Will ICOs make a comeback and replace airdrops by 2026?

TechFlow Selected TechFlow Selected

Will ICOs make a comeback and replace airdrops by 2026?

Many airdrop programs, due to poor incentive design, have fostered a widespread "dump upon receipt" culture, while ICOs offer a more rational and sustainable alternative for distribution and early community building.

Author: blocmates.

Compilation: TechFlow

If you've been active in the crypto markets recently, you may have noticed that as ICOs (Initial Coin Offerings) make a comeback, airdrops are gradually fading from the spotlight. Additionally, fundraising models are shifting from traditional venture capital (VC) approaches toward decentralized capital raising.

ICOs are nothing new—some of the most well-known projects in crypto, such as Ether and Augur, were initially distributed via ICOs. However, after a long dormant period, ICOs have made a strong return in 2025. Prior to this, project funding was primarily conducted through closed-door venture capital deals.

Why Are ICOs Making a Comeback?

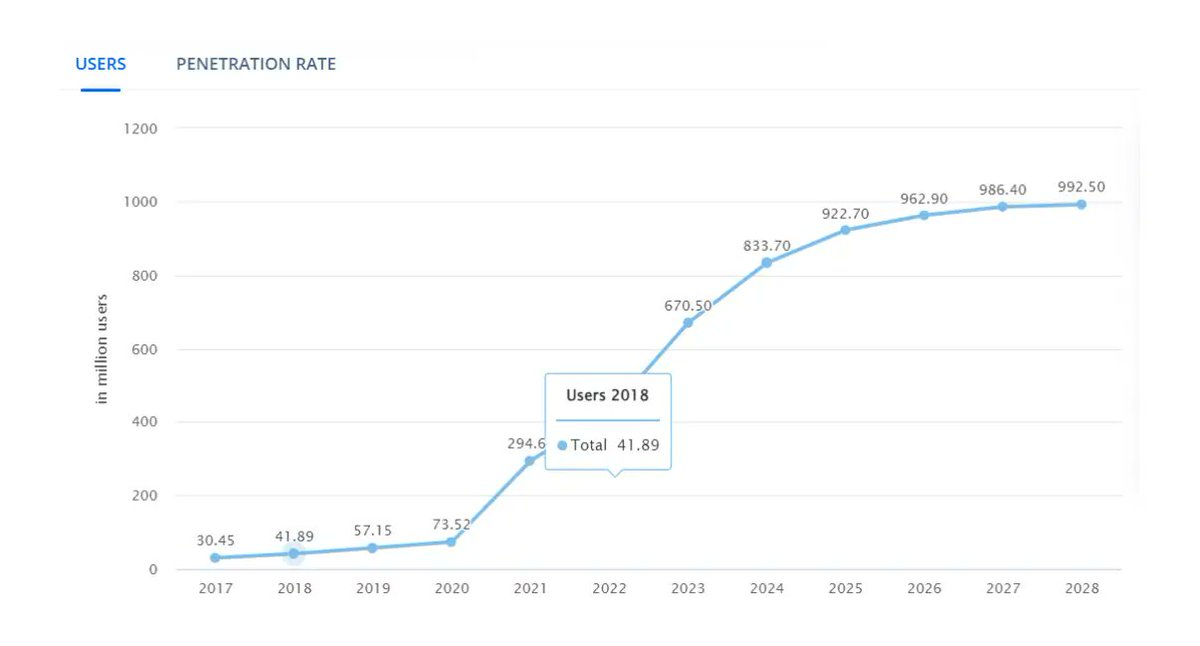

A positive argument for the renewed popularity of ICO-style fundraising is that the number of cryptocurrency participants has grown by over three times since the initial ICO boom of 2014–2018, with a compound annual growth rate (CAGR) of 4.46%. Moreover, today’s average participant is clearly more mature and experienced.

This, combined with the growing supply of stablecoins, naturally expands the scale of available capital and attracts more individuals willing to purchase discounted tokens prior to token generation events (TGEs).

While this narrative sounds appealing, increased market participation is not the primary driver behind the resurgence of ICO-like mechanisms.

To uncover the true reason for this revival, we must examine the shortcomings of previous capital formation methods.

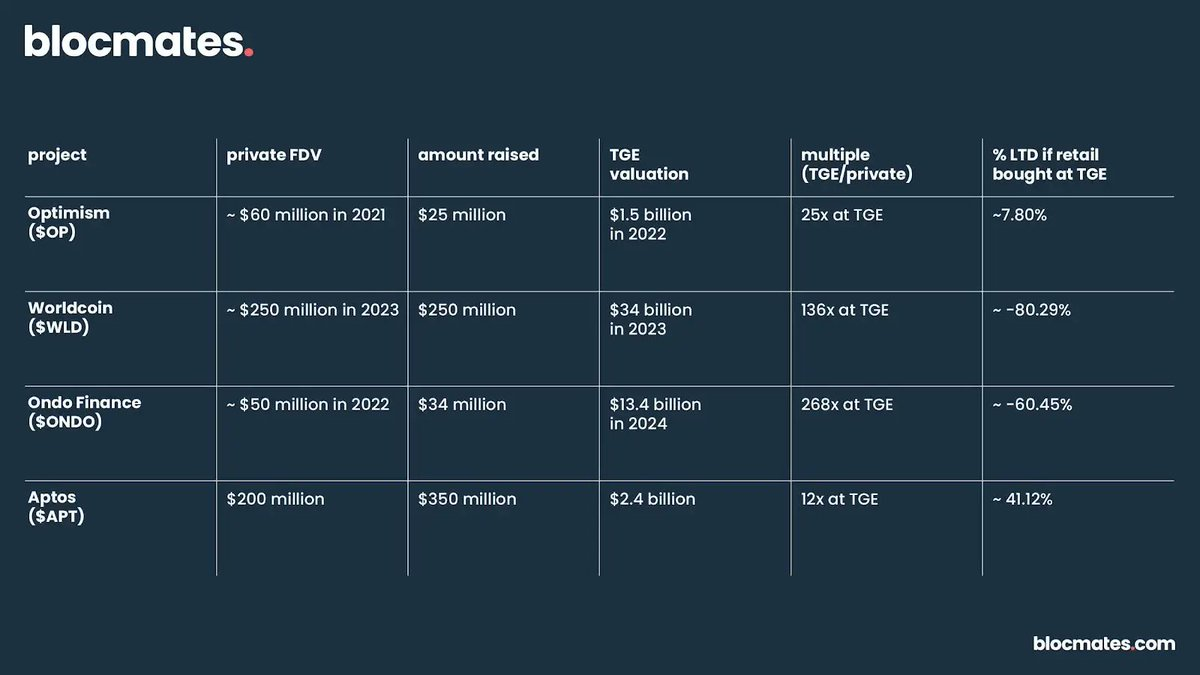

A close look at the 2022–2024 cycle reveals that many projects raised funds through venture capital at relatively low fully diluted valuations (FDVs), but upon public listing, their FDVs were significantly inflated due to artificially low initial circulating supplies.

Below are some examples from 2022–2024:

As shown in the table above, the vast majority of gains were captured by insiders, leaving little room for retail investors to profit.

In simple terms, altcoin returns were largely captured by insiders, while ordinary users either bought into overpriced tokens or received airdrops, which were often seen as “free money” and therefore typically dumped immediately, exacerbating selling pressure.

This dynamic has led to widespread fatigue among retail investors, who are increasingly losing confidence in traditional altcoin investments due to persistently poor risk-reward ratios.

Subsequently, retail capital shifted toward memecoins—assets with low entry barriers, high volatility, and no VC-driven sell pressure—fueling the memecoin craze and the rapid rise of memecoin launch platforms.

As a result, misalignments between retail investors, project teams, and VCs have intensified, with incentives becoming increasingly divergent: retail seeks fairer entry opportunities, teams aim to build sustainable communities rather than short-term speculation, and VCs favor asymmetric early-stage returns.

This tension has created a market-wide desire for a new model—one that can realign incentive structures across the ecosystem.

This shift appears to be materializing through the resurgence of ICO-style fundraising. The appeal of ICOs lies not only in offering an alternative capital-raising method but also in presenting a clearer incentive structure that allows retail investors to participate on fairer terms.

Why Might ICOs Replace Airdrops?

Taken together, it's clear that incentive culture may be shifting toward greater emphasis on "skin-in-the-game," with ICO discounts potentially replacing the traditional "task-for-reward" airdrop model.

This trend is already emerging—projects like MegaETH and Monad have publicly distributed what were previously VC-held allocations. While these may not represent the purest form of ICO distribution, choosing to offer tokens to the public at VC-round valuations is still a step in the right direction.

ICOs are generally seen as a more natural and inherently "skin-in-the-game" method of token distribution. Participants commit their own capital at foundational valuations, whether through single-round raises or tiered pricing structures.

Theoretically, this approach fosters stronger psychological and economic alignment between users and projects. Since participants are buying tokens rather than receiving them for free, they are more likely to hold long-term—a behavior that could help reverse the recent trend of declining holding periods for on-chain assets.

Furthermore, ICOs have the potential to restore profit margins in the altcoin market. Public fundraising tends to be more transparent, offering clearer visibility into circulating supply and valuation. Compared to private-sale-dominated models, ICOs often feature more reasonable fully diluted valuations (FDVs).

This structure increases the likelihood that early retail participants can achieve meaningful returns without competing against deeply discounted insider allocations.

In contrast, many airdrop programs, due to poor incentive design, have fostered a widespread "dump-on-receipt" culture. ICOs offer a more rational and sustainable alternative for distribution and early community building.

What Do the Rise of Startup Fundraising Platforms Reveal About ICOs?

Last month, one of the largest acquisitions in crypto history took place: Coinbase acquired the on-chain fundraising platform @echodotxyz for $375 million. The deal also includes Echo’s product Sonar, a tool enabling anyone to launch public token sales.

At the same time, @coinbase launched its native in-app issuance platform (Launchpad), with its first partner being @monad.

Beyond Echo and Coinbase, we’re also seeing the emergence of startup fundraising platforms—Kaito has launched its own Launchpad, while the ownership token platform @MetaDAOProject is redefining what an ICO can mean.

Notably, the MetaDAO platform clearly reflects market fatigue with insider-dominated, high-FDV projects. Their goal is to help projects launch early via high-circulating-supply ICOs to enable long-term growth.

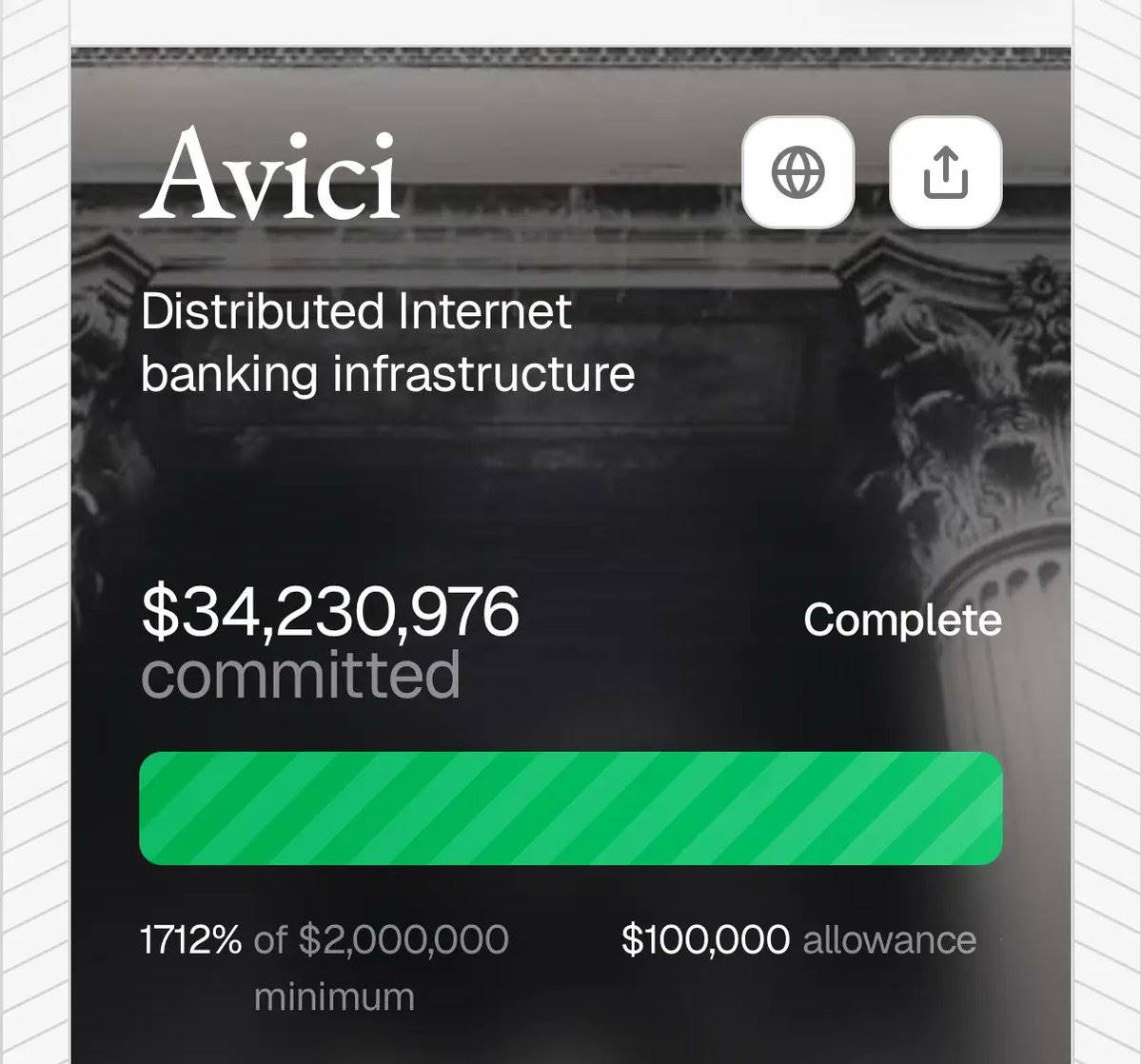

More excitingly, this model of token issuance has already produced some success stories. For example, @AviciMoney’s token $AVICI—a token for a new type of crypto-native bank—is currently trading significantly above its ICO price (around $6.39 vs. an ICO price of $0.20).

Another example is @UmbraPrivacy, a privacy solution built on Solana and powered by Arcium, whose token has appreciated over fourfold since launch, moving against broader market trends.

These successes indicate that the market is fully ready for the return of ICOs—but not just any ICOs. Rather, carefully designed and executed fundraising events that create strong synergy between teams, communities, and the broader market.

How to Seize the Opportunity?

Fairly speaking, as previously mentioned, renewed market interest in ICOs reflects a rethinking of incentive structures aimed at creating fairer opportunities for retail investors.

This fairness requires aligning the interests of projects and retail participants to cultivate more resilient communities—composed of active users and long-term token holders. In practice, this also suggests the era of "free tokens" may be coming to an end.

Closely examining successful airdrops that had broad ecosystem impact—such as HYPE—reveals how distribution design can be optimized. In Hyperliquid’s case, genuine users (rather than speculative "farmers") participated by paying fees and taking real risks, earning rewards closely tied to the product’s success.

This approach shows that when incentive structures are thoughtfully designed, retail participation can become meaningful and sustainable, rather than fleeting or purely speculative.

We believe this philosophy will gradually permeate how ICOs are implemented. For instance, future ICOs might offer discounts based on more sophisticated on-chain behaviors and long-term reputation, replacing traditional airdrop-style distributions.

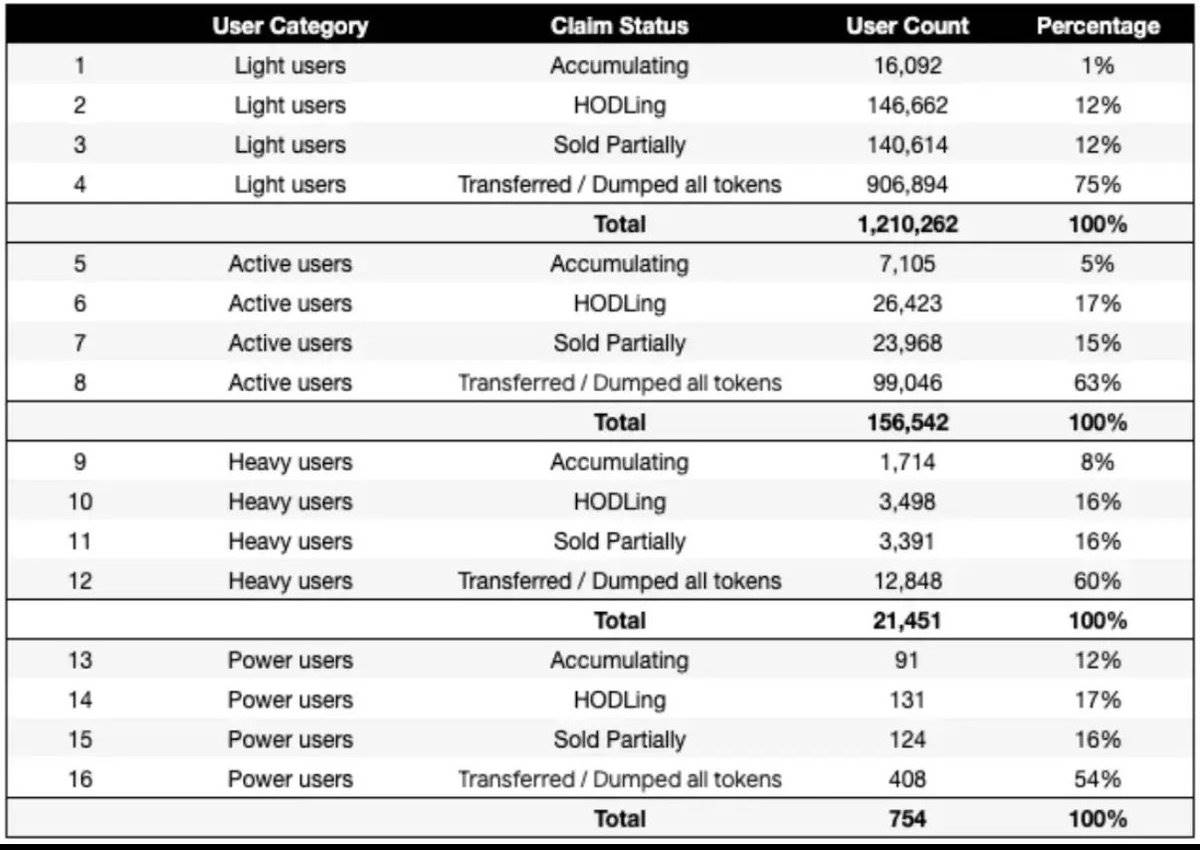

Here is a set of data from 2024 showing behavioral differences between light and heavy users regarding airdropped tokens: over 80% of light users tend to sell their airdropped tokens within 7 days, compared to only 55% of heavy users.

To succeed in this envisioned future, participants need to cultivate a long-term mindset and adjust their behavior accordingly. This means maintaining loyalty to specific wallet addresses to build reputation, and demonstrating consistent, project-aligned on-chain activity.

Such behaviors may include: trying different protocols, deploying capital into liquidity pools, contributing to public goods (like Gitcoin), and creating meaningful on-chain activities that reflect genuine engagement.

Even though projects like Kaito still face divided opinions among the public, we expect them to play a significant role in shaping the next phase of the ecosystem. For example, “yap” thresholds (a measure of user activity) combined with verified on-chain behavior could become key criteria for participating in ICOs or receiving discounted token allocations, thereby rewarding participants who demonstrate sustained commitment and aligned incentives.

If the above patterns become standard, one way to expand profitability is to leverage products like @Infinit_Labs or @gizatechxyz to deploy capital across different ecosystems.

Although this approach may have limited effectiveness in cases where wallet history and age are heavily weighted, it could still offer significant advantages if on-chain activity alone becomes the qualifying criterion for ICO participation or discounted allocations.

Potential Risks and Challenges

When ICOs become the default method for fundraising and reward distribution in the crypto industry, numerous potential challenges arise.

One key challenge is that, similar to VC-dominated funding, poorly designed ICO tokenomics could lead to project failure. If a project prices its token too high—especially relative to general market valuations (often manipulated by low circulation and high FDV)—these tokens may still struggle to gain traction in the open market.

Additionally, regulatory and legal issues remain major obstacles. While regulation in certain jurisdictions is becoming clearer, ICOs still exist in a legal gray area across many high-capital regions. This uncertainty can become a bottleneck to success and may even force lesser-known projects to revert back to VC funding.

Another interesting challenge is market saturation. When multiple projects launch fundraising campaigns simultaneously, participant attention becomes fragmented, potentially reducing overall demand for ICOs. This could lead to widespread "ICO fatigue," dampening participation and market enthusiasm.

Beyond these issues, as the market potentially shifts toward ICO models, projects must also address other critical considerations—including incentive alignment, community engagement, and infrastructure risks. Only by properly addressing these can the ICO model achieve sustainable success.

Final Thoughts

Currently, the market’s message is quite clear: there is a strong desire for fairer token distribution models and fewer VC-centric scams. This is evident in the current state of the altcoin market, where declining spot holdings and rising perpetual contract revenues reflect this sentiment.

We believe this clearly indicates that retail investors have largely abandoned pursuit of long-term gains, turning instead toward more speculative alternatives.

Against this backdrop, the negative effects of attention economics further exacerbate the problem, harming overall industry development and stifling innovation.

The return of ICOs appears to be a step in the right direction. Rather than completely replacing the familiar airdrop model, this trend is more likely to act as a catalyst for a "hybrid model"—one in which long-term incentive alignment becomes central to any project’s market strategy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News