A New Era of Token Financing: A Milestone in U.S. Compliant Fundraising

TechFlow Selected TechFlow Selected

A New Era of Token Financing: A Milestone in U.S. Compliant Fundraising

The issuance of assets in the crypto space is entering a new era of compliance.

By: Cookie

Monad's upcoming ICO on Coinbase has become this week's hot topic. Beyond market discussions about whether participating in a token sale with a $2.5 billion FDV is worthwhile, the "compliance level" of this offering—Coinbase’s first-ever ICO—has sparked widespread debate, being seen as a landmark event signaling greater compliance within the crypto industry.

Circle, the issuer of the stablecoin USDC, mentioned in its recent Q3 earnings report that it is exploring the possibility of launching a native token on the Arc Network. After nearly two years of silence, Coinbase indicated in October this year—through an interview with Base chain co-founder Jesse Pollak—that it will launch a Base token. These signs collectively indicate that asset issuance in crypto is entering a new era of compliance.

Coinbase’s First-Ever ICO: What Has Monad Disclosed?

For this historic first ICO on Coinbase, the Monad Foundation subsidiary MF Services (BVI), Ltd. released an 18-page disclosure document. This document clearly outlines Monad’s legal structure, fundraising details, and market-making plan, along with an 8-page section on investment risk warnings. Compared to past ICOs, such transparency is unprecedented and marks significant progress.

At the legal structure level, Monad has clarified the following:

- The seller of Monad tokens is MF Services (BVI) Ltd., a subsidiary of the Monad Foundation, which serves as the sole director of the company

- The three co-founders of Monad are Keone Hon, James Hunsaker, and Eunice Giarta. The core contributors to Monad are the Monad Foundation and Category Labs

- Category Labs, headquartered in New York, USA, is responsible for Monad’s technical development. James Hunsaker is the Chief Executive Officer of Category Labs

- The Monad Foundation is a memberless foundation incorporated in the Cayman Islands, responsible for community engagement, business development, developer and user education, and marketing services. Keone Hon and Eunice Giarta serve as Co-General Managers of the Monad Foundation. The Foundation is overseen by a board of directors consisting of Petrus Basson, Keone Hon, and Marc Piano

This level of legal disclosure provides stronger investor protection mechanisms, enhancing accountability and legal recourse for investors.

Regarding fundraising details, Monad has disclosed the following:

- Pre-seed funding: $19.6 million raised between June and December 2022

- Seed round: $22.6 million raised between January and March 2024

- Series A: $220.5 million raised between March and August 2024

- In 2024, the Monad Foundation received a $90 million donation from Category Labs to cover operational costs prior to the public launch of the Monad network. This donation covers expected expenses through 2026 and forms part of the $262 million total capital raised by Monad Labs across its financing rounds

Such detailed fundraising disclosures help prevent the inflated or fictitious funding claims that have plagued previous crypto projects, reducing misvaluation risks.

On the market-making front, Monad has disclosed the following:

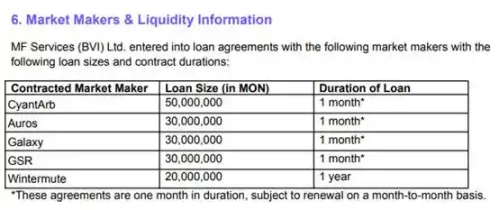

- MF Services (BVI) Ltd. has entered into loan agreements with five market makers—CyantArb, Auros, Galaxy, GSR, and Wintermute—to lend a total of 160 million MON tokens. Wintermute’s loan term is one year, while the others are one month, renewable monthly

- Third-party experts (Coinwatch) will monitor and verify the usage of loaned tokens, including idle balances held by CyantArb, Auros, Galaxy, and GSR

- MF Services (BVI) Ltd. may also deploy up to 0.20% of the initial MON token supply as initial liquidity in one or more decentralized exchange (DEX) pools

- Tokens used in market maker loans and initial liquidity are included within the ecosystem development allocation portion of the tokenomics

This is the first time a crypto project has transparently disclosed specific market-making arrangements before TGE. Taken together with all other disclosures, this represents the first instance in crypto where ICO transparency begins to mirror traditional financial market practices.

The Difficult Journey Toward ICO Compliance

In 2017, Ethereum emerged and ERC-20 triggered an ICO boom, leading to a surge in projects and the industry’s first major explosion. However, in July 2017, the SEC issued its first guidance on ICOs. At the time, the SEC declared that any new cryptocurrency sold to investors seeking profit, especially when offered by a centralized entity, would be considered a security and thus subject to securities regulations.

According to this guidance, ICOs conducted in the U.S. after this date were likely in violation of securities laws and exposed to enforcement actions by the SEC. Since the release of the guidance, multiple cases have been brought forward. According to the SEC’s 2018 annual report, dozens of investigations involving ICOs and digital assets were initiated that year, with many still ongoing by the end of the fiscal year.

In November 2018, the SEC issued its first civil penalties against unregistered ICOs. Projects Paragon (PRG) and Airfox (AIR) were each fined $250,000 and required to register their tokens as securities and file periodic reports.

In June 2019, Canadian social media company Kik Interactive became embroiled in litigation with the SEC over its ICO. To fight the case, Kik even established a new fund called crypto.org to raise sufficient legal defense funds.

The two largest ICOs in crypto history—EOS raising $4.2 billion and Telegram raising $1.7 billion—both faced legal battles with the SEC. Block.one paid a $24 million penalty to settle with the SEC, while Telegram reached a $1.24 billion settlement regarding the issuance of Gram tokens by its subsidiary TON Issuer. The $1.24 billion Telegram settlement included $1.22 billion in disgorgement and $18.5 million in civil penalties.

CEOs and influencers have also been sued by the SEC for alleged involvement in non-compliant ICO promotions. John McAfee, founder of the well-known antivirus software, was sued for failing to disclose income earned from promoting ICO tokens. Crypto influencer Ian Balina was also sued for participating in unregistered cryptocurrency ICO promotions.

On July 10, 2019, the SEC approved Blockstack PBC’s Tier II Regulation A+ qualified offering—the first compliant securities-law-governed ICO. Another project, Props, also received SEC approval that same month. However, two years later, Props announced plans to discontinue issuing its Props token under SEC Regulation A+ after December 2021 and terminate support for its Props Loyalty program. At the time, Props stated it had determined it could not sustain or further develop the loyalty program within the existing securities regulatory framework. Due to the lack of authorized domestic trading platforms such as Alternative Trading Systems (ATS), U.S. holders of Props tokens were restricted from trading, hindering the project’s growth.

For years, the ICO model has struggled with compliance issues, leading to its gradual replacement after the 2017 frenzy by VC funding, exchange-led IEOs, and retroactive airdrops. Therefore, Coinbase’s revival of the ICO model is not seen by the market as mere nostalgia, but rather as a “re-emergence” of ICOs in a new form—reshaped by years of regulatory advancement and operating within a fundamentally transformed market structure.

The Return of the ICO

On November 12, Bitwise Chief Investment Officer Matt Hougan stated that Coinbase’s newly launched Launchpad marks the strong return of crypto-based capital formation. Compliant ICOs are poised to become a central theme in 2026, reshaping startup financing models and emerging as the fourth pillar in crypto’s disruption of traditional finance—the first three being Bitcoin redefining gold, stablecoins redefining the dollar, and tokenization redefining trading and settlement.

Hougan noted that early ICO experiments proved blockchain could connect entrepreneurs and investors faster and at lower cost than traditional IPOs, despite the earlier speculative bubble. The key difference now lies in regulation and structure. Paul Atkins, the current SEC Chair—who previously co-chaired the pro-ICO advocacy group Token Alliance and serves on the board of tokenization firm Securitize—has recently called for new rules and safe harbor frameworks to support compliant token offerings. Coinbase’s new platform represents the first major real-world implementation of this vision.

In 2025, ICOs already accounted for approximately one-fifth of all token sale transaction volume, up from negligible levels just two years prior. Platforms like Echo, Kraken Launch, and Buidlpad have made significant strides beyond the crude ICO mechanisms of the past or simple gas wars, improving in areas such as self-custody, multi-chain issuance support, and controlled access. We’ve already seen highly successful cases on these platforms, including Plasma and Falcon Finance.

The return of the ICO reflects the maturation of the crypto market after years of compliance exploration. We will see more serious, transparent ICOs like Monad, offering better protection for retail investors. And as mentioned at the beginning—with Circle’s Arc and Coinbase’s Base—projects once widely considered unlikely to issue tokens are now sending new signals in this more mature regulatory environment.

We are entering a new era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News