ICO Revival: Echo, Legion, and Others Turn Speculative Frenzy into Structured Investment

TechFlow Selected TechFlow Selected

ICO Revival: Echo, Legion, and Others Turn Speculative Frenzy into Structured Investment

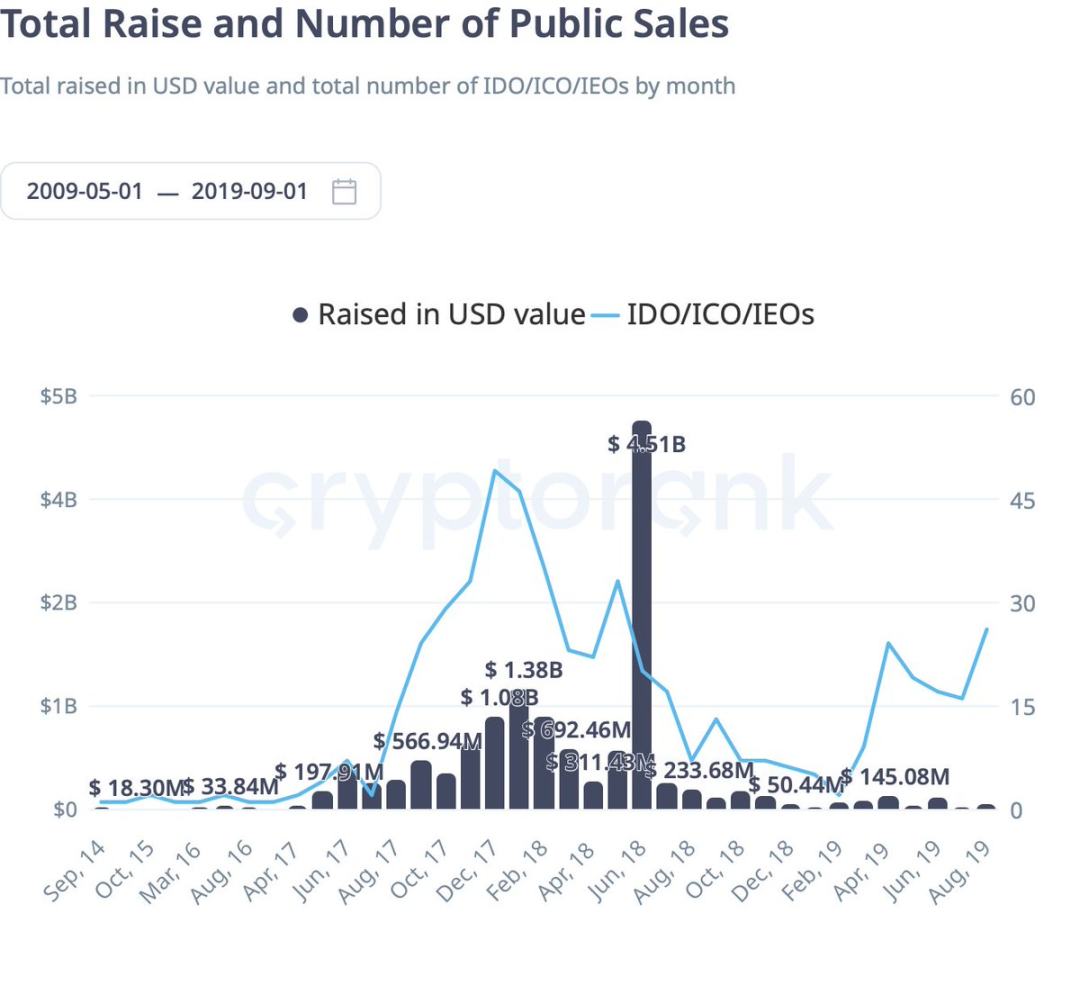

In 2025, ICOs accounted for approximately one-fifth of all token offering transaction volume.

Author: Stacy Muur

Translation: Luffy, Foresight News

After the frenzy of 2017, ICOs (Initial Coin Offerings) have finally returned to the market—but with mechanisms entirely different from the chaotic gas wars of the past. This is not a nostalgic revival, but a structurally new market shaped by new infrastructure, more sophisticated allocation designs, and clearer regulatory frameworks.

In 2017, anyone could raise millions of dollars within minutes using just an Ethereum contract and a whitepaper. There were no standardized compliance procedures, no structured distribution models, and no post-sale liquidity frameworks. Most investors entered blindly, only to watch their tokens plummet shortly after listing. As regulators stepped in, ICOs gradually faded over the following years, replaced by venture capital rounds, SAFTs (Simple Agreements for Future Tokens), exchange IEOs (Initial Exchange Offerings), and later retroactive airdrops.

Now, in 2025, the trend has reversed.

But the change isn’t that projects are launching at lower valuations—in fact, fully diluted valuations (FDVs) are higher than ever. The real shift lies in access mechanisms.

Launchpads no longer rely on pure speed competition or gas wars. Instead, they use KYC (Know Your Customer), reputation scoring, or social influence to screen participants, distributing allocations in small amounts across thousands of individuals rather than large allocations to whales.

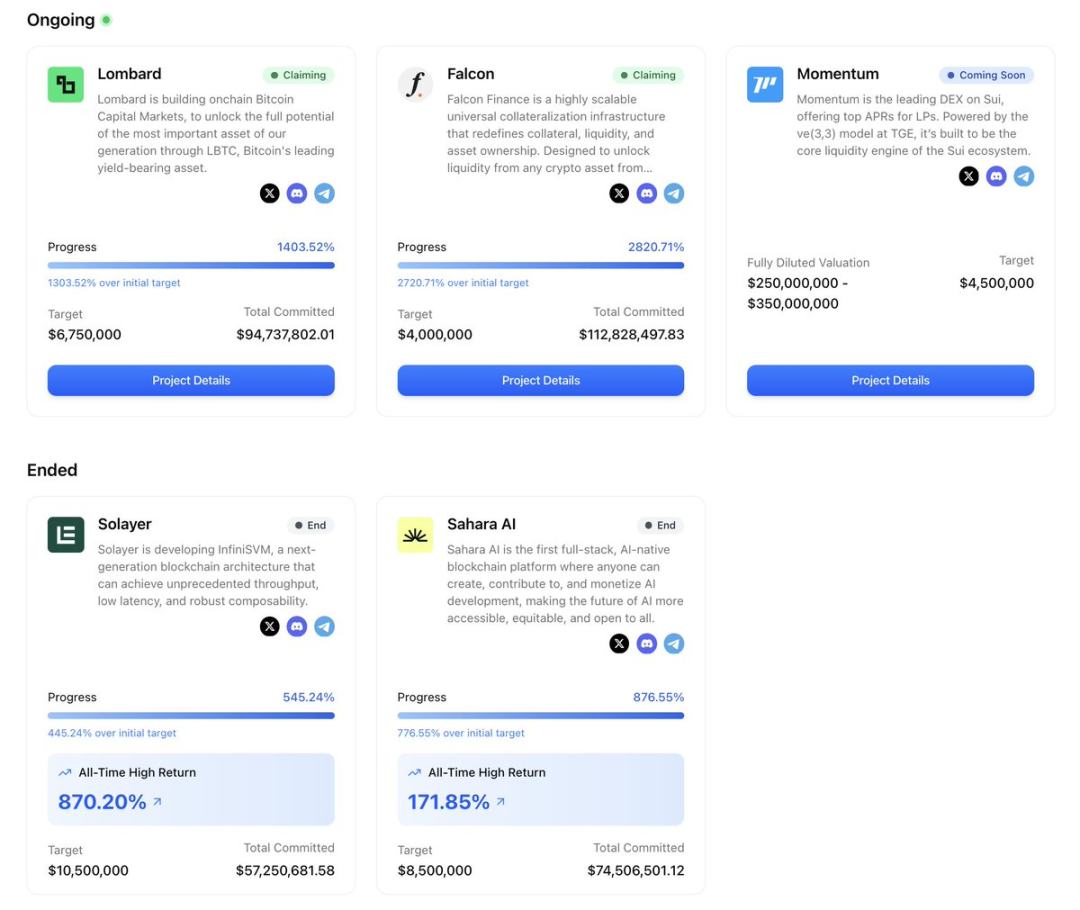

For example, on Buidlpad, I committed $5,000 to Falcon Finance but ultimately received only a $270 allocation, with the remaining funds refunded due to oversubscription. A similar situation occurred with Sahara AI—I committed $5,000 but received only a $600 allocation.

Oversubscription doesn't drive down prices—it simply reduces individual allocations, maintaining high FDVs while enabling broader token distribution.

Regulation has also caught up. Frameworks like the EU’s MiCA (Markets in Crypto-Assets Regulation) now provide clear pathways for compliant retail investor participation, and launch platforms have simplified KYC, geo-fencing, and eligibility checks into simple toggle settings.

On the liquidity front, some platforms go further—encoding post-sale policies directly into smart contracts, automatically funding liquidity pools or stabilizing early trading prices through buy-below/sell-above price band mechanisms.

In 2025, ICOs account for about one-fifth of all token launch trading volume, compared to a negligible share just two years ago.

This ICO revival is not driven by a single platform, but by a new generation of launch systems, each addressing different pain points:

-

Echo’s Sonar tool enables self-custodied, compliance-mode-switchable cross-chain launches;

-

Legion partners with Kraken Launch to integrate reputation-based allocation into exchange processes;

-

MetaDAO builds treasury control and liquidity bands directly into its protocol from day one;

-

Buidlpad focuses on KYC-gated, community-first distribution with structured refund mechanisms.

Together, these platforms are transforming ICOs from chaotic fundraising tools into carefully designed market structures, where participation, pricing, and liquidity are planned—not improvised.

They collectively address the issues that plagued the first wave of ICOs, building a more structured, transparent, and investment-worthy environment. Let’s examine each in detail.

Echo: Self-Custody, Switchable Compliance, Soaring Popularity

Founded by Cobie, Echo has emerged as one of 2025’s breakthrough token launch infrastructures, thanks to its self-custodied public sale tool, Sonar. Unlike centralized launchpads or exchange IEOs, Echo provides infrastructure—not a marketplace. Projects can choose their own sale formats (fixed price, auction, or vault/credit model), set KYC/qualified investor rules and geographic restrictions via Echo Passport, distribute their own sale links, and launch across multiple chains including Solana, Base, Hyperliquid, and Cardano.

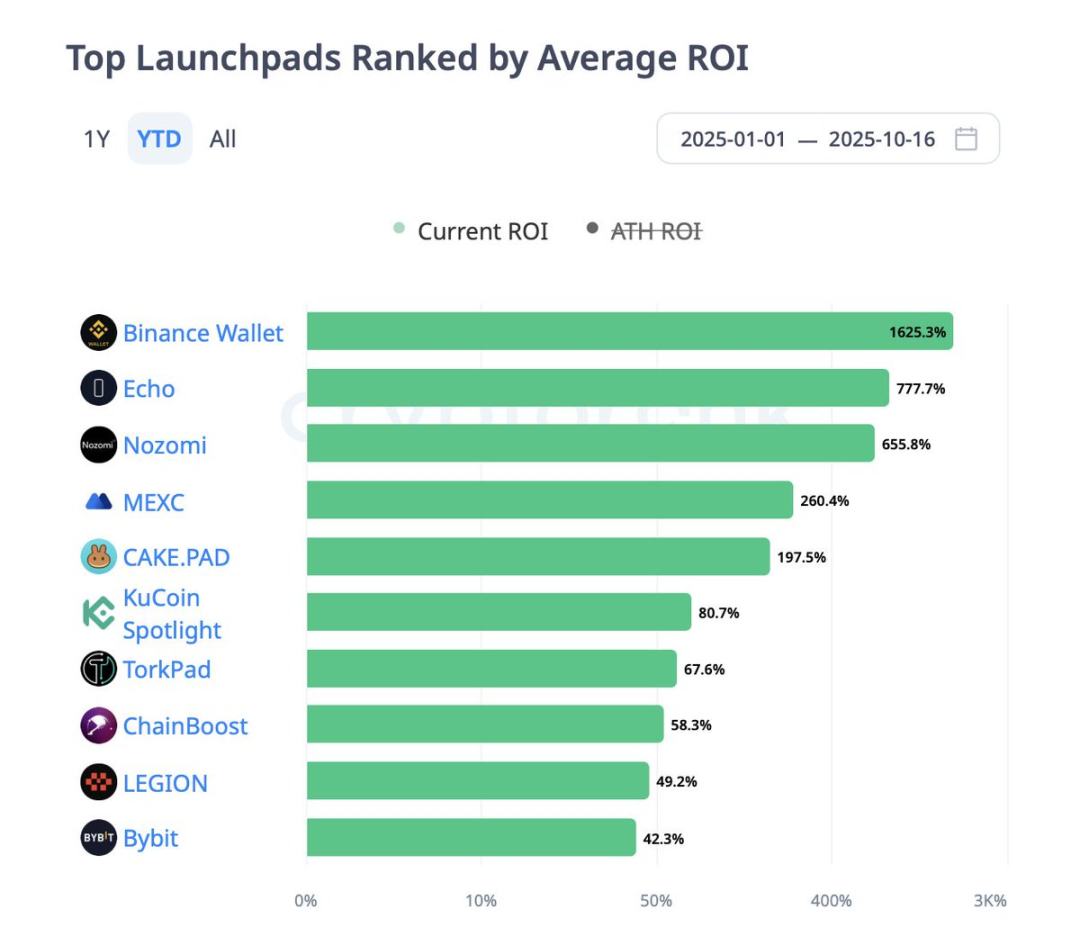

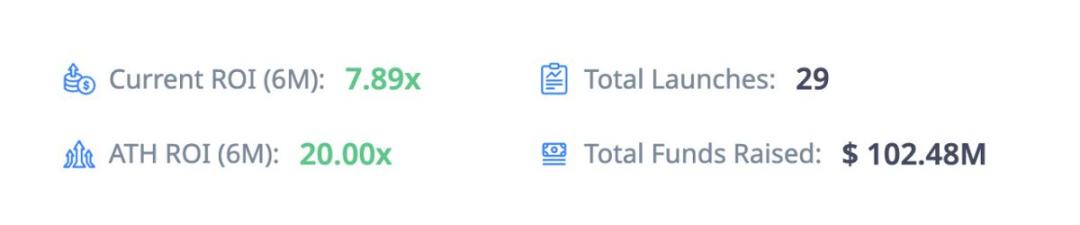

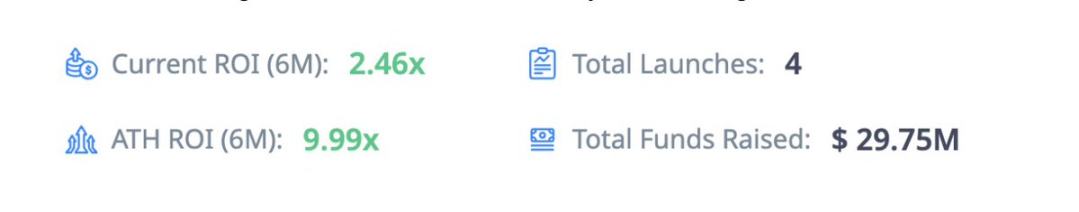

The platform is growing rapidly:

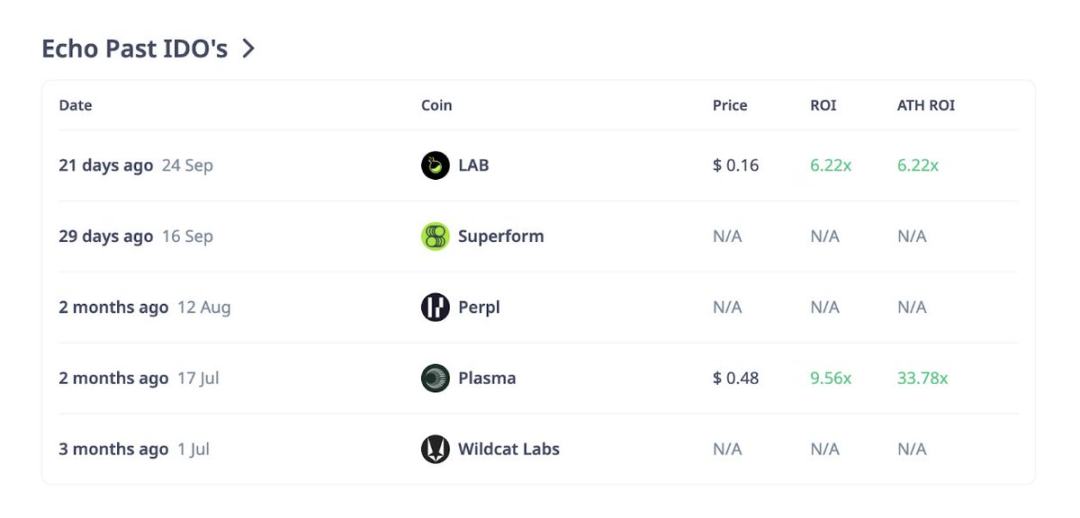

Echo’s standout case is Plasma. In July, the project used a time-weighted vault model to sell 10% of its tokens at $0.05, attracting over $50 million in commitments. Plasma achieved a peak return on investment (ROI) of 33.78x, making it one of the year’s top-performing ICOs. LAB followed closely, delivering a 6.22x ROI at launch.

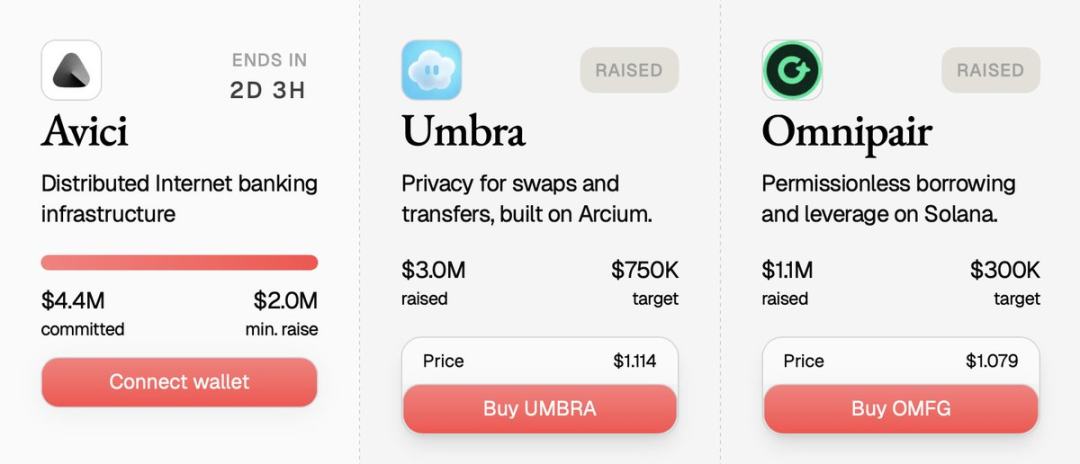

Here’s an overview of recent Echo launches:

These figures reflect both profit potential and variability. While Plasma and LAB delivered high multiples, other projects like Superform and Perpl have yet to list or report performance. Notably, Echo does not mandate post-sale liquidity frameworks—the funding of liquidity pools, market maker requirements, and unlock schedules are determined by issuers, not standardized by the platform.

Investor note: Echo’s flexibility makes it one of the highest-return launch infrastructures this cycle, but it demands thorough due diligence. Be sure to verify:

-

Compliance settings (KYC / qualified investor rules);

-

Sale format (vault, auction, or fixed price);

-

Issuer’s liquidity plan (Echo imposes no standardization here).

Legion & Kraken Launch: Where Reputation Meets Regulation

If Echo represents issuer-driven flexibility, Legion is its opposite—a structured, reputation-based public sale channel.

In September, Kraken Launch officially launched, powered entirely by Legion’s underlying technology. This marks the first time token sales occur directly within Kraken accounts, compliant with MiCA regulations and prioritizing participants based on reputation scores.

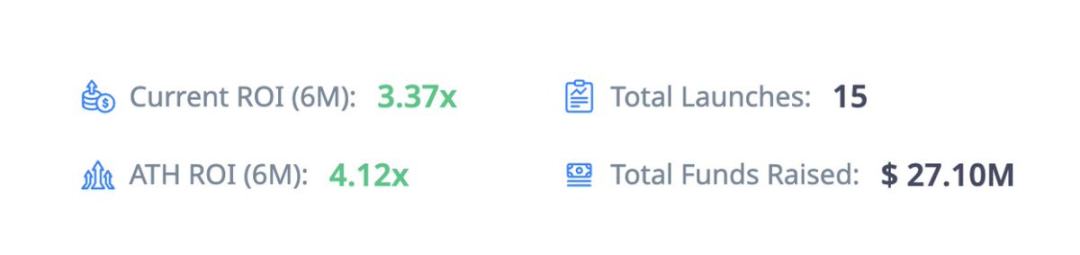

The platform is growing quickly:

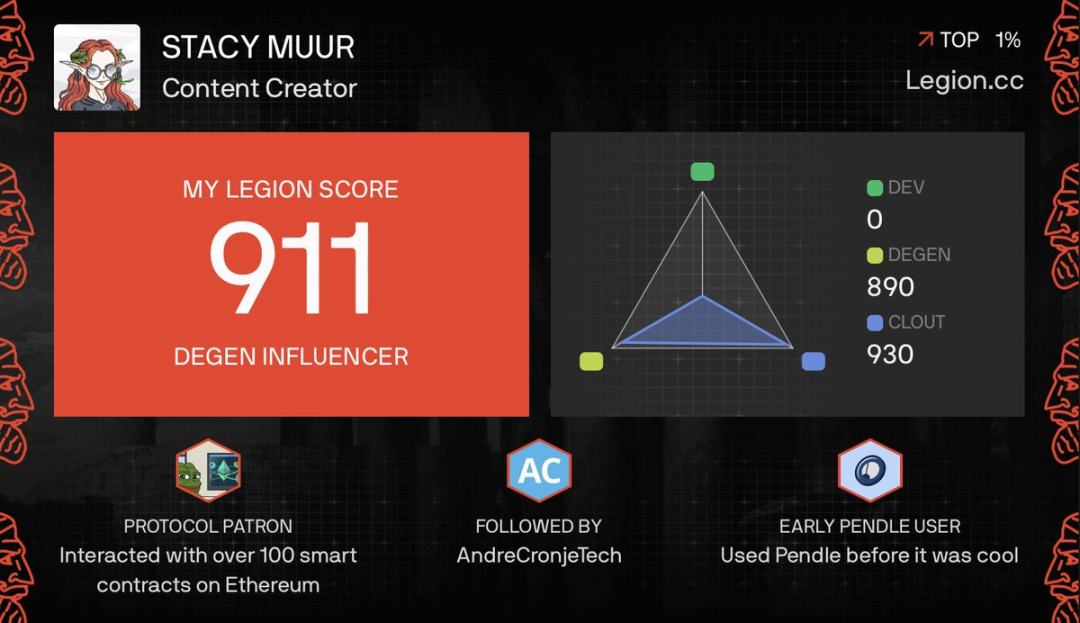

At the core of Legion is the Legion Score—a 0–1000-point reputation metric calculated from on-chain activity, technical contributions (e.g., GitHub commits), social engagement, and peer endorsements.

Projects can reserve a portion of token allocations (typically 20%–40%) for high-scoring users, with the remainder open to first-come-first-served or lottery phases. This flips traditional ICO allocation on its head—not rewarding the fastest bots, but developers, contributors, and influential community members.

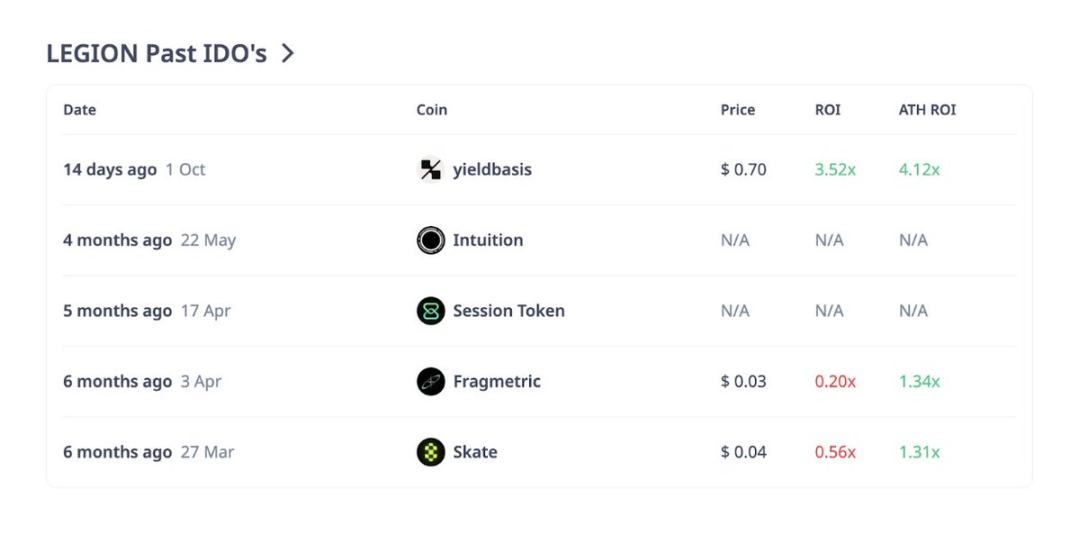

Here’s an overview of recent Legion launches:

Kraken’s integration adds another layer of security: exchange-level KYC/AML checks and day-one liquidity. This combines IPO-style launches with community allocation. Early cases like YieldBasis and Bitcoin Hyper saw massive oversubscription in the priority phase (for high-score users), while low-score users were directed to limited public rounds.

Of course, it's not perfect. Some early users argue the Legion Score may overemphasize social influence—large X account holders ranking above actual developers—and transparency around scoring weights needs improvement. Still, it’s a significant step forward from past lottery chaos.

Investor note: Your Legion Score matters. To secure allocations in high-demand projects, start building your on-chain history and contribution record early. Also, check the allocation split between priority and public rounds—this varies by project.

MetaDAO: Mechanism First, Marketing Second

MetaDAO is doing something no other launch infrastructure has attempted: encoding post-market policies directly into the protocol itself.

Here’s how it works: if a MetaDAO launch succeeds, all raised USDC goes into a market-managed treasury, and token minting rights transfer to that treasury. The treasury then allocates 20% of the USDC plus 5 million tokens into a Solana DEX liquidity pool. Additionally, the treasury is programmed to “buy below the ICO price and sell above it,” creating a soft price band around the initial price from day one.

This seemingly simple mechanism fundamentally changes early trading dynamics. In traditional ICOs, thin liquidity or insider dumping can crash secondary prices. With MetaDAO’s price band, early prices tend to fluctuate within a defined range—less downside, capped upside. It’s a mechanistic safeguard, not just a promise. If there's no market demand, the treasury will eventually deplete, but it helps guide behavior during critical early hours.

The most representative case is Umbra, a privacy protocol on Solana. Umbra’s sale attracted over 10,000 participants, with reported commitments exceeding $150 million. The sale page even displayed real-time data on large allocations. Witnessing such transparent distribution feels like glimpsing a more structured future for ICOs—transparent, on-chain, policy-controlled.

Investor note: When participating in MetaDAO launches, remember the ICO price and understand the price band rules. Buying slightly above the upper limit means the treasury may become your counterparty (selling tokens back). Buying slightly below the lower limit means the treasury might absorb your order. MetaDAO rewards those who understand the mechanism, not just hype-driven speculators.

Buidlpad: Empowering Compliant Retail Investors

Buidlpad focuses on one simple yet powerful function: providing compliant retail investors with a clear path to participate in community rounds. Launched in 2024, its core process has two stages: first, users complete KYC registration and sign up; then, during a funding window, they submit capital commitments. If oversubscribed, excess funds are refunded. Some sales also manage demand via tiered FDVs—lower FDV in early stages, higher in later ones.

Buidlpad’s defining moment came in September with the Falcon Finance launch. Targeting $4 million in funding, it received $112.8 million in commitments—an astonishing 28x oversubscription. KYC ran from September 16–19, funding from 22–23, and refunds were processed by the 26th. The entire process was smooth, transparent, and entirely driven by retail investors.

Simplicity is Buidlpad’s strength. No complex scoring systems, no predictive treasuries—just a structured participation channel for vetted communities. However, liquidity still depends entirely on issuer planning, and cross-chain distribution can sometimes fragment post-launch trading volume.

Investor note: Mark key dates. KYC/sign-up windows are hard cutoffs—miss them, lose eligibility. Also, study the tier structure—early stages often offer entry at lower FDVs.

Cross-Platform Commonalities and Risks

Overall, these platforms share several characteristics:

-

Oversubscription is common, but hype doesn’t guarantee longevity. Falcon’s 28x oversubscription, Plasma’s hundreds of millions in interest, Umbra’s massive demand—all impressive headlines. But without sustained utility, high FDVs often mean early prices fall once the post-launch glow fades.

-

Mechanisms shape volatility. MetaDAO’s buy/sell bands do reduce chaos, but cap gains near the upper bound; Echo and Buidlpad rely entirely on issuer discipline; Legion leverages exchange listings for deeper liquidity.

-

Reputation systems redefine allocation logic. With Legion, building your score early could mean the difference between a generous allocation and scrambling in a restricted public pool.

-

Compliance filters are a feature, not a flaw. KYC windows, qualified investor toggles, and priority scoring reduce chaos but increase participation stratification.

Beneath the surface, risks remain: scoring systems can be gamed, treasuries mismanaged, whales can still dominate via multi-wallet strategies, and regulatory enforcement may lag behind marketing claims. These mechanisms aren’t silver bullets—they merely shift the battlefield.

2025 Investor Guide

To navigate the new ICO wave wisely, think structurally:

-

Understand the mechanism before succumbing to FOMO. Fixed price or auction? Priority round or pure first-come-first-served? Price band or free-for-all?

-

Mark eligibility deadlines. Missing a KYC/sign-up cutoff, qualification rule, or geo-restriction could cost you the entire allocation.

-

Study the liquidity plan. Is it MetaDAO’s coded price band? Kraken’s exchange listing? Or issuer-led planning on Sonar? Liquidity determines early price action.

-

Position accordingly. To succeed on MetaDAO, learn the price band. On Legion, build your score early. On Buidlpad, target early tiers.

-

Manage position size. Hype and oversubscription don’t guarantee strong secondary performance. Treat these as structured bets, not guaranteed moonshots.

Author’s Reflection

The return of ICOs in 2025 isn’t about nostalgia—it’s about new infrastructure, new rules, and a more disciplined market. Platforms like Echo, Legion, MetaDAO, and Buidlpad each address flaws of the 2017 ICO model—some focusing on compliance, others on allocation, others on liquidity. Together, they’re turning public token launches from speculative sprints into structured capital formation.

For investors, this means advantage no longer comes just from being early—but from understanding the mechanics. Because in 2025, ICOs haven’t died—they’ve matured.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News