2025 TGE Year-End Review: What Did Tokens That Haven’t Yet "Snapped Back" Do Right?

TechFlow Selected TechFlow Selected

2025 TGE Year-End Review: What Did Tokens That Haven’t Yet "Snapped Back" Do Right?

The market no longer pays for potential, but begins to reward structured design.

Author: Stacy Muur

Translation: TechFlow

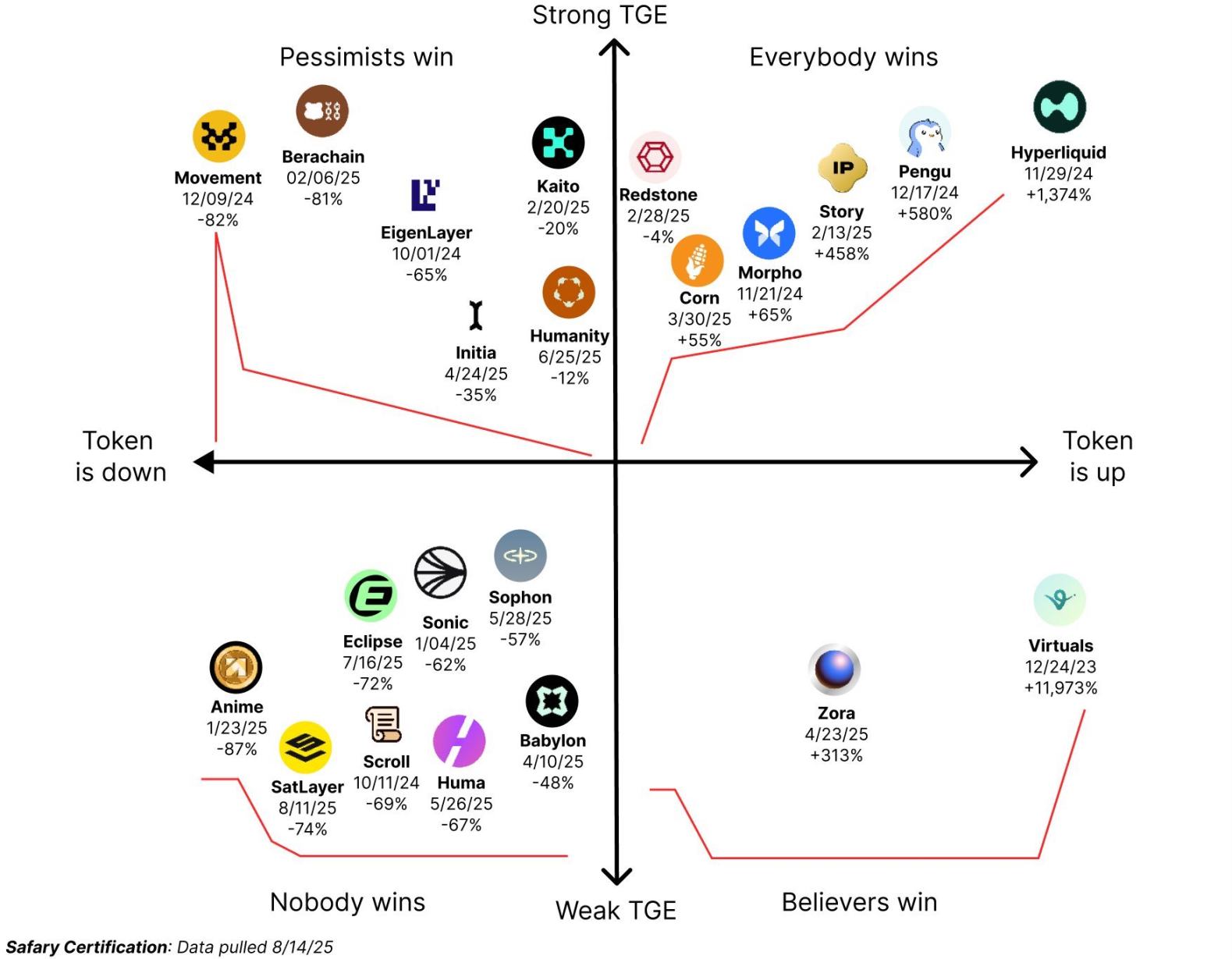

If you've participated in token generation event (TGE) trading in 2025, you're likely already familiar with the default script: a roaring first week, followed by a slow decline, and finally coming to terms with the fact that "the launch price was the peak."

Most newly launched tokens not only underperform but outright collapse, as the market has finally started treating tokenomics and liquidity as fundamentals rather than optional footnotes.

Nevertheless, a few tokens have achieved significant gains by the end of 2025 compared to their TGE prices. Their rises were not fleeting or dependent on buying at extreme lows, but instead indicate genuine market demand.

Below are the stronger-performing tokens I’ve identified from 2025: $ASTER, $FOLKS, $AVICI, $RAIN, $TAKE, and $SENTIS (along with a few others treading water, such as $IRYS, $FHE, and $CORN). While their performances vary, they share common traits.

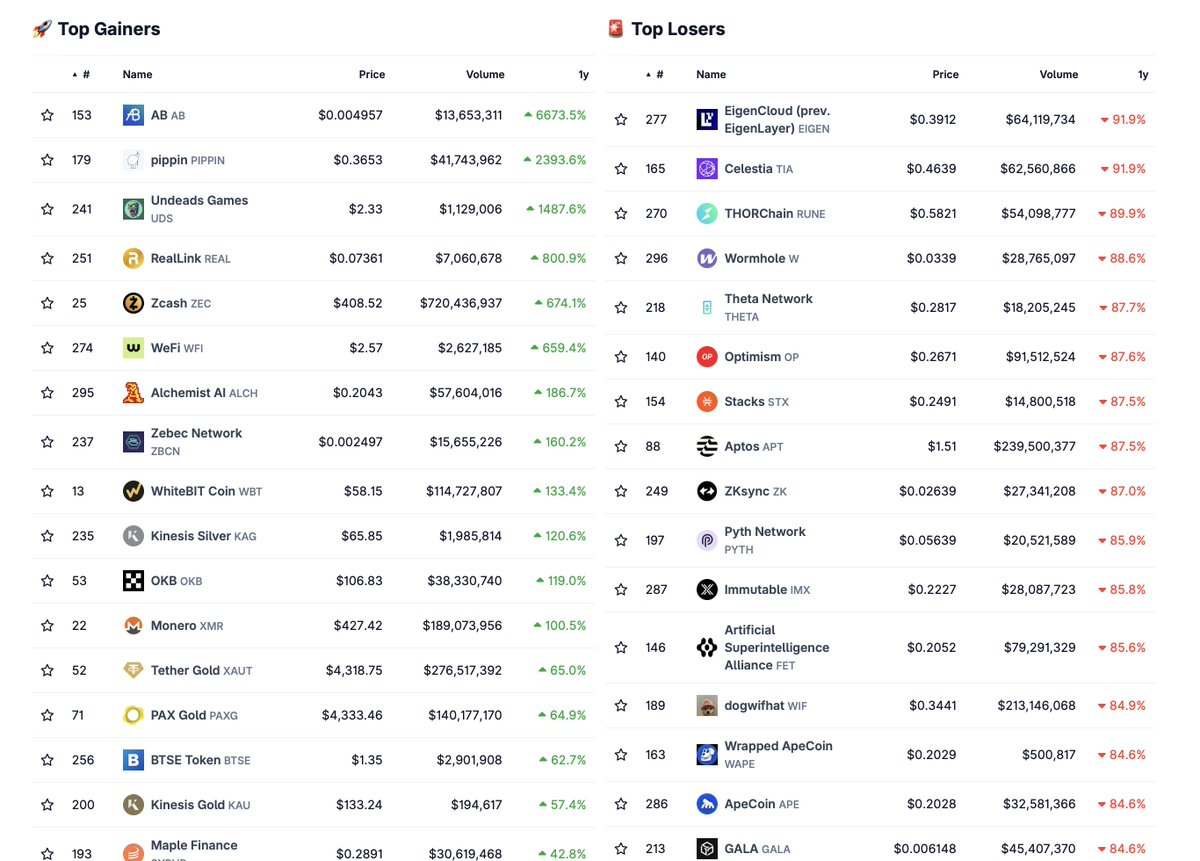

The Winners of 2025

@Aster_DEX ($ASTER) is one of the most textbook success stories—achieving on day one what most projects dream of: broad exchange coverage, deep liquidity, and a narrative around “DeFi perpetual contracts” that traders genuinely understand and embrace. The core story throughout the year could be summarized as: “A privacy-enhanced perpetual contract platform backed by Binance.”

While $ASTER’s price action sparked controversy (you can attribute it to zero-knowledge themes, CZ’s behind-the-scenes influence, or simply better execution), regardless, it was one of the few post-TGE tokens unsuitable for immediate dumping.

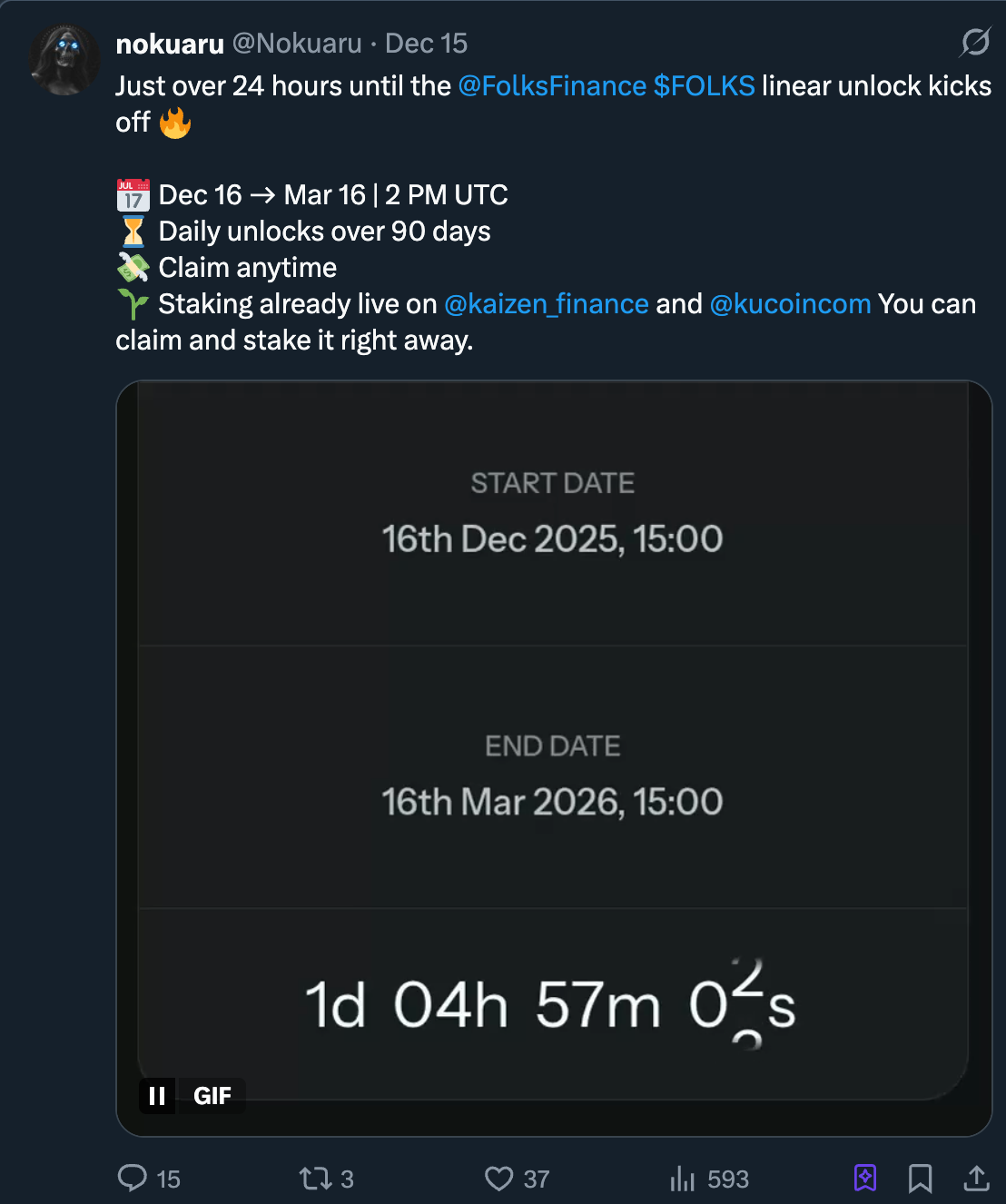

@FolksFinance ($FOLKS): How being “boring” became a winning strategy

$FOLKS stands out as an unusual lending token that proved its worth through being “boring”—and in 2025, boring turned out to be a winning formula. The recipe: “immediate listings on Binance and Kraken, continuously expanding cross-chain pools, and no cliff unlocks.” Especially the last point—“no unlock cliffs”—was more critical than most care to admit.

Everything seemed smooth sailing… until the unlock on December 15.

@AviciMoney ($AVICI): Breaking the rules with a simple narrative

$AVICI is a special case whose success didn’t stem from the most complex technology, but from offering crypto Twitter (CT) the clearest narrative: “a fairly launched project with real product-market fit.”

What people talked about wasn’t tokenomics—it was actual utility: “a functioning new digital banking app, Visa card support, real-world spending use cases.” In a market saturated with endogenous “utility,” $AVICI stood out by stepping away from on-chain fiction and delivering tangible real-world applications.

Undoubtedly, this may have been one of the year’s best TGEs.

When a token rises for a reason, it tends to rise steadily

In the latter part of 2025’s cycle, the strongest reflexive winner was @Sentism_ai ($SENTIS). Its setup was straightforward: AI agent narrative + sustained incentive distribution + broad exchange support. On crypto Twitter, the consensus remained consistent: “AI agents are the next layer of DeFi automation.” This clear narrative gave traders a simple mental model.

Mechanically, $SENTIS did not rely on a one-time listing surge. Its continuous token distribution (task rewards, retroactive airdrops, participation incentives) kept users engaged. This dynamic often translates into sustained spot demand, as participants position themselves for future allocations and ecosystem milestones. Such mechanisms can even support price before on-chain usage becomes evident.

@overtake_world($TAKE): Bridging “Web2 distribution + Web3 infrastructure” in gaming

$TAKE followed a similar successful template but wrapped it in the form of a gaming marketplace. The persistent narrative: “Web2 distribution power combined with Web3 infrastructure.”

Its strength lies in logical clarity—players trade assets, $TAKE serves as the toll token, and staking plus revenue-sharing incentivizes holders. When people talk about “real yield,” they often mean token emissions disguised as APY; $TAKE’s model leans closer to “fees → buyback → staker rewards.” Even if questioned, the market has validated its direction.

@Rain__Protocol ($RAIN): A textbook case of event-driven repricing

$RAIN is a more typical example of repricing driven by events rather than fundamental victory.

The token’s main rally stemmed from a simple, clear headline: a company going public on Nasdaq planning to allocate nine-figure capital into treasury strategies based on $RAIN. Such news rapidly shifts market positioning—liquidity providers adjust spreads, trend traders pile in, and sidelined capital quickly returns due to the simplicity of the story.

While this doesn’t directly prove long-term product-market fit or eliminate execution risk, it explains why $RAIN’s trading behavior didn’t resemble that of a typical small-cap TGE token: its buy-side wasn’t just retail reflexivity, but a seemingly “institutional-grade” narrative attracting sustained attention and larger capital flows.

Tokens that earned respect but didn’t reach the top tier

- @irys_xyz ($IRYS) and @mindnetwork_xyz ($FHE): Both fall into the “AI infrastructure and privacy arbitrage” category, benefiting from AI-related hype, maintaining prices above initial levels, and preserving enough liquidity to avoid becoming “dead charts.” If they can convert buzzwords into real on-chain usage, they stand a chance—because narrative alone isn’t sustainable.

- @use_corn ($CORN): $CORN didn’t explode but performed steadily relative to peers, behaving more like a “structured product.” In 2025’s market that punished overexpansion, stability itself became a signal.

- @LoadedLions_CDC ($LION): $LION demonstrated the importance of distribution and ecosystem appeal. Though it didn’t dominate 2025’s major narratives (like AI, perps, or points), it also didn’t fully collapse. The risk is that if GameFi token utility fails to expand beyond its core community, it could remain trapped in “permanent discount” territory.

Common Traits Among the Winners

After stripping away narratives and sentiment, certain structural patterns emerge.

- Distribution matters more than hype

The strongest performers avoided heavy internal liquidity dumps at TGE.

Examples: $AVICI (0% team allocation), $SENTIS (activity-based token release), $TAKE (community and user incentives).

Insight: Holder structure at launch matters more than the pedigree of private investors.

- Reasonable initial valuation beats perfect timing

Many top-performing tokens didn’t launch during peak market euphoria but chose reasonable initial valuations, allowing the market room to re-rate them later.

Example: $AVICI launched with a ~$3.5M FDV and a working product, creating asymmetric upside potential.

Insight: Tokens that “earn” high valuations tend to outperform those priced highly from day one.

- Real usage (or near-term visible usage) drives price

ASTER’s perpetual trading volume, FOLKS’ lending expansion, $AVICI’s credit card spend, and $TAKE’s marketplace transaction flow weren’t just whitepaper promises—they were observable signals.

Even early-stage $SENTIS tied token issuance to on-chain activity, using feedback loops between usage and price to sustain market interest.

Insight: Today’s market has no patience for waiting on visions. Real usage > grand vision.

- Unlock structure > unlock size

RAIN had a large token supply, but its unlocks were linear and transparent, so dilution was already priced in. SENTIS gradually released tokens via participation, while $TAKE linked issuance to growth metrics.

In other projects, what truly destroyed confidence wasn’t dilution itself, but unpredictable unlock cliffs.

Insight: Predictable dilution is tolerable; sudden, opaque dilution is not.

- Exchange listing is necessary, but not decisive

Nearly all strong tokens had solid exchange access, yet listing alone didn’t guarantee success.

Listings amplify outcomes: they help strong tokens rise faster and weak ones fall quicker. Even without Binance, $AVICI still succeeded.

Insight: Liquidity is an accelerator, not a foundation.

Core Takeaways

2025 quietly marked a shift in market behavior.

The market no longer pays for potential—it now rewards structured design:

- Reasonable circulating supply

- Fair distribution mechanisms

- Credible real-world use cases

- Controlled unlock schedules

The “heroes” of 2025 weren’t flawless projects—they were simply those capable of surviving their own issuance pressure.

If 2024 was about narrative, 2025 was about stress-tested token design.

And that, precisely, is the lesson most new TGE projects have yet to learn.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News