Crypto TGE Revolution: Public Sales on the Rise, Airdrops Losing Favor?

TechFlow Selected TechFlow Selected

Crypto TGE Revolution: Public Sales on the Rise, Airdrops Losing Favor?

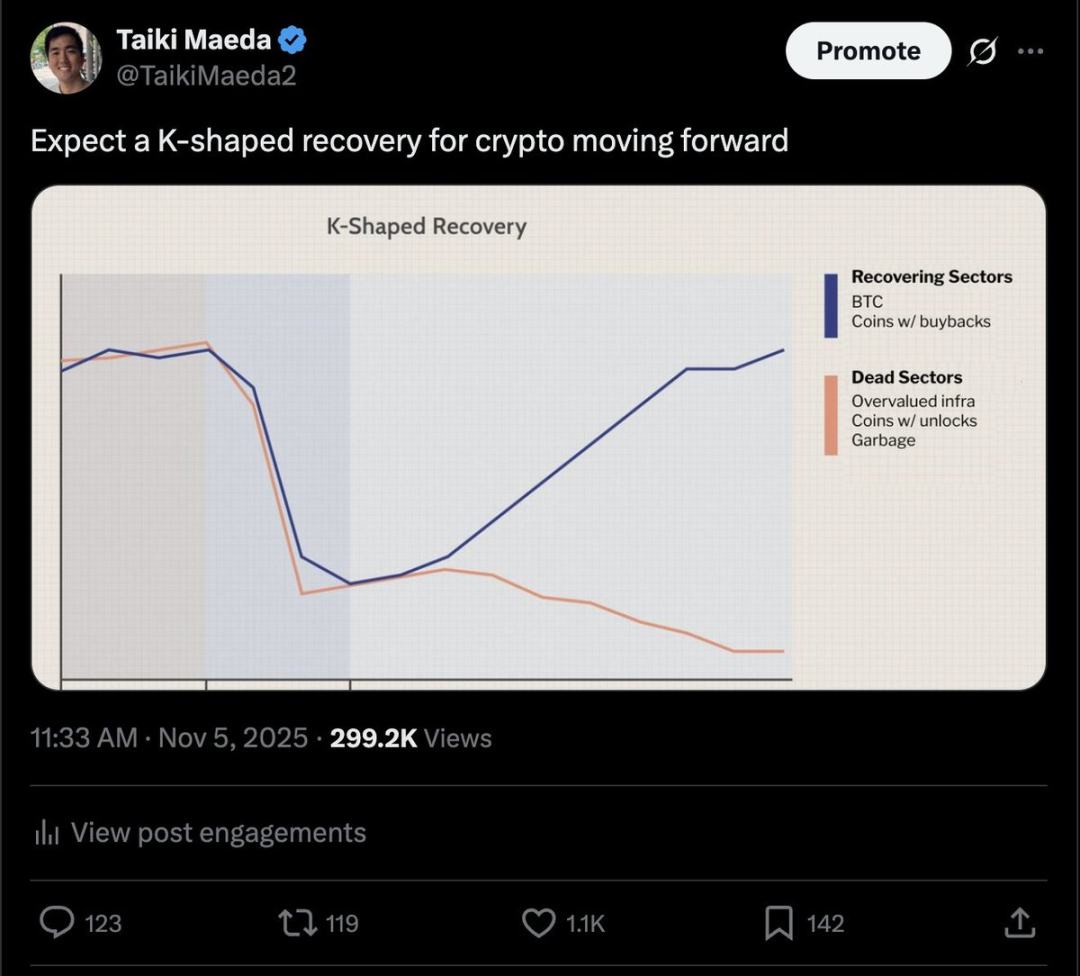

In the future, the gap between high-quality tokens and low-quality tokens may continue to widen.

Author: Taiki Maeda

Translation: Saoirse, Foresight News

There was a time when airdrops were the go-to method for token generation events (TGEs). Projects would distribute large amounts of free tokens to users, hoping to cultivate a loyal base of holders and promoters. For a while, this approach worked. The allure of "free tokens" created a viral hype cycle — Discord servers buzzed with activity, posts on X fueled momentum, and users rushed to deposit TVL into untested smart contracts, all chasing extra yield.

But there's no such thing as a free lunch. As airdrop farming became more sophisticated and "sybil attackers" (users who fake identities to claim multiple airdrops) gained notoriety, airdrops ultimately devolved into little more than "liquidity exit tools" during TGEs — arbitrageurs selling their freely obtained tokens to day-one buyers. Project teams realized they weren't building communities; they were merely "feeding locusts" (a metaphor for profit-driven actors who take without contributing).

The Rise of Public ICOs

Instead of distributing tokens widely via airdrops, project teams have discovered a new approach. They've learned that by offering seemingly "generous" high valuations, they can raise significantly more capital from retail investors and funds. The new pitch? "We're giving you early access — almost like it's free!" This model delivers the same dopamine rush as an airdrop, only now with a paid entry barrier, cleverly branded as "fair issuance."

Theoretically, this makes sense. People tend to value things more when they pay for them — a phenomenon driven by psychological factors like the "endowment effect" (where ownership increases perceived value). Thus, in theory, users are less likely to dump tokens immediately after TGE. Additionally, these "generous ICOs" allow teams to fill their treasuries rather than giving tokens away for free. In return, retail investors at least gain access to a trade with decent liquidity and a higher probability of profit.

Case Studies

PUMP raised around $600 million at a $4 billion valuation. Despite subsequent price declines, trading volume remained strong at approximately $4.4 billion, and participants in the pre-sale were able to exit at TGE with roughly 75% profits.

XPL ran a liquidity mining campaign allowing investors to enter at a $500 million fully diluted valuation (FDV), raising $50 million total. Somehow, when the crypto community went wild over the token, pushing its FDV to $16 billion, investors reaped massive returns. Even after price corrections, pre-sale participants still enjoyed about 6x gains.

Looking Ahead

Today, two highly anticipated ICOs loom before TGE: MegaETH and Monad. MegaETH raised around $50 million at an FDV between $900 million and $999 million, while Monad plans to raise nearly $200 million at a $2.5 billion FDV. Notably, neither project has launched its product yet.

While nothing is guaranteed, the market generally views these public sales as "good deals." This sentiment is reflected in market behavior — MegaETH’s fundraising round was oversubscribed by 27.8x.

But here's the catch: Where does the money come from? The answer is everyone buying these tokens at TGE (the same logic applies to airdrops). As long as people continue to flock blindly to these tokens at launch, it will remain a profitable trade for most participants.

I expect this trend to continue, but I want to highlight a few caveats. More projects may adopt this model for TGEs, but not all will be good opportunities. Over time, markets will become increasingly efficient, and these arbitrage windows won’t last forever. Public ICOs are far from "free money machines."

Since Coinbase acquired Echo/Sonar (project name), the upcoming BASE token is likely to launch via ICO rather than through an airdrop.

Moreover, this new trend could create headwinds across the broader altcoin market. The "marginal buyers" (those whose decisions tip supply-demand balance) for these ICOs are mostly existing altcoin holders. As more capital flows into ICOs, liquidity available to support high-FDV "fantasy projects" (those with only concepts, no actual products or execution capability) will dwindle. Many such projects already stumbled on October 10th, and future market competition will become increasingly "player versus player" (PvP), where investors battle each other for gains.

(Note: Taiki Maeda believes the crypto market will experience a K-shaped recovery, with Bitcoin and buyback-enabled tokens belonging to the recovering segment, while overvalued infrastructure, tokens facing unlock pressure, and low-quality projects fall into the declining segment.)

Going forward, the gap between quality and poor-quality tokens may continue to widen. Tokens with monetary premium (inherent value backing) and solid cash flow will perform well, while those relying solely on narratives or hype will underperform. Please manage your capital carefully.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News