE Markets and Early Valuation Signals

A notable emerging trend is pre-TGE token markets. Here, projects tied to major airdrops begin trading on perpetual DEXs or OTC platforms before official token launch.

These early markets often reflect aggressive expectations, sometimes implying multi-billion dollar FDVs based purely on hype. For “farmers,” these signals are important: high pre-launch pricing can validate the narrative and motivate farming. But it also amplifies risk—if fundamentals don’t support the hype, the token could crash immediately after claim.

I treat these early price signals as indicators of market sentiment, not guarantees.

The key is identifying when the market pays too high a premium for unrealized potential, and adjusting risk exposure before that mispricing corrects.

Distribution Fairness

Check whether airdrop allocation is overly concentrated among a few wallets or more evenly distributed.

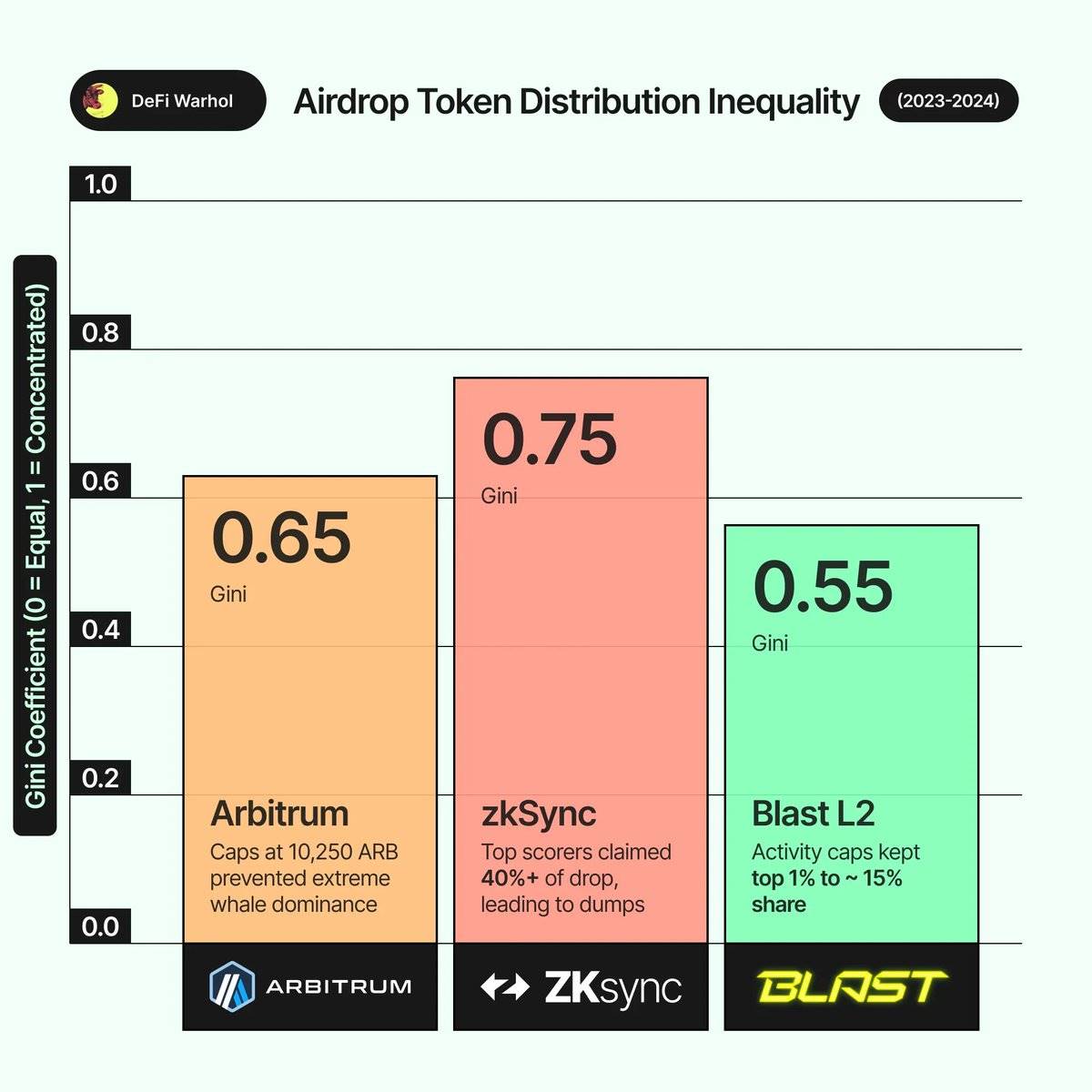

Highly skewed distributions may mean a few “whales” dominate selling. For example, while Arbitrum’s airdrop was generous overall, top users (highest scorers) received up to 10,250 $ARB, instantly creating a group of whales.

Interestingly, a small number of wallets often claim most of the tokens. If data (e.g., from Dune dashboards or project blogs) shows “top 1% of participants receive a large share,” I factor that in. I prefer designs that cap individual rewards or use quadratic-style distribution to prevent winner-takes-all outcomes. For example, Blast L2’s points program introduced activity-based caps, allowing even average users to receive meaningful allocations, preventing a “rich-get-richer” dynamic.

In summary, larger community allocations, higher token liquidity, and reasonable valuations typically signal healthier airdrops. Airdrops with tiny allocations, heavy lockups, or inflated valuations often fall into the “farm, withdraw, sell” category. They might suit short-term arbitrage if accessible, but rarely justify significant upfront effort.

Eligibility Criteria and Sybil Attack Prevention

Next, we need to closely examine how to meet airdrop eligibility requirements and how the project prevents Sybil attacks (multi-account “farming”). This helps assess the actual probability of receiving an allocation and whether returns can be scaled via multiple wallets (or limited to one).

Transparency of Eligibility Criteria

How transparent is the team about airdrop qualifications?

Some airdrops are “retroactive,” based on past behavior with surprising criteria (e.g., Uniswap’s airdrop gave 400 $UNI to anyone who ever used Uniswap—a pleasant surprise). Others are task- or points-based, like Optimism, Arbitrum, or many testnet programs.

If criteria are public (or at least inferable from docs or leaks), list them and assess difficulty. For example, Arbitrum clearly outlined an action-based points system (e.g., bridging funds, trading across months, deploying liquidity).

This transparency lets me plan ahead and maximize points across my wallets. Conversely, if criteria are vague, you may need to “spray and pray” across activities to qualify—inefficient and potentially wasteful.

Input vs. Reward per Wallet

Estimate how much reward eligible wallets might receive.

Sometimes teams hint at reward tiers, or you can extrapolate from historical precedents. For example, many Ethereum Layer 2 (L2) airdrops delivered $500–$2,000 worth of tokens to average user wallets. If I expect a similar range with relatively simple tasks, it’s definitely worth participating. But if high effort (e.g., running a node for months) yields similar returns, I might run just one wallet—or skip it entirely. On the other hand, if five-figure payouts are possible (like early dYdX traders getting tens of thousands in $DYDX), higher effort is justified.

Also consider whether using multiple wallets significantly boosts returns, or if rules limit such tactics. Many airdrops actively combat Sybil attacks (multi-account abuse). For example, Optimism’s 2022 airdrop identified and excluded over 17,000 Sybil addresses (~6.8% of eligible wallets); Hop Protocol even clawed back tokens from Sybil addresses post-airdrop.

If a project strongly opposes Sybil attacks, using dozens of wallets may backfire—you could waste gas and still get disqualified.

My rule: if Sybil risk is high, focus on one or a few high-quality wallets (with real activity), not spreading thin across many.

Sybil Resistance Mechanisms

Beyond direct bans, look for mechanisms that weight points or criteria toward genuine users.

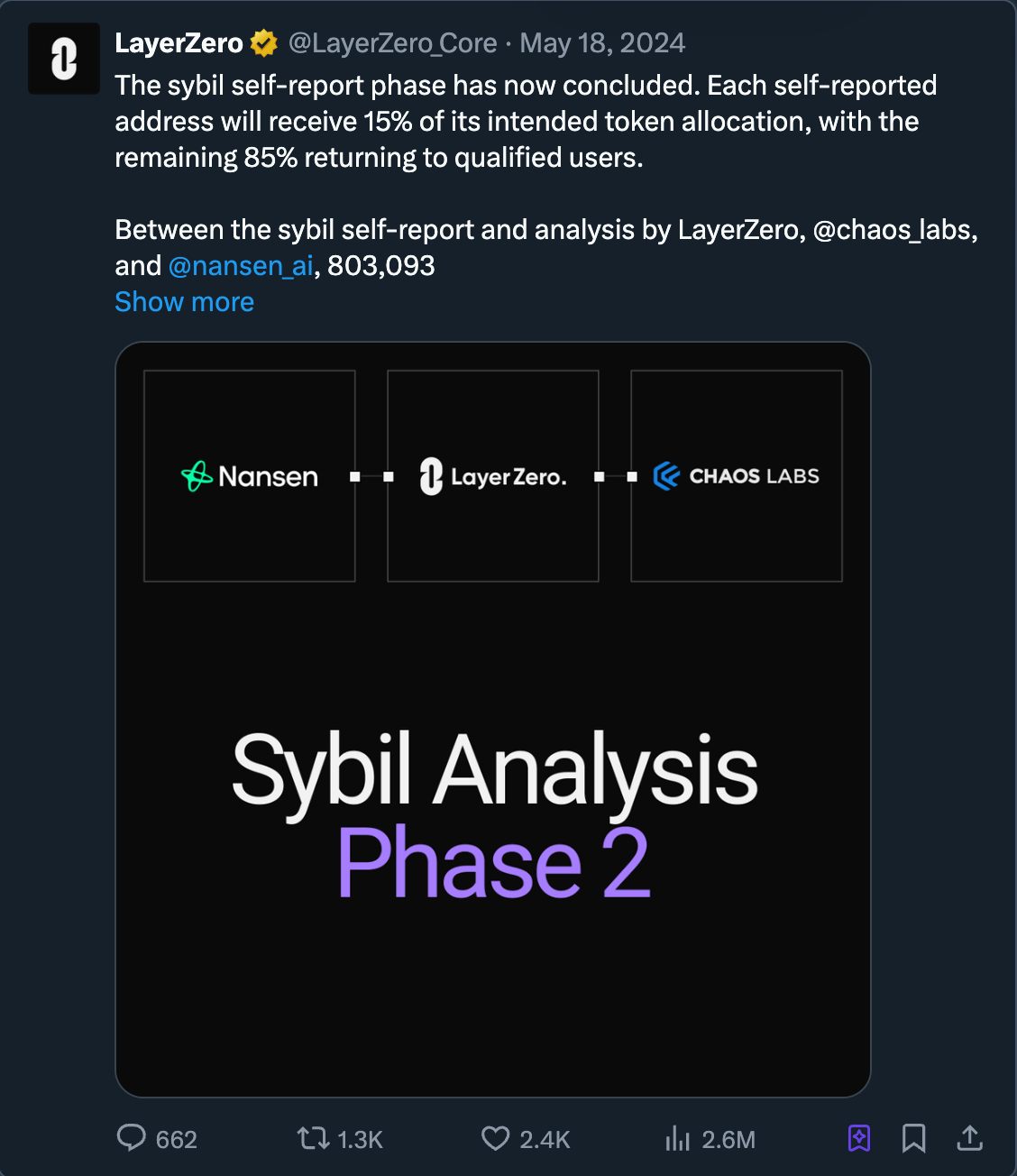

Some projects reward hard-to-fake behaviors more heavily (e.g., long-term activity, on-chain reputation NFTs, or KYC). In 2024, LayerZero flagged 800,000 addresses as Sybil and planned to reduce their rewards to 15% of normal.

Starknet’s first airdrop required holding at least 0.005 ETH on L2 at snapshot—seemingly minor, but it filtered out many users who didn’t keep funds on L2. I account for such quirks: if unusual criteria appear (minimum balance, specific NFTs, etc.), I adjust my airdrop farming strategy—e.g., ensuring all participating addresses meet balance requirements before snapshot.

Additionally, if a project issued testnet NFTs or ran Crew3/Galxe campaigns, those might be airdrop prerequisites; missing early tasks could disqualify you entirely, so I stay alert to such events.

Risk of Rule Changes

The worst-case scenario: you complete all requirements, only to be disqualified due to last-minute rule changes. While rare, some projects adjust criteria at the final hour to combat Sybil attacks or respond to community feedback. Sometimes users think they qualify, only to be excluded—sparking backlash. Staying active in project communities helps. I’ve seen protocols hint at what they consider illegitimate behavior (e.g., funding dozens of new wallets from one address = banned).

I appreciate clear communication from projects, but I always assume disqualification risk isn’t zero. This mindset prevents overconfidence. One key reminder: “If you miss the airdrop, it’s your fault—no excuses.” On-chain data doesn’t care about reasons, so I aim to farm in a way that looks natural under scrutiny.

The core takeaway: understanding eligibility rules helps judge competition level and optimal strategy. In high Sybil-risk scenarios, proceed cautiously (better to invest time in one solid identity); in fully open cases (no Sybil checks, purely volume-based), broader multi-wallet strategies may work—but rewards are often diluted by hordes of “airdrop farmers.” It’s a delicate balance. My default is to behave like a “true core user” on at least one account to pass most Sybil filters and earn solid rewards.

Effort, Cost, and Risk vs. Reward

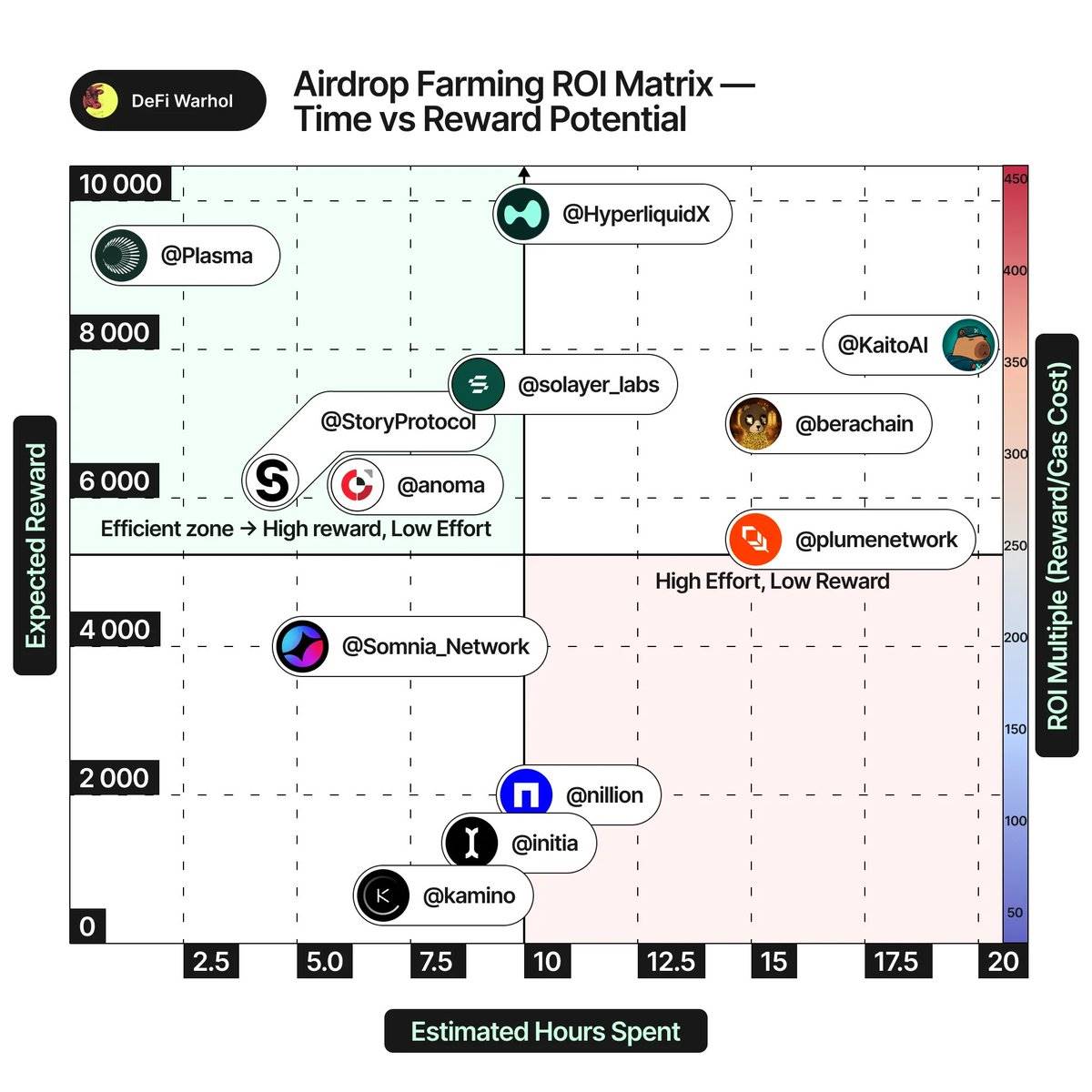

“Airdrop farming” is essentially an investment of time and money, so I must conduct a cost-benefit analysis upfront:

Time and Complexity

Some airdrops require just one-time actions (e.g., a single trade on a DEX). Others, like testnet programs, may involve weeks of software operation, task completion, or months of regular use. I map out these requirements. If the task list includes dozens of actions (e.g., bridge hops, trades, liquidity provision across dApps), I estimate total time investment.

Spending 100 hours for $500 in potential rewards is clearly a poor ROI. I’d rather spend that time on better opportunities. I’m especially wary of open-ended “points” programs with no clear end—they can become endless, diminishing-return treadmills.

My experience with 2022 L2 incentive programs taught me to set exit criteria. For example: “If after one month my points are below X% of top users, re-evaluate and possibly quit.”

Gas and Direct Costs

I calculate gas (transaction fees) and other costs (e.g., cross-chain bridge fees, minimum deposit requirements). For example, Arbitrum’s airdrop encouraged bridging over $10k and trading over months—but if network gas is high, these actions aren’t cheap. All expenses must be weighed against potential returns.

A good practice: simulate a few actions, observe gas costs, then multiply by iterations or wallet count. I’ve abandoned seemingly promising airdrop farming plans because gas costs exceeded expected rewards (especially during 2021’s high gas era, when many smaller airdrops weren’t even worth $100 in claim costs).

Capital Risk

Do you need to lock significant funds or take market risk? Providing liquidity, lending, or staking exposes you to impermanent loss or smart contract risks. For example, during DeFi’s “yield farming summer,” some liquidity mining programs (like Sushi) offered airdrops, but farmers faced impermanent loss or protocol exploits.

If you must deposit large sums into a new protocol (e.g., a new cross-chain bridge or lending dApp) to qualify, assess whether the smart contract has been audited and consider hack risks. This isn’t theoretical—from Ronin’s $600M bridge hack to smaller testnet bridge failures, I’ve seen “airdrop farmers” lose principal chasing airdrops in vulnerable systems.

Worst-Case Scenario Planning

Always ask: “What if I get nothing?”

If the answer is I wasted time or money beyond my tolerance, it’s not worth it. I assume a portion of airdrop farming will fail (project cancels airdrop, I get filtered out, or token becomes worthless). For example, I spent months on unnamed L1 testnets that never launched tokens—pure sunk cost. These failures taught me to minimize irreversible costs.

For time, this means setting periodic checkpoints to reassess (don’t fall for the sunk cost fallacy). For money, it means avoiding huge gas spends or maintaining flexibility (e.g., using scripts or operating off-peak to cut costs).

To decide “is it worth it?”, I often run a quick expected ROI calculation: e.g., probability of airdrop happening (say 80%) × estimated token value (e.g., $1,000 per wallet) minus costs. If the expected value is clearly positive and qualitative factors check out, I proceed. If near zero or negative, I walk away or wait for clearer signals.

Market Environment and Timing

Bull Market vs Bear Market

In bull markets, airdrops can deliver massive returns. Tokens often launch at higher valuations amid strong buyer FOMO (fear of missing out). In bear markets, even solid projects may face weak demand. For example, many major airdrops in 2022–2023 (like Optimism, Aptos) occurred during bearish conditions, resulting in steep post-launch drops and slow recovery.

In contrast, bull-market airdrops (e.g., 2021 cycle) often saw token prices rise after launch. I don’t try to perfectly time macro cycles (airdrop farming is relatively neutral pre-launch), but market context affects my exit strategy and farming aggressiveness. During bull mania, I might farm more opportunities and hold longer; in bearish times, I focus on highest-potential projects and plan to sell quickly at launch.

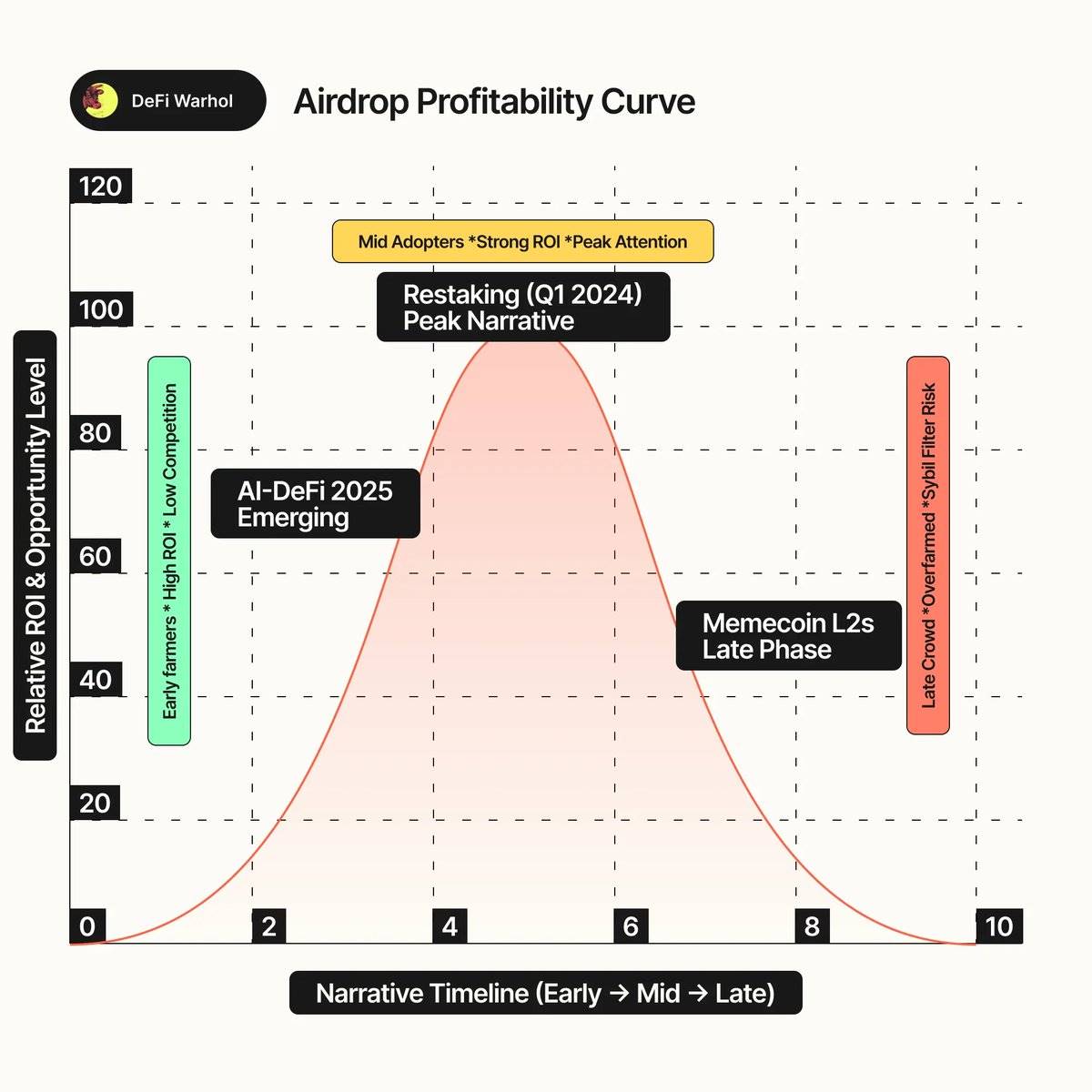

Narrative Cycle

I mentioned narrative alignment in fundamentals, but timing matters too. Is a narrative rising or already overcrowded?

For example, the restaking narrative was white-hot in early 2024—any airdrop rumor sparked massive attention. If you joined early (e.g., restaking ETH when TVL was low), you stood out; but by Q1 2024, latecomers entered a crowded pool.

I try to judge whether an airdrop’s “meta-narrative” is in “early stage” or “late stage.” If the entire crypto Twitter (CT) is farming a testnet, easy profits are likely gone—or anti-Sybil measures will be strict. Conversely, a quiet campaign in an emerging niche might be a hidden gem. For example, in 2025, hybrid AI-and-DeFi protocols began gaining traction—an area where airdrops may not yet be flooded with miners, offering higher success odds.

Project-Specific Timing

Consider where the project stands on its roadmap. If mainnet or token launch is imminent (e.g., within weeks), your farming window is short, and airdrop criteria may already be fixed.

If it’s an open-ended testnet, assess how long you can sustain farming. Some projects run “incentive seasons”; if the schedule is public, that info helps. Pay special attention to snapshot timing: many airdrops snapshot user activity at a specific block height. If you suspect a snapshot is coming, that’s your last chance to ensure达标 (or stop spending if you’re satisfied).

How Projects Handle News and Setbacks

This is subtle, but observing how a project responds to adverse events or updates reveals potential. Do users flee after a testnet crash, or do they return? Did the team delay a token sale? For example, if a project suffers a hack or exploit but handles it professionally while the community stays supportive, that resilience boosts my confidence (it shows crisis management capability). Conversely, if a minor delay causes mass Discord exodus, interest may be shallow.

Projects that “ignore bad news during bull narratives” (remain optimistic despite issues) are often in stronger positions. I saw this with Arbitrum and Optimism; despite controversies and governance FUD (fear, uncertainty, doubt) during airdrop distribution, user bases kept growing—indicating real underlying demand.

In short, context matters. During overheated periods (when everyone’s frantically farming, competition is fierce), I’m more cautious; during downturns (when few bother), I’m more aggressive—because final returns relative to input may be higher. For example, my biggest airdrop gains came from late-2022 farming when many were disillusioned; by the time tokens (like Arbitrum) launched in 2023, I was among the few claimers and rode the market wave.

Liquidity and Exit Strategy

Finally, I plan how to realize value if the airdrop actually arrives. An old trading adage: “Plan your trade, trade your plan.” For airdrops, this means:

Claim Strategy

When airdrop claims open, markets often swing wildly. Remember Arbitrum’s claim day—claimants paid high gas, RPC servers crashed, chaos ensued.

To handle this, I prepare: set up backup RPC nodes, script auto-claim if possible, and be ready at launch. With multiple wallets, I prioritize accounts I plan to sell immediately (to beat the rush); for small holdings I intend to hold, I don’t mind claiming later.

Also check for claim deadlines; many allow months to claim, but some reclaim unclaimed tokens to the DAO after a period. For me, missing a claim is rare—I actively claim.

Market Liquidity

I prefer airdrops listing on major exchanges or having deep AMM (automated market maker) liquidity from day one. If backed by big investors or high hype, tokens often list on Binance or Coinbase (or at least get deep pools on major DEXs).

For example, Arbitrum’s $ARB became tradable on major platforms almost immediately, with volume quickly surpassing $1B—making exits relatively easy. Obscure airdrops may trade only on a single DEX with thin liquidity; selling large amounts could crater prices or erode profits via slippage. So I research early: if the team announces market maker partnerships or exchange support, that’s positive; if it’s a niche Cosmos airdrop requiring native wallet swaps, I expect high volatility and adjust position size (or skip entirely if smooth exit isn’t guaranteed).

Sell, Hold, or Stake?

I decide in advance how much to sell versus hold. Historically, most airdrop tokens peak in price during the first two weeks post-launch.

I typically sell early: my strategy is to sell ~50% on day one or immediately after claiming to lock in gains, then hold the rest with trailing stops or price targets. This hedges against common “dump” risks while preserving upside if the token surges.

Only in rare cases (if I’m extremely bullish or the token launches well below my fundamental expectation) do I hold most long-term. Even then, I consider staking or lending for extra yield—but cautiously: if rewards require lockups (e.g., governance locks), I weigh the lost flexibility.

Tax and Legal Considerations

I can’t ignore regulatory impacts. In many jurisdictions, airdrops are taxable income (at least at claim value). I factor this in—large airdrops can trigger hefty tax bills.

Sometimes, selling immediately to cover taxes is wiser. Also watch for regional restrictions. For example, EigenLayer barred U.S. users from claiming. I monitor whether projects require KYC or geo-blocks. If so, the airdrop may be nearly worthless to me—or I’d need to participate via entities in friendlier regions. This is becoming an emerging issue; some 2025 airdrops now require basic KYC for compliance.

Ultimately, airdropped tokens aren’t real gains until cashed out. I craft a clear exit plan for every airdrop to avoid becoming the bagholder of rapidly depreciating tokens.

Best Practices and Final Thoughts

Putting it all together, here are my best practices when evaluating whether an early airdrop is worth investing in:

Do Your Homework

Before starting any “task,” research the project’s fundamentals and token plans. Read docs or governance forums if possible, hunting for token clues. Many missed opportunities stem from assuming an airdrop exists when it doesn’t (or vice versa). Don’t rely on rumors—verify.

Form Hypotheses (But Verify)

Create a clear rationale for why an airdrop might be valuable—e.g., “This project leads in an emerging space and may launch a low-initial-market-cap, high-demand token.” Then continuously test this hypothesis with on-chain data and news. If the narrative collapses (growth stalls or rivals overtake), be ready to pivot or abandon farming. Flexibility is a virtue; stubbornly clinging to a broken thesis wastes months. From experience, ego and confirmation bias are the biggest enemies. Never assume you “deserve” an airdrop—adjust based on reality.

Score and Compare

Score each opportunity across dimensions (fundamentals, tokenomics, cost, etc.). I sometimes use spreadsheets, weighting factors (e.g., 30% protocol quality, 30% reward potential, 20% cost/risk, 20% Sybil resistance). This quant approach forces honesty about weaknesses. A trendy project might score high, but poor token design lowers its total. Scoring might reveal a less popular airdrop offers better risk/reward than a hyped one with 100k competitors.

Manage Risk, Don’t Gamble

Treat airdrop farming as a portfolio. Diversify across several promising opportunities instead of betting everything on one. That way, if one fails (no airdrop or weak token price), others can offset losses. I typically run 5–10 farms per quarter, knowing maybe half will pay off. Always protect capital: “You need to be present when the mega-drop hits.” Don’t blow all your ETH on gas for marginal airdrops. Keep reserves to go all-in when a once-in-a-cycle opportunity arises.

Watch On-Chain Signals

Monitor on-chain activity: new wallet growth, testnet usage, or (if public) points leaderboards. If your rank drops while others farm harder, re-evaluate. Similarly, declining project activity may signal waning interest—a bad omen for final token value.

Plan Your Exit (and Entry)

Enter farming with the end in mind. Before starting, know how to claim and your sell strategy. Avoid illiquid traps. If an airdrop hints at long lockups or DEX-only trading on one chain, decide upfront if you can accept that. If not, skip it—you may not exit gracefully. When the airdrop comes, execute your plan. Don’t let greed or fear override it. I’ve seen people get $10k airdrops, hold hoping for $20k, then watch it drop to $2k. Don’t be that person. Systematically lock in wins. After all, not every day does someone “freely” hand you tokens; cashing in victories isn’t shameful.

Learn and Iterate

Every airdrop—success or failure—teaches lessons. Build a habit of reflection: note what you got right or wrong. Did you overestimate a project? Miss a key requirement? Or feel a hunch about an airdrop’s potential but didn’t commit enough (that “I knew it but didn’t act” regret)? We’ve all been there. Use these insights to refine your framework.

After years of practice, my approach to airdrops is more cautious yet opportunistic—skeptical of hype, but decisive when spotting undervalued opportunities. The goal is cultivating sharp intuition for edge cases: “The market undervalues this airdrop, and I can profit.”

Evaluating an early airdrop is both art and science. The art lies in understanding human motivation and crypto narratives; the science in analyzing data and tokenomics. The best airdrops often reward deep early participation, not just brief interactions.

This means if you genuinely use and support strong projects early, you’re usually rewarded best. My framework aims to identify such opportunities. By focusing on fundamentals, staying realistic about token design, carefully weighing effort versus reward, and adapting strategies with new information, I’ve greatly increased my success rate in farming only truly worthwhile airdrops.

In the end, airdrop hunting should be treated like any investment: thorough due diligence, risk management, and clear strategy. Master these, and you can cut through noise to find real opportunities—and when the next UNI- or ARB-scale airdrop comes knocking, you won’t miss it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News