A Guide to 12 Projects Planning TGE in October

TechFlow Selected TechFlow Selected

A Guide to 12 Projects Planning TGE in October

Q4 TGE is expected to continue the momentum.

Author: Zhou, ChainCatcher

So far this year, the number of TGEs (Token Generation Events) in the crypto market has shown an overall upward trend. Data indicates that total fundraising in the first three quarters exceeded $1 billion, with the highest FDV (Fully Diluted Valuation) for a single project reaching $315 million.

Currently, multiple high-profile projects have confirmed TGEs scheduled for mid-to-late October, signaling the arrival of a Q4 TGE surge. Below are detailed introductions to these projects.

Monad ($MON) | High-performance Layer 1 Blockchain

Monad is an Ethereum Virtual Machine (EVM)-compatible Layer 1 blockchain. According to official information, Monad defines itself as a high-performance EVM-compatible L1 using PoS consensus, aiming to pioneer a new paradigm for public blockchains through pipelined execution of Ethereum transactions. The project has raised approximately $244 million, with investors including Paradigm, Dragonfly, Coinbase Ventures, and Animoca Brands, resulting in a post-funding valuation of around $3 billion.

Official sources state that airdrop claims will open on October 14. Hyperliquid launched the MON-USD hyperps (pre-market perpetual contract) on October 8, allowing users to go long or short $MON with up to 3x leverage. Specific airdrop eligibility criteria have not yet been disclosed, but the community speculates that Monad's airdrop may follow a "first-come, first-served" model requiring users to complete challenging tasks before claiming.

Enso (ENSO) | Cross-chain Liquidity Protocol

Enso will launch on Binance Alpha on October 14. Eligible users can claim airdrops via the Alpha event page using Alpha points. Enso is a cross-chain liquidity protocol focused on automated trading and asset management, enabling users to optimize DeFi strategies through smart contracts. The project has raised approximately $9 million, supported by institutions such as Polychain, Spartan Group, and Mapital Capital.

Yei Finance (CLO) | Money Market on Sei Network

Yei Finance will launch on Binance Alpha on October 14 and will list the CLOUSDT perpetual contract (with 50x leverage) at 19:30 (Beijing time) on the same day. Eligible users can also claim CLO token airdrops using Binance Alpha points. Yei Finance is a decentralized, non-custodial money market protocol on the Sei network, currently achieving a total market size exceeding $389 million and total borrowing/lending volume over $170 million. The project completed a $2 million seed round in late 2024, led by Manifold Trading.

Fleek ($FLK) | Easily Build Open Websites and Apps

According to official information, Fleek is a social application where users can create AI-generated or AI-enhanced content and monetize it through tips, token trading, brand campaigns, and premium features.

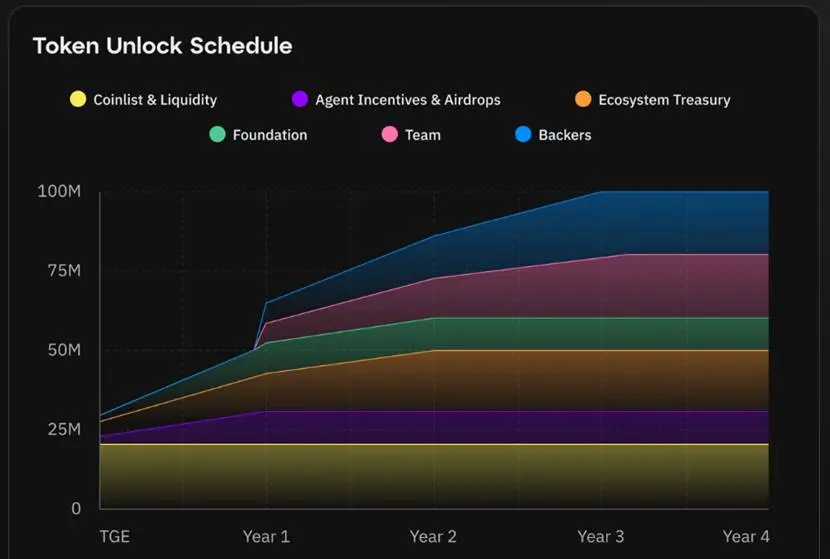

Official data shows that the FLK token has a maximum supply of 100 million, with an initial circulating supply of 28%, and 10% allocated for proxy rewards and airdrops. The Fleek team conducted a token sale via CoinList from May 1–8, 2025, pricing FLK at $0.75 per token, resulting in a Fully Diluted Valuation (FDV) of $75 million. Therefore, the October 14 airdrop will distribute 10 million FLK tokens to the community, valued at approximately $7.5 million.

LAB ($LAB) | Multi-chain Trading Terminal

LAB is a multi-chain trading terminal offering unique trading algorithms, multi-chain support, and customizable trading functions. The project has raised approximately $5 million, with core investors including Animoca Brands, Amber Group, GSR, and OKX Ventures. The airdrop will take place on October 14. While the official team has not disclosed the airdrop ratio or details, hints from Discord and Galxe community events suggest active traders and early users will be rewarded, with potential airdrops accounting for 1–2% of the total supply.

Novastro ($XNL) | AI-driven RWA Layer 2

Novastro is an AI-powered RWA Layer 2 chain. The project raised approximately $1.2 million, backed by investors including Woodstock and Double Peak.

The airdrop will be determined through Galxe campaigns and testnet tasks, where users increase eligibility by completing bridge and interaction activities. Total supply and allocation ratios remain undisclosed. The TGE date is set for October 15, 2025, with claims opening at TGE. Airdrop guide: https://cryptorank.io/drophunting/novastro-chain-activity311

Intuition ($TRUST) | Decentralized Identity Infrastructure

Intuition is a decentralized knowledge graph protocol and universal oracle, founded by William Luedtke from ConsenSys. The project raised $6.35 million, led by Superscrypt, Joseph Lubin, and Andrew Keys.

The TGE is scheduled for October 15, 2025, with a total supply of 1 billion $TRUST tokens and an initial circulating supply of 163.5 million. The expected FDV is $150 million, with 20% of the total supply allocated for airdrops, worth $24.53 million. On TGE day, 50% of the tokens will unlock, with the remainder linearly unlocked over 12 months. The community predicts a possible listing on Binance Alpha.

Recall ($RECALL)

Recall is a decentralized intelligence platform supporting autonomous AI agents in storing, sharing, and exchanging knowledge on-chain, incentivizing open agent development through cryptoeconomic rewards and transparent competitions. The project raised $42.5 million, supported by Multicoin Capital and Coinbase Ventures.

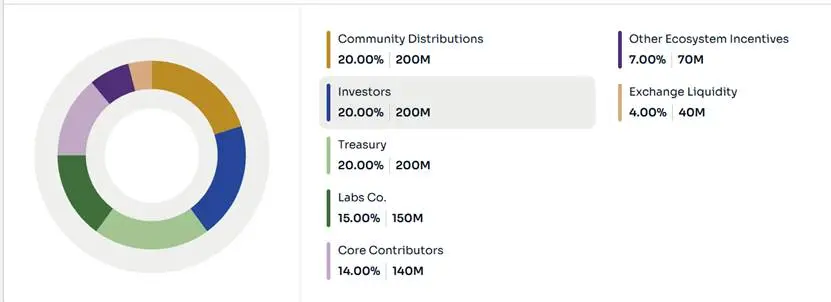

Recall will offer its native token RECALL to the public via major exchanges starting October 15, providing airdrop opportunities for selected early supporters. The issuance volume is 1 billion, with 200 million (20% of issuance) unlocking upon release. The largest share (30%) will be allocated to the community and ecosystem. After 12 months, 27% of the issued amount will unlock, with the remainder unlocking after 48 months.

Bluwhale ($BLUAI) | Intelligent Layer for Web3

Bluwhale is an AI-driven decentralized personalization protocol. Bluwhale has raised a total of $100 million, including seed and Series A funding, $75 million in token purchase commitments, grants, and node sales revenue, with investors including SBI Investment, gumi Cryptos Capital, and NxGen, along with additional funding from Arbitrum and Movement Labs.

Officially, the BLUAI token has a total supply of 10 billion, with 6% allocated for airdrops to reward the community, encourage participation, and expand the network. The TGE is scheduled for October 21.

Meteora ($MET) | Decentralized Exchange

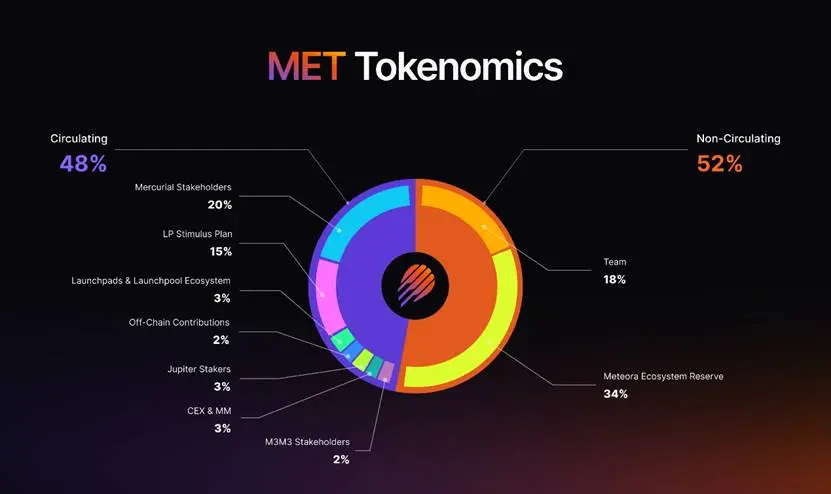

Meteora is a dynamic liquidity pool protocol built on Solana, supporting automated market making and token trading through a concentrated liquidity management mechanism (DLMM). The project’s co-founders, Ben Chow and Meow, are also co-founders of Jupiter. It has received investments from Alliance, Delphi Digital, and others, though financial terms were not disclosed. Meteora has achieved a TVL exceeding $780 million and generated $1.51 billion in fees.

The official team confirmed the TGE will take place on October 23, with a total token supply of 1 billion. At TGE, 48% of the tokens will unlock, with 3% of the TGE reserve allocated to Jupiter stakers in the form of liquidity position NFTs.

Planck Network ($PLANCK) | Decentralized AI Computing Network

Planck Network is a modular Layer 0 protocol. Public information shows that Planck Network secured a $200 million token investment commitment from Rollman Management Digital in April this year, and in June received strategic investment from Web3 pioneers Brock Pierce and Scott Walker through their venture capital firm DNA Fund.

Officials state that the TGE is scheduled for October 25, 2025. Total supply remains undisclosed. The $PLANCK token will be used for staking, governance, and rewards.

Limitless ($LMTS) | Social Prediction Protocol

Limitless is a decentralized prediction market platform based on the Base chain, having already achieved over $460 million in trading volume. The project has raised a total of $8 million, supported by institutions including Coinbase Ventures, 1confirmation, and Maelstrom.

Officials state the TGE will occur within October, with a total supply of 1.5 billion $LMTS tokens, 50% initially circulating, and the remaining 50% unlocking after six months. The FDV is projected to be between $75 million and $100 million. Airdrops are expected to account for 10–20% of the total supply, earned through product usage, providing liquidity, and friend referrals.

Notably, Limitless concluded its community sale on the Kaito Capital Launchpad on October 5, 2025. The originally targeted $1 million allocation attracted $200.96 million in subscriptions, oversubscribed by about 200 times. The sale distributed 20 million $LMTS tokens (1.33% of total supply at $0.05 per token), setting an FDV of $75 million, with priority given to Kaito community members.

Conclusion

The immediate price surge of tokens like ASTER/XPL in September ignited market anticipation for Q4 TGE projects. Institutions such as CryptoRank and PitchBook predict this quarter will continue the bull market peak, led by projects including Monad, Meteora, Limitless, Zama, and MegaETH.

To some extent, TGEs can stimulate community engagement and tokenized innovation, especially breakthroughs in RWA tokenization and cross-chain protocols. However, on the other hand, post-TGE valuation spikes combined with token unlocks have prompted warnings from some institutions that retail investors could face significant sell pressure, highlighting the need to watch out for the "VC coin dilemma" and market volatility risks.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News